Home / Labor Law / Payment and benefits / Wages

Back

Published: 01/12/2018

Reading time: 5 min

0

4312

At any time, an employee is faced with a situation where, for one reason or another, he cannot withdraw his earnings from the employer .

This could be due to the employee’s serious illness, being involved in an accident, or simply due to vacation. In our article we will analyze in detail what a deposited salary is, how it is calculated and where and under what conditions this salary is received.

We will also shed light on other issues of interest to working people.

- What it is?

- In what cases may it be necessary to deposit wages?

- Shelf life

- How to release deposited wages Employee actions

- Accountant Actions What is a payroll escrow notice?

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

General rules for payment of wages

Wages are the equivalent monetary expression of work performed, services rendered, the amount of which depends on the complexity of the work and the volume of labor applied.

Payment of remuneration for work performed should be carried out according to several rules:

- The issuance of funds is carried out in cash at the cash desk of the enterprise;

- Transfer in non-cash terms to the employee’s bank account, after providing documentation with card or savings book details;

- Wages can be paid in kind, which must be done by agreement between the employer and the employee, but the amount of payment in kind should not exceed 20% of the total amount of wages to be paid.

Transfers and methods of payment for work must be specified in the text of the employment contract with the employee. The issuance of monetary remuneration is carried out personally to the employee or representative with the appropriate power of attorney to receive remuneration.

To ensure compliance with Article 136 of the Labor Code, it is recommended that wages be paid twice per working month. However, the company retains the right to choose without making an advance payment for wages.

- For the first 15 days of the month, the organization pays an advance, towards the due payment for the full month. The amounts of social charges are not deducted from the advance funds. In the collective agreement or employment agreement, the employer must indicate:

- The date of payment of the advance payment and the remaining wages, as well as the maximum terms of payment;

- The monetary value of the amount of the advance paid for all employees or separately for structural areas, but not higher than the monthly tariff salary or rate. To control the amounts of the advance payment, timekeepers must provide time sheets to the accounting department of the accounting department twice during the reporting period, before the approved date of the advance payment and before the day of full payment for the month.

- If the company does not practice issuing advance payments, then the monthly payment is made before the 15th day of the month following the reporting period. Social charges are deducted from the total monthly wage.

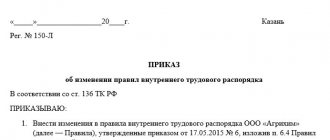

We comply with salary payment deadlines

The institution is obliged to pay wages to employees at least twice a month. Moreover, on a specific day, determined by the internal labor regulations, labor and collective agreement. Grounds: Part 6 of Article 136 of the Labor Code of the Russian Federation. In the code, labor and collective agreements are listed separated by commas, which emphasizes their equivalence.

Consequently, salary payment days can be indicated in any of them (letter of Rostrud dated March 6, 2012 No. PG/1004/6-1). However, it is most advisable to include such a norm in the internal labor regulations. After all, an employment contract regulates relations with a specific employee, and there may not be a collective agreement in the institution.

If the document establishes not specific days, but periods during which wages can be paid, then the institution as an employer will not be able to guarantee compliance with labor legislation. The Russian Ministry of Labor shares the same opinion in letter dated November 28, 2013 No. 14-2-242.

The optimal date for salary payment is a specific date from the date range: from the 20th to the 25th and from the 5th to the 10th of the month. For example, on the 20th the salary is paid for the first half of the current month, and on the 5th - for the second half of the previous month. If the day of payment of wages coincides with a day off or a non-working holiday, wages must be paid on the eve of such a day (Part 8 of Art.

136 of the Labor Code of the Russian Federation). Let us note that it is impossible to set a payment period of once a month even at the request of the employee himself (letter of Rostrud dated March 1, 2007 No. 472-6-0). As for vacation pay, it must be paid to the employee no later than three working days before the start of the vacation. This is stated in Part 9 of Article 136 of the Labor Code of the Russian Federation.

The employee can receive the corresponding payments from the institution’s cash desk, or they will be transferred to him in non-cash form to his personal bank account (Part 3 of Article 136 of the Labor Code of the Russian Federation). The duration of the period for issuing cash from the institution’s cash desk in relation to wages and other payments is determined by the head of the institution.

According to the rules in force until January 1, 2020, the accountant transferred tax from such a salary on the day he received money from the bank for its payment (Clause 6 of Article 226 of the Tax Code of the Russian Federation (as amended, valid until 01/01/2016). And only if the money is in the bank did not receive it and the salary was issued from cash proceeds; personal income tax could be paid the next working day after the salary was issued.

What is considered the date of payment of income? When depositing wages, no income is paid to the taxpayer, that is, wages must be deposited taking into account personal income tax. The safest option is to assume that the date of payment of income in the form of a deposited salary and deduction of personal income tax from it is the day the money is actually issued.

We invite you to familiarize yourself with a sample order for the payment of wages and advances.

And transfer the tax no earlier than that day and no later than the next business day. Because the Federal Tax Service believes that the amount transferred to the budget before the day the employee’s income is paid and personal income tax is withheld from this income is not a tax (Letters of the Federal Tax Service of Russia dated July 25, 2014 No. BS-4-11 / [email protected] , dated September 29, 2014 No. BS-4-11/ [email protected] ).

Systematize or update your knowledge, gain practical skills and find answers to your questions in advanced training courses at the School of Accountancy. The courses are developed taking into account the professional standard “Accountant”.

Example 1.

The salary was accrued to the employee on October 31. On November 7, wages were deposited and paid to the depositor on November 28. On what dates are personal income taxes withheld from deposited wages and the withheld personal income tax transferred to the budget?

Answer: When paying the deposited salary on November 28, 2016, personal income tax must be withheld on November 28 and transferred no later than November 29.

Salaries must be paid at least every half month. For example, until the end of the current month for the first half and until the middle of the next month for the second half (letter of the Ministry of Labor and Social Protection of Russia dated September 21, 2016 No. 14-1/B-911). Thus, the generally accepted approach is that the components of salary are:

- An advance paid before the end of the billing month.

Accounting records only reflect the fact of payment of the advance (later in the article we will look at the entries used for such purposes).

- The main part of the salary paid at the end of the payroll month.

If wages are accrued, the posting is as follows: Dt 20 Kt 70 - for the amount of wages for the entire month (regardless of the amount of the advance payment transferred).

In this case, the posting can also be generated by debit of accounts:

- 23 - if the salary is intended for employees of auxiliary production;

- 25 - if salaries are transferred to employees of industrial workshops;

- 26 - if the salary is accrued to management;

- 29 - when calculating wages to employees of service industries;

- 44 - if salaries are paid to employees of trade departments;

- 91 - if the employee is engaged in an activity that is not related to the main one;

- 96 - if the salary is calculated from reserves for future costs;

- 99 - if the employee solves problems to eliminate the consequences of an emergency.

The salary accrual date is determined based on tax accounting standards, according to which salaries are recognized as income only at the end of the billing month (clause 2 of Article 223 of the Tax Code of the Russian Federation).

The fact of calculation and withholding of personal income tax is reflected in the accounting registers by posting: Dt 70 Kt 68.

If a personal income tax deduction is applied to wages, then it does not need to be reflected in accounting.

- Insurance premiums.

The fact of their accrual is reflected by the posting: Dt 20 Kt 69. As in the case of salary postings, correspondence can also be generated by debits of such accounts as 23, 25, 26, 29, 44 and others discussed above.

The accrual of personal income tax and contributions is shown, like the accrual of wages, on the last day of the month.

Personal income tax and contributions are calculated on the total amount of salary without any adjustment for the advance payment.

When the salary is issued, the postings will be as follows.

Personal income tax is withheld and transferred from the paid salary (“main” payment) no later than the day following the day the funds are issued. Contributions are transferred by the 15th day of the month following the month for which the salary was accrued.

Information about this is reflected in the accounting registers when transactions are activated:

- Dt 68 Kt 51 - tax paid;

- Dt 69 Kt 51 - contributions transferred.

In order to reflect in accounting information about other types of labor payments - vacation pay, travel allowances - the same correspondence is used. But you need to keep in mind that in the entries used in payroll and those that characterize the issuance of, for example, vacation pay, the dates of deduction and calculation of personal income tax are determined differently.

The fact is that personal income tax on vacation pay is calculated not at the end of the month, but at the time the vacation is paid. The tax is withheld on the day the funds are issued to the employee (clause 4 of Article 226 of the Tax Code of the Russian Federation, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/2012 No. 11709/11 in case No. A68-14429/2009). Personal income tax on vacation pay can be transferred on any day before the end of the billing month (Clause 6, Article 226 of the Tax Code of the Russian Federation).

With insurance premiums, everything is also clear. Since insurance premiums are paid from the accrued salary and do not depend on the fact of its payment, contributions from the amount of the deposited salary must be transferred to extra-budgetary funds no later than the 15th day of the next month.

The procedure for writing off amounts of deposited salary in tax accounting depends on the method by which the company calculates income tax.

- With the accrual method, the deposited salary is included in expenses in the same month when it was accrued.

- With the cash method, the amount of the deposited salary is included in expenses only at the time of its payment. Then, in the month the salary is accrued, a deductible temporary difference arises and a deferred tax asset is created, which will be written off after the salary is issued.

Today, most companies have salary project agreements with banks with the transfer of money to employee cards, and salary deposit transactions rarely occur.

Kontur.Accounting is a web service in which you can easily conduct accounting, calculate salaries (and arrange salary deposits), and submit reports. Get to know the service's capabilities for free for 14 days!

Try for free

Salary Deposit

Depositing is most often encountered by enterprises that pay cash to employees through the organization's cash desk.

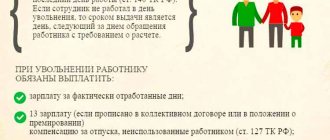

The concept of deposit is funds due for payment that have not been received in person within the regulatory time frame in accordance with the collective contract. The amount is considered subject to deposit only if it is not received through the fault of the employee.

Separately, for each enterprise, the Bank of Russia sets, through bank settlements, a certain limit - a limitation that, when storing monetary assets in the institution’s cash desk, cannot be exceeded.

Amounts for wages received from the bank must be issued within 3 days; in the conditions of the Far North, the period is extended by another 48 hours.

If you have not received payment for hours worked, the accrual should be deposited and deposited in a banking organization.

What is salary escrow?

In the article, we will consider a situation where an employee receives a salary in cash from the cash register, since receiving funds on a card does not require the employee’s presence at the workplace.

If the employee was absent on the day the salary was paid and did not instruct other persons to receive the money, his salary will remain unpaid. This means it must be deposited. Since you cannot store an unlimited amount of money in the cash register, the cash must be transferred to the bank. By order of the manager, a limit must be set at the cash desk (except for individual entrepreneurs and small business companies ((clause

2 Instructions No. 3210-U, clauses 1, 4 Letters of the Federal Tax Service of Russia dated 07/09/2014 No. ED-4-2/13338)). And although, according to the procedure for conducting cash transactions (Instruction of the Bank of Russia dated March 11, 2014 No. 3210-U), deposited amounts do not have to be handed over to the bank, undeliverable amounts will be taken into account in the cash limit, unlike wages.

Term and order

Funds for payment of wages exceeding the established limit are allowed to be kept in the cash register for no more than three days.

Upon arrival of the regulatory period, you should:

- The pay slip for the cashier should be closed.

- The remaining unpaid amounts shall be deposited.

- In the line with the last name and depositor, the entry “Deposited” should be made.

- An expense cash order should be drawn up for the amount of deposited wages, reflecting the transfer to the bank.

- For the same amount, draw up an advertisement for the delivery of cash assets to the bank.

Where to store the deposited salary - in a bank or at a cash desk

If an organization has established a cash balance limit, then storing funds in the organization's cash desk in excess of the limit is not allowed. Within 5 days, starting from the due date for salary payment, there may be funds in the cash register that exceed the limit by the amount indicated on the payroll.

After this period, the cash register must remain within the approved limit, including deferred funds. If the limit is not exceeded, the money can be kept in the cash register; if it is exceeded, then the organization deposits the amount in excess of the limit to a current account.

Accounting

When depositing amounts of wages, the company forms an account payable to the employee.

Accounting for amounts of deposited wages:

- During the storage period, accounting of amounts not received is kept on accounting account 76-4.

- After the end of the three-year period, the amount is transferred to 91 accounts.

- Accounting is maintained in the appropriate cash register, which indicates:

- Cash expense registration number and amount of deposited wages;

- Date of occurrence of accounts payable to the employee.

The register is opened for one calendar year , and the balances at the end of the reporting year are reflected in the balance column at the beginning of the year in the new cash register of the depositor for the next year.

In the balance sheet, deposited debt should be reflected in the line payables, and not payables to other counterparties.

It is worth noting that accounting for wages under employment agreements is also reflected in account 76, and the accountant needs to carefully monitor the separate maintenance of this wages and deposited amounts, since these expense items are reflected differently in the balance sheet.

Algorithm of actions of an accountant when depositing wages

Action 1. We check the receipts for receiving money in the payroll.

After the 5 days allotted for the payment of wages, the accountant opposite each unreceived amount in the columns “Money received” (when issuing money in Form No. T-49) or “Signature in receipt of money” (when issuing money in Form No. T-53) must put a stamp or o in the column intended for signature.

We suggest that you familiarize yourself with the Statement for the issuance of wages who signs

If an employee has not yet received his salary, he can submit an oral or written statement to the accounting department with a request to give him the money. The payroll accountant makes a request to the bank to receive the deposited funds. The employee can receive this money on the day of the advance, on the day the next salary is paid, or the issuance of funds will be postponed until the day of deposited payments (if one is determined at the enterprise). Recommendations for the payment of deposited funds must be specified in the organization’s local documents.

Action 2. Summarize the payrolls.

In the final line of the statements of form No. T-49 or form No. T-53, it is necessary to calculate and record the amounts:

- actual cash issued;

- subject to deposit and delivery to the bank.

If money for wages was issued not by the cashier, but by another person, an additional entry is made on the statement: “Money was issued according to the statement (signature).”

Action 3. Compile a register of deposited amounts.

In the Directive on the procedure for conducting cash transactions No. 3210-U dated March 11, 2014, there is no requirement to maintain a register of deposited amounts. Therefore, from June 1, 2014, this document is considered optional. But it is very convenient for tracking debts to employees, so you shouldn’t give it up at all. Registers of deposited amounts should be numbered in chronological order from the beginning of the calendar year.

The register of deposited amounts is compiled in any form. We recommend including the following details:

- name (company name) of the organization;

- date of registration of the register of deposited amounts;

- period of occurrence of the deposited amounts of cash;

- payroll or payroll number;

- last name, first name, patronymic (if any) of the employee who did not receive cash;

- employee personnel number (if available);

- amount of outstanding cash;

- the total amount according to the register of deposited amounts;

- cashier's signature;

- deciphering the cashier's signature.

The register of deposited amounts may contain additional details, for example, about the payment of deposited amounts.

Action 4. We enter the deposited amounts into the accounting book.

The obligation to keep a book of records of deposited amounts is also not stated in the Directive on the procedure for conducting cash transactions dated March 11, 2014 No. 3210-U. That is, it is not mandatory. Each organization develops the form of this book independently. The book opens for a year. In it, each depositor is given a separate line, which indicates his personnel number, last name, first name and patronymic, and the deposited amount.

In the group of columns “Attributed to the account of depositors” the month and year in which the deposit debt was formed, the numbers of payment (settlement and payment) statements and the amount of deposited payments must be indicated, and in the group of columns “Paid” the number of the cash receipt order is recorded against the name of the depositor and the amount paid for the corresponding month.

Step 5. We certify with a signature.

After this, the cashier signs the pay slips, register and ledger of deposited amounts (if any) and submits them to the accountant for signature.

Action 6. Submit for verification.

Forms No. T-49 or No. T-53, certified by the signature of the accountant, the register and book of accounting of deposited amounts must be submitted to the chief accountant for verification.

Action 7. We issue a cash receipt order.

We hand over the deposited amounts to the bank, and for the deposited amounts we draw up one general expenditure cash order.

Deposited wages are also issued to employees using a cash receipt. The cash register is signed by the chief accountant of the organization (or another person authorized to sign cash documents by order or power of attorney (clauses 4.2, 4.3, clause 4 of Directive No. 3210-U)).

The date and number of the cash receipt order are indicated in the book of depositors or the register of deposited wages.

When the deadline for paying wages expires, the cashier must check the payroll, recalculate the amounts paid and find out the amount of the balance. In column 23, opposite the names of employees who did not manage to receive the money, the entry “Deposited” is made or the same stamp is affixed. At the end of the statement the amounts are written down. Important: The totals of amounts paid and amounts to be deposited must be equal to the final amount on the statement.

The salary to be deposited must be submitted to the bank the next day after the end of the salary payment period. Record the deposit in the register. There is no unified form for the register of depositors; it can be compiled in free form. The register must contain the following details:

- company name or full name of the individual entrepreneur;

- date of registration of the register;

- period of occurrence of deposited funds;

- payroll number;

- Full name and personnel number (if any) of the employee who did not receive the money;

- amount of unpaid salary;

- total amount for unpaid salary;

- cashier's signature with transcript.

When an employee who has not received a salary applies for it, the amount will need to be given upon first request, written or oral. There is no deadline for issuing the deposited salary. You need to receive the salary amount from the bank, draw up a cash order in the name of the employee, and reflect the date and number of the order in the book of accounting for deposited amounts.

Depositing wages, postings

The accrual of wages in accounting records must be reflected directly in the current month, regardless of whether it will be deposited or not. The occurrence of deposited wages should be reflected in the organization’s accounting accounts with the following entries:

- If payment is not received, the amount of remuneration must be transferred to account 76-4 “Calculations for deposited amounts”: Dt 70 Kt 76-4 – 10000.

- Funds received to the “Cashier” account should be transferred to account 51 “Current account”: Dt 51 Kt 50 – 10000.

- If the employee has requested a deposit, then the issue must be reflected:

- Receiving funds from the bank back to the organization’s cash desk: Dt 50 Kt 51 – 10,000;

- Issue to the employee: Dt 76-4 Kt 50 – 10000.

- After the storage period for unclaimed amounts has passed, accounting correspondence is drawn up: Dt 76-4 Kt 91 - 10000.

When can wages be issued through distributors?

To account for deposited amounts, account 76 “Settlements with various debtors and creditors”, subaccount 76-4 “Settlements for deposited amounts” are provided.

On the last day of the period for which the payroll or payroll statement is open (clause 6.5 of Instruction No. 3210-U), the accountant reflects the deposit of wages:

- Debit 70 Credit 76, subaccount 76-4 “Calculations for deposited amounts” - the amount of uncollected wages without personal income tax has been deposited;

- Debit 51 Credit 50 - the amount of the deposited salary is credited to the company's current account.

The issuance of deposited wages is reflected by the following entries:

- Debit 50 Credit 51 - money received from the bank for the issuance of deposited salaries;

- Debit 76, subaccount 76-4 “Calculations for deposited amounts”, Credit 50 - deposited salary was issued.

If the salary is not claimed by the employee for three years (Article 196 of the Civil Code of the Russian Federation), then the accountant includes it as income for accounting purposes, and for tax purposes - as part of non-operating income for profit tax purposes (Letter of the Ministry of Finance of the Russian Federation dated December 22, 2009 No. 03-03-05/244).

To do this you need:

- carry out an inventory of settlements with employees regarding wages,

- prepare an inventory report, draw up an accounting certificate

- issue an order from the head of the organization.

The corresponding income must be recognized on the last day of the reporting period itself in which the statute of limitations expires.

We invite you to familiarize yourself with Effective advertising: TOP-12 chips 9 examples

Debit 76, subaccount 76-4 “Settlements on deposited amounts”, Credit 91-1 subaccount “Other income”

- deposited wages are included in other income after the statute of limitations expires.

If the employee has not received an advance (salary for the first half of the month, paid before its end), then the postings will be the same.

Example 2.

In January 2020, employees of the main production of Labyrinth LLC received a salary in the amount of 500,000 rubles. The total amount of personal income tax subject to deduction from accrued wages amounted to 65,000 rubles.

Labyrinth employee Ivanov did not receive wages for January due to illness. He was credited with 30,000 rubles. The amount of income tax subject to withholding from Ivanov’s salary is 3,900 rubles. The salary must be given to Ivanov in the amount of 26,100 rubles. (30,000 - 3,900).

Debit 20 Credit 70 - 500,000 rub. — wages accrued for January;

Debit 70 Credit 68, subaccount “Calculations for personal income tax” - 65,000 rubles. — personal income tax is withheld from wages accrued to the organization’s employees.

Debit 50 Credit 51 - 435,000 rub. (500,000 - 65,000) - funds withdrawn from the current account for the payment of wages for January were capitalized;

Debit 70 Credit 50 - 408,900 rub. (435,000 - 26,100) - wages were issued to Labyrinth employees (with the exception of Ivanov);

Debit 68, subaccount “Calculations for personal income tax”, Credit 51 - 61,100 rubles. - transferred to the personal income tax budget (with the exception of Ivanov).

Debit 70 Credit 76-4 - 30,000 rubles. — Ivanov’s salary was deposited;

Debit 51 Credit 50 - 30,000 rub. — Ivanov’s deposited salary was deposited into a bank account.

Let's assume that Ivanov never received his salary for January in the reporting year. In this situation, the amount of his salary is 30,000 rubles. must be indicated on line 1550 of the balance sheet for the reporting year.

Example 3.

Eight years after his release, a former employee, dismissed due to a prison sentence, contacted the organization with a request to pay unpaid wages. His salary was deposited and then written off. Payment for labor at the time of dismissal was made through the organization's cash desk. Does the employee have the right to claim the specified wages?

Answer: If the employee’s wages have been deposited, and the deposited debt has expired (the statute of limitations on the employer’s obligation to make a final settlement with the employee begins to run from the day following the day of dismissal (in this case, from the date of entry into legal force court verdict)) is written off in accordance with the established procedure, the former employee will no longer be able to claim unpaid wages from the employer.

The fact of salary payment is reflected in accounting by the entry: Dt 70 Kt 51 (or 50).

A similar posting is used when paying an advance.

For the convenience of paying employees in cash, wages can be given to them by specially authorized persons - distributors. Their list is approved by the head of the institution. For this purpose, a corresponding order is issued. As a rule, this method of issuing salaries is practiced in institutions that have separate structural divisions remote from the head office.

Distributors give money to employees according to payroll (pay) slips. The statements on which payments were made are submitted to the institution's cash desk no later than three working days after the expiration of the period for which the cash was issued. But sometimes, due to the remoteness of the structural unit, the person responsible for issuing cash cannot return the statement to the cashier on time. In this case, the funds are issued to the distributor on account. In this case, the distributor must be named in the order of the institution as an accountable person.

Taxation

Assets and unclaimed wages do not affect taxation. Before payment for work is issued and deposited, social taxes, according to the law, must be paid to the budget. When calculating and paying taxes, the company does not know whether accounts payable will arise with depositors who have not claimed payment for the work.

- When paying personal income tax in the accounting department, this fact is reflected by the posting: Dt 68 Kt 51.

- Payment of the Social Insurance Fund and contributions to the Pension Fund: Dt 69 Kt 51.

The deposited amounts influence the formation of the tax base when applying the simplified tax accounting system “Income minus expenses”, since the amount in account 76-4 is included in the expenses of the enterprise. It is worth noting that the salary deposit for taxation of the organization’s profits should be written off after a three-year period.

What to do with unclaimed wages?

The employee has three years to receive his deposited salary. The countdown begins from the next day after the date on which the company should have issued the salary. If the employee or his representative has not applied for a deposited salary within three years, the following actions must be taken.

In accounting, write off the amount as other income. To calculate the tax, include it in non-operating income. Prepare an inventory report, an accounting certificate and an order from the head of the organization to write off accounts payable.

Never miss a thing in payroll

“Accounting is a convenient program. Thanks to the developers. I have been working with Kontur for a long time. And it’s convenient to manage personnel; you’ll never miss anything in payroll. All reports reach the recipient on time. Everything is updated with the times. I really like it, everything is convenient. And when something is unclear, you can call - and they will always come to your aid. Thanks again to the developers."

Natalia Abbasova, accountant, senior Veshenskaya, Rostov region.

Cashier task

When an employee contacts the cash desk of an enterprise, the cashier must:

- Create a request, reporting the appearance of an employee demanding payment of uncollected deposit amounts;

- Submit an application to receive cash from the servicing bank;

- Make a payment, reflecting it in the expense registration order;

- Reflect the fact of payment in the ledger of deposited liabilities;

- Record receipt in the cash register;

- When received by an employee’s authorized representative, the debit order must reflect the data of the employee and the person receiving the deposit;

- Reconcile and sign expense documents by the chief accountant or director.

Special cases

The employer is required to pay the deposit upon the employee's first application. If the requirement is not met and the employer delays payment or refuses payment, the employee has the right to seek legal assistance from the labor inspectorate or the judicial authorities for administrative proceedings.

The manager should pay special attention to the accounting of the deposit and strictly control its issuance. If these requirements are unlawfully fulfilled, the authorities monitoring the activities of enterprises may bring the organization to administrative liability.