Fill out the payment form with the Federal Tax Service

The main sources of law regulating the procedure for filling out payment orders in the Federal Tax Service and other budget structures are:

- Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n;

- Regulation of the Bank of Russia dated June 19, 2012 No. 383-P.

These documents do not change often, but this does not mean that filling out payments, especially those related to paying taxes, is easy and simple. This procedure has a large number of nuances. They can be predetermined, in particular, by the method of filling out the payment order.

Thus, the Federal Tax Service of Russia gives taxpayers the opportunity to generate payments using an online tool developed by the department, which is available at: https://service.nalog.ru/. Let's learn how to use it.

How to fill out a payment order point by point

The details of the future payment in this document are filled in in strictly designated places. A large amount of information in this document is provided in coded form. The encoding is universal for all participants in the process of non-cash financial transfer:

- banking organization;

- recipient;

- payer.

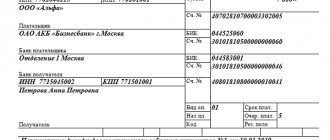

This versatility allows you to introduce automation when recording financial transactions for electronic document management. This instruction is relevant for the current version of the payment order, developed by the Bank of Russia in 2012. The settlement document is filled out on the OKUD form 0401060, the new form is approved by Appendix No. 2 of Regulation No. 383-P. and filled in as follows:

Field 3. Document number. According to the internal document flow in the organization, an ordinal value is assigned. When an individual applies, the number can be assigned by the banking organization independently. The number of characters should not exceed six.

Field 4. The date of sending the payment is indicated in the format DD.MM.YYYY. If you fill out a payment order electronically, the sending time is formatted automatically.

Field 5. Type of payment. Fill in how payment will be made (by mail, electronically, telegraph). It must be left blank when choosing another payment method. When using a client bank, a coded value developed by the bank is entered into the field. .

Field 6. Amount in words. The first letter must be capitalized. Everything is written without abbreviations, at the end the phrase “rubles” is written. Then the number of kopecks is indicated using numbers, after which “kopeck” is written. If the number of kopecks is zero, they can be omitted.

Field 7. Amount in numbers. Rubles are separated from kopecks by a comma. If there are no kopecks, the “=” sign is used. The presence of other characters will make the payment order unusable.

Field 8. Payer. The short name of the legal entity is indicated. persons of the organization, individuals indicate the full last name, first name and patronymic. The type of activity, address, and legal status are indicated in brackets. The person's name and organization name are separated from the location by a "//" (maximum 160 characters).

Field 9. Payer's current account, consisting of 20 digits.

Field 10. Name of the payer's bank, either in full or abbreviated with its location.

Field 11. BIC. Identification code of the payer's bank. It is taken in accordance with the “Handbook of the BIK of the Russian Federation”.

Field 12. Correspondent account, except for those cases when the payer is served by the Bank of Russia or its territorial divisions.

Field 13-17. Above, by analogy, we fill in information about the recipient, bank and account.

Field 18. The number 01 is entered - the type of operation indicating the payment order.

Field 19-20. Leave blank. Only if there were no special instructions from the bank.

Field 21. Payment queue, enter a number from 1 to 6. For example: 3 - contributions, taxes, wages, 6 - payment for purchases (Article 855 of the Civil Code of the Russian Federation).

Field 22. UIN (unique accrual identifier). It consists of 40 characters for legal entities, 25 for individuals. If it is missing, then 0 is written.

Field 23. This is a reserve field and must not be filled in.

Field 24. Purpose of payment. The name of the service or product purchased for which payment is made is indicated here. To be on the safe side, you can specify VAT.

Field 43. Client's stamp, if the payment form is filled out in printed form.

Field 44. Signature. It must correspond to the sample provided when opening an account with a financial institution.

Field 45 is intended for bank marks such as stamps and signatures.

Field 60. Payer’s INN, consisting of 12 characters for legal entities and 10 for individuals.

Field 61. Recipient's TIN.

Field 62. Date of receipt of the payment by the banking organization. This is done by a financial institution.

Field 71. Date of debiting money from the account, filled in by the bank.

Important! Paragraphs 101-110 are filled out only if the payments are intended for customs authorities or the tax service.

Field 101. The payer status is indicated using a special code designation in the range of numbers from 01 to 26 (Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

Payers of insurance premiums are recommended to use the following codes to fill out a payment order:

- code "01" - legal. persons making payments to individuals. persons;

- codes “09”, “10”, “11”, “12” - individual entrepreneur;

- code "13" - physical. faces.

Individual entrepreneurs must indicate whether they pay contributions for themselves or for their employee.

Field 102-103. The payer's checkpoint (9 digits), if there is one, and the recipient's checkpoint cannot begin with two zeros.

Field 104. Budget classification code (BCC).

Important! Since 2020, changes have occurred, and now the recipient of contributions is not the Pension Fund, as before, but the Federal Tax Service, with the exception of cases of contributions to the Social Insurance Fund for injuries. Starting in December, new BCCs must be indicated. You can find out the details of your Federal Tax Service here.

Field 105. OKTMO code.

Field 106. Payment basis, consisting of two special characters. Below are the main codes for filling out field 106 in the 2020 payment order.

| Situation | Code |

| Tax payments (insurance contributions) of the current year | TP |

| Voluntary repayment of debts for expired tax periods in the absence of a requirement from the tax inspectorate to pay taxes (fees, insurance contributions) | ZD |

| Repayment of debt at the request of the tax inspectorate for payment of taxes (fees, insurance contributions) | TR |

| Repayment of debt according to the inspection report | AP |

| Repayment of debt under a writ of execution | AR |

Field 107. Shows the frequency of tax payments: per month, per quarter, per year.

Field 108. Payment basis number. Enter the number of the document on the basis of which the payment is made. If the values of TP or ZD are indicated in the previous paragraph, then “0-zero” must be entered here.

Field 109. Document date. If the value 0 is specified in paragraph 108, then 0 is also entered here.

Field 110. Remains empty following changes in legislation in 2020.

Important! From 2020, any corrections to the payment order are not allowed.

Sending a payment order to the Federal Tax Service online: step-by-step instructions

The algorithm for filling out the online payment order form on the website of the Federal Tax Service of Russia involves step-by-step data entry. Let’s consider what they should be, having agreed that we need to pay the simplified tax system according to the “income” scheme.

You can familiarize yourself with a sample of filling out a payment order for paying under the simplified tax system in the article “Sample payment order for the simplified tax system “income” for 2015-2016.”

Immediately after clicking on the specified link, a page will load where you need to enter the Federal Tax Service code. Let this be Inspectorate of the Federal Tax Service No. 1 in Moscow. Its code is 7701. Enter it and click “Next”.

After this, you must indicate the municipality in which the taxpayer operates, i.e., indicate the municipal governing body. For example, if the payer interacts with the Federal Tax Service in the Basmanny region, you should select the “Administration of the Basmanny municipal district”.

Next, select the document type “Payment order”. After this, indicate the payment type “Payment of tax, fee”.

Then we fix the KBK. It depends on the specific type of tax. For the simplified tax system paid under the “income” scheme, the KBK 182 1 0500 110 is set for 2020. It must be entered into the online form without spaces. The next stage of forming a payment invoice is determining the taxpayer status. If we are talking about paying the simplified tax system:

- Individual entrepreneurs indicate status 09;

- legal entity - status 01.

Let’s agree that our company is an LLC, so we choose status 01.

Then we record that the payment relates to current payments - TP. Here is the quarter for which tax is paid under the simplified tax system.

The next point is to indicate the date the payer signed the declaration. If you pay the simplified tax system quarterly, you can skip it, since the declaration under this taxation regime is submitted once a year.

Next, we fix the order of payment - 05.

After this, indicate in the online form:

- INN and KPP of the payer;

- company name;

- the name of the bank in which the company has a current account;

- details of the company's current account;

- BIC of the credit institution where the current account is opened;

- the payment amount in full rubles (if the preliminary amount is in kopecks, we round it up or down).

Click “Next” and once again check the correctness of the entered data on all points. After that, click the “Generate payment order” button.

The system will immediately offer to download the corresponding document in RTF format. It will already contain such necessary details as:

- INN, KPP, details of the Federal Tax Service specified in the online form;

- correct name of the payee;

- OKTMO, type of payment.

The finished payment slip can be used as a sample for filling out the one that is generated in the “Bank-Client” system of the taxpayer when paying the tax independently. It can also be printed and taken to the bank so that the cashier of the financial institution can carry out the transactions necessary to pay the tax based on the data provided.

Read more about online services for filling out payment orders in the article “Where can I fill out a payment order online (2015)?”

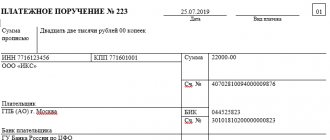

Example of filling out a payment order in 2019-2020: sample

Let's show a sample of filling out a payment order using a conditional example.

Let’s say the organization ICS LLC needs to pay personal income tax for January 2020 in the amount of 22,340 rubles.

About the deadlines established for paying personal income tax on wages, read the material “When to transfer income tax from wages?” .

The specific features of the order will be:

- payer status - code 02, since the payer organization is a tax agent;

- KBK for personal income tax - 18210102010011000110;

- the basis of the payment is the TP code, since this is a payment of the current period;

- The frequency of payment is MS.01.2020, since this is a payment for January 2020.

You can fill out a payment order - 2020 on our website.

How to fill out a payment form online on the Federal Tax Service website

This service distinguishes three types of taxpayers:

- individuals;

- Individual entrepreneurs, heads of peasant (farm) enterprises or individuals engaged in private practice;

- organization (legal entity).

Service capabilities

On the website, individuals can register a personal taxpayer account, which provides the following opportunities:

- timely receive information about accrued and paid tax payments, the presence of overpayments or debts;

- pay taxes and fees through banks that have entered into an agreement with the Federal Tax Service;

- fill out the 3-NDFL declaration online and send it to the Federal Tax Service in electronic form, as well as track the status of the verification;

- contact the tax office without a personal visit.

Reasons for filling out payments online

The online service has significant advantages for all types of businesses. Its use does not require special reasons or additional resources in the software. There is no need to install additional programs to generate payments. All you need is Internet access, and you can access the site that provides this service from any device, including portable electronic gadgets.

The main condition remains to avoid mistakes when creating a payment order. After all, the consequences of mistakes will have to be corrected, incurring financial losses in the form of penalties or fines.

What to pay attention to to eliminate errors in payments:

- Correctness of the specified data about the payee;

- Details of the recipient's account in the federal treasury;

- KBK, OKTMO tax or insurance premiums that are paid.

You should also check the correctness of the payer’s details (TIN, KPP, name of organization) for identification in the future when crediting tax amounts to taxpayers’ personal accounts.

Step-by-step instructions for filling out a payment order on the Federal Tax Service website

Let's look at how to fill out a payment order online 2020 on the tax website using a specific example.

Let’s say Romashka LLC pays income tax for the 4th quarter of 2018. First, go to the service of the Federal Tax Service website https://service.nalog.ru/payment/ and select the type of taxpayer and type of document.

Next, enter the data of the Federal Tax Service and the OKTMO code. If the Federal Tax Service Inspectorate and OKTMO are located in the same region, then the necessary codes can be easily determined by address.

Now it’s time for the payment details. BCC is determined automatically after entering the type and name of payment.

Next, fill in the payment details – the basis and amount of the payment, the tax period. The system determines the payer status and order of payment itself.

And finally, the payer's details. We have filled out all the necessary information and can now generate a payment order online with the Federal Tax Service.

Now you can save it, print it and pay through a bank operator, or use it as a sample in the Bank-client system.

How to pay taxes for individual entrepreneurs on the tax website, read here

For small business news, we have launched a special channel on Telegram and groups on Vkontakte, Facebook and Odnoklassniki. Join us! There is even Twitter.

Your browser does not support iframes!

What is a service for filling out payment orders?

The service for filling out payment slips online is available to both organizations and private businessmen, including notaries and lawyers. However, it is not necessary to have a personal account on the site. However, registration will give you a set of additional functions:

- Receive timely notifications about tax payments, debts or overpayments;

- Communicate with the Federal Tax Service regarding calculations and certificates via the Internet. Receive and send notifications, clarifications, requests, reconciliations, etc.

- Register and deregister an organization at the location of a separate division;

- Send documents for registration in the Unified State Register of Legal Entities, receive an extract from the register;

- Monitor the execution of requests, clarifications, etc.;

- Receive decisions from the Federal Tax Service online.

All this is available to legal entities and individual entrepreneurs with a personal account. But registration is not required to issue a payment. Any company or individual will be able to easily pay their taxes and contributions, duties and fees, both for themselves and for third parties. Payment is also available online, and you can also print the payment slip.

Despite the fact that the service involves the automatic entry of many indicators, to create an order, still prepare the following data:

- Details of your company: INN/KPP, official name (or “Limma” LLC for short) or full name of the individual entrepreneur;

- Your tax and OKTMO number. If you don’t know the latter, it doesn’t matter, it’s enough to imagine in which district or locality the enterprise is registered, then by scrolling the cursor on the server while filling out the payment form, you can find your OKTMO;

- It is good to understand what you want to pay and for what period: tax, contribution, penalties, as well as current payment, debt, Federal Tax Service requirement, etc.;

- It’s good to know the BCC of the payment, but it’s not necessary. When filling out the fields: type, type and name of the translation, the service itself will indicate the required code;

- Transfer amount;

- BIC of your bank and current account. The last detail is relevant if we are not talking about deductions through a bank operator. With this method, you do not need to indicate your current account.

If all the details are written correctly, the program will generate a payment invoice. Otherwise it will give an error message.

Federal Tax Service website

On the main page of the portal www.nalog.ru there is a publicly accessible “Pay taxes” service.

The section consists of three subsections:

- individuals;

- individual entrepreneurs;

- legal entities.

The service allows you to generate a tax receipt, print it, or make an online payment.

Individuals

The section for individuals consists of four subsections:

- Personal Area;

- payment of taxes;

- state duty;

- filling out a payment order.

Generating receipts for payment of individual entrepreneur contributions: step-by-step instructions

Our individual entrepreneur Apollo Buevy decided to pay the insurance premiums himself, without turning to an accountant for help. I went to the Federal Tax Service website, started filling out receipts and got confused in the KBK. We decided to help him and other individual entrepreneurs and compiled step-by-step instructions for filling out payment documents.

You can fill out payment orders and receipts through the “Pay Taxes” service on. We select the document we want to fill out. The payment order is intended for payment from your current account, while we fill out a receipt for payment through a bank cash desk or terminal. However, it will be possible to pay for it using the State Services portal or online banking with a bank card.

Click the “Next” button and you will be taken to the form for selecting the type of payment.

We need a tax group “Insurance premiums”. Having selected the desired group, we look for the required contributions to fill in the name and type of payment. If we fill out a document for pension contributions, then select the following lines in the drop-down menu.

If we need to fill out a receipt for payment of contributions to the Compulsory Medical Insurance Fund, then select the following lines: Next, we proceed to filling out the payer’s data. You don’t have to specify the index; it will be automatically added after filling out the address fields. Fill in the remaining details of the payment document.

https://youtu.be/4WTmlOPdcTU

Please note that individual entrepreneurs do not have periods for contributions such as a month or a quarter, so you can set the tax period to a year.

Although no matter what you put, it won’t be a mistake, the main thing is to indicate the year correctly.

Then we indicate the full name and tax identification number. And let's move on to payment. Here you can choose a payment method. If you choose cashless payment, you will be offered a payment method. If you choose cash payment, receipts will be generated. Now you can go to the bank and pay receipts1. Please note! Payment of pension contributions in the amount of 1% on income over 300 thousand rubles is made according to the same BCC that is indicated above in the receipt.

There is no separate BCC for payments for 2020!

More information about fixed contributions of individual entrepreneurs can be found on the page. You can calculate contributions for an incomplete year using.

Personal Area

Users can create a receipt for paying taxes on the tax website through the taxpayer’s personal account. When logging in, the amount to be paid is immediately displayed on the screen.

The following actions are available to the user:

- view details;

- pay now.

If you click on the “details” button, a decryption of the debt will appear on the screen.

When you select a specific charge, a page will open with a description of the object and a formula for calculating the amount of the charge.

If a citizen discovers an error in the charges, he needs to report this to the inspectorate. This can be done online by clicking on the appropriate button.

Help: To confirm the changes made, you must attach supporting documents.

If there are benefits for paying mandatory contributions, you should inform the Federal Tax Service about this.

If all charges are correct, then you need to click “pay” to go to the page with available methods of transferring funds. There are two options available in your personal account:

- online payment;

- generating a receipt.

When paying with a receipt, you need to click “Generate payment documents”, after which they will be automatically saved on your PC in PDF format. They can then be printed for presentation to the bank.

Useful: The debt will disappear from the website page 10 days after the funds are transferred.

Payment order

Menu On this website you can easily fill out or write out a Payment Order form online and print it.

- Download Payment order in Word format

- Download Payment order in Excel format

- Payment order in Word format

- Download Payment order in PDF format

Below you can fill out the Payment Order for free and print it, while the program itself will calculate VAT if necessary and fill out all the columns of the form. Saved forms Register and get the opportunity to save forms (for auto-filling) of payment order forms you created. After registering and saving the form, a list of your saved forms will appear in this place.

Alternative option

Debt verification is available on the government services portal. To do this, you need to log in and go to the “services” section, and then select “Tax debt”.

To obtain information, you need to provide payer information and TIN.

Data on accrued but not paid fees will be displayed on the screen. On the portal you can immediately transfer funds using a bank card. When the money is credited to the Federal Tax Service, the user will receive a notification in their personal account.

Online methods for generating payment documents for the payment of taxes and government duties - a convenient service. Using the Federal Tax Service website, you can easily pay any fees, without commission, which allows you to save money and time on visiting a bank or post office. If you are unable to receive notifications, you can fill them out yourself.

https://youtu.be/exd_0VV1GRI

Basic information ↑

Nowadays, creating a payment order online is not difficult. There are a lot of different online services for this. Many of them are equipped with tips on how to correctly fill out individual fields of a payment order.

As usual, such sites take into account all the latest legal requirements. To create a payment order online, you just need to correctly indicate all the data by filling out the fields of the document.

If you have difficulty filling it out, you can find a service with tips. Some online programs offer a completed example to review.

After specifying all the information, the service system independently generates a payment order. The user can only print the document or send it to the bank online.

What it is

A payment order is a payment document. With its help, the owner of a bank account gives the bank an order to transfer a certain amount to a specific recipient.

With the help of payments the following operations can be carried out:

- payment for the supply of goods, provision of services or performance of work;

- transfer of payments to the budget of the Russian Federation or to extra-budgetary funds;

- repayment of loans and interest on them;

- advance payments;

- making periodic payments;

- transfer of funds in other cases provided for by law.

Creating a payment order online involves drawing up a payment order using special Internet programs. The payer can create a payment document by filling out an online form.

The necessary data is entered into it. After this, the system generates a finished document, the user can print it and use it for its intended purpose.

As a rule, the online payment order form consists of blank fields divided into four blocks:

- payment order;

- payer details;

- recipient details;

- budget payment details.

The last group of details is filled in when transferring payments to the budget system of the Russian Federation. When making other payments, these details are not filled in.

Advantages of this payment method

Creating a payment order online has undoubted advantages. Firstly, there is no need to use a bank-client system or specialized programs.

Secondly, you can create a payment card at any time and anywhere, as long as you have access to the Internet. This method is also convenient for those users who do not have sufficient experience in filling out payment documents.

Most services have hints that pop up or are written in the appropriate fields. This allows you to fill out the payment form correctly without any experience in creating such documents.

Where is the best place to make a payment order online? It is unlikely that it will be possible to answer this question in monosyllables. There are quite a lot of different resources.

When filling out tax payments, it is best to use the primary source, namely the Federal Tax Service service. But you can use other sites.

This makes it very easy to fill out a payment order on the Service-online website. Here in each field there is an entry in gray font.

The only drawback is the inability to autofill data using the specified BIC code. Some fields are filled in automatically when entering the BIC on the Formz.ru website.

Partial autofill is also available on Operbank.ru. Some resources allow you, after registration, to save all forms created online in your personal archive and print them at any convenient time.

Almost any online program flags filling errors and does not allow you to continue filling out the document until the error is corrected. Thanks to this, the risk of incorrect document creation is minimized.

Current standards

Since 2012, a payment order has been issued in accordance with the requirements given in Bank of Russia Regulation No. 383 dated June 19, 2012.

According to the standard, the transfer of funds, regardless of the presence/absence of an account, is carried out by the bank only if there is an approved standard form of non-cash payments and only by order of the client.

Of all the forms of client orders, the most popular is the payment order. The Bank of Russia allows banks to perform the function of originating orders.

Due to this, the task of individuals in transferring funds is simplified. However, responsibility for the accuracy and completeness of the data lies solely with the client.

Before signing a payment order, the client is obliged to check the accuracy of the details. When filling out a payment order for payments to the budget and extra-budgetary funds, you must take into account the Orders of the Ministry of Finance.

Since January 1, 2014, Order of the Ministry of Finance No. 107n dated November 12, 2013 has been in force.

According to its provisions, the presence of blank details in a payment document is unacceptable. If it is impossible or unnecessary to fill in individual details, the value “0” is entered.

How can an individual entrepreneur fill out a payment form on the tax website for free?

Filling out a payment form online on the Federal Tax Service website is a modern, fast and free way to prepare an order to pay taxes, fees, contributions and other payments without leaving your home.

Individual entrepreneurs are exempt from mandatory accounting. This means that they do not need to spend money on an accountant’s salary and the purchase of specialized programs.

But you will have to make mandatory tax payments to the budget and settle accounts with counterparties in any case. How to do this, and preferably for free?

A special service from the Federal Tax Service allows you to partially solve this problem and make a payment online on the tax website without registering in your personal account or paying: it is provided completely free of charge.

The service is intended for preparing payment documents for tax payments (payment of fees, contributions, taxes, duties and other types of payments to the state budget).

We offer step-by-step instructions on how to create a payment order on the Federal Tax Service website quickly and reliably.

Fill out a payment order online 2020 on the tax website for an individual for LLC

Important

Select the file by clicking on the button: The Internet resource “Service-Online.su” is designed for free and free use. This site will never contain viruses or other malware.

Our task is to simplify your work and try to help you to the best of our ability. This site is a free service designed to make your work easier. The website offers a large number of forms that are convenient to fill out and print online, services for working with texts, and much more. The materials on the site are for reference purposes only, are intended for informational purposes only and are not an exact official source. When filling out the details, you must ensure their accuracy by checking them with official sources. To fill in the details (name and account), click the auto-fill button Account. No. Recipient Bank BIC Find and Specify the BIC. To fill in the details (name and account), click the auto-fill button Account. KBC and UIN for taxes paid by individuals are also excluded. If you do not know the required budget classification code to which you plan to make a payment, the system will allow you to fill in the name of the tax manually and then select the desired direction of payment (the desired BCC) from the additional directory. Important: Once you have decided on the codes, you should select the payment type:

- Basic tax;

- Penalties on taxes or contributions;

- Penalties.

The entire filling system is divided into blocks, which cannot be accessed until all required details are filled out and verified.