Why keep records of work books?

According to Art. 65 of the Labor Code of the Russian Federation, among the documents provided by the employee to the employer for concluding an employment contract, there must be a work book.

For a number of reasons, an employee may not have a work book, and therefore the employer must act in accordance with labor legislation:

| Reason for lack of work record | Employer's actions |

| An employee enters into an employment contract for the first time | The employer issues a work book |

The work book is lost:

| At the request of the employee (indicating the reason for the absence of a work book), the employer is obliged to issue a new work book. |

Important! The employer is obliged to issue a work book for each employee who has worked for him for more than 5 days.

Responsible person

As a general rule, responsibility for organizing the work of maintaining, storing, recording and issuing work books and inserts in them rests with the employer (clause 45 of the Rules).

In this case, the employer, by order or regulation (see Example 1), appoints a person responsible for working with work books (clause 45 of the Rules). If an organization has a personnel department, this is usually its head. If there is no such structural unit, an accountant does this.

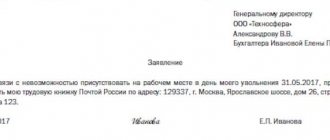

Example 1 Order appointing an authorized person responsible for maintaining, storing, recording and issuing work books

Don’t forget to include the requirement for working with work books in the employee’s job responsibilities (see Example 2).

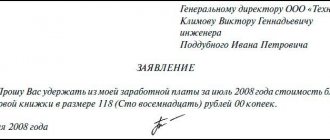

Example 2 Fragment of a job description and/or employment contract

Responsible officials for the timeliness of entering data into the journal and preparing reports on the movement of documents are appointed by the company's management.

Most often this is the company's accountant.

The designated ledger manager must:

- familiarize yourself with the written version of the obligations assigned to him;

- sign in the register of familiarization with job descriptions.

How can you keep track of work record forms?

According to clause 42 of the Rules for maintaining and storing work books, producing work book forms and providing employers with them, the work book forms and inserts in it are stored in the organization as strict reporting documents , as a result of which the work book form and the insert in it are accepted for accounting as a form strict reporting.

After the work book is issued to the employee, the employee’s debt to the employer, equal to the cost of the work book form, is taken into account.

The letter of the Ministry of Finance of the Russian Federation dated May 19, 2017 No. 03-03-06/1/30818 contains information provided by the Department of Tax and Customs Policy, which states that:

- operations involving the issuance by the employer of work books or inserts in them to employees , including the cost of their acquisition, are operations for the sale of goods and, accordingly, are subject to taxation with value added tax;

- the fee charged to the employee for the provision of work books or inserts in them is subject to corporate income tax in the generally established manner.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

What is it used for?

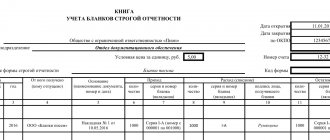

The receipt and expenditure book is a registration document where records are made about the new forms of work books received by the enterprise from their manufacturers/sellers and about their subsequent issuance to employees.

There they record information about:

- company costs for purchasing blank workbook forms;

- expenditure of purchased documents due to the issuance/registration of personal labor documentation to employees.

Sample book of accounting and movement of work books

What documents are used to record work records?

In accordance with clause 40 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers (approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225) in order to record work books, work book forms and inserts in it, Employers are required to maintain:

- receipt and expenditure book for accounting of work book forms and inserts in it;

- a book of accounting for the movement of work books and inserts in them.

The forms of these books are approved by the Ministry of Labor and Social Protection of the Russian Federation.

Why do you need a receipt and expense book?

To keep track of work books (otherwise known as Labor Books) provided to employees, as well as inserts in these documents, it is necessary to create and timely fill out the appropriate receipt and expense book - a journal in which registration entries are made by an authorized person.

With its help, costs associated with the acquisition of new forms are monitored, as well as operations associated with the receipt and transmission of these documents.

Previously, individual entrepreneurs could not fill out work books for employees, but this obligation appeared to them after changes were made to labor legislation, in accordance with Article 309 of the Labor Code of the Russian Federation.

Requirements for maintaining a receipt and expenditure book for recording work book forms and inserts in it

The rules for maintaining and storing work books, producing work book forms and providing them to employers (clause 41) regulate the procedure for maintaining documentation:

| Book title | Features of management |

| Receipt and expense book for accounting of work book forms and inserts in it | The book is maintained by the organization's accounting department. Information is entered on all operations related to the receipt and use of work book forms and the insert in it, indicating the series and number of each form. The book must be numbered, laced, certified by the signature of the head of the organization, and also sealed with a wax seal or sealed. |

The form of the receipt and expenditure book for recording work book forms and the insert in it was approved by Resolution of the Ministry of Labor of the Russian Federation of October 10, 2003 No. 69 “On approval of the Instructions for filling out work books.”

Maintaining the receipt and expenditure book for accounting for work book forms is carried out in the accounting department of the organization. The accountant appointed responsible for maintaining the document enters information as forms are received from the supplier and as the forms are used. When performing any transactions (income or expense), you must indicate the serial number of the work book form and the insert in it, as well as their cost.

When filling out this form, you must enter the following information:

| Column no. | Intelligence |

| 1 | Record serial number |

| 2, 3, 4 | Date (day, month year) in the format HH.MM.YYYY |

| 5 | From whom the forms were received or to whom they were given |

| 6 | The basis (name of the document, number and date) on the basis of which the receipt or transfer of work book forms and inserts was made. |

| 7 | Number of received work books indicating the series and number |

| 8 | Number of inserts received in the work book indicating the series and number |

| 9 | Cost of received forms |

| 10 | Number of work books issued indicating the series and number |

| 11 | Number of issued work book inserts indicating the series and number |

| 12 | Cost of issued forms |

The form of the receipt and expenditure book for accounting of work book forms and the insert in it can be.

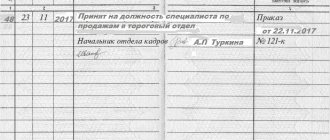

Sample of filling out the receipt and expenditure book for accounting of work book forms:

When maintaining a cash register book, the employee responsible for filling it out must provide reports both on the availability of work book forms and inserts, and on the number of issued (written off) forms.

This report is compiled once a month.

Logging Procedure

There are strict rules for maintaining such a document.

Each company should have a sufficient number of workbook forms and inserts for them.

If the person responsible for issuing them assumes that the unfilled documents may not be sufficient, then he is obliged to notify management about this in an application form.

The presence of an accounting journal for workbook forms and inserts is mandatory for every enterprise that uses hired labor. Such a journal, along with forms, acts as a document of strict accountability. Therefore they should be kept in a safe.

Storage

The journal should not be accessible to third parties. Even if the employee responsible for making entries is not at the workplace.

The money for receiving a new work form and insert is paid by the employee who received such a personalized document (money for issuance is collected according to clause 47 of Rules No. 225).

How to report

Every month, the person responsible for keeping records of forms must document the following:

- number of available unfilled forms;

- quantities received in hand;

- volumes of funds received for the issuance of executed documents.

The form is issued at the expense of the enterprise if the document:

- that was in storage at the company was lost by other employees responsible for its safety;

- lost, destroyed due to emergency circumstances (industrial accident, theft of documents from the company safe, fire, natural disaster).

Important! If the document is destroyed, an act is drawn up in which identification data must be pasted. To do this, you need to cut out the fields with the number and series of the destroyed document.

Accounting entries for work records

Work books are accepted as a strict reporting form:

| Debit | Credit | Explanation |

| 006 | Work books are accepted as strict reporting forms | |

| 91 | 60 | The cost of work books is accepted as expenses |

| 19 | 60 | VAT reflected |

| 006 | Writing off work books issued to newly hired employees | |

| 73 | 91 | Reimbursement of the cost of the work book by employees upon dismissal and receipt of the work book in their hands |

| 91 | 68 | VAT accrual on the cost of issued work record forms |

| 50 | 73 | The debt for the issued work record forms has been repaid |

Work books are accepted as assets:

| Debit | Credit | Explanation |

| 10(41) | 60 | Work books are accepted as inventories |

| 19 | 60 | VAT reflected |

| 006 | Work books are accepted as strict reporting forms | |

| 91(90) | 10(41) | The cost of issued work books is accepted as expenses |

| 91(90) | 68 | VAT accrual on the cost of issued work record forms |

| 006 | Writing off work books issued to newly hired employees | |

| 73 | 91(90) | Reimbursement of the cost of work books issued to employees upon dismissal is included in income |

| 50 | 73 | The debt for the issued work record forms has been repaid |

Administrative responsibility

Failure to comply with the procedure for maintaining, recording, storing and issuing work books is an administrative violation, for which a fine is imposed (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- for officials - from 1000 to 5000 rubles;

- for entrepreneurs - from 1000 to 5000 rubles. or administrative suspension of activities for up to 90 days;

- for legal entities – from 30,000 to 50,000 rubles. or administrative suspension of activities for up to 90 days.

Moreover, violation of labor and labor protection legislation by an official who was previously punished for a similar administrative offense entails disqualification for a period of one to three years (Part 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Responsibility for violations in the accounting of work books

Responsibility for violations in the accounting of work books refers to a violation of the labor legislation of the Russian Federation, for which sanctions are imposed (Article 5.27 of the Code of Administrative Offenses of the Russian Federation, Article 15.11 of the Code of Administrative Offenses of the Russian Federation):

| Person who has violated the law | Amount of administrative fine (RUB) |

| The offense was detected for the first time | |

| Executive | 1 000 – 5 000 |

| Official (accounting violation) | 5 000 – 10 000 |

| Individual entrepreneur | 1 000 – 5 000 |

| Entity | 30 000 – 50 000 |

| The offense was detected again | |

| Executive | 10,000 – 20,000 or disqualification for 1-3 years |

| Official (accounting violation) | 10,000 – 20,000 or disqualification for 1-2 years |

| Individual entrepreneur | 10 000 – 20 000 |

| Entity | 50 000 – 70 000 |

In case of theft, destruction, damage or concealment of official documents, committed out of mercenary or other personal interest, Art. 325 of the Criminal Code of the Russian Federation, where the following sanctions may be applied:

- a fine in the amount of up to 200,000 rubles or in the amount of wages or other income of the convicted person for a period of up to six months;

- compulsory work for up to 360 hours;

- correctional labor for up to one year;

- arrest for up to three months.

Filling out the cash book item by item

First, indicate the date of completion. This is carried out daily, on weekdays. Now we indicate the amount of cash balance in the cash register as of today (must match the amount of the balance of the previous working day). Next, fill out the table according to the operations performed. Item 1 – PKO or RKO number (receipt/expenditure cash order). Item 2 – Full name of the person to whom the cash was issued (or from whom it was received). Item 3 – indicate the subaccount number of the legal entity. Item 4 – income amount. Item 5 – amount of expense. At the end of the table, the “Total” amount is indicated separately for income and expense, as well as the balance at the end of the day. Under the table, the cashier puts his signature and indicates in words the number of incoming and outgoing orders processed per day (separately). Next, the accountant signs

Corrections are not allowed. If they appear, they must be certified by the signature of the cashier and accountant. For clarity, you can fill out the 2013 cash book.

Questions and answers

Question No. 1. What to do if a personnel service employee spoils the work book form?

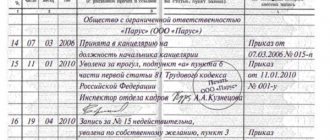

In this case, it is necessary to dispose of the damaged form, for which you will have to act in accordance with the algorithm:

- draw up an act on the disposal of the work book form, where you need to paste the cut-out part of the form, where the series and number are indicated;

- enter information into the income and expense book of work record books, where in a blank line indicate the following information: “The entry under No. ... is considered invalid” and create a new entry containing reliable information, indicating the position, full name, signature of the person responsible for making the entry, mark date of entry.

Question No. 2. What to do if the employee responsible for maintaining the receipt and expenditure book for accounting for work book forms and the insert in it made a mistake when entering information?

In this case, it is necessary to enter reliable information into the receipt and expenditure book, for which you will have to act in accordance with the algorithm:

- in a blank line directly below the entry or in the next free line, enter information in the income and expense book for accounting for work records, where you indicate the following information: “The entry under No. ... is considered invalid”;

- create a new record containing reliable information;

- indicate the position, full name, signature of the person responsible for making the entry, and note the date the entry was made.

Rules for storage and use

A newly purchased book of receipts and expenditures of work book forms must be equipped with an intact indicator numbered seal made in accordance with GOST 31282–2004.

Before the official use of the Book begins, its title page is filled out. The numerical code recorded on the factory seal in the corresponding column is entered there.

Important! Without indicating the numeric code, the magazine itself will not be considered sealed. Download for viewing and printing:

GOST 31282–2004

How to flash correctly

Firmware and sealing of lacing is required.

Sequence of the stitching procedure:

- through holes are made in the left unfilled magazine sector. When making holes, you need to take into account the convenience of further use of the book after flashing,

- Through the resulting holes, thread a harsh or other strong thread so that at the end of the work, two ends of the thread, 7–8 cm each, remain on the back. They are tied in a knot,

- a sheet of paper is glued over the knot. Its surface is intended for a certification inscription about the number of pages in the book, the date of the firmware, information about the person who performed the procedure (full and abbreviated full name, signature).

Attention! The person responsible for making entries laces the journal.

How to certify

Algorithm for certification of the accounting book:

- Continuous numbering of journal pages is carried out (data on the number of pages is indicated in words and in the form of numbers),

- a certification is made (it is performed by the company management, who confirms with their signature that the specified number of pages corresponds to the actual one).