Payment payment payment payment

The words “supplement” and “addition” have the same root, but differ in prefixes, which means they do not have the same meaning: the word “supplement” means something that is added to something (for example, food additives, ask for more at lunch);

the word “increase” means “increase in quantity, size, strength: “get an increase in salary,” but you cannot say “get an increase in salary.” Paronyms include not only words with the same root, but also words that have different roots, but are similar in sound: excavator (machine for extracting pounds) - escalator (continuously moving staircase), turkey (bird) - Indian (representative of India). Confusion when using paronyms can make a statement appear absurd. For example: “Coming out of the subway, I: climbed on an excavator”; “At an evening dedicated to Indian culture, I met a beautiful Indian.” In artistic speech, paronyms and words that sound similar perform different stylistic functions. The use of paronyms opens up great opportunities for conveying subtle semantic differences: “And there was beauty in her with interest, but beauty was lacking”;

enhances the effectiveness of speech:

A demon, evil, sinister, malevolent, suddenly appeared before her.”

pay - pay - pay - repay - pay

Pay - pay - pay - repay - pay. Pay (what?) – 1) Give payment for smth. Pay wages. 2) Repay the debt, loan in parts or in full. Pay compensation for unused vacation. Pay (for something) – 1) To make a payment for something, in compensation for something. Pay a fine to the traffic police. 2) transfer Commit, do something. in response to smb. action; repay. Pay for the deception. Pay (what?, whom?) Pay for something. Pay for the work. || Pay someone. Pay workers. 2. what to whom. To pay in repayment of something. Pay expenses…–– Pay . To pay for sth.; pay. Pay the membership fee. The invoice has been paid in full. Payment - payment - payment - payment. Payment (what? – 1) Action according to value. verb: to pay. Payment of remuneration. 2) conversational. Paid amount. Debt payments were meager. Payment (what and for what). 1. what (in the meaning of action). Payment of workers. Payment of business trip expenses. 2. for what (money paid for something). High pay for urgent work. Piecework wages. Payment – 1) a) Remuneration for labor, service, etc. services, etc.; wage. b) transfer Retribution, reward for smth. Paying evil for good. 2) Reimbursement of the cost of what was received or used; what is being reimbursed. Depositing money for smth.; payment . Payment for travel. Service fee. Payment. 1) Action by value. verb: to pay. Payment of taxes for individuals 2) colloquial. Payment, monetary compensation for smth.

“Disney” - Disney received his last Oscar three years after his death for the short cartoon “Winnie the Pooh and the Stormy Day.” In his extremely busy life, Walt Disney, as a director, made 111 films and was a producer of another 576 films. Disney's awards are not limited to just Oscars.

We recommend reading: Judicial practice of bankruptcy of a citizen

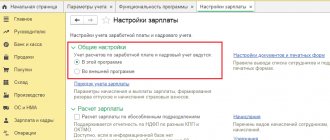

Absence with payment retained

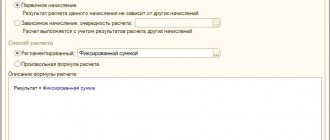

After applying the setting, one such accrual becomes available - Payment for days of donating blood and its components

.

Accruals for other types of absences, for example, during medical examinations, advanced training outside the main job, etc., are entered only directly into the list of accruals - there are no settings for their automatic creation. Document Absence with retention of payment in the application solution ZUP 3. 0/3. 1 is intended for recording various employee absences, during which he retains his average earnings, and calculating their payment based on average earnings in accordance with the law. If, during the initial setup of the program, the option to register intra-shift payment for days of blood donation was selected, then the Absence for part-time (intra-shift)

. Setting it allows you to specify the period of absence not in whole days, but in hours within the selected day.

The checkbox is also available if any accrual with the purpose Payment for time of saved average earnings

and the selected switch

Partial shifts

on the

Time tracking

. If, according to the employee, work is planned for different types of hours on this day (for example, during the day and at night), then you can clarify exactly how long the employee’s intra-shift absence will be. This will allow you to correctly calculate payments for different types of time.

Payment payment payment payment

Steiner's payment Any manager works in accordance with the motivation system that is provided for him. The work of Heinrik Steiner is a prime example of this concept at work. Remember, Steiner's variable pay depends only on sales growth.

87. Payment for travel Expenses for travel to the place of business trip and back to the place of permanent work are reimbursed to the posted employee in the amount of the cost of travel by air, rail, water, and general road transport, including insurance

Procedure for payment of wages: advance payment is required

The Labor Code of the Russian Federation establishes the obligation of the employer to pay wages to employees at least every half month (Article 136 of the Labor Code of the Russian Federation). It should be noted that the Labor Code does not contain such a thing as an “advance” at all: according to its wording, this is wages for the first half of the month. And the widely used concept of “advance” came from a Soviet-era document, Resolution of the USSR Council of Ministers dated May 23, 1957 No. 566 “On the procedure for paying wages to workers for the first half of the month,” which is still in effect to the extent that does not contradict the Labor Code of the Russian Federation. Therefore, to make it easier to understand, in this article, advance means wages for the first half of the month.

The conditions for paying wages in non-cash form must be specified in the collective agreement or employment contract with the employee. For the convenience of transferring wages, many employers enter into appropriate agreements with banks for the issuance and servicing of salary cards for employees. This allows the entire amount of wages to be transferred in one payment order with a register attached, which specifies the amounts to be credited to the card account of each employee.

The procedure and terms for payment of wages according to the Labor Code of the Russian Federation

It should be noted that a situation can often arise when working with credit organizations that the employee cannot receive his salary directly on the day it is accrued. In this case, if the delay in payment was not due to the fault of the employer and the necessary funds were sent from his current account to the accounts of employees or a credit institution, the employer is not responsible for late payment of wages.

- Article 131. It determines the possible form of salary payment. In particular, it establishes the obligation to pay wages to employees only in the national currency of the Russian Federation or with reference to it, if the payment is made partially in kind in non-monetary form.

- Article 133. Indicates that wages must comply with established minimum wage standards.

- Article 133.1. It assumes the possibility of establishing separate minimum wage standards for workers in various constituent entities of the Russian Federation, provided that regional standards are not lower than federal ones.

- Art. 135. Regulates the general principles of establishing wages for an employee in accordance with the wage system adopted by the enterprise.

- Article 136. Its standards generally consider the procedure, place, and timing of payment of wages by the employer and contain basic standards that both the employee and employees should first be aware of.

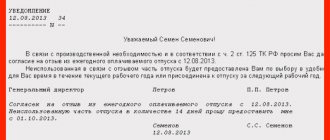

The employee verbally agreed to take time off.

Often employees verbally agree with their immediate superiors that they will not come to work. As a result, the head of the department may not even know that the subordinate is absent from work for a valid reason. However, from the point of view of the judges, such a failure to appear is justified and the employee cannot be punished for it (appeal ruling of the Supreme Court of the Republic of Buryatia dated February 4, 2013 in case No. 33–3678).

The company’s reference to the fact that the employee did not write an application for time off may also not work. Especially if your company has developed the practice of providing time off - without issuing an order and at the oral request of employees (appeal ruling of the Supreme Court of the Republic of Sakha (Yakutia) dated September 26, 2012 in case No. 33-3275/12).

At the same time, sometimes the absence of a written application for time off proves absenteeism. But it is still impossible to fire him if the absenteeism was the result of a misunderstanding between the manager and the employee, who believed that the right to time off was verbally agreed (ruling of the St. Petersburg City Court dated November 14, 2011 No. 33-16842/11).

Questions and answers on the topic

Payment of wages 2 times a month

Article 136 of the Labor Code establishes the terms within which an enterprise is obliged to pay wages to hired personnel. At the legislative level, the employer is required to pay wages at least twice a month.

The law establishes a deadline for transferring the amount of personal income tax from the earnings of employees of organizations to the budget - payment must be made no later than the day following the issuance of wages (or other income). It would be logical to assume that according to the new rules, the employer will have to pay personal income tax twice a month - after making the advance and remaining payments. But, guided by the Letters of the regulatory authorities, deductions of tax amounts on the income of employees need to be made only after the final settlement of wages with employees, that is, once a month.

We recommend reading: Donation agreement between commercial organizations consequences

How to pay housing and communal services through Sberbank online

For the convenience of using the service, Sberbank also has such a function as “Autopayment”. The manual states that the subscriber selects a payment date, and according to it, every reporting period on the same day, funds are transferred from the subscriber’s account to pay utility bills. At a certain time, the bank informs the client that funds will be debited from his account in a day. Thus, there are no problems if the subscriber forgot to pay for the service.

Time flies very quickly, so people strive to take care of their years and not waste them, languishing in line at the department to pay for “utilities”. Many people use self-service terminals for these purposes. Such devices are available almost everywhere: in stores, shopping centers, post offices, not to mention the banks themselves.

We recommend reading: Meals in Moscow Schools Cost

Remuneration according to the Labor Code of the Russian Federation

In addition, the clause of the employment contract concerning the terms of remuneration must necessarily contain information about the form in which remuneration is made: in monetary form or in a combination of monetary and non-monetary forms. A condition must also be specified regarding the form in which payment is made - in cash, that is, through the cash desk of the enterprise, or by transfer to the employee’s bank account.

According to the general rule established by Article 136 of the Labor Code of the Russian Federation, wages are paid to the employee at the place where he performs the work or transferred to the bank account specified by the employee under the conditions determined by the collective or labor agreement.

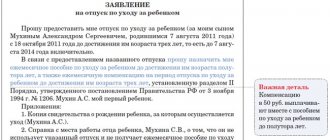

The employee performed government duties: when and what payments he was entitled to

Please note that in cases where the employer pays for the period when an employee performs government duties, the average salary must be paid for working days falling within the period specified in the supporting document from the government agency. If the employee still managed to work on one of these days, then he is paid for his work time in the usual manner. Sometimes one of the employees has to be absent from work for a very good reason - in connection with the performance of one or another state duty. This, in particular, may be a summons to court or to the prosecutor's office as a witness, victim, attesting witness, etc. As you may have noticed, in cases where the average salary of an employee is paid by the employer, the payment is made at the main place of work. What if a part-time employee is involved in the performance of government duties?

This is what the Rostrud specialist answered us. As for “profit accounting,” the amounts paid to the employee are taken into account in labor costs, except in the case where the employee was called to military training. Then these amounts must be taken into account when accruing in expenses, and after receiving compensation from the budget - in income

Payroll fund in 2020

Try it for free! Advanced training course “Documentation support for work with personnel.” Complies with the requirements of the professional standard “Human Resources Management Specialist”, for completion - a certificate of advanced training. The training materials are presented in the format of visual notes with video lectures by experts, accompanied by ready-made document templates that you can download and keep for your work.

The wage fund is an amount that takes up a significant part in the cost of production, so forecasting its value plays an important role in annual budgeting. It allows you to analyze salary expenses both for the organization as a whole and in the context of individual structural divisions and departments.

Wage

The employer notifies each of his employees in writing about the payment of wages, including the amount of wages accrued to him, its components, the amount of deductions and the amount to be received. Payment of wages is carried out either at the place of work, or by transferring funds to the employee’s bank card. Payment conditions are established by a collective or individual employment contract.

Any accruals, be it wages, vacation pay, bonuses and other payments, are made on the basis of local regulations. Salaries are calculated according to salaries, tariff rates, taking into account additional payments for deviations in working conditions, night work, overtime, piecework rates, payment for forced downtime due to the fault of the employer, and the like.

Personal income tax from salary - calculation, deduction, payment

- The rate for Russian residents is 13 percent, for non-residents – 35 percent;

- The tax base for residents is considered to be a cumulative total from the beginning of the year; for non-residents, the cumulative total is not applied;

- Child deductions continue to apply to children up to 18 years of age, and if studying full-time - until 24 years of age or completion of studies. Additional deductions for disabled children are added to the standard deduction;

- The amounts of standard deductions for children in 2020 are 1,400 for the first and second child, 3,000 for the third, fourth and subsequent children, 6,000 additional for children with disabilities, provided to the guardian or adoptive parent, 12,000 additional for children with disabilities, provided to the parent.

Wages are the income of an individual, from whom income tax must be paid at the rate established by the Tax Code of the Russian Federation. The calculation and payment of personal income tax in this case is the responsibility of the employer, not the employee. The latter receives his income minus withholding tax.

To whom and when is it due?

In the vast majority of cases, the right to be absent from the workplace without pay is granted by agreement of the parties. Is it possible to take a vacation at my own expense without notifying my manager? This should not be done, as the boss may regard this as absenteeism and fire the employee.

There are certain categories of workers who, according to the law, are entitled to a specific number of days of unpaid rest per year:

- participants of the Great Patriotic War – up to 35 days;

- pensioners who continue to work – up to 14 days;

- spouses of military personnel, police officers, fire department workers who died from wounds or shell shock;

- disabled people who are employed – up to 60 days;

- for any employees if the reason for the leave was the birth of a child, marriage, or the passing of a relative - up to 5 days.

In the listed situations, the manager is obliged to provide the number of days specified in the legislation.