Why is it necessary to write off accounts receivable?

Accounts receivable are included in the list of assets that will soon become a source of cash for the enterprise.

But if there are delays in transfers from debtors, the debt may become uncollectible, that is, impossible to collect. The existing accounting procedure establishes that the reflection on the balance sheet of an enterprise of overdue debts with an expired statute of limitations distorts reporting data.

After all, in fact, this asset will no longer bring any benefits for the enterprise. This means that in order to comply with the principle of reliability, the organization must monitor the timing of existing debts of debtors and promptly identify those that are overdue or impossible to collect.

Attention! The deregistration of accounts receivable is specified in the Accounting Regulations. In this case, special procedures are used that must be followed, since the inspectors of the Federal Tax Service very carefully check these points.

Not all debts of debtors can be removed from the company’s assets. The legislation establishes certain criteria for such situations. First of all, the statute of limitations on the debt must expire. You can withdraw a receivable if it receives the status of impossible to collect. For example, the debtor was liquidated and deregistered as a legal entity.

In what time frame can this be written off?

In order to recognize a receivable as overdue with the end of the claim period, according to the Civil Code of the Russian Federation, three years must pass. It is this period of time that is allotted to the creditor in order for him to take all available measures to collect the debt.

You definitely need to decide at what point you should start calculating the three-year period. It is stipulated that if the contract specifies the period for repayment of the obligation, then the limitation period must be calculated from the next day after it.

When the exact dates for making payments are not provided for in the executed agreement, the limitation period begins to be determined from the moment the creditor announces his claims to the debtor.

You also need to remember about such a point as interrupting the limitation period. If the debtor partially transfers the amount of the debt, or interest on it, or draws up and signs a reconciliation act with the organization, then the calculation of the limitation period is postponed to the next day after one of the listed events.

Thus, interruption of a given period can occur many times. However, at the level of laws, the limitation period is fixed, which is 10 years.

According to it, interruption of a claimable debt is possible until 10 years have passed from the moment the obligation arose; after that, the receivable in any case will be recognized as expired and will need to be removed from the organization’s balance sheet.

Attention! In addition, do not forget that the collection of receivables must be carried out in the reporting period when the statute of limitations expired. Excluding it from the composition of the property at the time of carrying out or issuing an order for write-off will be considered incorrect. It is desirable that all these dates coincide, so you need to constantly monitor this information.

From what point do you count the deadline?

The procedure for determining the moment from which the limitation period must be counted is fixed in Art. 200 Civil Code of the Russian Federation.

This is important to know: Child support debt after 18 years: statute of limitations

The first step is to carefully study the terms of the contract with the counterparty. If the deadline for transferring money for a product (service) is clearly defined, the statute of limitations must be calculated from the first day of delay. For example, under the terms of the contract, the buyer is obliged to pay for the goods until November 30, 2017 inclusive. If payment is not received by the specified date, the supplier will begin to calculate the limitation period from 12/01/2017. The supplier must write off such debt as expenses in the fourth quarter of 2020 (the statute of limitations will expire on November 30, 2020).

If the contract does not contain specific payment terms, the situation becomes more complicated. To start counting the statute of limitations, you need to issue a formal demand to the counterparty asking you to pay the debt. The period will be calculated from the date of submission of the request. In this requirement, the creditor can give the debtor additional time to repay the debt, then the statute of limitations will be calculated from the moment the additional period expires.

The statute of limitations for claims for overdue time payments (interest for the use of borrowed funds, rent, etc.) is calculated separately for each overdue payment (clause 24 of the Resolution of the Plenum of the Supreme Court dated September 29, 2015 No. 43).

The procedure for writing off overdue accounts receivable in accounting

Step 1. Conducting a debt inventory

Accounting requires that the information provided be reliable. This, in turn, is achieved through periodic inventory taking. In addition, this procedure will also need to be followed when issuing an order from the manager.

You might be interested in:

Writing off accounts payable with an expired statute of limitations instructions for an accountant

When carrying out an inventory of accounts receivable, it is checked according to concluded contracts and by reason.

It is recommended that you first reconcile with all debtors. However, on the other hand, it must be remembered that the signing of the act by the debtor automatically resets the counted period, and it must be counted again.

Each amount is analyzed for doubtfulness. At the same moment, you can decide whether to create a reserve to cover existing doubtful and overdue debts.

Step 2. Drawing up an inventory report

The results of the procedure are formalized in the form of an act. There is a standard form INV-17 for it, but its use is not strictly mandatory. The company can develop its own form for personal needs.

However, such a document must include a list of mandatory indicators. In the act, the responsible person reflects all verified debts, and not just those with an expired statute of limitations.

It needs to reflect:

- Name of the debtor company;

- Analytical accounting account;

- The total amount of debt incurred;

- The amount of debt for which the statute of limitations has expired.

Attention! The commission that carried out the inventory must draw up the act in two copies. In this case, one is sent to the accounting department, and the second remains in the hands of the commission members.

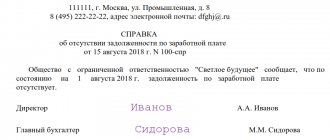

Step 3. Preparation of an accounting certificate

The person responsible for working with debtors needs to analyze the results of the inventory, and for debt with an expired deadline for filing claims, issue an accounting certificate about writing off accounts payable.

In this document you need to include:

- The name of the business entity with which the debt was identified;

- At what time and for what reason did it arise;

- Amount of debt obligations;

- The date on which the limitation period ended;

- Action on debt (write-off).

The act and accounting certificate are submitted to the director of the organization to make a decision on the debt.

Step 4. Confirmation of the date and amount of debit

In order to confirm the date and amount of the debt to the regulatory authorities, a simple act is not enough.

It is necessary to prepare copies of primary documents:

- Concluded purchase agreement (provision of services);

- Certificate of completion;

- Packing list;

- Transfer and acceptance certificate;

- Payment documents;

- Signed reconciliation statements, etc.

Step 5. Drawing up an order to write off debt

There is no special form for this document. As a rule, to draw up an order to write off debt, the responsible person uses the company’s letterhead.

The text must reflect the following points:

- Grounds for making a decision on write-off (Article 196 of the Civil Code of the Russian Federation, created an inventory act, accounting certificate);

- The decision to write off the debt, indicating its amount;

- Instructing the responsible person to note this action in tax and accounting records;

- Appoint a person who will be responsible for compliance with the document.

Sample order to write off debt

The order is signed by the director. Based on it, the accounting department makes a write-off.

Step 6. Reflection in accounting

Reflecting write-offs on accounting accounts has several nuances. The main one is whether or not there was a reserve for doubtful debts.

| Debit | Credit | Operation |

| A provision for debts was not created in the company: | ||

| 91 | 60, 62, 76 | Accounts receivable written off as expenses |

| The debt reserve has been formed | ||

| 63 | 60, 62, 76 | Accounts receivable were written off within the created reserve |

| 91 | 60, 62, 76 | The amount of debt exceeding the reserve amount is written off |

| Regardless of the write-off method, the debt must remain in off-balance sheet account 007 for the next 5 years. This is due to the fact that over time the debtor’s condition may improve and he will repay the debt. | ||

| 007 | – | The withdrawn debt is reflected in the off-balance sheet account |

| 50, 51 | 60, 62, 76 | Receipt of debt payment for previously written off debt |

| 60, 62, 76 | 91 | Income includes the amount of debt that was previously written off as overdue |

| – | 007 | The repaid amount of debt is written off from the off-balance sheet account |

You might be interested in:

Postings for the sale of goods and services: examples of which accounts are used

Procedure for writing off

In order to carry out the write-off procedure, there must be grounds for it . To do this, an inventory is carried out in the company, and a document is drawn up that describes the reasons why the debt should be canceled.

Inventory at the enterprise is carried out according to the established procedure , that is, at specific periods of time. To remove expired short notice, the head of the enterprise introduces a new procedure for conducting inventory. The order for its implementation indicates the assets and liabilities that are to be checked by the accounting staff.

The result of the completed inventory is an act of completed verification of settlements with creditors in form No. INV-17 . It includes the total and overdue debt for each legal entity. Accounting accounts are included in the text of the act. Based on them, information about each debt is entered.

For expired debt obligations, an accounting certificate confirming the write-off of the debt is attached to the inventory report . It states the reasons for the formation of the debt (for example, under a purchase and sale agreement for goods and materials, due to delays in their shipment and settlement). The certificate also includes the contract, the limitation period for the obligation, and the details of each creditor company.

This is important to know: Limitation period for arbitration cases

Based on the inventory report and the certificate prepared by the company’s accounting department, the director of the organization signs the order. Such an order is considered the basis for writing off accounts payable.

Important! Step-by-step instructions for writing off - 4 sequential actions: direct inventory, preparation of an inventory act for debts, drawing up an accounting certificate, issuing an order from the director to write off the debt. The last stage is making appropriate amendments to the accounting documentation.

The procedure for writing off overdue accounts receivable in tax accounting

The process of writing off overdue receivables differs depending on how the debt arose.

Step 1. The buyer made an advance payment, but the products did not arrive

In such a situation, the amount of debt must be written off as other expenses. It does not matter whether a reserve for doubtful debts has been formed in the company or not. The Ministry of Finance adheres to this position in its letter.

Step 2. The seller delivered the goods, but did not receive payment

In such a situation, there may be two options for writing off the debt:

- If a reserve has not been created in the company, then the debt must be written off for other expenses as stated in the Tax Code of the Russian Federation;

- If a reserve was created, then when the debt is written off, the reserve decreases. In this case, there is no need to check whether this amount participated in its initial creation. There is no reduction in the base when determining income tax.

Determining the write-off period

The debt must be discharged within the same period when the statute of limitations expired. In this regard, it is recommended to regularly take inventory of debts in order to identify expired debts in a timely manner.

Otherwise, there will be a need to adjust tax reports. Another reason for regular work in this direction is to ensure that accounting and tax data in this area coincide.

Determine what to do with VAT

When removing a debt, working with VAT on it depends on the method of its formation:

- If the seller delivered the goods, but did not wait for payment for it, then when writing off such a debt, you do not need to do anything with VAT. The fact is that the tax on this shipment has already been assessed and paid, and it cannot be reimbursed from the budget.

- If the buyer made an advance payment but did not receive the goods, the situation is ambiguous. Thus, the Ministry of Finance believes that the company should restore the amount of VAT that was previously deducted during the period of debt write-off. The department expressed this position in its letter. However, the Tax Code contains a list of cases when it is necessary to carry out restoration, and debt write-off is not included in it. However, it is quite possible that this point of view will have to be proven in court.

Writing off debt based on the statute of limitations: accounting and tax accounting

Accounting entries are reflected in debt accounts in correspondence with the income account as of the date of the inventory:

| D 60 (62, 76) – K 91.1 |

| D 91.2 – K 60 (62, 76) or, if a reserve was created: D 63 – K 60 (62, 76) D 007 (for 5 years the amount is listed on the balance sheet) |

In tax accounting, a creditor increases taxable income, and a debtor can reduce the income (profit) tax base, but must be justified and documented.

Main mistakes when writing off accounts receivable

When writing off overdue accounts receivable after the statute of limitations expires, some errors may be made:

- When registering the write-off, all required forms were not completed. Thus, the responsible person must draw up an inventory report, an accounting certificate, as well as an order to write off the debt. In addition, the fact of debt formation must be confirmed by a formalized agreement, accounting documents (certificate of completed work, delivery note, invoice, etc.).

- The debt period was calculated incorrectly. It starts counting again if a partial payment of the debt has been made or interest has been repaid, a reconciliation act has been signed, or the debtor has sent a letter asking to defer its repayment, etc.

- The VAT on the written off debt was recorded incorrectly. Depending on who the debtor is - the supplier or the buyer, you must either leave everything as is or restore the tax.

Documentation of writing off unreal receivables as losses

Due to the fact that tax officials very carefully check written-off debts, the organization should take care to formalize all transactions performed with the established documents.

Tax law establishes the need to audit obligations, both incoming and outgoing, systematically, and not only during the reporting period. Based on the results of the audit of debts, authorized employees must draw up an inventory report and fill out the corresponding document.

After the audit, the information is transferred to the head of the company for review. It is he who makes the decision to begin the procedure for writing off a bad debt and issues an order justifying this action.

The basis for a write-off is an inventory act and an accounting certificate. The certificate must disclose all information about the debt being written off, starting from the contract concluded between the counterparties and ending with the reason for the occurrence of unrealistic debt.

In addition to the above documents, the accountant should supplement the package of documents with signed reconciliation reports, invoices, invoices and other documentation characterizing the relationship between the company and its debtor.