Who conducts the inspection

To conduct an audit, both employees of third-party specialized companies and experts from government supervisory structures, as well as specialists from the enterprise itself can be involved (but not in all cases). In any case, these must be persons with a higher economic or accounting education, serious work experience, and an auditor certificate.

The main purpose of the audit is to assess the “purity” of the organization’s financial statements and their compliance with the laws of the Russian Federation.

Based on the results of the audit, the auditor issues his conclusion (positive or negative). Moreover, if the inspector believes that he has not received a sufficient amount of documentation and other supporting evidence about the company’s activities, he has the right to refuse to issue an opinion.

Audits can be:

- mandatory, regulated by the legislation of the Russian Federation - usually enterprises working with the financial resources of the population are subject to them;

- voluntary – these are carried out on the initiative of the company’s management.

Also, inspections can be one-time or regular (the latter are usually used in large organizations and are an effective method of monitoring the work of accounting and financial departments).

https://youtu.be/kImGTK7KH4o

Inspection report

Federal Standard No. 6 establishes the main types of audit reports. They can be positive, conditionally positive, negative, and also with a refusal to express opinions. Let's look at each of the documents.

- Positive. If the auditor involved in checking the accounting documents does not encounter doubts and discrepancies regarding the usefulness and reliability of the specified data, he draws up an unconditionally positive conclusion on the results.

- Conditional positive. Drawed up if the auditors have insufficient grounds for both a negative and a positive opinion. Such situations are usually encountered when auditors have doubts about the data provided for verification, or there are disagreements with the director. Also, the basis is the presence of minor factors that do not allow us to draw 100% positive conclusions.

- Negative. It is usually drawn up when, during the audit process, the auditor discovered serious violations or gross deficiencies in the reporting documents compiled by a full-time specialist. This includes situations where accountants did not comply with the form of filling out documents and were convinced of the discrepancy between real financial information and the information provided in the reporting documents.

- Refusal to express one's own opinion. This is a separate, very specific type of conclusion when the auditor does not want to leave his own opinion regarding the results of the audit. As a rule, the main reason is the presence of significant audit risks or serious factors, the influence of which can ultimately distort the results obtained. In addition, there are other compelling reasons that do not allow us to fully prepare alternative types of audit reporting documentation.

Sometimes situations occur in which the management of a company undergoing an audit expresses its disagreement with the results obtained. It should be noted that the audit company bears full responsibility for the effectiveness of analytical activities, and in case of serious errors - full responsibility. Challenging the results of the audit analysis is carried out only in the courtroom, on the basis of a pre-drafted statement of claim.

How is the check carried out?

Standards for conducting audit activities are prescribed in the legislation of the Russian Federation. In addition, some rules may be contained in the accounting policies of the organization.

During the verification process, many parameters are taken into account:

- direction of the company's activities;

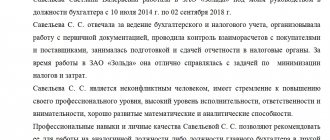

- personnel qualifications;

- rates of growth;

- financial condition, etc.

Next, the provided documents are reviewed and analyzed, as well as the actions performed by the company’s employees.

Often audit activities take several days, or even weeks - the specific period is negotiated individually and depends on many factors, including the size of the organization, the presence of structural divisions and branches, the duration of the period for which the audit is carried out, etc.

In any case, the audit is not carried out more than once a year.

How to fill it out correctly

The audit report template consists of three parts. The first states:

- Title of the document, day and city of compilation.

- Information about the company that conducts the audit (contact telephone number, registration address, tax identification number, checkpoint).

- Information about the auditor (full name, identification data).

- Information about the organization in which the audit was carried out.

The main section contains the following information:

- Purpose of the audit.

- Inspection period.

- Methods used in verification.

- Names and type of papers checked.

- Place of control (customer’s office or audit office).

- Division of responsibility. This paragraph states that the inspector is responsible only for the results of the audit. The manager of the enterprise, not the auditor, is responsible for the quality of documentation.

The final part describes the audit results in detail. Please note that the more detailed information is provided in this section, the more convenient it will be for the customer to correct comments in the future.

You can include other information in the document. It all depends on the specifics of the company’s activities. If other documents are attached to the form, this information must also be included in the contents of the official sheet.

Which documents are checked first?

Auditors check the entire package of accounting documentation (for a certain period of time), as well as reporting papers: balance sheets, applications, declarations, certificates, notes, etc. At the same time, for a complete and comprehensive analysis, all requested documents must be provided.

In some cases, only certain areas of the company’s activities are subject to audit, for example, in terms of settlements of taxes and other obligatory payments, financial relationships with counterparties, accounting for cash transactions, fixed assets, etc.

Sample audit report

An audit report is a document that is drawn up by several persons and confirms the fact of an audit. The document that is presented to the customer based on the results of the auditor’s work is an audit report. This is not the same as an audit report, in which the auditor's conclusions and recommendations to the client are written. An audit report is an additional document to the contract for the provision of audit services, which indicates the fulfillment of the terms of the contract and the conduct of an audit in a timely manner.

The act is drawn up in two copies, each certified by authorized representatives of the interested parties.

The audit report is a confidential document that must be stored and transmitted in strict secrecy. The information displayed in the report may compromise company employees.

Essence of the Audit Report

The audit report is a document that the customer receives after the completion of the auditor’s work. Such an act should be distinguished from the auditor's report. It does not contain the auditor’s conclusions, but is an addition to the contract for concluding audit services. This document contains information that all conditions for conducting the ordered audit have been met. The audit report is usually drawn up in 2 copies, which are received by the customer and the contractor. This document is strictly confidential, as it often contains compromising information about the company and its employees.

In the audit report, with sufficient detail and evidence, but without including unimportant details, auditors inform the client about the work done, about its main directions and which of these areas are subject to a complete audit and which are selective. After this, the identified deficiencies are indicated in a sequence corresponding to their significance. At the same time, the act, along with the noted shortcomings, must set out specific recommendations for correcting them and preventing them in the future. However, auditors should not make such corrections themselves, that is, do the work of accounting personnel.

The audit report is a strictly confidential document, the contents of which auditors do not have the right to disclose to third parties without the client’s consent, except in cases provided for by current legislation (detection of theft, fraud and other special cases). In this regard, the audit report is drawn up in two copies, one of which is handed over by the auditors personally to the chief accountant of the enterprise or a person replacing him, and the second copy remains with the audit organization that conducted the audit for subsequent monitoring of the elimination of identified deficiencies.

After preparing the draft act, auditors familiarize the management of the enterprise with its contents, consider the objections and comments expressed, if necessary, make appropriate adjustments to the act and sign it.

Contents of the Audit Report

The title of the act states: “Act of audit of accounting and reliability of financial statements (the name of the audited entity is indicated here) for ... year.” Then the location of the inspection is noted and the date for drawing up the report is set. It should be borne in mind that the date of drawing up the act records the moment until which the auditor is responsible for the quality of the audit and the conclusions that he made on its basis.

Next, the auditors indicate which areas of accounting work have been fully verified, that is, subjected to a complete audit, and which areas have decided to conduct a partial (selective) audit. At the same time, the noted shortcomings that require correction are listed in detail. Since such shortcomings are sometimes found in abundance, it is very important when drawing up an audit report to first highlight the largest ones, and only then list minor omissions that do not make a difference, but must be corrected.

However, the client has nothing to fear from a detailed indication of all shortcomings, major and minor deficiencies in the audit report. Auditors are required to indicate in the act the correct correspondence and sequence of entries in the accounts reflecting a particular business transaction. If incorrect calculations of the amounts of taxes, fees and various payments due are discovered, then it is also necessary to make correct calculations, indicating where and why the accountants of the audited entity made mistakes.

Deadlines for signing the act and rules for signing / transferring

The report is a confidential document, drawn up in two copies, one of which is transferred to the client so that appropriate measures are taken and corrections are made to the accounts, and the second remains in the audit organization for the purpose of subsequent control. Therefore, the audit report must be transferred directly into the hands of those persons who are responsible for maintaining accounting and financial reporting at the enterprise, that is, first of all, the chief accountant or the person replacing him. Top managers of the enterprise should be familiar with the act, but its contents should in no case be made public. Consequently, the audit report should not be sent to the relevant organization by mail, transmitted by chance through unauthorized persons or through the secretary of the head of the enterprise. There is always a danger that the audit materials may be used by someone as facts that compromise the management of the enterprise and accounting workers. It must be remembered that confidentiality is the most important requirement for an audit.

A written report (Act) is a confidential document and can only be transferred to:

— the person who signed the agreement (contract, letter of commitment) for the provision of audit services;

— the person directly indicated as the recipient of the auditor’s written report in the agreement (contract, letter of commitment) for the provision of audit services;

- to any other person in the event of a written instruction to this effect addressed to the audit organization of the person who signed the agreement (contract, letter of commitment) for the provision of audit services.

Between the preparation of the audit report and the conclusion itself, there may be a break of weeks or even months, caused by the need to eliminate all those shortcomings for which comments were made in the audit report. Therefore, the contract concluded with the client for the audit specifically states that payment for the audit must occur in any case, regardless of its results. Such a clause is necessary to ensure that the independence of the auditor's judgment is not in danger of being undermined by the client's reluctance to pay for the work done by the auditors in the event of receiving a conclusion that is not at all what he expected.

Sample audit report

Auditor's report on the audit of the financial and economic activities of OJSC "Metelevo"

for 2008

Director of Auditorskaya LLC Alexey Vladimirovich Luzyanin

Auditor qualification certificate No. K 002869 for the right to carry out audit activities in the field of general audit

(Decision of TsALAC MF RF dated November 25, 1999. Protocol No. 74)

Telephones in Novosibirsk:

(383) 335-84-41, 335-84-42 8-913-910-53-60

LLC "Auditorskaya"

License for the right to conduct a general audit No. E 005972 dated June 24, 2004, issued by Order of the Ministry of Finance of the Russian Federation.

Policy No. 56065/756/0061/09 liability insurance for carrying out the professional activities of an auditor was issued by the NF OJSC Alfa-Strakhovanie

May 13, 2009

Novosibirsk city

SECTION 1. INFORMATION ABOUT THE AUDIT ORGANIZATION

1.1 Official name

Full name – Limited Liability Company “Auditorskaya”.

Abbreviated name: LLC AF MIAlaudit.

1.2 Legal address

Russian Federation, 630102, Novosibirsk, st. Guryevskaya 37A.

1.3 Postal address

Russian Federation, 630005, Novosibirsk, st. Frunze, 86 of. 708

1.4 Information on registration of a legal entity

Limited Liability Company "Auditorskaya", registered by the Novosibirsk City Registration Chamber of Novosibirsk, registration number 1025401926549, registration date June 9, 2000.

TIN 5405204330

Gearbox 540501001

1.5 License information

License to carry out audit activities in the field of general audit No. E 005972, issued on the basis of Order of the Ministry of Finance of the Russian Federation dated June 24, 2004 No. 158 for the implementation of audit activities in the field of general audit for five years.

1.6 Information on membership in professional associations

Limited Liability Company "Auditskaya" is a member of the non-profit partnership "Audit Chamber of Russia" in accordance with the decision of the Presidium of the Council of the APR dated 08.25.05. (No. 1188 in the APR register).

SECTION 2. INFORMATION ABOUT THE AUDITED ECONOMIC ENTITY

2.1 Official name

The full name of the organization is Open Joint Stock Company "Metelevo".

The abbreviated name of the organization is OJSC Metelevo.

2.2 Legal address

632751, Novosibirsk region, Kupinsky district, village. Metelevo.

2.3 Postal address

632751, Novosibirsk region, Kupinsky district, village. Metelevo.

2.4 Information on state registration of the enterprise

OGRN 1055474000141

INN 5429107180

Gearbox 542901001

2.5 List of officials responsible for the preparation and preparation of financial statements

The head of the enterprise is G. G. Belokur.

Chief accountant – Belokur L.N.

SECTION 3 GENERAL INFORMATION

3.1 Reasons for conducting an audit

The audit was carried out in accordance with the Federal Law of August 7, 2001 No. II9-FZ “On Auditing Activities” on the basis of a concluded contract for the provision of audit services for an audit for 2008.

3.2 Features of the audit

The audit was carried out in accordance with approved auditing standards.

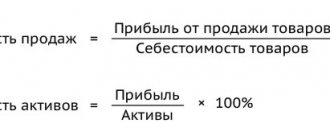

The main purpose of the audit is to confirm the compliance of the financial reporting data with the accounting data of the enterprise.

3.3 Period to be audited

The audit was carried out for the period from January 1 to December 31, 2008.

3.4 Place of inspection

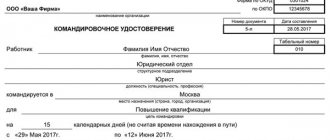

The audit was carried out in the contractor’s office on the basis of primary documents, contracts, accounting registers, accounting and tax reporting.

3.5 Audit methodology

The audit was carried out on the basis of the Federal Rules (Standards) of Auditing Activities and the Intra-Company Standards of AF MIALaudit LLC.

3.6 Data on the organization of accounting of the audited economic entity

During the period under review, the organization used a memorial order form of accounting.

3.7 Accounting policy of the audited economic entity

The accounting policy for tax and accounting purposes was approved by order of the manager.

3.8 Other significant points

The audit was carried out to determine the reliability of the data presented in the financial statements for the period from January 1, 2008 to December 31, 2008, as well as the compliance of the accounting methodology with Russian legislation.

The verifying party is responsible for the correctness of the conclusions drawn on the basis of the submitted documents. Metelevo OJSC is responsible for the authenticity of documents and the correctness of explanations, as well as for the validity of financial and economic transactions for which documents were not provided to the inspectors.

The final part of the auditor's report.

Auditorskaya LLC conducted an audit of the attached financial (accounting) statements of Metelevo OJSC for the period from January 1, 2008 to December 31, 2008 inclusive. The financial statements of OJSC Metelevo consist of:

balance sheet;

profit and loss statement;

appendices to the balance sheet and profit and loss account (form No. 3, 4, 5).

Responsibility for the preparation and presentation of these financial statements lies with the executive body of OJSC Metelevo. Our responsibility is to express an opinion on the reliability in all material respects of these statements and the compliance of the accounting procedure with the legislation of the Russian Federation based on the audit performed.

We conducted the audit in accordance with:

Tax Code of the Russian Federation;

Federal Law “On Auditing Activities in the Russian Federation”;

federal rules (standards) of auditing activities approved by the Decree of the Government of the Russian Federation;

internal rules (standards) of auditing activities approved by the Interregional Audit Chamber of Siberia;

rules (standards) of the auditor's audit activities;

regulations of the Ministry of Finance of the Russian Federation.

The audit was planned and performed to obtain reasonable assurance that the financial statements are free from material misstatement. The audit was carried out on a selective basis and included a study, based on testing, of evidence confirming the meaning and disclosure of information on financial and economic activities in the financial statements, an assessment of the principles and methods of accounting, rules for preparing financial statements, and the determination of the main estimated values obtained by the management of the audited entity , as well as an assessment of the overall presentation of the financial statements.

We believe that the audit provided provides sufficient grounds for expressing our opinion on the reliability in all material respects of the financial statements of the accounting data and the compliance of the accounting procedure with the legislation of the Russian Federation.

However, we did not monitor the inventory of inventories and fixed assets as of December 31, 2008.

In our opinion, with the exception of adjustments (if any) that might have been necessary had we been able to verify the quantity of inventories and the actual availability of fixed assets, the financial statements of OJSC Metelevo present fairly, in all material respects, the financial position of December 31, 2008 and the results of the financial and economic activities of the enterprise for the period from January 1 to December 31, 2008 inclusive in accordance with the requirements of the legislation of the Russian Federation regarding the preparation of financial statements.

Director of AF MIALaudit LLC A.V. Luzyanin

Head of the audit A.V. Luzyanin

General audit certificate No. K 002869 dated November 25, 1999 without limitation of validity period

Drawing up an act, features of the document

There is no unified sample audit report, so it can be written in any form. However, when compiling it, it is important to take into account some features common to all such documents.

In particular, it is necessary to divide the act into sections. There must be at least three of them:

- beginning (the so-called “head”),

- main part,

- conclusion.

The details of the organization in which the inspection is being carried out, as well as information about the person checking, are entered at the beginning, the methods and progress of the inspection are included in the main block, and the conclusions of the experts are included in the conclusion.

The act must be signed by the person or group of persons who carried out the inspection - thus, they indicate that all the information entered into it is correct and they bear full responsibility for it. The act must also contain the auditor's seal.

The document is drawn up in two identical copies . One of them remains with the auditor, the second is transferred to the customer company. A note about the act should be entered in the enterprise's documentation journal - it is usually kept by the secretary.

General information

Business owners confuse the contract of the audit report with the conclusion made by the audit specialist. Please note that these are two different papers. In the second case, the auditor draws conclusions about the organization’s work and forms proposals to eliminate weaknesses and inaccuracies in the work.

In turn, the audit report document acts as an addition to the auditor’s services agreement. The official document indicates the fact that the agreed upon agreements have been fulfilled. The contents of the official paper are confidential and should not be disclosed to competitors or third parties. The certified document is stored for at least five years.

The audit report sheet contains information about:

- the work done;

- main areas of audit;

- type of inspection of each direction (continuous, selective);

- identified deficiencies in the order and their significance.

Please note that auditors are not involved in correcting deficiencies. This task is assigned to the company's accountants. Auditors are prohibited from disclosing data contained in reports without the permission of the head of the company. The exception is precedents related to theft, fraud and other cases of theft of property.

An audit report form is drawn up in two copies. The first remains with the auditor, and the second is given to the chief accountant or the employee who replaces him. After reconciliation, the auditor undertakes to monitor the process of eliminating deficiencies.

The completed sample audit report is handed over personally to management and then to the chief accountant. It is not allowed to send documentation by mail or transfer it to unauthorized persons, for example, to a secretary. Official paper is transmitted only:

- The person who signed the contract for the provision of auditor services.

- To the employee specified in the contract as the recipient of the reporting sheets.

- The person indicated in the written referral to the audit service.

Please note that payment for auditor services is carried out regardless of the results of the audit.