Conditions under which offset can be carried out

Offsetting allows you to pay for goods or services received in return.

In difficult market relations, many enterprises in the small sector of the economy experience certain problems with finances - they are often in short supply, they are invested in turnover, goods, etc., and yet it is necessary to pay off with partners. This is where mutual offset fits perfectly.

Key conditions for implementing this method of calculation:

- the presence of at least two contractual obligations in relations between companies . Moreover, according to one of them, each organization must be a creditor, according to the second, a debtor: in this way, mutual “overlapping” of debts occurs. In some cases, several enterprises participate in mutual settlements at once - the law fully allows this.

- the homogeneous nature of the obligations (for example, in the form of finances); in addition, it is necessary that certain deadlines be allocated for the offset to be completed or the possibility of demand be stipulated.

Organizations can use offset not for the entire amount of obligations, but partially, in other words, they can offset in the amount of the smallest debt. The rest can be paid in monetary terms.

Peculiarities of execution of a unilateral act of offset

According to Russian legislation, it is not prohibited to offset mutual obligations at the request of one party. Thus, mutual obligations can be repaid unilaterally.

To do this, you must first notify your partners about this in writing. To do this, the initiator must send a registered letter to the other party with a notice inside.

This is done in order to subsequently have documentary evidence in the form of a notification of receipt as evidence.

It will definitely come in handy in the event of controversial situations and litigation.

The act of mutual settlements is a simple document and significantly facilitates the work of employees and interaction between organizations. It has many benefits and is designed to make life easier for businesses in general. It is easy to put together and has little nuance.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, call

8 Moscow and Mos. region

8 St. Petersburg and Len. region

8 Regions of Russia

It's fast and free!

Positive and negative aspects of offset

Offsetting has both its pros and cons. The advantage is that such an offset can be carried out without the participation of financial resources, but, for example, when using any goods or services, which, accordingly, leads to a reduction in costs and saving cash.

At the same time, this calculation method also has its own disadvantages , which, first of all, include the fact that for any business the most profitable and interesting thing is the receipt of financial resources.

Transactions of this kind, especially those carried out with some regularity, often attract the attention of tax authorities during their audits, which often entails the imposition of various types of fines on companies.

That is why it is better to resort to the practice of mutual settlements only in the most extreme cases, when other forms of settlement are impossible for some reason. And in the offset agreements, all the nuances of the transaction should be spelled out as carefully and in detail as possible.

Prohibition on offset

Offsetting mutual claims is not allowed for the following obligations:

- in respect of which the statute of limitations has expired;

- related to compensation for harm caused to life or health;

- related to the collection of alimony;

- associated with the lifelong maintenance of citizens.

We invite you to familiarize yourself with: Donation agreement, notarization of the Civil Code of the Russian Federation

In addition, offset is impossible if this is expressly stated in the contract, as well as in other cases provided for by law. For example, offset cannot be carried out:

- if a bankruptcy case has been initiated against one of the parties to the offset (clause 14 of the information letter of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 No. 65).

Such restrictions are provided for in Article 411 of the Civil Code of the Russian Federation.

Advice: before setting off a settlement with a counterparty, draw up a reconciliation report of mutual settlements with a breakdown for each agreement concluded with him (if there were several agreements). This will allow you to determine the exact amount of debt that can be repaid by offset.

The reconciliation act is documentary evidence of the amount of mutual debts. If in the future disputes arise between the parties that will have to be resolved in court, then the absence of a reconciliation report may lead to the recognition of the offset as invalid. Similar consequences may occur if the act of reconciliation of mutual claims is drawn up in violation of legal requirements (for example, if the act was signed by a representative of the organization who is not authorized to sign the primary documents).

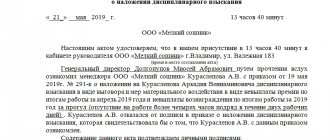

How to compose a paper

The netting agreement does not have a unified form, so representatives of enterprises and organizations can write it in any form or according to a model developed and approved within the company. The main thing is that the structure of this document complies with certain standards of office work; in addition, in terms of content, it must include some mandatory information. These include:

- the name of the organizations between which the agreement is being formed, their details;

- place and date of drawing up the form.

In the main part of the document it is necessary to record:

- the fact of an agreement reached;

- reference to the agreements under which it is carried out.

If there are any additional conditions or documents that are attached to this agreement, they must be noted as a separate paragraph.

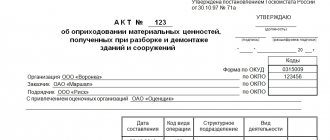

Instructions for filling out the netting act

The act has a completely standard structure from the point of view of office work.

- In the “header” of the act the name of the document is written with a short description of its essence. Next, enter the locality in which the company issuing the act operates, as well as the date of its creation.

- Then information about the first company is indicated: its name is entered, indicating the organizational and legal form (IP, LLC, OJSC, CJSC), the position of the responsible person (usually the Director, General Director is written here, or another employee authorized to sign such documents is indicated) last name, first name, patronymic (in full).

- We indicate on the basis of which document it operates (Charter, Power of Attorney, Regulations, etc.).

- Next, similar information is entered about the second party: name of the organization, position, surname, first name, patronymic of the responsible person and the document on the basis of which he acts.

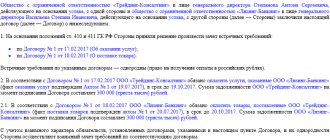

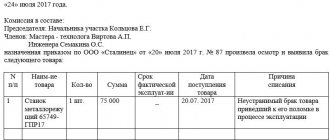

The second part of the act concerns detailed information on the basis of which agreements mutual debts arose (with a reference to them - numbers and dates of preparation), as well as their full amounts on both sides (in numbers and in words).

The fact of agreement to repay mutual financial (or other material) claims through offset is recorded (here it is necessary to indicate whether the offset is full or partial). If one party owes the other a large amount, then the deed should indicate within what period from the moment of its signing the remaining debt must be repaid.

In the final part, the act must be signed by all interested parties (the position, surname, and patronymic name of the employee signing the document are indicated here). The act can be certified with seals, but this is not necessary.

Nuances of drawing up an agreement between organizations

The execution of the agreement, as well as its content, is completely left to the employees of the companies. It can be written on an ordinary sheet of paper of any convenient format or on the letterhead of any organization, by hand or in printed form. Next, the document is signed by the directors or their representatives on both sides. Signatures must be “natural”.

If organizations use seals and stamps in their activities, then the agreement form should be endorsed.

The agreement is made in two identical and equivalent copies - one for each of the interested parties. After the document is completed and endorsed, it must be registered in the document register of each company. In the future, the document serves as the basis for carrying out relevant accounting operations.

The agreement should be stored together with the contract in a separate folder for the period established by the legislation of the Russian Federation or internal regulations of companies (but not less than three years).

Act of offset of mutual claims: sample 2020 and requirements for it

Correct execution of the act is possible provided that the document contains the names of the companies that participate in the transaction, the names of the heads of the organizations are given, and the provisions of the document are confirmed by the signatures of directors on both sides. The act of offsetting mutual claims is drawn up in written format. It must describe in detail the subject of the agreements - the reasons for the occurrence of debts to each other, their sizes, information identifying the requirements as homogeneous, the timing of the entry into force of the document.

To avoid controversial situations with counterparties or regulatory authorities, it is necessary to indicate not only the current amount of debts, but also what part of them should be considered repaid as a result of the transaction. The act of offsetting mutual claims, a sample of which you can develop yourself, has no restrictions on the number of details and the amount of information in the descriptive part of the document. To justify the correctness of the netting operation before the regulatory authorities, it is recommended to enter all amounts with a VAT breakdown in their composition.

An act of mutual settlement between organizations can be drawn up by two or three counterparties. If there are two parties involved, then the document is drawn up in 2 copies; if three companies act as participants in the transaction, then the number of copies of signed forms increases to 3. The acts must contain the following mandatory elements of primary documentation:

- name of the form;

- date of transaction;

- place of preparation (in which city the document was drawn up, agreed upon and signed);

- the act of offset of counter homogeneous claims, a sample of it, must contain information about the transaction meters - the currency of the transaction for the offset of funds;

- justification of the reasons for drawing up the act - the presence of debts under contractual relations, details of agreements, unpaid bills, outstanding certificates of work and services performed;

- the act of offset, an example of its preparation, must have in the text a monetary expression of the obligations on both sides that are subject to offset;

- indication of the transaction amount - the amount of debt that can be repaid as of the current date; if the amount of debts of one of the parties is higher than this value, the document displays the outstanding balance, which the debtor company will pay through the cash register or by bank transfer;

- a sample act of mutual settlement between two organizations contains information about the timing of operations to implement the provisions of the document;

- listing the persons responsible for the accuracy and compliance with the terms of the transaction;

- signatures of the managers of the companies participating in the mutual settlement.

The act of offsetting mutual claims of legal entities is supplemented with copies of the documents indicated in it as justification for the occurrence of mutual debts.

Legal aspects and benefits

The possibility of carrying out the netting procedure, as well as the legal grounds and features, are spelled out mainly in the Civil Code. The main purpose is to reduce your costs and solve accumulated problems regarding unfulfilled obligations. In this case, offset is assumed specifically for obligations related to the provision of services and/or supply of goods, and not payment obligations, which is reflected in the diagram.

In practice, the obligations of one party and the other are rarely equal to the nearest ruble, so in fact the offset is always made for a smaller amount. Accordingly, one partner owes the other a certain difference.

The advantages of this type of interaction are obvious:

- the parties can resolve long-standing problems with outstanding debts or other obligations under the contract;

- partners can agree on the most acceptable form of mutual settlement and thereby save on costs that will arise in the case of ordinary (literal) execution of the contract;

- finally, even in the simplest option of offsetting funds against debt obligations, the parties are guaranteed to save on bank commissions, which in the case of large amounts are quite noticeable.

When can you make a settlement?

Carrying out such a procedure is possible if the parties not only agreed on their positions, but also took into account two conditions simultaneously:

- Homogeneous nature of debts.

- The fact that the moment of fulfillment of obligations has arrived.

Uniformity

The homogeneity of debts that are supposed to be liquidated between organizations by signing an act is a very important requirement. The most common example of homogeneous claims is debt obligations in the same currency: rubles, euros, dollars, etc. At the same time, for any foreign currency it is also important to agree in advance on a single settlement rate (usually at the rate of the Central Bank of the Russian Federation on the day of the transaction).

However, the parties can also agree to offset claims of a heterogeneous nature - for example, obligations in different currencies. It is enough to agree on a unified approach to the exchange rate for the amounts.

If we are talking about the fact that one company has a monetary debt, and the other has not completed part of the work that it must do under the contract, then the requirements are clearly heterogeneous, therefore there can be no offset between organizations, and therefore it is impossible to sign a sample act .

Arrival of the deadline

The procedure is allowed only in cases where the actual deadline for fulfilling obligations has already arrived. For example, the parties agreed to supply goods from May 1, 2020. Offsetting such claims today, in November 2020, is impossible because the delivery has not yet been fulfilled.

NOTE. Often, the supply agreement or other agreements do not indicate specific deadlines within which the debt must be repaid. Accordingly, it can be considered that the moment of occurrence of the obligation has already occurred after the signing of the contract. Thus, offsets can be carried out.

When the procedure cannot be performed

Carrying out netting becomes impossible in cases that are directly provided for by civil law and/or an agreement between partners:

- When the contract expressly prohibits such a condition. A clause on the impossibility of netting should be included in the text of the agreement in advance, when it can be foreseen that this will be clearly unprofitable for your company.

- When it comes to interaction with a foreign counterparty with whom foreign economic activity is conducted. Offsetting is prohibited in most such cases.

- If 3 years have already passed since the deadline for fulfilling the requirements - i.e. statute of limitations.

Advantages of netting over barter

Mutual settlement between organizations, a sample act for which is discussed above, has some similarities with barter, because in both cases we are not talking about the literal fulfillment of one’s obligations, but only about exchange. But in fact, the external similarity is formal, and netting is more profitable than barter:

- Barter is carried out under an exchange agreement, in which only 2 parties can participate.

- It is easier to arrange a mutual settlement: no additional agreements are needed, it is enough to obtain consent, draw up and sign a deed.

- The very concept of barter is not in the legislation (but mutual offset is). In this case, the exchange agreement is equivalent to a purchase and sale agreement, and the exchange agreement can only be associated with material objects (inventory assets). At the same time, the subject of offset may also be services and/or work.

- Carrying out accounting for offsets is much simpler: the tax base is calculated in the usual way, and sales transactions are prepared. As for the offset of obligations, they are reflected in the following entry: