What are the statutes of limitations?

Accounts receivable (RA) is the amount of debts and obligations of third parties to an enterprise or organization (creditor). Debtors (obligors) are obliged to repay the debt in accordance with the agreements. If this does not happen, the organization must apply to the court to protect its interests.

The statute of limitations for a loan is the period during which the creditor has the opportunity to file a statement of claim in court to protect his interests. The total value is usually 3 years. This means that after this time the debt is considered bad and cannot be paid. The countdown begins not from the moment debt obligations arise, but from the end of the deadline for repaying the debt under the terms of the contract.

To make legal proceedings go faster, it is recommended to seek help from specialists in the field of debt collection. A lawyer can act on behalf of a company under a contract. The process and final decision sometimes takes months.

It is worth noting that there are factors under which this period is interrupted. Among them are:

- the creditor went to court

- the debtor partially repaid the debt

- the debtor requested a deferment

- the debtor admitted the debt

The company must monitor debtors and monitor the status of debt. Problem debt is considered to be debt obligations that have not been fulfilled for more than 90 days.

The procedure for conducting remote sensing on video:

Accounting certificate on debt write-off and its contents 2020

An accounting certificate about the write-off of accounts receivable - a sample of such a document will help justify the increase in tax and accounting expenses. Get acquainted with the nuances of issuing a certificate using our material.

To draw up a certificate of write-off of accounts receivable (RA), you will need the following information:

- about the occurrence of debt (terms, amounts, payment terms);

- payments made and offsets carried out;

- legal periods of interruption of the limitation period;

- actions taken to collect debt, etc.

The set of documents from which this information can be obtained may include:

- agreements with counterparties on unpaid (or partially paid) transactions;

- payment documents (payments, PKO), indicating the dates and amounts of repayment of the loan;

- acts of reconciliation and offsets for debt subject to write-off;

- extracts from the Unified State Register of Legal Entities confirming the fact of liquidation of the debtor;

- court decisions indicating the completion of the bankruptcy procedure of counterparties;

- other documents (correspondence with debtors, their responses to demands for payment of debt, orders of bailiffs, etc.).

In each specific case, a separate set of documents is collected to write off the debt, depending on the situation (if the statute of limitations expires, bankruptcy and (or) liquidation of the debtor, or in connection with the write-off of the debt on other grounds established by law).

For a sample of an accounting certificate about the write-off of accounts receivable, see the material “Accounting certificate - procedure and sample writing.”

In the certificate of write-off of property, it is necessary to indicate accounting entries reflecting the nuances of its write-off:

- due to the previously formed reserve for doubtful debts; or

- at the expense of other expenses (in the absence or insufficiency of reserved amounts).

The accounts involved in writing off debt depend on:

- on the type of counterparty (60 - suppliers, 62 - buyers, 76 - other debtors, 71 and 73 - company personnel, etc.);

- method of writing off debts (63 - at the expense of the reserve, 91 - in its absence or insufficiency).

We should also not forget about the further fate of the written-off remote control - the legislation (clause 77 of the Regulations on accounting and reporting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n) requires organizing the process of subsequent tracking of the fate of the written-off remote control. It includes the following steps:

- reflection of debt on off-balance sheet account 007 “Debt of insolvent debtors written off at a loss”;

- within 5 years it is necessary to monitor the emergence of the possibility of debt collection;

- When repaying a previously written off loan, other income is recognized.

For more detailed information on accounting entries for writing off receivables, see the material “Procedure for writing off accounts receivable”.

It is possible to make any accounting entries related to the write-off of property rights on a legal basis only if, after drawing up a certificate for writing off property rights, one important mandatory document is followed by the execution of one important mandatory document - we will talk about it in the next section.

Still have questions? Ask on our forum. For example, in this thread we’ll figure out which transactions should reflect the write-off of a buyer’s prepayment that has expired.

Drawing up a certificate is necessary, but not the only condition for the full write-off of the debt. It is not a sufficient condition for reflecting all “debtor” transactions in accounting and reducing the tax base for income tax.

Moreover, if the above-mentioned certificate can be replaced by another document - an act or protocol containing the information necessary to justify the write-off of the property, then the name of the mandatory document, drawn up immediately after drawing up the certificate, is specified by law.

We are talking about clause 77 of the Regulations on accounting and reporting, approved. by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, according to which at the final stage of writing off the assets, it is necessary to issue an order (instruction) from the manager.

There are no requirements for the content of such an order in the legislation, however, when drawing it up, all aspects that allow this internal administrative document to acquire official status should be taken into account.

Among these important aspects are the following:

- design - the order form must contain at least 3 mandatory parts (heading, content and final);

The material “Orders for core activities - what are these orders?” will introduce you to the design nuances and examples of drawing up orders.

- organizational - the appearance of an order is possible only at the final stage of the procedure for writing off the property (after collecting all the necessary documents, conducting an inventory and drawing up an appropriate justification);

Find out what to pay attention to when conducting an inventory of receivables from the material “Inventory of receivables and payables.”

- accounting - only after the order to write off the property is issued, any accounting actions are possible (reflection of the written-off property in expenses, transfer of information about the written-off property to an off-balance sheet account, etc.).

A certificate of write-off of accounts receivable is a document drawn up by accounting specialists based on primary sources of information (agreements with counterparties, payment and other documents). The write-off of the asset is completed by issuing an order.

Accounts receivable are written off if, by law, it is impossible to collect them from the debtor. This happens in the following situations:

- The statute of limitations has passed. In most cases, this is 3 years from the date the debt arose. This period may be interrupted if the debtor acknowledges the debt - signs a reconciliation report, additional. agreement, will pay part of the debt. Or if the company filed a lawsuit to collect a debt. In these cases, the deadline must be started again.

- The debtor company was liquidated.

- The debtor was excluded from the Unified State Register of Legal Entities in the period after September 1, 2014 (clause 2 of article 64.2 of the Civil Code of the Russian Federation).

- The debtor is an individual declared bankrupt.

- The bailiff issued a ruling due to the impossibility of collecting the debt. This happens if the debtor does not have property with which to repay the debt, or if the debtor himself cannot be found.

- Other reasons why the law recognizes that the debtor’s obligation cannot be fulfilled. For example, all the property burned down.

This is interesting: Return of accounts receivable from previous years in a budgetary institution 2020

It is impossible to write off a debt only on the basis of a certificate. The law prescribes the preparation of a number of documents (clause 77 of the Regulations on accounting and reporting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n):

- inventory act or other document with the results of inventory calculations;

- order from the head of the company to write off debts;

- a written justification for the write-off (this is the accounting certificate about the debt write-off, it explains the essence of the accounting entries made - what amount was written off, on what basis, what documents are available for the transaction).

In tax accounting, “uncollectible accounts” are written off as expenses that reduce income tax. To do this, you need to confirm expenses with documents. The same package as in accounting will do. It is important to confirm that the debt is uncollectible. Therefore, save all documents related to the transaction with the debtor - contracts, invoices, acts, court decisions. A certificate of debt write-off will help with this and make your work easier. After all, it is easier to find documents from the list in the reference.

The form of the accounting certificate for writing off accounts receivable is not fixed by law. But all documents that are accepted for accounting must contain the following data (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- document's name;

- date of its preparation;

- company name, individual entrepreneur;

- operation description;

- amounts of debts;

- positions of those who performed the operation and are responsible for its execution;

- signatures with a transcript of the names of those responsible for the operation and its execution.

The form of certificate that the company will use must be approved in the accounting policy.

In addition to the mandatory details that give the document accounting status, the certificate must indicate the information that is required to accurately identify the debt. As mentioned above, for tax accounting, in the text of the certificate you need to provide details of the contracts on the basis of which the debts arose, invoices, acts, claims. That is, all documents that confirm the existence of the debt and the fact that it is hopeless to collect.

It would not be amiss to indicate the transactions by which the debt is written off. After all, this can be done either through the reserve for doubtful debts or through expenses. Such information will help the accountant himself to quickly track this operation in the future (for adjustments, explanations to controllers). And it’s still too early to forget written off debts. According to the law, for another 5 years it is necessary to monitor whether the opportunity to collect the debt has arisen. During this time, all written-off debts must be accounted for by counterparties on the company’s balance sheet. During the same time, all primary documents for this debt (agreements, invoices, checks) are also stored. And if the debtor nevertheless repays this receivable, you need to reflect the income. An accounting certificate on the write-off of accounts receivable - a sample can be downloaded here - in this case it will help you quickly navigate the essence of the operation and the necessary records.

Similar requirements apply to accounts payable accounting.

It also needs to be used to conduct an inventory and evaluate the grounds for write-off. The reasons for writing off accounts payable are the same as for accounts receivable. The only difference is that with regard to receivables, all actions are aimed at collecting from the debtor. And when analyzing accounts payable, they evaluate the status of the creditor - whether he is active, whether he has been excluded from the Unified State Register of Legal Entities, or whether the individual has been declared bankrupt.

The list of documents for writing off accounts payable is identical: inventory act, justification for write-off, order.

In this case, an accounting certificate is drawn up on the write-off of accounts payable - a sample of it can be drawn up on the basis of the corresponding certificate on the write-off of accounts receivable.

Only the creditor is written off as the company’s income (clause 18 of article 250 of the Tax Code of the Russian Federation, clauses 4, 7 of PBU 9/99 “Income of the organization”, approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 32n). In tax accounting, the exception is the creditor (clauses 3.4, 11, 21, clause 1, article 251 of the Tax Code of the Russian Federation):

- on taxes, fees;

- to the participants of the company with a share of more than 50% (except for loans) and to all participants in the case of debt forgiveness to increase net assets;

- to companies in which the share is more than 50% (except for loans);

- to the founders for unpaid dividends.

There is no need to take such debts into account in your income.

A certificate of write-off of receivables is needed when assigning unrealistic debts to company expenses. It should be issued along with the act of inventory of payments and the order of the manager.

This is interesting: Certificate of write-off of accounts receivable - sample, form 2020

The form of this document is not regulated; the company develops it itself and approves it in its accounting policies. Like any primary document, it must contain the mandatory details from the Law “On Accounting” No. 402-FZ. It also makes sense to enter detailed information about the details of documents for a specific debtor. This will help justify the uncollectibility of the debt for tax purposes. You can specify specific accounting entries for debt write-off.

A similar certificate is needed to write off accounts payable. To calculate income tax, this certificate is useful to confirm the amount of income and the period of its accounting.

One of the most common accounting documents is an accounting certificate of debt , as well as its write-off. Let's look at its main types and examples of filling.

Any accounting certificate about debt write-off is a kind of additional explanation in order to make the appropriate entries in accounting and write off “hanging” amounts.

The most important thing is that the mandatory form of this document is not established by law. Therefore, it is advisable to develop your own sample accounting certificate of debt and add it to the accounting policy of the enterprise. It's pretty simple. As a rule, only textual information is included in this certificate, so you should not bother with a complex structure or even a tabular form.

Keep in mind that it should include:

- full information about the debt (contract number, links to the “primary”, etc.);

- calculation of the limitation period.

Typically, an accounting certificate of debt is generated based on the results of an inventory. It can either state the existence or absence of a particular debt or contain an instruction to write it off.

The inventory is carried out on the basis of Art. 11 Law

Mandatory cases of inventory are listed in:

- paragraph 27 of the order of the Ministry of Finance dated July 29, 1998 No. 34n;

- paragraph 22 of the order of the Ministry of Finance dated December 28, 2001 No. 119n.

In practice, the following types can be distinguished:

- accounting statement of accounts receivable;

- accounting certificate of accounts payable.

The main task of accounting as part of the inventory of liabilities is to correctly determine the limitation period for a specific debt. Since this directly affects accounting, as well as the final amount of tax payments. Therefore, to avoid mistakes, keep your guide to Chapter 12 of the Civil Code. It covers the main issues of limitation of actions. Let us recall that the total period is 3 years (Article 196 of the Civil Code of the Russian Federation).

The accounting specialist generates an accounting certificate on the write-off of accounts payable on the basis of clause 18 of Art. 250 of the Tax Code of the Russian Federation. That is, based on the results of the inventory, he gives the go-ahead to include it in non-operating income when he sees that the time for a claim on it has passed.

In turn, according to the accounting certificate about the write-off of receivables, it is attributed to non-operating expenses by virtue of Art. 265 and paragraph 2 of Art. 266 Tax Code of the Russian Federation.

Here is a sample accounting statement of accounts receivable for this situation:

LIMITED LIABILITY COMPANY "Guru"

ACCOUNTING CERTIFICATE No. 24 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS PAYABLE

This debt arose under the contract for the supply of goods dated April 25, 2014 No. 63-P. Clause 3.8 of the said agreement establishes the payment deadline - until March 15, 2014 (inclusive).

The statute of limitations expires on March 13, 2020.

Chief Accountant____________Shirokova____________/E.A. Shirokova/

Here is an example of an accounting statement about accounts receivable and their write-off for this situation:

LIMITED LIABILITY COMPANY "Guru"

ACCOUNTING CERTIFICATE No. 25 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS RECEIVABLE

This receivable arose on the basis of the contract for the supply of goods dated December 15, 2013 No. 9-P. It is also confirmed by: • invoices dated December 25, 2013 No. 147 and dated December 26, 2013 No. 149; • invoices dated December 26, 2013 No. 147-SF and dated December 28, 2013 No. 149-SF.

According to the terms of the contract for the supply of goods dated December 15, 2013 No. 9-P, the payment period for the supplied goods is 5 (five) working days from the date of presentation of the specified documents. No money was received from Sfera LLC. The statute of limitations for this debt was not interrupted. Based on the inventory report dated March 30, 2017 No. 2-A and the minutes of the meeting of the inventory commission dated March 30, 2017 No. 17-INV, the receivables of Sfera LLC are subject to write-off as non-operating expenses in tax accounting. Reason: Art. 265 Tax Code of the Russian Federation.

Chief Accountant____________Shirokova____________/E.A. Shirokova/

As you can see, the above example of an accounting certificate on the write-off of receivables is drawn up in more detail. In any case, the structure of both certificates is approximately the same. Also see “Accounting statement: how to draw it up correctly.”

Companies and entrepreneurs interact with each other based on agreements concluded between them. As a result of such agreements, business entities must fulfill obligations. When either partner breaks the agreement, arrears arise. Existing rules in accounting and tax accounting require that the company write off accounts receivable with an expired statute of limitations, as well as accounts payable.

Current regulatory documents governing accounting require that it reflect information that corresponds to reality.

This is interesting: Seizure of the debtor’s property as an interim measure: stages, nuances 2020

After a certain time, the chance of returning overdue receivables is reduced to zero. Therefore, it will be incorrect to show it as part of the company’s property, since the principles of accounting reliability and compliance will be violated.

However, the company does not have the right to simply write off the debt. If accounts payable with an expired statute of limitations are written off, this leads to the company generating income, which is associated with additional taxes.

The same situation applies to accounts receivable. If it is written off without reasonable grounds, then these amounts cannot be included in expenses recognized for taxation, which means it is impossible to reduce the tax liability.

Civil law determines that after three years, debts can be considered bad, so the organization has the right to write them off.

It is imperative to take into account that the limitation period may be interrupted for reasons listed in the law. Also, do not forget about the existence of a limitation period - 10 years from the date of its occurrence.

To determine the moment from which to begin calculating the limitation period, it is necessary to take into account contracts, primary documents (invoices, acts, payment orders, etc.) on the basis of which the debt arose, as well as acts of reconciliation of mutual settlements.

The legislation provides for a procedure for the creditor to release the debtor from paying the debt. This is also the basis for debt write-off.

Cancellation of the fulfillment of an obligation by the debtor may be established by an act of a government agency. The terms of the contract may provide for cases of force majeure, when the creditor will have to write off the debt.

When withdrawing, you need to issue an order to write off receivables or payables, which is formed on the basis of an inventory report. In accounting, all entries are made on the basis of a correctly compiled accounting certificate.

There is no special form for the certificate - the company draws it up in any form, indicating the necessary data.

You need to start drawing up the document by writing down the full name of the company.

Further, on the next line the name of the form is indicated - “Accounting certificate”, after which the number and date of registration are recorded.

Below you can indicate the short name of the certificate - “On writing off accounts receivable”.

The preparation of the document begins with a list of regulations on the basis of which the write-off is carried out:

- Art. 11 Federal Law No. 402 “On Accounting”;

- Clause 27 Regulations on accounting and reporting;

- Inventory protocol (indicating its number and date of registration).

It is further indicated that, guided by these standards, a decision was made to write off receivables, indicating the name of the debtor and the amount of the debt.

The next step is to write down why the debt arose (for example, according to a contract for the supply of goods, with its details indicated). If there are any other documents that also confirm the debt, then information about them must be listed below.

Then it is advisable to indicate the terms of the signed agreement for the supply of goods - in what period and in what volume the payment should have been made. It also records whether the debt was actually repaid and to what extent.

The next step in the document is to indicate whether the statute of limitations has been interrupted. If “Yes” – then when and for what reason.

The last paragraph indicates the documents on the basis of which the decision was made to write off - the inventory act and the protocol of the inventory commission (with a record of their details), after which it is noted that the resulting debt is subject to write-off for non-operating expenses on the basis of Art. 265 Tax Code of the Russian Federation.

The document is signed by the person who prepared it (accountant, chief accountant, etc.)

There is no special form for this document; each organization can draw it up differently.

The preparation of the document begins with recording the full name of the company.

After this, on the next line the name of the form is indicated - “Accounting certificate”, after which the number and date of its creation are indicated.

On the next line you can enter a brief summary of the document - “On writing off accounts payable.”

The preparation of the document begins with indicating the fact that the company carried out an inventory, as a result of which accounts payable to the company were identified. Here you need to enter the name and details of this company.

It is also indicated that the statute of limitations for this debt has expired, which is confirmed by a completed inventory report (with its details affixed).

Then you need to write down the reason for which this debt arose (for example, under a supply agreement), and the established period for repayment of the debt is also indicated.

The next line records the full amount of debt indicating the amount of tax. Next, you must indicate the date on which the limitation period expired.

At the end of the document, it is concluded that this debt is written off and must be included in non-operating income on the basis of clause 18 of Art. 250 Tax Code of the Russian Federation.

The document is signed by the person who prepared it (accountant, chief accountant, etc.)

The article was written based on materials from the sites: nalog-nalog.ru, nsovetnik.ru, buhguru.com, buhproffi.ru.

»

Great article 0

What are the grounds for writing off debt?

The grounds for writing off debt are:

- debtor bankruptcy

- inability to locate the debtor

- death (if we are talking about an individual)

- liquidation of a company (if we are talking about a legal entity)

Also, a debt is considered hopeless if the impossibility of satisfying it is established by a resolution of the bailiff.

A large organization that collaborates with a large number of people and other companies often has debtors. Bad debts are taken into account and written off in order to reduce the tax burden on profits.

Accounting for write-offs

Accountants write off accounts receivable. The procedure follows a certain algorithm. The following actions are performed:

an inventory order is created

- certificate is filled out

- the manager creates an order

Only those debts that cannot be collected can be written off. The inventory report is accompanied by documents indicating the reality of the transaction, and papers confirming the bad debt (a bailiff's decree will do).

In accounting, the company’s responsibilities necessarily include compiling a specialized reserve for doubtful debts. The organization is required to retain debt write-off documents for 5 years. After this period of time, the debt is considered permanently written off.

Accounting certificate: details and sample writing

How to calculate maternity payments yourself {q} The guide is contained in our new article at the link.

An accounting certificate confirming the correction of an error must have:

- Name (in which the “accounting certificate” is actually written)

- Date of compilation

- Name of the enterprise on behalf of which the certificate was issued

- The content of the fact of economic activity

- Measuring the fact of economic activity in real and value terms

- The names of the positions of the subjects who are responsible for the business transaction, as well as for its correct execution

- Personal signatures of the specified subjects

As stated earlier, the certificate drawn up when writing off receivables is an explanatory certificate.

Most often, with the help of accounting statements, mistakes are corrected (for example, on depreciation charges) or the book value of fixed assets is confirmed.

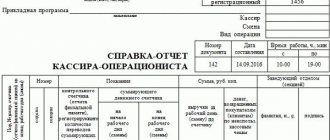

To write off a debt, you will need documents confirming the receivables. To do this, first of all, you will need to correctly determine the amount of overdue debt. For this purpose, the company carries out an inventory, based on the results of which the identified receivables are reflected in the act. An act is drawn up in form INV-17.

An inventory is carried out based on the order of the manager. The manager will also need to issue an order to write off receivables. The basis for issuing an order will be an inventory act and an accounting certificate.

As noted above, as a basis for an order to write off receivables, you will need to draw up an inventory report, as well as an accounting certificate. For convenience, we provide a sample of the latest document.

Let's look at how to correctly draw up an accounting certificate on a unified form using current examples. The accountant of the NPO Dobrovol, when reconciling the results for January 2020, revealed that inventories in account No. b/n in the amount of 15,000 rubles were capitalized twice. To correct the error, a corresponding entry was made in the accounting records and an accounting certificate was issued.

In January 2020, the NPO Dobrovol spent 300,000 rubles to hold a celebration on the occasion of the company’s anniversary. Costs are considered representative. Such costs can be taken into account as part of the non-taxable base, but not more than 4% of labor costs.

The organization pays quarterly income tax in the amount of 24% (OSNO). For the first quarter of 2020, personnel costs amounted to 1,500,000.00 rubles.

NPO “Dobrovol”, under agreement No. 1 dated 01/01/2017, supplied LLC “Buyer” with products worth 450,000.00 rubles. According to the agreement, Buyer LLC had to transfer funds to the NPO’s current account by 02/28/2017. However, the payment has not been received to date.

Tax accounting for write-offs

When maintaining tax records, creating a reserve for doubtful debts is considered an optional procedure. If there is no reserve, then the debt is written off for non-operating expenses. If it is available, then the write-off of the receivables is carried out at the expense of the reserve.

Only companies that calculate their income tax liability using the accrual method have the opportunity to write off debt that cannot be collected as expenses. Organizations that keep records in another way cannot do this.

Carrying out a debt check

The company must regularly check the data when creating reports. As a rule, verification is performed during a debt inventory. Obtaining information is necessary to assess the property and financial situation, determine the amount of available cash, and take measures to control debts.

Before drawing up most reports, a debt review is carried out. It is worth noting that a rapid increase in receivables indicates unreliability of counterparties or a significant increase in unnecessary expenses.

During the inspection, an information paper about the remote control is drawn up. It can be compiled for internal or external use. The document is created and filled out according to the sample or in free form.

How to write off a “creditor”

Let’s assume that on March 30, 2020, Guru LLC carried out an inventory of settlements with counterparties, as a result of which an accounts payable to Septima LLC was identified in the amount of 145,000 rubles. The statute of limitations on it expired on March 13, 2020.

Let’s assume that on March 30, 2020, Guru LLC carried out an inventory of settlements with counterparties, as a result of which the 2013 receivables of Guru LLC were identified due to non-payment of goods delivered to it in the amount of 300,000 rubles

|

Functions of help about remote sensing

The certificate for internal use is used for reporting. With its help, the current situation of the organization is monitored and assessed. Paper intended for external use is attached to the statement of claim and is used in legal proceedings.

The paper can also be drawn up at the request of other persons and government bodies. The data can be used to evaluate existing assets. The certificate is often requested by insurers and other creditors.

When using the sample, no problems with drawing up the document arise. An experienced accountant, having access to all the data, takes very little time to compile a certificate.

Legal basis

The legislation does not provide recommendations on the choice of a specific form of certificate to reflect the PD. When compiling, you can use different samples depending on your goals and objectives. Most often, when drawing up a document, the INV-17 form is used. Ultimately, the paper should reflect detailed information about the loan agreement, the reporting period, the amount of obligations and other nuances.

The certificate is always compiled by the organization itself for internal or external use. An organization can use its own sample certificate, which is created from scratch or built on the basis of an existing form.

What is

In the process of drawing up this certificate, the company representative must show recognized and unrecognized debt. The first group includes debts that can be confirmed through a completed reconciliation statement, which can subsequently be used to confirm the information shown in the accounting records, even if the company does not use accounting standards as a basis and does not conduct regular annual audits.

In the vast majority of cases, the reconciliation act represents a special card of the account from the point of view of a certain party to the drawn up agreement. This document must indicate detailed information about the transaction, including the content of the transaction being carried out and the specific document number, as well as details of various papers confirming the existence of a specific debt.

The drawn up reconciliation act must necessarily contain the signatures of all officials of the enterprise who participated in the process of its execution, and the document itself must additionally be sealed with the seal of the organization. If we compare the reconciliation act with the act drawn up in form No. INV-17, then in this case the key point is the need to fill out the reconciliation act on both sides, and therefore it contains accounting data of both parties to the concluded agreement.

Unified form N INV-17

Classification of certificate forms

Typically, classification is carried out based on the purpose of the paper. The document can be used in the following cases:

- to create swelling

- to provide information about current receivables for other persons

- during legal proceedings

A plaintiff who attaches a certificate of confidentiality to his claim significantly increases the likelihood that the court will satisfy the requirements specified in the claim. The certificate acts as one of the documents that confirms the existence of debt obligations of the defendant to the plaintiff.

Regardless of the purpose of creation, the universal form INV-17 can almost always be used for compilation. The template is freely available, so anyone can use it.

Types of document

There are many types of certificates about the presence or absence of debt. Depending on which organization issues it, where such a certificate may be required, the forms and details of the document differ. Let's look at the most popular of them.

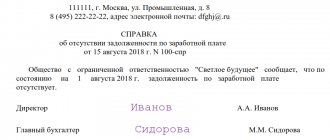

By salary

Despite the fact that labor legislation enshrines the employer’s obligation to pay employees on time, delays in wages and the formation of debt on them are quite common phenomena. Most often, such delays are irregular and short-term, and employees soon receive the payment due to them.

But it also happens that workers wait for their money for several months and even six months and a year. In such a situation, they may decide to leave the organization, and in order to receive the money they have earned, they must file a complaint with the labor inspectorate, the prosecutor's office or the court. Then they will need a certificate of arrears of wages, which must be given to them free of charge upon request; the employer has no right to refuse to issue it.

The document is drawn up in any form; the chief accountant and the head of the enterprise are responsible for the correctness and completeness of the information in it. It is their two signatures that should be on the certificate. In addition, it should contain the following information:

- information about the organization (name, details, address);

- information about the employee (full name, position, salary, total period of work at the enterprise and the period when there was no payment);

- amount of actual debt.

Certificate of wage arrears to employees

Unpaid wages must be collected even when the enterprise has gone bankrupt and is in the process of liquidation. In this case, the package of documents along with a certificate of debt must be sent to the bankruptcy arbitration manager, who will add the employees to the register of creditors.

For taxes

The applicant can receive one of two types of certificates from the tax authorities:

- on the fulfillment of the obligation to pay taxes;

- about the status of tax payments.

The first type of certificate can be considered a document confirming the presence or absence of tax debt, but it will not contain information about its amount. The status of settlements as of the current date for all types of taxes, fees, fines and penalties will be reflected in the second certificate.

A certificate of the presence (absence) of debt issued by the tax office will contain the entry: “has an unfulfilled obligation...” or “does not have an unfulfilled obligation.” The form of the certificate is established by order of the Federal Tax Service. According to the regulations, the document is issued free of charge within ten days after registration of the taxpayer’s request. The following may refuse to issue a certificate:

- if the application sent via telecommunication channels is not signed with an electronic signature or it is not confirmed;

- if the applicant does not have a power of attorney from the organization;

- if the text of the application is impossible to read.

Certificate from the tax office confirming payment of taxes

Such a certificate may be needed to verify counterparties, when participating in tenders or to obtain a loan.

Documents for obtaining a certificate of no tax arrears are described in this video:

For accounts receivable

An enterprise often has accounts receivable when buyers, customers and other persons - debtors - owe it money. The size of this debt is determined as a result of the work of the inventory commission. The inventory procedure is formalized by an inventory act in form No. INV-17 and a certificate to the act, which, in essence, will be a certificate of the presence (absence) of receivables.

Compiled in the context of synthetic accounting accounts, a certificate of settlements with buyers, suppliers and other debtors and creditors is made in two copies, one is stored in the accounting department of the organization, the other is kept by the inventory commission.

Sample certificate of accounts receivable and payable

The document is a mandatory document in accounting, and is drawn up annually to write off bad receivables. Can serve as evidence in court if a creditor files a lawsuit to recover funds from the debtor.

For overdue debt

Overdue loan debt is also a fairly common phenomenon among bank clients. If a borrower, due to the deterioration of his financial situation, does not pay his loan for a long time, he develops overdue debt, which spoils his credit history. All banks now submit lending data to a common database on the basis of which the NBKI (National Bureau of Credit Histories) operates.

NKBI data is publicly available. If the borrower decides to take out another loan, the bank can check his solvency by looking at his credit history. Seeing the presence of overdue debt there, the credit institution will refuse such a client, even if in fact the old loan is already closed. NKBI databases are often out of date. Therefore, after repaying the overdue debt, it is better for the borrower to take such a certificate.

The document is issued by the bank that issued the loan. The certificate is called “Confirmation of the absence of overdue debt on the borrower’s loan” and is drawn up according to standard form No. 10-040.

For the court

Almost any correctly executed certificate of the presence or absence of debt can serve as evidence in court. For example, during a court hearing of a debt collection case, the defendant can prove that he has no debts with the help of such a certificate.

For loan debt

The loan debt is the amount of the remaining debt. There are times when it needs to be confirmed. For example, a citizen took out a long-term mortgage loan from a bank to purchase a home.

Due to the fact that he is an officially working citizen paying personal income tax, he has the right to receive a property deduction. The package of documents required to obtain it may include a certificate of absence of loan debt to confirm that payments have been made.

Certificate of absence of loan debt

For accounts payable

Accounts payable are closely related to accounts receivable when it comes to obligations of the same individuals to each other. Accounts payable are subtracted from accounts receivable if counterparties have counter debts.

Therefore, the previously described inventory act in form No. INV-17 and the attached certificate of settlements with creditors and debtors reflect both types of these debts. Documents may be required, for example, during enterprise reorganization, merger or change of owners.

Before the budget

You can obtain a certificate from the tax office about the status of settlements with the budget. It will reflect information on all types of taxes, fees, fines, penalties, contributions for which the taxpayer may be in debt to the budget, as well as on amounts. In this way, this certificate differs from other tax certificates, which contain only a record of the presence or absence of debts on taxes and fees.

As in the previous example, a certificate is often required when participating in tenders, checking counterparties, concluding contracts and taking out loans. The form of both such certificates, which can be obtained from the tax office, was approved by Order of the Federal Tax Service dated December 28, 2016 No. ММВ-7-17/ [email protected] The document preparation period is 5 working days.

For utility bills

Not everyone pays utility bills in good faith; for some, this is a sore subject. However, it is often necessary to confirm the absence of utility debts in various situations. Most often this is necessary when making real estate transactions. Potential buyers or tenants want to receive proof of the absence of utility debts, so that later they do not have to pay off other people’s debts.

This certificate is not mandatory for the sale or privatization of housing; it is done at the request of the purchaser, therefore its form is not strictly regulated. Its recommended form can be called the EIRTs-22 form. You can obtain the document at the Unified Settlement Center, where people most often pay for housing and communal services.

Rent arrears (certificate)

The video below will tell you what a certificate of absence of debt for housing and communal services is and how it is made:

https://youtu.be/PbaeLytuT_o

In the bank

A certificate about the presence (absence) of debt in a bank is often needed for another bank. Therefore, it is best to immediately confirm any closed loan with such a certificate.

Thus, the client will have in his hands all the evidence of the absence of overdue or outstanding debt on loans. The procedure for issuing these certificates is not established by law, so various banks themselves set the amount of the fee for it and the timing of receipt.

Rules for issuing a certificate

Among the basic design rules are:

indication of information about the amount of obligations, the name of the creditor and debtor and the period of occurrence of the debt

- filling in information based on inventory results

- use of a single template if the organization has approved a specific template

- paying attention to the purpose of the paper

For internal use, a document may be drawn up that additionally includes information about accounts payable. Such paper will allow you to obtain more data about the financial condition of the company, its assets and debts.

Results

A certificate reflecting information about accounts receivable can be drawn up for presentation to the court - as a document approving the list of unfulfilled obligations of the counterparty - or generated in the order of reporting by a business entity to a higher-level structure. In both cases, unified forms can be used to draw up a certificate.

You can learn more about working with accounts receivable and payable in the articles:

- “Keeping records of receivables and payables”;

- "Ratio of accounts receivable and accounts payable."

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Instructions for compilation

In order to properly issue a certificate, it is advisable to draw it up according to a ready-made sample. The template contains individual thematic blocks. The following information must be reflected in the paper:

detailed name of the debtor

- reason for accrual of debt (provision of services, sale of goods)

- Date the debt arose

- name of the papers damaging the existence of the debt (act of work performed or transfer of goods)

- amount of debt

The details of the persons responsible for drawing up the certificate are also indicated. If necessary, an additional column is created in which special tags or individual comments can be placed. In addition to signatures, the organization’s seals are affixed to the certificate.

Information sources

The debt repayment procedure must be accompanied by the execution of relevant documents: an inventory list, an order from the head of the company and a written justification. An accounting certificate (AC) is a free-form form containing detailed information about the business operation and the debts that are being written off.

An enterprise has the right to independently develop and approve a stationary form in its accounting policy or use a standard appendix to INV No. 17.

The BS reflects the following information:

- Debtor's name.

- The document providing the basis for the debt.

- Amount of liabilities.

- Beginning, extension, restoration and end of the limitation period.

- List of collection actions.

- Justification for write-off.

- Responsible person.

When paying off debts, it is important to prepare documents confirming this.

To fill out the form, the accounting service will need the following documents:

- Certificates of work performed, services rendered, invoices.

- Invoices.

- Contracts.

- Offsets.

- Payment documents.

- Invoices issued, received, offers.

- Official correspondence, other documentary evidence from the debtor about the existence of the creditor.

- Acts of reconciliation of mutual settlements.

- Office notes.

- Extracts from the unified register of legal entities.

- Litigation Forms.

- Acts of government bodies.

- Resolutions of the FSSP, etc.

For each specific situation, sources of information for the formation of a BS are determined individually. For example, a company may have several mutual settlement documents (invoices, contracts, bills, etc.), but there may be a debt confirmed by only one form.

The main task of the certificate is to correctly determine the timing of repayment of obligations in accounting in order to comply with the norms of current legislation, generate transparent information about the financial and property status of the debtor, and draw up correct reporting in accordance with the requirements of IFRS.

The document can be used as a self-generating entry that explains a particular entry. A correctly completed form with certain details will serve as proof of correctness before the inspection authorities and in court. An explanatory note from a specialist with a detailed description of the business transaction may be attached to the form.

The basic criterion for writing off receivables from accounting accounts according to the accounting certificate is the end of the limitation period, calculated according to the criteria of Chapter 12 of the Civil Code of the Russian Federation. The generally established period of demand for unfulfilled obligations is three years. In exceptional cases, the time period may be increased or shortened.

The certificate is compiled on the basis of various documents

The need to form a BS when writing off a creditor by including it in non-operating income is dictated by the requirements of clause 18 of Art. 250 of the Tax Code of the Russian Federation, for receivables, the amount of obligations increases other expenses under Art. 265, 266 code.

Written justification of the generated entries in the accounting and tax registers allows you to defend your opinion when checking the correctness of the formation of the taxable base by Federal Tax Service inspectors.

How to get

The certificate is usually compiled by a senior economist or financial director of the company. An organization can use third-party help from specialists when creating reports and drawing up certificates of remote sensing.

Within the company, the paper is filled out when reporting or at the request of management. Controlling and supervisory authorities do not have the right to require the provision of a certificate of PD. If desired, the organization provides paper on a voluntary basis.

Features of filling in a legal dispute

In the certificate that will be used in court proceedings, it is recommended to additionally indicate the following information:

- detailed details of your own company

- date of compilation

- manager's signature

Sometimes additional information about the destination (name of the court) is added to the paper for the court. Signatures of members of the commission that conducted the inventory may also be required.

The certificate duplicates the information from the reporting, providing data in a compressed form. A correctly drawn up paper will help you count on receiving a positive decision in a dispute related to debt collection.

Large companies are recommended to have their own lawyer on staff in order to resolve debt problems as quickly as possible. The statement of claim must clearly reflect the organization's requirements and refer to available documents confirming the debt to the plaintiff.

Supporting papers for going to court

Only a certificate of confidentiality is not enough for the court to take the plaintiff’s side. The following documents must be submitted along with the claim:

- contracts concluded with the counterparty (supply of goods, provision of services, etc.)

- invoices

- signed acts

- invoices

It is documents confirming that the company provided certain services to the other party or transferred goods that play a critical role in debt collection.

After receiving a positive result, the federal bailiff service is responsible for the execution of the court decision. If the debtor refuses to fulfill his obligations under the contract, it is recommended to try to resolve the issue in court as quickly as possible. It is advisable that all actions be carried out within 1 year, when the debt is still considered problematic and not hopeless.

Certificate of ownership is an important document that is required for both internal and external use. Drawing up a document does not require much time. There are no strictly regulated samples, but it is recommended to use common and unified templates.

Top

Write your question in the form below

Certificate of accounts receivable and payable (sample)

Almost all enterprises in their direct economic activities are constantly faced with the concept of “debt”.

It comes in two varieties:

- creditor;

- accounts receivable

In the first case, the organization has debts to other companies and institutions, for example:

- before counterparties under concluded agreements for which the statute of limitations has not expired;

- for unpaid taxes and fees to various government bodies;

- for enforcement proceedings initiated by court decision, etc.

If it is not repaid within the documented period of time, then it becomes overdue, which sometimes entails quite unpleasant consequences: fines, penalties, penalties, etc.

If for ordinary contractual obligations their amount can be agreed upon in correspondence or negotiations, or reduced in court on the basis of articles of the civil code, then penalties awarded by government bodies are larger and are rarely reduced.

If, on the contrary, someone must pay money to the company, then in the accounting department such debt is listed as a receivable. Legal entities, individual entrepreneurs, citizens can recover it in court or achieve voluntary repayment through negotiations, sending letters, claims, pre-arbitration reminders and other ways and methods that do not contradict the law.

Firms, regardless of their organizational and legal form, must know reliably about accounts receivable and payable in order to function normally and conduct their business activities. This importance is manifested in the fact that you can inadvertently miss the statute of limitations for large sums of money and lose the right to collect them. This could lead to significant losses for the company. However, the court can restore the missed deadline, but if the reasons are considered to be quite valid.