Sometimes employers consider it necessary to pay their employees additional funds in addition to their salaries in order to reward them for good work or to compensate them in some way. The very name of the bonus indicates that it is not assigned to everyone, but only to specific employees based on certain indicators.

Let us clarify on what basis a personal allowance can be established, which categories of workers are not entitled to it at all, how to properly formalize it, and, if necessary, cancel it.

The essence of a personal allowance

An employee can receive not only a “bare” salary, but also additional payments, including those assigned in addition to wages.

The Labor Code does not have a precise definition of a bonus. The bonus included in the salary, reflected in the employment contract or additional agreement to it, is common to all personnel when certain conditions occur, for example, for work in certain climatic zones, for shift work, etc. Such bonuses are not considered personal.

If the employer is not obliged to assign a bonus, but he does it for individual employees on an individual basis, reflecting the conditions of the appointment in a special Regulation, collective agreement or other local act, such payment will be a personal bonus . The right to assign such payments by the employer is granted by Art. 135 Labor Code of the Russian Federation.

https://youtu.be/-zg86n_-VAI

What is the premium paid for?

An additional payment to the official salary of a civil servant is calculated:

- if the work involves conditions of increased danger;

- in case of performing complex professional tasks;

- if a person works on a special schedule and has a working regime that is different from others.

The bodies whose work is subject to “special conditions” include the prosecutor’s office, the Federal Customs Service, the correctional system, the Ministry of Emergency Situations and the Ministry of Internal Affairs.

The feasibility of assigning personal allowances

In what cases may an employer need a personal allowance mechanism? When might it be necessary to make remuneration special for a specific employee or group of employees? The following options are possible:

- the employer wants to highlight the successes of a particular employee;

- there is a desire to reward an employee for having outstanding or unique knowledge and skills;

- It is undesirable to change the existing system of rates and salaries, but at the same time there is a need for additional incentives for workers.

Allowances and surcharges: application procedure

At the legislative level, the procedure for applying additional payments and allowances to an employee’s wages is regulated by Chapter. 21 Labor Code of the Russian Federation. However, questions about additional payments and allowances arise in practice quite often. They are mainly due to the fact that some of these payments are mandatory, while others can be set at the discretion of the employer.

Additional payments and allowances are additional payments to employees that are accrued to them in addition to wages and are included in the remuneration system.

Bonuses , mean incentive that are awarded for specific merits or characteristics of an employee. The purpose of such bonuses is to reward employees for high professional qualities and to make them want to improve further.

However, there are allowances that do not fit into this definition and are more of a compensatory nature . They are designed to reduce staff turnover in jobs with special working conditions.

Allowances, as a rule, are not associated with the assignment of additional responsibilities to the employee beyond those provided for in the employment contract.

At the legislative level, the procedure for applying additional payments and allowances to an employee’s wages is regulated by Chapter. 21 Labor Code of the Russian Federation. However, questions about additional payments and allowances arise in practice quite often. They are mainly due to the fact that some of these payments are mandatory, while others can be set at the discretion of the employer.

For example, incentive bonuses can be paid for length of service (work experience), for the class of drivers, for professional excellence, for an academic degree or title, for the duration of continuous work, etc.

An example of a compensatory allowance could be an allowance for work in the Far North and equivalent areas (Articles 315–317 of the Labor Code of the Russian Federation), as well as an allowance for shift work (Article 302 of the Labor Code of the Russian Federation).

An additional payment is usually a compensation . It is awarded for increased intensity of work or work in conditions deviating from normal ones.

For example, additional payment is established for work on weekends and holidays (Articles 149, 153 of the Labor Code of the Russian Federation), for work at night (Article 154 of the Labor Code of the Russian Federation), for work in difficult, harmful, dangerous working conditions (Article 147 of the Labor Code of the Russian Federation ).

PAYMENT PROCEDURE

Not all allowances and surcharges have the same status. Some of them must be paid compulsorily , and in the amount strictly established by law.

But there are also those that the organization has the right to introduce independently and determine their size at its discretion.

As a rule, bonuses and additional payments are required, which are associated with special working conditions and unfavorable factors of production.

According to Art. 135 of the Labor Code of the Russian Federation, incentive payments - bonuses, additional payments and allowances that are not established at the legislative level, the employer can establish independently, taking into account the opinion of the representative body of employees (if there is one).

For example, incentive bonuses as a percentage of the established salary can be enshrined both in local acts of the organization (for example, in the provision on material and moral incentives) and in the collective agreement .

In addition, allowances and additional payments in force in the company must be reflected in the text of the employment contract with the employee, since the amount of salary (including the amount of allowances, additional payments, bonuses) is a mandatory condition of the employment contract (paragraph 5, part 2, article 57 of the Labor Code RF) - at least in the form of a reference condition.

Thus, the procedure and conditions for the payment of bonuses, the amount of which is set as a percentage of the monthly salary (monthly tariff rate), must be recorded in the above documents.

As a rule, the amount of the bonus, set as a percentage of the salary, changes if the monthly salary (monthly tariff rate) changes.

Payment of bonuses and additional payments is not suspended during the next vacation, business trip and in other cases when the employee retains his average earnings.

ADDITIONAL PAYMENTS AND ALLOWANCES FOR SUMMARY ACCOUNTING OF WORKING TIME

Summarized working time recording is actually a special regime of working time and rest time, based on shift schedules. At the same time, the recording of working time, in contrast to the normal one, allows for deviations in the duration of working hours per day and during the week from that established for this category of workers. That is, fulfillment of labor standards is ensured not in a week, but over a longer period (month, quarter, year).

The introduction of summarized accounting in an organization involves establishing:

• duration of the accounting period (month, quarter, year);

• norms of working hours for the accounting period;

• work schedule.

The standard working time is determined on the basis of the production calendar (or production calendar sheet).

Let's consider the algorithm for calculating bonuses for cumulative recording of working hours using a specific example.

Example

An employee of the organization has a monthly salary of 20,000 rubles. and a bonus for length of service of 5% of the salary for cumulative accounting of working hours. The accounting period is a quarter. Let’s say that an employee worked 460 hours in a quarter, while the norm according to the production calendar is 447 hours per accounting period (quarter).

The number of overtime hours will be:

460 – 447 = 13 hours.

In other words, overtime for a quarter is determined by the difference between the time actually worked and the standard working time for the accounting period.

Let's determine the average hourly wage rate by dividing the amount of salaries, taking into account the percentage premium for all months of the quarter, by the normal number of working hours in this accounting period:

((20,000 + 20,000 × 5%) × 3) / 447 hours = 140 rub. 93 kopecks

Overtime work (taking into account the corresponding additional payment) must be paid for the first two hours of work at least one and a half times the hourly wage rate, for subsequent hours - at least double (Article 152 of the Labor Code of the Russian Federation). The specific amounts of additional payment for overtime work may be determined by a collective agreement, local regulations or an employment contract.

Additional payment (for overtime or overtime) is calculated as follows:

RUB 140.93 × 2 hours × 1.5 + 140.93 rub. × 11 hours H 2 = 422.79 rub. + RUB 3,100.46 = 3,523 rub. 25 kopecks

DOCUMENTING

In Art. 135 of the Labor Code of the Russian Federation states that the wage system, tariff rates, salaries and various types of payments are established by collective agreements, agreements, local regulations of the organization, and employment contracts . For employees of state and municipal institutions, it is necessary to take into account the provisions of Art. 144 Labor Code of the Russian Federation.

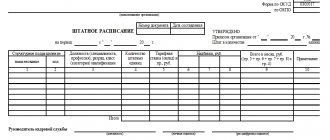

According to the above-mentioned norms of the Labor Code of the Russian Federation, it is not enough to indicate the amounts of allowances and additional payments only in the staffing table and in employment orders. In order for these payments to be included in the wage system, they must be regulated at the local level.

Different types of personal allowances

The type of allowance can be determined by various factors:

- Basis for accrual - the employer has the right to assign a personal allowance:

- for experience;

- for skill level;

- for a certain intensity of work;

- for professional excellence;

- for performing tasks of special importance and/or urgency;

- for “bonus” skills and abilities, for example, knowledge of a foreign language;

- for an academic degree in a specialized field;

- for work under conditions of official secrecy, etc.

- Duration of validity of the provisions on the allowance - these payments can be established either permanently or temporarily:

- for a month;

- per quarter;

- for a year;

- indefinitely.

- The amount of the premium can be determined in different ways:

- a fixed amount is fixed in local documents;

- the amount of the bonus is calculated in a certain way, for example, as a percentage of the salary or average salary;

- determination of the size by the labor participation rate: the monthly amount allocated for allowances will be distributed differently within the group of workers.

NOTE! Despite the fact that the amount for personal allowances is not limited by law, they should not be set in an amount exceeding the monthly salary. Large premiums are difficult to justify in court in the event of any disputes; there is a high probability that they will be recognized as part of mandatory payments. Practice shows that the maximum amount of a personal bonus should not be more than 50% of the salary, and the optimal amount is 10-20%.

Who is entitled to

An allowance for special conditions of municipal service is given to the following categories of civil servants:

- managers - these include the management staff of government agencies, staff and deputy managers;

- advisors are civil servants holding positions at various levels;

- specialists ensure the smooth functioning of organs by performing their functional duties;

- supporting specialists are employed in the economic, information, consulting and financial spheres.

Who gets a personal allowance and who doesn’t?

Additional personal benefits can be assigned to any full-time employee of the organization, since they are added to his salary, often calculated as a percentage of his salary. At the same time, the registration of an employee on the staff does not have much significance; the following may qualify for a personal allowance:

- an employee who has entered into a regular employment contract;

- "conscript";

- part-time worker.

It is not customary to assign personal bonus payments to the following categories of workers:

- freelancers;

- workers working under a contract;

- who have concluded civil contracts.

Remuneration under special conditions according to the Labor Code of the Russian Federation

Labor legislation provides certain rules for remuneration within limits that deviate from the norm. First of all, this concerns several of the most significant factors:

- Wages are increased. As a rule, the employer sets specific coefficients by which bonuses are calculated. Establishing additional payment to employees for work under special conditions is a mandatory requirement of the law. Typically, such allowances are calculated as a percentage of the salary portion of income. For example, many civil servants who work in special conditions that deviate from the norm receive payments in the amount of 5 to 10% of their official salary;

- Shortened retirement period. These working conditions, which deviate from the norm, provide benefits to employees in the form of a reduction in retirement experience. For example, when working in the penal system of the Federal Penitentiary Service of Russia, the preferential length of service is only 15 years. After this time, the employee receives the right to receive a pension;

- Sanatorium-resort and medical services. Special working conditions require good health. Accordingly, caring for the health of personnel is an important area of the organization’s activities. This is expressed in conducting planned comprehensive examinations of workers, providing them with vouchers, and so on.

Registration of a personal allowance

The employer is not obliged to include the terms of the personal bonus in the employment contract, since this is an incentive payment. But since this is still part of the remuneration, it must be documented. To do this, you need to regulate the personal bonus in a collective agreement or in the Regulations on remuneration and be sure to refer to this document in the text of the employment agreement (Article 57 of the Labor Code of the Russian Federation).

IMPORTANT! If the employer does not include provisions on the bonus in local documents, paying it without registration, he is not threatened with legislative liability. The only thing that can serve as a disadvantage for the employer in such a situation is that unreasonable payments cannot be attributed to expenses that reduce the tax base.

Petition and order for personal allowance

How else can you arrange the payment of a personal allowance, if not through a separate document? This may be necessary when the nature of the payments is not systematic, but one-time or calculated for a certain period. In this case, it is advisable to draw up a memo (petition) from immediate management to a higher one who has the authority to assign a bonus. This could be the general director, financial director, head of the personnel department, chief accountant, etc. In the text of the note, in addition to the mandatory details of business documents, you should indicate:

- arguments justifying the assignment of a bonus to a specific employee or their group;

- the expected amount of additional payment;

- at what expense is the premium supposed to be assigned (for example, from the wage fund or by increasing profits from sales, etc.);

- validity period of additional payments.

ATTENTION! It is not customary to formalize permanent allowances using memos. After the expiration of the specified period, you can again apply for a supplement. With this kind of document you can request the appointment, increase, decrease, extension or cancellation of a personal payment.

The compiled memo, signed by management, will become the basis for preparing an order for the calculation of the allowance. The execution of this order can be in any form. It is important to correctly motivate the appointment of additional payments, since their feasibility from a production or economic point of view is a guarantee that these costs are included in the cost of production, which is very strictly checked by tax authorities.

After issuing an order to assign an allowance, the employee must be familiar with it, which is confirmed by a personal visa (this procedure is common for any orders).

How do special working conditions differ from harmful ones? Thank you

In this case, the work must be carried out in appropriate personal protective equipment and in compliance with the regimes regulated for such work.

A harmful factor in the working environment is a factor in the environment and the labor process, the impact of which on an employee can cause an occupational disease or other health disorder, or damage to the health of offspring. Dear Natalya, the concept of special working conditions is broader; it includes, along with others, the concept of harmful conditions. Special working conditions are the following types of activities: 1) Underground work, work with hazardous working conditions and in hot shops, 2) Work with difficult working conditions, 3) Work of women as tractor drivers in agriculture and other sectors of the national economy, and also drivers of construction, road and loading and unloading machines, 4) Labor (women) in the textile industry in work with increased intensity, 5) Work as locomotive crew workers and workers of certain categories who directly organize transportation and ensure traffic safety on railway transport and subways, as well as truck drivers involved directly in the technological process in mines, mines, open-pit mines and ore quarries for the removal of coal, shale, ore, rock, etc. A complete list of activities with special conditions can be found in the resolution of the Pension Fund Board of July 31, 2006.

We recommend reading: Is it possible to apply for pension recalculation?

Important nuances of personal increases

It is important to regulate all financial issues correctly and take into account all legislative subtleties. When assigning personal increases, the employer must take into account certain circumstances:

- A correctly executed personal allowance in accounting is treated as “labor expenses”.

- The bonus is calculated simultaneously with the salary.

- This payment is included in the calculation of average earnings necessary for calculating, for example, vacation pay (Resolution of the Government of the Russian Federation No. 922 of December 24, 2007, as amended on October 15, 2014).

- If the deadline specified in the bonus regulations is violated, when the payment is unreasonably and unexpectedly terminated earlier for the employee, the employee has the right to demand additional accrual of the bonus and payment of late fees.

- If the head of a structural unit does not send a memo on time, personal payments will be stopped, because this document is the basis for issuing an order to accrue funds.

- If an employee receiving a personal allowance is transferred to another position, the right to the allowance is not retained unless it is provided for by the provisions of the new position.

- A change in the leadership of an organization may lead to changes in the provisions on personal allowances.

- A personal allowance must be reflected in the staffing table, indicating the numbers of orders for its accrual.

What kind of work is considered work at height?

B - coefficient 1.1; from 15 to 30 m when installing power networks, distribution and control equipment, electrical equipment of units and electrical machines, busbars and workshop trolleys and cable lines up to 35 kV - coefficient 1.25; for the same types of work at a height of 30 to 60 m - coefficient 1.4; from 60 to 100 m when installing distribution and control gear, electrical equipment of units and electrical machines - coefficient 1.6; for the same types of work at a height of more than 100 m - a coefficient of 1.8. When installing electrical equipment of open switchgears of 35 kV and above, the base of which is installed at a height of more than 4 m, norms and prices are multiplied by a coefficient of 1.2.