Author of the article: Anastasia Ivanova Last modified: April 2020 4819

Working time used directly to perform professional duties has certain characteristics. One of the initial indicators in this case is the working time fund, calculated separately. Moreover, such a procedure has a considerable number of features. In particular, the formulas used for calculation depend on the type of indicator itself. There are several such types and it is highly recommended not to confuse them with each other.

The essence of the concept of “working time fund”

In a broad sense, the working time fund (WF) is an indicator containing the expected volume of hours available in the future for carrying out certain work. This value can be calculated both within the entire organization and relative to just one employee.

The main purpose of calculating the PDF is, first of all, planning the use of work resources and capabilities. Having data on potentially available days and hours of labor, it is realistic to calculate planned productivity. In the future, based on analysis and comparison of the latter with actual indicators, it is possible to identify losses and take steps to increase employee productivity. The result will be an increase in the efficiency of a particular organization as a whole.

It is also important to understand that the calculation of the working time fund is always based on information for each individual employee. In particular, when determining how long an employee can work in the future, a number of special factors are taken into account. Namely:

- physical capabilities of a person;

- requirements of the Labor Code of the Russian Federation;

- company capabilities aimed at harnessing the potential of the working citizen.

It is allowed to determine the working time fund in both hours and days. Accordingly, the units of its measurement are either man-days or man-hours.

Expert commentary

Kireev Maxim

Lawyer

At the same time, when calculating the FER indicator, periods of employee illness for a specific period, as well as parental leave, being late for work, holidays and other factors must be taken into account. The value of the working time fund in each of these cases is subject to change downwards by the corresponding number of days or hours.

https://youtu.be/igWR_XnyQnA

Analysis of the use of working time by employees

The total working time depends on the number of workers, the number of days worked by one worker on average per year and the average working day. This relationship can be expressed as follows:

PDF = PR×D×P. (2.1)

where, CR - Average annual number of workers; D - the number of days worked by one worker per year; H - the number of hours worked by one worker per year; P - Average working day

FRW - Total number of man-hours worked by workers (total working hours)

As can be seen from table 2.6. At the enterprise, the actual working time fund in 2009 increased by 20,272.29 people. hour, but in 2010 its size decreased by 67,174.07 man-hours.

Let us identify the reasons for this decline in 2010. We will calculate the influence of factors using the method of differences in absolute values:

Due to changes in the number of workers:

∆FRV HR = (CR2010 - CR2009) × D2009 × P2009 = (268 -309) × 184.42 ×7.95 = -60180.76 people. hour.

Due to a reduction in the number of employees by 41 people, the total number of hours worked was reduced by 60,180.76 man-hours.

Impact of changing the number of days worked by one worker:

∆FRV d = CR2010 ×(D2010 - D2009) ×P2009 = 268 × (180.75-184.42) × 7.96 = -7828.28 people. hour.

Thus, by reducing the number of days worked by 3.67 days, the total number of hours worked was reduced by 7828.28 man-hours

Impact of changing working hours:

∆FRVp = CR2010× D2010× (P2010 - P2009)× P2009 = 185× 213× (7.674 - 7.789) = 185× 213× (-0.115) = 834.97 man-hours.

As can be seen from the calculations, an increase in the duration of work of one worker by 0.02 hours led to an increase in the total number of hours worked by 834.67 man-hours.

Balance of deviations: -67174.07 man-hours, which corresponds to the calculated indicator.

As can be seen from the data given in Table 2.6, the enterprise does not use the available labor resources fully enough. On average, in 2010, one worker worked 180.75 days, which is lower than in 2009.

To identify the causes of daily and intra-shift losses of working time, data from the actual and planned balance of working time are compared (Table 2.10).

Table 2.10.

Calculation of calendar fund of working time

The calendar fund of working time is considered basic, because with its help all other types are calculated.

In this case, the calculation formula is based on 2 values:

- the total number of calendar days in a year;

- number of employees of the enterprise.

The indicated indicators are multiplied among themselves. The result is the value of the calendar fund for the specified period.

For example, the number of days in a year is 365, and the company has 1000 employees. Multiplying the indicators we get 365,000 man-days. The calendar annual fund for one employee will be equal to 365 days.

Expert commentary

Gorchakov Vladimir

Lawyer

It is worth clarifying that this indicator cannot be called at least somewhat informative. This is due to the fact that its calculation does not take into account days on which employees are absent on site for the reasons specified in the Labor Code of the Russian Federation. Or for other reasons. However, without calculating the calendar fund, it will not be possible to identify other types of financial reserves. It is for this reason that it has value and always requires calculation.

Production calendar

In order for managers to correctly calculate labor standards, there is a special document. This is the so-called production calendar, which takes into account all working days, as well as rest days, including holidays. This document is not a normative act and therefore has no legal force.

However, it is very useful for accountants or HR employees whose responsibilities include keeping time records and calculating earnings. The production calendar can be found online and used at your discretion. Also, the law does not prohibit organizations from independently developing such documents. To do this, you can take a regular calendar and indicate working days and weekends in it in accordance with established rules.

Standard working time is a very important concept, as it allows you to control the performance of professional duties. In addition, using the obtained result, the employer cannot increase the load on his subordinates by forcing them to work beyond measure. Employees can also follow a procedure to verify the amount of time worked.

Fresh materials

- F 0504421 timesheet How to maintain a timesheet using form 0504421 for 2020 Timesheet using the form...

- How to calculate the tax burden Formula and calculation procedure ★ Best-selling book “Accounting from scratch” for dummies (understand how to keep an accounting…

- How to calculate personal income tax Withholding personal income tax from wagesIncome tax for individuals must be withheld from...

- What does the Pension Fund of the Russian Federation do? Pension Fund of the Russian Federation Pension Fund of the Russian Federation PFR Type of organization Pension Fund Managers Chairman of the Board...

The principle of calculating the nominal working time fund

The nominal working time fund, or, as it is also called, the time fund, indicates the expected number of days the employee will go to work in accordance with the schedule. This takes into account holidays, the right to which is granted to working citizens on the basis of the Labor Code (Article 112). Weekends are also taken into account. For example, with a five-day work week, this could be Saturday and Sunday.

Article 112 of the Labor Code of the Russian Federation

“Non-working holidays” (more details)

At the same time, the nominal FRF is based on one or another calendar period. It could be as follows:

- year;

- quarter;

- month.

The latter period is used in most cases. It is important when calculating wages, as well as when identifying the ratio of days actually worked to the established production rate.

To calculate the nominal PDF, the following algorithm is used:

- subtract the total number of holidays and weekends from the number of calendar days for the required period;

- multiply the resulting value by the number of employees of the enterprise.

Expert commentary

Shadrin Alexey

Lawyer

If the calculation is made in man-hours, then not only holidays and weekends, but also shortened pre-holiday days should be taken into account. For the latter, the shift is reduced by 1 hour.

The nominal FRF indicator is directly related to the production calendar compiled annually for Russia. The calendar contains information about all holidays and weekends, as well as working hours.

For the current year, the calendar fixes the following standard:

| Calendar days | 365 |

| Working days | 247 |

| Weekends and holidays | 118 |

But for a 40-hour week, the hourly norm of permissible working time will be 1 thousand 970 hours. At 35 hours – 1 thousand 772 hours.

In general, the production calendar is of significant importance for accountants and HR specialists throughout Russia. With its help, wages are calculated, a work schedule is drawn up, sick leave is paid and vacation is calculated.

Production calendar for 2020

Working time is part of the calendar time spent on producing products or performing a certain type of work. To characterize its use, special indicators are used. The initial indicator is the calendar fund of time - the number of calendar days of the month, quarter, year per worker or per group of workers. For example, the calendar annual fund of time for one worker is 365 (366) days, and for a team of 1000 workers – 365,000 (366,000) person-days.

The calendar time indicator reflects working and non-working time, i.e. number of man-days of attendance and absence from work.

Man-days of attendance at work are actually man-days worked and man-days of full-day downtime

Person-days of absence from work are days of absence from work for valid and unexcused reasons. Person-days of absence from work for valid reasons include days of annual leave, holidays and weekends, absences due to illness and in connection with the performance of public, national duties, as well as other absences permitted by law.

Person-days of absence from work for unexcused reasons are days of absenteeism with the permission of the administration and absenteeism.

The number of man-days of absences, with the permission of the administration, includes absences from work for valid personal reasons: days of short-term leave without pay, provided to employees upon marriage, the birth of a child and other family circumstances.

The number of man-days of absenteeism includes the man-days of employees who did not show up for work without a good reason or were absent from work without a good reason for more than three hours (continuously or cumulatively) during the working day.

The basic units of time worked and not worked by workers are man-days and man-hours.

Based on working time recording data, working time funds are determined in man-days.

Let us show the methodology for calculating working time funds in man-days using the following information for an industrial enterprise as an example:

| Average number of workers |

| Man-days worked by workers |

| Number of man-days of full-day downtime |

| Number of man-days of absence from work, total |

| Including: |

| annual holidays |

| study holidays |

| maternity leave |

| absences due to illness |

| other absences permitted by law (performance of government duties, etc.) |

| failure to appear with the permission of the administration |

| absenteeism |

| Number of person-days on holidays and weekends |

| Number of man-hours worked, total |

| Including overtime |

From these data, it is possible to determine, first of all, the values of the calendar, time and maximum possible working time funds.

The calendar fund of working time is calculated as the sum of the number of man-days of attendance and absence from work or worked and unworked man-days: 110790+10+71700 = 182500 man-days, and is equal to the product of the average number of workers by the number of calendar days in a year, t .e.

500 people × 365 days = 182500 person days.

The time fund of working time is determined by subtracting man-days of holidays and weekends from the calendar fund of time:

182500 - 56500 = 126000 person days.

The maximum possible working time fund represents the maximum amount of time that can be worked in accordance with labor legislation. Its value is equal to the calendar fund with the exception of the number of man-days of annual vacations and man-days of holidays and weekends:

182500 - 56500 - 9000 = 117000 person days.

Based on absolute indicators of working time in man-days, relative indicators are calculated that characterize the degree of use of a particular fund of time. For this purpose, the proportion of time worked in the corresponding working time fund is determined.

The coefficient of use of the maximum possible working time fund characterizes the degree of actual use of the time that the workers of the enterprise could work to the maximum. Unused working time at the enterprise amounted to 5.31% (100%-94.69%). This is time not worked for valid reasons (study and maternity leaves, days of illness and absences permitted by law), as well as loss of working time (downtime, absences with the permission of the administration, absenteeism).

Based on the above data, let's calculate the relative indicators of unused working time.

The share of time not used for good reasons in the maximum possible working time fund is the ratio of the number of man-days of absence from work for good reasons to the maximum possible working time fund in man-days:

The share of lost working time in the maximum possible fund of working time is equal to the ratio of the sum of the number of man-days of all-day downtime and absences for unexcused reasons to the maximum possible fund of working time:

You can also determine averages. The average duration of a working period (in our example, a year) shows the average number of days worked by one worker for a given period. This indicator is calculated as the ratio of the number of man-days worked during the period under study to the average number of workers for the given period. In our example, the average actual working year is

.

The number of days of absence for all reasons on average per worker is determined by dividing the total number of man-days of absence, including holidays and weekends, by the average number of workers. On average, per worker in our example there are no-shows for work throughout the year.

The average number of all-day downtime per worker is found by dividing the number of man-days of all-day downtime by the average number of workers. In our example, on average, there are 10:500 = 0.02 days of downtime per worker per day.

So, the sum of all average indicators for the year per worker is 221.58 + 143.40 + 0.02 = 365 days, or, accordingly, 60.71 + 39.29 + 0.001 = 100%.

The degree of use of the working period reflects the coefficient of utilization of the working period (Ki.r.p). It is calculated as follows:

The actual duration of the working year, as calculated, is 221.58 days, and the maximum possible duration of the working year is determined as the ratio of the maximum possible working time to the average number of workers:

Hence,

In magnitude, this indicator coincides with the coefficient of use of the maximum possible working time fund, since both coefficients have the same economic meaning:

The average actual working day is defined as the ratio of man-hours worked, including man-hours of intra-shift downtime and man-hours worked overtime, to the sum of man-days actually worked:

Thus, the working day utilization factor (Ki.r.d) can be calculated using the formula

Calculation of the maximum possible fund

The maximum possible working time is another one of the most informative indicators. This takes into account not only rest periods and holidays, during which the working population of the country does not legally attend work, but also vacations. According to the Labor Code of the Russian Federation, the latter period is 28 days. Every officially employed citizen can count on this amount. And it is this parameter that is required to calculate the maximum possible fund.

You will need to perform the following steps for calculation:

- the number of days attributable to the vacation of one employee is multiplied by the number of people enrolled in the company's staff;

- subtract the resulting value from the amount of the nominal fund.

Expert commentary

Gorbunova Olga

Lawyer

The maximum FRF more accurately indicates the number of working hours (or days) an employee is potentially available for work. If, after calculating the actual time worked, a large difference is revealed, this will indicate that labor time is being allocated ineffectively.

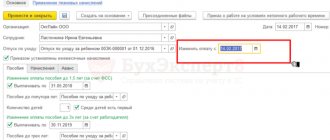

Actual (appearance) working time fund

The indicator is recognized as the most significant for analyzing production activities and recording working time actually spent on professional duties. Here the calculation is based not only on the reduction of the PDF due to legal reasons (vacation, weekends, holidays), but other cases are also taken into account. For example:

- absence due to illness;

- child care leave up to 1.5 years;

- vacation period due to pregnancy and childbirth;

- student leave;

- other options for absence - absenteeism, tardiness, rest days without pay, days off after donation, etc.

When calculating the actual PDF, individual cases of reduction in working hours are also taken into account. We are talking about special working conditions, for example, when involved in hazardous work or if the employee has one of the disability groups.

In this case, the number of days missed by the employee for one reason or another is subtracted from the maximum possible FER.

For example, the reporting period is 1 month, in which there are 8 weekends and 2 holidays. The nominal fund is 20 days, where 10 attributable to legal rest are subtracted from the total number of days of the month. There is no vacation period for this month; therefore, there is no need to identify the maximum possible PDF. However, this month the employee was on sick leave for 7 days. The actual fund will be 13 days (20 days - 7 days).

Calculation for a year

Labor rationing is an important procedure that allows you to determine the number of hours that employees are required to work. When making calculations, the calendar year is often used as the accounting period. Hours are calculated in two ways. You can use the method that is used to calculate the quarter. You just need to determine the amount of the working period for all 12 months.

Another procedure for determining the norm was established by order of the Ministry of Health and Social Development of the Russian Federation No. 588n. The calculation is carried out using the formula: 40/5*number of working days per year. After this, from the resulting number you should subtract the number of hours that the employees did not work. We are talking about reductions before the holidays.

When determining the norm for 2020 according to the billing period, the following nuances should be taken into account:

- Sunday must be counted as a day off. And it doesn’t matter how many days of rest a subordinate actually has per week - 2 or 1. For some categories of subordinates, it is possible to transfer the day of rest to another date.

- Don't forget about official holidays, which are not used in calculations.

- When a holiday falls on a day of rest, the day off is postponed. These rules do not need to be used only when calculating labor standards for January.

- The length of the working day before a holiday is always reduced by 1 hour.

When making calculations, you must follow these rules, otherwise the final number of hours will be incorrect.

Effective working time fund

Separately, it is worth mentioning such a concept as an effective PDF. It is impossible to plan such an indicator for an individual employee. The calculation is made for each category of employees. This also takes into account special working conditions, absences from previous years and other issues.

The purpose of such planning is to identify the optimal number of employees to perform their activities within a specific period. And also the calculation of this type of PDF is required to assess the efficiency of using labor resources.

For example, an employer accepts an order that requires 400 hours to complete. When dividing the indicator by 8 (the number of labor hours in a standard working day), it turns out that it takes 50 days for one person to complete an application. However, this approach is ineffective, so the employer attracts 10 people to fulfill the order. Each of them will be allocated 40 hours of work. Accordingly, it will take only 5 days to complete the entire order.

The FRF indicator is necessary to identify the level of efficiency of workers relative to the working time they use. Comparison and analysis of the planned and actual PDFs indicate shortcomings in the organization of the service process and help improve the company's performance in the future. In addition, the indicator is actively used by accountants and HR employees. For example, to draw up an optimal shift work schedule, identify the required number of staff in the company, calculate earnings and other issues.

Effective PDF

This type of indicator most accurately characterizes the labor resources of an enterprise. When calculating it, not only weekends and regular vacations are taken into account, but other absences from the place of work and special working conditions are also analyzed:

- individual reductions in work hours: for example, due to harmful working conditions or due to the employee’s disability;

- absence due to illness;

- maternity leave, parental leave;

- study leaves;

- other absences: vacations at your own expense, donor days, absenteeism, etc.

In order to determine the effective working time fund, an analysis of absenteeism for previous years and special conditions of employment contracts is carried out.

It is the effective FRP that is used for comparison with the actually used annual working time fund. Actual usage is determined based on the data in the accounting sheets.