The issue of calculating employee leave and accruing vacation pay becomes especially relevant for accounting during the holiday season. A special configuration - 1C Accounting 8.2 - will help the accountant in this matter. Let's look at an example of calculating vacation pay in it.

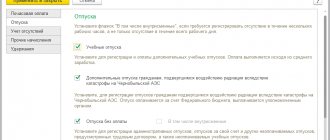

To perform certain actions in this version, you need to fill out some directories by entering the data necessary for calculations. To calculate vacation pay, you need to check the reference book, which is called “Plans for types of calculations”. It stores data on accruals and deductions of organizations. It is important to identify the presence in the directory of an element corresponding to a vacation.

When opening 1C in the “1C: Enterprise” mode, you need to select the “Operations” main menu item, then click on the “Plans for calculation types” button. A new window will open in which we select “Basic accruals of organizations.”

In the open directory, in addition to other accruals, there are elements that are responsible for vacation. We need an element called “Vacation Pay (A3)”.

It is necessary to fill out several options on this card, which are necessary for calculating vacation pay. You should start by filling out the data on the “Basic” tab, then go to the “Base for calculations” tab. The figures show an example showing the parameters of the most general case.

After completing the steps described above, we will proceed with the accrual. We propose to consider in detail the operation of adding leave for employees.

You need to open a new payroll document. Depending on personal need, we fill it out and calculate it either as a list or one employee at a time. The picture shows the accrual for one employee.

Having carried out an automatic calculation, we will see that the program did not display vacation pay in our document. This type of accrual will have to be added manually separately. To do this, press the button with the “+” sign or the “Insert” key in the tabular part of the calculation. Next, you need to add an accrual type. This can be done by successively pressing the “…” buttons in the “Accrual” column, and then in the window with accruals by selecting the “Vacation Pay (AZ)” item.

Then we set the start and end dates of the vacation in the appropriate columns. It is necessary to pay attention to the fact that the base period, which will switch automatically, must be selected corresponding to the accrued month. After that, we will set the amount. For example, it will be equal to 500 rubles

Please note that the salary remained unchanged, but the total amount payable increased. To prevent overpayment, we eliminate the resulting discrepancy by changing the number of days worked for a specific employee in the salary line. The days spent on vacation must be subtracted from the total number of days worked. Having completed this operation, click the “Calculate” button and the “Calculate by employee” menu item.

After completing the above steps, the salary will be calculated again, as a result of which the numbers will take the desired form.

Then, to correctly calculate accruals and deductions, it is worth re-filling and calculating manually in all tabs of the table. This is necessary because the accrual amount has changed, and now contributions need to be recalculated. Thus, we select an employee, click on the “Fill” - “Fill by employee” button, and after that “Calculate” - “Calculate by employee”.

After the amount has been verified and clarified, you need to go to the “Transactions” tab and generate them by clicking the appropriate button.

To complete the accrual of vacation pay, press the “Record” and “OK” buttons in sequence. Let us note once again that we considered the most general case, for which the described actions are sufficient. Depending on the situation, you may have to resort to additional automation methods within the calculation itself.

If it doesn’t work out for you, our specialist can come and solve the problem.

Let's set it up. Let's connect. We'll fix it. Let's find error 1c.

Leaders of sells!

Step-by-step instructions on vacation pay

Now, probably, there are practically no businesses left that manually keep their records. There is a huge variety of software products that help accountants in this matter. The most common among them is 1 C and I will tell you about the main steps of working in it when calculating vacation pay and how to calculate vacation pay in 1 C.

Step 1 – On the “Salaries and Personnel” tab in the “All accruals” section, this process occurs. Come here.

Step 2 – Here you should accumulate all kinds of calculations for employees. At the top right you will see the “Create” function, click on this button and you will see a list with the following options for further work:

- Wage.

- Sick leave.

- Vacation pay.

It is clear that you should choose the latter.

Step 3 – You should select the employee who is going on vacation, do not forget to indicate the period of his absence in the drop-down window. The machine takes on further actions, and it calculates what the person will ultimately receive and how much taxes need to be withdrawn from him. When you click on “Base, period of work”, additional rows become available. Here you have the right to list the papers thanks to which a person goes on vacation, that is, the grounds for this action. In all companies there are 3 options for going on vacation, among them:

- employee statement;

- the company's vacation schedule approved at the beginning of the year;

- note calculation.

You will also see the “For work with” field; the machine enters it automatically, pulling information from “Hiring”.

Step 4 – Having filled out the information in the previous window, you need to record and post such a document in the program. In the absence of this action, the entry made for the accrual and taxation of vacation payments will not be reflected anywhere.

You have access to the function of printing a vacation order according to the accepted form and can see the average income of the employee. The company's accounting policy provides for the creation and storage of various personnel orders.

Creating a “Vacation” document and accruing vacation pay

Let's see what the “Vacation” document looks like in 1C 8.3. The header indicates the month (this is the month of accrual of vacation pay), the employee, and the date of registration of the document.

On the “Main” tab, you must indicate the vacation period and the period of work of the employee for which the vacation was granted. This information is filled in manually.

After selecting an employee and a vacation period, the program automatically calculates the average daily earnings and accrued vacation pay. She does this based on the data available in the program - the employee’s length of service and the salary accrued to him.

If adjustments are necessary, click the “Edit” link. A data entry form for calculating average earnings will open. It displays the employee’s accrued salary by month, as well as calendar days.

Please note that this only includes months during which the person was an employee of the organization. The user has the opportunity to change the amounts accrued for each month. Then the program will recalculate the amount of average earnings. However, you cannot add new months.

The “Accruals” tab automatically displays the accrual (“Basic vacation”) and the amount of vacation pay calculated by the 1C program. If necessary, this amount can be adjusted manually.

Checking holiday pay postings

No matter how complete and competent the program is, no one is protected from errors. Therefore, it is always worth double-checking the automatic calculation, as this affects the amount of deductions. There is no need for unnecessary inspections by regulatory authorities. You can click on the amount you are interested in and a pop-up window will appear with the necessary calculation.

Pay attention to the correctness of the months taken by the machine, the payment amount and the number of rest days. Any shape in 1 C can be corrected. When you notice an error and make adjustments, vacation pay is recalculated automatically.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Calculation of vacation pay from the 1st day of the month: what is the difficulty?

Vacation is paid according to average earnings. It is counted for 12 calendar months preceding the month in which the employee goes on vacation. It would seem that there is nothing difficult in calculating vacation pay in this situation. But we remember that the vacationer needs to pay money no later than three days before the start of the vacation (the days are still calendar days). This means that at the time of calculation, the last month of the billing period has not yet ended and the final earnings for this month may be unknown. What to do?

In practice, vacation pay is calculated from the 1st day of the month in one of three ways:

- according to expected salary;

- based on accruals at the time of payment of vacation pay;

- excluding earnings for the last month.

Let's look at each method with examples.

IMPORTANT! The day of payment of vacation pay is not included in these three days. For example, if vacation starts from July 1, when should vacation pay be paid? July 1 is Monday, three days before vacation are Friday, Saturday and Sunday. This means that the employee must be given the money no later than Thursday, June 27.

Nuances of calculating vacationers

You always need to know not only the order in which these amounts are reflected, but also what the letter of the law says. Changes are made constantly and you need to track them so that you can know if they are in the program. There are main postulates that every accountant should know:

- all issues related to personnel, and vacation pay are no exception, are regulated by the Labor Code of the Russian Federation;

- Personal income tax should be paid no later than the end of the month in which the vacation amount was paid;

- the deadline for transferring vacation pay to a person is three days;

- if you are late in transferring funds for vacation or tax, a fine will be charged;

- insurance premiums are also subject to transfer in the month in which vacation pay was paid.

Example of payment of funds for vacation

Security guard of the sales department of the confectionery factory “Sladkoezhka” Slesarchuk V.A. has been working here since March 2020. Slesarchuk V.A. brought an application to the HR department to sign a continuous leave of absence for 14 days. It starts on May 7, 2020 and ends on May 21, 2020. The holiday on May 9, which falls during vacation, adds another day of rest on May 21, but it will not be reimbursed financially. As a result, the vacation period includes 4 days off and 1 unpaid day subject to transfer. The amount of earnings of Slesarchuk V.A. for the last 12 months equals 240,000.00 rubles.

- Let's find the average daily income of Slesarchuk V.A.

240,000.00/(12*29.3)=682.59 rubles

- We calculate vacation pay for him

682.59*14=9,556.26 rubles

- We charge personal income tax

9,556.26*13%=1,242.31 rubles

- We display the amount that V.A. Slesarchuk will receive.

9,556.26-1,242.31=8313.95 rubles

Slesarchuk V.A. vacation pay was calculated in the amount of 9,556.26 rubles, and issued in hand minus taxes was 8,313.95 rubles. Let us reflect the main transactions for this operation.

| No. | Debit | Credit | Sum | the name of the operation | A document base |

| 1 | 20 | 70 | 9556.26 rubles | Vacation pay accrued | Payroll statement |

| 2 | 26,44 | 69 | 1,242.31 rubles | Insurance premiums accrued from vacation pay | Payroll statement |

| 3 | 70 | 68 | 1,242.31 rubles | Personal income tax withheld from vacation pay | Payroll statement |

| 4 | 70 | 50,51 | 8313.95 rubles | Vacation pay paid | Account cash warrant |

In order to correctly calculate when it is more profitable to take annual leave, you need to take into account the nuances of calculating vacation pay.

Sick leave during vacation

Example.

Employee E. N. Orlova went on annual paid leave for 14 calendar days (from 05/14/2018 to 05/27/2018), but suddenly fell ill during her vacation, and the medical institution issued her a sick leave from 05/24/2018 to 05/31/2018 (on 8 calendar days).

In this case, according to Article 124 of the Labor Code of the Russian Federation (as amended on February 5, 2018), the employee has the right to choose:

- she can either extend her annual leave by the number of sick days that coincide with the vacation, and then instead of May 27, she will go to work on June 4;

- or the employee has the right to return to work immediately after the end of her vacation (14 days), and the number of vacation days during which she was sick must be transferred to another period (that is, 4 days are transferred, for example, to August 2020).

Both when transferring and extending leave, it is important that the employee provides the accountant or the personnel service with an officially issued certificate of incapacity for work. Vacation and sick leave will be paid separately! Also, the employee himself must notify the employer that he is sick and inform him about the further option of postponing or extending vacation days.

Let's consider the first option, when the vacation is extended. In this case, the accountant does not need to recalculate vacation, since the billing period remains the same and the amount of vacation pay, accordingly, does not change.