A bank payment order is processed electronically; sometimes accountants and financial specialists print out and personally deliver a certified copy of the document to the bank. Payment orders are issued for transactions on the current or current bank account of an organization. For example, payment orders are issued to pay for goods, services, transfer salaries to personnel, and make tax and budget payments.

One of the required fields in the payment order is the item indicating the status of the payer (field 101 in the accounting program). According to Order No. 107 of the Ministry of Finance of the Russian Federation, when paying insurance premiums to extra-budgetary funds, it is necessary to fill out the payer status. According to Federal Law-212, an organization or individual entrepreneur (individual entrepreneur) must transfer monthly contributions for employees to the Pension Fund (PFR), the Compulsory Medical Insurance Fund (MHIF), and the FSS (social insurance fund). When making such payment orders, you must indicate the payer's status.

Payer statuses in a payment order: what to indicate in the status?

When filling out field 101 of the payment order, you must be guided by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107-N, where all payer status codes are indicated: (click to expand)

| Status code | Explanation |

| 01 | Taxpayer – legal entity |

| 02 | Tax agent |

| 03 | The federal postal service organization that drew up the order for the transfer of funds for each payment by an individual |

| 04 | Tax authority |

| 05 | Federal Bailiff Service and its territorial bodies |

| 06 | Participant in foreign economic activity – legal entity |

| 07 | customs Department |

| 08 | A legal entity (an individual entrepreneur, a notary engaged in private practice, a lawyer who has established a law office, the head of a peasant (farm) enterprise) that transfers funds to pay insurance premiums and other payments to the budget system of the Russian Federation |

| 09 | Individual entrepreneur |

| 10 | Notary in private practice |

| 11 | Lawyer who established a law office |

| 12 | Head of a peasant (farm) enterprise |

| 13 | Another individual – bank client (account holder) |

| 14 | Taxpayer making payments to individuals |

| 15 | A credit organization (a branch of a credit organization), a payment agent, a federal postal service organization that has drawn up a payment order for the total amount with a register for the transfer of funds accepted from payers - individuals |

| 16 | Participant in foreign economic activity – individual |

| 17 | Participant in foreign economic activity - individual entrepreneur |

| 18 | A payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties |

| 19 | Organizations and their branches (hereinafter referred to as organizations) that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears of payments to the budget system of the Russian Federation on the basis of an executive document sent to the organization in the prescribed manner |

| 20 | Credit organization (branch of a credit organization), payment agent, drawing up an order for the transfer of funds for each payment by an individual |

| 21 | Responsible participant of a consolidated group of taxpayers |

| 22 | Member of a consolidated group of taxpayers |

| 23 | Bodies monitoring the payment of insurance premiums |

| 24 | Payer - an individual who transfers funds to pay insurance premiums and other payments to the budget system of the Russian Federation |

| 25 | Guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of value added tax excessively received by the taxpayer (credited to him) in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods outside the territory of the Russian Federation , and excise taxes on alcohol and (or) excisable alcohol-containing products |

| 26 | Individual, legal entity for repayment of claims against the debtor |

Results

The payer status is filled in field 101 of the payment order, code from 01 to 26 is used when making payments to the state budget. Depending on the code, payments are classified as taxes and fees from individuals, individual entrepreneurs, organizations acting as tax agents, parties to foreign trade transactions and participants in the procedure for forced debt collection.

We recommend

- Everything about a payment order: how is the document drawn up and can it be revoked?

- UIN and UIP details in the payment order: we consider the nuances

- How to fill out the Billing and Shipping Address fields on foreign websites?

- A loan in your name for another payer: how to apply and repay?

What should the tax authorities do if the payer discovers an error in the status?

The tax authority, after receiving an application from the taxpayer with a request to clarify the status, based on Article 45 of the Tax Code of the Russian Federation, will take the following actions:

- will require from the bank a copy of the payment order on the basis of which the funds were transferred. In this case, the bank does not have the right to refuse to provide this document within 5 days;

- after verification activities, a decision will be made to clarify the date of payment;

- within 5 days after the decision is made, the Federal Tax Service will notify the taxpayer about it.

Payment of taxes and contributions through the banking portal

Not all payments require filling out field 101. If payment for preschool services is expected, then an individual’s account is used and the column is filled in automatically.

To complete the payment procedure you need to perform a number of steps:

- Log in to the portal using your username and password.

- Go to the “Payments and Transfers” tab.

- Open “Transfer to organizations”, select the desired institution from the list or enter details to identify the organization.

- Specify the account from which payment will be made.

- Fill in the payer information (name and address). Leave field 101 blank.

- Specify the payment amount.

- Confirm the operation by entering the code from the SMS notification.

Features of payer status for individual entrepreneurs

It is necessary to clearly understand that the payment order in section 101 indicates the status of the legal entity or individual who executed this document. As for individual entrepreneurs, Order No. 107-N, which must be followed when filling out the payment form, contains 2 codes - 09 and 14.

It is very important to understand here that when making deductions for himself, an individual entrepreneur takes into account code 09 , but if deductions are planned for employees, then in this case code 14 is entered in section 101 , because an individual entrepreneur acts as a person making payments to individuals.

Basic moments

Tax legislation of the Russian Federation obliges all tax payers to issue payment orders in accordance with the rules established by the Ministry of Finance of the Russian Federation.

Indicator 101 is filled out in accordance with Appendix No. 5 thereto.

The details should be filled in when making payments relating to mandatory payments to the budget or extra-budgetary funds. Field 101 is filled with a two-digit numeric value.

This allows you to determine the payer’s organizational and legal form, its line of activity and the purpose of the payment.

Tax payments, payment of insurance premiums, etc. are especially characterized. That is, this detail contains information about who pays and for what.

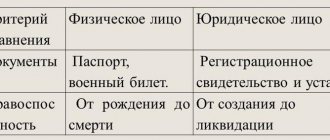

What it is

Taxpayer status is a digital code that allows you to identify the payer, the recipient of the payment and the payment itself. It is mandatory to indicate the status when filling out the payment form. Previously, there were twenty status values.

After adjusting the legislative provisions, twenty-six statuses were established depending on the type of payer, namely:

| Taxpayers who are legal entities | 01 |

| Subjects acting as tax agents | 02 |

| "Russian Post" for some payments by individuals | 03 |

| Individuals, legal entities, individual entrepreneurs importing and exporting goods | 06, 16, 17 |

| Payers of insurance contributions to extra-budgetary funds | 08 |

| Individual entrepreneurs, notaries, lawyers, farmers paying taxes for themselves | 09, 10, 11, 12 |

| Individuals | 13 |

| Taxpayers paying funds to individuals | 14 |

| Individuals paying insurance premiums | 24 |

| Financial organizations, banks, Russian Post for generalized payments of individuals | 15 |

| Legal entities paying tax debts of individuals | 19 |

| Financial organizations and banks for some payments by individuals | 20 |

| Off-budget funds | 23 |

| Guarantor banks | 25 |

| Individuals and legal entities for debt repayment | 26 |

| Tax authorities | 04 |

| Bailiffs Service | 04 |

| Customs | 07 |

| Payer of customs duties on the basis of the law of the Russian Federation, but without filling out a declaration | 18 |

| Representative of a consolidated group of taxpayers | 21 |

| KGN member | 22 |

The status of the sender, or payer, is an indicator that certainly correlates with the organizational and legal status of the payer and the nuances of its activities.

At the same time, some status meanings are unambiguous and do not require additional interpretation. Others are not so obvious and require clarification regarding their applicability to specific individuals.

Non-obvious statuses include the following:

| «14» | Typically, this was indicated by individual entrepreneurs who hire workers and pay them wages. However, the Ministry of Finance clarifies that individual entrepreneurs should use status 08, while status 14 should be used exclusively by individuals |

| «18» | Indicates the payer of customs duties, without being the declarant. The fact that it is possible not to declare imports/exports raises doubts. However, these may be persons who have received permission to process products outside the customs territory or the owner of a duty-free outlet |

| "21" and "22" | Indicate firms from the consolidated group of taxpayers (CGT). To do this, the KGN must be officially registered in compliance with the legal requirements for the structure |

What is his role

The fundamental meaning of the Payer Status field is for financial statistics purposes. However, there is also a role for props that is important from a technical point of view.

In particular, the digital code helps determine whether the payment is budgetary. When any value is specified in field 101, the banking institution is obliged to check the completion of fields 102-110.

Therefore, blank fields are not allowed. When a field is not filled in, it is set to “0” by default.

In addition, the code helps determine who exactly makes the payment. If the payer status is correctly indicated in field 101 of the payment document, there will be no complaints from payment recipients.

The transferred funds arrive on time and exactly as intended. As a result, there are no grounds for applying penalties.

Legal grounds

The main legal source regulating the filling out of payment orders when making payments to the budget system of the Russian Federation is Order of the Ministry of Finance of the Russian Federation No. 107n dated 12.111.2013.

This legal act has been in force since the beginning of 2020. From that moment on, the number of payer statuses changed from twenty to twenty-six.

The Ministry of Finance periodically supplements this standard and provides clarifications regarding the application of certain rules. So explanatory is .

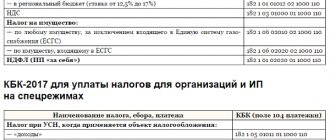

It defines how to relate payer status and individual BCCs. The main points of filling out a payment order are specified in Bank of Russia Regulation No. 383 dated June 19, 2012 “On the rules for transferring funds.”

Status 01, 08, 09, 14

In 2020, insurance premiums were transferred to the tax authorities, which will regulate their calculations and payments. In this regard, managers and accountants had a question regarding filling out section 101 of the payment order.

If before 2020, when paying insurance premiums, code 08 was indicated, then when filling out a payment from January 1, 2020, the Federal Tax Service recommends indicating the following statuses: (click to expand)

| Code | Explanation |

| 01 | Organizations |

| 09 | Individual entrepreneur when paying insurance premiums and tax deductions personally for himself |

| 14 | When paying contributions for employees |

Thus, in 2020, when generating a payment order in section 101, code 08 is not indicated.

What may need to be specified

When filling out a standard document form, it is the Russian payer column that causes problems (2 digits of the checkpoint or an attempt to enter the number 14) in Sberbank Online. With such taxpayers, the Federal Tax Service is forced to carry out parallel work aimed at further clarifying their situation - because of this, the process of processing an application for payment may be delayed. When performing the next inspection, you do not need to provide additional papers, but you will have to collect information such as:

- date (or period), amount, type and purpose (often issued upon request by the organization);

- information about the selected recipient (TIN, OKATO, KPP of the individual payer);

- payment number and details (BIC of the domestic bank and its full name).

On the territory of Russia, the status of a current payer is the main central element of document flow, which helps tax authorities to quickly identify an individual or company that regularly carries out financial transactions addressed to the state budget. Error-free recording of your own status will make it possible to reduce the number of arrears in payment and large fines.

You can write in the comments if you have any questions or want to share your opinion on this article.

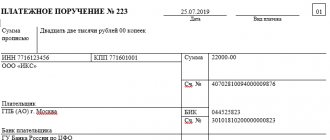

Completed sample payment order with status

| 0401060 | |||||||||||||||||||||||||||||

| Admission to the bank of payments. | Debited from account plat. | ||||||||||||||||||||||||||||

| 02 | |||||||||||||||||||||||||||||

| PAYMENT ORDER No. 18 | 11.03.2017 | ||||||||||||||||||||||||||||

| date | Payment type | ||||||||||||||||||||||||||||

| Suma in cuirsive | Three thousand one hundred rubles 08 kopecks | ||||||||||||||||||||||||||||

| TIN 663312345 | Gearbox 663301001 | Sum | 3100-08 | ||||||||||||||||||||||||||

| ABV LLC | |||||||||||||||||||||||||||||

| Account No. | 40702810094000009876 | ||||||||||||||||||||||||||||

| Payer | |||||||||||||||||||||||||||||

| PJSC "UBRD" | BIC | 044030002 | |||||||||||||||||||||||||||

| Account No. | |||||||||||||||||||||||||||||

| Payer's bank | |||||||||||||||||||||||||||||

| North-Western State Administration of the Bank of Russia, St. Petersburg | BIC | 044030001 | |||||||||||||||||||||||||||

| Account No. | |||||||||||||||||||||||||||||

| payee's bank | |||||||||||||||||||||||||||||

| INN 7820027250 | Gearbox 782001001 | Account No. | 40101810200000010001 | ||||||||||||||||||||||||||

| UFC in St. Petersburg | |||||||||||||||||||||||||||||

| Type op. | 01 | Payment deadline. | |||||||||||||||||||||||||||

| Name pl. | Outline of boards | 5 | |||||||||||||||||||||||||||

| 0 | |||||||||||||||||||||||||||||

| Recipient | Code | Res.field | |||||||||||||||||||||||||||

| 18210102010011000110 | 40307000 | TP | MS.02.2017 | 0 | 0 | ||||||||||||||||||||||||

| Personal income tax for February 2020. | |||||||||||||||||||||||||||||

| Purpose of payment | |||||||||||||||||||||||||||||

| Signatures | Bank marks | ||||||||||||||||||||||||||||

| Ivanova | |||||||||||||||||||||||||||||

| M.P. | |||||||||||||||||||||||||||||

| Petrova | |||||||||||||||||||||||||||||

Common mistakes when determining status

Despite the fairly clear explanation for filling out section 101 of the payment order, mistakes are still made.

| Error | Explanation | Which is correct? |

| When transferring personal income tax for employees, code 01 is indicated | In case of personal income tax payment for employees, the organization acts as a tax agent | Code 02 is indicated |

| When paying insurance premiums for employees, an individual entrepreneur indicates code 09 | In this case, the entrepreneur acts as a person paying income to individuals. | If the payment of insurance premiums is “for injuries”, then code 08 is indicated, in all other cases - 14 |

| Individual entrepreneurs indicate codes 09, 14 separated by commas | Filling out a payment order is regulated by regulations, namely Regulation No. 383-P and Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107-N | It is necessary to indicate only one code: 09 or 14. Two payments are generated. |

Payments to the Social Insurance Fund: the fund’s opinion

01 - when paying taxes, fees and contributions (except for contributions for injuries)

02 - when paying personal income tax on employees’ salaries

08 - contributions for injuries

09 - individual entrepreneur contributions for himself

09 — individual entrepreneur contributions for employees

Due to the fact that from 2020 the payment of insurance premiums is administered by the tax office, the payer must indicate code “01” in the payment order.

Thus, now issuing a payment order for the transfer of insurance premiums is identical to a payment order for the payment of taxes. The difference is in the BCC and the purpose of payment.

There is an opportunity to repay your debt to the budget at the expense of third parties. This is directly indicated by paragraph 1 of Art. 45 of the Tax Code of the Russian Federation. In this regard, the list of codes for field 101 has been supplemented.

Here is an updated list of payer status codes for 2019.

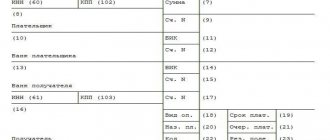

In 2020, a payment order is used in the form approved by the Bank of Russia Regulation No. 383-P dated June 19, 2012. This form is mandatory for everyone; the company cannot independently supplement or change any details of this document.

The payer status in the payment order in 2020 is indicated in field 101.

The status indicator is filled in only when money is transferred to the budget. If you are transferring funds to a counterparty, field 101 remains empty: do not fill in the payer status.

The field with code 101 is located in the upper right corner of the payment order. You need to enter a two-digit digital payer status code into it.

The payer can be: a legal entity, individual entrepreneur, individual, authority (for example, tax, customs, bailiff service, bank).

This information allows you to correctly identify the person transferring money to the budget and correctly carry out the complete transfer of money.

The need to fill out this indicator in column 101 has appeared since 2014.

General regulations for filling out and describing sections of a payment order are determined by Bank of Russia Regulation No. 383-P. Order of the Ministry of Finance dated November 12, 2013 No. 107n regulates how exactly when making budget payments to indicate information that identifies the sender of the transfer and its addressee.

Field 101, located at the top right of the document, serves to indicate the status of the sender of funds. If the transfer is sent to the budget or extra-budgetary funds, a numeric code is required. For calculations not related to budget transfers, field 101 is left empty.

That is, the status is assigned only when paying taxes, mandatory fees, contributions to extra-budgetary funds, state duties, and penalties. According to the two-digit code, the money is distributed by the treasury to personal budget accounts, and filling out the field is mandatory when making payments to the budget (Appendix 5 of Order No. 107n).

Field 101 is filled in by all taxpayers: legal entities, individuals and individual entrepreneurs. Order 107n provides for several options for the status of an individual entrepreneur for different types of budget transfers. The most popular status for individual entrepreneurs, which accumulates common contributions to the budget, is 09. Let’s consider all possible situations.

| 02 | Tax agent (regarding personal income tax of employees). |

| 08 | Payer to the budget (except for payments administered by tax authorities). |

| 09 | Individual entrepreneur is a taxpayer of payments supervised by tax authorities. |

| 15 | The payment agent is the preparer of the order for the final amount with a register attached for the transfer of money received from citizens (individuals). |

| 17 | Individual entrepreneur - participant in foreign economic transactions. |

| 18 | The payer (not the declarant!) of customs duties according to the law. |

| 20 | The payment agent is the preparer of the order for the transfer of money for each transfer of individuals. |

| 26 | The founder of the debtor or a third party when transferring money to pay claims against the bankrupt debtor. |

| 28 | Recipient of an international postal transfer for foreign economic transactions. |

What status should be entered on payment slips for insurance premiums in 2018/2019 for individual entrepreneurs?

In 2020, issues of overseeing insurance premiums (except for injuries) were transferred to tax authorities. The approach to coding such payments has also changed. Previously, the transfer of contributions when paid to individual employees was accompanied by the coding “14”. This code was canceled by the Ministry of Finance from April 25, 2017.

After accepting responsibilities for administration, the Federal Tax Service explained in a separate memo the execution of payment orders for insurance premiums (Letter of the Federal Tax Service of the Russian Federation dated February 17, 2017 No. BS-4-11 / [email protected] ). This letter in field 101 proposes the following statuses for insurance premiums (payments) transferred under the control of tax authorities:

- 01 – legal entity;

- 09 – IP;

- 10 – private notary;

- 11 – lawyer (when establishing a law office);

- 12 – head of a peasant/farm enterprise;

- 13 – individual.

Accordingly, the code for an entrepreneur is the same for contributions both for himself and for employees. For lawyers who work without establishing a law office, field 101 must be filled in with the code “09”.

The changes also affected the procedure for applying the code “08”. The FSS remained the body administering insurance payments for injuries. Therefore, encoding 08 in field 101 is used for contributions of this purpose, as well as when transferring funds to the budget of a nature other than tax fees and contributions - for example, state duties.

Thus, the required individual entrepreneur taxpayer status in 2018/2019 when paying insurance premiums is 09.

Having sent the payment, the payer may not even realize that he filled out field 101 incorrectly. A typical example of a tax arrears is when the sender acts as a tax agent, being at the same time a taxpayer. The error is most often detected by the bank, which returns the payment order unexecuted.

Common mistakes:

- When paying income tax for your employees, “01” is indicated in field 101 (the code is used for organizations).

- When paying land tax, “01” (for legal entities) or “13” (provided for individuals if the land is not used for business purposes) is entered.

- The payment slip for insurance premiums indicates “08” (the code is set for payments to the budget for other purposes, excluding taxes and fees).

- When participating in foreign economic transactions, fill out 16 (the status is provided for individuals who are not registered as individual entrepreneurs).

What happens if you indicate the wrong status and how to correct the situation (sample application)

Accounting for budget revenues is carried out on various personal accounts. If the status is incorrect, the sent amount goes to pay off a debt that may not exist, but the actual debt for which payment was supposed to be made remains. Then the tax authorities will charge penalties and fines (Articles 75, 122, 123 of the Tax Code, Part I).

The main source of law, according to which one or another status is recorded in budget bills generated by taxpayers, is Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. From time to time, clarifications appear on certain nuances of the application of the provisions of this document. Among the key explanatory documents of recent years are letters:

- Ministry of Finance of Russia dated January 16, 2015 No. 02-08-10/800, which clarified the use of payer status indicators in correlation with the BCC used as identifiers of budget obligations;

- Ministry of Finance of Russia dated May 20, 2016 No. 02-08-12/29143, which determined the relationship between who pays where and for some codes, in particular, indicating the code number entered when paying tax by one individual for another;

- Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/19125, which noted that an error in indicating the payer’s status does not make the tax payment unpaid and can be corrected by clarification through an application sent to the tax authority.

In connection with the transfer of insurance premiums under the control of the tax authorities, the explanations about the status in the payments are as follows:

- Letters of the Federal Tax Service of Russia, Pension Fund of the Russian Federation, Federal Tax Service of the Russian Federation dated January 26, 2017 No. BS-4-11/ [email protected] /NP-30-26/947/02-11-10/06-308-P, Federal Tax Service of Russia dated January 20, 2017 No. BS-3-11/ [email protected] require the indication of codes according to the rules from the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n: for legal entities and individual entrepreneurs when paying for their employees - code 14;

- for individual entrepreneurs paying for themselves - code 09.

- 01 - for legal entities;

Read about the position of the Bank of Russia regarding code 14 in the material “The Bank of Russia spoke on filling out field “101” when paying insurance premiums.”

By Order of the Ministry of Finance of Russia dated 04/05/2017 No. 58n, 2 payer statuses were updated from 10/02/2017:

- 03 - it is indicated in the payment order by the federal postal service organization when drawing up an order to transfer money for each payment by an individual (except for payment of customs duties);

- 06 - this code is provided for participants in foreign economic activity - legal entities (except for the recipient of international mail).

The main source of law, which sets out the rules for indicating the status in payment orders sent to the bank in order to fulfill budget obligations, is Appendix 5 to Order No. 107. In accordance with these rules, the status of the payer should be considered as the key identifier of the person generating the order for the transfer of financial funds into the budget system of the Russian Federation.