Sometimes the tax inspectorate does not fully fulfill its functions and responsibilities towards citizens. For example, she did not respond to a citizen’s written request, did not provide the information he requested, or provided a tax deduction and delayed the tax refund.

Thus, you can complain both about the actions of the tax inspectorates and about their inaction.

This article describes where and how you can file a complaint against the tax office.

Where to send a complaint to the tax office?

Filing a complaint against the work of the tax inspectorate occurs in several stages:

- Initially, a complaint is filed with the tax office at the applicant’s place of residence;

- Then you need to send a complaint to the tax office of the applicant’s region;

- And only as a last resort should the application be sent to the central office - the Federal Tax Service.

Attention

Please note that you must send your appeal to a higher tax authority through the tax authority to which the complaint is written.

If the inspection is inactive and the conflict situation is not resolved, you should contact the following authorities:

- Prosecutor's Office;

- Court.

Contents of the complaint

Table 2. What we write in the appeal

| Complaint to the Federal Tax Service | Complaint against a fiscal institution |

| Recipient's name and address | |

| Information about the applicant (except for personal data and address, for citizens it is sometimes advisable to indicate the TIN, for organizations - KPP, OGRN, when acting through a representative - information about him and details of the power of attorney) | |

| Title (for example, a complaint to the tax office regarding non-payment of accrued taxes by Mr. Koreiko M. M.) | |

| Text of the appeal (brief summary of the circumstances that prompted the writing of the complaint) | |

| Applicant's claim | |

| Attachment of existing documents, audio or video recordings | |

| Date of preparation | |

| Signature of the applicant or his authorized representative | |

Attention! A complaint against the fiscal authority, whose decisions or actions are disputed, is filed through it.

The template below can serve as a sample application.

Anonymous appeal

According to the law on working with citizens' appeals, when submitting them, it is required to indicate the mandatory minimum, including last name and first name. If this is not done, the claim may remain unanswered.

It is not possible to submit an anonymous complaint to the tax office online. This is due to the fact that when filling out the template, you must indicate mandatory information, which includes personal data. You cannot submit a form on the site without entering them.

How to file a complaint with the tax office?

Where can I complain if I park on the lawn?

How to contact the military prosecutor's office with a complaint?

Where to complain about major repairs?

How to complain about Uber?

Complaint against refusal to initiate criminal proceedings

How to write a complaint against a bank to the prosecutor's office?

A complaint to the tax authority can be submitted as follows:

- By online contact;

- By submitting your application in person. It is important here that the applicant has 2 copies of the application. The first copy remains with the tax office, and on the second copy the inspector must put his signature and date of acceptance;

- By sending a registered letter. Before sending a letter, you must ask the postal employee to draw up an inventory of the attachment in 2 copies. The first is sent to the inspection along with the letter, and the second is certified by the postal worker and remains with the applicant. It is also necessary to order the delivery notification service.

Personal appeal

To submit an appeal to the tax office, you can visit this authority in person. A dissatisfied citizen has the right to go to the territorial body or the central office. He will be asked to present his passport and they will find out what the essence of the appeal is. If an oral conversation is not enough, an employee of the Federal Tax Service will help you draw up an application.

In order to get not to an ordinary specialist, but to a manager, a preliminary appointment is required. Depending on the workload of management, the schedule changes, and you need to be prepared to wait 1-2 weeks.

Individuals who decide to write an application to the tax office are traditionally given more attention than citizens who contact the hotline. It is necessary to draw up an appeal in accordance with the current rules and bring it to the address: Moscow, Neglinnaya st. 23. Prepare two copies of the document: one will remain with the tax office, the second will be returned to you with a receipt stamp.

Another option is suitable for residents of regions who complain about the Federal Tax Service. They write appeals and send them by mail to the specified address. You must select the “registered” shipping type. Documents submitted in this way are considered in the standard manner.

A complaint to the tax office about illegal business or other issues is an effective way to defend your rights and restore justice.

How to file a complaint with the tax office online?

The tax service has an official website through which a registered user can submit an online application.

Attention

To register on the Federal Tax Service website, you need to contact the nearest tax office with your passport, after which the applicant will be given a registration card with information to log into the site.

After the user has registered on the Federal Tax Service website, he can send a complaint. To do this you need:

- On the main page of the site, go to the “Individuals” tab;

- Next, the system transfers the user to a page with a list of services provided, among which you need to select “Filing a complaint to the tax authorities”;

- On the next page the user must select one of four proposed situations. In order to file a complaint, you must select “I want to file a complaint against the actions/inaction of the tax authorities”;

- On the newly opened page, the user can familiarize himself with the information provided. For example, about how a complaint is filed. After studying the information, the user is asked to act according to further instructions.

Filing a complaint to the Federal Tax Service online

The regulations do not stipulate any rules for filing an electronic complaint with the Federal Tax Service. Several features of this treatment can be identified:

- All fields marked with an asterisk are required;

- If there is inaccurate information about the taxpayer in the system, you must submit an application to eliminate the inaccuracies;

- If the reason for the appeal was an appeal against the act, listing the details of this document is mandatory;

- The response is sent to the applicant by mail or attached to his personal account. A person chooses the best option for informing about the decision made independently;

- The finished document is signed electronically.

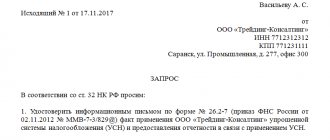

Sample document

To the Head of the Federal Tax Service of Russia for the Moscow Region

from Semenovich Anna Sergeevna

passport series 46 00 No. 000000 issued by the Moscow Region Department of Internal Affairs

date of issue April 24, 2002 Address: 141730 Moscow region, Lyubertsy, st. Lenina, 1111/2/222

contact number

COMPLAINT

to the inaction of the tax authority

Moscow region May 24, 2013

On December 7, 2012, I sent by mail with a notification to the Tax Inspectorate of the Federal Tax Service of Russia No. 1000 for the Moscow Region: a tax return for personal income tax for 2011 and documents confirming the right to receive a property tax deduction for the purchase of an apartment.

The application for a refund was written and submitted to the tax office No. 1000 on March 7, 2013, it indicated the details of the passbook and provided all the necessary documents.

At the time of writing the complaint, the amount due for refund from the budget had not been received to the specified bank account.

In accordance with Article 88 of the Tax Code of the Russian Federation, a desk audit is carried out within three months from the date the taxpayer submits a tax return and documents that must be attached to the tax return.

In accordance with Article 78 of the Tax Code of the Russian Federation, the amount of overpaid tax is subject to refund upon a written application from the taxpayer within one month from the date the tax authority receives such an application.

All deadlines established by the Tax Code of the Russian Federation for conducting a desk audit and for transferring funds have expired.

Thus, the overpaid amount of personal income tax must be returned by the tax authority no later than 04/07/2013.

In this regard, I ask you to oblige the Tax Inspectorate of the Federal Tax Service of Russia No. 1000 for the Moscow Region:

- return the overpaid tax for 2011 in the amount of 100,000.00 (One hundred thousand) rubles;

- pay penalties for each calendar day of violation of the tax refund deadline (in accordance with paragraph 10 of Article 78 of the Tax Code of the Russian Federation).

Otherwise, I will be forced to turn to the judiciary to protect my interests.

Complaint against the tax office to the prosecutor's office

A complaint against the tax service should be sent to the prosecutor's office only in cases where the rights of the taxpayer have been grossly violated.

You must contact the prosecutor's office at the location of the Federal Tax Service. You can draw up an application on paper and take it to the prosecutor’s office in person, or you can send an electronic appeal. For this:

- In the online reception of the Prosecutor General's Office, the applicant must select his region in the drop-down menu “Prosecutor's Offices in the constituent entities of the Russian Federation”;

- After this, the system transfers the user to the Internet reception of the prosecutor’s office of his region. There the user needs to study the information offered, after which he needs to click the “Agree” button;

- Then the applicant is asked to fill out a form where it is necessary to enter the requested data in the corresponding empty fields: Full name;

- Address;

- Email;

- Telephone;

- Area;

- To whom is the appeal addressed;

- Text of the appeal;

Going to court

Citizens can appeal to the arbitration court if they believe that the decisions or actions of the tax authorities:

- Their rights and interests in the field of entrepreneurship and other economic activities are not respected;

- It is illegal to impose obligations on them;

- They create other obstacles.

Info

The applicant may go to court no later than 3 months from the moment he became aware of the violation of his rights by the tax service. If the deadline for filing an application was missed for a good reason, the court has the right to reinstate it.

If the decision of the arbitration court does not satisfy the applicant, he has the right to appeal this decision in the court of appeal, and then in cassation proceedings carried out by the supreme (cassation) court.

Complaint consideration period

An appeal sent to the tax office is registered within 3 days, after which it is considered within 30 calendar days.

In some cases, the review time may be extended by another 30 days, but no more. The official notifies the applicant in advance of the extension.

The prosecutor's office reviews appeals and makes decisions on them within 30 days.

The judge alone considers cases challenging the illegal actions of the tax service and makes a decision within 3 months from the date of receipt of the application. This period can be extended by the judge on the basis of a reasoned statement up to 6 months.

How to compose correctly

It is necessary to take into account the purpose of the appeal: what was the reason and what violation of rights the citizen wishes to report. How to write a complaint to the tax office about the inaction of tax officials: in free form. The appeal is signed and dated by the applicant. Be sure to include in the text:

- last name, first name and patronymic of the applicant;

- subject of appeal: a document issued by the inspectorate, a specific action of a Federal Tax Service employee, or the fact of refusal to take the required actions on the part of the employee;

- an indication of the specific body of the fiscal system, the actions or inactions of whose employee are being appealed, or the name of the department of the Federal Tax Service that issued the appealed document;

- grounds for appeal: what rights of the applicant and legal norms were violated by the employee or the inspection document;

- requirements - the result that the applicant wants to achieve as a result of filing a complaint.

IMPORTANT!

The applicant has the right to appeal the actions, inactions or decisions of service employees within one year from the moment the citizen learned that his rights were violated, as established by Part 2 of Art. 139 of the Tax Code of the Russian Federation.

The instructions on how to write a complaint to the tax office against an employer are similar: such an appeal is signed by the applicant, and he indicates personal data in the header of the document. The text must indicate:

- the name of the organization or individual entrepreneur who, being the applicant’s employer, violates fiscal legislation;

- what the violation was;

- what legal norms have been violated;

- requirements - what measures to take.