Requirements for registration of BSO

By registering a BSO, a business entity (seller) has the right to confirm the fact of receiving funds from an individual (buyer).

It is noteworthy that in this case the buyer can pay either in cash or with a bank card. Accordingly, the seller can receive the funds paid either in cash or in non-cash form.

https://www.youtube.com/watch?v=ytabouten-GB

The requirement for strict accounting of all SSO documents is of particular importance. This indicates the need to comply with certain rules by the person drawing up and taking into account strict reporting documents when receiving money from the buyer.

A typical example of a BSO can be considered a transport ticket. This document officially certifies the fact of provision of transport services to the passenger. The issuance and presentation of a travel ticket confirms payment for the service provided.

If you want to issue BSO instead of checks, check whether the form contains all the required details:

- name of the form, number of 6 characters and series;

- name and legal form of the legal entity or full name of the entrepreneur;

- TIN and location of the company;

- type and cost of service;

- amount of cash or non-cash payment;

- date of the operation and completion of the form;

- information about the person who filled out the BSO and his signature;

- seal.

NOTE! Tax authorities require that the BSO be stamped manually when filling out a form for the buyer: it certifies the signature of the employee who compiled the document. Inspectors prohibit printing forms immediately with a seal (clause 5 of the letter of the Federal Tax Service of Russia dated September 10, 2012 No. AS-4-2 / [email protected] ).

If even one of the above details is missing from the BSO, the tax authorities will recognize the document as invalid and fine the company.

Read more about the amount of fines in the article “What is the responsibility for non-use or loss of SSO?”

There are a number of BSOs, the registration of which requires separate requirements: tour packages, cinema tickets, various types of receipts (for example, for payment of veterinary services), etc. For them, mandatory details are established by the relevant regulatory legal acts.

When filling out the BSO, corrections of any kind are prohibited, otherwise the form is considered damaged. Such a document is crossed out and attached to the BSO accounting book.

The BSO must contain a tear-off part. Then the employee gives the form itself to the buyer, and keeps the tear-off part for himself. If the primary form is not provided with a tear-off part, the form is filled out in 2 copies: the original is taken by the buyer, and the copy remains with the company (clause 8 of the Decree of the Government of the Russian Federation dated May 6, 2008 No. 359).

See also our article “What part of the SSB should be given to the client?”

Working outside the cash register: who can?

Strict reporting forms are an alternative way to record payments in cash or by card when cash register is not used. Clause 3 art. 2 of Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment when making cash payments and (or) payments using payment cards” allows such accounting for certain categories of individual entrepreneurs or organizations. Those engaged in certain activities have the right to use BSO instead of checks, namely:

- sells press and related products at kiosks (newspapers and magazines should make up more than half of the assortment);

- sells securities;

- sells lottery and city transport tickets;

- provides food to pupils and students, as well as employees of educational institutions;

- engages in trade in specially designated places, such as markets, fairs, exhibition complexes, etc. (separate pavilions, shops, tents, etc. inside such places are subject to other requirements);

- peddles or sells from carts (except for complex equipment and perishable food products);

- offers tea and similar products in train carriages;

- makes it possible to purchase medicines at paramedic stations in rural areas;

- sells ice cream from trays, soft drinks, beer, butter, etc. spilling from tanks, waddling live fish and vegetables;

- accepts glass containers and scrap (except metal);

- offers to buy religious products and literature in specially designated places (temples, church shops, etc.), provides services for worship;

- sells stamps at their face value.

ADDITIONALLY. It is allowed not to use cash registers, using BSO instead of checks, for those entrepreneurs who operate in hard-to-reach areas (their list is approved by regional legislation).

In what ways can BSO be made?

The legislation establishes 2 methods of manufacturing BSO:

- Typographic. To do this, you need to choose a printing house, bring your own template of the form, or use ready-made samples. The BSO indicates not only the customer’s details, but also information about the printing house: its name, Taxpayer Identification Number, order number, year of execution and circulation size (clause 4 of Resolution No. 359).

- Using an automated system. It must be protected from unauthorized access, and all transactions with forms must be stored and recorded for at least 5 years. Tax authorities have the right to request information about BSO from the system (clause 11 of resolution No. 359).

https://www.youtube.com/watch?v=ytpolicyandsafetyen-GB

If you were going to make forms yourself on a regular computer and printer, read the letter of the Ministry of Finance of Russia dated November 25, 2010 No. 03-01-15/8-250. Officials indicate in it that BSOs can only be printed in a printing house or through an automated system; other methods of their production are prohibited.

The taxpayer does not need to register the BSO circulation with the Federal Tax Service - see the publication “Do I need to register the BSO with the tax office in 2020?”

NOTE! From 07/01/2018, the algorithm for registration and issuance of BSO will change: forms can only be printed via online cash register. The new rules will affect all taxpayers who can now issue printed BSOs to clients (Article 7 of the Law “On Amendments...” dated July 3, 2016 No. 290-FZ).

Accounting for strict reporting forms

BSO turnover is recorded in off-balance sheet account 006, which is called “Strict Reporting Forms”. BSO accounting is carried out through entries reflecting the amount of costs for the production of forms (clause 22 of the minutes of the GMEC meeting No. 4/63-2001). As a rule, these are the postings:

- Dt account 26 “General business expenses”;

- Kt account 60 “Settlements with suppliers and contractors.”

In some cases, BSO accounting involves the creation of subaccounts for account 006. This is possible if the forms capitalized by the accounting department are subsequently issued to other employees who actually manage the BSO (we examined a similar scenario above). In this case, subaccount 006-1 “BSO in accounting”, as well as subaccount 006-2 “BSO from executors” can be formed.

How to correctly write off BSO in accounting and what documents to prepare? The answer to this question was given by 2nd class State Civil Service Advisor I. O. Gorchilina. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

Legislative regulation

Clause 2 Art. 2 of Federal Law No. 54 speaks of the possibility of using BSO instead of cash registers when providing services to the population included in the corresponding list of OKUN.

Federal Law No. 290-FZ of July 3, 2020 amended the aforementioned Federal Law No. 54, making the list of services, payment for the provision of which can be registered using BSO, without cash register, exhaustive.

In 2008, the government of the Russian Federation updated the regulations on making payments without the use of cash registers (Resolution No. 359 of May 6, 2008). It covers in detail the requirements for this type of documentation, the procedure for settlements with their help, and the features of accounting and disposal. The main changes (compared to previous requirements) are as follows:

- old BSO forms are considered irrelevant and cannot be used;

- entrepreneurs must themselves develop new forms of SSB (except for certain types of activities for which standard ones have been approved);

- The BSO must contain certain details;

- You must indicate typographical information if the BSO was printed in this way.

Is it possible not to put a stamp on the BSO?

Since 2020, LLCs and JSCs are allowed to operate without using a seal (Law “On Amendments to Certain Legislative Acts of the Russian Federation Regarding the Abolition of the Mandatory Seal of Business Companies” dated 04/06/2015 No. 82-FZ). But an individual entrepreneur may not have a seal - the regulatory framework of the Russian Federation does not contain a requirement for businessmen to have a seal. The judges confirm this (resolution of the 17th Arbitration Court of Appeal dated July 19, 2013 No. 17AP-7016/2013-AKu).

However, there is a requirement for a mandatory seal in many legal regulations, including the regulation “On the procedure for making cash payments and (or) settlements using payment cards without the use of cash register equipment,” approved by Resolution No. 359 (clause 3). According to the inspectors, both the legal entity and the individual entrepreneur must put a stamp on the BSO forms, otherwise the document will be declared invalid and fined under Art. 14.5 of the Code of Administrative Offenses of the Russian Federation for a minimum of 30,000 rubles.

The procedure for storing strict reporting documents

BSO are stored in metal cabinets or safes. A cash register can be used for these purposes because it is specially equipped to accommodate valuables. If documents were printed in large quantities, they are placed in separate rooms (offices) in which conditions are created that exclude the possibility of damage or theft.

At the end of the working day, the safe in which the BSO is located is sealed. The head of the company enters into an agreement with one employee who works with strict reporting documents and ensures their safety. An agreement on full financial responsibility is signed with this official.

Nuances of form design

The form for strict reporting must be produced exclusively in printing or generated by automated programs that meet certain requirements for the protection and recording of data (the second method is practically not used in practice due to the difficulty of meeting these requirements).

FOR YOUR INFORMATION! Forms printed using a regular printer are invalid.

A number of fields must be required; the rest can be entered by the entrepreneur at his own discretion. The law requires that the form must contain the following information:

- name, a unique number of 6 characters and a series of two capital letters (assigned arbitrarily by the entrepreneur);

- name of the organization or name of the individual entrepreneur;

- for legal entities – address of the executive body;

- TIN;

- type and cost of the service provided (in money);

- amount to be paid;

- date of payment and completion;

- details of the person filling out the document, signature, seal (if applicable);

- additional service details.

IMPORTANT! External registration of your own form of the form is not required; it is enough to approve it in the internal accounting policy.

First of all, we note that it is necessary to distinguish:

- strict reporting forms made on printing equipment, as well as generated through automated systems that are not cash register equipment (the procedure for their use is regulated by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359);

- BSO, formed with the help of automated systems, which are cash register equipment (their use is regulated by the Law “On Cash Register Equipment” dated May 22, 2003 No. 54-FZ).

Some service providers are required to use BSOs produced using cash register systems in settlements with the population from 07/01/2018, and others from 07/01/2019 (clauses 7, 8, article 9 of the Law “On Amendments...” dated 07/03/2016 No. 290 -FZ).

Read more about the timing of the transition to online cash registers in the material “Current amendments to the law on online cash registers.”

Printing BSOs, as well as those generated using systems that are not cash registers, will most likely be cancelled. But until the deadline (07/01/2018 or 07/01/2019), at the choice of the business entity, any of the current types of BSO are applicable:

- typographical;

- generated using automated systems that are not cash registers;

- formed using CCT.

Who has the right to use BSO instead of a cash receipt, read here

How strict reporting forms are taken into account

A financially responsible person must be responsible for recording, storing and disposing of BSO (an appropriate agreement is concluded with the employee or management takes over this function). The receipt of forms from the printing house is reflected in the acceptance certificate signed by the commission.

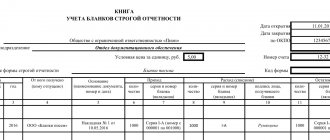

Further dynamics are kept in the BSO Accounting Book.

BSO accounting book

https://www.youtube.com/watch?v=ytadvertiseen-GB

The form of this mandatory accounting document has not been approved; an enterprise or individual entrepreneur can develop it independently. Primary requirements:

- the sheets should be numbered, stitched, and the firmware sealed;

- they must contain the signature of the manager or chief accountant;

- forms are counted by names, series, numbers.

The book is divided into several parts: the forms received and those transferred for use are separately reflected, the balance for each type of form is displayed (it must match the inventory data). The following columns are provided:

- date of receipt (transfer);

- number of forms;

- who transmitted;

- Based on what document?

Upon receipt of BSO from the printing house, an acceptance certificate should be drawn up in a free form, taking into account the requirements of the law on mandatory accounting documentation details (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

Forms received from the printing house should be taken into account in the book of document forms (clause 14 of Resolution No. 359).

An employee who conducts transactions with BSO is a financially responsible person; an appropriate agreement must be concluded with him. An example of its preparation can be found in the article “Liability Agreement - sample 2015”.

Forms must be stored in a safe or special room to prevent the possibility of damage or theft. The BSO storage area is sealed at the end of the day every day. Forms should be stored for 5 years.

Printed forms must be checked regularly - during the cash inventory period.

For more information on how to conduct a BSO inventory, read the article “Procedure for recording and storing strict reporting forms.”

If you print BSO from an automated system, then they are recorded and stored in it. They need to be printed at the time of the transaction itself. Accordingly, there is no need to purchase a safe or equip a special room for forms. Also, the automated system provides the user with the opportunity to maintain a BSO accounting book in electronic form.

BSO accounting has one nuance: the forms must be taken into account in off-balance sheet account 006 “Strict reporting forms” of the chart of accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). The BSO should be reflected in the conditional valuation. The company prescribes the procedure for determining it in its accounting policies.

| Debit | Credit | Contents of operation |

| 10 | 60 | The receipt of BSO into the organization is reflected |

| 19 | 60 | VAT included on purchased forms |

| 68 | 19 | Accepted for deduction of VAT according to BSO |

| 006 | Capitalized by BSO for balance in conditional valuation | |

| 20, 44 | 10 | Forms were issued to the responsible employee |

| 006 | BSO issued to customers are written off |

In a situation where forms are printed by an automated system, accounting reflects the acquisition of non-exclusive rights to use the system by making an entry in the debit of account 97 and the credit of account 60 or 76. Then the costs of the program are written off to the debit of account 20 or 44 according to the methodology approved by order of the manager in the accounting policy for accounting purposes.

If an organization has received the rights to use an automated system under a license agreement, such a system is recognized as intangible assets received for use (clause 39 of PBU 14/2007, approved by Order of the Ministry of Finance of Russia dated December 21, 2007 No. 153n). The system must be reflected on the balance sheet in a separate account, which the organization will independently put into use and record in its accounting policies.

VAT on the purchased automated system is taken into account in the usual manner.

When using an automated system, the company incurs costs for ink and paper for forms. Such expenses are written off as follows:

- Dt 10 Kt 60 — consumables for the automated BSO printing system were purchased;

- Dt 20, 44 Kt 10 - consumables are included in costs.

In tax accounting, expenses for the production of BSO can be written off as expenses for stationery (subclause 24, clause 1, article 264 of the Tax Code of the Russian Federation) or material expenses (subclause 2, clause 1, article 254 or subclause 5, clause 1, article 345.16 of the Tax Code) RF for simplified firms). The company indicates the method of writing off costs in its accounting policy for tax purposes.

The OSN company takes into account the costs of a special system for printing BSO on the basis of subclause. 26 clause 1 art. 264 of the Tax Code of the Russian Federation as part of other costs. If the documentary agreement for the acquisition of a non-exclusive license to work with the system specifies the period for using the acquired rights, the enterprise recognizes such expenses evenly over this period (letter of the Ministry of Finance of Russia dated August 31, 2012 No. 03-03-06/2/95).

https://www.youtube.com/watch?v=upload

If there is no deadline in the documents, the company’s accountant records the period for writing off expenses in the accounting policy (letter of the Ministry of Finance of Russia dated March 18, 2013 No. 03-03-06/1/8161). Simplified people recognize the costs of the system on the basis of subparagraph. 19 clause 1 art. 346.16 Tax Code of the Russian Federation.

Write-off or destruction of strict reporting forms: is there a difference?

The fact that the procedure for carrying out write-offs is not clearly stipulated by law does not mean that this procedure will not have to be done. It is quite logical that before destroying important business papers, you should write them off from the financially responsible person and display all this in accounting. Thus, the write-off of strict reporting forms in itself actually takes place. In addition, there are a number of circumstances in which it is necessary to write off certain inventory items or business papers before destroying them.

The Regulations state that the head of an organization or an individual entrepreneur must create conditions that ensure the safety, as well as timely and complete accounting of BSO. It is quite natural that the office has an appropriately equipped storage place (clause 16 of Regulation No. 359) and agreements on material responsibility. It is also natural that employees are aware of the procedure for making payments and the sequence of actions when working with clients (clause 20 of the Regulations).

At the same time, this does not exclude the fact that if a shortage is discovered, it is necessary to conduct an investigation and, if possible, identify its causes. Based on the results of the investigation, the manager or individual entrepreneur makes a decision on further actions, and takes a number of measures aimed at improving the organization of work as a whole.

If the shortage is of a criminal nature (deliberate damage, theft, or other abuses), then in addition to conducting an inventory, it is necessary to identify the culprits. If printed materials are lost for other reasons, it will still be necessary to identify the culprit (if there is one) or describe the situation in detail (fire, flood or other emergency), and may even attach a certificate from the relevant authorities. Whatever the situation as a result of which the shortage arose, it will be necessary to draw up an act of writing off strict reporting forms, indicating the types and numbers of the missing license papers and the reason for the shortage. In addition, it is imperative to specify how it will be covered. How to conduct a BSO inventory has already been described, and you can draw up an act of writing off strict reporting forms using BLANKSOMAT.

How to fill out the BSO

The regulations set out a number of requirements for filling out this document:

- clear, legible, without discrepancies;

- corrections are not allowed;

- at least in two copies.

Made a mistake in a strict reporting document? This document cannot be thrown away because it is numbered. You are supposed to cross out the damaged form and hand it in at the end of the working day along with the proceeds and the current BSO (copies and counterfoils). They will be attached to the BSO Account Book.

Sometimes it happens that the form is filled out correctly, but the client refused the service at the last moment and therefore did not pay for it. With such a BSO you should do the same as with a damaged one: cross it out and hand it in at the end of the day in its entirety: 2 copies with the same number (or a copy and a spine).

NOTE! If the forms are not printed, but generated by an automated system, then opposite the damaged form should be written. Printed invalid BSOs are subject to recording and destruction in the usual manner.

Organizations and individual entrepreneurs that legally accept payment from individuals for work, services, goods in cash or by debiting from a bank card, but do not use cash register machines, have the right to draw up and issue BSO.

Thus, the legitimate absence of a cash register apparatus at an economic entity is the basis for the use of strict reporting documents in settlements with individuals.

The following business entities can practice filling out BSO when making payments to individuals (buyers):

- Organizations and private entrepreneurs providing certain services to the population (the applied tax regime does not matter).

- Enterprises or entrepreneurs who are not able to use cash register systems due to technical limitations (for example, due to territorial remoteness, due to lack of access to the necessary infrastructure). Categories of such economic entities are approved at the level of specific regions.

It is allowed to use strict reporting forms in settlements between a business entity (seller, recipient of money) and an individual (buyer, payer of money).

If the payer of funds is a legal entity, the seller must provide it not with a BSO, but with a cash receipt. However, the use of BSO is permitted in settlements between private entrepreneurs.

Filling out strict reporting forms is the prerogative of the financially responsible employee with whom the employer has entered into a corresponding agreement.

This requirement is clearly provided for by Resolution No. 359, approved on May 6, 2008 by the Government of the Russian Federation (clause 14).

Starting in 2020, organizations and individual entrepreneurs are allowed to develop and use their own BSO template forms.

However, settlement documents of this type must necessarily contain the following details:

- The name of the payment document (for example, a receipt).

- Document series and its unique number.

- Name of the person issuing the BSO (name of the enterprise, full name of the entrepreneur).

- TIN of an economic entity (enterprise, entrepreneur).

- Information about the location (address) of the organization.

- Type of service provided (short designation).

- The total cost of the service provided (in monetary terms).

- The amount of money actually paid by an individual (buyer).

- The date the payment transaction was completed and the document was issued.

- Information about the employee of the organization who issued the BSO (full name, position).

- Signature of the responsible employee, seal of the business entity (if any).

However, they may be supplemented with other information if such a need arises.

The procedure for executing a settlement transaction by issuing a strict reporting form, provided for by Decree of the Government of the Russian Federation No. 359 of 05/06/2008, is carried out in the following order:

- All details of this form are filled out by the responsible employee of the organization immediately before receiving money from an individual (buyer). The paper form is filled in manually. The use of an automated filling system allows this procedure to be carried out on a computer. Information is entered clearly, legibly, without errors.

- Funds from an individual (buyer) are accepted in cash or, alternatively, by debiting the required amount from the payer’s bank card.

- The individual (payer of funds, buyer) is given a second copy of the BSO or, alternatively, a tear-off part of it, if the form is printed. If the form is generated using an automated system, it is simply printed on a computer.

- The counterfoils of the forms generated on paper are transferred to the accounting department at the end of the shift (day). Typically this process accompanies the daily transfer of cash proceeds.

A strict reporting form containing an error made when filling out is immediately crossed out and attached to the accounting journal on the day this document is issued.

Damaged forms, as well as completed BSOs, are stored in the accounting archives of the business entity for 5 (five) years.

Do you need a seal?

https://www.youtube.com/watch?v=ytdeven-GB

A seal (stamp) is affixed to the paper BSO form only if the use of the seal (stamp) is provided for by the internal regulations of the business entity using the strict reporting form.

If the use of a seal (stamp) is not regulated by local regulations of an economic entity, the corresponding stamp is not affixed.

Current legislation provides organizations/entrepreneurs with the opportunity to make such a choice.

Algorithm for drawing up an act of writing off strict reporting forms according to form 0504816

In the upper right corner of the form there should be the word “I approve”, in the line below in the middle we write: “Head of the institution”, opposite we leave space for the signature and its decoding.

The next line should indicate the date of approval of the document. This data is located on the right.

A line below, in the middle of the page, should contain the phrase “ACT on writing off strict reporting forms”, opposite it there should be a place to put the number of the corresponding document.

In a line below, also in the middle, you should put the date of drawing up the act, write the word “Institution” below, and leave space to the right of it to indicate the name of the organization. In the line below - enter the phrase “Financially Responsible Person”, on the right - a place to indicate his position, surname and initials.

To the right of the above two lines, you can insert a plate of 5 lines. In the first - enter the word CODES, in the second - indicate the code of the form used as a basis, according to OKUD - 0504816. The following lines can record the date, as well as the organization's OKPO.

OKPO codes are also often used in many other reporting documents, for example, in Form 2 of the balance sheet, the completion of which can be found in the article “Filling out Form 2 of the balance sheet (sample)” .

In the line below you need to insert 2 table cells located at some distance from each other. The first will record the debit of the account, the second - the credit (the cells must be signed accordingly).

On the next line you need to enter the phrase “Commission” and leave space on the right to indicate the positions, surnames and initials of the organization’s employees included in this commission.

In the line below you can enter the phrase “Assigned by order from”, on the right indicate the place to indicate the date and number of the corresponding order, then enter the phrase “drew up this act that for the period from”, on the right - indicate the place to indicate the beginning period, then enter the preposition “by” and leave space to indicate the end of the period. The phrase “subject to write-off” should be inserted below.

conclusions

Thus, strict reporting documents in settlements between business entities and individuals are analogous to a cash (fiscal) receipt.

The use of BSO is permitted in situations where an economic entity does not legally use CCP in its activities.

Filling out the BSO is carried out by organizations and individual entrepreneurs performing settlements with individuals, according to the rules provided for by special legislation.

Compliance with these standards is an important requirement, since the form in question is subject to strict accounting.

| The article describes typical situations. To solve your problem, write to our consultant or call for free: 7 – Moscow – CALL 7 – St. Petersburg – CALL 7 – Other regions – CALL It's fast and free! |

Results

The procedure for writing off strict reporting forms is not difficult, but you need to remember that the form of the act on the basis of which it is supposed to write off the BSO must be approved in the accounting policy of the organization or individual entrepreneur.

The exception is public sector organizations. They are required to use the form established by Order No. 52n of the Ministry of Finance of Russia. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

BSO audit

It is necessary to carry out an inventory of forms from time to time. This is usually done simultaneously with cash reconciliation. The forms are checked by numbers and series, separately for each storage location and the persons responsible for them. The actual availability is verified with the records in the accounting documentation.

The results are reflected in the inventory list, the form of which (INV-16) was approved by Decree of the State Statistics Committee No. 88 of August 18, 1998. The inventory is drawn up in two copies, and if the financially responsible persons have changed, in three.

Accounting for blank products

General provisions Accounting for strict reporting forms Receipt of strict reporting forms Issuing, monitoring the use of strict reporting forms Accounting for damaged, canceled strict reporting forms, their destruction Accounting

General provisions

Forms of primary accounting documents are presented to us in the form of strict reporting forms and forms that are not such.

Forms that are not strict reporting forms can be developed by the organization itself; they can be downloaded from any information and legal system or purchased. Forms that are not purchased are not subject to posting and write-off, unless the paper used to print the forms is subject to write-off. Purchased blank products are subject to capitalization:

DEBIT 10 – CREDIT 60.

Based on the requirements of clause 3 of the Inventory Accounting Instructions, approved by Decree of the Ministry of Finance dated November 12, 2010 No. 133 (hereinafter referred to as Instruction No. 133), individual items included in funds in circulation include:

- inventory;

- household supplies;

- tools;

- equipment and devices;

- replacement equipment;

- special (protective), uniform and branded clothing and shoes;

- temporary (non-title) structures and fixtures.

It is clear from the list that blank products do not apply to individual items as part of funds in circulation; therefore, clause 107 of Instruction No. 133, which provides for the procedure for transferring the cost of individual items as part of funds in circulation to accounts for recording production costs and sales costs, is unacceptable .

And since this is so, blank products should be written off as they are used (issued to responsible executors as consumables). However, to write off used blank products, an additional document is required. The register of blank products issued to responsible executors or a write-off act can be used as such a document. According to the final data of the register (act), blank products can be written off as general business expenses (or) as sales expenses:

DEBIT 26 – CREDIT 10.

Accounting for strict reporting forms

A completely different procedure is established when recording strict reporting forms (documents with a certain degree of protection).

In accordance with sub. 3.2 clause 23 of the Resolution of the Council of Ministers of December 22, 2001 No. 1846 “On some issues of the production and use of forms of securities and documents with a certain degree of protection, as well as documents with a certain degree of protection” forms and documents include printed products made with elements ( means) of protection against counterfeiting, meeting the requirements determined by the Ministry of Finance in agreement with the Ministry of Internal Affairs and the Ministry of Justice, and (or) the numbering (identification number) applied during its manufacture, which is manufactured, distributed, used and destroyed in the manner prescribed by law. Forms of securities and documents with a certain degree of protection, as well as documents with a certain degree of protection (hereinafter - forms and documents) are subject to:

- mandatory registration in the State Register of forms of securities and documents with a certain degree of protection, as well as documents with a certain degree of protection;

- accounting during their manufacture and use.

Maintaining the State Register of forms of securities and documents with a certain degree of protection, as well as documents with a certain degree of protection, is entrusted to the Ministry of Finance.

Accounting for strict reporting forms is carried out in accordance with the requirements of the Instructions on the procedure for using and accounting for strict reporting forms, approved by Decree of the Ministry of Finance dated December 18, 2008 No. 196 (hereinafter referred to as Instruction No. 196). Strict reporting forms can include not only forms of documents included in the State Register, but also forms recognized as such by the organization itself. Therefore, the list of documents related to strict reporting forms, the place, procedure for their storage and use are established by order of the head of the organization (individual entrepreneur). At the same time, proper accounting must be organized and the safety of strict reporting forms must be ensured.

Receipt of strict reporting forms

Strict reporting forms received by the organization must be recorded by the financially responsible person.

If there are discrepancies between the actual availability of books of strict reporting forms and the data of accompanying documents, a report on checking the availability of strict reporting forms is drawn up (Appendix 1 to Instruction No. 196). This act reflects the number of books of strict reporting forms that were not available, with the obligatory indication of the series and numbers of the forms themselves. The act must be drawn up in two copies, of which the first copy is sent to the supplier to clarify the reasons for the discrepancy and take action, and the second copy remains with the organization (individual entrepreneur). The receipt of strict reporting forms is reflected by the financially responsible person in the receipt and expenditure book for recording strict reporting forms (Appendix 2 to Instruction No. 196). Before entries can be made in it, the book must be numbered, laced, sealed and signed by the head and chief accountant of the organization (individual entrepreneur).

Maintaining a receipt and expenditure book on computer storage media is not excluded. In this case, the protection of information, the preservation of an archive of this information for the period established by the legislation of the Republic of Belarus, and the possibility of obtaining a duly certified paper copy must be ensured.

Issuance and control over the use of strict reporting forms

Accounting for the movement (receipt, expense) of strict reporting forms is carried out by financially responsible persons in quantitative terms by numbers and series and is reflected in the receipt and expenditure book for accounting of strict reporting forms in the columns “receipt”, “expense”, “balance”.

The issuance of strict reporting forms to responsible executors for reporting is carried out using invoices on strict reporting forms (Appendix 3 to Instruction No. 196) with the permission of the head and chief accountant of the organization (individual entrepreneur) or persons authorized by them, indicating the series and numbers of the forms.

As strict reporting forms are issued to responsible executors, the data of invoices is entered by the organization's accounting department (individual entrepreneur) into a certificate card for issued and used strict reporting forms (Appendix 4 to Instruction No. 196).

If strict reporting forms are lost or stolen, the financially responsible person is obliged to inform the head of the organization (individual entrepreneur) about this. In this case, the appointed commission checks the actual availability of the forms and draws up a report indicating the circumstances of loss (theft), damage, the number of missing strict reporting forms, listing their series and numbers. The act is presented to the head of the organization (individual entrepreneur) to make an appropriate decision.

Strict reporting forms issued to responsible executors by the financially responsible person are written off from the register on the basis of an act for writing off used strict reporting forms (Appendix 5 to Instruction No. 196).

Accounting for damaged and canceled strict reporting forms and their destruction

Damaged and (or) canceled strict reporting forms are retained by the organization (individual entrepreneur) along with a compiled register of strict reporting forms subject to destruction, in the form in accordance with Appendix 6 to Instruction No. 196 for a month after the tax authorities have checked compliance with tax legislation.

Preparation for the destruction of damaged and (or) canceled strict reporting forms begins after the expiration of the above period, with the written permission of the head of the organization (individual entrepreneur) or persons authorized by him. For this purpose, the order appoints a commission consisting of officials of the organization (individual entrepreneur), which is obliged to check the presence of strict reporting forms subject to destruction and give an opinion confirming the need for their destruction.

In the presence of the commission, the verified strict reporting forms are packaged and sealed. Then an act is drawn up for the write-off of damaged, canceled strict reporting forms (Appendix 7 to Instruction No. 196) indicating the series and numbers of strict reporting forms to be destroyed.

Written off strict reporting forms are left for storage in the same organization (with the same individual entrepreneur). Within 3 days, the act for writing off strict reporting forms is submitted for approval to the head of the organization (approved by the individual entrepreneur). The head of the organization approves the act within 5 days after its receipt.

After approval of the act on the write-off of damaged, canceled strict reporting forms, the commission carries out their actual destruction, about which an act on the destruction of strict reporting forms is drawn up in the form approved by the head of the organization (individual entrepreneur).

The act of destroying strict reporting forms within 3 days is approved by the head of the organization (individual entrepreneur).

Accounting

Accounting for strict reporting forms is carried out by the accounting department of the organization (individual entrepreneur) in cost and quantitative terms:

- commercial organizations and individual entrepreneurs maintaining accounting records - on the account. 10 "Materials";

- budgetary organizations - on the account. 21 “Other expenses” subaccount 210 “Expenses for distribution”.

In addition, analytical records of strict reporting forms are maintained.

An off-balance sheet account is intended for their accounting. 006 “Strict reporting forms”, and in budgetary organizations - to an off-balance sheet account. 04 “Strict reporting forms.” Analytical accounting is maintained for each type of form and the place where it is stored (materially responsible persons). Coming. Received strict reporting forms in accordance with clause 21 of Instruction No. 196 are reflected in accounting:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 10 “Materials” and credit account. 60 “Settlements with suppliers and contractors” in the assessment based on the actual costs incurred for their acquisition. At the same time, the receipt of forms of specific series and numbers is reflected upon receipt in the off-balance sheet account. 006 “Strict reporting forms” at face value or conditional valuation;

- budgetary organizations - on the debit of the account. 21 “Other expenses” subaccount 210 “Expenses for distribution” and credit account. 17 “Settlements with various debtors and creditors” subaccount 178 “Settlements with other debtors and creditors”; at the same time, receipt of forms of specific series and numbers - on the debit of the account. 04 “Strict reporting forms” (sub-accounts for financially responsible persons) for the actual costs incurred for their acquisition.

Issue. The issuance of strict reporting forms is reflected in the following accounting entries:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 08 “Investments in long-term assets”, 20 “Main production”, 23 “Auxiliary production”, 26 “General production costs”, 29 “Servicing production and facilities”, 44 “Sales expenses” and other accounts in correspondence with the credit account. 10 "Materials";

- budgetary organizations - by debit of accounts:

20 “Budget expenses” (subaccounts 200 “Budget expenses”, 202 “Expenditures from other budgets”);

21 “Other expenses” (subaccounts 211 “Expenditures on extra-budgetary funds”, 215 “Expenditures on extra-budgetary funds”); 08 “Production costs” subaccount 080 “Production costs”. In this case, the account is credited. 21 “Expenses for distribution” subaccount 210 “Expenses for distribution”. Write-off. Write-off of strict reporting forms from the accounts of financially responsible persons (write-off of specific series and numbers of forms) is reflected in the expense of the corresponding off-balance sheet account:

- commercial organizations and individual entrepreneurs maintaining accounting records - 006 “Strict reporting forms”;

- budgetary organizations - 04 “Strict reporting forms”.

The deregistration of damaged and (or) canceled strict reporting forms, if the damage or cancellation did not occur through the fault of a specific employee when storing the forms before they were transferred by the financially responsible person to the responsible executors, is reflected in the following accounting entries:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 90 “Income and expenses for current activities” subaccount 10 “Other expenses for current activities.”

The account is used as a corresponding account. 10 "Materials". At the same time, specific series and numbers of forms are written off for the consumption of the off-balance sheet account. 006 “Strict reporting forms”;

- budgetary organizations - by debit of accounts:

20 “Budget expenses” (subaccounts 200 “Budget expenses”, 202 “Expenditures from other budgets”);

21 “Other expenses” (subaccounts 211 “Expenditures on extra-budgetary funds”, 215 “Expenditures on extra-budgetary funds”); 08 “Production costs” subaccount 080 “Production costs”. The account is used as a corresponding account. 21 “Expenses for distribution” subaccount 210 “Expenses for distribution”. At the same time, budgetary organizations write off specific series and numbers of forms for the consumption of off-balance sheet accounts. 04 “Strict reporting forms.”

If damage or cancellation of strict reporting forms occurred due to the fault of persons who did not ensure the safety of strict reporting forms in storage areas, the cost of these forms is reflected in the following accounting entries:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 94 “Shortages and losses from damage to property” and a credit to one of the accounts where the cost of the forms was written off when they were issued to the responsible executors:

10 "Materials";

08 “Investments in long-term assets”; 20 “Main production”; 23 “Auxiliary production”; 26 “General production costs”; 29 “Service industries and farms”; 44 “Implementation costs”; other accounts. At the same time, the write-off of forms of specific series and numbers is reflected in the expense of the off-balance sheet account. 006 “Strict reporting forms.”

The cost of damaged and (or) canceled strict reporting forms is reflected in the debit of the account. 73 “Settlements with personnel for other operations” and account credit. 94 “Shortages and losses from damage to property”;

- budgetary organizations - on the debit of the account. 17 “Settlements with various debtors and creditors” subaccount 170 “Debtors for shortages” and a credit to one of the accounts where the cost of the forms was written off when they were issued to the responsible executors:

20 “Budget expenses” (subaccounts 200 “Budget expenses”, 202 “Expenditures from other budgets”);

21 “Other expenses” (subaccounts 211 “Expenditures on extra-budgetary funds”, 215 “Expenditures on extra-budgetary funds”); 08 “Production costs” subaccount 080 “Production costs”. At the same time, the write-off of specific series and form numbers is reflected in the expense of the off-balance sheet account. 04 “Strict reporting forms.”

As established by paragraph 26 of Instruction No. 196, the following accounting entries are compiled for the amount of VAT calculated in the presence of guilty persons from the cost of damaged and (or) canceled strict reporting forms:

- commercial organizations and individual entrepreneurs maintaining accounting records - by debit of the account. 94 “Shortages and losses from damage to valuables” and credit account. 68 “Calculations for taxes and fees”;

- budgetary organizations carrying out entrepreneurial activities - on the debit of the account. 17 “Settlements with various debtors and creditors” subaccount 170 “Debtors for shortages” and credit of the same account. 17 “Settlements with various debtors and creditors” subaccount 173 “Settlements with the budget”.

Vasily Pasevich , auditor

BSO storage

Forms must be stored in safes or specially equipped rooms where they cannot be stolen and where they will not be damaged. At the end of each working day, storage areas must be sealed or sealed.

Used documents confirming the acceptance of money (copies, counterfoils) must be saved for another 5 years. To do this, they should be placed in bags that are sealed.

https://www.youtube.com/watch?v=ytcopyrighten-GB

After the expiration of the 5-year period, the BSO that has lost its relevance is destroyed according to a protocol similar to the destruction of documentation (based on the commission’s act).

Reflection of BSO in the accounting department of an enterprise

The legislation does not provide for uniform rules for accounting forms, but the rules for their receipt by the organization and storage are set out fully and clearly.

BSO arrives at the company along with an accompanying document (consignment note), which indicates their quantity, type, series, number and other details. Admission is carried out by a commission that counts documents and checks their numbers. If no errors are found, an acceptance certificate is drawn up in free form. It is signed by the head of the enterprise and serves as the basis for accepting the BSO for accounting.

There are two types of acceptance certificates: temporary (responsible persons receive BSO for a clearly defined period) and quantitative (company employees are given an indefinite number of forms). The act must contain information about the number of papers received from the printing house, their series and numbers.

In the chart of accounts, there is a separate group for reflecting strict reporting forms. Costs associated with their printing are deducted from the income tax base. At the frequency established by law (usually once a month), an inventory of documentation is carried out.