Dismissal is the end of the employment relationship between the employee and the employer. As a result of this action, the employee ceases to perform his duties in the organization, and the employer stops paying the resigned employee, and the employment contract is terminated.

The relationship and the procedure for its termination (dismissal) between an employee and an employer are defined in the Law “On Employment in the Russian Federation” and the Labor Code of the Russian Federation.

Labor legislation provides for the following main reasons for dismissal:

- The initiator is the employee (dismissal at his own request).

- The initiator is the employer (dismissal for failure to comply with the employer's requirements, liquidation of the enterprise, reduction of staff, etc.).

- By common decision of the employee and employer (by agreement of the parties).

The dismissal procedure and the final settlement between the employee and the employer depend on the reasons for termination of the employment contract.

Dismissal: how is it formalized?

It is possible to terminate an employment relationship with an employee only if there are documents confirming the basis for the dismissal procedure:

- Employee application (dismissal by own decision).

- An agreement between the employee and the employer if the dismissal occurs by mutual consent.

- Notification of termination of employment if the term for concluding a fixed-term contract has expired.

Further, the employer is obliged:

- Issue an order for the dismissal of an employee, it must indicate the date and reason.

- To accompany the order, issue a settlement note indicating the number of days of unused vacation and all payments due upon final settlement.

- Make the necessary entries in the work book of the resigning employee.

- Issue a work book.

- Pay off the resigning employee.

- Issue certificates 2NDFL, 182n, SZVM-STAZH.

Compensation for vacation without dismissal

An organization can pay compensation for vacation exceeding 28 days accumulated by an employee only by decision of the management team. Only in special situations can an employee take advantage of this opportunity, since by law he is obliged to take the granted leave, otherwise the employer will be under threat of punishment.

Is it possible to receive compensation without leaving your current job?

Availability of additional leave is another prerequisite. Without it, under no circumstances can the issuance of monetary compensation be carried out. The provision of such an allowance for rest days is made to individual employees whose day is not standardized, and they work more than they are entitled to, according to the law and the capabilities of the human body. Typically the additional leave is about five days.

The employing company does not always have the right to indulge the employee’s request and replace the vacation with a cash payment. There are certain categories of citizens, the list of which is specified in the Labor Code of the country, who must rest for the prescribed period of time.

Table 1. Who cannot replace vacation with monetary compensation?

| Category of citizens | |

| Future mothers | |

| Persons under the age of majority | |

| Employees of enterprises operating in conditions that are harmful or even hazardous to health | |

| Workers who were exposed to radiation in the Chernobyl disaster |

Keep in mind that for those people who spend their working days in conditions hazardous to health, the replacement of vacation with cash is meant only for days exceeding at least a week. That is, if an employee received 10 days of vacation, 7 of them remain untouched, and the other 3 are compensated.

As for payments for personal income tax, they also apply to compensation for vacation days that a hard-working employee receives. According to the country's Tax Code, a whole list of incomes of officially employed citizens is not subject to calculation, but such compensation is not included within it.

In addition, when paying the amount of income tax, the working employee is also obliged to lose a part of the vacation pay that goes to insurance premiums, the amount of which is determined by the tax legislation of the country at the federal level.

Compensation for leave upon dismissal is paid to employees for all holidays used by them, regardless of the reason for termination of the contract. That is, when calculating compensation, you need to take into account not only unused basic, but also additional vacations.

Dismissal: final settlement

On the last working day (day of dismissal), it is necessary to make a final payment and pay all amounts due to the employee.

Typically this is:

- Wages (salary, bonuses, allowances, additional payments for part-time work, etc.) accrued for time worked.

- Leave compensation upon dismissal (subject to personal income tax).

- Compensation payments based on dismissal.

Compensation payments based on dismissal include:

- Severance pay for redundancy.

- Severance pay upon dismissal for disability pension.

- Redundancy benefits while looking for a new job.

- Compensation to the manager, his deputies, and the chief accountant upon termination of the employment contract.

On the day of dismissal, it is necessary to transfer the entire accrued amount minus income tax (calculated according to the Tax Code of the Russian Federation) to the employee’s personal account or issue it at the company’s cash desk.

The employer has no right to delay payment (even if the bypass sheet is not signed).

Personal income tax on compensation for unused vacation upon dismissal

Compensation for unused vacation upon dismissal is considered taxable payments, therefore, personal income tax is charged on it.

At the same time, employers often have difficulties as to when it is necessary to transfer personal income tax from vacation compensation. After all, in relation to vacation pay, personal income tax is transferred not on the day of payment, but at the end of the month. The employer should take into account that compensation for unused vacation is not a vacation payment (according to Articles 114, 122, 126 of the Labor Code). The date of receipt of compensation is the last working day. Therefore, personal income tax is withheld on the employee’s last working day, i.e., he receives compensation already minus personal income tax.

In this case, personal income tax must be transferred to the budget no later than the next day (according to paragraph 6 of Article 226 of the Tax Code of the Russian Federation). For example, if an employee quits on May 22, then compensation minus tax is transferred to him on that day. And on May 23, the employer is obliged to transfer it to the budget.

But if the employer fulfills his duties as a tax agent ahead of schedule and transfers the tax on the day the income is paid, this will not be considered a violation.

Dismissal: personal income tax

The accountant of the enterprise calculates and withholds personal income tax on all amounts due upon dismissal.

Personal income tax is subject to:

- Salary (bonuses, allowances, payment at a tariff or salary, additional payments for replacement, etc.).

- Compensation for days of unused vacation.

Attention:

- Compensations related to dismissal and provided for in an employment or collective agreement are not subject to personal income tax if they do not exceed three times the average monthly salary (for workers in the Far North and equivalent regions - six times the amount).

- Amounts exceeding three (six) times the average monthly earnings are taxed in accordance with the established procedure.

- This procedure for withholding personal income tax is common to everyone and does not depend on the position of the resigning employee.

Important: personal income tax withheld upon dismissal must be paid to the budget no later than the day following the day of dismissal (final payment).

When is tax time

In any organization, certain dates are assigned each month when employees receive salaries. Usually, money is given to employees on the following dates - the 5th or 10th.

The Tax Code of the Russian Federation establishes the deadline for transferring income tax to the budget. Thus, personal income tax from wages, in accordance with current regulations, must be received by the treasury no later than the next day after the payment of remuneration for labor. This period is set quite clearly and does not depend on the method of payment of salaries. The following situations are possible:

- The organization transfers the salaries of its employees to bank cards. This means that personal income tax must be paid no later than the next day. The same procedure is relevant in the case of issuing money in person after first withdrawing it from a bank account.

- Salaries are paid from the cash register (daily earnings). The tax must be transferred to the treasury before the end of the next day.

These rules are enshrined in paragraph 6 of Article 226 of the Tax Code of the Russian Federation. They have been in effect since 2020.

An enterprise accountant may have a question: when to pay personal income tax when dismissing an employee in 2020? After all, the previous rules do not apply if an employee leaves the company on a day other than the day the remuneration is issued. What to do in this case?

EXAMPLE

All employees receive their salary on the 5th of every month. One of the employees left the company on May 29.

When should he be paid? What about personal income tax upon dismissal in this case? Will the employee have to wait until June 5 or will the money be paid earlier? To resolve these issues, you must be guided by the letter of the Ministry of Finance No. 03-04-06/4831 dated February 21, 2013. More on this later.

Dismissal: personal income tax certificate 2

After all the necessary calculations, a personal income tax certificate is issued upon dismissal. It reflects all monthly accruals of the current calendar year that are subject to income tax. Personal income tax certificate 2 upon dismissal must take into account the accruals of the final payment. They are reflected as follows:

- salary with code 2000;

- awards with code 2002;

- compensation for unused vacation - 4800;

- compensation payments in the amount exceeding three times (six times) average monthly earnings - 4800;

2nd personal income tax certificates for those dismissed are submitted to the Federal Tax Service at the end of the calendar year.

How to calculate personal income tax?

The most convenient way: use an online personal income tax calculator.

First, the following amounts are deducted from the amount of vacation pay issued:

- Social Security contributions.

- Pension and medical contributions.

- Insurance premiums for occupational injuries and illnesses.

Only after this the tax is deducted. Its rate is 13%.

Calculation of tax on additional vacation days

An employee may request additional paid vacation days. They are also taxed. For each day of vacation, the employee's average salary for the shift is calculated. For example, it is 300 rubles. In this case, for 3 days of additional vacation, vacation pay will be 900 rubles. To calculate the tax, you need to multiply this amount by the rate of 13%. Personal income tax will be 117 rubles.

Calculation example

Ivan Sidorov goes on vacation from June 20 to July 3, 2020. First you need to calculate the amount of his vacation pay. They are determined depending on the size of the salary. Ivan Sidorov receives 47 thousand a month. The average salary per shift is 1,600 rubles. In June, the employee worked 10 shifts. His actual salary for the month was 23,500 rubles. The accountant makes the following calculations:

- 47 thousand rubles * 5 months (time worked in 2020) + 1,600 rubles * 14 (number of vacation days) = 257,400 rubles.

- 1,600 *14 days – 1,400 (standard deduction). The result is multiplied by 13%. Income tax is 2,730 rubles.

The procedure for calculating tax on compensation for unused vacation is similar.

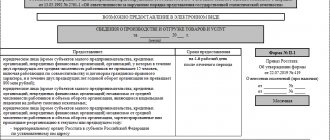

Registration of 6 personal income tax upon dismissal

On the day of dismissal, the employer makes the final payment to the dismissed person. This event is reflected in the report on Form 6 of personal income tax as follows.

The second section of the report states:

- on line 100 - the day of final settlement with the employee (ideally, the day of dismissal);

- on line 110 - the date of calculation (withholding) of income tax (coincides with the date on line 100);

- on line 120 - the date following the day of tax withholding (the day that follows the day of dismissal).

Report 6 of personal income tax indicates only the income on which income tax is levied. Compensation payments from which personal income tax is not withheld are not reflected in the report.

Example: Ivanov I.I. resigns on April 26. On the day of dismissal he was accrued:

30,000 rub. — salary payment for days worked in April.

10,000 rub. — compensation for unused vacation.

15,000 rub. — severance pay (not subject to income tax).

Income tax is withheld from the accrued amounts at a rate of 13% - (30000+10000)*13% = 5200 rubles.

In the arms of Ivanov I.I. received (30000+10000+15000)-5200=49800 rub.

In Form 6, personal income tax is reflected as follows:

Line 100 - 04/26/2017, line 130 - 40,000 rubles.

Line 110 - 04/26/2017, line 140 - 5200 rub.

Line 120 - 04/27/2017.

The company paid severance pay upon dismissal

The employee resigned by agreement of the parties. Upon dismissal, the company provided severance pay.

Three average earnings upon dismissal are exempt from personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation). If the company issued compensation within these amounts, it has the right not to reflect them in 6-NDFL.

If the company issued more, reflect in the calculation only the amount that exceeds three average earnings. Write it down in line 020 of the calculation and line 130. The date of receipt of income and withholding of personal income tax is the day of payment. Reflect this date in lines 100 and 110. And in line 120 put the next day.

For example

The company fired the employee by agreement of the parties. On May 20, she paid him severance pay - 90,000 rubles. This is 20,000 rubles. higher than three times average earnings. The company withheld personal income tax from the difference - 2,600 rubles. (RUB 20,000 × 13%). The date of receipt of income is 05/20/2016. The next day, May 21, falls on a weekend, so the company reflected the nearest working day in line 120—05/23/2016. She filled out section 2 as in sample 89.

Sample 89. How to reflect severance pay upon dismissal in the calculation:

Top

Date of actual receipt of income in the form of vacation compensation upon dismissal

Vacation compensation upon dismissal does not apply to payments made for the performance of job duties, since in accordance with Article 106 and Article 107 of the Labor Code of the Russian Federation, vacation is rest time, i.e. the time during which the employee is free from performing his job duties . Consequently, the date of actual receipt of such income will not be the last day of the month or the last day of work, as in the case of remuneration (clause 2 of Article 223 of the Tax Code of the Russian Federation), but the day of payment of compensation (clause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation).

Income deductions upon dismissal

In order to accurately determine whether compensation for leave upon dismissal is subject to personal income tax, it is necessary to study in detail the current regulatory documents governing this issue.

All this information will help the employee who has broken his employment relationship with the company to receive the full amount of payments due by law. The Labor and Tax Code of the Russian Federation contains several articles that describe in detail how to receive compensation for unused vacation upon dismissal. Personal income tax is also mentioned in these regulations, which simplifies the withholding procedure and makes it more understandable for most people.

If a company employee who did not take legal paid leave voluntarily or forcibly terminated his employment contract with the employer, then he is entitled to compensation by law. It does not matter for what reason and on whose initiative the dismissal occurred.

Features of paying vacation pay to a former employee:

- The amount of compensation should be the same as for full use of vacation.

- The vacation period cannot be shortened, even if the worker performed his duties part-time.

- The Russian Labor Code prohibits an employer from forcing an employee to go on vacation at one time or another during the year.

- Any option for paying compensation for missed vacation is subject to personal income tax.

In some cases, a fired employee does not have a legal right to receive payment for unused vacation time. Both of them are prescribed in labor legislation and must be taken into account when severing employment relations.

Possible options:

- An employee works at an enterprise under a contract where the corresponding clause is not specified.

- The employee worked less than 15 days before being fired.

Estimated deadlines

In order to avoid any problems and litigation, the employer is obliged to strictly adhere to the deadlines for payment of compensation provided for by the Labor Code. The same applies to income tax, which is paid in the same way as when transferring wages.

Standard deadlines for tax payments:

- The dismissed employee's salary was transferred to a special bank card. In this case, a slight delay (no more than 1 day) is allowed for the bank transfer.

- Receiving funds from the cash desk of a company or firm. With this method of payment, personal income tax must be paid no later than the next day after dismissal.

- Payment of funds withdrawn from the company's bank account at the cash desk. In such a situation, income tax should be calculated and paid on the day the employment contract is terminated.

Filling out documents

Labor law requires the employer to correctly draw up several basic documents: 6-NDFL, 2-NDFL. Both of these certificates must display reliable information that will help the dismissed employee receive the required payments as quickly as possible, and the owner of the company - pay the income tax withheld from compensation.

The following information should be indicated in the 6-NDFL certificate::

- Section 2, line No. 100. The date when the employee who terminated the employment contract received monetary compensation is entered in this field.

- Item No. 110. It indicates the same date as in line No. 100.

- Field No. 120. Enter the day, month and year that correspond to the next day after payments to the former employee are made.

- Clause No. 130. It includes the total amount of compensation provided for the dismissed employee for unused vacation.

- Line No. 140. It must contain a numerical value corresponding to the amount of personal income tax withheld. If compensation for unused vacation is not subject to personal income tax, then this field is left empty.

A 6-NDFL report must be submitted to the competent service by all persons who are considered tax agents. All of them are listed in the Russian Tax Code, so evading their responsibilities can cost them a lot of money and time.

Certificate 6-NDFL must be submitted:

- individual entrepreneurs;

- firms, organizations, companies, enterprises and other legal entities;

- private notaries;

- lawyers who practice independently.

The document drawn up by individuals or legal entities must be sent to the place of registration of the individual entrepreneur or enterprise.

Individual entrepreneurs using a single tax on temporary income or a patent taxation system are required to provide a document as taxpayers. All other subjects engaged in labor activity can send a 6-NDFL certificate to the tax service at the location of the separate divisions. In addition to this document, a certificate is also prepared in form 2-NDFL. It is issued no later than three days from the date of filing a letter of resignation or an order for forced dismissal. In both cases, the billing period can include the full year or months worked before the contract was terminated.

The following income is indicated in a special section of the 2-NDFL certificate :

- maternity benefits;

- child care payments;

- the amount of three months' earnings;

- compensation for damage caused.

The employer must attach the completed certificate to other documents and send it to the tax service. This must be done no later than April 1 or March 1 (if the dismissed person had non-taxable income) of the next year.

Carrying out calculations

To determine whether personal income tax will be withheld from compensation for unused vacation, you need to make all the calculations correctly. To do this, you should use the standard formula, which involves multiplying the average daily earnings by the number of vacation days. On average, every working Russian citizen receives 28 paid days of rest per year.

However, there are some categories of workers for whom this indicator is higher than the standard. These include :

- judges - 30 days;

- civil government employees - 35 days;

- judges working in the Far North - 45 days;

- workers fulfilling their labor obligations in the Far North - 51 days.

In special cases, some days are deducted from the billing period. Because of this, the amount of compensation is reduced, which leads to a decrease in income tax payments. The following days may be subtracted from the standard value :

- maternity leave;

- unpaid sick leave;

- payroll;

- unpaid leave.

There are several nuances that are specific only to a certain situation. They must be taken into account before starting calculations and determining the amount of personal income tax.

Main nuances:

- If the dismissed employee worked at the enterprise for 11 to 12 months, then the full working year is used in the calculations.

- If after rounding the result is 11 months, then there is no additional increase in the working period.

- An employee who is dismissed due to circumstances beyond his control and has worked for the company for 6 to 11 months has the right to receive payment for the whole year.

Basic Concepts

In accordance with Article 122 of the Labor Code of Russia, all officially employed citizens have the right to annual paid leave for a period of 28 days. Some types of professions allow a longer period of rest, which is enshrined in legislation.

Attention! If a person’s dismissal is not carried out the next day after his vacation, then certain funds have accumulated in his internal account. In general, they will have to be paid during the next vacation, but if a person quits, then he is obliged to receive them along with his last salary.

The regulations governing the process of receiving monetary compensation are:

- Article 127 of the Labor Code of the Russian Federation - on the right to payment;

- Article 140 of the Labor Code - on the procedure for settlement with a dismissed employee;

- Article 217 of the Tax Code of the Russian Federation - on types of income from which taxes and fees are not deducted;

- Article 223 of the Tax Code – on taxation;

- 212 Federal Law - on insurance fees.

When studying these regulations, we can conclude that upon dismissal, every person receives compensation for unused vacation (except for cases when leaving work occurs immediately after rest). Taxes and insurance contributions are fully deductible from this payment.

Prohibition of tax withholding

In judicial practice, there are quite often situations where the withholding of personal income tax is considered illegal.

In this case, the employer pays the prescribed fine and incurs many additional financial losses. In order to understand why personal income tax is not withheld from vacation compensation, it is necessary to carefully study the Labor Code of the Russian Federation and the letter from the Ministry of Finance of the Russian Federation. They contain all the information that will help the business owner avoid litigation and unexpected expenses.

Tax is not charged for dismissed employees in the following cases :

- Reduction in the number of employees due to financial difficulties of the enterprise.

- Death of an employee (compensation is paid to relatives through inheritance).

There are several cases where it is prohibited to withhold personal income tax. This applies to certain cash payments that are prescribed in the Tax Code of the Russian Federation. These include the following :

- funds aimed at treating injuries sustained at work and compensating the employee for damage caused;

- humanitarian aid;

- compensation for harm caused to the health of an enterprise employee;

- payments based on your stay in the area where hostilities are taking place;

- funds issued to relatives of disabled citizens;

- funds that provide for the purchase of special food for workers in hazardous and hazardous industries;

- payments for business trips;

- rewards for performing a heroic act or assisting law enforcement officers;

- pensions provided for the loss of a breadwinner;

- cash assistance issued at the birth of a child, marriage registration and other pleasant events in the life of company employees.

https://youtu.be/B9fPRKd0N8k