Reporting for travel expenses

The employee must be given money before the business trip. An advance can be issued from the cash register or funds can be transferred to the employee’s personal bank account. At the same time, in 1C 8.3 financial documents are drawn up in the Bank and Cash Department section:

Issue for travel expenses from the cash register

In cash documents, you need to add the Cash Issue document using the Issue button:

Let's move on to filling out the cash document. The type of transaction must be specified Issue to the accountable person:

- The number and date in 1C 8.3 are automatically set when posting a document, but can be adjusted manually;

- The recipient is a business traveler.

Details of the printed form:

- By document – employee ID data from the Individuals directory is automatically displayed;

- Reason - for what needs the funds were issued;

- Appendix – document – basis for issuing funds:

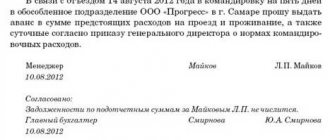

Important! Since 2012, funds for business trips are issued on the basis of an application in any form.

Enter the employee's ID data from the Individuals directory:

If you specify for the DDS item in the Cash Flow Items directory that it is used by default in transactions for issuing accountable amounts, then the DDS item in the Cash Withdrawal document will be entered automatically:

The movements of the document (posting) for issuing cash to an accountable person are standard:

A cash outgoing order in the KO2 form can be opened by clicking the Print button. Using the Print command, you can print the standard form Cash receipt order (KO2).

Transfer of travel expenses to a personal bank account

If Client-Bank is not used

We create a Payment order document on the Bank and cash desk – Payment orders tab and, based on it, we will generate a Debit from a current account document:

- The type of transaction must be indicated – Transfer to an accountable person;

- Employee – business traveler;

- Recipient – you must indicate the Employee or the Bank, depending on how exactly the funds are transferred, through the bank or directly to the employee’s current account;

- Check the Paid box.

The document Write-off from a current account in 1C 8.3 is generated via Enter a document written off from a current account:

Next, you need to check the data in the document Write-off from the current account. The Confirmed by bank statement checkbox must be unchecked and checked when the payment goes through:

If Client-Bank is used

If Client-Bank is used in 1C 8.3, then you do not need to create a Payment Order document. The document Write-off from the current account is generated on the basis of an uploaded payment order or manually. When creating manually, do not forget to set the transaction type – Transfer to an accountable person.

For the first option, you need to sort the documents in the list of payment orders using the selection fields and find the required payment order:

For the second option, use the command Write off bank statements from the document register:

Document movements Debit from current account are generated only after checking the box Confirmed by bank statement:

Business trip of one employee to 1C ZUP

I suggest you familiarize yourself with the process of traveling on official matters for one person. As a result, all actions regarding group trips in one way or another intersect with the process of booking a trip for one. I have presented the information in a table to display the essence more clearly.

| No. | Action taken | Characteristic |

| 1 | Formation in the program | Creating a document involves entering information already known to us regarding the subordinate and the trip itself. It is important to enter the period so that the machine calculates the cash payment and the month in which it will be paid. Of course, do not forget to enter the name of the person who is traveling and to whom the calculations will need to be made. Some companies prescribe exemption of wages for the period of absence of a subordinate, this is also provided for in the program |

| 2 | Information in the main | After entering the requested information, the machine itself will calculate the average income and, based on it, calculate the travel allowance, taking into account income tax |

| 3 | Payment of the money | Don’t forget to write down a clear date for your subordinate to receive money for the trip and choose one of the proposed options for transferring it:

|

| 4 | Calculation of the amount | By default, the machine contains an annual period for calculating average income, but you, in fact, have the right to change most of the initial parameters. For this purpose, in front of the average amount there is a change button that opens a form for entering new data. You check the flag for manually specifying the period and enter the one you need. When you click on recalculate, the average income will be updated based on the presence of new information entered. Next click OK |

| 5 | Adjustment of cash amounts | The Accrued field contains in detail the amount calculated by the machine, but in manual mode you have the right to adjust it. This is only available here, since it is no longer possible to change the amount in the main field |

| 6 | additional information | When filling out the form, you will be faced with additional information that the machine will require from you. Here you enter the budget item from which the money is allocated, on what basis the person is traveling and how long he will be on the road. |

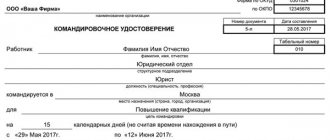

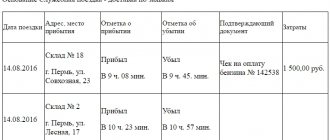

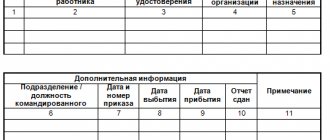

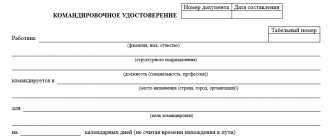

| 7 | Carrying out the operation | The business trip is carried out by machine in a standard way and you will eventually receive printed forms of documents:

|

There are a number of regions in our country where people work in which they retire earlier. So in our situation, when you send a subordinate to such a region, be sure to indicate the desired region in the territorial conditions field, which will be offered to you from the list. This action is performed in the form of Pension Fund experience.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to arrange a business trip in 1C 8.3

Upon returning from a business trip and returning to work, the employee is required to report on travel expenses within three working days.

Reimbursable travel expenses:

- Travel expenses;

- Housing rental expenses;

- Daily expenses;

- Other expenses, confirmed and economically justified.

How to fill out an advance report in 1C 8.3

To reflect travel expenses in 1C 8.3, the Advance Report document is used. The journal of advance reports is located on the Bank and cash desk - Advance reports tab:

An advance report in 1C 8.3 can be created from the Advance reports journal using the Create button:

- The reporting person is a posted employee;

- Purpose – indicate for what needs the funds were issued;

- Attachment of __ documents on __ sheets – the number of documents and their sheets attached to the expense report;

- In the Advances table we enter all the documents for which the employee is accountable using the Add command;

- Using the selection button, go to the required type of documents;

- Travel expenses are filled in on the Other tab;

- If during a business trip an employee purchased goods, packaging, or made a payment to a supplier, then these expenses are indicated on the Products, Returnable packaging and Payment tabs, respectively:

Important! You do not need to provide any documents to confirm your daily allowance expenses. For other expenses, you must have supporting documents (receipts).

If the payment is made by non-cash funds, then there must be confirmation of payment by a personal bank card, which displays the last name of the traveler.

In the Other tabular section, you must enter all the data from the reporting documents provided by the employee:

- The “SF” checkbox is set to register a received invoice or BSO, where VAT is allocated as a separate amount, for example, tickets. If VAT is not allocated, then the entire amount is included in expenses and there is no need to check the “SF” checkbox.

- The “BSO” checkbox (strict reporting form) is checked if it is necessary to register a BSO, according to which VAT is deducted and displayed in the Purchase Book.

Further in the table you can also edit accounting accounts. At the bottom of the tabular part the balance of this advance report is displayed:

The invoice received is generated automatically based on the data in the Invoice details column:

and is displayed in the Purchase Book:

Features of working with accountable persons in 1C 8.2 (8.3), how to correctly fill out the Advance report are discussed in the following video:

Over-limit daily allowance - BU, reflected in 1C

How to reflect in the accounting records of an organization and in the 1C program the payment of excess daily allowances to an employee of an enterprise - read the article.

Question : How to correctly reflect daily allowances in accounting? The director was given a daily allowance in the amount of 15,000 rubles based on the advance report. 3 days and air tickets (accommodation and flights were paid by bank transfer). Taxes were paid on the excess amount, but 1C8 takes this amount into account as a salary and is included in the payroll.

Answer: In accounting, reflect the payment of daily allowances, the reflection of the advance report on daily allowances and the accrual of personal income tax on excess daily allowances using the following entries:

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

“Cash payment systems should be used only in cases where the seller provides the buyer, including its employees, with a deferment or installment plan for payment for its goods, work, and services.

It is these cases, according to the Federal Tax Service, that relate to the provision and repayment of a loan to pay for goods, work, and services.

If an organization issues a cash loan, receives a repayment of such a loan, or itself receives and repays a loan, do not use the cash register. When exactly you need to punch a check, look at the recommendations.”

From the recommendation: Is it necessary to use cash register when issuing, receiving and repaying a loan?

Ask your question to the experts of the Glavbukh System

Debit 71 Credit 50 – daily allowances were issued to the employee;

Debit 20 (26, etc.) Credit 71 – daily allowance written off as expenses;

Debit 70 Credit 68 – personal income tax is charged on the amount of excess daily allowance.

Also read: sample order for daily allowance on a business trip 2020

In the 1C program, you need to create a separate accrual type with which you will reflect the employee’s similar income. When setting up this type of accrual, there should be a checkmark in the “Is income in kind” field.

Then the amount according to this calculation will not be taken into account by the program for payment to the employee and will not form a double entry for payroll. This amount will be used only for calculating personal income tax.

The detailed procedure for accounting for excess daily allowances in the 1C program is given below in the recommendation.

Rationale

Expenses incurred by accountable persons on business trips

Reflection in accounting of the write-off of individual expenses incurred by an employee of an organization while on a business trip upon submission of an advance report.

| № | Debit | Credit | operations |

| Accounting entries when reflecting daily allowances for business trips | |||

| 1 | 20, 26, 44, etc. | 71 | Daily allowances for business trips have been written off. The daily allowance amount is established by the organization’s local regulations |

| 2 | 70 | 68 subaccount “Calculations for personal income tax” | Income tax (NDFL) is withheld from amounts of excess daily allowance from the employee. The norms within which daily allowances are exempt from taxation by personal income tax are established by paragraph 3 of Article 217 of the Tax Code of the Russian Federation |

We take into account above-limit daily allowances in the 1C program

Dear readers! We continue the conversation about how to implement the features of accrual and payment of various amounts in 1C programs. This time we will talk about withholding personal income tax from amounts exceeding the daily allowance.

The accountant uses two programs in his work - “1C: Salary and Human Resources Management” (release 8.2) and “1C: Accounting” (release 8.2).

When uploading data from the 1C: Salary and Personnel Management program to the 1C: Accounting program, the amount of daily allowance paid in excess of the limit is doubled in the 1C: Accounting program.

In addition, the said amount is due to the employee to be paid in person, although he has already received the daily allowance.

How to make adjustments in the 1C program to get rid of doubling the amount?

This question came from our reader via email from Zarplata magazine.

Accrual in the 1C: Accounting program

Before a business trip, the employee receives a daily allowance in advance. In the program, the accountant makes the appropriate posting:

— DEBIT 71 CREDIT 50 — funds were issued to pay the daily allowance (for the days of stay on a business trip). In this case, the entire amount of daily allowances issued is entered (without breaking down into daily allowances within the limit and daily allowances above the limit).

Upon returning from a business trip, the employee will submit an advance report, on the basis of which the accountant will write off the amount of daily allowance by posting:

— DEBIT 26 CREDIT 71 — reflects the organization’s expenses for the payment of daily allowances.

ACCRUALS IN THE PROGRAM “1C: SALARY AND PERSONNEL MANAGEMENT”

The accountant needs to calculate the amount of personal income tax on daily allowances paid to an employee in excess of the limit (clause 1 of Article 224 and clauses 1 and 4 of Article 226 of the NKRF) 1C daily allowance amounts not exceeding 700 rubles. (for business trips within the country) or 2500 rubles. (for business trips abroad), personal income tax is not withheld (paragraph 10 p.

3 tbsp. 217 NKRF). — Note. ed.. This must be done on the day the advance report is approved. When issuing funds to an employee on account, the organization does not withhold personal income tax from the amount of daily allowance exceeding the established standard.

The fact is that until the approval of the advance report, the funds issued to the employee from the cash register for travel expenses for travel expenses are the employee’s debt to the organization and cannot be recognized as income received by the employee, included in the tax base for personal income tax (clause 1 of Article 210 of the NKRF) . posted worker.

WHAT HAPPENS WHEN DATA IS UPLOADED

So, on the day the advance report is approved, the excess daily allowance must be registered in the employee’s personal income tax base in the 1C: Salary and Personnel Management program.

The program must calculate the tax and generate transactions.

At the same time, if in the payroll calculation program, in addition to transactions for withholding personal income tax, transactions are generated for accrual of the amounts of excess daily allowances themselves, when uploading data from this program to the 1C: Accounting program, the amount of daily allowance will be doubled precisely in terms of accrual of daily allowances exceeding the limit ( that is, the excess amount will double).

In addition, the amount of daily allowance payable to the employee will double (since the posting will be unloaded, which will turn out to be superfluous).

HOW TO SET UP THE 1C PROGRAM

To avoid doubling the amount, you need to set the settings correctly in the 1C: Salary and HR Management program. It's easy to do.

It is necessary to create a separate accrual type with which you will reflect the employee’s similar income. When setting up this type of accrual, there should be a checkmark in the “Is income in kind” field. Then the amount for this calculation will not be taken into account by the program for payment to the employee and will not generate a posting.

This amount will be used only for calculating personal income tax (Fig. 1).

Rice. 1

On the “Taxes” tab there should be a personal income tax code (Fig. 2).

Rice. 2

Amounts in excess of the excess daily allowance are registered in “1C: Salary and Personnel Management 8” using the document “Registration of one-time accruals for employees of organizations.”

In this case, the mentioned excess amount in mutual settlements with the employee for payment of wages will not be registered.

This type of accrual will only register income for calculating personal income tax, which will be taken into account when calculating wages using the document “Payroll for employees of organizations” (Fig. 3).

Rice. 3

In the payslip, accruals with the established attribute “Is income in kind” will be displayed in a separate section (Fig. 4).

Rice. 4

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

“Cash payment systems should be used only in cases where the seller provides the buyer, including its employees, with a deferment or installment plan for payment for its goods, work, and services.

It is these cases, according to the Federal Tax Service, that relate to the provision and repayment of a loan to pay for goods, work, and services.

If an organization issues a cash loan, receives a repayment of such a loan, or itself receives and repays a loan, do not use the cash register. When exactly you need to punch a check, look at the recommendations.”

From the recommendation: Is it necessary to use cash register when issuing, receiving and repaying a loan?

Accounting for travel expenses in 1C 8.3

You can check the status of settlements with a traveler in 1C 8.3 using the Account balance sheet report:

Using this report in 1C 8.3, you can reconcile mutual settlements with an employee for travel expenses, as well as for all accountable amounts:

Return of unused funds

To return unused funds issued for travel expenses, in 1C 8.3 it is necessary to create a Cash Receipt document based on the advance report:

In the created document you need to check the data:

Overexpenditure of funds used

For overspending in 1C 8.3, you need to create a document Cash Withdrawal or Debit from Current Account, as described earlier in the Bank and Cash Department section.

The procedure for entering an Advance report on travel expenses (per diems, travel, accommodation), and the specifics of accepting VAT for deduction on travel expenses are discussed in more detail in our course on working in 1C 8.3 Accounting in the module Settlements with an accountable person. For more information about the course, watch the following video:

Give your rating to this article: (

1 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Algorithm for issuing funds

Remember I told you about the procedure for issuing travel allowances. So, when the method of payment in salary or advance is selected, travel allowances for the team of subordinates will also be displayed in the general statement for such payments.

But in the situation of choosing an intersettlement payment period, automatic calculation occurs after you decide on one of the options:

- By generating a new salary slip, a payment window will appear where you should indicate the payment for business trips based on the document of the same name. The machine itself will open the proposed amount for you, and you, in turn, continue to act according to the standard payment scheme.

- The second method requires you to pay from the business trip field. Here the salary payment window is displayed, which already includes travel allowances. The paper on the basis of which such issuance of money is carried out is, as usual, a statement to the cashier or bank. It all depends on how the work on settlements with personnel is organized in your company or for a certain circle of people. It is not surprising that statements are subject to adjustment and after checking it, all you have to do is post it and close it.

Alternative to monetary documents

As part of the integration with the Smartway service, starting from version 3.0.65 in 1C: Accounting 8 CORP (starting from version 3.0.68 in 1C: Accounting 8), the following changes occurred:

- A new program object has appeared - Ticket (an element of the Tickets directory), which is an alternative to a monetary document (Fig. 3).

Rice. 3. New program object - “Ticket”

- In the program’s chart of accounts, a new subaccount 76.14 “Purchase of tickets for business trips” has been opened to account 76, which is intended to account for tickets purchased by the organization for business trips in the currency of the Russian Federation. Analytical accounting is maintained for each seconded employee (subaccount Employees of Organizations

) and ticket (subaccount

Tickets

). Each employee is an element of the Individuals directory, and each ticket is an element of the Tickets directory. - In the Advance Report

a separate tab

Tickets

, which displays a list of tickets purchased for an accountable person (electronic ticket details can now be specified in one resource instead of four). Tickets are automatically downloaded from the Smartway service, which supplies all the necessary information on dates and amounts, including VAT (Fig. 4). Thus, the cost of travel is included in expenses on the date of the advance report.

Rice. 4. Reflection of tickets in the advance report

Please note that access to tickets is only possible if integration with Smartway is enabled (tickets are hidden without Smartway).

Calculation of business trips in ZUP 3.1 based on average earnings

To calculate the average earnings, we take the last 12 months. When it becomes necessary to view or adjust the average earnings calculation, you can use the “Change average earnings calculation data” button:

Fig.7 Checking the calculation of average earnings

To display the average salary for the period manually, enter the required dates, click “Set manually” and “Recalculate”.

Filling out the “Business trip” document

The accrual will be reflected in the month indicated in the header of the document. For output to printed forms, the date and document number are used. The number is generated automatically when recording a document. The organization prefix is added to the beginning, then the base prefix and the actual next sequential number. Prefixes are set for the convenience of distinguishing documents entered in different organizations or databases.

If prefixes are not specified, then when generating the number, zeros are set instead. To calculate, you must indicate the start and end of the trip. This period includes the days the employee is on the road. Travel allowances in 1C ZUP 8.3 are paid for days or hours that are working hours, according to the schedule established by the employee.

When maintaining the staffing table in the ZUP, by checking the appropriate box, you can release the rate for the period of absence of the employee. In this case, in staffing reports, the rate will be shown as free, and it will also be possible to hire another employee at this rate.

If a business trip is issued to an employee who is employed in the organization at the main place of work, as well as part-time, it is required to register the absence of all the employee’s jobs. To do this, the document form contains a link “Absences from other places of work.”

Fig.4 Rate exemption when calculating travel allowances in ZUP 3.1

In case of a long business trip, you can choose different types of payment:

- Pay immediately and in full – payment will be fully charged in the current document;

- Pay for your stay on a business trip monthly.

Fig.5 Payment for long-term travel allowances in ZUP 8.3

The document is calculated automatically. If automatic recalculation of documents when editing them is disabled, then to calculate the document you must manually click the arrow button. The yellow color of this button indicates that the document has not been recalculated in accordance with the changes made to it. The calculation results area shows a summary of the calculations for this document. This data is provided for viewing purposes only.

If you need to view or edit detailed records of accruals or recalculation, use the “Accrued (detailed)” tab:

Fig.6 Result of accrual of travel allowances

According to the conditions specified on the “Main” tab, the accrual for payment of a business trip is calculated: the number of paid days or hours of a business trip is multiplied by the average daily or average hourly earnings.

Business trips are paid by the hour for employees with a schedule of summarized working hours or by day from the average daily earnings.

Work with the calculation results is carried out in the same way as with “Calculation of salaries and contributions”.