How to check the readiness of documents at the tax office?

Checking the readiness of the package of papers submitted to the Federal Tax Service is carried out in several ways.

The duration of the procedure is limited to three days, but exceptions are possible.

To independently verify the completion of the registration procedure for an LLC or individual entrepreneur, the tax service provides several options.

Namely:

- a personal visit to the registrar at the Federal Tax Service is a traditional way of obtaining information, characterized by accuracy and reliability, but requires a significant amount of time;

- a call to the registration department of the tax service - the hotline is often overloaded with incoming calls, and a conversation at the number of a specific department may be fruitless (the registrar will refuse to provide information over the phone);

- a special service on the Federal Tax Service website is a convenient option available around the clock if you have access to the Internet; the pitfall is associated with technical errors.

Important! Regardless of the chosen method of obtaining information about the results of the registration procedure, you cannot do without a receipt from the Federal Tax Service. This document contains the date of submission of the complete package and the number assigned to the taxpayer’s application.

Should I call or go find out at the Federal Tax Service?

Reliability of information is the main trump card of the most time-consuming option. A personal visit to the Federal Tax Service takes place according to the following algorithm:

- preparation of passport, TIN and receipt;

- visiting the tax office on the selected day according to its work schedule;

- receiving an electronic queue coupon;

- waiting for an invitation to the registrar;

- clarification of the necessary points - the date of registration and issuance of a set of documents (difficulties are possible - the need to deliver documents, etc.).

Depending on the workload of the inspection, this event can take from several hours to a full working day. In this case, most of the time will be spent waiting - the trip, the queue, the receptionist’s operating hours, etc. A telephone call saves time, but does not allow you to obtain complete and reliable information. Often, registrars insist on discussing such issues during a personal visit rather than over the phone.

Use the status check on the Federal Tax Service online service

Telecommunication technologies significantly save time and allow you to independently find the information you are interested in with a high degree of reliability. The algorithm for checking status on the Federal Tax Service online service consists of the following steps:

- filling out form fields;

- entering captcha - to eliminate spam and robotic requests;

- analysis of the status assigned to the application.

Attention! Incorrect display of information, lack of status, or retention of the “processing” value for more than three business days indicate technical errors. Reliable information is available during a personal visit or by calling the Federal Tax Service.

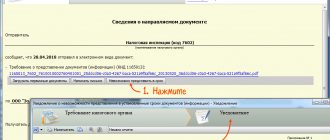

Submitting documents for tax deductions through the taxpayer’s personal account on the Federal Tax Service website

Online filing with a government agency is also convenient because here you can find out about the progress of the desk audit at any time. To do this, in the menu we select the same “Tax on personal income” and “3-NDFL”. Sometimes, however, current data is delayed or not updated at all. Then, if all the deadlines have passed and no information about the verification has been received, it is better to call the Federal Tax Service office where the declaration was sent and find out this issue. It is quite possible that in fact, the verification has already been completed. It’s just that we haven’t had time to enter the updated data online yet.

- On the official website of the Federal Tax Service we find “Individuals”, “Login to your personal account” and click there.

- In the rectangular form called “Login to your personal account”, enter the TIN, then the password received from the tax service, and click on the “Login” button.

- Select “3-NDFL” from the menu.

- On the new page we fill out the declaration.

https://youtu.be/TQ1OlwYrUgA

What information should I provide to verify my application?

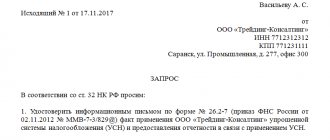

Checking the status of your application online requires entering the following data:

- type of economic entity - legal entity or entrepreneur;

- OGRN or OGRNIP - if the application concerns not the initial registration, but amendments to the constituent documents or registration information;

- name of the organization or full name of the businessman;

- form of the submitted document - the application form is saved in the receipt (P110001 when registering a company, P24001 for making changes to information about the entrepreneur, etc.);

- code of the Federal Tax Service that accepted the documents from the applicant;

- the time period in which the documents were submitted - the date, month and year can be indicated exactly (according to the receipt) or approximately.

How to apply for a tax deduction and submit a 3rd personal income tax return through the taxpayer’s personal account

- You must contact any Federal Tax Service. You must have your passport and your TIN with you (a copy or original is possible). If you apply to the tax office at your place of registration, it is enough to have only your passport with you.

- If you have an account on the Gosulugi service: https://esia.gosuslugi.ru/, which is confirmed in an authorized center, then you can use it to log in (Button No. 3 in the picture). However, if you confirmed your account through Russian mail (that is, you sent your login and password by mail), then this may not be enough, since your account may not be complete. In order to get full access, you just need to contact the center where you can do a second “identity confirmation”; you can find one using the link on the official website: https://esia.gosuslugi.ru/public/ra. To do this, you will need the original SNILS and passport. After “identity confirmation” you will be able to log into your personal account using your account.

This instruction has been compiled for those who have decided to save their personal time and apply for their social (treatment, education) or property deduction (for the purchase of an apartment, room or house) via the Internet. For these purposes, the tax office has created a personal account in which you can submit your declaration online, confirming the data specified in it with scanned copies of the necessary documents. Where and how to do this correctly? Read about this and much more below.

When should I apply for information?

The date of the return visit to receive notification of the registration of the enterprise or a reasoned refusal is indicated in the receipt. However, you can clarify the status of consideration of a package of documents at any time in the interval between the transfer of papers to the Federal Tax Service until the date specified in the receipt.

The applicant has the right to choose any convenient format for receiving information:

- personal visit;

- phone call;

- electronic tax service.

Peculiarity! From 10/01/2018, when re-registering an enterprise within three months after refusal, the founder is exempt from paying the state fee. But you can use this benefit only once.

List of affected areas

The list of industries affected by the coronavirus pandemic was determined by Russian Government Resolution No. 434 of April 3, 2020 “On approval of the list of sectors of the Russian economy that were most affected by the worsening situation as a result of the spread of the new coronavirus infection.” This list includes the following areas: hotel business, catering, physical education and recreation and sports, trucking, air transportation and airport activities.

Affected industries also include: conference and exhibition activities; activities of additional education organizations, non-state educational institutions; activities to provide household services to the population (repairs, laundry, dry cleaning, hairdressing and beauty salons).

The IT sector at the time of publication of the material was not included in the list of affected areas, despite the fact that on March 30, 2020, the Association of Computer and Information Technology Enterprises (APKIT) addressed the Ministry of Telecom and Mass Communications of Russia with a corresponding request. On April 27, 2020, as CNews reported, the Ministry of Telecom and Mass Communications sent a letter to the Government with a list of 15 proposals to support the Russian IT sector, which suffered greatly as a result of forced global measures to combat coronavirus.

In its letter, the Ministry of Telecom and Mass Communications proposed, among other things, to suspend a number of requirements of the Yarovaya Law, defer until the end of 2020 the payment of income taxes for employees of IT companies and cancel their payment of insurance contributions to the payroll fund. After the termination of the deferment, the Ministry proposed to provide companies with the opportunity to pay taxes on preferential terms over the next three years. The letter also mentioned zeroing out VAT on services related to food delivery, online education and telemedicine.

- How much is 2,000 GB object storage today? Offers from dozens of suppliers - on the IT marketplace Market.CNews

- Short link

How long will it take to know about registration?

As a general rule, the decision to register a new economic entity is made within three working days. In exceptional cases (high workload of registrars), the duration of the procedure is increased to five working days.

After receiving a favorable decision from the tax service, you must quickly:

- register with the Social Insurance Fund;

- obtain statistical codes from Rosstat;

- notify Rospotrebnadzor about the start of activities (if necessary);

- obtain a license (if necessary);

- open a bank account.

Conditions of receipt

The subsidy can be received by Russian organizations and individual entrepreneurs who, as of March 1, 2020, were listed in the register of small and medium-sized businesses. To receive money you also need to meet a number of other conditions.

In particular, a company or individual entrepreneur must be included in the list of economic sectors affected by the coronavirus pandemic according to OKVED. In addition, the company should not be in the process of liquidation, bankruptcy proceedings, and no decision should be made regarding its upcoming exclusion from the Unified State Register of Legal Entities.

Conditions for receiving a subsidy and filling out an application. Click to enlarge

In addition to the above, the company or individual entrepreneur, as of March 1, 2020, must not have debts on taxes and insurance contributions exceeding 3,000 rubles, and the number of company employees (individual entrepreneurs) in April and May 2020 must be at least 90 % in relation to March 2020. Also, companies and individual entrepreneurs applying for subsidies had to submit SZV-M reports for March 2020 to the Pension Fund of Russia (PFR) before April 15, 2020.

Is the data stored by the state inspectorate?

Federal Tax Service databases store information about all changes occurring with entrepreneurs, private firms and state corporations:

- date of commencement and termination of activity;

- history of the enterprise - mergers, divisions and other reorganizations;

- change in the number of founders, company name, amount of authorized capital;

- versions of constituent documents, etc.

Interesting! From 2020, when sending documents for registration of an enterprise or small business electronically, the applicant is exempt from paying state fees.

The date of registration of a new enterprise or entrepreneur is the starting point for further steps in starting a business. Checking the readiness of documents is carried out in person, by phone or online. From filing an application to receiving a decision, 3-5 business days pass, during which information about the status of the application is requested.

New procedure for confirming tax residency

Since mid-January 2020, confirmation of the status of a tax resident of the Russian Federation has become possible using the new electronic service of the website of the Federal Tax Service of Russia. It’s called “Confirmation of the status of a tax resident of the Russian Federation”:

Here is the exact link to it (relevant for all regions of Russia):

https://service.nalog.ru/nrez/

Let us recall that from July 1, 2020, tax authorities have a new obligation: upon application, issue him or his representative an electronic or paper document confirming the status of a tax resident of the Russian Federation (subclause 16, clause 1, article 32 of the Tax Code of the Russian Federation).

The paper form, electronic format and procedure for issuing a certificate confirming the status of a tax resident of Russia are fixed by Order of the Federal Tax Service dated November 7, 2020 No. ММВ-7-17/837.

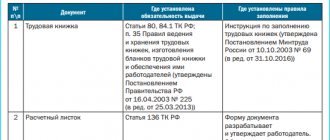

To be more precise, this order contains a sample application confirming the status of a tax resident of the Russian Federation and the status document itself (it does not have a separate name).