Was your travel permit canceled or not?

As of January 8, 2015, as a general rule, drawing up a travel certificate is no longer required (Resolution of the Government of the Russian Federation dated December 29, 2014 N 1595). Taking this into account, the question of whether a travel permit is needed in 2020 should be answered in the negative.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Ask a Question

According to Article 22 of the Labor Code, the employer also has the right to independently develop the enterprise’s personal identification document, including regulations on business trips, which may provide for the preparation of certificates in the recommended T-10 form or in its own sample. At the same time, it remains mandatory for employees to prepare expense reports in order to confirm expenses incurred and submit primary documents on expenses (invoices, checks, receipts, tickets, etc.).

Despite the fact that the travel permit was canceled in 2020, control authorities do not recommend that enterprises rush to abandon their use. And here are the reasons. This document (along with the expense report) was necessary, first of all, to confirm the validity of the expenses incurred. Indeed, according to Article 252 of the Tax Code, the taxpayer has the right to legally reduce the income received for expenses, provided that they are justified and documented.

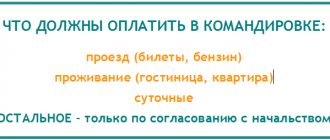

If we are talking about business trips, then the costs include both daily allowance and payment for travel, accommodation and other expenses associated with the trip. The main source document for confirmation remains the expense report. However, in the absence of a certificate, you will need to attach to it indirectly confirming the fact of the trip - an order from the head on a business trip and travel cards (clause 2 of Article 252 of the Tax Code). The actual period of stay of a specialist on a trip is confirmed on the basis of travel documents, and if they are lost, by documents on rental housing (clause 7 of Resolution No. 749). In the absence of hotel documentation, a memo or other document with notes from the host party will be required.

On a business trip on official transport: design features

The rules do not specify how to confirm the days an employee was on a business trip if he goes on a business trip on official transport, or how to confirm that he was on a business trip if he has no travel documents at all.

Employers themselves determine the amount and procedure for reimbursement of expenses related to business trips in local regulations or collective agreements, unless otherwise provided by the regulations of the Russian Federation (Article 168 of the Labor Code of the Russian Federation). This means that in all other cases (except for those when the employee goes on a business trip, he has tickets or he goes on a business trip by personal transport), the employer has the right to determine how the employee’s time on a business trip will be determined and on the basis of what documents this will be carried out.

If an employee goes on a business trip on a company vehicle and is driving himself, an official note with a waybill attached will confirm the fact that he is on a business trip.

If several employees go on a business trip with a driver at the wheel, you can write in the manager’s order that the employees go on a business trip on a company bus. In this case, in the application for payment of travel expenses, it can be stipulated that upon returning from a business trip, employees are required to draw up a memo. In the memo, employees will record to the employer which bus they took on their business trip, when they left and when they returned. The memo and waybill will serve as confirmation of the number of days the workers are on a business trip. Such document flow should be specified in local regulations.

https://youtu.be/MylTAfHDUcM

Mandatory documents

According to current laws, registration of a business trip begins with management making an appropriate decision and documenting it in the form of an order containing the following mandatory items:

- The name of the document, its number and date of publication.

- Name of the enterprise that issued the document.

- Personal data of the traveler, his position.

- Destination of a business trip.

- Start date and duration of the business trip.

- Purpose of the trip, official assignment.

- The traveler’s method of travel (personal, official or public transport).

- Identification of the person or organization bearing the travel expenses.

This is also important to know:

How to restore a work book if lost, independently or through government agencies

The next required document is the employee’s advance report on the funds spent. Within three days from the end of the business trip, the employee is required to submit a report to the organization paying for the business trip, accompanied by documents confirming the business trip.

On December 29, Decree of the Government of the Russian Federation dated December 29, 2014 No. 1595 on the abolition of travel certificates was signed. The document came into force on January 8, 2020.

Let's figure out how to arrange a business trip without a travel certificate.

From January 8, 2020, travel documents can be used to confirm business trips and expenses. To travel abroad, stamps in your passport are also required. If the employee travels by personal vehicle, he will have to write a memo in any form, to which must attach documents about the use of the car on the trip (gas station receipts, toll road payment receipts and other similar documents).

In addition, as of January 8, 2020, the requirement to draw up a work assignment and a report from the business traveler on the work performed has been abolished.

Here is a list of documents required to apply for a business trip in 2020:

1. Order to go on a business trip

2. Log book for posted employees (check the boxes)

3. Time sheet (check marks)

4.Employee advance report

5. Employee’s official note (if he is driving a personal car)

Before an employee leaves on a business trip, fill out an order

The order indicates the full name and position of the employee, destination and duration of the business trip. Please note: you can use form T-9a, only it needs to be modified by excluding from it the mention of the official assignment (second line from the bottom).

Record the fact that an employee goes on a business trip in the log book of business travelers and the time sheet

First of all, the fact that an employee is leaving on a business trip must be recorded in the logbook of posted employees. The form of this document is established by order of the Ministry of Health and Social Development of Russia dated September 11, 2009 No. 739n. And it's easy to fill out. It indicates the employee’s full name, the name of the organization to which the employee is being sent, and the destination. Since a travel certificate is no longer issued, dashes must be added in the certificate column. Soon the Ministry of Health will approve a new form of the document, but for now you need to use the old one.

In addition, business trip days must be noted on the timesheet. The absence of an employee due to a business trip is indicated by code K. In this case, the number of hours worked does not need to be indicated.

If an employee on a business trip was involved in work on a day off from his main place of work, then such a day must be shown in the report card with two codes at once - K and RV. This will mean that the employee worked on a business trip on a day off.

It is necessary to indicate the number of hours worked on such a day if the employer gave instructions on the duration of work on a day off. It is clear that you need to pay for work on such days at double rates (Article 153 of the Labor Code of the Russian Federation).

After the employee returns, receive from him documents confirming expenses

After the employee returns from a business trip, you need to draw up an advance report on the amounts spent on the business trip (Form No. AO-1). The document indicates how much money was spent on the business trip. Please note: it is mandatory to fill out an advance report in 2020. This requirement has been retained in the procedure for sending employees on business trips.

Supporting documents (checks, contracts, receipts, transport documents, etc.) must be attached to the report. Next, the employee must submit an advance report to the accounting department. And based on this set of documents, business trip expenses incurred can be reflected in accounting and tax accounting.

How to confirm expenses after canceling a travel permit in 2020

So, travel certificates have been canceled in 2020. But this does not mean that other documents are no longer required to confirm expenses and the actual time an employee spends on a business trip.

The actual length of stay of the employee at the place of business trip is determined by travel documents presented by the employee upon return from a business trip.

If an employee travels to the place of business trip and (or) back to the place of work by personal transport, the actual period of stay at the place of business trip is indicated in the memo. The service note must be filled out in any form and submitted upon return from a business trip to the employer along with supporting documents confirming the use of the specified transport for travel to the place of business trip and back (waybills, invoices, receipts, cash receipts, etc.). That is, the memo must be attached to the expense report.

When traveling abroad, the travel time is determined by the marks in the passport (make a photocopy and attach it to the advance report). When sending an employee on a business trip to the territory of member states of the Commonwealth of Independent States, the date of crossing the state border of the Russian Federation will be determined by travel documents (tickets)

Subscribe to our newsletter

LiveJournal

How to confirm the fact of a business trip after cancellation of a travel certificate

The main function of a travel certificate under the previous legislation was to confirm the time an employee spent on a business trip. Based on this document, the daily allowance paid to the employee was calculated. Currently, since travel certificates were abolished in 2015, the documents confirming the length of stay of an employee on a business trip are travel documents, which the employee is obliged to hand over to the employer upon returning from a business trip (clause 11 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 N 749 (hereinafter referred to as the Regulations)).

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

Recognizing travel documents as the main primary documents that confirm the duration of an employee’s stay on a business trip, the legislator nevertheless does not exclude in paragraph 11 of the Appendix the possibility of confirming the fact of being on a business trip with other documents (in the absence of travel documents).

In particular, other documents instead of travel cards can be used in the following cases:

- if the employee did not purchase transport tickets and he went on a business trip using official or his own transport, the actual duration of the business trip is indicated by the employee in a memo, to which the employee attaches supporting documents (waybills, invoices, cash receipts, etc.);

- in case of loss or absence of travel documents for other reasons, the period of the employee’s stay on a business trip can be confirmed by documents for the rental of residential premises (a receipt (coupon) or other document issued by the hotel).

In a situation where the employee does not have both travel documents and documents confirming accommodation in a hotel or other residential premises, the period of stay on a business trip is determined on the basis of an internal memo and (or) other document in which the organization to which the employee was sent confirmed the terms his arrival and departure.

Why do you need a travel permit?

Do I need a travel permit? As was said, the company has the right to apply this document. The receiving party where the employee is sent on a business trip must fill it out.

A travel certificate can help confirm the feasibility and economic justification of a business trip. However, when checking expenses, the tax office will check the connection between travel expenses and activities aimed at generating income. you cannot such expenses even with a completed travel certificate.

Registration of business trips using a travel certificate today is an internal control tool. He confirms that the employee was actually in the organization to which he was sent. For example, I went to a business forum in another city. Stamps on the travel document of the forum organizer and the dates of arrival and departure will confirm the fact of his presence at this event.

List of sources:

- https://spmag.ru/articles/otmena-komandirovochnyh-udostovereniy

- https://ppt.ru/forms/komandirovka/udostoverenie

- https://glavkniga.ru/situations/s502385

- https://znaybiz.ru/kadry/rezhim/komandirovki/otmena-udostoverenij.html

- https://www.law-education.ru/staff/otmena-komandirovochnogo-udostovereniya/

- https://exchangeee.ru/vash-yurist/nuzhno-li-komandirovochnoe-udostoverenie-v-2016-godu

- https://rg.ru/2015/01/13/komand-site.html

- https://www.tk-legal.ru/page/268/

Subscribe to the latest news

What documents confirm the terms of the business trip?

In 2020 and in 2020, travel certificates are not required. The government has canceled travel permits. And now there is no need to write them out. And expenses are confirmed by other documents (receipts, tickets, etc.). If we are talking about business trips, then the costs include both daily allowance and payment for travel, accommodation and other expenses associated with the trip. The main source document for confirmation remains the expense report.

Any business trip, be it long-term or short-term, must be properly arranged and paid for. Recently, employers who regularly send staff on business trips have had fewer headaches - some of the documents that were previously considered mandatory have been abolished.

A travel certificate is a standard form of paper confirming the fact that an employee is working on a business trip, as well as a valid reason for his absence from the workplace.

How to keep records of posted workers

The abolition of travel certificates in 2020 means that now, when sending an employee on a business trip, the employer is not required to issue one. We are talking not only about the cancellation of a travel certificate - the obligation to draw up an official assignment and a report from the posted employee on the work performed has also been cancelled.

The travel certificate was canceled by Decree of the Government of the Russian Federation of December 29, 2014 N 1595. What documents are considered mandatory for a business trip. What to provide to the employer instead of a travel document to confirm the trip.

Why is this possible? The Government Decree, as already mentioned, does not prohibit the use of forms, and many accountants believe that the use of these forms is very effective for reflecting the employee’s expenses and monitoring the implementation of the tasks assigned to him (in particular, the fact of being at the destination). Its preparation is not required by law, but internal, local regulations at the enterprise can approve these forms for official travel, and in this case, all employees of this organization must use them.

In 2020, the travel certificate was canceled: what to do now, how to switch to the new business trip registration scheme and what documents to require from the employee upon returning from a trip, read the article.

Do you need a travel permit in 2020? The form was canceled, but it was not prohibited from being used if the manager officially included the form in the accounting policy of the enterprise.

Not official reports and travel certificates are considered as supporting documents, but receipts, checks, contracts and receipts issued to the employee during the trip.

We deal with questions regarding the use of an online cash register. Sometimes it can be difficult to independently understand the intricacies of “cash” legislation. For example, is it necessary to issue a check if an individual pays for a legal entity and vice versa? At the same time, it remains mandatory for employees to prepare expense reports in order to confirm expenses incurred and submit primary documents on expenses (invoices, checks, receipts, tickets, etc.).

Is it necessary to obtain a travel permit in 2019?

A travel certificate delegates certain official powers to the employee and is a valid reason for his absence from the workplace.

If the duration of the trip is no more than one day, a travel certificate is not issued.

Previously, it was required to issue certificates for all posted workers without exception. The tax office might not accept a document with violations, which led to a refusal to account for the corresponding expenses. In January 2020, some changes were made to labor legislation. In particular, Russian Government Decree No. 1595 dated December 29, 2014 excluded the mandatory issuance of travel certificates. The innovation is designed to simplify document flow and make it easier for employees on business trips.

Thus, travel certificates are no longer mandatory. Payment and accounting for business trips can be carried out on the basis of other documents, for example, travel tickets indicating the days of departure and arrival. However, these changes are rather advisory in nature. If it is more convenient for an organization to keep records according to the old rules, then no one can force it to change the usual order. It should be taken into account that the receiving party has the right to refuse to put marks on the certificate of the arriving employee.

Previously, a business trip was considered a trip by an authorized employee for more than 1 day. In this case, the maximum duration of the trip should have been no more than 40 days. After adjustments were made to the current regulations, making the travel certificate an optional document, all restrictions regarding the duration of travel on official business were abolished. Thus, in 2020, the duration of a business trip directly depends on production needs and is determined personally by the head of the enterprise or his deputies. If necessary, the period of a business trip can be extended several times.