Contributions at additional rates for employees with early retirement

One of the changes introduced by Federal Law No. 243-FZ1 dated December 3, 2012 is the introduction, from January 1, 2013, of additional insurance tariffs to finance the insurance part of the labor pension in relation to payments and other remuneration in favor of persons employed in the types of work specified in paragraphs.

1-18 paragraph 1 art. 27 of the Federal Law of December 17, 2001 No. 173-FZ. The amount of the additional tariff depends on whether the work is classified as, relatively speaking, “harmful” (clause 1, clause 1, article 27 No. 173-FZ) or “heavy” (clauses 2-18, clause 1, article 27 No. 173-FZ). It is also envisaged that additional tariffs will increase in future years.

When calculating insurance premiums for these tariffs, there is no limitation on the base by a maximum value (in 2013 - 568,000 rubles).

Let us remind you that these persons have the right to early assignment of a labor pension and personalized accounting information for them is submitted with the appropriate notes regarding information about their length of service. To automatically generate such information in the program, it is (and was) possible to indicate the appropriate grounds in the staffing table or in information about the position.

However, these signs cannot be used when the program decides whether to accrue contributions at an additional rate to employees employed in such positions or staffing positions, since, in particular, the law provides for an exemption from the payment of such contributions “based on the results of a special assessment of the conditions labor."

In connection with these changes, in version 2.5.59 it is possible to indicate in the information about a position whether contributions at an additional rate should be charged to employees employed in it, and also to clarify which category (harmful or heavy) this position belongs to , since contribution rates vary for different conditions.

Picture 1

To enable this feature, you need to set the appropriate flag “Works with early retirement are used” in the form for setting up accounting parameters on the “Calculation of insurance premiums” tab.

Figure 2

Please note that when updating an information base in which records are already kept to version 2.5.59, the flag in the settings will be set automatically if at least one of the conditions is met:

| Code of length of service | Subclause 1 of Art. |

What codes to put in SZV-STAZH

In 2020, employers report to the Pension Fund on the personalized data of their employees using an updated form. No significant changes were made to the report, but some innovations, incl. in order of completion, yes.

All codes necessary for filling out the SZV-STAZH are deciphered in Resolution 507p dated December 6, 2018 in the appendix to the Procedure for filling out the “Parameters Classifier”. When submitting a report by deadline, employers must enter information in the first three sections, and if the basis for submitting the form is the employee’s retirement, then information will need to be reflected in all blocks of the report.

Codes in the SZV-STAZH form are reflected in the following columns of the table from section 3:

- 8 – it is necessary to record information about the presence of specific territorial working conditions;

- 9 – characterizes non-standard conditions for carrying out labor activities, which are the basis for an individual to receive early pension payments;

- 10, 11 – here the codes in the SZV-STAZH report reveal the features of calculating the insurance period in certain time periods;

- 12, 13 – the possibility of early pension assignment is justified;

- 14 – code designations in this column can only be used when drawing up a document for an unemployed individual by the employment service.

https://youtu.be/z3jnrrS8P0s

Special working conditions

27 No. 173-FZ

27-11GR, 27-11VP1127-1212AIRPLANE, SPETSAV, SPASAV, UCHLET, VYSHSPIL, NORMAPR, NORMSP, REAKTIVN, LETRAB, ITSISP, ITSMAV, INSPEKT1327-141427-151527-SP (28-SP - until 2011) 16| Code of special working conditions | Subclause 1 of Art. 27 No. 173-FZ |

| 27-1 | 1 |

| 27-2 | 2 |

| 27-3 | 3 |

| 27-4 | 4 |

| 27-5 | 5 |

| 27-6 | 6 |

| 27-7 | 7 |

| 27-8 | 8 |

| 27-9 | 9 |

| 27-10 | 10 |

| 27-OS (28-OS - until 2011) | 17 |

| 27-PZh (28-PZh – until 2011) | 18 |

- Contributions are paid to finance pension supplements in the coal industry or flight crew members, i.e. in the settings for calculating insurance premiums (Figure 2), the flag “Using the labor of those employed in mining operations for coal and shale extraction” or “Using the labor of flight crew members” is set.

However, regardless of whether these characteristics have already been indicated in the staffing table or information about the position, the indicator itself for the imposition of additional contributions to the position should be entered independently; it is not automatically entered when updating.

To decide whether a particular position should be subject to additional contributions, as well as which of the two additional contribution rates to choose, you can analyze the previously filled in values of the “Bases of length of service” for the position and the “working conditions” indicated in the staffing table "

| Sign of imposition of additional contributions, established in the information about the position | The basis of length of service specified for the position | Working conditions specified in the staffing table |

| Work with hazardous working conditions, subparagraph 1 of paragraph 1 of Article 27 of the Law “On Labor Pensions in the Russian Federation” Figure 3 | Not specified | |

| Work with difficult working conditions, subparagraphs 2 - 18 of paragraph 1 of Article 27 of the Law “On Labor Pensions in the Russian Federation” Figure 4 | 27-11GR 27-11VP 27-12 AIRPLANE SPETSAV SPASAV UCHET VYSSHPIL NORMAPR NORMSP REACTIVE LETRAB ITSISP ITSMAV INSPEKT 27-14 27-15 27(28)-SP | 27-2 27-3 27-4 27-5 27-6 27-7 27-8 27-9 27-10 27(28)-OS 27(28)-RV |

| Not specified Figure 5 Note. It is also not indicated for all positions in which work is not related to the right to early assignment of a labor pension | 27(28). | 28-SEV |

Please note that if the same position appears in the staffing table in different departments, and for one of such positions special working conditions are indicated from those listed in lines 1-2 of the table (i.e. for this position, the attribute of additional contributions should be set ), and for the other are not indicated, then you should highlight separate elements for these jobs in the “Positions” directory and indicate for them different signs of additional contributions.

Thus, to calculate additional contributions, it is only necessary to set the appropriate attribute for “harmful” positions. Contribution rates do not need to be configured; they are filled in automatically in the “technological” information register “Contribution rates for those employed in jobs with early retirement”

Figure 6

When calculating insurance premiums using the document “Calculation of insurance premiums”, all employee income is recorded indicating the relationship to the assessment of additional contributions (with the exception of the document “Piece work order for work performed”, which itself registers its income for the purposes of calculating insurance premiums).

Figure 7

Insurance premiums are calculated taking into account the value of this characteristic. Additional contributions are placed in a separate column depending on their type.

Figure 8

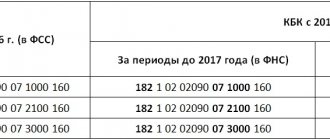

Separate accounting of “harmful” and “heavy” additional contributions is associated with their separate payment (each type has its own BCC). The document “Calculations for insurance premiums” registers the payment of accrued additional contributions.

Figure 9

In accounting, accrued additional contributions are recorded in subaccounts 69.02.5 and 69.02.6

Figure 10

In the document “Adjustment of accounting for personal income tax, insurance contributions and unified social tax” it is possible to indicate the ratio of income to taxation with additional contributions, as well as the amount of accrued additional contributions

Figure 11

Changes have also been made to analytical reporting. The report “Analysis of accrued taxes and contributions” implements an additional option “PFR, contributions for employees with early retirement” for the analysis of additional contributions

Figure 12

An additional section has been added to the “Insurance Contributions Accounting Card” report, shown for employees who have been accrued additional contributions

Figure 13

Changes to the regulated reporting of contributions will be made as the relevant regulations are published.

Please note:

- If the organization pays contributions to finance additional pension payments in the coal industry or flight crew members, i.e. in the settings for calculating insurance premiums, the flag “Uses the labor of those employed in mining operations for coal and shale extraction” or “Uses the labor of flight crew members” is set, and the corresponding flags are set in the job information, then these contributions will continue to be calculated regardless of the “new” additional contributions

Figure 14

- Additional insurance premiums are registered without dividing into UTII and non-UTII parts

PFR service codes in the SZV-STAZH report

Table 3 presents codes that characterize the basis for calculating the insurance period in specific working conditions:

These ciphers fit into column 10, provided that column 9 is filled in.

Codes “Calculation of insurance period: basis”

| Code | Full name |

| SEASON | Work for a full navigation period on water transport, a full season at enterprises and organizations in seasonal industries |

| FIELD | Work in expeditions, parties, detachments, on sites and in teams during field work (geological exploration, search, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work) directly in the field |

| UIK104 | Work of convicts while they are serving a sentence of imprisonment |

| DIVER | Divers and other underwater workers |

Fixed-term employment contracts with temporarily staying foreign citizens

Another change introduced by Federal Law No. 243-FZ of December 3, 2012 and in force since January 1, 2013, is the replacement in Art. 7 of the Federal Law of December 15, 2001 No. 167-FZ from the phrase “or a fixed-term employment contract for a period of at least six months” to the phrase “or a fixed-term employment contract (fixed-term employment contracts) lasting at least six months in total during the calendar year.”

There was no need to reflect this change in the structure of the program; see the article “Calculation of insurance premiums for temporarily staying foreign citizens since 2013.”

The remaining changes introduced by Federal Law No. 243-FZ of December 3, 2012 will be in effect after January 1, 2014, and therefore are not reflected in the program yet.

Hint when choosing an insurance premium rate for organizations using the simplified tax system

In the general case, an organization using the simplified tax system calculates insurance premiums at the “general” rate, and accordingly forms section 2 in the RSV-1 report with code “52” and the category of insured persons “NR” in the personalized accounting information.

However, if the organization meets the conditions specified in clause 8, part 1, art. 58 of Law No. 212-FZ of July 24, 2009, then it has the right to apply a “preferential” rate of insurance premiums and must report with code “07” in section 2 of the RSV-1 report and with the category of insured persons “PNED” in the personalized accounting information.

The program provides for the calculation of contributions at such a “preferential” rate and the generation of appropriate reporting. To do this, in the accounting parameters settings, you should select the tariff type “Organizations using the simplified tax system, engaged in production and equivalent types of activities”

Figure 19

With this choice, contributions will be calculated at reduced rates, and reporting will be generated with the appropriate codes.

However, a situation may arise when a user who wants to establish the use of a “preferential” tariff selects the “general” insurance premium rate for the simplified tax system in the accounting settings and edits the rates in the tariff table in accordance with the “preferential” tariff, which is not correct.

Figure 20

As a result of such editing, contributions will be calculated in the expected amount, but problems will inevitably arise when generating reports. For example, personalized reporting will be generated with the “wrong” category and will not pass the ratio test.

To minimize the likelihood of such situations occurring, in version 2.5.59 the name of the “regular” tariff has been clarified: “Organizations using the simplified tax system, except for those specified in paragraph 8 of part 1 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ”, and also an additional one has been added to the form clue.

Figure 21

For the “preferential” tariff, the name remained the same: “Organizations using the simplified tax system, engaged in production and equivalent types of activities”

Figure 22

27-8 and 27-9: work in the port

These codes can be combined for a logical reason, because they include areas related to the port.

So, first we should talk about code 27-8. It denotes the area of loading and unloading port activities in which machine operators of complex teams are employed.

Code 27-9 defines a wider spectrum. To be more precise, work as a crew member on river, sea and fishing fleet vessels. The following ships are exceptions:

- Port workers who work in the port waters.

- Traveling.

- Service and auxiliary.

- Intracity and suburban communication.