O deferred income tax is the most important among the entire set of factors that every accountant has to evaluate and calculate when preparing a tax return for income tax and determining the difference between the amount of tax in accounting and in tax accounting. In our article, let's take a closer look at the essence of deferred income tax and the procedure for calculating it.

Accounting for income tax calculations

Temporary differences as a basis for deferred tax

SHE and IT as parts of deferred tax

Permanent differences, permanent tax liabilities and permanent tax assets

Conditional expense and conditional income for income tax - what is it?

How is the current income tax formed?

Temporary differences as a basis for deferred income taxes

If income (expenses) are recognized both for accounting and tax accounting purposes, and the difference arises only in the time of their recognition, such a difference is called a temporary difference.

The resulting temporary differences result in deferred income taxes.

Deferred income tax is the amount of tax calculated by multiplying temporary differences by the tax rate. This tax is “deferred” into the future, that is, it will affect (either decreasing or increasing) the amount of tax payable in future reporting periods.

Accounting distinguishes between deductible temporary differences and taxable temporary differences. The former influence the deferred tax in the direction of increase, the latter – in the direction of decrease.

Deductible differences arise when expenses are recognized later for tax accounting purposes, and income earlier than for accounting purposes.

Examples of deductible differences:

- the amount of fixed assets depreciation in accounting is greater than in tax accounting;

- tax loss that will be carried forward;

- income (expenses) arising from the difference in exchange rates based on calculations in conventional units.

Taxable differences are income and expenses that increase accounting profit in the current reporting period and taxable profit in subsequent reporting periods.

Examples of taxable differences:

- the amount of bonus depreciation with fixed assets is taken into account for tax accounting purposes and is not included in the accounting records;

- customs duties are included in direct expenses for tax accounting purposes and are written off in proportion to the goods sold in accounting;

- brokerage services are included in direct expenses for tax accounting purposes and are written off in proportion to the goods sold in accounting.

https://youtu.be/j_eG72VUTkU

Line 2450 “Change in deferred tax assets”

This line reflects information on changes in the amount of deferred tax assets recognized in accounting in accordance with the requirements of PBU 18/02 (clause 24 of PBU 18/02).

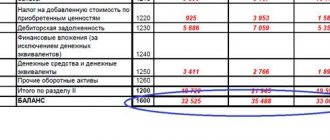

Accounting data used when filling out line 2450 “Change in deferred tax assets”

The value of the indicator of this line (for the reporting period) is determined as the difference between debit and credit turnover on account 09 “Deferred tax assets” for the reporting period (Without taking into account credit turnover on account 09 in correspondence with account 99 “Profits and losses”). If the difference turns out to be negative, this means that more deferred tax assets were written off for the reporting period than accrued.

The deferred tax asset upon disposal of the asset for which it was accrued is written off to account 99 in the amount by which, according to the legislation of the Russian Federation on taxes and fees, the taxable profit of both the reporting period and subsequent reporting periods will not be reduced (paragraph 4, paragraph 17 PBU 18/02).

In order to exclude the impact of changes in deferred tax assets on the net profit indicator, when calculating this indicator on the Statement of Financial Results, it is necessary to add the positive difference between debit and credit turnover in account 09 (increase in deferred tax assets) to the accounting profit indicator (line 2300 “Profit (loss) ) before tax"), and subtract the negative difference (reduction of deferred tax assets) from the accounting profit indicator. Accordingly, the resulting negative difference should be indicated in line 2450 “Change in deferred tax assets” in parentheses, and a positive difference without them.

Line 2450 “Change in deferred tax assets” of the Income Statement = Turnover on the debit of account 09 - turnover on the credit 09

The indicator in line 2450 “Change in deferred tax assets” (for the same reporting period of the previous year) is transferred from the Statement of Financial Results for this reporting period of the previous year.

Example of filling out line 2450 “Change in deferred tax assets”

Indicators for account 09 in accounting:

rub.

| Turnover for the reporting period (2014) | Sum |

| 1 | 2 |

| 1. By debit of account 09 in correspondence with account 68 | 47 000 |

| 2. On the credit of account 09 in correspondence with account 68 | 21 000 |

Fragment of the Financial Results Report for 2013

| Explanations | Indicator name | Code | For 2013 | For 2012 |

| 1 | 2 | 3 | 4 | 5 |

| Change in deferred tax assets | 2450 | 27 | 85 |

Solution

The increase in deferred tax assets for the reporting period is 26 thousand rubles. (47,000 rubles - 21,000 rubles).

A fragment of the Income Statement in Example 6.16 will look like this.

| Explanations | Indicator name | Code | For 2014 | For 2013 |

| 1 | 2 | 3 | 4 | 5 |

| Change in deferred tax assets | 2450 | 26 | 27 |

SHE and IT as parts of deferred income tax

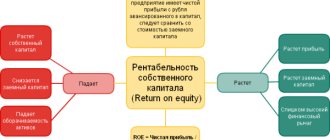

Deferred tax asset (DTA) is that part of deferred income tax that should reduce income tax in subsequent reporting periods. The amount of the deferred tax asset is determined by multiplying the deductible temporary differences by the income tax rate.

Deferred tax liabilities (DTL) are that part of deferred income tax that leads to an increase in tax in subsequent reporting periods. The amount of deferred tax liability is determined by multiplying taxable temporary differences by the income tax rate.

Constant differences, PNO and PNA

Permanent differences are income and expenses that are taken into account in accounting, but are not taken into account in tax accounting. These include:

- the amount of excess of actual expenses reflected in accounting records over expenses according to the norms adopted for tax purposes;

- expenses for the gratuitous transfer of property;

- a loss that is carried forward but which, after the lapse of time, cannot be accepted for tax purposes.

When permanent differences arise, a permanent tax liability (PNO) or a permanent tax asset (PTA) arises.

PNO, like PNA, is calculated by multiplying the constant difference by the income tax rate.

PNO leads to an increase in income tax in the reporting period.

PNA leads to a reduction in income tax in the reporting period.

PNO and PNA are recognized in the reporting period in which the permanent difference arises.

Examples of the occurrence of VNR

Temporary tax differences arise as a result, for example, of using different methods of calculating depreciation for accounting purposes and determining income tax: the amount of accrued expenses in accounting will be less than in tax accounting.

Another case: the use of bonus depreciation in tax accounting. Or in the case of applying different rules for reflecting interest paid by an organization for providing it with funds (credits, borrowings) for use for accounting and tax purposes.

There are other transactions that result in temporary differences.

Example 1. Depreciation

In January 2020, the organization accepted a fixed asset for accounting; it was put into operation with a cost of 600,000 rubles (including VAT 20% - 100,000 rubles).

In accounting, the method of calculating depreciation is determined - linear, in tax accounting - non-linear. The useful life of the OS is 5 years. For profit tax purposes, the organization classified the fixed asset into the fourth depreciation group, for which the monthly depreciation rate in a non-linear manner is 4.8 (clause 5 of Article 259.2 of the Tax Code of the Russian Federation). Depreciation begins to be accrued in accounting and accounting records from February 2019 (see table 1). The taxable temporary difference will be 15,666.67 (24,000 – 8,333.33) rubles. Because of the difference, tax profit becomes less than accounting profit (profit according to NU < Profit according to accounting), so the organization has a deferred tax liability in the amount of 3,133.33 (15,666.67 × 20%) rubles. The accountant needs to make the following entry: Debit 68, subaccount “Income Tax” Credit 77 “Deferred tax liability”

- 3,133.33 rubles, the amount of IT is reflected (15,666.67 rubles × 20%).

Example 2. Depreciation bonus

In January 2020, the organization accepted a fixed asset for accounting; it was put into operation with a cost of 1,320,000 rubles (including VAT 20% - 220,000 rubles).

In accounting, the method of calculating depreciation is determined - linear, in tax accounting it is also linear. The useful life of the fixed assets is 5 years, the depreciation rate is 0.01667. The organization's accounting policy for the third to seventh depreciation groups provides for the use of a depreciation bonus in the amount of 30% of the original cost. The initial cost is 1,100,000 (1,320,000 – 220,000) rubles. Depreciation begins to be accrued in accounting and accounting records from February 2019 (see table 2). The taxable temporary difference will be 324,522 (330,000 + 12,782 – 18,260) rubles. Due to the temporary difference, tax profit becomes less than accounting profit (profit according to NU < profit according to accounting), so the organization has a deferred tax liability in the amount of 64,904.4 (324,522 × 20%) rubles. The posting in this case will be as follows: Debit 68, subaccount “Income Tax” Credit 77 “Deferred tax liability”

- 64,904.4 rubles, the amount of IT is reflected (324,522 rubles × 20%).

Example 3. Cash method

An enterprise uses the cash method for tax purposes; the goods were delivered to the counterparty by the organization in February 2020 in the amount of 540,000 rubles (including VAT), and the money for it was received only in April 2020.

In accounting, the organization reflected income from the sale in February 2020, while in tax accounting, these income will be shown only in the income tax base for the first half of 2020 (see Table 3). The taxable temporary difference in February 2020 will be 450,000 rubles. Because of it, the tax profit becomes less than the accounting profit (profit according to NU < profit according to accounting), so the organization has a deferred tax liability in the amount of 90,000 (450,000 × 20%) rubles. Debit 68, subaccount “Income Tax” Credit 77 “Deferred tax liability”

– 90,000 rubles, the amount of IT is reflected (450,000 rubles × 20%).

Table 1. Occurrence of IRR due to depreciation

| Conditions | Accounting | Tax accounting |

| Initial cost excluding VAT | 500 000 | 500 000 |

| Depreciation rate | 0.0166 (1/60 month) | 0,048 (4,8/100) |

| Amount of accrued depreciation | 8333,33 (500 000 × 0,0166) | 24 000 (500 000 × 0,048) |

Table 2. The occurrence of IRR due to depreciation bonus

| Conditions | Accounting | Tax accounting |

| Initial cost excluding VAT | 1100000 | 1100000 |

| Depreciation start date | February 2020 | February 2020 |

| Depreciation rate | 0.0166 (1/60 month) | 0.0166 (1/60 month) |

| Calculation of depreciation premium | 0 | 330 000 (1100 000 × 0,0166) |

| Amount of accrued depreciation | 18 260 (1 100 000 × 0,0166) | 12 782 ((1 100 000 – 330 000) × 0,0166) |

Table 3. Occurrence of IRR if the cash method is used

| Conditions | Accounting | Tax accounting |

| Initial cost excluding VAT | 450000 | 450000 |

| Recognition start date | February 2020 | April 2020 |

Table 4. Start date of depreciation

| Conditions | Accounting | Tax accounting |

| Initial cost | 200 000 | 200 000 |

| Depreciation start date | February 2020 | March 2020 |

| Method of calculating depreciation | Linear | Linear |

| Depreciation rate | 0.0166 (1/60 month) | 0.0166 (1/60 month) |

| Amount of accrued depreciation in February 2020 | 3320 (200 000 × 0,0166) | 0 |

Conditional expense and conditional income for income tax - what is it?

Conditional income (expense) is the amount of income tax calculated according to accounting data.

The deemed income tax benefit is the product of the amount of the accounting loss and the income tax rate.

The notional expense, in contrast to the notional income tax income, is the product of the amount of accounting profit and the income tax rate.