Terms and concepts

Financial investments - These are assets (investments in assets) owned by an organization that are not directly located in the enterprise, but are capable of generating income, at the same time there is a risk of losing these assets partially or completely.

Accounting for financial investments is regulated by PBU 19/02 ACCOUNTING FOR FINANCIAL INVESTMENTS.” This PBU covers the following points:

- Conditions for accepting assets as financial investments.

- What assets are not recognized as financial investments.

- Evaluation of financial investments.

- The procedure for disposal of financial investments.

- Income and Expenses on financial investments.

- Depreciation of financial investments.

- Disclosure of information in reporting on financial investments.

- Examples of calculating the value of retired financial investments are given.

To accept assets as financial investments, the following conditions must be met:

- Documenting.

- Financial risks.

- The asset must have the ability to generate income.

Financial investments do not include:

- Treasury shares purchased from shareholders for resale or cancellation.

- Bills issued by the organization of the drawer to the seller, bills issued are reflected in account 60 sub-account “Bills issued”, and bills received in account 62 sub-account “Bills received”

- Fixed assets intended for rent.

- Precious metals, etc.

Financial investments include:

- Securities.

- Contributions to the authorized capital of other organizations.

- Deposits.

- Deposits under a simple partnership agreement.

- Loans issued.

- Purchased accounts receivable.

One type of security is a Share. And there are many more securities.

Promotions, in turn, are:

1a) Ordinary.

1b) Privileged (give the right to receive a fixed dividend)

2a) Registered (contains the name of the holder and is in the register).

2b) To bearer.

3a) At par price.

3b) At market value. (No comments).

Also, one type of securities is a Bond (Read on the internet our lesson on accounting and not the securities market :))

There are 2 types of financial investments:

-Short-term.

-Long-term.

Evaluation of financial investments.

Financial investments in accounting at original cost. (Approximately like OS).

The initial cost refers to all the costs of acquiring financial investments. These are costs such as:

- The purchase price from the seller of financial investments. Let's say the stock price.

- Consulting services for the acquisition of financial investments.

- Remuneration for intermediaries.

If the costs (except for the price paid to the seller of the Finnish investment) are not significant, then these costs can be written off as other expenses account 91.

Financial investments by price and by the method of current assessment are divided into:

- By which the market price is determined. (Reflected in financial statements taking into account adjustments to the market price) (In tax accounting, income in the form of an increase in the price of a share is not taken into account in the base)

- For which the market price is not determined. (Reflected in reporting at historical cost).

There is one more nuance for debt securities for which the market value is not determined; it is possible to adjust the initial value to the nominal value, income and expenses from this operation are attributed to other income and expenses (to account 91 Debit or Credit, another account in the posting 58).

When disposing of financial investments (for which the market price is not determined), various methods are used to assess the cost of the disposed financial investment (Asset). Since there may be 2 shares at different prices, one thing has been disposed of - you need to determine at what price to write off.

There are the following methods:

- At the original cost of each unit.

- Based on average initial cost.

- According to FIFO.

(these methods are identical to the prices for the supply of materials, read the article material accounting account 10)

Unlisted securities

Reflect unquoted securities in accounting and reporting at their original cost (clause 21 of PBU 19/02).

Exceptions to this rule are:

- debt securities whose original cost differs from their par value;

- securities for which a significant price reduction has been established.

Such financial investments in accounting and (or) reporting may be reflected at a cost different from the original (accounting value).

This procedure follows from paragraph 22 and section VI of PBU 19/02.

If the original cost of unquoted debt securities (for example, bills or unquoted bonds) differs from their par value, the entity may charge the difference to financial results (other income or expenses). This must be done evenly during the circulation period of the security, according to the income due on it, provided for when it was issued. This procedure is provided for in paragraph 22 and section V of PBU 19/02.

At the same time, make accounting entries similar to entries for the revaluation of quoted securities.

In particular, an organization can use this procedure to take into account the discount on a bill or the discount on a bond.

For tax purposes, adjustment of the value of debt securities towards par value according to rules similar to accounting is not provided (letter of the Ministry of Finance of Russia dated April 8, 2005 No. 03-03-01-04/1/175).

For more information about accounting and taxation of income in the form of discount on debt securities, see, for example, How to record interest (discount) on a bill.

Depreciation of financial investments.

Depreciation of financial investments is a steady decrease in the expected benefit from the Finn. investments for which the market value is not determined.

Here is how it is written in PBU 19/02:

A sustained significant decrease in the value of financial investments for which their current market value is not determined, below the amount of economic benefits that the organization expects to receive from these financial investments under normal conditions of its activities, is recognized as impairment of financial investments. In this case, based on the organization’s calculations, the estimated value of financial investments is determined, equal to the difference between their value at which they are reflected in accounting (accounting value) and the amount of such reduction

For Impairment of Financial Investments, the following conditions must be met simultaneously:

- At the reporting date and at the previous reporting date, the accounting value is significantly higher than their estimated value.

- During the reporting year, the estimated value of financial investments changed significantly only in the direction of its decrease;

- At the reporting date, there is no evidence that the estimated value of these assets will increase significantly in the future.

If an audit comes to the conclusion that the Finnish investments have become worthless, the organization creates a reserve for the depreciation of financial investments as the difference between the book value and the estimated value of such financial investments.

Financial investments are shown in the balance sheet net of provisions for impairment of financial assets. investments.

Depreciation of financial investments, I think, occurs in such cases when the issuer of securities (these securities are owned by the organization) has a borrower who goes bankrupt.

Accounting of financial investments.

Financial investments in accounting are accounted for in account 58 “Financial investments”. The financial investment account is Active. That is, an increase in assets by debit is reflected by a decrease in credit. In accordance with the instructions for using the chart of accounts, sub-accounts can be opened for account 58:

-58/1 “Units and shares”;

-58/2 “Debt securities”;

-58/3 “Loans provided”;

-58/4 “Deposits under a simple partnership agreement”

Consider the following examples:

- Accounting for deposits.

- Accounting for the purchase of shares.

- Accounting for adjustments to financial investments (shares for which the market price is determined).

- Accounting for adjustments to bonds (for which the market price is not determined).

- Accounting for contributions to the authorized capital.

- Creation of a reserve for depreciation of securities.

1) Accounting for deposits.

Let's look at the transactions for accounting for deposits:

- Debit 55/3 (58/Deposit) Credit 51 - 50,000 rubles. - A deposit has been opened in the bank.

- Debit 76 Credit 91/Income - 15,000 rubles - Interest accrued on the deposit.

- Debit 51 Credit 58/Deposit - Funds from the deposit were returned.

- Debit 51 Credit 76-15,000 rubles - Interest received on the current account.

Comments: Deposits can be taken into account in both account 55 and account 58.

2) Accounting for the purchase of shares.

Let's look at the entries for accounting for the purchase of shares:

- Debit 58/Shares Credit 76/Seller-10,000 rubles.- Shares purchased.

- Debit 58/Shares Credit 76/Intermediary 1-5000 rubles - Intermediary services are reflected.

- Debit 58/Shares Credit 76/Intermediary2-1500 rubles -Reflects the services of intermediary 2.

- Debit 76/(Seller, intermediary1,2) Credit 51-16500 rubles (10,000+5000+1500) - Paid through a bank account to the seller and intermediaries.

Comments: 16,500 rubles (10,000+5000+1500) will be called the initial cost.

3) Accounting for adjustments to financial investments (shares for which the market price is determined).

Problem conditions:

01/01/2018 DaxNet CJSC bought 10 shares for 3,000 rubles.

These shares are traded on the securities market.

As of May 1, 2019, the price of shares was 3,200 rubles per share.

Let's make the wiring:

- Debit 76 Credit 51-30,000 rubles (10*3000) - Paid for shares.

- Debit 58 Credit 76-30,000 rubles. - Shares accepted as financial investments.

- Debit 58 Credit 91-2,000 rubles. ((3200-3000)*10) - Share price adjusted.

4) Accounting for adjustments to bonds (for which the market price is not determined).

Conditions of the problem:

01/01/2019 JSC "Tredax" bought 100 bonds at a price of 10,000 rubles.

Nominal value 12,000 rubles.

Quarterly income 5%.

CJSC "Tredax" will adjust the initial cost to the nominal value for 4 quarters.

Solution to the problem (wiring):

- Debit 76 Credit 51- 1,000,000 rubles. (100*10000) - Bonds purchased, paid.

- Debit 58 Credit 76-1,000,000 rubles - Bonds accepted as Finnish. investments.

- Debit 76 Credit 91-60,000 rubles. (12000*100*0.05) - Interest accrued on the bond.

- * Debit 58 Credit 91-50,000 rubles. ((12000-10000)*100)/4 - 1/4 of the difference between the initial and par value of the bonds is taken into account

*-Such posting will be carried out 3 times at the end of the quarter.

5) Accounting for contributions to the authorized capital.

Making a contribution to the authorized capital of the transaction:

- Debit 76 Credit 51-100,000 rubles - Money transferred as a contribution to the authorized capital.

- Debit 58 Credit 76-100,000 rubles. - The deposit is reflected as financial. investments.

If a company invests property in its authorized capital, then the postings will be slightly different (since there is an agreed upon value of the property valuation contribution and the actual price recorded in the property accounting account)

- Debit 76 Credit 43.10 - 10,000 rubles. - The book value of the property was written off as a contribution to the authorized capital of another organization.

- Debit 76 Credit 01/09-25,000 rubles. -The residual value of the fixed asset transferred as a contribution to the authorized capital has been written off.

- Debit 58 Credit 76-40,000 rubles. (10,000+25,000+Difference) - The contribution to the authorized capital is reflected as part of financial investments, at an agreed price with the founders, in the constituent agreement.

- Debit 76 Credit 91/Income - 5000 rubles (40000-25000-10000) - The difference in price between the contract price and the book value of the assets that were contributed to the authorized capital is reflected. In this case, as income, since the valuation of the contribution is greater than the actual value of the contributed assets.

- Debit 91/Expense Credit 76-?, If the value (balance sheet) had been added. agreed value of the deposit. There would be other expenses.

Listed securities

Quoted securities are accepted for accounting at their original cost. However, at the end of each year, the value of quoted shares must be reflected in accounting and financial statements at the current market value. To do this, you should adjust their assessment as of the previous reporting date, decreasing or increasing it. Revaluations can be done monthly or quarterly. The frequency of revaluation is fixed in the accounting policy of the organization (clause 7 of PBU 1/2008).

This procedure follows from paragraph 20 of PBU 19/02.

Do the revaluation on the basis of official data on quotes (clause 13 of PBU 19/02, letter of the Ministry of Finance of Russia dated March 21, 2005 No. 07-05-06/83). In this case, the organization must use all available sources of information on market prices, including data from foreign organized markets or trade organizers (letter of the Ministry of Finance of Russia dated January 29, 2014 No. 07-04-18/01).

Tip: information on prices (quotations) of securities can be found in the media (newspapers, magazines, Internet, etc.). This data is also provided by the trade organizer or intermediary through whom the securities were purchased.

If on the reporting date the organizer of trading in the securities market does not calculate the market price, then take the latest market price for the current market value of these securities (clause 24 of PBU 19/02 and letter of the Ministry of Finance of Russia dated March 21, 2005 No. 07-05- 06/83).

Reflect the results of the revaluation as a decrease or increase in the initial (book) value of securities and other expenses or income of the organization. To do this, reflect the difference between the new valuation of securities as of the reporting date and their previous valuation on account 58 “Financial investments” in correspondence with account 91 “Other income and expenses”. Make the following entries:

Debit 58 Credit 91-1 – reflects the revaluation of securities;

Debit 91-2 Credit 58 – reflects the markdown (impairment) of securities.

This procedure follows from paragraph 20 of PBU 19/02, paragraphs 7, 10.5 and 16 of PBU 9/99, paragraphs 11 and 14.4 of PBU 10/99 and the Instructions for the chart of accounts (accounts 58 and 91).

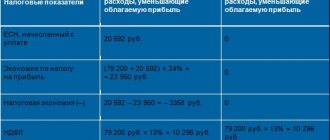

When calculating taxes, do not take into account the revaluation of listed securities, regardless of the tax regime that the organization applies.

For the general taxation regime, this is explained as follows.

When calculating income tax, the results of revaluation are not included either in income (subclause 24, clause 1, article 251 of the Tax Code of the Russian Federation), or in the expenses of the organization (clause 46, article 270 of the Tax Code of the Russian Federation).

The revaluation of securities does not affect the calculation of VAT, since in this case there is no object of taxation (clause 1 of Article 38 and Article 146 of the Tax Code of the Russian Federation).

The results of revaluation do not affect the calculation of the single tax under simplification for the following reasons.

When determining income (regardless of the object of taxation), the income mentioned in Article 251 of the Tax Code of the Russian Federation (subclause 1, clause 1.1, Article 346.15 of the Tax Code of the Russian Federation) is not taken into account. That is, in this case, the increase in the value of securities does not affect income during the simplification, since it is excluded from them on the basis of subparagraph 24 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

When determining expenses (in the case where an organization calculates tax on the difference between income and expenses), a decrease in the value of securities does not affect the tax base, since this type of expense is not mentioned in Article 346.16 of the Tax Code of the Russian Federation.

If an organization pays UTII or combines the general taxation regime and payment of UTII, reflect all transactions with securities (including revaluation) according to the rules of the general taxation system (clause 7 of article 346.26 and clause 9 of article 274 of the Tax Code of the Russian Federation) . This is due to the fact that certain types of activities are transferred to UTII, the list of which does not include transactions with securities (clause 2 of Article 346.26 of the Tax Code of the Russian Federation). Revaluation of securities is not taken into account when calculating income tax (subclause 24, clause 1, article 251 and clause 46, article 270 of the Tax Code of the Russian Federation) and VAT (clause 1, article 38 and article 146 of the Tax Code of the Russian Federation).

An example of how revaluation of listed securities at market value is reflected in accounting and taxation. The organization applies a general taxation system

As of September 30, the records of Torgovaya LLC (debit of account 58-1) included 10 shares of Proizvodstvennaya JSC. The book value of each share is 6,000 rubles.

According to Alpha's accounting policy, for accounting purposes, financial investments traded on the securities market are revalued quarterly.

When preparing financial statements for nine months, Hermes' accountant revalued these securities.

According to the trade organizer, the market price of shares as of September 30 was 6,395 rubles. per share.

The Hermes accountant reflected the revaluation in accounting as follows:

Debit 58-1 Credit 91-1 – 3950 rub. ((RUB 6,395 – RUB 6,000) × 10 pieces) – reflects the overvaluation of shares.

At the same time, the analytical accounting of Hermes reflects the additional valuation of each share in the amount of 395 rubles.

The revaluation of shares did not affect the calculation of income tax and VAT.