What are budgetary and monetary obligations?

According to Art. 6 of the Budget Code of the Russian Federation, budget obligations are expenditure obligations to be fulfilled in the corresponding financial year. Budget commitments reflect planned expenditures limited by budget commitment limits (BLO).

In turn, monetary obligations are the obligation of the recipient of budget funds to pay to the budget, to an individual (legal entity) at the expense of budget funds, certain funds in accordance with the fulfilled conditions of a civil law transaction concluded within the framework of his budgetary powers, or in accordance with the provisions of the law, other legal act, terms of a contract or agreement.

Also, the concepts of obligations are enshrined in the norm of clause 308 of the Instructions, approved. By Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n (hereinafter referred to as Instruction N 157n).

Where, by whom and when are LBOs used?

Maintaining a summary list and accounting for limits on budgetary obligations (hereinafter referred to as LBO) is the function of the financial authority. In accordance with the provisions of paragraph 5 of Art. 217 of the Budget Code of the Russian Federation, the approved indicators must be communicated to the main managers of funds from the budget (hereinafter referred to as GRBS, main managers) before the start of the financial year.

After they have been brought to the attention of the consumer, he has the right to assume responsibilities, for example, to plan and carry out the purchase of goods, works and services, and conduct competitive procedures. It is important to remember that the approved budget indicators must comply with the LBO.

Acceptance of budget obligations in excess of the established limits is grounds for the court to declare them invalid. Responsibility for ensuring that the amount of expenses for the purchase of products corresponds to the established limits of public money rests with the head of the institution for which they are established.

Control is entrusted to the Federal Treasury.

These restrictions do not prohibit concluding an agreement for the supply of products for a period that exceeds the limits of the financial year. The main thing is that there is no excess spending this year. In case of refusal to sanction such contracts, you can appeal the actions of the Treasury.

GRBS cannot reduce the established amounts if the public sector organization already has obligations for them. But in practice, there are often situations when the main managers, in the event of sequestration (that is, a proportional reduction of all expenditure items) of the budget, are “forced” to terminate contracts in order to thus free up money and reduce spending from the budget.

How to accept budgetary and monetary obligations?

The implementation of budgetary and monetary obligations in government institutions takes place in several stages.

Budgetary obligations are accepted within the limits of LBO and (or) budgetary allocations through the conclusion of state (municipal) contracts, as well as other agreements with individuals and (or) legal entities, individual entrepreneurs, or concluded in accordance with laws, other regulations, agreements (Article 162, paragraph 3 of Article 219 of the Budget Code of the Russian Federation). Therefore, the grounds for accepting budgetary obligations, for example, are such documents as: a concluded contract, agreement, advance report, payroll, cash order for the issuance of accountable funds, etc.

Monetary obligations typically arise after an institution makes budgetary commitments. However, the order in which monetary obligations arise may vary depending on the provisions of the accounting policies of the government institution. Sometimes a monetary obligation may be made before a budgetary one. Monetary obligations are accepted upon the occurrence of conditions that require the institution to fulfill accepted budgetary obligations. Grounds for acceptance: certificate of completion of work, advance payment to the supplier, invoice, pay slip, invoice and other documents confirming the occurrence of monetary obligations.

Thus, as part of the formation of the accounting policy of a government institution, a list of documents must be determined - the grounds for reflecting accepted obligations in account 502 00 “Liabilities” (clause 318 of Instruction No. 157n). This list may include documents that are not primary documents (invoices, universal transfer documents, orders for sending on business trips, etc.). When developing the list, you can take into account, in particular, the provisions of Appendix No. 4.1 to Order of the Ministry of Finance of Russia dated December 30, 2015 No. 221n.

Let’s assume that in December of the current year, the LBO for the next financial year is brought to the institution. The institution then assumes budgetary obligations in the following order:

- for items for which contracts are not required, based on the established limits;

- by items for which contracts are required, at the cost of these contracts

After this, the institution can proceed to fulfill budgetary and monetary obligations.

Can I take over the limit?

Acceptance in excess of the established limits is the receipt and use of budget funds in an amount exceeding the limits established for it for a certain financial year.

Contracts concluded by the PBS are executed and paid for from the budgets of the constituent entities of the Russian Federation and municipalities, taking into account accepted and unfulfilled BOs (Part 5 of Article 161 of the Budget Code of the Russian Federation).

Accepting BO in the absence of established limits or in excess of the established LBO is a serious administrative offense that provides for certain penalties: penalties in the amount of 20,000 to 50,000 rubles are imposed on the official. (Article 15.15.10 of the Code of Administrative Offenses of the Russian Federation).

Contractual relations that are concluded beyond the accepted LBO, on the basis of clause 5 of Art. 161 of the BC RF are declared invalid.

For concluding a BU and CU contract, an unsupported obligation and in excess of established restrictions, penalties and fines will follow under Art. 15.15.10 Code of Administrative Offenses of the Russian Federation.

Accountants need to carefully check the documentation received for accounting (agreements, accounts, cash settlements, advance reports) for free limits. You should be especially careful in the case of expenses made by accountables in cash.

Inspectors can also be held accountable if there is actually a limit on the date of adoption of the BO, if at the time of concluding the contract (agreement) there is no approved detail for KOSGU in the budget estimate. However, starting from 2020 to the present day, KOSGU is not used when drawing up current and planned budgets.

How to adjust accepted budgetary and monetary obligations?

Often, after the fulfillment of contractual obligations, the amount of accepted budgetary and monetary obligations for the material assets supplied or the service provided (work performed) may change. In this case, the institution must take measures to adjust its obligations.

If, for example, services are provided for a smaller amount than expected, it is necessary to draw up an additional agreement and adjust budget obligations using the “red reversal” method by the corresponding amount.

Otherwise, if the amount of services provided under the contract turned out to be greater and the institution confirmed the receipt of services with acceptance certificates or other documents, it is necessary to draw up an additional agreement to increase the contract price, increase budget obligations and, therefore, additionally accrue the amount of obligations under this contract.

However, it should be borne in mind that this option is only possible when the institution has an unspent balance of LBO. This is due to the fact that accepting budgetary obligations in excess of the established limits is unacceptable.

Please note: a change in the contract price, as well as a change in the volume of work (services) provided under the contract, must occur in accordance with the current norms of federal legislation, in particular with the Federal Law of 04/05/2013 N 44-FZ.

Authorization procedure

The main stages of the authorization process are prescribed by state regulations, in particular, the Budget Code of the Russian Federation, and industry standards. To obtain authorization, you need to follow 4 steps in sequence:

- Approval of the consolidated budget schedule.

- Acceptance of expenditure and income estimates.

- Agreeing on the limits of accepted obligations.

- Accounting and control of fulfillment of accepted obligations.

Budget list

In this document, funds from the budget are distributed according to destinations, their recipients and managers are determined. Art. 217 of the Budget Code of the Russian Federation says that it should be drawn up by the body that is responsible at its level for the formation of the draft budget, then it is approved by the head of the relevant financial structure:

- in the federal budget – the Minister of Finance of the Russian Federation;

- in the regional – the Minister of Finance of a given subject of the Russian Federation.

The funds are broken down by quarter. After approval, the summary estimate is sent to the treasury.

The consolidated estimate is compiled on the basis of schedules made by the main managers of budget funds separately for each type of assignment, divided by budget items (there are certain codes).

ATTENTION! Corrections may be made to this estimate if a legislative requirement to save budget funds is adopted, the amounts for revenue items are inflated in comparison with previously made decisions, or the main manager changes the recipients of allocations.

Features of using expense and income estimates

The manager of budget funds brings to the knowledge of the budget organization all the nuances of the adopted allocations. Based on this notification, an expense and income estimate is generated, which must reflect:

- the amount of funds received;

- the intended purpose of the allocated money;

- distribution of finances by quarter.

Only after approval of this document can the institution use funds allocated from the budget.

Limits of accepted obligations

Limits are the grounds for providing funds to cover accepted obligations, reflecting the possible maximum of their acceptance. They are established by the State Treasury. In the banking system, unlike budget financing, there is no such concept. The basis for their establishment is the data from the summary list.

The Treasury provides information about limits to the main managers of budget funds, and they provide information to recipients. After approval at the recipient level, the limits are taken into account by a special treasury body that controls their implementation.

Confirmation of Commitment

After the circumstances have been accepted (an agreement has been concluded taking into account the established limits), they must be confirmed. Confirmation of obligations - checking the coincidence of budget funds and payment documents for concluded contracts. Confirmation occurs before funds are written off from budget accounts. The inspection is carried out by a body authorized by the State Treasury.

SO, the authorization procedure is designed to exclude the possibility of allocating budgetary allocations for non-target purposes or not covered by the revenue side of the budget.

The role of the treasury in fulfilling obligations

If a government institution has certain obligations, it is obliged to fulfill them. In order to do this, it is necessary to go through the procedure of authorizing the payment of monetary obligations. At its core, authorization is a permitting inscription (acceptance) carried out by the treasury authorities after checking the documents (see paragraph 5 of Article 219, paragraph 5 of Article 267.1 of the Budget Code of the Russian Federation).

Thus, the Russian Treasury is responsible for authorization. The institution provides documents to this department confirming the fact that a monetary obligation has arisen. The procedure for authorizing monetary obligations for recipients of federal budget funds is discussed in Order of the Ministry of Finance of Russia dated November 17, 2016 N 213n. According to paragraph 5 of Art. 219 of the Budget Code of the Russian Federation, the authorization procedure for recipients of funds from regional and local budgets is developed by the financial authorities of public legal entities. It establishes the documents necessary to confirm the occurrence of budgetary and monetary obligations.

Only after receiving a mark confirming authorization can the institution fulfill its obligations. At the same time, it is important to confirm your actions with payment documents, in accordance with clause 6 of Art. 219 BC RF.

Fulfillment of conditions

As mentioned above, a budget obligation is, for example, a debt to pay maintenance (contentment), salaries to employees of recipients of funds from the corresponding items for the current financial period. They are provided for execution at the expense of expenses for the reporting year and are reflected in the debit of the account. 0 502 11 211. Their accounting is carried out within the approved limits. Fulfillment of the conditions is certified by the relevant payment documents.

The method by which expenses covering the budget obligation are reflected is by debiting funds from the personal account. In balance sheet items, this operation is recorded on the account. 1,302 11,830. It reflects the decrease in payables for wages. Also, operations are carried out on account. 1 304 05 211. It records settlements with the financial authority regarding wages.

Reflection of budgetary and monetary obligations in accounting

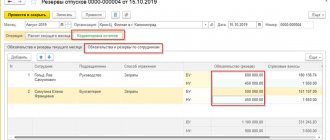

As practice shows, for some accountants, keeping records of budgetary and monetary obligations becomes a stumbling block. Budgetary accounting for these obligations is maintained in the following accounts:

- Accounting for budgetary obligations of a government institution is carried out in accordance with clause 140 of the Instructions, approved. By Order of the Ministry of Finance of Russia dated December 6, 2010 N 162n on account 0 502 01 000 “Accepted obligations”.

- Accounting for monetary obligations of a government institution is carried out in accordance with clause 141 of the Instructions, approved. By Order of the Ministry of Finance of Russia dated December 6, 2010 N 162n on account 0 502 02 000 “Accepted monetary obligations”.

Let us pay close attention to the fact that failure to reflect the indicators of accepted obligations in the expense authorization accounts leads to distortion of budget reporting and, as a consequence, recognition of such reporting as unreliable. This fact, in turn, may be the basis for prosecution in accordance with the norms of the Code of Administrative Offenses of the Russian Federation and the imposition of fines.

Accounting for authorization transactions

It is carried out on the basis of the “primary” adopted in the financial requirements of the relevant budget sector. Clauses 239, 241 and 251 of the Instructions for the Application of the Unified Chart of Accounts require that accounting reflect transactions on transactions authorizing expenses using the following accounts :

- liability limits – account 150201000;

- deductions based on accepted estimates - account 250202000.

The following accounting entries :

- debit 150115000, credit KRB 150113000 - reflection of the amounts under the limits of accepted obligations communicated to recipients, as well as the amount of adjustments during the reporting year;

- debit 150113000, credit 150113000 – breakdown of limits communicated to recipients by codes of articles and subitems of types of budget expenditures;

- debit 150113000, credit 150211000 – accounting for the amounts of accepted obligations (within limits and their adjustments).

If the activities of a budget organization are aimed at generating income, the postings will look like this:

- debit 250411000, credit 250412000 – accounting for the amounts of allocations for the organization’s expenses according to the expense and income estimate;

- debit 250412000, credit 250212000 – reflection of the amounts of the organization’s obligations within the limits of the allocated allocations (in this reporting period).