When to use the form

Filling out the T-49 form is the responsibility of the accountant; the cashier is also allowed to enter data. The document is compiled in one copy monthly.

The payroll sheet (download form T-49 0301009 for printing) is compiled only for those employees who receive cash at the cash desk. The document is filled out based on the primary document:

- report card in form T-12;

- production accounting sheets;

- orders for bonus payments, vacation pay, sick leave and others.

If the company’s policy provides for maintaining a payroll statement (a sample is presented below), then forms T-51 and T-53 do not need to be drawn up.

Note. If employees receive payments via bank cards, then you can only maintain a payslip (download form T-51 form 0301010 in xls format).

Features of salary documentation

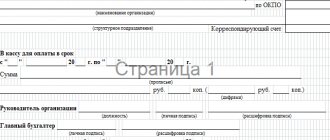

The title page of the payroll slip contains the following details:

- name and OKPO code of the company;

- debit account;

- validity period of the document;

- the total amount intended for payment under this statement;

- signatures of the head of the enterprise and the chief accountant with the date of signature;

- name of the document, its number and date;

- duration of the billing period.

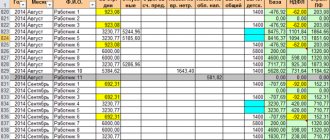

The salary slip (a sample of which we are considering) can be drawn up on several pages, and their total number must be indicated in the corresponding line. These pages, which follow the title page, contain a table that shows:

- serial number of the record;

- employee’s personnel number and full name;

- amount, and in the next column the employee puts a mark on receipt (his personal signature) or, if the money was not received, the cashier puts down “deposited”.

The “Note” column usually indicates the number of the identification document that is presented by the recipient of the money. This is practiced if there is a very large staff and the cashier does not know everyone by sight.

At the very bottom of the document, the cashier indicates how much money was paid and how much was deposited. The signature of the person responsible for issuing money (usually the cashier) is affixed, and the number and date of the cash receipt order are affixed. The accountant who checked the statement handed over by the cashier along with the cash reports puts his signature and indicates the date of the check.

Information from the payroll goes to the payroll, and according to it, wages are calculated. Only the last column T-51 takes part in this process. In order to create it, you need a time sheet. All these documents are prepared for each employee separately.

In most cases, employees are paid twice a month. Such conditions are specified in the Labor Code of the Russian Federation; for violating it, the company risks incurring administrative liability. Moreover, the first payment is considered an advance payment (usually a percentage of the salary), and the second payment is considered the main payment (the remaining part of the amount). Thus, a simple payslip will be issued for the advance (it indicates the amount that was paid in the first half of the month).

Form T-51 serves to illustrate and document the main part of the payment of wages to employees of the institution.

The column “Retained and credited” in the tabular part of the document must also take into account the advance part - data from the first paper.

In the absence of mandatory personnel documents approved by the organization, the inspecting labor inspector may bring the organization to administrative responsibility. Thus, in accordance with Article 5.27 of the Code of Administrative Offenses of the Russian Federation, violation of labor and labor protection legislation entails the imposition of an administrative fine:

- for officials - in the amount of 1,000 to 5,000 rubles,

- for legal entities - from 30,000 to 50,000 rubles. or suspension of activities for up to 90 days.

Violation of labor and labor protection legislation by an official who has previously been subjected to administrative punishment for a similar administrative offense entails disqualification for a period of one to three years.

In accordance with Article 13.20 of the Code of Administrative Offenses of the Russian Federation, for violation of the rules of storage, acquisition, accounting or use of archival documents (such documents include: work books, personal cards of employees, orders for personnel, etc.) entails:

- warning or imposition of an administrative fine on citizens in the amount of 100 to 300 rubles,

- for officials - from 300 to 500 rubles.

In accordance with Article 90 of the Labor Code of the Russian Federation, persons guilty of violating the rules governing the receipt, processing and protection of employee personal data are subject to disciplinary and financial liability in the manner established by the Labor Code and other federal laws, and are also subject to civil penalties , administrative and criminal liability in the manner established by federal laws.

The same provision applies to employees responsible for maintaining, storing, recording and issuing work books.

In accordance with Article 137 of the Criminal Code of the Russian Federation, illegal collection or dissemination of information about the private life of a person, constituting his personal or family secret, without his consent, or dissemination of this information:

- in public speaking

- publicly displayed work,

- in mass media,

are punished:

- a fine of up to 200,000 rubles,

- or in the amount of wages or other income of the convicted person for a period of up to 18 months,

- or compulsory work for up to 360 hours,

- or correctional labor for up to 1 year,

- or forced labor for a period of up to 2 years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to 3 years,

- or arrest for up to 4 months,

- or imprisonment for up to 2 years with deprivation of the right to hold certain positions or engage in certain activities for up to 3 years.

In this case, the same acts committed by a person using his official position are punishable:

- a fine in the amount of 100,000 to 300,000 rubles,

- or in the amount of wages or other income of the convicted person for a period of 1 to 2 years,

- or deprivation of the right to hold certain positions or engage in certain activities for a period of 2 to 5 years,

- or forced labor for a period of up to 4 years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to 5 years,

- or arrest for up to 6 months,

- or imprisonment for a term of up to 4 years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to 5 years.

The timeliness, completeness and correctness of maintaining personnel documentation, as well as compliance with labor legislation and other regulatory legal acts containing labor law norms, are controlled by the State Archive and the Labor Inspectorate, which conduct periodic scheduled and unscheduled inspections.

Complaints from employees can be considered by the Prosecutor's Office together with the Labor Inspectorate.

Actions in case of loss

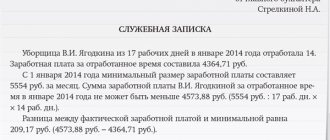

According to the Letter of the Ministry of Labor dated November 27, 2001 No. 8389-YuL, responsibility for storing the salary slip rests with the employer.

The best option to solve the problem is to restore the document. To do this, the payslip is reprinted. All signatures are affixed, including employees.

If it is impossible to fill in the lines due to the dismissal of some employees, you should leave them blank or indicate “could not be restored.”

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation

We will answer your question in 5 minutes!

The duplicate statement must be marked “Duplicate”.

Thus, the salary slip is an integral document when calculating wages to employees. Depending on the method of issuing money, the document is divided into forms No. T-51, No. T-53, No. T49.

The accountant fills out the document. The chief accountant and the head of the enterprise signs and is responsible for incomplete payment of wages to employees or payment in excess of what is necessary.

If mistakes are made, corrections are allowed. The statement is kept in the accounting department for 5 years.

When entering data into a document, the responsible person may make mistakes. But it must be remembered that this document is a primary one, and corrections are not allowed in it. If inaccuracies were identified before the payment of wages, then it is necessary to issue a new statement and destroy the old erroneous one.

However, if payments have already been made on the document, then you should not destroy it. It is necessary to make a correction directly in the document; the director and chief accountant must sign next to it. In addition, an accounting certificate is prepared, which sets out the reasons for making the corrections.

Using accounting programs to compile it will allow you to avoid errors in the document.

Typical errors that are made in the statement:

- Errors in personal data of employees;

- Incorrect indication of the amounts of accruals, deductions, etc.

- Incorrect application of tax deductions;

- Arithmetic errors when calculating totals.

It can be compiled in either paper or electronic form. The electronic payment document must be signed with an electronic signature. The filling procedure is regulated by Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014.

Filling out the document is possible both manually and in typewritten form using appropriate software. Form T-49 “Payment Sheet” is compiled in one copy and stored in the accounting department.

Payroll is calculated separately for each employee. Information about hours worked is transferred from time sheets. Accruals are calculated based on the time worked or output of the employee. Information about accruals due is filled in based on the following data:

- employment contracts (salary, bonus for qualifications);

- provisions on wages and bonuses for employees;

- bonus orders.

After this, deductions are calculated for each employee and the amount payable is calculated. The title page indicates the total amount to be paid to all employees. The manager (or other authorized person) makes a record of the transfer of the document for making payments through the cash register.

After the deadline for the payment of wages expires, a deposit note is made opposite the names of employees who have not received wages. A summary of amounts paid and deposited is provided at the end of the document. A note is also made there about the number and date of the cash register, as well as the signatures of the cashier and the accountant who checked all the records.

The procedure for compiling the statement

The document is drawn up after the authorized employee has checked the time sheet actually worked and submitted it to the accounting department:

- relevant data is entered on the title page and in the tabular part;

- endorses the statement and sends it to the head of the organization;

- the director or authorized person authorizes the payment, signs the form;

- then the document is given to the cash desk where information is entered as funds are dispensed;

- after the money is issued, form No. KO-2 is drawn up for this amount;

- information about the cash order is indicated at the end;

- The form is returned to the accounting department.

The chief accountant makes the necessary reconciliations, registers the statement in the internal document register and transfers it to the enterprise archive for storage.

.

Who draws up and maintains the T-49 form?

Filling out and maintaining this document is carried out by an accountant or cashier of the organization. The basis for filling out this document is the working time sheet.

The accountant fills out the title page and table, and also puts his signature on the document. Once the T-49 form is signed, it is given to the cashier.

Before issuing funds, the statement is signed by the head of the enterprise.

After issuing money to employees, the cashier passes the document back to the accounting department. In accounting, the document is checked and a corresponding entry is made in a special journal.

Rules for filling out the payroll slip (sample)

An example of filling out (the picture is clickable)

How to correctly display information in the form is specified in Resolution No. 1.

In the header they write:

- name of the company in accordance with the constituent documents;

- if the statement is compiled in a structural unit, indicate its name;

- OKPO code, the period for which the document is transferred to the cash desk;

- the total amount to be paid in words and figures.

They are endorsed with the signatures of the manager and responsible persons.

The tabular part is filled out on the basis of primary documents:

- gr. 1 numbers in order of employees in the state, the last digit must be equal to the total number of employees;

- in columns 2–4 data from form T-2 (personnel number, position and salary);

- from f. No. T–13 transfer the indicators to columns 5–7;

- in gr. 8–13 the amount of all accruals due to the employee in the reporting month;

- in column 14 the total amount of accrued funds for each employee;

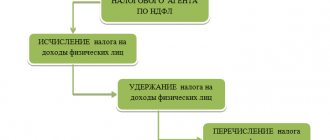

- the columns of the “Withheld, offset” section display personal income tax, advance payments and other deductions (loan repayment, alimony);

- in gr. 19 the employee’s debt to the enterprise (according to advance reports, or as a result of a shortage);

- if the employee’s debt is more than the salary due to him, then the difference is entered in column 20;

- in column 21 write the amount to be paid after all deductions;

- in gr. 22 - staff payroll;

- in gr. 23 When receiving cash, employees sign next to their last name.

If someone has not received the money, then the cashier writes “Deposited” next to his full name in column 23. Then in the line “Paid according to this statement” indicate the amount of money issued in words and figures. They also display information on deposited wages.

Indicate the details of the expense order and endorse it with signatures and a transcript.

How to make adjustments to the form

When a mistake is made at the drafting stage, it is easier to redo the document again. But if a blot is made by the cashier, then part of the payments have already been made on the form and it cannot be changed.

In this case, you need to carefully cross out the incorrect data with a straight line and enter new data on top. Certify the correction with the date and signatures of all responsible persons, and mark it as “corrected believe.” Without this data, changes will not be valid.

Note. To remove errors or blots, do not use a stroke or other correctors.

Error correction

Despite the fact that this document is filled out with the utmost care, and the entered data is carefully checked and double-checked several times, errors still occur.

In this case, if the documentation cannot be completely redone, it is necessary to cross out the erroneous data and add new ones on top. Next to the correction you need to leave a note “believe the corrected” and re-sign all the necessary signatures. Under no circumstances should you use a barcode corrector to make corrections. If used, the document will be considered invalid.

Despite the possibility of correction, it is best to avoid making mistakes at all when preparing such important documentation, which often involves large amounts of cash.