Primary recording of working time in an organization

Definition 1

Working time is the time during which an employee of an organization, in accordance with the rules and regulations of the internal regulations and the terms of the employment contract, is obliged to perform his or her job duties. Working time also includes other periods of time established by law.

Working hours should take into account:

- The duration of the working week, which can be five days or six days with two or one day off, respectively, with days off on a rotating schedule, as well as a part-time work week.

- Irregular working hours for some categories of workers;

- Duration of work shift, part-time;

- The start period of work and the moment of its end, the time of breaks;

- Number of shifts per day, alternating working days and weekends.

With irregular working hours, some categories of workers are periodically, by order of their employer, involved in performing their job duties beyond a certain working time.

Can not understand anything?

Try asking your teachers for help

The general working hours are determined by the labor regulations in force outside the organization, in accordance with labor legislation.

The working week cannot exceed 40 hours.

The length of the shortened working week can be:

- no more than 24 hours (if the employee is under 16 years old);

- no more than 35 hours (if the employee is from 16 to 18 years old or is a disabled person of group 1 or 2);

- no more than 36 hours (for the category of workers who work in harmful and dangerous working conditions).

Shift work can be carried out in 2, three or four shifts. It is advisable to introduce when the duration of the production cycle greatly exceeds the permissible duration of a daily shift and in order to effectively use the organization’s equipment and increase the volume of products.

Note 1

The establishment of a part-time working week or part-time working day is carried out by agreement of the employee and the employer.

Primary recording of working hours of employees of the organization

When applying for a new job, each employee is required to provide an identification document and a work book. If a certain qualification is required for a particular position, the relevant documents must be provided: diploma, driver's license, certificates, etc.

The document in which employee records are kept is a personal card. This card is filled out in a single copy.

When hired, a hiring order is drawn up and a personal file is opened for the new employee. Therefore, a personal file consists of several documents: an employee’s profile, autobiography or resume, letters of recommendation, employment contract, copies of orders and all documents that are directly related to this employee.

To keep track of working hours, a time sheet is designed, where the moment of arrival and the moment of departure of employees should be recorded daily. Then it goes to the accounting department, where wages are calculated on its basis.

Working hours are recorded in:

- Time sheet and calculation of wages (form T-12);

- Working time sheet (form T-13).

The very essence of timesheet accounting is the daily registration of an employee’s attendance at work, his departure from work, all cases of absences indicating the reasons, all delays, downtime, overtime, etc. are also recorded.

Form T-12 takes into account the time that was actually worked or not worked by each employee of the organization. This is done to monitor compliance by all employees of the organization with the established working hours, as well as to obtain the necessary data on the time worked by one or another employee for further calculation of wages and reporting.

The timesheet for recording working hours and calculating wages is drawn up in a single copy and signed by the head of the department and the HR employee. The correctly completed form is subsequently sent to the accounting department, where the timesheet is used to calculate employee wages.

The report card in form T-13 is used for automated data processing.

This report card is drawn up in a single copy and signed by the head of the unit and the HR employee. Then it is transferred to the accounting department for payroll calculation.

Note 2

In these two forms, working time is recorded by constantly recording all employee appearances and absences, or only registering absences, tardiness, etc.

Primary accounting of settlements with personnel for wages

There are several documents for proper accounting of settlements with personnel regarding wages.

Payroll, payroll and payroll are the basis for calculating and paying wages to employees. In addition, all information about accruals and payments of wages to a particular employee is simultaneously reflected on his personal account.

If the organization uses payroll, then the use of payroll and payroll is inappropriate.

Note 3

At their core, both payroll and payroll statements are supporting documents that contain the fact of payment of wages to all employees of the organization.

All statements are compiled in the accounting department in a single copy.

The calculation of wages itself is carried out on the basis of all primary documents, which take into account the actually worked time of employees, the output of employees is taken into account, absences and tardiness are taken into account, etc.

The first sheet of the payroll and payroll statements must indicate the amount to be paid to employees. If for one reason or another the employee has not received wages after the payment deadlines established by law, then these amounts are deposited.

All payrolls are recorded in the payroll register.

The personal account of the organization’s employee is also filled out, where all information on the wages paid to the employee is entered. The personal account also reflects information about all accruals, deductions from wages, all work performed, and time worked.

Source: https://spravochnick.ru/buhgalterskiy_uchet_i_audit/suschnost_i_soderzhanie_buhgalterskogo_ucheta/pervichnyy_uchet_rabochego_vremeni_v_organizacii/

Overtime work and requirements for its documentation

According to Article 99 of the Labor Code, overtime is considered to be work outside the normal working hours. Overtime work in cumulative accounting of working hours is defined as work in excess of the established number of working hours during the accounting period.

The law allows overtime work in several situations:

- if there is a threat of property damage, harm to human life or health;

- if it is necessary to restore mechanisms, the non-working state of which will lead to downtime for large groups of workers;

- if it is necessary to continue work if the replacement does not show up in cases where the work process cannot be interrupted and the employer must take immediate measures to replace the employee.

A mandatory requirement when engaging an employee to work overtime is to obtain his written consent. Without written consent, overtime work is permitted only to eliminate the consequences of disasters.

Overtime work must be reflected in time sheets. In a remuneration system where hours worked outside working hours are taken into account in the motivational part, the time must be recorded in timesheets.

https://youtu.be/5HykqrRC7xc

Primary documents for payroll accounting

The primary payroll accounting documents contain data that is important both to your employees and to representatives of government regulatory agencies.

How reliable or erroneous the information provided in them is depends on the qualifications and integrity of the accountant and HR officer (in some companies these functions are combined by one specialist).

How to increase the organization’s budget thanks to savings on the work of a human resources accountant and the absence of sanctions from fiscal authorities, read in the publication.

Primary documents on personnel and wages accounting are the main evidence of the correct calculation of budget payments and the distribution of employee income according to their labor costs. Both are strictly regulated at the legislative level, but in companies, work with these papers is often less strictly controlled.

On the part of the management, this is a mistake: what business representatives see as “compliance with formalities”, for the state, is the key to timely replenishment of the budget in full and compliance with current tax and labor laws.

Gaps in the “primary” payroll calculation are fraught not only with fines from regulatory authorities, but also with other consequences, including reputational losses as a result of proceedings with government agencies and labor disputes with employees.

The importance of “primary” accounting for salaries and personnel for business

Every year the state tightens the external conditions for the existence and development of business.

Therefore, the main task of the owner is to predict and minimize possible losses if the company suddenly comes under the attention of regulatory authorities.

“Correct” primary documents in this sense are a reliable way to demonstrate your integrity and eliminate the desire of the relevant structures to check your business more thoroughly.

Papers involved in personnel records deserve no less attention. The Labor Code of the Russian Federation largely protects the interests of the employee, not the employer. Compensating for such injustice, as well as assigning to each employee the degree of responsibility that the specifics of your business provide, can only be done through competently developed local regulations.

In addition, personnel document flow is often a “collection” of errors that are accidentally discovered only during an inspection by Rostrud, Roskomnadzor, FSS, proceedings by the prosecutor’s office, police, migration service, or on the eve of a labor dispute with an employee. For a formal approach to routine work, you will have to pay fines of hundreds of thousands of rubles.

If you outsource HR administration to 1C-WiseAdvice, you will receive specialized specialists: an assistant, a HR specialist, an HR support expert, and a labor law lawyer.

It will cost about the same as the services of a full-time personnel officer working “for show.”

A high level of automation not only minimizes manual labor in performing typical tasks, but also eliminates the human factor, which turns into annoying mistakes at the most inopportune moments.

But the most important thing is that we are financially responsible for the quality of the services provided. An exclusive professional liability insurance contract includes an expanded list of risks that are not covered by a standard policy and are not insured by most other accounting companies.

Advantages of HR outsourcing

General requirements for the preparation of primary documents

Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ states that every fact of the company’s economic life must be documented in the appropriate primary document. And he immediately warns that “imaginary and feigned” transactions are not allowed in accounting.

The reality of government transactions is receiving increased attention today. In this regard, since 2013, not all primary documents are subject to mandatory registration according to samples from albums of unified forms approved by the resolutions of the State Statistics Committee of Russia.

Now the “primary” data can be processed to suit the needs of your accounting department and business - the main thing is that the data is not hidden or falsified.

In any case, an independently developed primary document must contain all the mandatory details listed in Part 2 of Article 9 of Law No. 402-FZ.

Not only the state, but also the business owner is interested in ensuring that the information in primary documents corresponds to reality. If the state is confident that you are law-abiding, you, in turn, can also be confident, for example, that you will not be exposed to manipulation by employees, labor disputes, or sanctions.

1C-WiseAdvice experts will help you assess existing risks and correct HR errors. provides for a general assessment of the organization’s personnel records management and its compliance with labor legislation, identification of accounting errors and direct violations of the Labor Code.

Our experts will describe the identified risks and the penalties provided for them, and comment on how best to correct the mistakes made. In serious cases, when many violations have accumulated, we can draw up a plan for restoring personnel records and implement it ourselves.

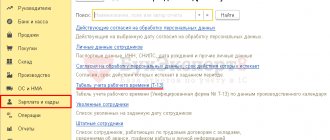

List of documents for calculating wages and recording working hours

Primary documents for payroll calculation include:

- Time sheet and calculation of wages (form No. T-12)

- Time sheet (form No. T-13)

- Payroll statement (form No. T-49)

- Payroll (form No. T-51)

- Payroll (form No. T-53)

- Payroll register (form No. T-53a)

- Personal account (form No. T-54)

- Personal account (form No. T-54a)

- Calculation note on granting leave to an employee (Form No. T-60)

- Calculation note upon termination (termination) of an employment contract with an employee (dismissal) (Form No. T-61)

- Certificate of acceptance of work performed under a fixed-term employment contract concluded for the duration of a specific job (Form No. T-73)

And now about all these documents in more detail.

Time sheet and calculation of wages

It is more logical to talk about the T-12 form, since T-13 includes only the first section of the T-12 sample. One way or another, the company has the right to independently develop and approve the form of time sheets and payroll calculations. In this case, the document must contain accurate information:

- on the number of days (hours) of absences (appearances);

- on the number of hours by type of overtime (substitution, work on holidays, night work, part-time work, etc.).

Depending on the work schedule of a particular employee, the following methods of recording his working time are used:

- Daily . In this case, with a five-day working week, the normal working day will be eight hours, and with a six-day week, it will be seven hours. Any overtime will be considered overtime.

- Weekly accounting . The generally accepted working hours are 40 hours per week. Employees may work more on some days and less on others. This must be recorded on the report card.

- Summarized accounting . This method of recording working time is used if the specifics of the work do not provide for weekly or daily standardized working hours. The employer himself determines the accounting period: month, quarter or year.

Settlement and payment, as well as payroll statements

Statements reflecting the calculation and payment of salaries to employees exist in three unified forms approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1. These documents can also be customized to the specifics of the company’s accounting policies, but subject to compliance with the mandatory details provided for in the same part 2 Article 9 of Law No. 402-FZ.

The forms differ from each other in their purpose and methods of subsequent settlement with employees.

How to prepare a payroll sheet T-51

Payroll register (form No. T-53a)

The payroll register is an accounting ledger. It is intended for systematization and accumulation of information contained in the payment (T-53) and settlement and payment (T-49) statements.

According to Article 10 of Law No. 402-FZ, omissions, “withdrawals” or corrections by “unauthorized persons” are not allowed in accounting registers.

Any correction must be accompanied by the date, signatures with transcripts of the employees responsible for maintaining this register.

Personal accounts

A personal account is an internal document in which, from the moment of hiring and throughout the entire career, information about all types of payments and deductions from an employee’s salary is entered. This type of “primary” is carried out in two forms:

- T-54 – used to record all types of charges and deductions.

- T-54a – electronic form of personal account.

Settlement notes

Unified form No. T-60 provides for two types of leave:

- annual paid

- annual additional (other) leave.

Vacation pay according to this sample is calculated based on the employee’s average daily earnings multiplied by the number of vacation days. The company can develop its own form of calculating vacation pay, again complying with the mandatory mentioned requirements for recording the real facts of the company’s economic life.

The situation is similar with form No. T-61, reflecting the procedure for calculating “calculation”.

Certificate of acceptance of work performed under a fixed-term employment contract

The document reflects the types, volume and cost of work performed by a third-party contractor. Detailed information about each service is provided on a separate line.

Other primary documents involved in payroll calculation and working time recording:

- an employment contract that sets out the system and amount of remuneration;

- orders for transfer to another position and subsequent salary changes;

- expense cash orders indicating bonuses for a certain number of employees, as well as corresponding orders;

- sick leave and other documents confirming the legality of payments to employees from the Social Insurance Fund;

- travel orders.

A professional assessment of the HR document flow that has developed in your company is included in. Our experts:

- will evaluate the thoroughness, efficiency and correctness of the system for preparing, approving, registering and storing personnel documents;

- will correct errors and provide you with a complete set of personnel documents, impeccably executed from the point of view of Russian legislation. This in turn will eliminate the financial and administrative liability of the company and its owners.

Source: https://1c-wiseadvice.ru/company/blog/pervichnye-dokumenty-po-uchetu-zarabotnoy-platy/

STATE COMMITTEE OF THE RUSSIAN FEDERATION ON STATISTICS

On the basis of a contract (employment contract), the head of an organization or a separate division issues an order. The order specifies the position, working hours (full or shortened working hours), and other significant parameters. The time clock system is one of the main mechanisms for recording working time. The time worked is reflected in the document of the approved form N T-12 “Table of accounting for the use of working time and calculation of wages.”

The decision made must be fixed in the accounting policy and the forms of primary documents used by the organization must be attached to it.

In addition, the execution of this document (working time sheet) is regulated by GOST R 6.30-2003 “Organizational and administrative documentation. Documentation requirements." Calculation of earnings in the piecework form of remuneration is carried out according to production documents. Accounting for the output of workers in organizations is kept by foremen, foremen and other workers who are assigned these responsibilities.

Primary documentation for personnel records and wages

In every organization conducting economic activity, there is a need to maintain personnel documents, as well as monthly calculations and payroll for employees.

Accounting calculates benefits, vacation pay and travel allowances, salary and piecework accruals, calculates taxes and insurance contributions, reports to funds and the Federal Tax Service.

Often, accounting also deals with personnel documents, because not every company has its own personnel department.

At the same time, not every accountant is also a well-versed HR employee. But the Labor Inspectorate is no joke these days.

Calculation and calculation of wages must be carried out in accordance with the provisions of Chapter 21 of the Labor Code of the Russian Federation. The payroll calculation process is carried out in several stages.

The first stage is the analysis of the information contained in the primary documents on labor accounting and payment, compiled according to unified forms.

The second stage is the calculation of wages (and other payments) to employees, as well as to persons performing work and providing services under civil law contracts (CPL).

At the third stage, the calculation and withholding of personal income tax (NDFL) takes place in accordance with Chapter 23 of the Tax Code.

The fourth stage will be the calculation of insurance premiums levied on accrued wages.

At the fifth stage, documents (also standardized forms) for the payment of wages are drawn up.

Taking into account the fact that in accordance with paragraph 1 of Article 9 of the Law “On Accounting” No. 129-FZ, all business transactions carried out by the organization must be documented with supporting documents, since these documents serve as primary accounting documents on the basis of which accounting is maintained, the importance of primary documentation cannot be underestimated.

Moreover, many primary documents on personnel records and wages must be stored for 75 years (or permanently, i.e. at least 10 years) 75 years in accordance with the requirements of the Order of the Ministry of Culture dated August 25, 2010. No. 558 with subsequent transfer to the State Archives in the event of termination of the company’s activities.

In addition, the legislation provides for administrative and even criminal liability for violation of the procedure for maintaining and maintaining personnel documents.

The article will discuss the types and forms of primary documents on personnel records and wages, as well as the periods of their storage.

The information presented can serve as a “memo” in the work of an accountant.

PRIMARY DOCUMENTS CONTAINED IN ALBUMS OF UNIFIED FORMS

When generating primary documents on personnel records and remuneration, you should remember the provisions of paragraph 2 of Article 9 of Law No. 129-FZ.

In accordance with this paragraph, primary accounting documents are accepted for accounting if they are compiled in accordance with the form contained in the albums of unified forms of primary accounting documentation.

Unified forms that should be used when registering labor relations with employees were approved by the Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004. No. 1 “On approval of unified forms of primary accounting documentation of labor and its payment.”

This Resolution approved the following forms of primary documents:

1. For personnel records:

- No. T-1 “Order (instruction) on hiring an employee,”

- No. T-1a “Order (instruction) on hiring workers.”

These forms are used to formalize the hiring of an employee (T-1) or a group of employees (T-1a). Shelf life 75 years.

- No. T-2 “Employee’s personal card”,

- No. T-2GS (MS) “Personal card of a state (municipal) employee.”

An employee’s personal card is the main document for recording employee data and is issued for all, without exception, employees of the enterprise with whom employment contracts are concluded. Shelf life 75 years.

- No. T-3 “Staffing table”.

A mandatory and very important document reflecting data on the structure of the organization, its staffing and staffing levels. And the staffing table itself and changes made to it are approved by order of the manager. Shelf life 3 years.

- No. T-4 “Registration card of a scientific, scientific and pedagogical worker.”

This form is used in scientific and educational institutions to register scientific workers. Filled out on the basis of diplomas of Doctor of Science and Candidate of Science, certificate of associate professor and professor and other similar documents.

- No. T-5 “Order (instruction) on the transfer of an employee to another job”,

- No. T-5a “Order (instruction) on the transfer of workers to another job”,

arranges the transfer of employees to another position within the organization. The employee’s written consent is attached to the order. Shelf life 75 years.

- No. T-6 “Order (instruction) on granting leave to an employee,”

- No. T-6a “Order (instruction) on granting leave to employees”,

Used for registration and accounting of vacations. Shelf life: 5 years.

A mandatory local regulatory act that annually determines the order of provision of paid leave to employees of the organization in accordance with the provisions of Article 123 of the Labor Code.

Approved by the employer no later than two weeks before the start of the calendar year.

The procedure for drawing up a schedule can be fixed by internal labor regulations or provisions of a collective agreement, or other internal documents of the organization.

The employee must be notified of the start time of the vacation by signature no later than two weeks before it begins. Shelf life: 1 year (we recommend storing until you pass an inspection by the Federal Tax Service or the Labor Inspectorate).

- No. T-8 “Order (instruction) on termination (termination) of an employment contract with an employee (dismissal)”,

- No. T-8a “Order (instruction) on termination (termination) of an employment contract with employees (dismissal)”,

used for documentation upon termination of employment relationships. Shelf life 75 years.

- No. T-9 “Order (instruction) on sending an employee on a business trip”,

- No. T-9a “Order (instruction) on sending workers on a business trip”,

is issued when sending an employee (employees) on a business trip. Filled out on the basis of a job assignment (form T-10a). Shelf life: 5 years (for long-term foreign business trips - 10 years).

- No. T-10 “Travel certificate”,

serves to confirm the time spent on a business trip. The certificate indicates the time of arrival of the employee at the destination, as well as the time of departure.

This document is drawn up on the basis of an order for sending on a business trip (form T-9) and is certified by the receiving party.

Shelf life is 5 years (for business trips to the Far North and equivalent areas - 75 years).

- No. T-10a “Official assignment for sending on a business trip and a report on its implementation”,

contains information about the purpose of the employee’s trip and its final results. It is the basis for issuing an order in the T-9 form and serves to confirm the economic justification of business trip expenses. Shelf life: 5 years (for long-term foreign business trips - 10 years).

- No. T-11 “Order (instruction) on employee incentives”,

- No. T-11a “Order (instruction) on incentives for employees”,

issued when employees are rewarded for success at work. The order is the basis for making a corresponding entry in the employee’s personal card (form No. T-2, No. T-2GS (MS)) and the employee’s work book. Shelf life 75 years.

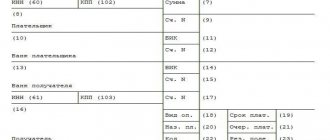

2. For recording working hours and settlements with personnel for wages:

• No. T-12 “Working time sheet and calculation of wages”,

It is not only a document reflecting the labor discipline of the organization, but also serves as the basis for calculating wages to employees.

Companies need this document not only for maintaining accounting records of payroll calculations. The report card is also necessary to confirm the economic justification of expenses for remuneration of employees for tax accounting purposes, since in essence it is a document confirming the actual performance of their work activities by employees.

The T-12 form is universal and is used in most organizations. Shelf life: 5 years (under hazardous working conditions – 75 years).

- No. T-13 “Working time sheet”,

used by companies that use an automatic system for monitoring employee attendance and absence from the workplace (turnstiles, electronic passes and other recognition systems that record the time of arrival and departure of employees). Shelf life: 5 years (under hazardous working conditions – 75 years).

- No. T-49 “Payment and payroll”,

- No. T-51 “Payment sheet”,

- No. T-53 “Payroll”,

used to calculate and pay wages to employees. If form No. T-49 is used, other settlement and payment documents according to forms No. T-51 and No. T-53 are not drawn up.

In case of transfer of wages to bank cards of employees, only a payslip is drawn up (forms No. T-49 and T-53 are not drawn up). Shelf life is 5 years, subject to inspection. (If there are no personal accounts - 75 years).

- No. T-53a “Payroll Registration Journal”,

used for accounting and registration of payroll records for payments made to employees. Shelf life: 5 years.

- No. T-54 “Personal account”,

- No. T-54a “Personal account (svt)” (svt – computer equipment),

are used for monthly reflection of information on wages, all accruals, deductions and payments in favor of the employee during the calendar year. Shelf life 75 years.

- No. T-60 “Note-calculation on granting leave to an employee”,

used to calculate vacation pay due to the employee. Shelf life is 5 years, subject to inspection. (If there are no personal accounts - 75 years).

- No. T-61 “Note-calculation upon termination (termination) of an employment contract with an employee (dismissal)”,

used for accounting and calculation of wages, compensation for unused vacation and other payments to employees upon termination of an employment contract. Shelf life is 5 years, subject to inspection. (If there are no personal accounts - 75 years).

- No. T-73 “Act on the acceptance of work performed under a fixed-term employment contract concluded for the duration of a specific work.”

It is used to register and record the acceptance and delivery of work performed by an employee under a fixed-term employment contract concluded for the duration of a specific job.

Serves as the basis for the final or phased calculation of payment amounts for work performed. Shelf life is 5 years, subject to inspection. (If there are no personal accounts - 75 years).

Salary by product type

Based on the results of processing primary documents, the PEO generates accumulative statements that:

- used as a basis/reconciliation when creating calculations;

- display consolidated direct costs by type of product;

- are used to calculate the percentage of compliance with standards, control time standards, control and reconciliation of volumes of manufactured products.

The best option is that the required form is printed automatically at the user’s request after entering statements of work performed into the database.

The cumulative list of labor costs by type of product is useful for analyzing wages by type of product and calculating costs.

In the column “Basic salary” the piecework salary from the accounting sheets (individual, team) is indicated; in the “Additional salary” column - bonuses, surcharges for harmful activities, etc.

Payroll

The following block of primary documents for payroll accounting:

- payroll statement (form T-49);

- pay slip (form T-51);

- payroll (form T-53).

Important! It is necessary to reflect the amounts of accrued wages only in unified forms approved by Resolution No. 1.

As the names indicate, form T-49 is a combination of forms T-51 and T-53, so the accountant draws up either one payroll sheet, or a payroll sheet and a payroll sheet.

The payroll sheet is used to calculate and pay wages in cash from the company's cash desk. It contains the number and date of compilation, signatures of the manager and chief accountant, the total amount of payment to all employees, as well as the start and end dates for the payment of wages from the cash register - this period is 5 working days. The statement contains information about the personnel number, position, tariff rate and hours worked by each employee. The accountant enters into it all accrued amounts for all types of payments, as well as all deductions for the period for which funds are paid to the employee. This can be either an advance, or wages, or vacation pay, and so on.

At the end of the statement, information about the amount paid and deposited (if any), the signature of the responsible person and the number of the cash receipt order for which the payment was made are entered. The far right column is filled in by employees of the organization, where they sign to confirm receipt of funds from the cash register . Amounts not received within five days are deposited.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

A sample payslip is provided at the link.