Drinking water for office needs: accounting and registration

Accounting Based on paragraphs. 2 and 5 PBU 5/01 “Accounting for inventories” (hereinafter referred to as PBU 5/01), drinking water is accepted for accounting purposes as inventories (hereinafter referred to as inventories) at actual cost. The actual cost of inventories purchased for a fee is recognized as the amount of the organization's actual costs for the acquisition, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation) (clause 6 of PBU 5/01). The chart of accounts for the accounting of financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, determines that inventories purchased for their own needs are subject to reflection in accounting as the debit of account 10 “Materials”.

We take into account the costs of a cooler and water

If you carefully study the list, you will not be able to find the costs of ensuring normal working conditions, which include the purchase of drinking water. A similar rule applies to the purchase of sweets and coffee. To know the tax implications, you must carefully study the table below.

Types of taxes Expenses for the purchase of tea for employees Expenses that are representative Impact on accounting for income tax Taken into account Accounting cannot be carried out Accounted for Accounting cannot be carried out Personal income tax The profit of an enterprise employee can be determined: It is possible + + — — It will not work — — — — UST + contributions to compulsory pension insurance It is possible + — — — It won’t work — — — — What to do with VAT when accounting for costs If a company purchases tea and sweets for employees, it is considered that there is a gratuitous transfer of goods. This is the official position of the Ministry of Finance.

Second option

In some cases, the cost of drinking water is taken into account as a firm expense, which reduces taxable income.

To do this, any of two conditions must be met:

- providing employees with water. The obligation is provided for by regulatory documents on labor protection. For example, workers in hot shops must be provided with carbonated salted water (Order of the Moscow Government of March 30, 1999 N 250-RP);

- providing employees with water of one quality or another (for example, with a high content of salts and minerals). The obligation is provided for in an employment or collective agreement.

In the first case, the cost of water is taken into account as part of other expenses as the cost of ensuring normal working conditions (clause 7, clause 1, article 264 of the Tax Code of the Russian Federation).

In the second case, the cost of water is reflected as part of labor costs (clause 25 of article 255 of the Tax Code of the Russian Federation).

If the labor (collective) agreement stipulates that the company is obligated to provide employees with water of a certain quality, you need to obtain a certificate from the State Committee for Sanitary and Epidemiological Supervision stating that tap water does not meet this quality.

Note. To take into account the cost of drinking water when taxing profits, you must have a certificate from the State Committee for Sanitary and Epidemiological Supervision.

If you do not have a certificate from the State Committee for Sanitary and Epidemiological Supervision, tax authorities during the audit may consider that expenses to reduce taxable profit were attributed unlawfully. Therefore, in this case, it is better to write off the costs of drinking water at the expense of the company’s own funds. Otherwise, you will have to prove your position in court.

Example 2. CJSC Aktiv purchased deep purified drinking water for employees. The cost of water is 6,000 rubles. (including VAT 1000 rub.).

According to the terms of employment contracts concluded with employees, the company is obliged to provide them with water. Tap water does not meet the quality requirements specified in the contracts. This is confirmed by a certificate from the State Committee for Sanitary and Epidemiological Supervision.

When purchasing and writing off water, the company accountant made the following entries:

Debit 20 Credit 60

- 5000 rub. (6000 - 1000) - the cost of water is included in expenses for ordinary activities;

Debit 19 Credit 60

- 1000 rub. — the amount of VAT on water is taken into account;

Debit 60 Credit 51

- 6000 rub. — the water supplier was paid;

Debit 68 Credit 19

- 1000 rub. — the amount of VAT on water is accepted for deduction.

Expenses for the purchase of drinking water (6,000 rubles) reduce the taxable profit of Asset.

Accounting for the cost of purchasing drinking water

Attention

How to record the receipt of materials in accounting. If the cooler is accepted for accounting as part of materials, then immediately after installation, write off its cost as expenses: Debit 23 (25, 26, 44, 91-2...) Credit 10-9 - the actual cost of the cooler is written off. Water for the cooler Take bottled drinking water, which is necessary for the operation of the cooler, into account at the cost of its acquisition (excluding taxes) and reflect in the debit of account 10 “Materials” subaccount 10-1 “Raw materials and materials”. Document the transfer of water to the department with a demand invoice in form M-11 (or an act for writing off drinking water in a self-developed form).

Based on this document, write off the cost of water as expenses: Debit 23 (25, 26, 44, 91-2...) Credit 10 subaccount “Raw materials” - the actual cost of water is written off. The bottles in which drinking water is supplied are reusable (returnable) containers.

How to account for drinking water

The Labor Code of the Russian Federation contains an open list of conditions that ensure normal working conditions. Note that in paragraph 2 of Art. 25 of the Federal Law of March 30, 1999 N 52-FZ “On the Sanitary and Epidemiological Welfare of the Population” establishes the obligation, including legal entities, to carry out, in particular, sanitary and anti-epidemic (preventive) measures to ensure safe working conditions for humans and fulfill the requirements sanitary rules and other regulatory legal acts of the Russian Federation for production processes and technological equipment, organization of workplaces, in order to prevent occupational diseases, infectious diseases and diseases (poisonings) associated with working conditions.

Write-off of drinking water in an organization

Info

The drinking norm for people doing work is multiplied by coefficients depending on the category of work severity: light I - 1.125; moderate severity IIa - 1.330 and IIb - 1.540; severe III - 1,750. We take into account the costs of a cooler and water. Consequently, the cost of water cannot be taken into account as income received by employees in kind, which is subject to personal income tax and insurance contributions to extra-budgetary funds. This conclusion follows from paragraph 1 of Art. 210, pp. 2 p. 2 art.

Accounting and tax accounting of drinking water for employees Obviously, in this case, attributing the costs of purchasing bottled water and renting coolers to entertainment expenses seems unlikely.

First option

The costs of purchasing drinking water for employees are written off from the company’s own funds. In accounting, such costs are reflected as non-operating expenses and do not reduce taxable profit.

Tax authorities also propose a similar procedure for writing off these expenses. As stated in the Letter of the Department of Tax Administration for Moscow dated March 20, 2002 No. 26-12/12511, “...considering that the costs of purchasing drinking water... are not listed in Article 163 of the Labor Code as costs of ensuring normal working conditions indicated expenses do not reduce the amount of income received by the enterprise when calculating the tax base.”

An example will show how to reflect the costs of purchasing water in this case.

Example 1. Passive LLC purchased drinking water for employees. The cost of water is 6,000 rubles. (including VAT 1000 rub.).

The Passiv accountant made the following entries:

Debit 91-2 Credit 60

- 5000 rub. (6000 - 1000) - the cost of water is included in non-operating expenses;

Debit 19 Credit 60

- 1000 rub. — the amount of VAT on water is taken into account;

Debit 60 Credit 51

- 6000 rub. — the water supplier was paid;

Debit 91-2 Credit 19

- 1000 rub.

>DRINKING WATER and COOLER rental. ENTRY - the amount of VAT on water has been written off.

Expenses for the purchase of drinking water (6,000 rubles) do not reduce taxable profit.

Accounting for water, coffee, tea, sweets at the enterprise

Type of operation Document name Form Accounting after purchase Invoice No. TORG-12 Receipt order No. M-4 Movement of products within the company Request invoice No. M-11 Write-off of drinking water Act on write-off of materials for production A form that a company specialist developed independently. It must be drawn up taking into account the requirements of Federal Law No. 402-FZ. To confirm the validity of attributing water to expenses, experts advise drawing up internal organizational and administrative documents. An example could be an order from a manager. The company has the right to develop its own corporate standards in accordance with which workers are provided with drinking water and sweets. The action is carried out with the aim of creating favorable conditions for carrying out work activities. Tax authorities will certainly have questions regarding the legality of the action. The absence of a clause on the provision of drinks and sweets in the collective agreement leads to changes in the accounting procedure for tea and coffee. In this situation, the accountant must include the products among other expenses.

Writing off drinking water as expenses

Important

Will employees who consume products purchased by the employer for everyone have taxable income? Personalizing the consumption of products that a company has purchased for all employees is not possible. For this reason, it is impossible to charge insurance premiums and withhold VAT from employees. Question No. 3. Is it possible to take into account expenses for the purchase of drinks and sweets for employees if the company is on the simplified tax system? No, you won't be able to perform the action.

A list of expenses that can reduce profit is given in the Tax Code of the Russian Federation. The purchase of drinks and sweets is not included in the list. Question No. 4. Do water, tea, coffee, candy and other products included in this category belong to OS or MPZ? If you carefully study the rules for classifying objects into one category or another, it turns out that drinks and sweets belong to inventories. Question No. 5.

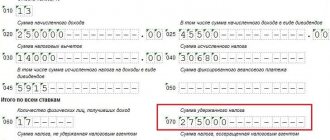

Accrual of unified social tax and personal income tax

If the cost of drinking water is written off without reducing taxable profit, then the unified social tax does not need to be charged on such expenses (clause 3 of Article 236 of the Tax Code of the Russian Federation).

What to do if the costs of purchasing water were taken into account when taxing profits?

In this case, tax authorities require that the unified social tax be accrued and that income tax be withheld from employees. In their opinion, in such a situation, the company's employees receive income in kind.

However, if the company does not keep track of the amount of water drunk by each employee, this is not necessary.

Note. Unified social tax and personal income tax do not need to be charged on the cost of drinking water.

The fact is that the unified social tax and personal income tax are levied on income received by employees. However, in this case, it is impossible to take into account how much water each specific employee consumed.

In addition, as stated in the Resolution of the Federal Antimonopoly Service of the Moscow District dated July 19, 2000 N KA-A40/2965-00, “...an employee’s taxable income cannot include impersonal payments for services... since he may not use these services. The fact that an enterprise has concluded contracts for the purchase of food products and their payment... is not sufficient evidence that the employee receives income.”

N. Karaseva

Expert Editor

Writing off drinking water as expenses

Every month, starting from the next month after putting the cooler into operation, make the following entries: Debit 23 (25, 26, 91-2...) Credit 02 - depreciation of the cooler has been accrued. This procedure follows from paragraphs 17 and 19 of PBU 6/01 and the Instructions for the chart of accounts. Cooler included in materials Property worth no more than RUB 40,000.

in accounting can be reflected not as part of fixed assets, but as part of inventories (clause 5 of PBU 6/01). A specific value limit for classifying property as one or another group of assets must be fixed in the accounting policy for accounting purposes. If the cost of the cooler is less than the established amount, capitalize it on account 10-9. The same should be done if the cooler will be used for a period not exceeding 12 months (clause 4 of PBU 6/01). Then register the purchase of the cooler and reflect it in accounting in the usual manner prescribed for materials. For more information, see

Types of bank commissions

The most common types of bank rewards are:

- for cash settlement services (SSC);

- for making a payment;

- for the remote banking system (RBS or Bank-client);

- for cash withdrawal;

- acquiring commissions.

The commission for cash settlement services and remote banking services is set at a fixed amount and in some credit institutions it is charged as a subscription fee even in the absence of transactions on the account.

The remuneration for making payments is most often set at a fixed amount for each payment and only when transferring money to another bank.

For cash issuance and acquiring – it is set as a percentage of the amount of funds.

All of the above services of credit institutions are not subject to VAT. But, in addition to this, banks provide services subject to VAT: collection, maintenance of a credit line, provision of safe deposit boxes or SMS information.

It is advisable to account for accounting entries for bank commissions with and without VAT on different accounting accounts.

Write-off of drinking water for expenses during sleep

The company is able to independently decide how expedient certain expenses are. Determination of the Constitutional Court of June 4, 2007 No. 320-O-P, No. 366-O-P How to document expenses All operations related to the company’s business activities must be accompanied by primary documentation ( Law No. 402-FZ). Such papers can be accepted for accounting only if they were compiled according to the form that is present in the albums of primary documentation forms. If an accountant needs to draw up a document for which a special form is not established, it is necessary to include the details specified in the law.

The papers required to record sweets and drinks purchased for employees and visitors are presented in the table.

Banks pointed out to the authorities the threat of writing off alimony for debts

Until now, protected payments in favor of a citizen have not been allocated in any way to the total amount of income. Typically, bailiffs to collect debts contact the banks where the debtor is serviced, and the banks, based on a writ of execution, write off the required amount from the client’s accounts. As a result, the problem of incorrect write-offs of sacred money was widespread, RBC wrote. “The bank could not and was not obliged to figure out what category of income these funds belong to,” notes Dakhanago Nagoeva, partner at the Bishenov and Partners law office. According to the new law, from June 1, employees making government social payments and employers will be required to indicate the code of types of income so that the bank can see that they cannot be written off under a writ of execution.

Write-off cannot be appealed: what and how much bailiffs can take from an account Money

How to label child support

Banks are ready to filter clients’ income, but there is a problem, says Sergei Klimenko, the main issue concerns transfers by individuals, for example alimony. According to him, we are not talking about cases where a bailiff, through an employer, forcibly seeks payment of alimony, but about cases when the citizen himself voluntarily pays. “Conventionally, the child’s parents may have a notarial agreement, according to which one of them voluntarily transfers a certain amount to a specific account. When an individual pays alimony on his own, he does not indicate the type of income code,” explains the lawyer.

In this regard, the question arises whether the client is required to mark the transfer of funds in accordance with the new amendments. If so, then banks should convey this information to their clients, points out the head of the ADB's legal department. Most bank clients are not aware of such markings - they transfer money using a phone number, and they do not have the opportunity to indicate the type of income code. “At most, the client can write a message to the recipient,” adds Klimenko.

Banks asked the Central Bank and bailiffs for help in the fight against cashing out Finance

According to ADB estimates, 95% of alimony transfers to clients of large banks are payments for child support. Credit institutions fear that, despite the amendments, customer complaints about incorrect write-offs will not stop. Banks will be subject to administrative liability, Klimenko emphasizes: “The so-called client immunity from incorrect crediting and debiting of funds against the debt will not appear.”

Representatives of VTB and Rosselkhozbank told RBC that their systems are ready to filter cash receipts into client accounts in order to protect social benefits and alimony from collection, but organizations will check the assignment of payments to individuals in different ways.

VTB has updated its services so that clients have the opportunity to indicate the code of the type of income in the payment document. “A new field “translation type” will appear, which will have a fixed drop-down list of three source options. The payer is responsible for indicating and correcting the type of income code. In the absence of information about the code, such funds will not have immunity from seizure or collection,” explained a bank representative.

Rosselkhozbank believes that indicating the type of income code is the responsibility of the client himself. “The bank is interested in bringing such information to its individual clients by posting the necessary information, for example, on the bank’s website,” said a representative of the Russian Agricultural Bank.

Other large banks and the Central Bank did not respond to RBC's requests.

What risks may banks face?

The press service of the Ministry of Justice did not comment on how banks should act if clients do not indicate information about alimony or other social payments in the purpose of payments, citing only the content of the amendments made to the law “On Enforcement Proceedings”. The department also did not explain whether the bank would be liable if, for example, it wrote off alimony without markings.

The Ministry of Finance agreed to the appearance of private bailiffs in Russia Economics

Now, according to the law, if a bank does not carry out a transaction in accordance with the writ of execution, it faces a fine of 50% of the amount of claims, but not more than 1 million rubles. (Article 17.14 of the Administrative Code). If a credit institution makes a mistake and wrongfully writes off a client’s funds, he can be brought to civil liability, Nagoeva reminds: “The bank is obliged to pay interest on the amount unreasonably debited from the account. The amount of interest is usually determined by the key rate of the Bank of Russia in force during the relevant periods.”

The issue of labeling payments by individuals can hardly be resolved both from a technical and legal point of view, Nagoeva believes. “Of course, in a message or in comments to these transfers, a citizen can indicate that this is alimony or money that he is transferring in connection with causing harm to the health of another citizen. However, it is unlikely that the bank is obliged to pay attention to this comment and consider it a mark. Moreover, a problem arises with the actual determination of the purpose of the payment, whether this transfer is alimony or a loan,” explains the lawyer.

Partner of the DE-JURE Bar Association, Anton Pulyaev, believes that banks should not be held responsible if a payment to an individual remains unmarked. “And this is not a problem of the bank, but of the person transferring funds to the debtor, and the debtor. But another question: how can the bank verify the integrity of the person transferring funds to the debtor, for example, alimony?” - says the lawyer. He does not exclude that for this, banks will have to request additional evidence and documents from clients.

Subscribe to the RBC newsletter. We talk about the main events and explain what they mean.