Payers

Insurance premiums for injuries in 2020 are paid by all employers operating in the Russian Federation:

- Russian organizations and individual entrepreneurs;

- foreign organizations if they involve Russian citizens in their work;

- individuals if they hire persons subject to compulsory accident insurance.

At the same time, Russian organizations pay contributions both in relation to citizens of the Russian Federation and in relation to foreigners. The rules for their calculation are established by Federal Law No. 125-FZ of July 24, 1998.

After registering a new company with the Federal Tax Service, information about this is transmitted to the territorial body of the Social Insurance Fund. From this moment, the newly created organization automatically becomes a payer of contributions and is assigned a registration number. To find out, and also to determine how much interest to pay to the Social Insurance Fund for injuries in 2020, you need to contact the Social Insurance Fund. You can find out the registration number by requesting an extract from the Unified State Register of Legal Entities from the tax office.

https://youtu.be/bK3qBm2Zhu0

KBK for payment of contributions for temporary disability

Contributions for temporary disability and maternity, previously paid to the Social Insurance Fund, from 2020 employers pay to the tax service at the place of residence.

Codes:

- 18210202090071010160 - code for payment of insurance premiums;

- 18210202090072110160 - code for paying accrued penalties;

- 18210202090073010160 - code for paying a fine.

Please note that employers have been using these codes since January 2020. At the beginning of the year, accountants had many questions about how to pay contributions correctly. After all, the payment for the reporting month is made in the next month. In January 2020, employers paid for December 2020. What to do? The codes are already new, the department has officially changed, and payment is made for the previous year. What to do in this case?

The solution was proposed in one of the clarifications of the Federal Tax Service. In January 2017, employers pay contributions under a special BCC, which was designed to identify payments during the period of transition from one department to another.

- 18210202090071000160 - contribution for temporary disability and in connection with maternity for December 2016;

- 18210202090072100160 - penalties for 2016;

- 18210202090073000160 - fines for 2020.

In the future, these budget classification codes will not be used:

Rates

The interest rate at which the payer calculates social contributions from accidents at work is set annually depending on the professional risk of the company’s main activities in accordance with Federal Law No. 179-FZ of December 22, 2005. It varies from 0.2 to 8.5%. To find out what the rate of insurance premiums for injuries will be according to OKVED, you need to refer to Order of the Ministry of Labor dated December 30, 2016 No. 851n.

Your main activity must be confirmed annually. To do this, you must provide the FSS with:

- Statement.

- Certificate confirming the main type of activity.

- A copy of the explanation to the financial statements (small businesses do not submit).

If this is not done, the FSS will set the maximum possible rate based on the OKVED codes registered in the Unified State Register of Legal Entities for the organization.

See application and certificate samples at the end of the article.

Paying off debts from previous years

Debts and arrears on tax payments for previous years are not new. Quite often, regulatory authorities send requests to pay for previous years. If no questions arise when filling out payments for basic taxes, then how to pay social security debts, for example, for 2020. Let's define it using a specific example.

Let’s say the inspectors carried out another inspection, and as a result, arrears were discovered for VNIM for 2020 and 2020. But in these reporting periods, policyholders transferred insurance premiums directly to an extra-budgetary fund, namely to the Social Insurance Fund. How to pay off debt correctly?

IMPORTANT! In such a situation, transfer compulsory health insurance, compulsory health insurance and VNiM contributions, even for previous periods up to 2020, exclusively to the Federal Tax Service. If debts were identified for earlier years, for example, for 2013 or 2007, then in field 104 of the KBK, indicate the codes in accordance with Letter of the Federal Tax Service of Russia dated December 30, 2016 No. PA-4-1/25563.

Fill in the fields:

- Recipient - Federal Tax Service Inspectorate (first indicate the Treasury authority, then the name of the inspection in brackets). TIN and KPP - assigned to the tax authority.

- Field 101 - indicate code 01.

- Field 104 - indicate the insurance premiums for compulsory social insurance 2020 corresponding to the KBK. We take into account the category: basic payment, penalty or fine.

- Field 106 - TR - if we pay the Federal Tax Service upon request from regulatory authorities, AP - if debts are identified as a result of inspections, ZD - if underpayments are transferred voluntarily (without waiting for the requirements of controllers).

- Field 107 - set 0 if no demands for payment of debts have been received from the Federal Tax Service. If we transfer on request, then we fill out the field in accordance with the document.

- Fields 108 and 109 of the payment order are the document number and date, respectively. If we pay on demand or an audit report, then indicate the relevant details of this document. When paying off debts voluntarily, enter 0 in the fields.

Please note that an error in filling out payment order details can lead to significant trouble for the organization. Therefore, be careful!

Accrual procedure and reporting

Contributions for insurance against industrial accidents and occupational diseases are calculated monthly on the last date using the formula:

The calculation base includes all payments to employees accrued under employment contracts. As well as payments under civil and copyright contracts, if under the terms of the contract the customer is obliged to pay them to the Social Insurance Fund. There is no maximum accrual base for contributions for injuries, so they are accrued from all payments during the year.

Payers submit a quarterly report 4-FSS to the Social Insurance Fund about the amounts of accruals. The deadlines for delivery are as follows:

- for a paper report - no later than the 20th day of the month following the reporting quarter;

- for electronic - no later than the 25th day of the month following the reporting quarter.

KBK codes in the FSS injuries, NS and PZ, penalties, fines, arrears in 2017

Have the BCCs changed for contributions to the Social Insurance Fund in 2020? No, there were no changes to the social insurance codes, it remains the same as in 2020. Below is the List of income classification codes (KBK FSS), also reserved by the Ministry of Finance of the Russian Federation to reflect payments to the FSS of the Russian Federation for organizations and individual entrepreneurs.

| KBK number | Purpose of transfer |

Insurance against injuries at work and occupational diseases | |

| 393 1 0200 160 | Insurance premiums for employees for “injuries” |

| 393 1 0200 160 | KBC for paying penalties to the FSS from the National Tax Service in 2020 |

| 393 1 0200 160 | Fines - amounts of monetary penalties |

KBC voluntary contributions to the Social Insurance Fund in 2020 for individual entrepreneurs for themselves | |

| 393 11700 180 | voluntary contributions from the entrepreneur |

| 393 1 1600 140 | Fines for violation of the established deadline for submitting reports to the Social Insurance Fund or failure to submit them, late registration) |

Note: If, due to an error in the KBK FSS details, the money does not go to the correct account, the policyholder will be charged a penalty.

to menu

Kontur.Extern: How to easily submit a new 4-FSS form through an EDF operator

How to issue a payment order

Social contributions are transferred to the Social Insurance Fund monthly no later than the 15th day of the month following the billing month. Bank details of the Social Insurance Fund must be requested from your territorial branch of the Fund.

As for any payment transferred to the budgetary system of the Russian Federation, contributions for injuries are assigned a BCC. The BCC for injuries in 2020 for employees is set to be uniform and does not depend on the rate:

KBC of contributions for injuries: 39310202050071000160.

In addition, when filling out a payment order, you must fill in the fields in a special way.

| Payment order field | Meaning |

| 101 - payer status | 08 |

| 104 - KBK | 39310202050071000160 |

| 106 — 109 | 0 |

| 24 — purpose of payment | In this field you should indicate the type of social contribution, the period for which it is paid, and the registration code of the company in the Social Insurance Fund |

Sample of filling out a payment order to the Social Insurance Fund

Details of the Social Insurance Fund and Pension Fund for payment of insurance premiums 2020

You will find the BCC required for filling out payment orders for the transfer of insurance contributions to the tax office (contributions for compulsory health insurance, compulsory medical insurance and VNiM) in a separate material. Samples of payment orders for payment of these contributions can be found in our Accounting Calendar.

From 01/01/2020, the calculation and payment of insurance premiums (except for contributions “for injuries”) is carried out in accordance with Chapter. 34 “Insurance premiums” of the Tax Code of the Russian Federation. That is, starting from the specified date, contributions to compulsory health insurance and compulsory medical insurance are not paid to the Pension Fund (including arrears for old periods).

Liability for non-payment

The following sanctions may be applied to non-payers of personal injury contributions:

- Accrual of penalties and fines.

- Forced collection of arrears.

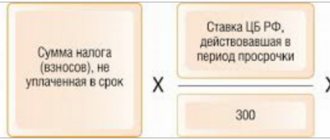

A penalty is charged in the amount of 1/300 of the Central Bank refinancing rate for each day of delay (Article 26.11 125-FZ). When transferring them, you must indicate the KBC for penalties for injuries in 2020 - 39310202050072100160.

In case of violations in the area of calculating social contributions in the Social Insurance Fund (underestimation of the calculation base), a fine of 20% of the unpaid amount is collected. If the act was committed intentionally, then the fine increases to 40% of the arrears. When transferring a fine to the budget, you must indicate KBK 39310202050073000160.

Statement

Certificate confirming the main type of activity

KBK table for individual entrepreneurs to pay insurance premiums “for themselves” in 2020

| Payment | KBK payments | |

| on compulsory pension insurance (OPI) | for compulsory health insurance (CHI) | |

| Fixed contributions | 182 1 0210 160 | 182 1 0213 160 |

| Contributions of 1% on income over RUB 300,000. | – | |

| Penalty | 182 1 0210 160 | 182 1 0213 160 |

| Fines | 182 1 0210 160 | 182 1 0213 160 |

KBK-2016 for all organizations and entrepreneurs

392 1 0200 160 392 1 0200 160 392 1 02 02103 08 1011 160

| Name of tax, fee, payment | KBK (field 104 of payment) |

| Insurance premiums: | |

| - to the Pension Fund of Russia | 392 1 0200 160 |

| — in FFOMS | 392 1 0211 160 |

| - to the FSS | 393 1 0200 160 |

| Insurance premiums (individual “for oneself”): - to the Pension Fund of the Russian Federation, including: | |

| - contributions calculated from the amount of income not exceeding the established limit | |

| - contributions calculated from the amount of income exceeding the established limit | |

| — in FFOMS | |

| Additional insurance contributions to the Pension Fund for employees who work in conditions entitling them to early retirement, including: | |

| — for those employed in jobs with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) | 392 1 0200 160 |

| - for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) | 392 1 0200 160 |

| Contributions to the Social Insurance Fund for compulsory accident insurance | 393 1 0200 160 |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from EAEU countries | 182 1 0400 110 |

| Income tax on dividend payments: | |

| — Russian organizations | 182 1 0100 110 |

| - foreign organizations | 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Fee for the use of aquatic biological resources: | |

| — for inland water bodies | 182 1 0700 110 |

| — for other water bodies | 182 1 0700 110 |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010х0 01 6000 120 |

| In the KBK, in order to correctly charge the fee “for dirt”, you must indicate a different 10th category: 1 - for emissions of pollutants into the air by stationary objects; 2 - for emissions of pollutants into the atmospheric air by mobile objects; 3 - for discharges of pollutants into water bodies; 4 - for the disposal of production and consumption waste; 5 - for other types of negative impact on the environment 7 - for emissions of pollutants generated during flaring and/or dispersion of associated petroleum gas | |

| Regular payments for the use of subsoil, which are used: | |

| - on the territory of the Russian Federation | 182 1 1200 120 |

| — on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

| MET | 182 1 07 010хх 01 1000 110 |

| In the BCC, to enroll the mineral extraction tax, you must indicate different 10th and 11th categories: 1 and 1 - for oil production; 1 and 2 - during the production of natural combustible gas; 1 and 3 - during gas condensate production; 2 and 0 - during the extraction of common minerals; 3 and 0 - when mining other minerals, except for the mining of natural diamonds 4 and 0 - when mining minerals on the continental shelf of the Russian Federation; in the exclusive economic zone of the Russian Federation; from subsoil outside the territory of the Russian Federation; 5 and 0 - when mining natural diamonds; 6 and 0 - during coal mining | |

Changes from 04/23/2018

On April 23, 2020, the budget classification code numbers for citizens for whom fees are paid at special rates changed. In particular, the code for paying penalties on insurance premiums has changed. BCC 2020 and 2020 on additional tariffs for citizens working in harmful and difficult conditions.

Encodings changed from 04/23/2018 are valid in 2020 and 2019. If the employer indicated the old code on the payment slip, then you need to submit an application to the Federal Tax Service to clarify the payment so that the funds are sent to the required budget.

| Purpose of payment | Encoding |

| Standard | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 020 2050 07 3000 160 |

Insurance premiums to the Social Insurance Fund for accidents in 2020

And although officials are only coordinating the draft government decree, the Ministry of Labor believes that the limits are final. The experience of past years shows that limits can be adjusted before approval, but by no more than 5 thousand.

rubles per month). This year, officials used the same indicators for indexation as before: the average salary from the forecast of the Ministry of Economic Development and the coefficient for 2020 - 1.9 (clause 5 of Article 421 of the Tax Code of the Russian Federation as amended on 01/01/17). But in the end, the base grew less than in 2020—not by 12, but by 10%.

Accident insurance premiums 2020 - tariffs in the Social Insurance Fund

Order No. 851N is in effect from 01/01/2020. It defines new classification rules. The type of activity is confirmed annually. In order for the Social Insurance Fund authorities to set a tariff at which the injury rate will be calculated, you must send supporting documents before April 15 of the current year:

If the taxpayer does not provide documents, then the FSS will independently assign a professional risk class, and the highest rate is selected - 8.5. Therefore, documents must be submitted on time, because it will be impossible to challenge the tariff, according to the new rules in force this year.

New BCCs in the FSS for 2020: table with codes

In order for the payment to arrive on time as intended, it is important in the payment order to correctly indicate the KBK for contributions from accidents 2020 for employees. An error in filling out will result in the funds not being received as intended - this is a reason for the accrual of a fine or penalty.

When filling out payment orders, you must be guided by the Central Bank Regulation No. 383-P dated June 19, 2012 and the appendix to the Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013. You can transfer insurance premiums in different ways - at a bank branch, at the post office or on the website Federal Tax Service. Regardless of the payment method, the main thing is to correctly indicate all the details in the payment order, without making any mistakes in any numbers.