Personal income tax calculation: tax agent entries (basic)

First, let’s clarify: personal income tax is a tax on personal income. From the name itself it follows that the payers of this tax are individuals:

- residents of the Russian Federation;

- non-residents of the Russian Federation receiving income in the Russian Federation (Article 207 of the Tax Code of the Russian Federation).

Who is a resident for personal income tax, read the article “Tax resident of Russia for personal income tax purposes.”

On the website of the Federal Tax Service of the Russian Federation there is a Service for confirming the status of a tax resident of the Russian Federation.

The procedure for calculating and paying personal income tax is regulated. 23 Tax Code of the Russian Federation. Following the rules set out in this chapter, an organization paying income to an individual is obliged to calculate, withhold and transfer personal income tax to the budget on accrued income, and to pay the individual income minus personal income tax (clause 1 of Article 226 of the Tax Code of the Russian Federation). Thus, when paying income to an individual, an organization becomes a tax agent for personal income tax (Article 226 of the Tax Code of the Russian Federation).

If you have access to ConsultantPlus, find out how a tax agent calculates personal income tax. If you don't have access, get a free trial of online legal access.

Correctly determining the tax withholding date is important for filling out the 6-NDFL report. Read more about this in the article “Date of tax withholding in form 6-NDFL” .

Tax accounting is carried out on account 68, subaccount “NDFL”. Accruals are reflected on the credit of this account in correspondence with accounts selected depending on the situation. Let's take a closer look at them.

Here are the main cases that a company may encounter when paying income to an individual.

Personal income tax

If an organization recovers damages from an employee, there is no need to withhold personal income tax, since in this case the employee does not generate income. This follows from Article 41 of the Tax Code of the Russian Federation.

Situation: is it necessary to withhold personal income tax if an organization refuses to recover material damage from an employee?

Answer: yes, it is necessary.

Personal income tax is assessed on employee income received in cash or in kind (Article 209, paragraph 1 of Article 211 of the Tax Code of the Russian Federation). Income in kind includes, in particular, payment by an organization for employees of goods, work, and services (subclause 1, clause 2, article 211 of the Tax Code of the Russian Federation).

The employee’s obligation to compensate the employer for direct material damage caused to him is prescribed in Article 238 of the Labor Code of the Russian Federation. Thus, if an employee’s guilt in causing material damage is proven and the amount of damage is determined, the employee has an obligation to the organization to compensate for this damage. However, the manager may completely or partially refuse to recover damages from the perpetrator (Article 240 of the Labor Code of the Russian Federation). In such a situation, it turns out that the organization compensated for the damage (to itself or third parties) instead of the employee. And accordingly, the latter receives income in kind. Withhold personal income tax from this

(Articles 210, 211 of the Tax Code of the Russian Federation).

Similar conclusions follow from letters of the Ministry of Finance of Russia dated April 10, 2013 No. 03-04-06/1183, dated November 8, 2012 No. 03-04-06/10-310.

In this case, personal income tax is calculated from the amount of direct damage

which includes:

– the cost of destroyed (damaged) property;

– costs of acquiring, restoring property (for example, repairs);

– costs of compensation for damage caused by an employee to third parties (for example, compensation for damage in a road accident).

At the same time, the Federal Tax Service of Russia believes that it is not necessary to withhold personal income tax from the amount of a fine paid for an employee for violating traffic rules.

Situation: is it necessary to withhold personal income tax if an organization paid an administrative fine for an employee (for example, for violating traffic rules on the organization’s car)?

Answer: yes, it is necessary. Although the explanations of regulatory agencies on this issue are ambiguous.

According to representatives of the financial department, the cost of paying an administrative fine is damage caused to the employer. Refusal to collect the fine from the guilty employee results in the latter receiving income in kind. Consequently, in such a situation, the organization must withhold personal income tax (letters of the Ministry of Finance of Russia dated June 17, 2014 No. 03-04-05/28925, dated April 12, 2013 No. 03-04-06/12341, dated April 10, 2013 No. 03-04-06/1183, dated November 8, 2012 No. 03-04-06/10-310).

However, according to the Federal Tax Service of Russia, in this case there is no need to withhold personal income tax. After all, if an organization does not collect the amount of a fine from an employee who committed a violation, he does not receive income in kind. This means that there are no grounds for calculating personal income tax.

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated April 18, 2013 No. ED-4-3/7135.

It is worth noting that the right to explain the legislation on taxes and fees is vested in the Russian Ministry of Finance (Clause 1, Article 34.2 of the Tax Code of the Russian Federation). At the same time, tax inspectorates are required to be guided by written explanations from financial department specialists on the application of legislation on taxes and fees (subclause 5, clause 1, article 32 of the Tax Code of the Russian Federation).

Thus, when deciding on the withholding of personal income tax in a case where the organization has not collected the amount of an administrative fine from the guilty employee, be guided by the position of the Russian Ministry of Finance. For example, in the case of paying an administrative fine for an employee who violated traffic rules in the organization’s car. It does not matter how the violation was recorded: by a photo/video recording camera or directly by a police officer.

Advice: there are factors that make it possible not to withhold personal income tax from an administrative fine that the organization did not collect from the guilty employee. They are as follows.

From letters of the Ministry of Finance of Russia dated April 12, 2013 No. 03-04-06/12341, dated April 10, 2013 No. 03-04-06/1183 it follows that in some cases personal income tax does not need to be withheld. This is possible if:

- the employee committed a violation under circumstances excluding financial liability (Article 239 of the Labor Code of the Russian Federation);

- the employer did not provide the employee with conditions for the safety of property;

- the employee acted in accordance with the employer’s order, regulation, or other mandatory documents. For example, a written instruction stating that the employee is obliged to get to the destination as soon as possible.

In such situations, the employee cannot be held financially liable. This means that when an organization pays a fine for an employee, it does not have the obligation to withhold personal income tax.

The procedure for calculating other taxes when compensating for damage caused by an employee depends on what taxation system the organization uses.

https://youtu.be/2_y-LzxyV-M

How to calculate personal income tax under an employment contract (formula)

The main type of income for which an organization becomes a tax agent for personal income tax is accruals under an employment contract.

As a rule, such payments are: wages, bonuses of various types, allowances, compensation in excess of the norm related to the employment contract.

In what cases are bonuses not subject to personal income tax, read the article “Are bonuses subject to personal income tax?”

From all these payments, minus the deductions provided (Articles 218, 219, 220 of the Tax Code of the Russian Federation), tax is withheld: monthly in the amount of 13% for residents and 30% for non-residents, except for those listed in Art. 227.1 Tax Code of the Russian Federation.

The formula for calculating personal income tax is as follows:

Personal income tax = (Dex – Deductible) × St,

Where:

- Personal income tax - the amount of tax to be withheld;

- Doh - the amount of employee income for the month, including bonuses, allowances, etc.;

- Deduction - the amount of deductions (children's, property, social) provided at the request of the employee;

- St - tax rate (13% for residents, 30% for non-residents).

Postings are made:

- Dt 44 (20, 26) Kt 70 “F.I.O. employee" - wages accrued;

- Dt 70 “F.I.O. employee" Kt 68 "Personal Income Tax" - personal income tax is accrued (withheld);

- Dt 70 “F.I.O. employee" Kt 51 (50) - wages issued;

- Dt 68 “Personal Income Tax” Kt 51 - Personal income tax is transferred to the budget.

The article “Calculation of personal income tax (personal income tax): procedure and formula” can also help you calculate personal income tax.

What to do if the personal income tax deduction is greater than the accrued salary?

The main types of income for which personal income tax must be withheld are all kinds of accruals under an employment and civil service agreement.

This list includes not only direct wages, but also bonuses, allowances, and some compensation received. Special formulas are used to calculate payments. However, personal income tax postings are made in the following situations:

- when calculating salaries;

- when deducting tax;

- when issuing wages;

- after transferring the personal income tax amount to the budget.

https://youtu.be/QdOppT9S7hM

If an organization has employees who are periodically sent on business trips, they are entitled to appropriate travel allowances, which are also taxed (subject to the legal limit).

So, after deduction of personal income tax, the posting is completed in accordance with the appropriate procedure.

In the situation with travel expenses, several types of postings are provided:

- when issuing an advance to an employee for travel expenses;

- when calculating expenses;

- if personal income tax is assessed on amounts for business trips that exceed the norm;

- After the personal income tax is transferred to the budget, the posting is also done.

Also see “Changes on business trips in 2020: analysis of the legal framework.”

If you purchase any services from an individual, you may also need to make tax payments. In this case, the organization must deduct the appropriate amount and provide the seller with funds, taking into account the payment of personal income tax. In such a situation, wiring is also done:

- when the product or service was purchased from an individual;

- posting when withholding personal income tax;

- when transferring personal income tax to the budget;

- when transferring the amount for services or goods to the seller.

When personal income tax has been assessed on the amount, the posting of its deduction and transfer to the treasury is mandatory. After all, entities that transfer income to individuals, as a general rule, simultaneously become tax agents. Accordingly, their responsibilities include withholding and remitting tax payments.

Also see “Transferring personal income tax from wages: rules for a tax agent.”

The earnings of citizens are subject to personal income tax on the territory of the Russian Federation. In addition, from the funds earned it is necessary to make payments for accident insurance in the organization and other contributions to funds outside the budget (PFR, FSS and FFOMS).

According to the law (Article 5 of Federal Law No. 212), the manager is obliged to transfer insurance premiums for his subordinates. and personal income tax is withheld from earnings and transferred within specific terms (Article 207 of the Tax Code).

The manager must make correct calculations of withheld taxes for each worker and transfer them to the state budget (Article 226 of the Tax Code).

Currently, personal income tax is 13% of a worker’s earnings.

It is advisable to consider the transfer of personal income tax using an example: if a worker receives a salary of twenty-two thousand rubles and pays a tax of thirteen percent, then he will receive 19,140 rubles from his income (22 thousand rubles minus 13%).

https://www.youtube.com/watch?v=GVu9QqtUIJY

Apart from this deduction, the worker does not transfer any more payments. And the manager needs to pay a decent amount for each employee.

In addition to income tax, the manager must make contributions to the compulsory medical insurance, the Social Insurance Fund and the Social Insurance Fund.

For this reason, transfers to the state amount to a larger amount than the income tax figure. This figure is equal to half the amount that is paid to the worker at the end of the month.

You can submit a request to return personal income tax from your salary to those employees who purchased living space or spent money on treatment or study (clause 3 of Article 219 of the Tax Code). You can return funds in some other cases, which include spending money on charity (clause 1, Article 219 of the Tax Code).

The Tax Code sets certain restrictions on the amount of the refund. For example, the deduction for children’s education cannot exceed fifty thousand rubles. It doesn’t matter that the amount spent on training may be much more, only fifty thousand and no more are allowed to be returned.

The deduction of 3-NDFL tax will also affect the amount. That is, in the end, the amount of 6,500 rubles (50 thousand rubles * 13%) is subject to return.

When the year in which large expenses were incurred comes to an end, it will be necessary to file a 3-NDFL declaration. and also attach the necessary documents for your Federal Tax Service at the place of registration.

The application along with the declaration must be submitted before the three-year period from the date of payment has expired.

Required papers: payment documents and agreements, 3-NDFL declaration, application for refund to tax authorities. Documents can be brought in person to the inspection office or sent by mail.

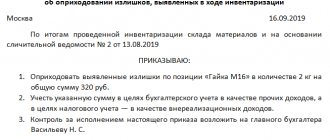

(The picture is clickable, click to enlarge)

If, when calculating personal income tax for a certain period of time, it takes into account months when the deduction is greater than the amount of remuneration, then the income is considered zero (Article 210 of the Labor Code). During this period, no tax will be withheld.

Balance transfer is also provided. This action is recognized as permissible for one tax period (Article 216 of the Labor Code).

Unused deductions cannot be transferred to the next year (clause 3, article 210 of the Labor Code). This rule does not apply to property types of deductions. You can use deductions in other months, but only for one year.

We suggest you read: Gift deed in marriage

The procedure for calculating personal income tax on material benefits (example)

When receiving a low-interest or interest-free loan from an organization, the employee receives a material benefit in terms of savings on interest.

IMPORTANT! Since 2020, new conditions for the taxation of personal income tax for this type of financial benefit have been introduced. Read more here.

It matters in what currency the loan agreement is drawn up.

If it is issued in rubles, then the threshold rate is 2/3 of the current refinancing rate established by the Central Bank of the Russian Federation on the date of receipt of income (clause 2 of Article 212 of the Tax Code of the Russian Federation).

IMPORTANT! Since 2020, the refinancing rate has been equal to the key rate (directive of the Central Bank of the Russian Federation dated December 11, 2015 No. 3894-U). See its sizes for different periods here.

If the loan is issued in foreign currency, then the established threshold value is 9% per annum (clause 2 of Article 212 of the Tax Code of the Russian Federation).

If interest is less than the threshold values or is not charged at all, personal income tax is withheld from the difference at a rate of 35%.

It is better to consider the postings for calculating personal income tax using a specific example.

The organization issued a loan to employee Ivanov I.I. (resident of the Russian Federation) for a period of 1 year in rubles at a rate of 3% per annum with interest paid at the end of the loan term. Loan size - 500,000 rubles.

Dt 73 “Ivanov I. I.” Kt 50 - 500,000 rub. — the loan amount was issued to Ivanov on January 15, 2020.

Income from the amount of the benefit from 2020, regardless of the date of payment of interest, is determined monthly on the last day of the month. Let's calculate the amount of interest on the loan for January 2020. There was no partial repayment of the loan in January. The number of days for which material benefits are calculated from 01/16/2020 to 01/31/2020 is 16.

500,000 × 0.03 × 16/365 = 657.53 rubles.

Dt 73 “Ivanov I. I.” Kt 91 - 657.53 rub. — interest accrued for using the loan for January 2020.

Let's calculate personal income tax on the amount of material benefit (at a Central Bank rate of 6.25%).

2/3 × 6.25% = 4.17% - threshold, taking into account the current refinancing rate.

4.17 – 3 = 1.17% - interest on material benefits.

500,000 × 0.0117 × 16 / 365 = 256.44 rubles. - material benefit for January 2020. Let's calculate personal income tax (35%) from it: 256.44 × 0.35 = 90 rubles.

If Ivanov were a non-resident of the Russian Federation, then the tax would be withheld at a rate of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation).

Dt 70 (73) “Ivanov I. I.” Kt 68 “NDFL” - 166 rubles. — Personal income tax on material benefits for January 2020 is withheld from the employee’s salary (or other income).

Dt 68 “NDFL” Kt 51 - 166 rubles. — Personal income tax from savings on interest for January 2020 was transferred to the budget.

Is it necessary to charge personal income tax if a third party paid the tax for an individual, ConsultantPlus experts explained. Learn the material by getting trial access to the system for free.

Calculation of insurance premiums

Today, the basis for personal income tax is certain types of income. These are basic and additional wages, amounts of sales or leasing, rental payments for movable, immovable property and other material assets that are the property of an individual, work performed and services provided, dividends from participation in capital, income from deposits and other receipts. The main points of personal income tax accounting should be considered separately.

Personal income tax is quite rightly called one of the most specific deductions. Its features are that the basis for calculating tax is the entire income of an individual, and payers as tax agents are legal entities.

| № | Content | Dt | CT | Primary document |

| 1 | Personal income tax under GPC agreements | 76 | 68 | GPC agreement |

| 2 | Personal income tax on interest on short-term loans from individuals | 66 | 68 | Loan agreement |

| 3 | Personal income tax from salary | 70 | 68 | Tax accounting register |

| 4 | Personal income tax when renting premises from a company employee | 76 | 68 | Lease contract |

| 5 | Personal income tax on financial assistance to an employee | 73 | 68 | Employee statement |

| 6 | Personal income tax on dividends | 75 | 68 | Protocol |

| 7 | Personal income tax on interest on long-term loans from individuals | 67 | 68 | Loan agreement |

The main task of an accountant in the accounting department of an enterprise is the correct calculation of earned income, vacation pay, sick leave, night pay, compensation payments, various allowances, financial assistance and the accurate withholding of tax from this income. Regulatory acts provide that taxable total income includes dividends, winnings, prizes, gifts, compensation for travel expenses exceeding the daily expense limit established by the state.

We invite you to read: What is the period for reviewing a claim?

Personal income tax is calculated within the framework of clause 3 of Art. 225 of the Tax Code of the Russian Federation, which defines all types of charges subject to taxation. Tax rates are clarified in the Tax Code, Art. 224.

The calculation is made using a standard formula, where the total tax is multiplied by the tax base by the tax rate:

- Personal income tax = (salary - SV) * tax rate

where ZP is the amount of income received, rub.; SV - standard deductions, rub.

An enterprise, in the role of a tax agent, calculates the amount of tax and, no later than the day following the day of payment of income, transfers it to the budget. The tax calculation will be as follows:

- Tax amount = (35,000 - 1,400) * 0.13 = 4,368 rubles.

| № | Content | Dt | CT | Amount, rub. | Primary document |

| 1 | Accrued for October to Anisimov | 44 | 70 | 35 000 | Payroll or payslip |

| 2 | Personal income tax withheld | 70 | 68 | 4 368 | Payroll or payslip |

Typical transactions for calculating personal income tax are presented in the table.

| Operations | Debit | Credit |

| Income accrued from salary | 70 | 68.01 |

| Tax transferred to the budget (simultaneously with salary payment) | 68.01 | 51 |

| Personal income tax accrued on the amount of sick leave benefits | 70 | 68.01 |

| Personal income tax from sick leave is transferred on the last day of the month | 68.01 | 51 |

| Income tax accrued on distributed dividends | 75 | 68.01 |

| Tax on dividends is transferred on the day of payment of income | 68.01 | 51 |

| Income accrued from the amount of excess of standard expenses for business trips | 70 | 68.01 |

| Income tax was accrued for the amount of the benefit for saving on interest on a loan received by the employee | 70 | 68.01 |

| Personal income tax accrued on the amount of financial assistance over 4,000 rubles | 73 | 68.01 |

| Income from financial assistance is transferred simultaneously with the payment of financial assistance | 68.01 | 51 |

| Personal income tax is calculated on the amount of the gift given to the employee | 73 | 68.01 |

| Personal income tax is transferred from the cost of the gift on the day the employee receives the gift | 68.01 | 51 |

More about personal income tax

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

ConsultantPlus TRY FREE

The withholding of personal income tax from employee salaries is reflected in the debit of account 70 “Settlements with personnel for wages” and the credit of account 68 “Calculations for taxes and fees”, subaccount “Personal Income Tax”.

For example, when paying for work or services under the GPA. Then you need to make a posting Debit account 76 “Settlements with various debtors and creditors” - Credit account 68-NDFL.

The withholding of personal income tax from employee salaries is reflected in the debit of account 70 “Settlements with personnel for wages” and the credit of account 68 “Calculations for taxes and fees”, subaccount “Personal Income Tax”.

For example, when paying for work or services under the GPA. Then you need to make a posting Debit account 76 “Settlements with various debtors and creditors” - Credit account 68-NDFL.

Withholding personal income tax from wages is an income tax, and this action is familiar to many citizens. Personal income tax is withheld from the salary if it is paid in the form of cash, as well as in the case when the remuneration is in kind (products, etc.). All deductions go to the federal budget.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

We will not consider payroll calculations in detail, but will analyze the entries that are generated in accounting after the calculations are completed for each employee.

To record all transactions related to wages, account 70 “Settlements with personnel for wages” is used. The credit of this account reflects accruals, the debit - personal income tax, other deductions and salary payments. Postings for payroll, deductions, personal income tax and insurance contributions are usually made on the last day of the month for which wages are accrued. Postings for salary payments and personal income tax and contributions are made on the day of the actual transfer (issue) of funds.

Wage expenses are written off against the cost of production or goods, therefore the following accounts correspond to account 70:

- for a manufacturing enterprise - 20 account “Main production” or 23 account “Auxiliary production”, 25 “General production expenses”, 26 “General (administrative) expenses”, 29 “Servicing production and facilities”;

- for a trading enterprise - account 44 “Sales expenses”.

D20 (44.26,…) K70

This posting is made for the total amount of accrued salary for the month, or for each employee, if accounting on account 70 is organized with analytics for employees.

Account 70 is not included in postings for insurance premiums, because they are not accrued to employees and are not deducted from their salaries.

Convenient online accounting

Quick establishment of a primary account, automatic payroll calculation, multi-user mode in Kontur.Accounting

D70 K50(51)

According to the law, various deductions can be made from employees' wages. For proper deduction, you need to know the nuances of the types of deduction and their accounting. Let's consider an example of calculating deduction from wages, as well as accounting entries generated when withholding personal income tax, according to writs of execution, when repaying a loan issued to an employee and withholding union dues.

These types are established by Art. 101 of Law No. 229-FZ. The main types of such income:

- Compensation for damage caused to health or in connection with the death of the breadwinner;

- Compensation for injury to an employee and family members if they die;

- Compensation from the budget as a result of disasters (man-made or radiation);

- Alimony;

- Amounts of business travel, moving to a new place of residence;

- Financial assistance in connection with the birth of a child, marriage, etc.;

We invite you to read: Dismissal due to changes in working conditions: we defend our rights

Deductions from an employee's salary are made in the following sequence:

- personal income tax;

- Writs of execution for alimony for minor children, for compensation for harm to health, death of the breadwinner, crime or moral harm;

- Other writs of execution in the order of receipt (other mandatory deductions);

- Retentions at the initiative of the manager.

The amount of mandatory deductions cannot exceed 50% of the wages due to the employee. In some cases, the amount of deductions may be increased. For example, deductions based on writs of execution. These deductions are subject to a 70% limit:

- On alimony for minor children;

- Compensation for damage caused to health, death of the breadwinner;

- Compensation for criminal damage.

Also, when calculating deductions, you should take into account:

- If the amount of mandatory deductions exceeds the limit (70%), then the amount of deductions is distributed in proportion to the mandatory deductions. No other deductions are made;

- The amount of limitation on deductions initiated by the employer is 20%;

- At the request of the employee, the amount of deductions is not limited.

In the name of employee Vasilkov A.A. 2 writs of execution were received: alimony for the maintenance of 3 minor children - 50% of earnings and compensation for damage to health in the amount of 5,000.00 rubles. The salary amount was 15,000.00 rubles. The personal income tax deduction for 3 children amounted to RUB 5,800.00.

Calculation of personal income tax on travel expenses

Travel expenses in terms of daily allowance and unconfirmed costs for renting residential premises, in accordance with clause 3 of Art. 217 of the Tax Code of the Russian Federation are standardized for personal income tax purposes. Daily allowances in excess of the norm and expenses for renting residential premises that are not documented are subject to personal income tax at a rate of 13%.

The norms for daily allowance are set within the following limits: for business trips in Russia - no more than 700 rubles. per day, for business trips abroad - no more than 2,500 rubles. in a day.

Read about similar restrictions that apply to daily allowances regarding the calculation of insurance premiums in this article.

When an organization pays daily allowance to an employee by internal order above the established norm, the following entries are made:

Dt 71 "F. Acting employee" Kt 50 (51) - an advance was issued to the accountable person for travel expenses.

Dt 44 (20, 26) Kt 71 “F. Acting employee”—travel expenses are accrued.

Dt 70 "F. Acting employee" Kt 68 "Personal Income Tax" - personal income tax is charged on amounts for business trips that exceed the norm. The date of receipt of such income from 2020 is considered to be the last day of the month in which the corresponding advance report was approved (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Previously, it was taken into account on the date of approval of the advance report.

Dt 68 “NDFL” Kt 51 - paid by personal income tax to the budget.

simplified tax system

If an organization applies a simplification and pays a single tax on the difference between income and expenses, then the amounts withheld from the employee as compensation for damage increase the tax base (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Take into account the amount of non-operating income at the time of deduction from wages, when depositing money into the cash register, etc. (Clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

When calculating a single tax, expenses in the form of amounts of damage caused do not reduce the tax base of the organization on a simplified basis. These costs are not in the list of expenses that can be taken into account when calculating the single tax (Clause 1, Article 346.16 of the Tax Code of the Russian Federation).

Alpha LLC uses simplification. The object of taxation is the difference between income and expenses.

In March, due to the fault of the organization’s manager A.S. Kondratyev's photocopier failed. According to experts, the device cannot be restored.

An agreement on full financial liability has not been concluded with Kondratiev.

The amount of material damage is less than the average salary of an employee, so Kondratiev compensates for losses in full.

(45,000 rub. – 45,000 rub. × 13%) × 20% = 7,830 rub.

If an organization applies a simplified tax system and pays a single tax on income, then the amounts withheld from the employee as compensation for damage also increase the tax base (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). The amount of damage itself does not affect the calculation of the single tax.

An example of how to take into account in a simplified manner (“income minus expenses”) deduction to pay off material damage caused by an employee

Alpha LLC uses simplification. The object of taxation is income.

The average employee salary is 44,000 rubles.

The total amount of damage is 40,700 rubles. (the residual value of the property is recognized as its market price).

The maximum deduction amount per month is: (RUB 45,000 – RUB 45,000 × 13%) × 20% = RUB 7,830.

Every month until the employee’s debt is fully repaid by this amount, the Alpha accountant will increase the organization’s non-operating income. The amount of material damage is not taken into account when calculating the single tax.

UTII

If an organization pays UTII, then the amount of deductions, as well as the cost of the damage itself, does not affect the calculation of the tax. UTII is calculated based on imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

As you know, after calculating personal income tax, it is necessary to make the appropriate entries in accounting. Personal income tax is deducted before the salary is paid, so employees receive the amount in their hands, taking into account the reduction made. Responsibility for carrying out this operation lies with the employer. When personal income tax is withheld from wages, the posting must also be made at the appropriate time so as not to violate the established procedure.

We invite you to read: UAE citizens do not pay taxes

Accrual of personal income tax on dividends paid

Dividends are the income of the founders. If the founder is an individual, then his income is subject to personal income tax at a rate of 13%. Accounting for paid dividends for founders who are employees of the organization can be kept in both account 70 and account 75, but if the founder is not an employee of the organization, then only account 75 is used.

Dt 84 Kt 75 “F. Acting founder”—dividends accrued.

Dt 75 "F. Acting founder" Kt 68 "Personal income tax" - personal income tax is accrued (withheld) from dividends.

Dt 75 "F. Acting founder" Kt 51 - dividends were paid to the founder minus personal income tax.

Dt 68 “NDFL” Kt 51 - paid by personal income tax to the budget.

Find the KBK for paying personal income tax on dividends paid in this article.

Purchasing works and services from an individual

Another situation that may arise is the purchase of work or services (for example, rental of non-residential premises) by an organization from an individual. By virtue of Art. 226 of the Tax Code of the Russian Federation, in this case, the organization is obliged to withhold personal income tax from the amount of payments, pay it to the budget, and transfer the amount to the seller minus personal income tax at a rate of 13% (with the exception of income listed in Article 217 of the Tax Code of the Russian Federation).

In this case, the following transactions are made:

Dt 20 (26, 44) Kt 76 “F. AND ABOUT." (60) - services and work were purchased from an individual.

Dt 76 "F. AND ABOUT." (60) Kt 68 “Personal Income Tax” - personal income tax is accrued (withheld).

Dt 68 “Personal Income Tax” Kt 51 - Personal income tax is transferred to the budget.

Dt 76 "F. AND ABOUT." (60) Kt 51 - the amount for services and work to an individual is transferred minus personal income tax.

The main thing to remember is that personal income tax is taken from the income of a specific individual, and no matter what account is used when calculating it, it is necessary to conduct analytics on it for each individual from whose income personal income tax was withheld. It should also be remembered that tax-free income of an individual is established by law - all of them are listed in Art. 217 Tax Code of the Russian Federation.

Read more about non-taxable income in the article “Income not subject to personal income tax (2019 – 2020)” .

Results

Business entities paying income to individuals become tax agents for personal income tax and are required to withhold and transfer the calculated amount of tax to the budget. Personal income tax accounting is carried out using account 68, the personal income tax subaccount, in correspondence with the accounts corresponding to the transaction being carried out.

Sources:

- Tax Code of the Russian Federation

- Directive of the Bank of Russia dated December 11, 2015 N 3894-U

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Posting when withholding personal income tax from wages

It is also important to note that personal income tax is withheld by the employer regardless of the form in which the employee’s salary is paid, that is, the tax is levied both on the monetary form of the salary and if the employee receives payment for his work in kind.

Since personal income tax is a mandatory deduction from an individual’s wages, current tax legislation obliges employers to withhold this type of tax, acting as a tax agent.