How to work according to the new rules of PBU 18/02 from 2020? In what ways can current income taxes be taken into account? What will change when switching to the balance sheet method? How to calculate temporary differences when comparing the book and tax values of assets and liabilities, as well as for transactions that do not affect accounting profit, but affect future income taxes? In this article you will find all the answers.

The new edition of PBU 18/02 must be applied starting with reporting for 2020. That is, before it occurs, it is necessary to make changes to the accounting policy and decide on the rules for accounting for income tax calculations. In addition to Order of the Ministry of Finance dated November 19, 2002 No. 114n and IAS 12 “Income Taxes”, you can use the following explanations for your work:

- Information letter of the Ministry of Finance dated December 28, 2018 No. IS-accounting-13;

- recommendations of the NRBU “BMC” Foundation dated April 26, 2019 No. R-102/2019-KpR.

New names PNO and PNA

There are permanent differences. They arise if income or expenses form accounting profit, but are not taken into account when calculating income taxes, either now or in the future. Or vice versa: they are reflected only in tax accounting. Now, on the basis of permanent differences, we form permanent tax liabilities and permanent tax assets (PNO and PNA). Since the new year, they are called differently - permanent tax expenses and permanent tax revenues (PNR and PND).

Debit 99 Credit 68

- fixed tax expense is reflected;

Debit 68 Credit 99

- constant tax income is reflected.

The new names better reflect the essence of the indicators. For example, PNR reduces net profit, so it is reflected in the debit of account 99 “Profits and losses”. IPA increases profit, so it is reflected in the credit of account 99.

https://youtu.be/-8c2itQHweE

Examples of PNO accounting

To clearly understand how to calculate permanent tax liabilities, let’s look at a specific example using the formula.

Let’s assume that a particular company’s spending on purchasing gift products for its anniversary amounted to 68,000 rubles. Expenses made must be reflected in accounting. We calculate the required indicator. If an enterprise uses general rules when reporting, then it should use regulation 18/02, which regulates how income tax calculations must be made.

It will take 68,000 rubles multiplied by 20%. We receive 13,600 rubles. This will be the permanent tax liability accrued by us.

Of course, the use of constant taxes in accounting is not limited to this example. Let's look at another common situation. When paying for certain types of advertising services, a limit is introduced on the amount that can be officially recognized for tax purposes. In particular, this value is 1% of the revenue achieved for the reporting period. Let's say that over the past tax period the company spent 100 million on advertising. Of these, 10 million will not be taken into account, since this is the difference that turns out to be above the norm.

Considering that the standard rate used by the enterprise is 20%, the size of the PNO will be equal to 2 million rubles.

The expenses incurred by the enterprise in this case are reflected as follows: 100 million Dt 44 – Kt 60.

To visually display the PNO, you will need to multiply 10 million by 20%: 2 million Dt 99 - Kt 68.

Another option is how such discrepancies between different reporting forms may appear and be taken into account. The company receives 200,000 rubles for development. One of the investors transfers this amount to her account. He is actually the largest owner, since he has over half of the authorized capital in the investment portfolio. According to Article 251 of the Tax Code of the Russian Federation, these funds at the disposal of the company are not taxed.

Reflection of obligations in 1C, watch the video:

When preparing financial statements, the money will have to be officially considered acquired income. A stable difference is formed on which the permanent tax asset is based. It is also calculated based on a base rate of 20%. In this situation, it turns out to be equal to 40,000 rubles.

Temporary differences

The Ministry of Finance approved a new procedure for calculating temporary differences - balance sheet. Temporary differences are calculated by comparing the value of an asset or liability, which does not coincide in accounting and tax accounting (clause 8 of PBU 18/02 as amended in 2020). This is the only way to calculate temporary differences in the new edition of PBU 18/02. From January 1, 2020, absolutely all organizations must apply it.

To calculate temporary differences, the accountant must prepare a table of assets and liabilities. It must be done on the reporting date, for example, December 31. Do not include assets and liabilities in the table by object; it is enough to reflect aggregated indicators. For example, the line “Fixed assets” will reflect the cost minus accrued depreciation for all fixed assets.

There may be provisions for reduction in value for raw materials, goods and finished products. The value of these assets can be shown collapsed, that is, minus reserves, you can open and show the value of assets and the value of reserves separately. The same approach applies to accounts receivable: you can immediately reduce accounts receivable by the amount of the reserve for doubtful debts; you can consider these two values separately. This will not affect the overall result.

Next, we look at similar data on the value of the same group of assets and liabilities in the tax accounting system. And, in addition to the assets and liabilities already reflected, we add to the table indicators from tax accounting that are not in accounting. For example, a loss carried forward to the future, a reserve for the repair of fixed assets, which is formed only in tax accounting. Their book value will be zero.

Next, calculate the total time difference. Use this algorithm.

- Calculate the differences for each row of the table. If the book value of assets is greater than the tax value, then a taxable temporary difference arises, otherwise it is deductible. Regarding obligations, the opposite is true. If the book value of the liability is greater than the tax value, then a deductible temporary difference arises, otherwise it is taxable.

- Add up all deductible differences across assets and liabilities and separately all taxable differences. So, on the slide table we calculated the sum for each column.

- Subtract the smaller difference from the larger difference. The result will be one difference - the one that was greater: either deductible or taxable.

There may be exceptions if an organization, for example, operates and pays income tax in several regions at different income tax rates. Then consider time differences related to different regions separately.

When applying the balance sheet method, temporary differences include “unrealized” permanent differences. These are the differences that will become permanent in the next reporting period. For example:

- excess costs in work in progress, finished goods in warehouse or shipped goods;

- excess interest on borrowed funds in unfinished construction;

- R&D expenses with a coefficient of 1.5 in unfinished developments.

For example, work in progress includes an expense that is recognized only in accounting and is not taken into account for tax purposes. When the finished product is sold, this expense forms a permanent difference. However, until it “reaches” account 90 “Sales” or 91 “Other income and expenses,” we consider it as temporary. These differences will accumulate in the composition of assets - goods, finished products in the warehouse, work in progress, etc.

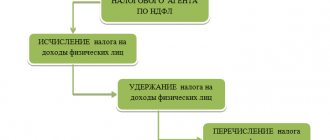

How to pay off deferred tax liabilities

Economic reporting standards, accepted throughout the world, contain instructions according to which it is recommended to calculate what the amount of taxes will be for a certain period. A basic standard is provided, containing comprehensive algorithms for how to determine all foreign and domestic existing tax payments, and suggests what to include in the final reports. Attention is paid to income taxes withheld at sources of payments.

According to this standard, there is a need to take into account not only those taxes that are required to be paid, but also the size of the resulting consequences determined by the specific results of the organization’s economic activities and completed transactions. This gives rise to a concept called deferred tax liability. When paying them, you should take into account the existing requirements. Everything together gives a specific final result.

Experts use deferred tax liabilities to determine the amount of taxes paid directly on profits. They must be entered for the corresponding calendar and reporting periods. In practice, they appear due to the introduction of taxation boundaries at the legislative level.

As a rule, such liabilities are recognized using reduced net benefits for the previous calendar year or other time period. An alternative option is to reduce the amount of equity capital after it is reflected in the balance sheet of the corresponding item.

When there is a reduction in the amounts subject to the corresponding taxes, a decrease begins, which is reflected in an increase in tax liabilities. They must be paid now. The result of this activity is a reduction in existing outstanding liabilities.

It is possible to establish their parameters by multiplying the amount of borders subject to taxation by a certain rate. Calculations are made for a specific period of time.

For a detailed calculation, it is recommended to use account No. 77, which describes tax liabilities that are currently deferred.

They are formalized in the accounting papers with a special entry, which provides comprehensive calculation parameters, profit charges, and the obligations themselves, which are still deferred.

Great importance is given to analysts' reports in determining temporarily deferred obligations. This activity is carried out on several different types of assets, creating existing tax differences over time.

Periodically, when these differences are gradually reduced or completely eliminated, tax liabilities are also reduced or eliminated. If a specific asset or one or more types of liabilities are lost, a write-off is issued. It is worth noting that it is for them that specific amounts are officially calculated. It increases tax profits. All time periods are taken into account, not just the current and upcoming ones.

About the deferred type in the video:

https://youtu.be/0V03o76kQq8

When changes are made to relevant bills and decrees regarding current rates, the amounts of assets and liabilities need to be recalculated. These actions will be required, since a gap will form during recalculation. Part of the profit may not be distributed, and uncovered losses will appear.

Given that there are currently several different rates, liabilities are assessed based on a specific type of income, and if necessary, it is reduced as much as possible.

To summarize, we note that permanent tax liabilities are an important tool for financiers and accountants. To fill out documents correctly and up to date, you must correctly use the formulas that are used for PNO.

Top

Write your question in the form below

Composition of temporary differences

The Ministry of Finance has expanded the list of situations that result in temporary differences. In particular, they now directly include estimated liabilities, which are formed only in accounting, or reserves, which are only in tax accounting (clause 8 of PBU 18/02 as amended in 2020).

It makes a difference when an organization:

- revalues assets;

- creates reserves according to rules that differ in accounting and tax accounting;

- recognizes estimated liabilities.

Please note the peculiarity of accounting for differences in the revaluation of non-current assets. If, as a result of revaluation, we reflect in accounting for the first time a depreciation of a fixed asset or an intangible asset, then we make entries in correspondence with account 91. And this amount gives us a permanent difference. When we compare the book value of a non-current asset after revaluation and its tax value, another difference appears. We must view it as temporary. That is, as a result of markdown, we will have two differences at once - both permanent and temporary.

The amount of the initial revaluation of fixed assets is charged to account 83 “Additional capital”. In this case, a permanent difference does not arise: there is no income either in accounting or tax accounting. A temporary difference will appear when comparing the book value of the overvalued object and the tax value.

The results of those operations that do not fall into account 99 are a new type of difference. Differences are formed according to them if these transactions do not form an accounting profit or loss, but are taken into account when taxing profits in another or other reporting periods. For example, these are transactions that are reflected in accounting in account 83 or 84 “Retained earnings (uncovered loss).”

Here are some other cases when the result of a transaction is not reflected in the profit of the current period:

- revaluation of fixed assets and intangible assets, if there was no depreciation before, or their depreciation in subsequent years if there is an revaluation (account 83);

- exchange differences that arise when translating the financial statements of a foreign subsidiary;

- correction of a significant error in accounting after approval of the financial statements (account 84);

- changes in accounting policies that entail retrospective recalculation (account 84).

As a result of such transactions, the carrying amount of assets and liabilities changes, and the adjustment is applied to account 83 or account 84. When comparing the carrying amount

There will be a temporary difference between such assets and liabilities and their tax value.

Introduction to PBU 18/02 - permanent differences

Published 10/30/2018 10:09 Author: Administrator We offer you an immersion in the topic of PBU 18/02 “Accounting for corporate income tax calculations”, regardless of whether you apply it in your business or not. We will try to show the relationship between the concepts of this complex PBU and look at “how it works” with examples.

PBU 18/02 is called upon to use special postings to link the income tax calculated in accounting and tax accounting.

Previously, we already looked at the interweaving of the concepts of PBU 18/02 in the article Basics of accounting using PBU 18/02 in 1C: Enterprise Accounting 8

Let's talk about this in more detail. Pay attention to the key feature of the concepts of “assets and liabilities” according to PBU 18/02.

There are four in total:

- permanent tax liability,

- deferred tax liability,

- permanent tax asset,

— deferred tax asset.

The concept of “tax liability” (permanent and deferred)

In the case of a permanent tax liability, it is understood that the organization has a certain “constant (conditional overpayment) for income tax”, and it will always remain so (“Pay more in principle”).

In the case of a deferred tax liability, it is implied that in the current period the organization is postponing payment of tax, but will definitely pay it in the future (“Pay less now”).

The concept of “tax asset” (permanent and deferred)

In the case of a permanent tax asset, it is implied that the organization has some “constant (conditional savings) on income tax”, and it will always remain so (“Pay less in principle”).

In the case of a deferred tax asset, it is implied that in the current period the organization “conditionally overpaid” the tax, but in the future it will necessarily compensate for this “overpayment” (“Will pay less in the future”).

Constant differences

Important Features:

1. Permanent differences affect the company’s net profit and are accrued from net profit through account 99.

2. Permanent differences are not reflected in the balance sheet because have no account balances at the end of the current period.

3. We do not accept permanent differences and will never accept them in the future for the purposes of calculating income tax with the budget.

When do permanent differences occur?

1. Permanent tax liability is the most common case of permanent differences.

As can be seen in the example, accounting and tax profits differ by the amount of expenses not accepted in tax accounting (394-354=40). We equalize the income tax in accounting by posting:

D-t 99.02.3 K-t 68.04.2 (40*20%=8).

When using PBU 18/02, account 68.04.2 appears, which is key because It is on this basis that the income tax payable to the budget is formed. This tax amount will be indicated in the income tax return. In this case, postings are generated for a specific analytical accounting object.

Principles of tax accounting in 1C

1. Accounting and tax accounting are carried out in parallel, i.e. One operation generates data from both accounts;

2. Accounting and tax accounting data can be compared using a control number because The rule BU=NU+PR+BP applies. In other words, accounting data always corresponds to tax accounting data with permanent and temporary differences. In this case, the differences can be both with a sign (+) and with a sign (-).

How it works in 1C

Let's consider an example of reflection in 1C: Enterprise Accounting 8 edition 3.0.

The organization paid tax penalties (VAT) for late payment. This type of expense is not accepted for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation)

We compare the data according to the rule BU=NU+PR+VR {2705.00 (BU)=2705.00 (PR)}. A permanent difference has been formed.

The operation “Closing the month” creates a permanent tax liability. The formula for calculation (PNO=PR*20%) and accounting entries (D-t 99.02.3-K-t 68.04) are indicated for reference in column 7 of the calculation certificate.

We generate a report on financial results (form No. 2). The permanent tax liability is reflected in line 2421 with a minus sign.

2. A permanent tax asset is a pleasant but rare case of permanent differences.

As can be seen in the example, accounting and tax profits differ by the amount of income not accepted into the NU (300+35=335). We equalize (reduce) the income tax in accounting by posting:

D-t 68.04.2 K-t 99.02.3 (335*20%=67).

How it works in 1C

Let's consider an example of reflection in 1C: Enterprise Accounting 8.3.

The organization received free assistance from the founder with a 100% share in the authorized capital. This type of income is not accepted for tax purposes (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

We compare the data according to the rule BU=NU+PR+VR {300,000.00 (BU)=300,000.00 (PR)}. A permanent difference has been formed.

With the operation “Closing the month” we create a permanent tax asset.

We generate a report on financial results (form No. 2). The permanent tax asset is reflected in line 2421 with a plus sign.

If in the current period an organization has both permanent tax liabilities (PNO) and permanent tax assets (PNA), they are reflected separately by type of liability.

In Form No. 2 (Report on financial results) PNO and PNA are shown as a total amount with a transcript attached.

Analytical accounting of permanent differences

If an organization has only permanent differences in its accounting, then analytical accounting for accounting accounts can be carried out by dividing income and expenses into “accepted for tax accounting purposes” and “not accepted for tax accounting purposes.”

“Meaningful achievements require significant effort.”

Author of the article: Irina Kazmirchuk

Introduction to PBU 18/02 - permanent differences

We offer you an immersion in the topic of PBU 18/02 “Accounting for corporate income tax calculations”, regardless of whether you use it in your business or not. We will try to show the relationship between the concepts of this complex PBU and look at “how it works” with examples.

PBU 18/02 is called upon to use special postings to link the income tax calculated in accounting and tax accounting.

Previously, we already looked at the interweaving of the concepts of PBU 18/02 in the article Basics of accounting using PBU 18/02 in 1C: Enterprise Accounting 8.

Let's talk about this in more detail. Pay attention to the key feature of the concepts of “assets and liabilities” according to PBU 18/02.

There are four in total:

- permanent tax liability,

- deferred tax liability,

- permanent tax asset,

— deferred tax asset.

The concept of “tax liability” (permanent and deferred)

In case of permanent tax liability

it is implied that the organization has a certain “constant (conditional overpayment) for income tax”, and it will always remain so (“Pay more in principle”).

In case of deferred tax liability

it is implied that in the current period the organization is postponing payment of tax, but in the future it will definitely pay it (“Pay less now”).

The concept of “tax asset” (permanent and deferred)

In the case of a permanent tax asset

it is implied that the organization has a certain “constant (conditional savings) on income tax”, and it will always remain that way (“Pay less in principle”).

In case of a deferred tax asset

it is implied that in the current period the organization “conditionally overpaid” the tax, but in the future it will definitely compensate for this “overpayment” (“Will pay less in the future”).

Constant differences

Important Features:

1. Permanent differences affect the company’s net profit and are accrued from net profit through account 99.

2. Permanent differences are not reflected in the balance sheet because have no account balances at the end of the current period.

3. We do not accept permanent differences and will never accept them in the future for the purposes of calculating income tax with the budget.

When permanent differences occur?

- Permanent tax liability

– This is the most common case of permanent differences.

As can be seen in the example, accounting and tax profits differ by the amount of expenses not accepted in tax accounting (394-354=40). We equalize the income tax in accounting by posting:

D-t 99.02.3 K-t 68.04.2 (40*20%=8).

When using PBU 18/02, account 68.04.2 appears, which is key because It is on this basis that the income tax payable to the budget is formed. This tax amount will be indicated in the income tax return. In this case, postings are generated for a specific analytical accounting object.

Principles of tax accounting in 1C

1. Accounting and tax accounting are carried out in parallel, i.e. One operation generates data from both accounts;

2. Accounting and tax accounting data can be compared using a control number because The rule BU=NU+PR+BP applies. In other words, accounting data always corresponds to tax accounting data with permanent and temporary differences. In this case, the differences can be both with a sign (+) and with a sign (-).

How it works in 1C

Let's consider an example of reflection in 1C: Enterprise Accounting 8 edition 3.0.

The organization paid tax penalties (VAT) for late payment. This type of expense is not accepted for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation)

We compare the data according to the rule BU=NU+PR+VR {2705.00 (BU)=2705.00 (PR)}. A permanent difference has been formed.

The operation “Closing the month” creates a permanent tax liability. The formula for calculation (PNO=PR*20%) and accounting entries (D-t 99.02.3-K-t 68.04) are indicated for reference in column 7 of the calculation certificate.

We generate a report on financial results (form No. 2). The permanent tax liability is reflected in line 2421 with a minus sign.

- Permanent tax asset

– a pleasant, but rarely encountered case of permanent differences.

As can be seen in the example, accounting and tax profits differ by the amount of income not accepted into the NU (300+35=335). We equalize (reduce) the income tax in accounting by posting:

D-t 68.04.2 K-t 99.02.3 (335*20%=67).

How it works in 1C

Let's consider an example of reflection in 1C: Enterprise Accounting 8.3.

The organization received free assistance from the founder with a 100% share in the authorized capital. This type of income is not accepted for tax purposes (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

We compare the data according to the rule BU=NU+PR+VR {300,000.00 (BU)=300,000.00 (PR)}. A permanent difference has been formed.

With the operation “Closing the month” we create a permanent tax asset.

We generate a report on financial results (form No. 2). The permanent tax asset is reflected in line 2421 with a plus sign.

If in the current period an organization has both permanent tax liabilities (PNO) and permanent tax assets (PNA), they are reflected separately by type of liability.

In Form No. 2 (Report on financial results) PNO and PNA are shown as a total amount with a transcript attached.

Analytical accounting of permanent differences

If an organization has only permanent differences in its accounting, then analytical accounting for accounting accounts can be carried out by dividing income and expenses into “accepted for tax accounting purposes”

and

“not accepted for tax accounting purposes.”

“Meaningful achievements require significant effort.”

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Our training courses and webinars

Reviews from our clients

Add a comment

Comments

0 Elena 03/15/2020 18:53 Very useful article! Thank you!

Quote

0 Marina Serebryakova 11/08/2018 00:43 I liked it very much! I'm waiting for the next materials.

Quote

0 Marina Serebryakova 08.11.2018 00:42

Quote

0 Goncharova Alina 10/31/2018 02:02 Thank you for the article! I'm looking forward to the next article

Quote

Update list of comments

JComments

Postings with ONA and ONO

As a result of the calculations, we have only one temporary difference, on the basis of which we form deferred tax. To do this, we multiply the temporary difference by the income tax rate. If as a result of the calculation we have identified a deductible difference, then it should be reflected in the balance sheet, if taxable - IT.

Then we look at how much SHE or IT has changed compared to the previous reporting date. If IT has increased, additionally accrue it to the debit of account 09 “Deferred tax assets”, IT – to the credit of account 77 “Deferred tax liabilities”. If IT has decreased, make an entry with a credit to account 09, IT – with a debit to account 77.

If at the beginning of the year there is an IT, and at the end of the year we have a deductible difference, then we fully repay the IT and reflect the accrued IT. That is, we make two entries: one for debit 77, the second for credit 09. In the opposite situation, when at the beginning of the year there is IT, and at the end of the year we have calculated the taxable difference, we repay IT and accrue IT. In this case, we also make two entries: one for credit 09 and the second for debit 77.

The amounts of deferred taxes that were reflected in debit 09 or debit 77 are included in the income statement with a “+” sign. And the amounts of deferred taxes reflected on loan 09 or loan 77 are marked with a “–” sign.

Correspondence for accounts 09 and 77 depends on the method of generating the current income tax. Depending on the accounting option, we will make the usual entries with account 68 “Calculations for taxes and fees” or use account 99.

How to account for deferred tax assets and liabilities

Recognition of OTA (deferred tax asset)

A deferred tax asset is the part of deferred income tax that should reduce the amount of income tax in subsequent periods. In other words, IT is possible if the amount of tax in accounting is less than in NU, and this difference is classified as temporary.

It is accounted for in active account 09 “Deferred tax assets”.

Let's look at an example.

Let’s say, according to accounting data, depreciation on fixed assets was calculated in the amount of 300,000 rubles. The tax base for depreciation is taken into account in the amount of 200,000 rubles.

For simplicity, we will assume that the company had no other costs. This means that the deductible temporary difference will be 300,000 - 200,000 = 100,000 rubles. Sirius's revenue amounted to 550,000 rubles. The tax rate is 20 percent.

Accrued deferred tax asset in transactions:

| Dt | CT | Operation description | Amount, rub. | Document |

| 62 | 90.1 | Reflection of revenue | 550000 | |

| 44 (expenses according to standards) | 02 | Reflection of expenses that reduce profit | 200000 | Accounting information |

| 44 (expenses above norms) | 02 | Reflection of expenses that do not reduce profit | 100000 | Accounting information |

| 90.2 | 44 (expenses according to standards) | Expenses to reduce profits are written off | 200000 | Accounting information |

| 90.2 | 44 (expenses above norms) | Expenses written off | 100000 | Accounting information |

| 90.9 | 99 | The financial result is reflected (550000 -200000-100000) | 250000 | Accounting information |

| 99 | 68 | IR accrued according to accounting data (250000*20%) | 50000 | Accounting information |

| 09 | 68 | SHE is reflected (100000*20%) | 20000 | Accounting information |

Settlement of deferred tax asset

Let's look at an example:

Let's assume that in November 2020, Rotor LLC sold the operating system. The loss in both BU and NU amounted to 12,000 rubles. The remaining period of use of the OS is 12 months.

In the accounting system, the amount of the loss is attributed to the financial result of November; in the accounting system, the loss is written off gradually over the remaining operating time. That is, monthly expenses include the amount of 12,000/12 = 1,000 rubles.

Repayment of deferred tax asset in transactions:

| Dt | CT | Operation description | Amount, rub. | Document |

| 09 | 68 | The amount SHE is reflected (12000*20%) | 2400 | Accounting information |

| 68 | 09 | Reflection of partial repayment of ONA (1000*20%) | 200 | Accounting information |

Recognition of IT (deferred tax liability)

A deferred tax liability is the part of deferred income that will increase its amount in subsequent periods. A deferred tax liability is obtained when the tax in accounting is greater than in tax accounting, and these differences are temporary.

Accounting for IT is maintained in passive account 77 “Deferred tax liabilities”.

Let's look at an example.

Astra LLC purchased equipment worth RUB 900,000. and a useful life of 10 years. Accounting depreciation of this equipment amounted to 90,000 rubles, tax depreciation for the same period - 180,000 rubles. due to the use of a special coefficient. Profit before tax - 600,000 rubles.

The difference between accounting and tax depreciation amounted to 90,000 rubles, this difference leads to the emergence of IT.

Accrued deferred tax liability in transactions:

| Dt | CT | Operation description | Sum | Document |

| 99 | 68 | Conditional consumption according to NP (600000*20%) | 120000 | Accounting information |

| 68 | 77 | Reflection IT (90000*20%) | 18000 | Accounting information |

Repayment of IT (deferred tax liability)

Let's give an example.

By the beginning of 2020, Astra LLC had a fixed asset on its balance sheet with a residual value of 40,000 rubles. At the beginning of the year, the remaining service life of this OS was 12 months. Depreciation was not accrued in the NU, since the service life of the NU expired in 2015.

Repayment of deferred tax liability in transactions:

| Dt | CT | Operation description | Amount, rub. | Document |

| 68 | 77 | IT accrued (40000*20%) | 8000 | Accounting information |

| 77 | 68 | Partial monthly write-off of IT (40000/12 *20%) | 667 | Accounting information |

Current income tax

The new edition of PBU 18/02 offers a choice of two ways to formulate the current income tax in accounting. Fix it in your accounting policy.

Delay method. Form the current income tax in a separate sub-account to account 68. Its amount will consist of conditional expenses or income (UR and UD), PPR, PND, SHE, IT - in this case, we reflect all the indicators in the same way as we did before. Reflect deferred taxes on account 09 or 77 in correspondence with account 68. Conditional expenses, PNR and PND - on accounts 68 and 99:

Debit 99 Credit 68

- a contingent income tax expense is reflected;

Debit 99 Credit 68

- fixed tax expense is reflected;

Debit 68 Credit 99

- constant tax income is reflected;

Debit 09 Credit 68

- a deferred tax asset is reflected;

Debit 68 Credit 77

- deferred tax liability is reflected.

Balance method. Transfer the current income tax from the income tax return and reflect it by posting debit 99 and credit 68. Do not reflect conditional expenses or income, PNR, PND in the accounting accounts. Deferred taxes should be reflected in account 09 or 77 in correspondence with account 99. The accounting records will include:

Debit 99 Credit 68

- current income tax is reflected;

Debit 09 Credit 99

- a deferred tax asset is reflected;

Debit 99 Credit 77

- deferred tax liability is reflected.

Regardless of the calculation method, the amount of the current income tax will be the same. This can be seen from the formula on the next slide.

Who should take into account the difference when generating profits?

In order for the discrepancy between the accounting profit and the tax profit indicated in the declaration to be correctly reflected in accounting, there is accounting regulation 18/02 “Accounting for income tax calculations on the profit of an organization” (Order of the Ministry of Finance No. 114n 11/19/2002).

Organizations that pay income tax are required to use such provisions. Companies that use simplified accounting and provide financial statements are exempt from calculating and paying income tax. Such companies can independently determine whether to apply this provision or not. The manager must consolidate his decision in the accounting policy (

Net profit or loss

The new edition of PBU 18/02 provides an example of calculating net profit, which reflects the two considered methods. Regardless of the method, the amount of net profit will be the same.

With the balance sheet method, profit before tax is reduced by the amount of income tax expense - current income tax and deferred taxes reflected in account 99. It is these indicators that are transferred to the financial results report.

With the deferment method, account 99 reflects the indicators of UR (UD) and PNR, PND. Based on these figures, the accountant should arrive at the same current income tax figure.

Let's look at this with an example.

Profit in accounting amounted to 1000 thousand rubles. (UR = 200 thousand rubles), and in tax accounting – 500 thousand rubles.

Deductible temporary difference – 100 thousand rubles. (SHE = 20 thousand rubles).

Taxable temporary difference – 800 thousand rubles. (IT = 160 thousand rubles).

Option 1: deferment method

We will calculate all indicators, including PPR and PND, and based on these indicators we will generate the current income tax.

The permanent difference, according to accounting data, is equal to 200 thousand rubles. (PNR = 40 thousand rubles).

We calculate the current income tax using the formula:

TNP = UR + PNR + SHE – IT

TNP is equal to 100 thousand rubles. (200 thousand rubles + 40 thousand rubles + 20 thousand rubles – 160 thousand rubles).

Option 2: balance method

Take the current income tax amount from the return and calculate the deferred taxes. Based on these figures, calculate the PNR or PND and calculate the constant difference. To do this, you do not need to compare income and expenses in accounting and tax accounting.

We calculate the constant difference using the formula:

PNR = (TNP – SHE + IT) – UR + UD

PNR is equal to 40 thousand rubles. (100 thousand rubles – 20 thousand rubles + 160 thousand rubles – 200 thousand rubles).

The permanent difference is equal to 200 thousand rubles. (40 thousand rubles: 20%).

With the balance sheet method of reflecting the current tax, the indicators of UR or UD, PNR or PND are not reflected in accounting. They are not disclosed on the balance sheet or income statement. But these indicators are disclosed in the notes to the balance sheet. Based on these data, users of financial statements will be able to draw a conclusion about the impact of permanent differences on the amount of current income tax.

31.05.2020What support measures do media and publishing houses receive?

The affected industries in the context of the worsening situation as a result of the spread of the new coronavirus infection are the media and publishing houses. Companies operating in these areas now have access to support measures for small and medium-sized businesses announced by the government due to the pandemic.

30.05.2020Bonus for a dismissed employee: how to take into account?

The bonus paid to a dismissed employee is taken into account as expenses when calculating the tax base for profits. But, only if the payment of this premium is provided for by local regulations.

29.05.20203 situations with personal income tax when testing for coronavirus

Testing for coronavirus has now become a very popular paid procedure. It is carried out by companies that are obliged to do this. Some companies test employees to ensure they have a safe working environment. Some compensate employees for the cost of tests they underwent on their own initiative. Well, in all these situations, the accountant has to resolve the issue of expenses and personal income tax. We'll help you figure it out.

29.05.2020Full list of OKVED affected industries as of May 26, 2020

Two new OKVEDs have been added to the list of those affected by the COVID-19 pandemic - media and publishing.

29.05.2020What has changed in accounting and tax legislation since June 1, 2020

June 2020 is not the richest month for changes in tax and accounting legislation. Just a few changes come into force on June 1, 2020.

29.05.2020Received “viral” subsidies! How to spend it?

The country's government continues to take measures to save businesses. One of these measures was the receipt of subsidies. Companies turn to the tax office for funds, the Federal Tax Service reports that entrepreneurs receive money. Some accounting specialists have a question: what to do after the funds have been received, how to properly account for them, and is it necessary to pay taxes on these amounts?

29.05.2020List of jobs for which postponing periodic medical examinations is prohibited

The Ministry of Health also did not waste time during the coronavirus epidemic. He issued an order according to which, from June 2, employers received the right to postpone mandatory periodic medical examinations of employees in connection with the declaration of a state of emergency or high alert. But not everyone. See the full list of such works.

29.05.2020How to fill out an application for a subsidy?

Small businesses most affected by the pandemic may receive a subsidy from the state. How to correctly fill out an application for a subsidy?

29.05.2020Will it become easier to fire workers during an epidemic?

The Ministry of Labor has prepared a draft resolution regulating the relationship between workers and employers during epidemics. It simplifies the procedure for dismissing employees, allows for the introduction of a simple shift work schedule and changes in an employee’s duties during an epidemic without the consent of the employee.

29.05.2020Vacation at your own expense: what do you need to know?

For family reasons and other valid reasons, an employee may be granted leave without pay. This is a vacation at your own expense. An employee cannot be forced to take such leave. However, during a crisis, companies go to great lengths to save money. Let us consider here the important nuances that an accountant needs to know.

29.05.2020Recommendations for children's holiday camps for the summer of 2020

Organizing children's holidays during a period of risk of an epidemic is not easy. Rospotrebnadzor prepared recommendations dated May 25, 2020 MR 3.1/2.4.0185-20.3.1, in which it spoke about the features of organizing children’s recreation and health improvement.

29.05.2020The law on how to “send” a landlord

When assessing the law, experts disagree. Some lawyers believe that the changes will balance the rights of participants in the turnover. Others warn that tenants will abuse their rights because the law has not been finalized. In addition, the lawyer compared the new norm with those already in force and debunked the idea that large businesses cannot get a “discount”.

28.05.2020How to round up insurance premiums correctly?

In order to correctly pay insurance premiums to the budget, they need to be calculated correctly. If the salary is calculated in rubles and kopecks, then contributions may also be in rubles and kopecks. And these pennies need to be rounded correctly. Let's figure out how.

28.05.2020What taxes will be written off for the second quarter of 2020? See the table!

SMEs operating in industries most affected by the coronavirus and socially oriented non-profits will not have to pay taxes, with the exception of VAT, and insurance premiums for the second quarter of 2020, with the exception of contributions for injuries. The State Duma adopted the law on amendments to the Tax Code in the third reading on May 22. We are waiting for the official publication of the law when it comes into force.

28.05.2020Preferential business loan 2.0

From the beginning of summer, the authorities will launch a new program of preferential business lending. The second version of the anti-crisis loan program provides for full repayment of the loan at the expense of the state. Let's talk about the new business lending program.

28.05.2020Ministry of Labor: non-working days of self-isolation do not need to be taken into account when calculating average earnings

The Russian Ministry of Labor recently clarified an important and currently pressing question for all accountants: how to take into account non-working days from March 30 to May 8 when determining average earnings. Let's take a closer look at letter dated May 18, 2020 No. 14-1/B-585.

28.05.2020How to obtain a license for agricultural wine producers

The activities of production, storage, supply and retail sale of wine products by agricultural producers are licensed activities. Obtaining such licenses is important for agricultural producers in the south of Russia and Crimea.

28.05.2020Let's open. We are opening! Are we opening?

Moscow was called ready for the first and even the second stage of lifting restrictions. And owners of beauty salons and restaurant workers in other regions launched flash mobs for the speedy opening of business.

27.05.2020A paper work book is a double burden for an accountant

It is impossible to keep work books in both electronic and paper form at the same time. But not everyone made the choice in favor of electronic ones. Someone still left a paper version. But due to this, the accountant has more work. For such “conservatives” they will still have to keep records in electronic form. Let's figure out why.

27.05.2020Remote business - satisfaction and efficiency

The massive transition to remote work has provoked a lot of research on both the comfort and satisfaction of the specialists themselves, and the reaction of employers who have already seen a change in the efficiency of employees.

We studied several surveys to understand how satisfied specialists and businessmen are with this format of work. 1 Next page >>

Income tax expense in accounting records

We disclose income tax expense or income on the income statement. This is a new measure and includes current income taxes and the change in deferred taxes for the period. If it reduces pre-tax profit, then it is an income tax expense (IPT). If the indicator has a positive value, it is called income tax income (IT).

One of the components of RNP or DNP is deferred income tax for the reporting period. But as part of deferred taxes, we should not reflect those that arise as a result of transactions that are not included in accounting profit.

In this regard, you will have to make two calculations of temporary differences. In the first calculation, include the carrying amount of assets and liabilities excluding transactions that do not affect profit before tax for the current period. And the second calculation will include only that part of the value of assets and liabilities that is associated with such transactions. That is, we separately highlight SHE and IT, which are accounted for in account 83 or account 84.

When do PNOs appear?

Such obligations are formed upon the official recognition of expenses only within the framework of accounting. This is also possible when income is recorded exclusively as part of tax reporting. This leads to the fact that when forming the base necessary for calculating income tax, there are several operations that can lead to the emergence of PIT.

Table 1. What leads to the appearance of PNO.

| Cause | Description |

| Property owned by the company is given free of charge to a third party for use | When preparing a report for the tax office, such an operation will not be taken into account in the expense column, and the resulting balance for the price of the object itself or a list of them will also be ignored. In accounting, such a procedure falls into the category of expenses. |

| When preparing a report for the Federal Tax Service, the company identified a certain loss | For example, expenses turned out to be higher than income when calculating the tax base. According to the legislation that was in force two years ago, it was allowed to reduce the tax base by the amount of the loss. This was allowed to be done for ten years from the moment of its formation. After the expiration of this period, the loss could no longer be taken into account when preparing tax reporting. However, it is still taken into account in accounting. |

| Expenses aimed at organizing corporate events also lead to the formation of PNO | To prepare income tax reports, expenses must be supported by official justifications related to specific business processes and documents. Spending on corporate events cannot meet these requirements, so they are not taken into account when preparing tax reporting. |

| Due to changes in the value of the object, fixed assets may be revalued | As a result, their original cost is recalculated. This leads to a recalculation of all depreciation that must be taken into account from the moment the object is used. These nuances are reflected in accounting, but for tax reporting they have no significance. |

These are the most common situations when PNO occurs. In practice, you have to deal with them much more often.

Watch the video on the topic:

Filling out reports using examples

Let's look at an example of how to divide and report deferred tax that does and does not affect accounting profit or loss.

The fixed asset was accepted for accounting in December 2020. The initial cost is 12,000 thousand rubles, the useful life is 60 months.

For 12 months of 2020, depreciation in the amount of 2,400 thousand rubles was accrued in accounting. The residual value as of December 31, 2020 amounted to RUB 9,600 thousand.

In tax accounting, an expense was recognized in the form of a depreciation bonus - 360 thousand rubles. and for the year they accrued depreciation in the amount of 2328 thousand rubles. Residual value as of December 31, 2020 – 9312 thousand rubles.

As of December 31, 2020, the organization carried out a revaluation in accounting, as a result, the amount of the revaluation amounted to 960 thousand rubles. After revaluation, the initial cost of the fixed asset in accounting is equal to 13,200 thousand rubles, accrued depreciation is 2,640 thousand rubles.

Data for the facility as of December 31, 2020 are presented in the table below.

| Indicator, thousand rubles. | Cost in accounting | Cost in tax accounting | Deductible temporary difference | Taxable temporary difference |

| OS cost excluding revaluation | 9600 | 9312 | – | 288 |

| Revaluation amount | 960 | – | – | 960 |

Let's assume that the organization calculates the current income tax based on the declaration. UR (UD), PNR, PND does not form. Deferred taxes are reflected in account 99:

Debit 99 subaccount “Deferred income tax” Credit 77

- RUB 57,600 (RUB 288 thousand × 20%) – ONO was formed;

Debit 83 subaccount “Additional valuation of fixed assets” Credit 77

- 192,000 rub. (960 thousand rubles × 20%) - ONO was formed.

In the statement of financial results, the organization will reflect IT in two amounts - 57.6 thousand rubles. and 192 thousand rubles. If the first amount, together with the current tax, will reduce profit before tax, then the second amount will reduce the total financial result.

In the balance sheet, the organization will reflect the total amount of IT at the end of the reporting period. At the same time, it will reduce the amount of revaluation by 192 thousand rubles. – the amount of IT arising in connection with the revaluation. Consequently, under the item “revaluation” the organization will reflect the balance in account 83.

In accounting for 2021, the company accrued depreciation in the amount of 2,640 thousand rubles, excluding revaluation - 2,400 thousand rubles. The residual value as of December 31, 2021 amounted to 7,920 thousand rubles, excluding revaluation - 7,200 thousand rubles.

In tax accounting for 2021, depreciation was accrued in the amount of 2,328 thousand rubles. The residual value as of December 31, 2021 amounted to RUB 6,984 thousand.

Data on the object as of December 31, 2021:

| Indicator, thousand rubles. | Cost in accounting | Cost in tax accounting | Deductible temporary difference | Taxable temporary difference |

| OS cost excluding revaluation | 7200 | 6984 | – | 216 |

| Revaluation amount | 720 | – | – | 720 |

The organization reduced IT with postings:

Debit 77 Credit 99 subaccount “Deferred income tax”

- 14,400 rub. (RUB 288 thousand – RUB 216 thousand) – IT was reduced;

Debit 77 Credit 83 subaccount “Additional valuation of fixed assets”

- 48,000 rub. (960 thousand rubles – 720 thousand rubles) – IT has been reduced.

In the financial results report, the organization will reflect IT in two amounts - 14.4 thousand rubles. and 48 thousand rubles. This time, the change in IT will be with a “+” sign, since you are reducing the previously generated indicators.

In the balance sheet, the amount of IT at the end of the reporting period will decrease by 62.4 thousand rubles. (14.4 thousand rubles + 48 thousand rubles). At the same time, the amount of revaluation will increase by 48 thousand rubles. compared to the previous period. In the future, an increase in revaluation will occur annually by the same amount as a result of a decrease in the previously formed IT and in three years will reach a value of 960 thousand rubles. It was precisely this amount of revaluation that was initially reflected in accounting as a result of the revaluation of fixed assets.

PNO in financial statements

The easiest way to illustrate tax obligations is to use the special Appendix 18/02, which is used by all representatives of this profession without exception. It regulates in detail and describes how the calculation of the income tax of a particular company or enterprise should be carried out according to the law. According to this document, tax liabilities recognized as permanent should be accounted for in debit account 99. It describes the losses and profits of legal entities. Additionally, it is necessary to consider the credit account No. 68, and not the subsidized account. Only together does it become possible to create a complete and objective picture.

Tax liabilities, considered permanent in accounting terminology, as well as the corresponding assets, are officially recorded precisely during the period when the financial transactions were directly carried out. It is recommended to limit them to a certain month so as not to delay reporting. Such requirements are contained in Article 7 of the Regulations. These transactions do not need to be reflected when preparing the balance sheet.

When compiling a report on the financial successes or failures achieved by the company, liabilities, along with assets, are written down in line No. 2421 specially designated for this. The difference in debit turnover compared to credit turnover is entered here.

Examples of calculating ONA and ONO on accounts 83 and 84

When correcting significant errors, a temporary difference can only arise if two conditions are met simultaneously: the error exists only in accounting and it was corrected through account 84.

For example, an organization incorrectly determined the useful life of a fixed asset in accounting and incorrectly calculated depreciation on it during the past year. Instead of 1000 thousand rubles. for the year, depreciation was accrued only for 600 thousand rubles.

The accountant corrected the error in accounting by posting:

Debit 84 Credit 02

- 400,000 rub. – additional depreciation accrued for the previous year.

There were no errors in tax accounting. Consequently, due to the correction of the error, a deductible difference will arise, on the basis of which the accountant will form IT:

Debit 09 Credit 84

- 80,000 rub. (400 thousand rubles × 20%) - ONA was formed.

In the future, the organization reduces IT by posting to the debit of account 99 and credit 09. This amount of IT will still go to account 84, but the accountant will not have to make a separate calculation for calculating temporary differences.

Apply the same principle when retrospectively recalculating due to changes in accounting policies. Temporary differences will arise if the recalculation concerns only accounting and affects account 84. For example, now organizations will reflect those deferred taxes that they must complete in connection with the new rules. Reflect them by counting 84.

Please note that if an organization has the right to choose the method of generating current tax, then for deferred taxes the accounting procedure does not provide any alternative. That is, in relation to revaluation, deferred taxes should be reflected in account 83, and when correcting errors or in case of retrospective recalculation - in account 84.

Transition to registration according to the new rules

If fixed assets or intangible assets were revalued, or if the organization recognized permanent differences in estimated liabilities and reserves before 2020, then do not recalculate anything in the previous period. To switch to accounting according to the new rules of PBU 18/02, adjust those ONA and ONO indicators that are listed in accounting. For this, at the beginning of 2020:

- compare the book value of assets and liabilities with their value in tax accounting;

- calculate deferred tax;

- compare ONO and ONA, which are registered as of January 1, 2020, with the calculated indicators. If they are equal, then no additional postings need to be made. If the calculated SHE and IT differ from what is reflected in the accounting, then on January 1, create deferred taxes in the required amount.

Examples of calculating deferred tax on an estimated liability, reserve for doubtful debts and reserve for repairs of fixed assets

| Object as of 01/01/2020, thousand rubles. | Accounting | Tax accounting | Deductible difference, SHE | Taxable difference, IT |

| Estimated liability | 1000 | 0 | 1000; Debit 09 Credit 84 · 200 (1000 × 20%) | – |

| Provision for doubtful debts | 2000 | 1750 | 250 (2000 – 1750); Debit 09 Credit 84 · 50 (250 × 20%) | – |

| Provision for repairs of fixed assets | 0 | 4000 | – | 4000; Debit 84 Credit 77 · 800 (4000 × 20%) |

Use the same principle if you carried out a markdown or revaluation of objects.

An example of calculating deferred tax when depreciating a fixed asset

| Fixed asset, thousand rubles. | 2017 | 2018 | 2019 | 2020 |

| As of January 1 | ||||

| Initial cost | 10 000 | 10 000 | used – 8000 well – 10,000 | used – 8000 well – 10,000 |

| Accumulated depreciation | – | 1000 | used – 1600 well – 2000 | used – 2400 well – 3000 |

| In a year | ||||

| Depreciation | 1000 | 1000 | used - 800 well - 1000 | |

| As of December 31 | ||||

| Markdown | – | 1600 | – | – |

| Initial cost | 10 000 | used – 8000 well – 10,000 | used – 8000 well – 10,000 | – |

| Accumulated depreciation | 1000 | used – 1600 well – 2000 | used – 2400 well – 3000 | – |

| Permanent difference (leads to formation of PNA) | – | – | 200 | – |

As of January 1, 2020, the cost of the OS is:

- balance sheet – 5600 thousand rubles. (8000 thousand rubles – 2400 thousand rubles);

- tax – 7000 thousand rubles. (10,000 thousand rubles – 3,000 thousand rubles).

Therefore, as of January 1, 2020, the accountant will form the following in accounting:

Debit 09 Credit 84

- 280 thousand rubles. ((7000 thousand rubles – 5600 thousand rubles) × 20%) – ONA is formed for the fixed asset.

Examples of calculating deferred tax when revaluing fixed assets

| Fixed asset, thousand rubles. | 2017 | 2018 | 2019 | 2020 |

| As of January 1 | ||||

| Initial cost | 10 000 | 10 000 | used – 12,000 well – 10,000 | used – 12,000 well – 10,000 |

| Accumulated depreciation | – | 1000 | used – 2400 well – 2000 | used – 3600 well – 3000 |

| In a year | ||||

| Depreciation | 1000 | 1000 | used – 1200 well – 1000 | |

| As of December 31 | ||||

| Revaluation | – | 1600 | – | – |

| Initial cost | 10 000 | used – 12,000 well – 10,000 | used – 12,000 well – 10,000 | – |

| Accumulated depreciation | 1000 | used – 2400 well – 2000 | used – 3600 well – 3000 | – |

| Permanent difference (leads to formation of PNO) | – | – | 200 | – |

As of January 1, 2020, the cost of the OS is:

- balance sheet – 8400 thousand rubles. (12,000 thousand rubles – 3,600 thousand rubles);

- tax – 7000 thousand rubles. (10,000 thousand rubles – 3,000 thousand rubles).

Therefore, as of January 1, 2020, the accountant forms IT in accounting:

Debit 83 Credit 77

- 280,000 rub. ((8,400 thousand rubles – 7,000 thousand rubles) × 20%) – an IT organization has been formed for the fixed assets object.