Scheduled inspections of the State Tax Inspectorate can be carried out subject to certain conditions and deadlines.

But in addition to scheduled ones, the tax inspectorate can also carry out other (unscheduled and counter) inspections, which are focused on identifying corruption among taxpayers.

Officials appointed for inspections undergo appropriate certification by the state tax service and are required to carry certificates authorizing all types of inspections.

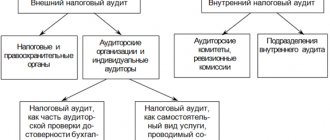

Types and participants of tax audits

A scheduled tax audit is carried out on the basis of an audit plan, which is approved by a certain body authorized to coordinate the actions of control bodies.

An unscheduled (short-term) audit by the tax service can be carried out in various cases:

- Before liquidation of a legal entity (application submitted).

- By decision of the President of the Russian Federation.

- Upon reporting to the tax service information about violations of the tax code.

A counter audit is carried out in case of connection of monetary transactions according to documents of different taxpayers, as well as to obtain or correctly compare reliable information for reflection in tax reports.

Note! An unscheduled inspection is most often carried out when an organization is suspected of laundering its own funds through another company or individual.

The inspection of the State Tax Service must be carried out by a certain group of officials appointed in the order to conduct the inspection, as well as by the taxpayer himself.

Depending on the situation, additional persons may be involved in carrying out the tax service audit in accordance with the Tax Code: a translator, a tax expert and persons acting as witnesses but not interested in this matter.

At the request or in the absence of impossibility for the taxpayer to come, his representative can participate in the audit.

The procedure for recording organizations and individuals

The current procedure for tax accounting of individuals and legal entities is established by tax legislation, in particular, Article 83 of the Tax Code of the Russian Federation. The initial stage of accounting is the application of the interested person to the tax authority located at the place of his registration, or the location of the organization, and submission of a written application according to the established form.

Legal entities, in addition to the application, must submit additional documents, a list of which can be obtained in advance from the tax authority.

All documents of the future taxpayer are accepted by an authorized employee, about which a corresponding note is made and a receipt is given. Next comes the verification of all submitted documents.

Registration must be carried out no later than 5 days after receipt of the application by authorized persons. Within the same period, the taxpayer must be sent a corresponding notification that registration has been completed.

At the immediate moment of registration, an individual or legal entity is assigned an individual taxpayer identification number.

This number is intended to ensure the most accurate accounting and control of the taxation procedure for individuals and legal entities. This number will contain all the most important information - the taxes the person pays, the presence or absence of debts, the payment procedure, the dates of previous tax payments, a list of the person’s official appeals to the tax authorities and other data.

In the future, the procedure for making changes to any calculation and accounting data, or registering additional taxable items, will begin with the main and mandatory stage - contacting the tax authority and submitting a corresponding written application by interested parties.

Grounds for conducting tax audits

Scheduled tax inspection.

The main basis for conducting a scheduled inspection of the tax service can be an extract issued by the authorized bodies in coordination of scheduled inspections, with a signature and seal in the appropriate format.

A new case of pledging property in favor of the tax service

According to the current rules, it is possible to pledge property to the tax authority only on the basis of an agreement. The mortgagor can be either the taxpayer himself or a third party (Clause 2 of Article 73 of the Tax Code of the Russian Federation).

From 04/01/2020, the taxpayer’s property will be recognized as being pledged to the tax authority on the basis of the law if (subclause “b”, paragraph 19 of Article 1 of Law No. 325-FZ):

- the taxpayer does not repay within one month the debt specified in the decision of the Federal Tax Service on collection, the execution of which is ensured by the seizure of property in accordance with Article 77 of the Tax Code of the Russian Federation. It is the seized property that will be recognized as being pledged to the tax authority. At the same time, from the moment the pledge arises, the arrest previously imposed on this property is terminated (subclause “b”, paragraph 21, article 1 of Law No. 325-FZ);

- The inspection decision came into force, the execution of which is ensured in accordance with subparagraph 1 of paragraph 10 of Article 101 of the Tax Code of the Russian Federation by the ban on the alienation or pledge (without the consent of the Federal Tax Service Inspectorate) of certain taxpayer property. It is this property that will be recognized as being pledged to the tax authority.

If the taxpayer’s property is already pledged to third parties, then the tax authority has a subsequent pledge (except for situations where the transfer of such property as a subsequent pledge is not allowed).

At the same time, the pre-emptive right to satisfy the requirements of the Federal Tax Service through the collateral does not apply to funds in accounts, contributions (deposits) intended to satisfy requirements that, in accordance with Article 855 of the Civil Code of the Russian Federation, precede the fulfillment of the obligation to pay taxes. A pledge in favor of tax authorities is subject to state registration and accounting according to the rules of Article 339.1 of the Civil Code of the Russian Federation.

Requirements for conducting tax audits

Tax audits can be carried out only on the grounds that are reflected in Article No. 89 of the Tax Code of the Russian Federation.

During inspections, the taxpayer can continue to work and the tax authority cannot prohibit him from doing so, but only if the prohibition is not reflected in legislative acts.

If a taxpayer carries out activities in several cities of the Russian Federation, then an audit by the tax service can be carried out if it does not duplicate its actions with authorities from another region.

Example. registered in Moscow and St. Petersburg. The tax service cannot simultaneously conduct 2 audits of this company.

The audit of the company must be carried out in strict compliance with the program drawn up and approved specifically for the given (inspected) organization, and none of the inspection persons can go beyond its scope, much less beyond the established norms of the tax service itself.

The program for conducting an audit by the tax service reflects the issues that will be studied during the audit, a list of acts that are being checked for violations, and other documents, depending on the type of audit being carried out.

Registration of organizations and individuals

The current norms of the tax legislation of the Russian Federation provide that an individual or organization must be registered for taxation from the moment of its registration.

Organizations are registered at the place of their direct registration, or at the location of their branches, as well as separate divisions. Registration of individuals is carried out at their place of residence or registration.

In this case, these persons must provide the following documents and information:

- FULL NAME;

- Date and place of birth;

- information about place of residence;

- passport information;

- information about citizenship.

All this information is indicated in a special written application, which the future taxpayer must submit to the tax authority. Registration must be carried out within 5 days from the moment the tax authority received an official application from the taxpayer.

Tax registration of a legal entity - organization and the procedure for this procedure require the provision of a larger package of documents. This includes:

- certified charter of the organization;

- information about its direct activities and authorized capital;

- management data;

- data on the presence or absence of branches, as well as official representative offices, etc.

Tax registration of individuals or organizations must be confirmed by a special certificate, which is issued by the tax authority within the prescribed period.

Only after receiving this document does a person become an official taxpayer and can begin certain activities provided for by its charter or other provisions.

Requirements for counter tax audits

A counter audit can only be carried out regarding the taxpayer’s relations with other organizations (“money laundering”).

During the audit, the tax office may require the provision of financial statements that relate to the subject of suspicion (transfer or transfers of funds for “laundering”) but nothing more (other financial transactions).

The counter audit is limited to the five reporting years that precede the audit itself, as well as the current year.

Example. A counter audit of the organization Privet LLC is carried out on August 22, 2010, which means the tax service can request financial turnover from 2009 to 2005, as well as for the year itself (2010) of the audit.

Procurement can take place in one or two stages. For single-stage tenders or auctions, order requirements cannot be changed during the entire bidding period. During two-stage sales, conditions may undergo some changes.

There are several types of systems for searching for purchases on the Internet. Some of them are free, like viewing the Register on the state website https://zakupki.gov.ru. Read about procurement tenders here.

When performing an audit, the tax service has the right not only to request any documents and materials that relate to this case, but also has the right to inspect all premises and territories belonging to the inspected entity, ask questions and receive appropriate answers from company managers and officials who are responsible for conducting financial transactions.

Responsible persons, managers and other employees have the right not to answer questions if the inspection body violates the rules for conducting an inspection and shows interest in unrelated financial and other transactions of the organization.

Making changes or any additions to reporting documents and documents provided upon request is strictly prohibited.

Determination of the start and end dates of the tax period for payers of the simplified tax system and unified agricultural tax

The tax period under the Unified Agricultural Tax and the simplified tax system is the calendar year, i.e. the period from January 1 to December 31 of the year (Articles 346.7, 346.19 of the Tax Code of the Russian Federation). However, an organization can be created, liquidated or reorganized (state registration of an individual as an individual entrepreneur is carried out or terminated) during the calendar year. In such cases, for taxes for which the tax period is a calendar year, the norms of paragraphs 2, 3 of Article 55 of the Tax Code of the Russian Federation establish special rules for determining the start and end dates of the tax period. According to these rules, the tax period is no longer equal to the calendar year.

For example, if an organization is created (an individual entrepreneur is registered) in the period from December 1 to December 31 of one calendar year, then, according to paragraph 2 of Article 55 of the Tax Code of the Russian Federation, the first tax period in this case will be the period from the date of creation of the organization (registration of an individual entrepreneur) to December 31 of the calendar year , following the year of creation of the organization (registration of individual entrepreneurs).

If an organization ceases its activities through liquidation or reorganization (a citizen ceases to operate as an individual entrepreneur), then, according to paragraph 3 of Article 55 of the Tax Code of the Russian Federation, the last tax period in such a situation will be the period from January 1 of the calendar year in which the organization’s activities were terminated (the state registration of the individual entrepreneur has expired) , until the day of state registration of termination of the organization’s activities (loss of validity of state registration of individual entrepreneurs).

In accordance with the amendments made to paragraph 4 of Article 55 of the Tax Code of the Russian Federation (clause 13 of Article 1 of Law No. 325-FZ), the specified rules for determining the tax period do not apply to taxes paid when applying the Unified Agricultural Tax and the simplified tax system. Previously, special rules for determining the start and end dates of the tax period did not apply only to PSN and UTII payers.

In practice, these innovations mean that for payers using the simplified tax system or unified agricultural tax, the tax period in any case is a calendar year (the period from January 1 to December 31 of the year), and tax returns based on its results must be submitted no earlier than January 1 of the year following expired tax period.

At the same time, these amendments came into force on September 29, 2019 and apply to legal relations that arose from January 1, 2018 (clause 1, 10, article 3 of Law No. 325-FZ).

The Federal Tax Service of Russia in a letter dated December 27, 2019 No. SD-4-3/ [email protected] , which was sent to the inspectorates for use in their work along with a letter from the Ministry of Finance of Russia dated December 20, 2019 No. 03-11-09/100305, notes that legislative acts on taxes and fees that establish new obligations or otherwise worsen the situation of taxpayers do not have retroactive effect.

Taxpayers registered in December 2020 and applying the unified agricultural tax or simplified tax system from the date of creation (registration) have the right to submit tax returns for 2020 based on the tax base calculated from the date of creation of the organization (registration of individual entrepreneurs) in December 2020 to 12/31/2019.

According to Articles 346.10, 346.23 of the Tax Code of the Russian Federation, the deadline for submitting declarations for 2020 is: for organizations and individual entrepreneurs on the Unified Agricultural Tax, organizations on the simplified tax system - no later than 03/31/2020, for individual entrepreneurs on the simplified tax system - no later than 04/30/2020.

In “1C: Accounting 8” edition 3.0, in accordance with the explanations of the tax department given in the letter dated December 27, 2019 No. SD-4-3 / [email protected] , it is possible for payers of the simplified tax system registered in December 2020 to form and send to the Federal Tax Service with using the 1C-Reporting service, a declaration based on the results of 2020, including data for December 2020.

If a taxpayer registered for the simplified tax system in December 2018 and the amount of income for 2020 with income for December 2020 exceeded the limit for applying the special regime, and income for 2019 alone did not exceed the limit of 150 million, then it is advisable to submit two declarations - for 2020 and for 2020 to retain the right to use the simplified tax system.

In addition, if at the end of December 2020 the payer has tax to pay, then an overpayment of the advance payment for the first quarter of 2020 arises for the same amount. In this regard, it is recommended to submit returns for 2020 and 2020 at the same time, and also apply together with them to offset the overpayment for 2020 against payment of tax for 2020.