Legislative norms

All organizations providing services to the public must use cash registers or strict reporting forms in their work. This is indicated in the Federal Law dated May 22, 2003 No. 55-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards.” According to it, the head of the company can independently choose the most convenient way for him to pay consumers.

Application in the work of BSO should be based on Regulation No. 359 of 05/06/2008. on the implementation of cash payments and (or) payments using payment cards without the use of cash registers and cash register equipment. There you can find basic information about such forms.

If an organization uses SSO in its work, it must have a journal of strict reporting forms, which should be filled out in a timely manner.

BSO accounting log, sample filling

BSO accounting log, sample

Can form 0504045 of the ledger of strict reporting forms be used?

For use by legal entities and entrepreneurs carrying out commercial activities in their own interests, there is no approved form of such a document as a book for recording strict reporting forms.

However, for use in state/municipal organizations and institutions, there is a form for such a book (form 0504045), approved by Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n.

There is nothing stopping organizations of other ownership and individual entrepreneurs from either using form 0504045 to compile the BSO accounting book, or using it as a basis when developing their own version of the book.

Form 0504045 can be downloaded from our website:

To work with it, it is most convenient to print the book on paper and sew it into a brochure.

The shelf life of a book cannot be less than the shelf life of the spines of forms or damaged BSO. This means that the book of records of strict reporting forms must be preserved for 5 years after the last entry was made in it.

For information about who, after the introduction of online cash registers, has the right to continue working with BSO according to the old rules, read the article “Strict reporting form instead of a cash receipt (nuances)”.

Requirements for maintaining a book

The obligation to maintain a BSO registration book is established by law. Information about this is contained in the Government Decree of 05/06/08. No. 359.

There is no approved form for this document, so organizations can use form 0504045, which is used in government agencies, or develop their own.

Sample BSO accounting book, form 0504045

The pages of the document are bound and numbered.

Next, it is signed by the director and certified by the seal of the organization (if any)

The document is maintained by an employee appointed by order of the manager. Typically this responsibility falls to the accountant or cashier. The responsible employee is responsible for the posting, storage of BSO, receipt of funds from clients and issuance of the form. He is also involved in making entries in the accounting journal.

Internal control over accounting is carried out during inventory simultaneously with checking cash balances. External verification is carried out by the tax authorities. The result of the inspection is indicated in the report.

An example of filling out a BSO accounting book

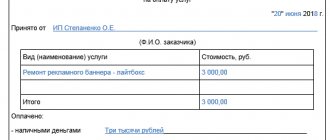

So, the BSO Accounting Book records any data relating to “strict” documents. Purchasing, issuing, returning, writing off, as well as removing balances. Let's try to understand this with a specific example.

LLC "Whiskers, Paws, Tail" provides veterinary services. In its activities, the company uses a Receipt for payment for veterinary services. On March 1, 2015, management received the next batch of numbered printed products produced in the printing house in the amount of 100 copies. The receipts were capitalized according to accounting and posted on all reporting forms, then, after following the procedure associated with capitalization, they were accepted by an official, and later (March 4 and 6, respectively) issued for use by three employees, 10 pieces each.

You can find out about who accepts forms and how, where they are recorded, how to correctly reflect them in reporting and what documents should be prepared in our article “BSO: instructions on how to buy and account correctly.” Let us only recall that for each of the employees involved in filling out numbered papers, which are an analogue of cash receipts when providing services to the population, agreements on financial liability are concluded.

Here we will consider step by step how to correctly fill out the BSO Accounting Book, which for some people is more commonly called a journal. There are several stages:

- admission;

- usage;

- storage.

First of all, take a look at the receipt, which we will consider the first form from the purchased batch. Let's start by entering the data highlighted in red.

Step 1. Record the receipt:

Step 2. We reflect the issuance of a certain number of them to the reporting of the MOL (financially responsible person):

CLUE! A damaged or incorrectly filled out form is crossed out and attached to the BSO book for the day on which it was filled out, but there is no need to make an additional entry regarding the return (see clause 10 of Regulation No. 359). At the same time, you can put a note about cancellation, it will not be an error. Do not forget that, in case of damage, you must return the complete set, i.e. two copies (original and copy or original and spine).

Step 3. Arrival of unused copies. When issuing forms to financially responsible persons, you must request from them a report on their use at a specified frequency; in the case where there is only one specially equipped place in the office, the return will have to be carried out at the end of each working day so as not to violate clause 16 of Regulation No. 359. When returning unused documents, you must reflect their receipt.

CLUE! In practice, it is advisable to demand the return of unused forms from MOL only if this particular employee will not carry out transactions with them in the near future (for example, he is going on vacation or a business trip). Otherwise, it is better to issue the next batch of forms, taking into account unused copies, but only if there is a properly equipped storage location, for example, if there are several service points or branches, as well as if there are several safes in the office, and they are at the disposal of accountable persons.

Filling procedure

The book is intended for internal accounting of BSO. It reflects information about the receipt of BSOs and their issuance to the responsible employee. The information is grouped indicating the BSO details. Information about received, written off and erroneously completed documents is entered. It happens like this:

- When entering data on receipt, the date of acceptance, name, series, number and number of forms are indicated. The full name, position and signature of the responsible person are indicated;

- the procedure for disposing of forms is formalized in the same way as receiving them;

- when writing off, information about the reasons for writing off and information about the document on the basis of which the sheet was written off (for example, a typographical defect) is entered into the document;

- Incorrectly completed forms must not be thrown away. They must be attached to the magazine.

Logbook of strict reporting forms, free

How to properly keep a book of accounts

Let's look at how to properly keep a book of strict reporting forms and who is obliged to do it. If an individual entrepreneur or LLC works with a BSO, then it is mandatory to keep such a book. First of all, let's decide which form to use. For entrepreneurs and limited liability companies, the so-called BSO accounting journal is used, the form of which is not established by law. We recommend a magazine that is used by municipal and state companies, approved by order of the Ministry of Finance of the Russian Federation in 2010. This will help you avoid misunderstandings and discrepancies between inspection bodies - such magazines are freely available and inexpensive. If necessary, you can supplement it with the necessary columns, adding the items you need.

Attention:

the accounting book of strict reporting forms is numbered, stitched and signed by the owner of the LLC or individual entrepreneur. The firmware is also stamped.

Try to keep the book neatly, without obvious errors or corrections. Indicate the date and number of forms received, series, numbers, names. If during the work the BSO was damaged or errors were made when filling it out, then the sheet is not thrown away, but crossed out and added to the accounting book.

Any actions with BSO are entered into the book

The journal must be maintained by a financially responsible employee or the head of the company, appointed by the relevant order (an agreement on financial responsibility is also signed). Entries in the journal are made during the work process - data must be entered on the day the sheets are received or issued.

It should be noted that only two actions are included in the book:

- Receiving printed sheets from the printing house.

- Transfer of sheets to the responsible person who issues them to customers.

There is no need to enter information about each sheet issued into the journal.

What else can you take as an example of a journal of strict reporting forms?

Any organization or individual entrepreneur can develop its own journal of strict reporting forms, adhering to the requirements that this document contains all the required details. Due to the fact that this register accumulates and systematizes information about the primary cash register, the book of accounting of strict reporting forms can be classified as registers that comply with the requirements of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The mandatory details of such registers are listed in clause 4 of Art. 10 of Law No. 402-FZ. Among them:

- name of the register and enterprise;

- start and end dates of register maintenance;

- units of measurement and size of accounting objects;

- chronological record of grouped accounting objects;

- Full name and position of the persons filling out the register, with signatures.

Read about the requirements for filling out the primary document in the material “Primary document: requirements for the form and the consequences of violating it .

Principle of data entry

In the header of the accounting register or on a separate sheet, which should become the title sheet, you should enter information about the name of this document, as well as data about the period that will cover the entries made in it.

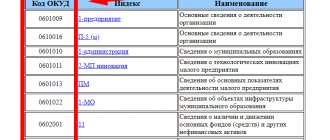

Directly below the register name is the name of the commercial structure or the full name of the individual entrepreneur. In addition, information about the OKPO code and the name of the department of the organization that will be responsible for maintaining this temporary list is entered (often this department will be the accounting department), as well as the name of the strict reporting form.

The part of the document with tables should contain the following data:

- Detailed date of the financial transaction.

- The full name of the organization that receives the forms, as well as the structure that supplies them.

- Information about the document that will act as a certificate of acceptance of each strict reporting form separately.

- Detailed data on the use and remaining quantity of forms with the entry of data on the series and numbers of these forms. In addition, information on the number of BSO is entered in the event that it is necessary to record the receipt or transmission of a package of documents. As an example, a similar situation may arise when BSO arrives from a printing house. In such a situation, you should indicate all serial numbers of the forms by their serial number of location in the bundle.

- The final number of BSOs: arrived, were issued, remained, and also for which a separate accounting journal was opened.

Documents for download (free)

- BSO accounting book

- BSO sample

All detailed information with detailed instructions regarding the methodology for filling out the journal of strict reporting documents should be located inside the local act, which is issued by the immediate manager of the commercial organization. This local act or a separate issued order from the head of the enterprise will indicate the person with the position he occupies, who will be assigned responsibility for the safety of the SSO.

It is also worth noting that a liability agreement must be drawn up with this employee of the company. This person will receive the functions of making the necessary entries in the accounting journal of strict reporting forms.

This document must contain information about the arrival of BSO, their issuance, as well as the return and procedure for writing off the initial blank documentation. All the counterfoils from the issued documents must be attached to the header of the register, along with incorrectly completed BSO and those forms that, for certain reasons, can no longer be issued to the company’s clients.

https://youtu.be/y72TFX45o18