Natalia, hello!

That's right - accounts 09 and 77 have their own analytics in 1C.

How you can and should check yourself after each Month Closing in the part of PBU 18/02: Reports – SALT – Show settings – select only BP on the Indicators tab. This is the base for the balance on account 09 and account 77. That is, base x 20% = the result on account 09 and account 77 in the context of specific analytics for the subconto Types of assets and liabilities.

Which accounts form the basis for the corresponding analytics on accounts 09 and 77: Non-current assets - 08 Finished products - 43 Accounts receivable - 62, 76 Income investments in tangible assets - 03 - 02.02 Deferred income - 98 Distribution costs - 44 Indirect production costs - 26 , 25 Accounts payable – 60, 76 Exchange differences for settlements in foreign currency – 60, 62, 76 Exchange differences for settlements in monetary units – 60, 62, 76 Materials – 10 Work in progress – 20, 23, 28, 29 Intangible assets – 04 – 05 Equipment – 07 Fixed assets – 01 – 02 Estimated liabilities and reserves – 96 Semi-finished products – 21 Deferred expenses – 97 Provisions for doubtful debts – 63 Goods – 41 Goods shipped – 45 Loss of the current period – 99.01 Financial investments – 58, etc. d.

If for some reason the cost of inventory in accounting and accounting system is different and you entered balances in 1C, then you should have entered different amounts in accounting and accounting system for account 10 and a temporary difference (20%) in account 09 (77) from analytics Materials.

Account 77 of accounting is a passive account “Deferred tax liabilities”, collects information on the presence and movement of deferred tax liabilities. Using standard postings and practical examples, we will consider the specifics of using account 77 in accounting.

How deferred tax liabilities arise

Deferred tax liabilities arise when permanent or temporary differences arise as a result of different procedures for recognizing income and expenses (profit/loss) in accounting and tax accounting.

Deferred tax liabilities are accounted for in an amount equal to the product of taxable temporary differences and the income tax rate at the reporting date.

Taxable temporary differences in the formation of taxable profit/loss form deferred income tax, which should increase the amount of income tax in subsequent reporting periods when paid to the budget.

Let's look at an example of how deferred tax liabilities are formed.

Let's say from January 2020. JSC "Zern" commissioned new equipment. Its cost was 240,000 rubles, its useful life was four years.

The procedure for recognizing expenses in accounting and tax accounting is as follows:

- Accounting - linear depreciation method, that is, for February = 5,000 rubles, the residual value as of March 1 was 235,000 rubles.

- Tax accounting is a non-linear depreciation method, that is, for February = 10,000 rubles, the residual value as of March 1 was 230,000 rubles.

- Therefore, the taxable temporary difference is RUB 5,000.

What is a deferred tax asset?

To understand what a deferred tax asset is, you need to understand the definition of deferred tax payable on a company's profits. It represents the obligations that the company will have in the future. Deferred tax usually arises as a result of poor business performance. The reason for its appearance is also problems with taxation.

That is, it is a conditional tax. It is calculated based on information from the enterprise’s reporting. It is equal to the amount payable in the current tax period. The methods for calculating amounts for tax and accounting reports differ, which is why a temporary difference appears. It can cause inconsistencies when taking into account the following indicators:

- Valuation of assets and liabilities of an enterprise.

- Determining the amount of income and losses.

We invite you to familiarize yourself with: Privatization of land under a private house in Omsk

Deferred assets appear in the following circumstances:

- The presence of a tax difference of a temporary nature.

- Receipt of income in the future, on which tax will be paid.

It is important to calculate them correctly.

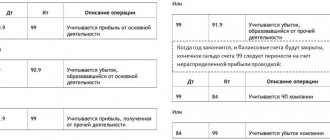

Postings to account 77 “Deferred tax liabilities”

Correspondence 77 accounts and entries for accounting for deferred tax liabilities are shown in the table below:

| Dt | CT | Wiring Description | A document base |

| 68 | 77 | Deferred tax reflection | Accounting certificate, Advance payment, Declaration |

| 77 | 68 | Reduction/full repayment of deferred tax reflected | Accounting certificate, Tax registers, Bank statement |

| 99 | 77 | Deferred tax liability written off | Accounting certificate, Tax registers |

Examples of transactions and postings on account 77

Let's look at an example:

- In the second quarter of 2020, Polor LLC (cash method) shipped goods to Vex LLC in the amount of 370,000 rubles, excluding VAT, and received payment of 210,000 rubles, excluding VAT.

- In the third quarter of 2020, the buyer fully repaid its debt to Polor LLC.

- In July of the same year, Polor LLC sold the machine, the accrued depreciation on which amounted to 46,000 rubles in accounting, and 52,000 rubles in tax accounting.

Let's do the calculation:

- income in the accounting records of Polor LLC will be recognized in the amount of 370,000 rubles, and in the tax accounting - in the amount of 210,000 rubles;

- taxable temporary difference – RUB 160,000.

The deferred tax liability for account 77 is reflected in the following entries:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 62 | 210 000 | Partial payment from Veks LLC is reflected | Bank statement |

| 62 | 90.01 | 370 000 | Reflected sales revenue | Packing list |

| 68.04.2 | 77 | 32 000 | Reflection of the increase in tax liability for the 2nd quarter of 2020 | Accounting certificate, Advance payment, Declaration |

| 51 | 62 NVR | 160 000 | Reflected payment from LLC "Vex" | Bank statement |

| 77 | 68.04.2 | 32 000 | Deferred tax liability settled | Accounting certificate, Tax registers, Bank statement |

| 77 | 99 | 1 200 | Reflection of the write-off of the amount of deferred tax liability (machine) | Accounting certificate, Tax registers |

Account 77 » Deferred tax liabilities Postings and Examples

Chart of Accounts Income Tax calculation Income Tax News Tax News

Main items Postings to Fixed Assets Leasing Accounting Account 09 Account 99

Account 77 “Deferred tax liabilities”

Posting Calculation and Examples

Account 09 "Deferred tax asset"

Account 77 of accounting, “Deferred tax liabilities,” collects information on the presence and movement of deferred tax liabilities that arise when calculating income taxes.

Deferred tax liabilities arise when permanent or temporary differences arise as a result of differences in the recognition of income and expenses in accounting and tax accounting.

Deferred tax liabilities (DTL) are accounted for in an amount equal to the product of taxable temporary differences and the income tax rate as of the reporting date:

IT = NVR x 20%

Taxable temporary differences (TDT) when forming profit/loss form deferred income tax, which should increase the amount of income tax in the next period.

Postings:

| No. | Debit | Credit | |

| 1 | Reflects part of the amount of previously recorded IT written off to increase the income of the reporting period | 77 | 68 |

| 2 | Reflects part of the amount of previously recorded IT written off to increase the conditional expense of the reporting period | 77 | 68 |

| 3 | Reflects the amount of IT, which reduces the amount of the conditional expense of the reporting period | 68 | 77 |

| 4 | Reflects the amount of IT, which reduces the amount of conditional income of the reporting period | 68 | 77 |

| 5 | Write-off of IT (accounting certificate) | 99 | 77 |

IT (account 77) corresponds with two accounting accounts - 68 and 99. The received entries reflect the following results:

Dt 68 - Kt 77 - deferred tax, which reduces the amount of income or expense.

Dt 77 - Kt 68 - repayment of deferred tax, formed when income tax is calculated at the end of the reporting period.

Dt 77 - Kt 99 - IT is canceled upon disposal of the asset or circumstance that forms it.

Examples of transactions and postings on account 77

Example 1.

- In the second quarter of 2020, Supplier LLC (operating on a cash basis) shipped goods to Buyer LLC in the amount of RUB 370,000. without VAT and received payment - 210,000 rubles. without VAT.

- In the third quarter of 2020, the buyer fully repaid its debt to Supplier LLC.

Calculation:

- income in the accounting records of Supplier LLC will be recognized in the amount of 370,000 rubles, and in the tax accounting - in the amount of 210,000 rubles;

- taxable temporary difference = RUB 160,000.

IT on account 77 is reflected by the following entries:

| Dt | CT | Transaction amount, rub. | Wiring Description | Base |

| 210 000 | Partial payment from the buyer is reflected | Bank statement | ||

| 370 000 | Reflected sales revenue | Packing list | ||

| 32 000 (370,000 – 210,000) x 20% income tax | Reflection of the increase in tax liability for the 2nd quarter of 2020 | Accounting certificate, Advance payment, Declaration | ||

| 62 Cash Time Time | 160 000 | Payment from buyer reflected | Bank statement | |

| 32 000 | Deferred tax liability settled | Accounting certificate, Tax registers, Bank statement |

What is IT

If expenses in accounting appear later and in greater quantities than in tax accounting, while at the same time income is determined at an earlier date, then conditions arise in the organization for the appearance of IT.

What affects the discrepancy between the calculation of income and expenses in tax and accounting:

— the company’s use of the cash method when accruing tax accounting, that is, receipt of revenue upon shipment of goods before receipt of actual payment;

— differences in calculating depreciation of fixed assets.

The resulting taxable temporary differences (TDT) lead to an increase in tax in the next period.

Example 2.

Supplier LLC sold goods to Buyer LLC for the amount of 170,000 rubles (excluding VAT).

Payment from the buyer was received in the amount of 100,000 rubles.

Supplier LLC uses the cash method when determining tax. The remaining part of the debt was transferred the following year.

At the end of the reporting period, the accountant of Supplier LLC makes the following entries:

Dt 62 - Kt 90 - 170,000 rubles - revenue in accounting for shipped goods;

Dt 51 - Kt 62 - 100,000 rubles - payment from Buyer LLC;

Dt 68 - Kt 77 - 14,000 rubles (debt 70,000 x income tax rate of 20%) - IT is reflected.

When reporting, the amount of 14,000 rubles is reflected in the balance sheet as a deferred income tax liability (IT).

In the subsequent period after closing the debt, the accountant will make the following entries:

Dt 51 - Kt 62 - 70,000 rubles - final payment received from the buyer;

Dt 77 - Kt 68 - 14,000 rubles - IT was repaid.

Fixed Assets

Accrual of depreciation of fixed assets leading to the formation of capital assets

| Initial data | Reflection in accounting | Reflection in tax accounting |

| Purchase of OS, initial cost | 960,000 rubles | 960,000 rubles |

| Depreciation method | Linear | Nonlinear |

| Depreciation group | 3 group | 3 group |

| Accrued depreciation | 20,000 rubles (960,000: 4 years: 12 months) | 53,760 (960,000 x 5.6:100) |

Sometimes there is a discrepancy between actual and planned profits at the moment. The income tax accrued on the income actually received does not coincide with the amount indicated in the tax reporting due to the time difference between the period of accrual and the period of actual payment. The transaction data for account 77 is reflected.

Example of IT reflection

Let’s assume that a certain business entity sold products to another, the cost of which was 185,000.0 rubles excluding VAT. Only part of the funds in the amount of 125,000.0 rubles was received from the customer. The company that sold the goods uses the cash method when calculating fiscal obligations. The remaining part of the debt was transferred only in the next fiscal period. Thus, the organization acting as a seller in this transaction displayed the following accounting entries:

1) Dt 62

Kt 90 – 185,000.0 rubles, revenue from the sale of goods;

2) Dt 51

Kt 62 – 125,000.0 rubles, accounting of received funds;

3) Dt 68

Kt 77 – RUB 12,000.0, reflected by IT.

In the next reporting period, when the remaining balance for the products was paid off, the following entries were made:

1) Dt 51

Kt 62 – RUB 60,000.0, receipt of final payment;

2) Dt 77

Kt 68 – 12,000.0 rubles, accounting for redeemed IT.

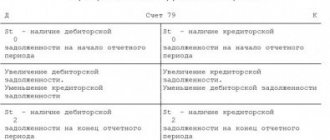

Features of account 77

Account 77 is used by income tax payers. It accumulates amounts that must be paid in subsequent tax periods. The term “deferred tax liability” refers to accrued but unpaid income tax, which will actually be transferred after filing reports for a certain period. The deferred tax amount is calculated as temporary accounting differences multiplied by the current tax rate. The amount of accruals must correspond to the data indicated in the tax reporting.

Accounting account 77 is a passive account. The credit of the account takes into account the amount of deferred income tax liabilities, and the debit takes into account the decrease in the amount due to tax payments.

The right not to use this account arises for organizations exempt from paying income tax: organizations using the simplified tax system, UTII, firms related to Skolkovo. It is better to secure this right by an internal local act of the organization.

Account 77 – accounting entries

Account 77 reflects the movement of the amount of accrued income tax in correspondence with account 68. Subaccount 01 “Calculations for income tax” is opened to account 68. The tax amount is calculated in the current period and is included in expenses for the current period of time. It is carried out from the debit of account 68.01 to the credit of account 77. The documents on the basis of which data is entered into the account will be:

- tax return,

- accounting certificate-calculation.

On the debit of account 77, the amounts due for repayment of income tax in the current reporting period are posted. The amounts are posted to the credit of account 68.01. The debit is made on the basis of a payment order or bank statement.

In the case of writing off an asset on which tax has been charged, the posting will be made from the debit of account 77 to the credit of account 99. In this case, a sub-account “Write-off of deferred tax liability” is also opened to account 99.

Features of the accrual method

When accounting for costs in this way, in accordance with Article 330 of the Tax Code, insurance deductions under the contract are included in expenses on the date of occurrence of the obligation to pay them in favor of the insured person or policyholder. In this case, the incident must be expressed in an absolute amount, calculated according to the rules provided for by law. When applying the accrual method, two entries are made:

- Calculation of compensation and the amount of compensation for expenses incurred to reduce the loss, if they were necessary or carried out by order of the insurer - Db account. 22.1 CD count. 77.1.

- Payment of the above amount – Db account. 77.1 CD count. 51.

Accrued insurance benefits may be included in the next premium. In this case, the entry is made:

Db 77.1 Kd 92.1.

At the expense of compensation, it is allowed to repay loans taken from an insurance company in accordance with the terms of the agreement (Db 77.1 Kd 58) and interest on them (Db 77.1 Kd 91).

Account 77 – deferred tax liabilities, example

In the first quarter, the company sold a batch of building materials worth 420,000 rubles. According to the agreement, payment was made in two parts: the buyer paid 200,000 rubles immediately, and paid another 220,000 rubles in the second quarter. Used equipment was also sold, for which depreciation was charged in accounting records of 45,000 rubles, and for tax purposes 53,000 rubles. The amount of tax deferred for payment was 8,000 rubles.

Based on the terms of the agreement, the total amount will be 420,000 rubles, but the actual taxable base at the moment will be equal to 200,000 rubles - the amount paid by the buyer.

In the posting table it will look like this

| Dt | CT | Amount, rub. | Description | Accounting documents |

| 51 | 62 | 200 000 | The first part of the payment is reflected | Statement from the bank |

| 62 | 90.01 | 420 000 | Total revenue | Invoice |

| 68.04 | 77 | 52 000 | Tax increase for the reporting period of the 1st quarter | Declaration, advance payment, bank statement. |

| 51 | 62 | 220 000 | Final payment for goods | Statement from the bank |

| 77 | 68.04 | 52 000 | Repayment of tax amount | Bank statement, accounting certificate |

| 77 | 99 | 8000 | Writing off the amount of tax liability | Certificate from accounting department |

Let's summarize: accounting account 77 is an account that reflects the amounts of taxes planned for payment in the future, but taken into account when calculating the tax base for income tax.

Systematization of accounting

07/24/2018 | no comments

Account 77 “Deferred tax liabilities” is used in the accounting of companies that calculate taxes in accordance with PBU 18/02 to display information about emerging deferred tax liabilities.

Account 77 in accounting is a highly specialized account, designed exclusively to concentrate information about all emerging debts to the budget in terms of taxation of the company's profits, the payment of which will be carried out in the future. These debts arise due to the occurrence of temporary differences.

Deferred tax liabilities mean that part of the income tax, the payment of which to the budget is transferred to subsequent transfers. That is, these are amounts determined by calculation, which will subsequently lead to an increase in tax, or compensation for previously underpaid debt. This value is determined as the quotient of the product of existing taxable temporary differences that arose or were settled in the reporting period by the income tax rate (20% in 2016-2017).

Temporary inconsistencies may appear in a company’s accounting in the following situations:

- Various methods have been recorded for calculating depreciation of existing equipment for accounting and tax accounting (for example, linear and non-linear methods).

- Different times for taking into account the company's revenue received.

- Inconsistency in the time of acceptance of calculated vacation pay, etc.

The company bought an expensive machine, the price is 1 million rubles, the useful life will be 12 years. The accounting policies record different methods for calculating depreciation; the difference between the calculations was determined to be 150 thousand rubles.

Introduction to PBU 18/02 – temporary differences

Published 06.11.2018 13:25 In this article we will continue to look at the basics of PBU 18/02 and look at some of the nuances of temporary differences (we talked about permanent differences earlier in the article Introduction to PBU 18/02 - permanent differences). At the level of semantic understanding, in this case the rule works: “now we will pay more or less, but then, on the contrary, it’s a matter of time.” Thus, temporary differences arise in the presence of income and expenses that are accepted in accounting and tax accounting in different periods of time.

Important Features:

1. Temporary differences do not affect the company’s financial result, which is formed on account 99, but they affect the amount of income tax, which is formed on account 68.04.

2. To reflect deferred income taxes, there are special accounts: 09 (deferred tax assets) and 77 (deferred tax liabilities). The income tax amounts will be listed in these accounts, and when the time comes, they will be written off to account 68.04.

3. Temporary differences “defer” income tax into assets and liabilities, but in the future they will definitely be taken into account. Sooner or later there will come a time when the discrepancy “goes to zero.”

4. Temporary differences are accounted for for each type of asset and liability.

Account 09 “Deferred tax assets” can only be active, the balance is debit. When the time comes, we will write off this asset as debit 68.04 and thereby reduce income tax, i.e. we will receive a tax benefit.

In the reporting period, the deferred tax asset increases the amount of income tax (D-t 09 K-t 68.04), but then, as the temporary differences that arise are repaid, it decreases (D-t 68.04 K-t 09).

Analytical accounting of deferred tax assets is carried out by type of asset.

Account 77 “Deferred tax liabilities” can only be passive, the balance is credit. When the time comes, we will write off these obligations on credit 68.04 and thereby increase our obligation (income tax) to be paid. Analytical accounting of deferred tax liabilities is carried out by type of liability.

An organization can have balances for both account 09 and account 77 at the same time, but never for one analytical accounting object.

In the balance sheet (Form No. 1), deferred tax assets are shown as part of non-current assets, and deferred tax liabilities are shown as part of long-term liabilities.

The income statement (Form No. 2) shows changes in deferred tax assets and deferred tax liabilities that arose and were settled in the reporting period.

How it works in 1C: Enterprise Accounting 3.0

Let us recall that a deferred tax asset arises if in the reporting period the organization’s current income tax is higher, but in the next or subsequent periods it will be lower. "We'll pay less in the future"

Example No. 1 . In January 2020, the organization purchased and put into operation technological equipment No. 1 worth RUB 140,000.00 (excluding VAT). The useful life (SPI) in the BU is conditionally 3 months, the useful life (SPI) in the NU is conditionally 6 months.

Let's look at the emergence of a deferred tax asset (DTA) and its settlement.

1. Appearance of a deferred tax asset:

BU 140000.00: 3 months * 20% = 9333.33

NU 140000.00: 6 months * 20% = 4666.66 (expenses in NU are lower, which means more profit, tax is higher than in BU)

SHE No. 1 9333.33 – 4666.66 = 4666.67 rubles.

As can be seen from the analysis of account 09, in the period from February to April, a deferred tax asset is accrued in the accounting system.

2. Repayment of the tax asset.

After the fixed asset is fully depreciated in accounting (accounting) (in the example, this is 3 months), repayment begins for the amount of depreciation deductions in tax accounting (TA). The ending balance goes to zero.

Let me remind you that the accrual and repayment of a deferred tax asset is carried out using the “Month Closing” operation. Here, using a calculation certificate, you can check the accrual and repayment of tax assets and liabilities.

Important:

If temporary differences arise for several objects of analytical accounting, then it becomes necessary to maintain object-by-object accounting outside the 1C program. Paragraph 3 of PBU 18/02 defines the maintenance of group accounting (by type of assets and liabilities), this accounting principle was introduced by the developers of 1C. However, tax authorities may require a breakdown of assets and liabilities. It is convenient to keep such records in Excel tables; the double entry method is not required.

Let's look at an example.

Example 2. In February 2020 the same organization bought and put into operation technological equipment No. 2 worth 50,000.00 (excluding VAT), SPI in BU - conditionally 4 months, in NU - conditionally 7 months.

BU 50000.00: 4 * 20% = 2500.00 rub.

NU 50000.00: 7 * 20% = 1428.57 rub.

SHE No. 2 2500.00 – 1428.57 rub. = 1071.43 rub.

As can be seen from the analytical accounting, the reflection is in the group “Fixed Assets” SHE No. 1 + SHE No. 2 = 5738.10 (4666.67 + 1071.43)

A deferred tax liability arises if in the reporting period the organization's current income tax is less, but in the next or subsequent periods it will be more. “We’ll pay less now.”

Let's consider an interesting case (as Olechka Shulova says).

Example 3. Organization in July 2020 purchased and put into operation technological equipment No. 3 worth RUB 230,000.00. (without VAT). The useful life (USL) in both accounting and tax accounting is set to the same - 12 months. But in tax accounting a depreciation bonus of 30% is applied.

Let's consider the emergence and repayment of a deferred tax liability (DTL).

The depreciation bonus will be 230,000.00 * 30% = 69,000.00 rubles.

In the first month of depreciation (in the example, August 2018), two events occur: the appearance of a depreciation bonus (RUB 69,000.00) and the write-off of 5,750.00 (69,000.00/12 months) {"Month closure" - "Depreciation and amortization" OS" - "Show transactions"}

Deferred tax liability (DLT) is accrued on the balance at the close of the month.

In the second month of depreciation (in the example, September 2018), the deferred tax liability is repaid.

BU 230000.00: 12 months * 20% = 3833.33 rub.

NU 230,000.00 – depreciation. bonus (230000.00 * 30%) = 161000.00;

161000.00:12 months*20% = 2683.33 rub.

IT 3833.00 – 2683.33 = 1150.00 rub. This amount will reduce the deferred tax liability monthly until it is completely written off.

In our example, at the end of 2020. the balance will be 8050.00 rub. At 7 months In 2020, the deferred tax liability will be settled in full.

In the annual reporting, the deferred tax liability will be reflected as follows: Form No. 1 (Balance Sheet)

Form No. 2 (Report on financial results)

If you are interested in accounting according to PBU 18/02, please write your questions and specific examples from practice in the comments. Let's figure it out together!

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Our training courses and webinars

Reviews from our clients

Add a comment

Comments

+4 Goncharova Alina 11/25/2018 11:59 pm thanks for the article! Very helpful!

Quote

Update list of comments

JComments

Account 77 “Deferred tax liabilities” in accounting

The company's profit before tax is 700 thousand rubles, the taxable base, taking into account the discrepancy in depreciation charges, is 550 thousand rubles.

The base mismatch is temporary, because After 10 years, full depreciation will be carried out in both types of accounting.

The resulting transferred tax liability = 150 thousand rubles. * 20% = 30000.

Account 77 is passive. For the loan, the calculated amount to be transferred to the budget is displayed, which allows you to reduce the amount of the financial result of the reporting period, the obligation to pay is transferred to future payments. The debit of the account includes information about the reduction of transferred debts or their full repayment against the calculated income tax for a given period. Transactions are displayed in correspondence with the account. 68.

When disposal of fixed assets, the transferred tax liability calculated on it is written off from the company's records. The write-off occurs for the amount by which the tax base for profits of both the reporting and subsequent periods will not be changed (carried out in Dt99).

Since the account is highly specialized, a certain number of transactions are carried out on it. Account 77, according to the instructions to the Chart of Accounts, corresponds only with the account. 68 (accounting for taxes and fees) and 99 (profits and losses):

- Appearance of transferred tax liability in accounting:

- Movement of previously calculated amounts (for example, an increase in current tax by previously deferred debts):

- Cancellation of an existing tax liability as a result of equipment write-off:

Victor Stepanov, 2017-07-13

>Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

Why are deferred tax assets required?

Tax assets are a method of reducing income taxation. To calculate them, you need to multiply the current tax amount by time intervals.

The temporary difference represents the totality of expenses and losses that make up the profit reported in the report. Instead of profits there may be losses. These indicators are the basis for creating a tax summary. Assets are formed in the following cases:

- using different methods for calculating depreciation;

- making tax payments in excess of the required amount. This is relevant if the overpayment was not returned to the company;

- the presence of a loss transferred to the account of subsequent periods;

- the appearance of accounts payable arising from the purchase of services or goods;

- application by the enterprise of the cash method of calculation.

We invite you to read: Petition for awarding a Certificate of Honor in 2020

Deferred assets must be accounted for correctly. This is required for the following purposes:

- Collection of accounting data.

- Collection of data for analysis.

- Possibility of generalized results of the enterprise's activities.

Having all the recorded data will help protect the company during tax audits.

What are tax differences

In order to take into account the mentioned differences in accounting, account 77 “Deferred tax liabilities” is used. To decide how to handle this aspect of accounting, you need to understand what taxable differences are.

They can be:

- Permanent.

- Temporary.

Permanent differences will never be used to calculate income taxes, which is why they are called permanent differences. They can occur for a number of reasons:

- expenses on property received free of charge are not recognized for accounting purposes;

- a loss carried forward to future periods can no longer be taken into account due to the expiration of the period.

Temporary taxable differences can be used to calculate income taxes in the current or future periods. The temporary difference arises due to certain differences between accounting and tax accounting:

- depreciation of fixed assets in tax is greater than in accounting due to different methods of calculation;

- the company credited the proceeds from the sale of goods, but did not actually receive any cash;

- The methodology for calculating interest on loans varies in accounting.

Note from the author! Temporary differences must be positive to be reflected in deferred receivables.

Difference when calculating profit

When maintaining tax reporting and accounting, the moment of receipt of income does not always coincide. Due to the fact that the legislation provides for special rules for summarizing information about accounting profits, the results at the end of the year differ significantly from the declared indicators. This situation arises, for example, with different methods for calculating depreciation. Accelerated calculation of amounts used in tax accounting is unacceptable for financial reporting. The costs incurred when calculating the base will be higher than the costs of accounting.

How are liabilities accounted for?

IT accumulations are formed according to the product formula:

Temporary differences * income tax rate in%.

In other words, liabilities (abbreviated as IT) appear if expenses are accepted later in accounting. Income, on the contrary, is recognized earlier. Therefore, they can be considered debt.

How is IT formed?

For example, an organization calculates depreciation in accounting using a linear method, but in tax accounting using a non-linear method. Let’s say a company bought a fixed asset “High-voltage line” worth 200,000 rubles. Since it costs more than 100,000, it is legally subject to depreciation in tax accounting, according to Art. 256 Tax Code of the Russian Federation.

According to the OKOF directory, according to which organizations are required to determine depreciation periods, high-voltage lines are classified as the 10th depreciation group, which means that the useful life is set at 361 months (30 years * 12). Since accounting uses the straight-line method, depreciation is calculated as follows:

200,000 / 361 months = 554.02.

This means that 554.02 rubles of depreciation charges will be written off monthly from the cost of the object. In turn, the 10th group assumes a monthly depreciation rate of 0.7% under Article 259.2 of the Tax Code of the Russian Federation:

200 000 * 0,7% = 1 400.

This means that every month depreciation deductions in the amount of 1,400 rubles are written off in tax accounting.

| Data | Accounting | Tax accounting |

| Purchasing an OS, cost | 200 000 | 200 000 |

| Method of calculating depreciation | Linear | Nonlinear |

| Depreciation group | ||

| Formula for calculating depreciation | 200,000 / 361 months | 200 000 * 0,7% |

| Depreciation accrued | 554,02 | 1 400 |

Thus, you can find the temporary taxable difference:

1,400 - 554.02 = 845.98 rubles.

The difference amounts will be credited to the 77th ONO account as follows:

845.98 * 20% = 169.20 rubles,

where 20% is the total income tax rate, taking into account the federal and regional shares. In this case, the following wiring should occur:

Debit 68.4 “Calculations for income tax” Credit 77 - 169.20 rubles.

Note from the author! The income tax rate and distribution by shares are regulated by law depending on the type of activity and the region of residence of the organization.

Change in deferred liabilities

According to the Chart of Accounts, adopted by law, movements in account 77 are strictly prescribed within certain limits. Operations on it can be performed to increase or decrease the indicator.

When IT is completely repaid or reduced, the following posting is made:

Debit 77 “Deferred liabilities” Credit 68.4 “Calculations for income tax.”

When the value of debts increases in addition to income tax, the following entry is made:

Credit 77 “ONO” Debit 68.4 “Calculations for income tax.”

If IT is removed from the balance sheet of the enterprise, then the posting will be as follows:

Debit 77 “Deferred liabilities” Credit 99 “Profits and losses”.

In this case, it is necessary to write off not only the amount of debt, but also the temporary difference.

For example, an organization sold a gas boiler. At the time of sale, the amount of accrued depreciation was:

- 400,000 rubles in tax accounting;

- 350,000 rubles in accounting.

Savings on ONO in the 77th account:

- 400,000 - 350,000 = 50,000 rubles;

- 50,000 * 20% = 3,000 rubles.

This means that the following must be written off from the balance sheet:

- Debit 77 Credit 99 “Profits and losses” - 3,000 for the amount of the deferred liability.

Typical situations

In this case, the credit balance of account 77 is displayed in expanded form in line 1420 and the debit balance from account 09 “Deferred tax assets” in the balance sheet asset on line 1180 of the “Non-current assets” section.

The collapsed view assumes a decrease in the credit balance of the 77th account by the debit of the 09th account.

Note from the author! If the income tax rate changes, the deferred liabilities must be recalculated in accordance with the change. The change in value is reflected in the balance sheet in the year following the reporting year. This circumstance is stipulated by PBU 18/02.

The content of the 1420 balance line is one of the most difficult aspects to understand and requires a good understanding of the differences. Incorrectly reflected amounts are fraught with arrears, fines and, accordingly, a full measure of liability.

>Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

In this case, the following entries are made in accounting:

- when writing off IT - by the debit of account 99 in correspondence with the credit of account 09 “Deferred tax assets”;

- when writing off IT - by debiting account 77 “Deferred tax liabilities” in correspondence with the credit of account 99.

How to reflect changes in deferred tax assets

Changes in assets are reflected in line 2450. The amount of changes must be established in accordance with PBU 18/02. To carry out calculations, you need to subtract from the debit turnover (account 09 “SHE”) the credit turnover (account 09 “SHE”).

The calculations do not use the loan turnover on account 09 with correspondence account 99. If the asset on the basis of which it appeared is eliminated, a write-off occurs. Taxes for current and subsequent periods are not reduced by the established write-off amount.

Increase

An asset that has increased expenses and income is reflected as follows:

- DT 09 “SHE”;

- CT 68 “Tax calculations”.

It is also required to indicate the content of the performed operation: accrual of IT.

Written off SHE and IT affect the amount of net profit (loss) for accounting purposes.

Let us give a formula for calculating net profit (loss), from which this will be clear. —————————————————————————————————————————————————— ———————————————¬ | Net profit (loss) of the reporting period (line 190 of the Profit and Loss Statement) | L————————————————————————————————————————————————— ———————————————— = ————————————————————————————————— —————————————————————————————————¬ | Profit (loss) before tax (line 140 of the Profit and Loss Statement) | L————————————————————————————————————————————————— ———————————————— + ————————————————————————————————— —————————————————————————————————¬ | Deferred tax assets (line 141 of the Profit and | | Loss Statement) = Difference between debit and credit turnover by | | account 09 in correspondence with account 68 for the reporting period | L————————————————————————————————————————————————— ———————————————— — ————————————————————————————————— ————————————————————————————————- | Deferred tax liabilities (line 142 of the Profit and Loss Statement) = Difference between credit and debit turnover by | | account 77 in correspondence with account 68 for the reporting period | L————————————————————————————————————————————————— ———————————————— — ————————————————————————————————— —————————————————————————————————¬ | Current income tax (line 150 of the Profit and | | Loss Statement) = Line 180 of sheet 02 of the Income Tax Declaration | | organizations for the reporting period | L————————————————————————————————————————————————— ———————————————— — ————————————————————————————————— —————————————————————————————————¬ | Deferred taxes written off during the reporting period | | assets upon disposal of objects for which these deferred| | tax assets (shown on the free line of the Statement of | | profit and loss after the current income tax + —————————————————————————————— ———————————————————————————————————¬ | Deferred tax liabilities written off during the reporting period | | liabilities upon disposal of assets , for which these | | deferred tax liabilities arose (shown on the free | | line of the Profit and Loss Statement after the current tax on | | profit +/- —————————————————— ———————————————————————————————————————————————¬ | Recalculation for income tax (for example, errors of previous years | | when calculating income tax) and payments from profit | | (for example, tax sanctions) (shown on free lines | | of the profit and loss statement after the current tax on | | profit)

Please note the fact that

> the amount reflected on account 99 as a result of writing off ONA or ONO upon disposal of the object

according to which they are calculated,

does not participate in the formation of accounting profit (loss) before tax

, from which the conditional income tax expense (income) is calculated.

The current income tax for the reporting period, reflected on line 150 of the Profit and Loss Statement, is the income tax calculated according to tax accounting data and shown on line 180 of sheet 02 of the Organizational Income Tax Declaration for the reporting period. If permanent tax assets and liabilities, as well as deferred taxes are correctly accounted for in accounting, then current income tax can also be calculated using the following formula