Advantages and disadvantages

pros

- There is no need to purchase a cash register.

- Therefore, there is no need to conduct annual performance testing of the cash register.

- When working related to outdoor activities (for example, photo shoots, organizing celebrations, etc.), it will be much easier and more reliable for you to write out a BSO.

Minuses

- You can only use BSO when working with the public.

- It is necessary to keep strict records of the BSO and store all necessary documents for 5 years (including their copies).

- New sample forms must be ordered as needed.

What it is

A strict reporting form is a fiscal document that, instead of a cash receipt, can be generated for their clients by organizations and individual entrepreneurs engaged in the provision of services to the public.

Until July 1, 2020, organizations and individual entrepreneurs, regardless of the chosen taxation system, had the right not to use a cash register, but instead of cash register receipts, issue their clients with strict reporting forms printed in a typographical manner.

From July 1, 2020 paper forms

cannot be used in place of cash receipts. This is due to the fact that all fiscal documents must be transmitted via the Internet to the Federal Tax Service. Therefore, BSOs should be formed at special BSO-KKT or regular online cash registers. To print them, you need to choose devices whose name contains the letter “F” - they are equipped with a printer.

Paper forms of strict reporting were used as an alternative to checks and made it possible not to purchase a cash register. Now, when they need to be generated on cash registers, the use of BSO does not make sense for most companies and individual entrepreneurs. However, this does not mean that paper forms are completely prohibited. If it is convenient and necessary, you can continue to issue them, but at the same time generate a check at the online cash register.

note

, from July 1, 2020, it is possible to issue printing BSOs

without issuing a check

only in cases where the business is exempt from using cash register equipment, and the law does not require issuing any document with certain details.

Thus, typographic BSO in 2020 can be used at will:

- Individual entrepreneurs without employees from the service sector. For them, there is a deferment for the use of CCP until July 1, 2021. At the same time, they are not obliged to issue any payment documents, but can do this at their own request or at the request of the client;

- other business entities exempt from the use of cash register systems (Article 2 of Law 54-FZ on cash register systems), if they do not have to issue a document with specific details;

- other companies and individual entrepreneurs from the service sector - not instead of, but in addition to the online cash register receipt.

If BSOs are used instead of cash register receipts, they must be generated on a special BSO-KKT or a regular online cash register.

For some types of activities, there are BSO forms developed by the state. Here they are:

- tickets (railway, air, public transport);

- parking services;

- tourist and excursion packages;

- subscriptions and receipts for payment of veterinary services;

- pawn tickets and safety receipts for pawnshop services.

However, from July 1, 2020, the above paper forms are also valid only if a cash receipt is simultaneously generated. For example, if the buyer is issued a train ticket, the following options are possible:

- The ticket is purchased electronically. The buyer is sent an electronic travel document with the cash receipt details printed on it, including a QR code. Or he is sent an electronic ticket and a separate online cash register receipt in electronic form.

- A paper ticket is purchased. The buyer is issued a standard railway ticket form (approved by the BSO) + an online cash register receipt. Or he is given a standard ticket form, which contains the receipt details, including a QR code.

Companies in the arts and culture sector need to apply SSR

, if they want to receive VAT exemption. It is provided if tickets are sold in the form of an approved document. However, this does not relieve them of the obligation to use online cash register systems. That is, in order not to break the law and receive an exemption from VAT, cultural institutions need to generate a cash receipt and issue a paper ticket (BSO from Order of the Ministry of Culture No. 257). By the way, the ministry has developed a new ticket form, and after approval it will replace the current BSO form.

Main types of BSO in the Russian Federation

The main types of BSO on the territory of the Russian Federation, which are used instead of cash receipts, include receipts, travel documents (subscriptions and tickets), coupons, vouchers, work orders, waybills.

- Receipts are strict reporting forms, which cover all the necessary requirements of the legislation of the Russian Federation. First of all, receipts are used when the population pays for services provided by the state (gas supply, utilities, life support, etc.).

- Travel documents are approved by public road transport companies , which allow travel on certain types of transport. They are issued on a general basis and are divided into two types of communication: long-distance or suburban. The travel document contains the name of the departure station and point of arrival, distance, price, transport number, departure and arrival times, commissions and insurance fees, which are included in the cost of the travel document.

- The subscription provides multiple use of various types of services, visits to individual organizations and institutions (for example, sports sections, libraries, skating rink, entertainment complex, etc.) for a certain period of time, which is specified in this document.

- A ticket gives you the right to visit or use something for a fee.

- A coupon is a type of paper document for various purposes, usually of a small format, certifying its owner to receive any service, value, thing, as well as permission to access something.

- Travel vouchers are a document that is issued to a person on business trip or sent somewhere.

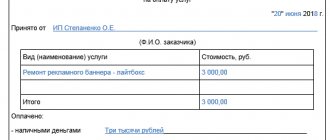

- A work order - an order is one of the types of documents that has the meaning of a contract for the performance of any work or the provision of a service. It specifies items such as agreed upon obligations, calculation of the cost of work and technical specifications. Also, a work order can be used when registering the performance of household services for the population, for example, repair of radio and television equipment, various types of equipment, furniture, as well as cars or their spare parts.

- A waybill is one of the forms of documents allocated for drivers of transport (public or belonging to any enterprise), which indicates the route of movement, the amount of fuel issued and instructions for the task being performed.

instructions for use

Published in the magazine “Modern Entrepreneur” No. 9 (September 2007)

When accepting cash from customers as payment for goods, work or services, the merchant must issue the customer a cash receipt. There is an exception to the rule. When providing services to the public, instead of checks, an entrepreneur may not use a cash register, but issue strict reporting forms (SSR) to clients. This rule is established by paragraph 2 of Article 2 of the Law on Cash Register Machines of May 22, 2003 No. 54-FZ. At the same time, the Government of the Russian Federation is entrusted with the responsibility to develop a procedure for approving forms of “strict” forms, as well as their recording, storage and destruction.

The corresponding Regulation was adopted by parliamentarians only 2 years later - Resolution of the Government of the Russian Federation of March 31, 2005 No. 171 (hereinafter referred to as the Resolution). In this document, officials established the Russian Ministry of Finance as responsible for the development of forms, limiting the development period to a time frame.

Dashes should be entered in all unfilled columns of the strict reporting form. Corrections when filling them out are not allowed.

Before their appearance, merchants were allowed to use “old” forms, that is, those that were approved before April 12, 2005, the date the resolution came into force.

Financiers had to develop new SSBs before January 1, 2007. What didn't happen.

The Government of the Russian Federation was forced to extend the period for using the “old” forms until September 1, 2007 (Table 1). Another postponement has come to an end, but there have been no new forms. Financiers approved BSO only for a few types of activities. Most likely, a new postponement will be made. In this article we will talk about how to properly use BSO in your work.

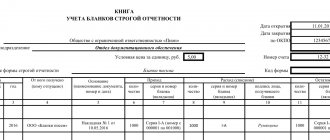

Table 1: Some BSOs approved before the advent of Resolution No. 171 (“old” forms)

| Activity | Name of the form | Document approving the form |

| Performing household services | Forms of forms BO-1 - BO-11 (receipt, work order, copy of receipt) | letter of the Ministry of Finance of Russia dated April 20, 1995 No. 16-00-30-33. Recommendations in the letter of the State Tax Service of Russia dated March 31, 1998 No. VK-6-16/210 |

| Catering | Subscription book, bill, food subscription | letter of the Ministry of Finance of Russia dated December 20, 1993 No. 16-31 |

| Car park services for car parking | Car parking receipt | letter of the Ministry of Finance of Russia dated February 24, 1994 No. 16-38 |

| Insurance activities | Receipt for receipt of insurance premium, for acceptance of payment for property types of insurance, for acceptance of contributions (payments) for long-term types of insurance | letter of the Ministry of Finance of Russia dated June 16, 1994 No. 16-30-63 |

The right to work without a cash register

Strict reporting forms, equivalent to cash receipts, include receipts, tickets, travel documents, coupons, vouchers, subscriptions and other papers that are intended for cash payments when providing services to the population. If BSOs have not been approved for any type of activity, it will not be possible to replace them with forms intended for other areas; you will have to buy a cash register.

An entrepreneur cannot independently develop and apply his own form of BSO. Forms must be produced in a typographical manner. The Russian Ministry of Finance outlined this requirement in letter dated September 27, 2005 No. 03-01-20/5-193.

In addition to all the required details, the strict reporting form must indicate the name of the manufacturer, his tax identification number, address, as well as the order number, year of execution and circulation

Another limitation is that a cash receipt order (PKO) is not a strict reporting form. Issuing a receipt for the PKO to buyers does not replace a cash receipt or a “strict” form (see, for example, letter of the Federal Tax Service of Russia for Moscow dated November 24, 2005 No. 22-12/86764). In such a situation, a businessman may be punished for working without a cash register. The fine under Article 14.5 of the Code of Administrative Offenses for a businessman will be from 3 to 4 thousand rubles.

To have the “right to exist,” when filling out the form, at least one copy must be made at the same time, for example, using carbon paper, or the BSO must have tear-off parts.

As a general rule, the form contains a number of mandatory details:

– information about the approval of the form;

– name, six-digit number and series (put down by the manufacturer of the forms);

– code of the form according to the All-Russian Classifier of Management Documentation;

– last name, first name and patronymic of the individual entrepreneur who issued the form;

– TIN;

– name of the service and its unit of measurement;

- service cost;

– calculation date;

– title of the position, surname, name and patronymic of the person responsible for the transaction and the correctness of its execution, place for his personal signature and seal of the individual entrepreneur.

All unfilled fields on the form should be filled with dashes. Corrections when filling them out are not allowed. Damaged or incorrectly filled BSOs should not be thrown away. They are crossed out and filed with the cash report for the day on which they were issued.

In addition to the above-mentioned mandatory details, the manufacturer must be indicated on the BSO, including its name, tax identification number, address, order number, year of order execution and circulation.

Registration forms

Individual entrepreneurs are required to organize and maintain records of strict reporting forms (clause 14 of the Resolution). Such records must be kept in a special book for accounting for BSO. Since the form of the book has not been approved, you can develop it yourself. The pages of the book must be numbered and laced.

According to the current rules, BSO must be stored in safes or in specially designated premises in which their damage or theft is excluded

In addition, they must be certified by the signature and seal of the entrepreneur (if any).

By order, it is necessary to appoint an employee responsible for issuing forms, with whom an agreement on financial liability is concluded. This employee will accept the purchased BSO in the presence of a commission that verifies the compliance of the actual quantity, series and numbers of the forms with the data specified in the accompanying documents. At the end of this procedure, an act of acceptance of the forms is issued, which is approved by the merchant.

Special conditions must be organized for the storage of BSO. Thus, according to the current rules, papers must be stored in safes or in specially designated rooms in which their damage or theft is excluded. At the end of the working day, the storage areas for forms are sealed.

The BSO inventory is carried out simultaneously with the inventory of cash and cash documents in the cash desk.

Copies of used forms or their spines, as well as damaged forms, are packed in special bags, which are then sealed. They must be kept by the merchant for at least 5 years. After this period they can be destroyed. For this purpose, an act on the write-off of forms is drawn up, drawn up by a commission specially appointed for this purpose.

Forms in action

The regulations on the use of BSO established a clear procedure for issuing forms for settlements. So, according to paragraph 25 of this document, you must first fill out the form, but not sign it. Then receive money from the client, name the amount received and place the bills in front of the buyer. Only then should you sign the form. Finally, the seller must announce the amount of change due and give it to the client at the same time as the form.

If the Government does not extend the validity of previously approved strict reporting forms, merchants will have to purchase cash registers

Please note that violating this procedure will give the controllers reason to accuse you of failure to issue the form. Responsibility for failure to issue a strict reporting form is the same as for failure to use a cash register. This is indicated by the resolution of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16. Thus, an entrepreneur can be fined under Article 14.5 of the Code of Administrative Offenses of the Russian Federation.

As stated earlier, in accordance with the government regulations on the application of BSO, the Russian Ministry of Finance had to approve the forms before September 1, 2007. To date, new forms are available for only a few types of activities (Table 2).

An entrepreneur running a business for which there are no approved forms is required to use the cash register (clause 24 of the Resolution).

Where can I get BSO?

One of the very first and simplest ways to produce BSO is in any department of the printing house. This kind of government organization works according to approved forms, therefore, they should have a sample form.

Print using an automated system. An automated system is a device that is similar in appearance to a cash register, but has different functions. Such devices protect the system from illegal access, and also determine and save information on all actions performed with forms for 5 years.

https://youtu.be/7scjezvmE7M

Mandatory requirements for BSO

Strict reporting forms must be consistent with legal requirements regarding their design and production:

- The name of the required document (for example, voucher, subscription, payment receipt), as well as the series and six-digit number.

- The name of this organization that provides its services to the population, a document indicating its registration and its organizational and legal form, as well as permission to perform a particular type of service.

- Location (including actual and legal).

- Types and services provided by this organization.

- A unit of service or product that is provided by an organization.

- Cost and total amount of payment, method of carrying out this operation (cash or using a bank card).

- It is necessary to indicate the date of compilation of the BSO and the calculation.

- In addition, it is necessary to indicate the full name and position of the person who is responsible for carrying out this financial transaction, as well as his signature and the stamp of the printing house where the forms were produced.

How to check BSO for authenticity

If the driver decides to issue this type of vehicle license, then it is worth checking its authenticity. Incomplete information on the form will invalidate it.

The document must contain:

- information about the insurer, OKUD and OKPO;

- TIN of the insured;

- form, number and series of the document;

- service data;

- price;

- seal and signature of the representative of the Investigative Committee;

- date.

If this data is available, then there is no need to worry.

For greater confidence, you can use insurance document verification services. For example, look at the RSA database or on the insurer’s website.

Filling out and recording: requirements

sample filling out the BSO in MS Excel format.

For some types of business activities, certain types of legislation and forms of forms were established. For example, for such organizations related to tourism, insurance companies, veterinary services, as well as services provided by budget organizations and pawnshops. Each entrepreneur must select one required form. If your activity is not related to the above, then you have the opportunity to make a form yourself, according to your requirements and preferences. To do this, you should take an existing form as an example and add changes to it according to your wishes.

It is worth considering that the BSO is an important document and you will need to keep records of it. When filling out the data, it is strongly recommended to write in a legible and neat handwriting, and also carefully enter all the necessary information, which will be processed in the future. In addition, the issued forms will be recorded in the accounting book upon their issuance. It is also necessary to take into account that all responsibility for storing the form throughout the entire period rests with the entrepreneur.

It is recommended to store all documents in a secure place from illegal interference, for example, in a safe

In addition to all of the above, you should take into account some requirements when filling out the BSO:

- The BSO must be filled out as a carbon copy, with at least one copy saved.

- If the BSO does not have a tear-off part, then the form is filled out using carbon or self-copying paper.

- All columns and fields of the prepared form must be filled out.

- No corrections are allowed on the form; handwriting must be clear and legible.

Is it possible to replace E-OSAGO with a BSO policy?

If for some reason the owner of an electronic OSAGO policy has a desire to change it to BSO, then this is possible. To obtain a paper version, you need to contact your insurer. Be sure to take E-OSAGO with you. Without it, registration of a BSO is impossible.

Employees will check all information and issue a policy on a strict reporting form. But there may be a fee for this service, so before you want to change, it's worth considering the feasibility of replacing.

From the point of view of legislation, BSO and E-OSAGO are equivalent, therefore, when choosing insurance, a person should be more guided by his own preferences: which document is more convenient for him to use, which inspires confidence and is easier to issue.

Video files

https://youtu.be/0NWQNPnic_g

https://youtu.be/L4bCMxCyRfM

Fines for failure to issue BSO to clients

If any violations were discovered during use or the BSO was not issued to clients of the company, organization or enterprise, such illegal actions entail a fine:

- For individual entrepreneurs and officials of the organization who have the position of manager - from 3,000 to 4,000 rubles;

- For legal entities – from 30,000 to 40,000 rubles

Purposes of inventory

The inventory process is carried out to check reporting, verify the data specified in the accounting journal (income, expense, balance), as well as to control all these points.

As a rule, the inventory is carried out within the time limit set by the head of the organization or company, and before starting, a receipt is taken from the person responsible for financial processes:

- One of the first and main purposes of inventory is to identify shortages. This goal can be achieved using the method of comparing the availability of goods with available accounting data, which will help identify shortages or other financial discrepancies.

- Also in the inventory process, an important aspect is to detect obsolete material that is unsuitable for use and has lost its original quality. In addition, you need to check the entire availability of forms and exclude from the archive those that are unsuitable and have expired. Additionally, it is necessary to conduct an inventory of the BSO, paying special attention to checking securities, financial and accounting records, as well as all available shares and bonds. If the company has transferred all its securities to the bank for safekeeping, then in this case the essence of the inventory will be to reconcile the availability of assets available in the company’s accounts, and an extract from the bank is also required, indicating the presence of all the necessary documents.

Accounting and tax accounting

The methods of accounting for forms by tax services, as well as the conduct of transactions upon acceptance and write-off, directly depend on the further use of BSO.

In this case, records are kept if the forms are used by the owner or for resale. Most organizations and individuals involved in business activities use forms to pay clients. When conducting settlement transactions, the cost of printing forms is indicated in account 20 (OS) or account 44 (sales expenses).

If you prepare your own invoices, which reflect the cost of the document, they remain unchanged. Only depreciation of fixed assets and materials for production can be taken into account.

There is a need to reflect the calculation of forms on the off-balance sheet account 006, since the contingent valuation sub-report must show the company's balance sheet. Also, to eliminate additional issues, you should keep analytical records that relate to the types and locations of storage of forms.

When carrying out tax control, the cost of the forms is included in current expenses.

In the process of purchasing forms, a company may not decide how the forms will be sold. In this case, it is better to reflect the income on account 10 (Materials). This is followed by several accounting entries to complete the sale. For tax purposes, it should be written off as an expense to the organization at the time of sale.

Monitoring storage conditions

Since control over the safety of SSO is mandatory, in particular, the protection of information and data from unauthorized persons and illegal interference, the entrepreneur of a company or organization is subject to obligations, which include the need to provide reliable conditions for storing all information on SSO.

A mandatory point that must be observed by the entrepreneur is to allow access to the storage of documents only to those persons who are directly related to them and are responsible for their safety. These persons and all necessary information about them must be recorded in the log book.

In the legislation of the Russian Federation, there is no specific storage period for BSO; however, according to the rules, it is recommended to regularly conduct an inventory of documents. If copies are found that have been in storage for more than five years, they must be removed from the archive. The inventory process itself should only take place in the presence of a commission established by the head, which is responsible for this entire process.

In addition, a very important point in ensuring proper storage conditions for BSO is the need for all officials who maintain accounting records, are responsible for receiving, storing and issuing BSO, to enter into an agreement with the entrepreneur or the head of the company, organization or firm. This document will indicate that the person appointed to the executive position agrees to bear the responsibilities assigned to his position, as well as for certain processes carried out in the company.

When an entrepreneur carries out all the above-described verification processes, compilation and maintenance of records, it can be argued that the manager is responsible for his activities and wants to avoid problems with the law and the imposition of a fine if any violations are detected. Honest and correct business conduct, responsible attitude towards clients is the key to a thriving business and profitable income.