No matter how well the accounting of an enterprise is organized, no one can guarantee that the inventory carried out will not reveal deviations in the availability of inventory. After all, their safety depends not only on formal reasons. Most often, shortcomings in accounting and control are indicated by a shortage discovered during inventory, what to do in this case and how to resolve the issue, says the Labor Code of the Russian Federation. Such a phenomenon as a shortage allows the manager to draw unpleasant conclusions regarding the integrity of the materially responsible person (MRP).

What is inventory and what documents are used to document it?

Without exception, all legal entities have a certain amount of inventory items (TMV) associated with the implementation of their activities.

Inventory is an event during which the actual availability of goods or other valuables is compared with accounting data in order to detect discrepancies. Moreover, this procedure is typical not only for shops, banks and enterprises with large reserves of raw materials and products.

Government institutions whose activities are financed from the budget are also required to periodically check the safety of furniture, office equipment, transport, cash and even strict reporting documents in the form of work books and special forms.

The list of assets subject to inventory includes all types of property on the balance sheet of the enterprise:

- fixed and working capital;

- financial investments in deposits, shares, securities of other enterprises;

- intangible assets in the form of intellectual property;

- financial liabilities in the form of loans, credits and accounts payable.

The list is not closed, since each enterprise has its own ideas about the value of things.

Inventory responsibilities are assigned to a special commission, which is established by order of the head. At large enterprises there may be several such commissions, each of them checks the actual availability of objects in a certain category of material assets.

In terms of frequency of inventory, they are divided into:

- Planned, which are usually carried out in the last month of the calendar year in order to record the availability of inventory items as of January 1 of the next year and check the effectiveness of accounting before preparing reports for the current year.

- Unscheduled, which are appointed in the event of a change in the manager or financially responsible person, as well as after damage to the property of the enterprise by external factors or perpetrators.

At some enterprises, planned inventories are carried out more than once a year. This is due to the specific features of their activities, which is why inspections, as a rule, concern only certain categories of material assets.

Reasons for inventory

Inventory is the identification, through inspection and counting, of available goods or money, as well as comparing them with data obtained from accounting. It can be planned or unscheduled. Carrying out an inventory is a mandatory procedure. Every legal entity faces it. Many people believe that it is only needed in organizations involved in trade, but this is not so.

ATTENTION! The procedure is required both in budgetary institutions and in government organizations. Everything that is owned by the company - goods, appliances, chairs or tables - belongs to inventory materials, and therefore must be assessed and recalculated.

Regardless of whether the inventory is planned or unscheduled, the procedure must be carried out in any case, following the instructions and rules. Any changes to the original data must be recorded in a special document. Reasons for taking inventory:

- emergency situation associated with natural disasters;

- change of persons who are financially responsible for the goods;

- change of owner of the company;

- the presence of a crime or the employee’s suspicion of committing one.

The shortage of material assets or their surplus becomes a general problem of the company, affecting both employees and employers.

Procedure and presentation of results

The work of the inventory commission begins with the receipt in the accounting department of the enterprise of turnover sheets containing information about the balances of material assets as of the date of the inventory. A receipt is taken from the responsible person stating that at the time of the inspection, all receipts and write-offs of materials have been completed, and receipt and expenditure documents have been submitted to the accounting department. Members of the commission, in the presence of the MOL, remove the cash register, recalculate and measure all values related to its accountability.

The actual availability of property is entered in the matching statements opposite the quantitative indicator corresponding to accounting. If these two columns are not equal to each other, we can talk about a shortage or a surplus. Both situations equally negatively characterize the state of accounting at the enterprise and require an objective investigation regarding the causes of discrepancies and the persons responsible for their occurrence.

Any accountant knows how to document shortages during inventory, since this procedure is described in detail in the Methodological Recommendations for Accounting.

Comparison statements are compiled separately for each category of property in accordance with the accounting systematization by subaccounts.

Based on the matching statements, inventory lists are formed containing:

- quantitative measurement of inventory items;

- indicators of their cost expression.

Therefore, after compiling inventory records, the actual financial damage from the shortage or the income received by the enterprise from the identified surplus is visible.

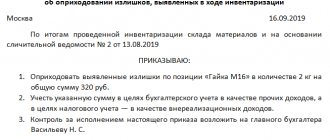

Statements and inventories with the results of the inventory are approved by the manager, whose competence also includes making decisions regarding the procedure for recording identified discrepancies.

We recommend you study! Follow the link:

Rules for the transfer of material assets upon dismissal of an employee

Inventory shortage: postings

Important! As a result of the inventory, not only a shortage of valuables, but also a surplus can be identified. In addition, a result such as misgrading is also possible. It means that it is necessary to remove some items from the balance and capitalize others.

The accounting treatment will be as follows:

- If a surplus is identified, the valuables arrive at the time of the inventory. They are paid at the market price, unless a different order is provided for by the company’s internal rules. Monetary indicators are included in financial results along with other expenses, or as income in non-profit organizations.

- If the shortage falls under natural loss, then the amounts are written off as expenses or as expenses. If the shortage exceeds the natural loss, then the write-off occurs at the expense of the guilty parties. If the culprits cannot be identified, then the write-off is made to the financial results.

Basic entries when writing off shortages: