Can 3 companies enter into a netting agreement?

Any agreement within the jurisdiction of civil law can be multilateral, that is, involve the participation of three or more parties (Article 154 of the Civil Code of the Russian Federation). An agreement of offset - a voluntary refusal of a party to exercise a contractual right of claim in exchange for a similar refusal of the other party - can also be tripartite. Such an agreement must meet the criteria specified in Art. 410 of the Civil Code of the Russian Federation, that is, to assume the mutual termination of the obligations of the parties (for example, to pay for the supply of goods or services in rubles) after the deadline for claiming such obligations (unless otherwise permitted by law).

Any party to the agreement has the right to initiate offset unilaterally. However, other participants in legal relations may subsequently have objections to such an initiative, and each party will have to prove its case in court. Therefore, many companies prefer to formalize the offset of obligations under a separate agreement, which can be tripartite.

At the same time, the structure of obligations that the parties have to each other may be different. A “vicious circle” of obligations is common, when all 3 companies owe each other something.

Company A owes 100,000 rubles. company B, which owes 100,000 rubles. to firm C. In turn, firm C owes 100,000 rubles. to firm A. If the parties agree to offset the amount of 100,000 rubles, then no one will owe anyone.

Drawing up a netting agreement, including a tripartite one, has a number of nuances. Let's study them.

Settlement between two organizations

The company has the right to offset mutual obligations in two ways:

- unilateral statement by any of the participating parties;

- mutual agreement of both participants.

Unilateral procedure for offsetting mutual claims

Art. 410 of the Civil Code of the Russian Federation provides for the possibility of mutual offset at the request of any of the companies.

Documents for registration:

- Act of reconciliation;

- application for offset of mutual claims;

- agreements on the conclusion and terms of the transaction (required);

- invoices (required);

- invoices (required);

- acts on the provision of services (required).

Act of reconciliation

The reconciliation report plays a big role in the netting process (this is an optional document, but it is recommended to draw it up before the offset). It helps to study the information available to both organizations and determine the exact amount of debt. Subsequently, this will help prevent possible disagreements and court proceedings.

The reconciliation report includes a table of two columns containing information about the amount of debts according to each counterparty

The reconciliation report includes:

- date at the time of reconciliation;

- the names of both organizations;

- amount of liabilities;

- commitment agreements;

- balance as of the reporting date;

- signatures;

- print.

Settlement application

In the absence of a unified statement, it is written in any form with the presence of the main details of the primary accounting documents (Clause 2, Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”). And also the application must include information about the terminated obligations, the amount of offset, and the time of offset of mutual claims.

A prerequisite for carrying out offset at the request of any of the companies is to receive information confirming that the partner was notified of the termination of obligations by offsetting mutual claims, otherwise the offset requirement will be rejected.

You should draw up an application according to the sample, not forgetting the details, date and place of its execution

Bilateral settlement procedure

This option is more reliable than the previous one. To carry out mutual offset, the same documents are required as for unilateral, only the application for offset of mutual claims is changed to a mutual agreement, which implies the signing of a mutual act (agreement) by both parties. This eliminates the possibility of cancellation. This document is also drawn up in any form with all the details.

The bilateral agreement should indicate the addresses and bank details of the parties

Accounting entries

Offsetting reflected in accounting does not lead to the formation of new expense or income items in the balance sheet.

Table: accounting of claims offset operations

| Account debit | Account credit | |

| Account 60 “Settlements with suppliers and contractors” (Account 76 “Settlements with various debtors and creditors”) | Account 62 “Settlements with buyers and customers” (Account 76 “Settlements with various debtors and creditors”) | Settlement |

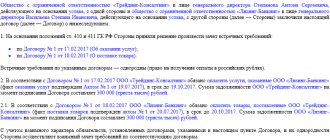

Example of unilateral netting

On January 14, 2020, Alpha LLC purchased 60 sets of tools for repairing various equipment from Beta LLC in the amount of 75,000 rubles. Payment is made after successful receipt of the goods, until February 10, 2020. Alpha LLC provided repairs to production equipment worth 80,000 rubles with a payment date of February 10, 2018.

On February 1, 2020, the companies issued a reconciliation report for all contracts they had. On February 2, 2020, Beta LLC sent to Alpha LLC an application for offset of mutual claims in the amount of 75,000 rubles with no date for the offset. The document was received by Alpha LLC on February 3, receipt was confirmed by a notification from Alpha LLC. The offset of mutual claims was taken into account in the accounting reports of the organizations immediately after the settlement. And 5,000 rubles will have to be paid by Alpha LLC until February 10, 2020.

Other nuances

There are nuances to reflecting the offset of mutual claims in tax accounting and VAT calculations.

Income tax

In case of netting, income tax will be accrued based on the method established in the organization for accounting for income and expenses. When using the accrual method, the offset operation is not reflected at all when calculating income tax, because neither income nor expenses will arise (clause 1 of Article 271, clause 2 of Article 272 of the Tax Code of the Russian Federation).

When using the cash method, income and expenses are taken into account if there is a fact of repayment of obligations (clause 2 of Article 273 of the Tax Code of the Russian Federation). That is, an income equal to the amount of the counterparty’s debt is reflected, and an expense equal to the amount of its own debt, repaid by offset.

VAT

When calculating VAT, the offset process is not taken into account, since the moment of shipment of goods (works, services) is the payment of VAT, and the right to deduction is the acceptance of purchased goods (services, works). It is necessary to recalculate VAT when the repayment of obligations occurs through mutual advances.

Sample triple netting agreement: how to draw up a document

When drawing up the document in question, you need to keep in mind that:

1. Immediately before signing the agreement, it is advisable to reconcile debt settlements (resolution of the Arbitration Court of the North Caucasus District dated July 7, 2016 No. F08-3112/16 in case No. A32-7482/2015).

The results of the reconciliation can be recorded in a separate act.

2. Offsetting is possible only for homogeneous claims.

The main criterion of homogeneity here is the method of repaying obligations. It can be presented, for example:

- cash payments in the established currency;

- supplies of certain goods in a specified quantity (certain services in a specified volume);

- transfer of promissory notes (bills of exchange) or assignment of the right to claim the debt of third parties.

That is, if the agreement between firms A and B provides for cash payments, and the agreement between firms B and C provides for natural deliveries, then offset will not be possible.

Read more Order of the Ministry of Health on dispensary observation of patients

3. An agreement cannot be drawn up if (Article 411 of the Civil Code of the Russian Federation):

- at least one countable obligation is related to compensation for harm to health, lifelong maintenance, payment of alimony;

- at least one of the obligations has expired;

- there are other obstacles to its conclusion, stipulated by law or contract.

4. The contract must reflect the following information:

- on the composition of mutually offset obligations;

- legal grounds for the emergence of relevant obligations (with references to contracts, primary documents);

- on the monetary expression of obligations.

You can view a sample of a triple netting agreement on our website using the link below.

Netting between three organizations

Situations arise when not two, but three organizations become participants in the mutual settlement.

Conditions, documents

Cases when offset is possible and impossible are also regulated by Art. 410 and Art. 411 of the Civil Code of the Russian Federation. However, there are certain conditions for carrying out trilateral netting:

- each company is both a creditor and a debtor to the other at the same time (company A is a debtor to company B and a creditor to company C; company B is a debtor to company C and a creditor to company A; company C is a debtor to company A and a creditor to company B);

- there is cyclicality and homogeneity of obligations;

- the debt is not overdue;

- obligations and the amount of debt are confirmed by a tripartite reconciliation act.

A bilateral agreement can serve as an example of a netting agreement. It must include:

- All participants;

- amount of debt;

- terms of obligations;

- offset amount;

- time spending;

- accounts receivable and payable before and after offset;

- approved acts of reconciliation of the parties.

All amounts subject to offset must be indicated including VAT.

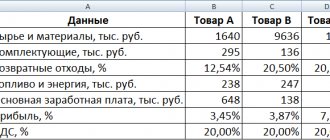

Accounting entries as an example

has a debt obligation to LLC "B" in the amount of 20,000 rubles, LLC "B" has a debt obligation to LLC in the amount of 40,000 rubles, LLC "C" has a debt to LLC "A" in the amount of 15,000 rubles. A tripartite agreement was adopted to carry out a netting operation in order to partially repay the debt in the amount of 15,000 rubles.

Table: netting in the accounting of LLC “A”

| Account debit | Account credit | Amount (rub.) | |

| D 62/C | K 90 | Supply of goods for LLC "S" | 15 000 |

| D 41 | K 60/B | Acceptance of goods from the supplier LLC "V" | 20 000 |

| D 60/B | K 62/S | Settlement | 15 000 |

Table: netting in the balance sheet of LLC “B”

| Account debit | Account credit | Amount (rub.) | |

| D 62/A | K 90 | Supply of goods for LLC "A" | 20 000 |

| D 41 | K 60/C | Acceptance of goods from the supplier "S" LLC | 40 000 |

| D 60/C | K 62/A | Settlement | 15 000 |

Table: netting transactions in LLC “S”

| Account debit | Account credit | Amount (rub.) | |

| D 62/B | K 90 | Supply of goods for LLC “V” | 40 000 |

| D 41 | K 60/A | Acceptance of goods from supplier LLC "A" | 15 000 |

| D 60/A | K 62/V | Settlement | 15 000 |

So, an incomplete offset was carried out, equal to the amount of 15,000 rubles, between LLC “V” and LLC “S”.

Tripartite agreement on the offset of mutual claims sample

Related publications

A triple netting agreement is an example of a joint settlement by counterparties of debts arising under supply or service contracts in the event of a shortage of financial resources. The conclusion of such an agreement is recognized as a transaction in accordance with the provisions of Art. 153 Civil Code of the Russian Federation, Art. 154 allows the implementation of agreements between several participants by concluding a multilateral treaty. The basis for offset of funds is the existence of debts to each other by three organizations that agree to offset.

Settlement agreement sample 2020 - 2020 free download standard form example form

Example #1

Settlement agreement

_____________________________________________________________________________________________________, hereinafter referred to as the Customer, represented by _________________________________________________________________, acting on ________________________________________________________________________________, on the one hand

hereinafter referred to as the Contractor, represented by __________________________________________________________,

acting on the basis of _____________________________________________________________________ have entered into this agreement as follows.

1. The Customer and the Contractor have come to an agreement to offset mutual claims under the following agreements, in which the Customer and the Contractor are independent parties.

1.1. According to contracts:

1) N __ from “____” ________ 20__ ___________________________

Tripartite agreement for the offset of mutual claims: mandatory details

Regardless of the number of parties to the contractual relationship, the document indicates a full set of mandatory details approved by the legislator for primary documentation. The tripartite netting agreement must include information about:

- names of the enterprises participating in the transaction;

- personal data of representatives of organizations that have the authority to conclude transactions and approve contracts with their signatures;

- the grounds for the emergence of powers among representatives of legal entities;

- tripartite settlement of mutual claims (sample document) requires listing the obligations of each party in relation to the counterparties participating in the transaction;

- if there are financial obligations and a desire to offset them, it is necessary to register the details of the documents on the basis of which the debt arose in the accounting;

- an agreement on the offset of mutual claims, a tripartite sample agreement must limit the period for repayment of debts - the document specifies the deadline for the implementation of debt write-off;

- the amounts of the claim that can be repaid by offset are given;

- At the end of the document form, registration information about each participant in the transaction is written down and the signatures of the responsible persons are affixed.

A tripartite netting agreement must be based on reconciliation acts between all parties. This is necessary to prevent controversial situations and subsequent legal proceedings regarding the part of the debt remaining after the offset procedure.

Read more Is a serviceman required to write an explanatory note?

Settlement agreement

- - has a debt to, and, at the same time, is a creditor;

- - debtor and creditor;

- - debtor and creditor in relation to.

In this case, it is logical for legal entities to use netting as a tool for repaying mutual obligations. When concluding a tripartite agreement, the same rules apply as for bilateral offset of claims. You can draw up three independent documents, but it’s easier to limit yourself to one tripartite agreement.

When drawing up a contract, you must include the following information:

- list of organizations participating in mutual settlement;

- a list of debts of each party;

- register of acts of reconciliations carried out;

- the amount of debts of the subjects after the offset.

We invite you to read: Inheritance of brothers and sisters: do children from common parents have the right to claim inherited property after the death of one of them?

By virtue of the general requirements of the Civil Code of the Russian Federation, the decision on offset can be either in the form of an agreement or drawn up in the form of an act, statement, or additional information. netting agreements.

The specific name of the form is determined by its parties.

Considering the fact that the offset agreement is a transaction, the same requirements and rules of the legislation of the Russian Federation apply to it as are provided for contracts.

Consequently, in the absence of all or several information that is mandatory to be reflected in the agreement on mutual settlement between organizations, a sample of which is given at the link below, such an agreement may be declared invalid. This circumstance will not allow mutual demands to cease, and the obligations will remain unchanged.

Triple offset of mutual claims: example of filling out an agreement

Mutual repayment of debts between counterparties without the use of non-cash and cash payments is possible subject to a number of conditions:

- the debt of all parties to the transaction can be characterized as homogeneous;

- all companies agree to set off;

- This procedure is not systematic.

Tripartite netting is possible in the following situations:

- Transaction participant “1” did not pay, a possible reason is a violation of payment terms for products that previously entered into an agreement with transaction participant “1”.

- has a receivable to enterprise “3”, the balance sheet shows the outstanding amount of payment from organization “1”.

- acts as a debtor for legal entity “1”, while simultaneously performing the role of a creditor for institution “2”.

Triple offset, subject to partial debt write-off, can be used for the following case:

- LLC "Class" owed LLC "Svoe" 50,000 rubles for goods supplied;

- Svoe LLC has an outstanding invoice from Mel LLC in the amount of 43,000 rubles;

- Mel LLC did not pay Class LLC the amount of 77,000 rubles on the agreed dates.

Triple offset for these companies is possible in the amount of the smallest debt - 43,000 rubles. As a result, LLC “Class”, after concluding the transaction, will have to repay LLC “Svoe” a debt in the amount of 7,000 rubles (50,000-43,000), LLC “Mel” undertakes to repay the debt to LLC “Class” in the amount of 34,000 rubles (77,000- 43,000). The obligations of Svoe LLC to Mel LLC after signing the agreement and recording it in accounting will be considered repaid in full.

Triple agreement on the offset of mutual claims: sample and algorithm of actions

The desire to repay existing debts without transferring funds to the counterparty can be realized if this counterparty has counter-obligations. In such situations, acts or multilateral mutual offset agreements are used. A triple netting agreement, the sample of which is not established by law, is drawn up through a series of sequential measures:

- The overall settlements between the three parties involved in the transaction are verified. This is done by drawing up reconciliation acts and their approval.

- When the final values of debts under all agreements between interested counterparties are documented, the acts are signed by the directors and accounting officer.

- A netting agreement between three organizations (a sample can be downloaded below) can be drawn up if there is consent to the transaction from each of the intended participants.

- If the amounts of debts do not have signs of homogeneity, for example, they are given in different currencies, then for the agreement all currencies are converted into a single monetary measure (the conversion rate is indicated in the agreement).

- For mutual offset between three organizations, a sample agreement is developed by legal entities independently, ends with the signing of the document by all parties to the agreement and the making of accounting entries for each of the companies to write off debts.

Read more What to do if you are sprayed with pepper spray

If you are not yet a user of the IS “PARAGRAPH”, then become one. Become a user of IS "PARAGRAPH"

Why do you need the “Court Decisions Database”? see more details

Analysis of the information contained in the database will help the lawyer to foresee the consequences of his legal decisions and not bring the case to court.

Helps to build a competent litigation strategy based on the study and analysis of decisions already available in the database on similar cases.

Helps check the “purity” of partners and contractors:

- – did you take part in legal proceedings?

- – as who? (Plaintiff, defendant, third party, etc.)

- – on what matters?

- – did you win or lose?

The most complete database - more 7 000 000

documents

The database contains cases:

- – civil proceedings

- – administrative proceedings

- – criminal cases of open court proceedings

Simple and convenient search for documents:

- – by territory

- - by court

- - by date

- - type

- - by case number

- - on both sides

- - according to the judge

We have developed a special type of search - SEARCH BY CONTEXT

, which is used to search the text of court documents using specified words. All documents are grouped into

individual cases

, which saves time when studying a specific court case. Each case is attached with

an information card

that contains brief information on the case - number, date, court, judge, type of case, parties, history of the process, indicating the date and action taken.

If you are not yet a user of the IS “PARAGRAPH”, then become one. Become a user of IS "PARAGRAPH"

Why do you need the section “Responses from government agencies”? see more details

1. Responses of government bodies to specific questions from citizens and organizations in various sectors of activity. 2. Your practical source for applying the law. 3. The official position of government bodies in specific legal situations requiring decisions.

The section contains all the responses of government bodies, which are posted on the “Open Dialogue” portal of the Electronic Government of the Republic of Kazakhstan. Questions and answers are included in the IS “PARAGRAPH” unchanged in accordance with the original, which will allow you to refer to them when situations arise that require confirmation and justification of your position (when interacting with government agencies, among other things). Unlike the E-Government portal, the answers from government agencies in the PARAGRAPH IS section are equipped with additional search mechanisms that allow you to search by:

- – subject matter;

- – date;

- - auto RU;

- – question number;

and also conduct a full-scale contextual search in questions and answers - both individual words and phrases in the form of a phrase.

We are confident that the new capabilities of the PARAGRAPH IS will make your work even more effective and fruitful!

How to make offsets under different agreements with one counterparty?

A scenario is possible in which a company’s counterparty has obligations to it (or it to the counterparty) under two different agreements. This is not of fundamental importance from the point of view of the possibility of mutual offset. The main thing is to consistently set out in the agreement the procedure for mutual offset of the parties’ claims with references to different agreements, and to correctly reflect the financial component.

How to make offsets between contracts of one counterparty comply with legal requirements? The main thing here is to make sure that the content of the legal relationship does not imply any obstacles to the offset of claims from the point of view of the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

Thus, an obstacle to the offset of claims under several contracts with a counterparty may be the heterogeneity of obligations reflected in different contracts. For example, if one agreement is drawn up in rubles, and the other in foreign currency. In this case, netting between contracts of one counterparty will not be possible. To offset claims under each contract, the company needs to draw up a separate agreement with the counterparty (provided, of course, that he has claims against it in a similar currency).