Home » Human Resources Department » Is studying at a vocational school included in the length of service and where is it noted?

Whether study at a vocational school is included in the length of work experience is not a rhetorical question, since the length of work experience directly affects benefits and the calculation of pensions. In connection with regular changes in labor legislation, one can often hear an ambiguous and pressing question: whether study at a vocational school or university is included in the work experience . In the Soviet edition of the Labor Code, the answer was clear: all periods of training were included in the total length of service and did not interrupt it. However, today such a characteristic of length of service as continuity no longer applies; there are only insurance periods. So how do HR officers now calculate experience?

How to process pension accrual taking into account the time spent studying at a technical school

The law allows the conclusion of an employment contract upon reaching 14 years of age, that is, from the moment of receiving a civil passport.

On this basis, when providing independent financial support for a child who has reached the age of 16, it is possible to declare himself fully capable. The procedure is governed by the rules on the recognition of early emancipation. In this case, the citizen is assigned the rights and responsibilities as an adult who has reached the full age of 18.

When concluding an employment contract, a 14-year-old citizen has the right to manage contributions to extra-budgetary funds independently by appointing an organization to which insurance premiums will be transferred.

The pensioner, first of all, will need to document his work experience. For this purpose, he should prepare the following documents:

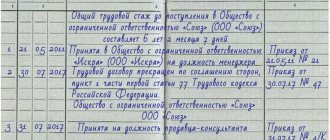

- Employment history. It is the main basis by which pensions are calculated. If the pensioner studied at a technical school before 2002, then the corresponding notes are available in this document. Providing your work record book to the Pension Fund is a mandatory condition for recalculating your pension.

- If for some reason a pensioner cannot provide a work book, then he is obliged to confirm his work experience with the help of certificates and extracts from places of work.

- Other documents providing information about the pensioner’s work experience.

Thus, the question of whether studying at a technical school is included in the length of service for calculating a pension is closed, as we can judge from the provisions of modern legislation. However, if training at a technical school took place before 2002, then a citizen can take advantage of this to increase his insurance pension. Unfortunately, modern students do not have such a privilege.

The time spent in training is included in the work experience, which is necessary for accumulating pension benefits for mixed work experience.

This includes time spent in educational institutions, vocational schools, preparatory courses, advanced training and retraining. This is indicated by law. Such persons include:

- Those who reached 45 years of age during the layoff.

- More than 25 years of experience in insurance.

- If a citizen has been working for more than 12.5 years in the Ministry of Internal Affairs.

Three types of higher educational institutions are defined: academy, university and institute. Citizens under 25 years of age are accepted for full-time training if they have previously received a secondary technical education. If the Ministry of Internal Affairs of the Russian Federation pays for the years of education, an agreement is concluded between applicants and the educational institution, according to which the service is determined from 5 years.

The following period is counted during your stay at study:

- time, which is accrued with confirmation of the order assigned for pension payments more than fifteen years ago. Until the amended law regarding pension accruals was signed;

- time, which is calculated and confirmed in the manner prescribed by the updated regulatory acts of Russia.

In most cases, cadets are equated to employees of the Ministry of Internal Affairs; they have opportunities and preferential positions, compensation that is guaranteed to employees of the Ministry of Internal Affairs. After graduating from a higher educational institution, in addition to a diploma, students are awarded the status of “police lieutenant,” and their training periods are counted toward their length of service.

Is vocational school included in the pension experience?

In addition to the main experience, there is also an insurance type of savings. For this, you only need to have 5 years of experience, and if you didn’t get it without taking into account your studies at a vocational school, then it still adds up. Work experience only includes studies up to 2002. After 2002, pensions began to be calculated according to new rules, with the so-called. IKP, now years of study are not counted towards future experience (of course, if they were not combined with work).

We recommend reading: My 18-year-old son is studying at the institute. Is it considered that he is our dependent or not?

According to Law 173 on pension savings (and it controls this issue), in order to receive a pension in old age, you must have five years of work experience or more. The official length of service is “insurance”. Previously, when asked whether vocational school is included in the pension experience, one could answer “yes”, because the studies counted. But today, vocational school is considered only with the following options:

What applies to retirement experience?

Legal norms for determining a pension establish requirements for the length of service that gives the right to assign it. How study is considered part of the pension period depends on the period of working activity. The legislator distinguishes the following categories of experience:

- insurance – forms the insurance part;

- general labor – determines the citizen’s labor activity before 01/01/2002;

- preferential – affects the right to retire early.

The time spent in training is included in the work experience, which is necessary for accumulating mixed pension experience. This includes time spent in secondary educational institutions, vocational schools, preparatory courses, advanced training and retraining. This is indicated by law.

Based on regulations, insurance experience is considered to be the total period of professional activity taken into account when assigning rights to pension payments, during which insurance contributions are paid to the authorized Pension Funds of Russia, and other periods included in the length of service.

The pension period includes:

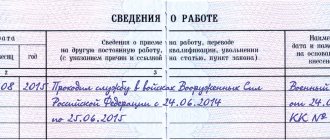

- periods of service by those liable for military service, which is provided for by Russian legislation;

- time to purchase benefits and finance compulsory social insurance if there is temporary disability;

- the time for a single parent to care for each minor until he turns one and a half years old, but in general should not exceed three years;

- the time of accrual of benefits during unemployment, the time of being in a paid public position, the time of moving or relocation, if the state employment service sends to another country for permanent employment;

- the presence in captivity of individuals who were unreasonably brought to criminal or administrative liability if they were unreasonably repressed, and then, after the actions committed, were rehabilitated after these persons were in exile in another state or imprisoned;

- time of care for a person with the first group of disability, a disabled minor and a citizen who has reached old age after 80 years;

- the time spent by those liable for military service who serve on a contract basis with their families.

Today, the expression “work experience” refers to insurance, but the definition itself remains the same. According to the law it is designated:

- If the citizen is officially employed.

- If a citizen has registered an individual entrepreneurship.

- If the citizen is in a state (or municipal) job.

In addition, this period of time may include:

- Time of maternity leave, but not more than six years.

- Completion of military service.

- Being registered with the Center for the Unemployed.

- The presence in captivity of individuals who were unreasonably brought to criminal liability.

- Guardianship of the seriously ill and disabled.

- Payment of unemployment benefits.

How to process pension accrual taking into account the time spent studying at a technical school

The time spent studying in educational institutions is not mentioned in Federal Law No. 400 “On Labor Pensions” as counted towards the insurance period. The possibility of including it in such a period is established depending on the contributions to extra-budgetary funds. If such payments were not made, then the periods of study do not give the right to early retirement.

Studying at a technical school

The same rules apply to studying at technical schools and vocational schools. The period is included in the work experience if it was carried out before the introduction of changes in 2002 and is included in the work book, and education is confirmed by a diploma.

If the acquisition of knowledge was carried out after 2002, then confirmation is required:

- entry in the work book;

- payments to the Pension Fund of insurance contributions;

- undergoing professional practical training if there were deductions to extra-budgetary funds;

- registration as an individual entrepreneur, subject to the deduction of funds to finance the insurance part.

If the work book does not contain information about periods of work or it is lost or damaged, proof of activity from the employer is required. In case of work carried out after 2002, the data is recorded according to individual (personalized) accounting.

The time spent receiving education at a school or college is counted if contributions were made to the Russian Pension Fund on the basis of an employment contract.

Whether the period is included in the length of service is determined at the time of registration of the pension on the basis of the legislation in force at the time of completion of studies.

Example of a diploma issued before 2002

With regard to education received before 2002, the period is included in the length of service; after this period - only when making contributions to the insurance portion of the Pension Fund of the Russian Federation.

What types of internships are there?

Work experience is the period of time when a person was employed or engaged in socially useful activities defined by law.

A document confirming a person’s work experience is usually a work book. If it is lost, certificates confirming the employee’s salary can play the role of proof of official employment. Before the 2002 reform, the concept of “total length of service” was valid - the sum of all periods of work activity mentioned in legislative acts, excluding breaks. At that time, such periods included full-time study at a university or special educational institutions. An entry about the period of study was made in the work report.

Since the beginning of 2002, the new Federal Law “On Labor Pensions in the Russian Federation” has replaced the general labor pension with the term “insurance period”. From the definition itself, the main feature by which an activity is suitable for work experience is clear: it is necessary that during the person’s employment there are legal contributions to the Pension Fund (in Soviet times, contributions to state insurance).

IMPORTANT INFORMATION! It does not take into account whether there were breaks between employment: “continuous experience” has been abolished.

Sometimes in special documentation there may be other concepts of length of service that affect the calculation of various accruals:

- experience in public service – work in government organizations;

- continuous service is a concept eliminated on January 1, 2007. It is not taken into account when calculating accruals for pensions and sick leave. It may turn out to be significant only when compared with the insurance experience after a year of reform (if the continuous experience exceeds the insurance period, the pension will be calculated based specifically on the continuous one);

- special insurance experience is a job that gives the citizens employed in it the right to early retirement.

What kind of training is included in the insurance period?

Among the conditions determining the right to receive old-age pension payments, not only the minimum age limit is indicated, but also the citizen’s insurance period. This parameter has been established since 2015 by Law of December 28, 2013 No. 400-FZ. Taking into account transition periods, it will be 15 years, increasing gradually to this value by 2024. In 2020 it will be 10 years.

Since 2002, Law No. 173-FZ “On Labor Pensions” came into force. According to the document, years of study began to be included in work experience when studying before January 1, 2002, and studies before 1992 are taken into account if a person had already started working or completed compulsory military service (for men) before entering the institute.

According to amendments to Law No. 173-FZ, since 2002, training is not taken into account when calculating the parameters determining the assignment of old-age pension payments. From this date, other “non-insurance” periods are taken into account, for example, caring for a disabled person or caring for children.

In vocational schools and technical schools

If a Russian studied at a special vocational institution on December 31, 2001, he has the right to count on including periods of study in the insurance period. For a potential pensioner, the status of an educational institution, university or secondary school is important. Studying at a vocational school is considered work experience. There are no additional requirements or reservations.

Studying at a university

If a citizen has received a higher education, periods of study are included in the insurance period with a limitation. That is, when studying at an institute or university before December 31, 1991, it is necessary that before entering a university, a Russian has already worked or served in the army, served in the Ministry of Internal Affairs or other law enforcement units equivalent to the armed forces (for men).

It makes sense to insist on including student time in the insurance period if the minimum required period has not been worked out (for 2019 this is 10 years).

It is important to note: the time of study does not affect the amount of the applicant’s pension.

Insurance experience, according to Art. 3 of Law No. 400-FZ “On Insurance Pensions”, this is the total duration of work or other activity during which insurance contributions were paid to the Pension Fund. It also includes other periods for which contributions were not deducted, but their list is strictly limited (they are listed in Part 1 of Article 12 of Federal Law No. 400)

Studying at a school or institute is not included in the list of other periods, that is, this period is not included in the insurance period. But there is an exception:

- If a citizen studied under the direction of an enterprise, he could continue to receive wages for the duration of his studies. In addition, he could study and work at the same time.

- In this case, to include studies in the insurance period, you need to confirm the fact of receiving student wages (for example, a certificate from the archive).

It is likely that in order to prove the right to take this period into account when calculating a pension, you will need to go to court. Judicial practice in such cases has developed in such a way that the decision is made in favor of the pensioner.

Which law stipulates

There are three normative legal acts that define the rules for calculating pensions:

- Federal Law No. 400 of December 28, 2013 “On insurance pensions”;

- Federal Law No. 167 of December 15, 2001 “On compulsory pension insurance in the Russian Federation”;

- Federal Law No. 173 of December 17, 2001 “On labor pensions in the Russian Federation.”

The latest law has not been applied since the beginning of 2020, with the exception of a number of rules governing the calculation of pensions, provided that they do not contradict Federal Law 400.

Legislation adopted before 1990 is also partially applied, in norms that do not contradict the current one.

Is studying at an institute included in the length of service for calculating a pension?

Since 2002, the concept of “insurance period” has been introduced into labor legislation, based on the indicators of which the right to a pension and its amount are calculated.

During this period, all years of labor activity during which contributions were made to the Pension Fund of the Russian Federation are counted. Also, accounting is carried out on the basis of legislation in force before the introduction of Federal Law No. 400 of December 28, 2003. These rules apply to the dates when work was carried out while receiving education.

Also, on the basis of Article 12 of this law, the following are included in the length of service:

- time to care for a child until he reaches 1.5 years of age;

- Military service;

- illegal detention;

- when receiving temporary disability benefits from the state;

- when applying for unemployment benefits;

- when caring for a disabled child of group 1, a disabled citizen unable to independently care for himself, elderly relatives after 80 years of age;

- when in remote places with a spouse in military service, in the absence of enterprises and employment opportunities;

- when living with a husband or wife who is employed abroad.

If the time of study coincided with the specified periods, and if the student worked previously and continued to work on the basis of a previously concluded employment contract, then they are counted towards the length of service and participate in the calculation of the pension.

Labor legislation allows the inclusion of a record of full-time study in the work record book. However, this period is not counted towards the length of service, since during this time no contributions are made to the Pension Fund.

Even while studying full-time in a technical or other specialty, a student has the right to enter into an employment contract if he has reached 14 years of age.

When debiting funds to extra-budgetary funds, periods of activity are included in the insurance period and are taken into account when determining the amount of pension contributions.

Under other conditions, and even if there is an entry in the work book, length of service is not taken into account for the purposes of providing state support.

An exception to the general rule for full-time students is when the law applies to medical workers and teachers when establishing early retirement. To do this, the following conditions must be met:

- before enrollment in an educational institution, the citizen worked in a specialty that gives the right to an early retirement pension;

- The course listening period has a time frame until 01/01/1992.

It does not matter which department the citizen studied at while working. Periods of work are counted towards the provision of pension benefits if contributions have been made to the Pension Fund.

https://www.youtube.com/watch?v=aMOcGtKr9VM

When concluding an employment contract while studying, the employer is obliged to provide the employee with paid leave during tests and exams.

The length of service is confirmed for calculating a pension on the basis of deductions reflected in the personalized (individual) accounting data in the pension system of the Russian Federation.

Also, confirmation of length of service in periods prior to the introduction of the insurance period takes place on the basis of previously existing legislation upon provision of documents, certificates, testimony about the conduct of labor activities and deductions made.

Based on the Decree of the Ministry of Labor No. 70 of October 17, 2003, periods of work during study can be counted as work experience in relation to activities that were carried out during the period of validity of the USSR legislation.

This requires the provision of documentary evidence or confirmation by witness testimony. This position was confirmed by the Constitutional Court of Russia, indicating in Resolution No. 2-P of January 29, 2004. According to the position of the supreme body, previously adopted norms apply in relation to citizens working during the validity of the defunct Soviet legislation. This rule applies to pension rights.

According to parts 3 and 4 of Art. 36 of Law No. 400-FZ, the norms of pension legislation in force before the entry into force of the Law “On Insurance Pensions” are preserved in relation to determining the size of pensions. This means that pension rights formed before 2002 are taken into account when assigning a pension in accordance with the norms of the old legislation (that is, Federal Law No. 173 of December 17, 2001 “On Labor Pensions”).

When assigning pensions before 2002, it was not the insurance period that was taken into account, but the total length of service. This is the duration of work or other socially useful activity until January 1, 2002. Pension rights formed by that time were then converted into estimated pension capital.

The duration of the total work experience may include the time spent studying at a school or institute. But there are also some nuances here.

The difference is not only in the calculation formula, but also in the conditions for accounting for length of service:

- In the formula from paragraph 3, periods of work before 2002 are taken into account in calendar order in accordance with their actual duration. According to point 4, they are taken into account using coefficients. For example, time spent working in the northern regions is counted at one and a half times the rate, military service at double rate, etc.

- However, when calculating according to point 3, the maximum value of earnings is limited, and according to point 4, the maximum value of the pension is limited.

And most importantly: when calculating according to point 4, the list of periods taken into account in the length of service is longer. And it is when calculating according to these standards that experience includes studying at a college, university, graduate school, courses in personnel training, advanced training, and so on.

If the Pension Fund assessed pension rights before 2002 according to the norms of clause 3 of Art. 30, then the period of training was not taken into account in the work experience. For most pensioners, this particular calculation option was beneficial, so the time they spent studying at the institute or college was not taken into account.

General work experience: what is it and what does it include?

- Work experience is required to grant an old-age pension. It is required for all citizens.

- Insurance experience is the time period during which a citizen is insured in compulsory pension insurance. This is regulated by the transfer of mandatory contributions to a personal account. Responsibility lies with the employer.

- Temporary disability;

- The period of unemployment, if the citizen is registered at the labor exchange;

- Time for a government employee to move to another settlement;

- Detention;

- Being with a spouse who served in military service under a contract for no more than 5 years;

- Living abroad with a spouse who is a citizen of a Russian institution;

- Staying under occupation during the Second World War;

- Life in Leningrad during the siege.

26 Jan 2020 etolaw 808

Share this post

- Related Posts

- Is it possible to quit your job while on maternity leave?

- Can a Bailiff Take a Car Near a House Without the Owner?

- Samples of receipt for goods received

- Pristov was taken away from the debtor and the court ordered him to give the goods back

Is the period of study counted when determining the right to early retirement?

Most often, those who retire early are interested in the question of including periods of study in their work experience. For example, teaching and medical workers. They study for quite a long time - in addition to the institute, there may also be residency, internship, and so on. Therefore, taking into account the period of study in their work experience is very important for them.

For these categories of citizens, study is counted towards the length of service for the purpose of a long-service pension in accordance with Resolution of the Council of Ministers of the USSR No. 1397 of December 17, 1959. However, the provisions of this Decree ceased to apply on October 1, 1993. Accordingly, if the training took place before October 1, 1993.

An important condition: the time spent studying in secondary specialized or higher educational institutions will be counted as special experience if immediately before or immediately after this period there were periods of work in the profession (for example, working as a teacher, doctor, and so on).

It is likely that the Pension Fund will refuse to count your studies as part of your special experience (for example, teaching). In this case, it is necessary to obtain a written refusal from the Pension Fund and go to court.

The time spent on training is directly proportional to work in this profession. However, Russian legislation does not mention that the period of study should be included in the list for which pension accruals are made. As already mentioned, if no contributions were made to the Pension Fund, then there is nothing to talk about any pension.

However, the 2001 law mentions that persons who studied or worked before 2002 have the right to receive a pension. Such people have a unique opportunity to include in their retirement experience exactly the periods during which they received their education. Modern legislation, unfortunately, does not provide such an opportunity.

Types of length of service

When calculating pension contributions, the total length of service determined as of 01/01/2002 is taken into account. Then, study affects the amount of the pension, which is determined depending on how long a person worked and the amount of his earnings. There are the following methods for calculating pensions (clauses 3 and 4 of Article 30 of Law No. 173-FZ):

- The value is calculated based on the ratio of a person’s earnings to the average statistical salary, multiplied by the length of service coefficient and the average salary for 07/01/2001 - 09/30/2001. With this method, length of service does not include study: this is beneficial for those who had high earnings in the USSR.

- The amount is calculated using a formula where the average monthly salary is multiplied by the length of service coefficient. This method was preferred for those with low incomes during the Soviet era.

According to the second option, taking into account studies, an increased pension amount may result due to an increase in the valorization percentage.

If for a given period the worker’s salary was at a high level, then the first method is applied. When training at a vocational education institution is not taken into account, it will be more profitable.

Postgraduate education in postgraduate internship and other forms

If the student receiving an education already had a work record, the period of work before completing the training will also be summed up with subsequent years of work. However, the period during which the person studied will be excluded from this amount.

However, it is possible to take into account certain time during the period spent receiving education. Basically, this time refers to production practice. This period can be taken into account and attributed to seniority. It is mandatory to sum up this time if the student was officially employed, received a salary, and all necessary deductions were made from it.

Students can also work part-time during their studies. For example:

- get officially employed during the holidays;

- remote work, but it is mandatory that the employer makes all necessary contributions to the Pension Fund.

What does length of service include?

Those citizens who managed to cover this period have the right to recalculate the final amount of their pension. However, for this it will be necessary to resort to a special formula that will determine the size of the pension. A citizen who is already receiving a pension can use this opportunity if he believes that modern methods are less effective and beneficial for him.

Thus, a citizen can receive time spent studying at a technical school as credit for his insurance experience in several cases:

- if the pensioner decided that the method of calculating a pension taking into account the time of study would be more correct for him;

- During his student years, the pensioner underwent practical training, for which he received a salary, and also contributed personal income tax amounts to the Pension Fund.

In any case, the pensioner will need official registration.

What is not included in work experience

According to Federal Law No. 125 on higher education, postgraduate study refers to a type of form of education. Postgraduate students can be admitted both full-time and part-time. According to pension legislation, such periods are not included in either the length of service or the insurance period, since they are not taken into account when determining the right to a pension.

Based on Order of the Ministry of Health No. 23 of February 17, 1993, the same rules are established for clinical residency when undergoing off-the-job training.

The internship lasts 1 year after graduation. A referral for appointment to a position is issued by the chief physician on the basis of an order from a healthcare institution.

While receiving additional education, the employee is assigned a salary, from which contributions to the Pension Fund are made.

The employee’s duties are carried out on the basis of the labor regulations with the right to benefits also entitled to other medical personnel. Thus, the period of internship training is counted towards the length of service and is taken into account when calculating the pension.

Training and title of labor veteran

Article 7 of the law on veterans specifies the grounds for conferring the title of labor veteran. Thus, a citizen is recognized as a labor veteran if:

- have a “Veteran of Labor” certificate or awards in the labor field (including Soviet-style ones);

- the man has 40 years of insurance experience, and the woman 35.

Again, periods of training are not included in the length of service. However, there is a caveat: the procedure for assigning such a title can be changed by the laws of regional authorities (regional, regional, city halls of Moscow and St. Petersburg).

According to the norms of regional laws, periods of training may well be counted towards length of service.

Features of accounting for assigning a preferential pension

The pension reform provides for maintaining from 2020 some of the grounds for early retirement based on age (old age). An exception is provided for teachers, doctors, creative workers and workers in the northern regions.

After the innovations, the requirements regarding how work experience during the period of study is considered for preferential categories have changed. According to previous requirements, apprenticeship in vocational institutions (technical schools) was taken into account as a benefit under Lists No. 1 and No. 2 if the following conditions were met:

- date of training no later than December 31, 1991;

- upon graduation, the graduate immediately began work in his specialty from Lists No. or No. 2.

Apprenticeships are also counted after 1991 for situations where the list refers to the general work performed rather than a specific position. For example, for a milling machine operator - “working on the machining of a product.” After 2013, the benefit applies to periods when the employer paid insurance contributions. This is also true during training. For educators and teachers, studies are taken into account until 01.10.1993, if before and after studies there was work in the pedagogical profile.

According to the latest legislative changes to increase the retirement age (Law No. 350-FZ), starting from 2020, earlier retirement (by two years) is provided. This is allowed for a working life of 42 years for men and 37 years for women. This duration only provides for crediting the period of temporary incapacity for work, but not the training time.

For work in rural areas over 30 years, an additional “rural” bonus will be awarded from 2020, but this thirty-year period also does not include the student period. In addition to work activity, sick leave and parental leave will be considered with a cumulative limit of up to six years.