A sample payment system for the simplified tax system for income minus expenses for 2020 is drawn up according to the instructions of the past year. It must be provided no later than the appointed date. Legislation affects both individual entrepreneurs and various organizations. However, for all simplifiers, this document will be filled out individually. Immediately before entering payment information, you will need to recalculate the simplified tax system, and only after that you can enter information into the payment form.

To recalculate for the entire tax period, you do not have to do it yourself. You can use the services of free services that accept the entered data, after which the system automatically calculates the amount that needs to be paid. After filling out and checking, the service offers to send the data to the tax service via the Internet. It converts information into electronic format and then delivers it to the desired address. This can be done with any type of tax, regardless of the purpose of the transaction.

Payment deadlines according to the simplified tax system for 2020

Entities carrying out financial transactions under the simplified concept are required to submit a completed declaration at the end of the current semester. In December, it is necessary to recalculate all payments and pay the final tax amount, taking into account all previous advance payments made for the entire reporting period.

According to the regulations of the Tax Code of the Russian Federation, art. 346.21 paragraph 7, the deadline for the payment of final contributions for entrepreneurs and commercial companies, are completely different. In the first case, the final tax according to the simplified tax system is paid until April 30, and in the second - until March 31. Sometimes you can extend these deadlines: if they fall on a general day off. For example, this factor was taken into account in 2020, so the dates were moved to 05/03/2018 for individual entrepreneurs, and to 04/02/2018 for companies.

The advance payment period is the same for everyone - and is paid at the end of the period until the 25th of the next month. In 2020, all payments will be made according to OKUD 0401060 in accordance with the 2020 regulations.

Deadlines for payment of the simplified tax system “income” in 2019-2020

Tax for 2020 - no later than:

- for organizations - 03/31/2020;

- IP - 04/30/2020.

Advance payments in 2020 must be transferred no later than:

- for the 1st quarter - 04/27/2020 (postponed from Saturday, April 25);

- 2nd quarter - 07/27/2020 (postponed from Saturday, July 25);

- 3rd quarter - 10/26/2020 (postponed from Sunday, October 25).

Tax for 2020 - no later than:

- for organizations - 03/31/2021;

- IP - 04/30/2021.

The principles for filling out a payment order have not changed in 2020.

Before filling out a payment order, check whether you have correctly calculated the amount of advance payments under the simplified tax system with the “income” object. Get trial access to the ConsultantPlus system and see a calculation example for free.

How to correctly enter payment information in a simplified form for 2020

Before you start filling out the document, you must carefully study all the points to avoid mistakes:

- The name of the recipient is the personal details of the tax authority where the funds are transferred.

- Recipient identification number, which represents the attributes of the tax service.

- The name of the regional UFC.

- Taxpayer and recipient account codes.

- Taxpayer identification details.

- Full name and place of residence of the entrepreneur.

- In the KBK column you need to write the encodings approved by the Ministry of Finance of the Russian Federation No65n dated July 1, 2013.

- In the order of the simplified tax system for income, you need to enter the code 18210501011011000110, and for the simplified tax system for expenses, the same code is prescribed, only the tenth character is 2, and the minimum tax is also paid using this code.

- Next, you need to indicate the payer status, where you enter 01, and individual entrepreneur - 09.

- In the next column you need to indicate 01, indicating the code in accordance with the resolution of the Russian Bank of June 19, 2012.

- The procedure for the payment transaction is indicated in accordance with civil law according to the simplified tax system, where code 5 is entered.

- Then enter the twenty-digit payment identifier noted in the order sent by the tax service. If the payment is carried out arbitrarily, in the absence of any regulations, then put 0.

- OKTMO. The code specified by the payer in the payment application, established by a generally accepted classifier, is written here.

- Basis of payment. The two-digit code of the current payment is entered in this column.

- Next, you need to enter the date of the payment at the end of the year - GD.00.2019, and if this is an advance, then you will need to enter the letters KV (example: KV.11.2019).

- In the line “document date” enter the last number for tax payment.

- To pay a quarterly tax or debt, enter 0 in the column.

- In the very bottom line of the simplified form, you need to enter the specific payment that needs to be made.

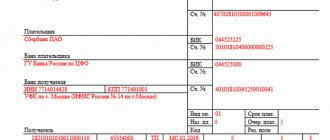

For a clear example, below is a sample simplified payment order for 2020:

Purpose of payment of the simplified tax system “income minus expenses”

You can calculate all contributions and prepare payment slips using this service. The first month is free.

Starting from 2020, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment;

From February 6, 2020, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

Taxes, unlike contributions, are calculated and paid rounded to whole rubles.

Purpose of payment: Advance payment for the simplified tax system for 2020.

Payer status: Payer status: 01 – for organizations / 09 – for individual entrepreneurs (if paying their own taxes).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

See also: Free simplified taxation tax declaration calculator

Using this online service, you can also generate payment slips, keep tax records on the simplified tax system and UTII, 4-FSS, RSV-1, submit any reports via the Internet, etc. (from 150 rubles/month). 30 days free. With your first payment (via this link) three months free.

| Payment under the simplified tax system in 2020 | KBK |

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fine | 182 1 0500 110 |

Let’s assume that an organization with the object “income minus expenses” lost the right to the simplified tax system in September 2020. Following the results of 9 months of 2016, it reached the minimum tax according to the simplified tax system. It must be transferred no later than October 25th. You need to deposit money to KBK 182 1 05 01050 01 1000 110. It is this KBK that is valid for the minimum tax under the simplified tax system in 2020.

Now let’s imagine that the organization has finalized the simplified version by the end of the year. She has reached the minimum tax and must pay it no later than March 31, 2020. You need to transfer the money to another KBK - 182 1 0500 110. The new KBK from 2020 is valid both for the regular tax on the object “income minus expenses” and for the minimum “simplified tax”.

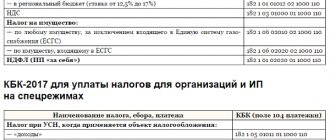

In other words, in 2020, organizations with the object “income minus expenses” used two different BCCs. One for regular tax under the simplified tax system, the other for the minimum tax. Starting from 2020, the situation is changing - the BCC for such payments will be uniform. Below is a table of the BCC according to the simplified tax system for 2017.

If you find an error, please highlight a piece of text and press Ctrl Enter.

The payer of the simplified tax system can be business entities of different status - individual entrepreneurs or legal entities. The payer status is indicated by a two-digit identifier code and is entered in field “101” of the payment order. Thus, a legal entity is designated by the code “01”, an individual entrepreneur – by the code “09”.

In field “8” of the payment slip the name of the payer is indicated in accordance with the registration documents. For individual entrepreneurs, information about the location (full address) is also indicated - the full name and address are written sequentially, without a separate line break, but must be separated by the “//” symbol.

Another feature of filling out payment slips that you should pay attention to is the indication of the checkpoint code. This requirement applies exclusively to organizations (it does not apply to individual entrepreneurs), the checkpoint is indicated in field “102” of the payment.

- in field “18” – enter the type of payment being made – “01”;

- in field “21” – indicate the order of payment execution “5”;

- in field “22” - if there is a requirement from the fiscal authority, indicate the 20-digit UIN code, if not, enter “0”;

- in field “24” - indicate which payment is being transferred - tax for the year, minimum tax or advance payment (for the corresponding period);

- in field “101” – payer status. Legal entities enter code “01”, individual entrepreneurs – code “09”;

- in field “104” - enter the KBK identifying the type of payment. BCC indicated when paying the simplified tax system “income minus expenses” in 2019:

advance payment, tax, minimum tax – 18210501021011000110,

- fine – 18210501021013000110,

- penalties – 18210501021012100110;

- “TP” – payment of tax, advance payment for the current tax period,

- tax based on the results of 2020 - “GD.00.2018”, 2020 - “GD.00.2019”);

- when making payments in advance – put “0”,

The simplified tax for the entire 2020 must be paid:

- organizations - no later than 04/02/2018;

- for individual entrepreneurs - no later than 05/03/2018.

- was withdrawn from the bank;

- contained incorrect bank details of the Russian Treasury (treasury account number and name of the recipient's bank).

- at the end of 2020, a loss was received (i.e., expenses are greater than income);

- the amount of “simplified” tax for 2020 is less than the amount of the minimum tax (1% of income received). This procedure follows from paragraph 3 of paragraph 6 of Article 346.18 of the Tax Code of the Russian Federation.

March 31, 2020 is Friday. This means there are no transfers. But April 30, 2020 is Sunday. May 1 is a non-working holiday. Consequently, the deadline for paying the minimum tax under the simplified tax system for 2020 for individual entrepreneurs has been postponed. Payment must be made no later than May 2, 2020. See “How long do we rest during the May holidays in 2017.”

| Period | Deadline |

| 2018 | 04/01/2019 - legal entity, 04/30/2019 - individual entrepreneur |

| I quarter 2019 | 25.04.2019 |

| 1st half of 2019 | 25.07.2019 |

| 9 months 2019 | 25.10.2019 |

| 2019 | 30.04.2020 |

Clause 7 of Article 346.21 of the Tax Code of the Russian Federation reflects the timing of payment of the simplified tax system for the corresponding purpose of payment (i.e., advances and taxes).

All details of the payment order are important for the correct identification of the payment by the credit institution and the correct execution of the payer’s will to transfer funds. If there are inaccuracies in the payment order (including when indicating the purpose of payment for the simplified tax system), this may result in an erroneous transfer of funds or incorrect identification of the payment.

The list of payment details with their explanation is contained in Appendix 1 to Rules No. 383-P.

A description of the relevant details is contained in clause 24 of Appendix 1.

The number of characters in this field should not exceed 210 (Appendix 11 to Rules No. 383-P). This rule applies, among other things, to the purpose of payment under the simplified tax system in 2020.

As for the field of the payment invoice “purpose of payment”, it should indicate: “Tax paid in connection with the application of the simplified taxation system (USN, income minus expenses), for 2020.”

The dates for transferring tax to the budget are the same, and the calculation of the amount of the advance payment depends on what is taxed: income or income reduced by expenses.

Also in the article, samples of payments for different taxation objects are available for download.

- VIP access to the newspaper “Accounting. Taxes. Right" for 3 days

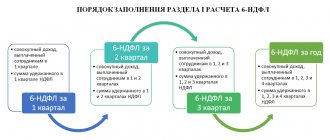

When simplified, the tax period is a calendar year. The reporting periods are the 1st quarter, 2nd quarter (six months) and 3rd quarter (9 months). The taxpayer calculates the amount of the advance payment quarterly and transfers the remaining tax to the budget at the end of the year.

The taxpayer calculates advance payments based on the level of actual income. Beginning entrepreneurs often forget about this, because the declaration is submitted once, but you have to pay after each quarter.

When to pay an advance payment under the simplified tax system for the 3rd quarter of 2020. Advances under the simplified tax system are paid no later than the 25th of the month following the reporting quarter. The 3rd quarter ends on September 30 and the last day when you can pay the advance payment without interest is October 25, 2020.

ATTENTION SPECIAL EDITION!

To simplify things, a lot has changed in the working technique. There are online cash registers, and now inspectors can easily find out if a company has hidden income. You can save taxes legally. There are simple solutions for this and with less risks.

Read about this in a special issue from UNP

Advance payment under the simplified tax system for the 1st, 2nd, 3rd quarters of 2020

Reporting period Advance payment deadline

| 1st quarter 2020 | April 25, 2020 |

| 2nd quarter (half year) 2020 | July 25, 2020 |

| 3rd quarter (9 months) 2020 | October 25, 2020 |

As a general rule, deadlines for paying taxes and contributions that fall on a holiday or weekend are postponed to the first working day. There are no such transfers for the simplified tax system in 2020.

To ensure that the tax office does not have questions about the payment, correctly indicate the budget classification code in field 104. Select the BCC you need depending on the object of taxation:

- simplified tax system with the object “income”

- simplified tax system with the object “income minus expenses”

Fines and penalties also need to be listed on a separate code (see table below)

BCC for a simplified taxation system for 2020: table

| KBK simplified tax system “income” tax | 182 1 0500 110 |

| KBK simplified tax system “income minus expenses” tax | 182 1 0500 110 |

| KBK simplified tax system “income” penalties | 182 1 0500 110 |

| KBK simplified tax system “income minus expenses” penalties | 182 1 0500 110 |

| KBK simplified tax system “income” fines | 182 1 0500 110 |

| KBK simplified tax system “income minus expenses” fines | 182 1 0500 110 |

- Payment receiver. This line contains the name of the tax authority with which your organization or individual entrepreneur is registered.

- TIN and KPP of the recipient. This detail reflects data on your Federal Tax Service;

- Name of the local body of the federal treasury: UFK.

- Current account number and BIC. The payment order stipulates that these fields must be filled in for both the payer and the recipient.

- Name, INN/KPP of the taxpayer. In these fields you must provide information about your organization.

- Individual entrepreneurs must indicate their full name and place of residence.

- KBK. This field is filled out in accordance with the order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n. In the payment order of the simplified tax system, income 2017 must be indicated as KBK 182 1 0500 110. But for the income-expenditure simplified tax system, a different KBK is provided. Moreover, it is the same for paying the minimum tax - 182 1 0500 110.

- Taxpayer status. In this line, organizations must indicate code 01, and individual entrepreneurs - 09.

- Type of operation. Here is the code according to Appendix 1 to the Bank of Russia Regulations dated June 19, 2012 No. 383P. In our case, you need to enter code 01 in this field.

- Sequence of payment. In accordance with civil law, when paying tax according to the simplified tax system, the number 5 is entered in this field.

- UIP code. When paying tax, you must enter 0 in this line. If the tax authority sent a request to the taxpayer, then this code is taken from this document. In any case, you cannot leave the field empty, since in this case the bank will not accept the payment.

- OKTMO. This field is filled in in accordance with the All-Russian Classifier. The code must correspond to the one that will be indicated by the taxpayer in the tax return.

- Basis of payment. This field requires a two-digit code. Since in our case we are talking about a standard tax payment, you need to indicate the TP in the field.

- Taxable period. This line indicates the tax payment period. Since we pay annual tax, we will need to put GD.00.2017 in the field. For advances, the letters KV are used instead of GD.

- Document date. Since we are filling out a payment slip for the final tax amount, this field must indicate the deadline for payment of the payment (that is, March 31 or April 30). If the payer needs to pay an advance under the simplified tax system or a debt, then 0 must be entered in the field.

- Purpose of payment of the simplified tax system: income 2020 or income minus expenses 2017. In this line of the payment slip you need to indicate what kind of payment you want to make. For example, when indicating the purpose of payment for the simplified tax system for income 2020, you can indicate “Single tax for 2020 according to the simplified tax system for income.”

- in accordance with the requirements stipulated by the Regulation of the Bank of Russia on the rules of transfer of funds dated June 19, 2012 No. 383-P - in it you will find a description and composition of all payment details;

- taking into account Appendix No. 2 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n - it clarifies the procedure for reflecting information in the payment details for the transfer of tax payments.

Registration of penalties and debts according to the simplified tax system

A penalty on the tax paid is a necessary condition, not a penalty. It facilitates timely payment of taxes and has almost no difference with the original example of the simplified tax system for profit and is filled out in the same way. There are several distinctive nuances, one of which requires a description of the KBK code. Before providing the penalty form, you must enter the appropriate code, and when paying the income-expense penalty, enter the code 18210501021012100110.

There is one more nuance regarding the “Basis of payment” field. If the entrepreneur decides to recalculate the penalty himself with an arbitrary payment, then when paying, he must indicate - ZD. If the payer has received a written notification of payment, the TP code is written in this column. If the recalculation of penalties is made on the basis of an act after the corresponding tax audit, then the AP is indicated in the column. These conditions are met when paying the minimum tax.

The field that prescribes the terms of repayment, in a payment order according to the usn, is sometimes set to 0. This happens when the penalty is paid in an arbitrary manner, or in the presence of a drawn up act, and therefore does not require a specific date. In other cases, the column indicates the numbers corresponding to the appointed date. And if the calculation is carried out upon request, then the number indicated in the resolution is written in the column.

In addition to the above aspects, in case of arbitrary payment of penalties, without the presence of various regulations, it is recommended to indicate 0 in the order number and date. After the control audit, the numbers specified in the requirement are indicated in this line.

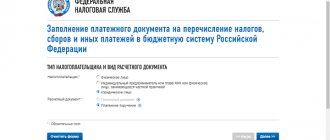

Where can I get up-to-date details for filling out a payment order?

Important!

Due to the fact that payment details (including BCC in a payment order for individual entrepreneurs) tend to change almost every year, it makes sense each time before generating a payment order to double-check the relevance of the details used when filling out the document in previous times.

Since the Federal Tax Service is the initiator of changes in the details of individual entrepreneurs’ payment orders, the latest news is published on the official website of the

. Adjusted details for entrepreneurs immediately appear on this → page.

KBK in a payment order for individual entrepreneurs on the simplified tax system

There are many CBCs, the diversity of which can make an entrepreneur confused. In addition, budget classification codes sometimes change. At the same time, if you indicate the wrong BCC in a payment order for an individual entrepreneur, the payment will not be credited to the required budget. In this regard, the tax authorities will not be able to record the fact of payment - penalties will be charged as for non-payment of tax

.

The BCC in a payment order for individual entrepreneurs on the simplified tax system is indicated in field 104, specially designed for this purpose. The set of numbers depends on the tax base under the simplified tax system - “Income” or “Income minus expenses”:

| № | STS “Income” of KBK for 2020 | STS “Income minus expenses” KBK for 2020 |

| 1 | 182 1 0500 110 | 182 1 0500 110 |

| 2 | 182 1 0500 110 (if minimum tax is paid) |

Calculation of the simplified tax system for 2020

The amount of the “simplified” tax (advance payment) can be reduced by no more than 50% for all reasons (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation). However, this restriction does not apply to individual entrepreneurs who do not have employees, do not pay remuneration to other individuals and pay insurance premiums only for themselves in the amount determined based on the cost of the insurance year. They can reduce the simplified tax by the entire amount of insurance premiums paid for themselves .

Articles on the topic

From 2020, new rules must be taken into account when calculating the advance payment. In an “income” facility, employers can only reduce the advance on contributions and benefits by half. But individual entrepreneurs without employees completely deduct the amounts.

Firms and individual entrepreneurs applying this regime must pay the advance payment under the simplified tax system for the 1st quarter of the year no later than April 25. In the article we will tell you about everything that is necessary for calculating and transferring payments to the budget: calculation features, BCC, form and sample payment slip. We have prepared documents that will help you pay the single tax correctly and on time under the “simplified” system. Download for free:.

pp_dlya_usn.jpg

Related publications

The form of the payment order is given in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012. For ease of filling out, each field is assigned a number (a form with numbered fields is given in Appendix 3 to the specified Regulations). The payment order for tax payment must be filled out in accordance with the filling rules given in Appendices No. 1, 2, 5 to Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on April 5, 2017).

All individual entrepreneur reports are in simplified format: how to properly prepare and submit them without problems

The main and only regular report for individual entrepreneurs on a simplified basis without employees is a declaration according to the simplified tax system. For 2020, the declaration must be submitted by April 30, 2020. Its form was approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ It has not changed since last year.

Simplified individual entrepreneurs at the “income” rate of the simplified tax system do not have to fill out all sections of the declaration. All they need to do is fill out:

- Title page;

- Section 1.1, which indicates the amount of tax or advance payment under the simplified tax system “Income”;

- Section 2.1, where the tax calculation itself is carried out.

If individual entrepreneurs pay a trading fee, then you need to additionally fill out Section 2.1.2. There are no reports or calculations on advance payments for the simplified tax system.

On the Federal Tax Service website, in the “Software” section, you can download and install a free program for filling out the “Legal Taxpayer” declaration. And there, on the tax portal, you can send it through the online reporting service. But for this you need to issue an electronic digital signature. In addition, the declaration can be submitted online through a specialized operator company, by mail, by proxy or in person at the inspection office.

If an individual entrepreneur does not have employees, then he does not report to the tax authorities on other forms:

- He does not need to provide information about the average number of employees.

- He also does not submit reports on insurance premiums and does not confirm his income to calculate the 1% insurance premium from the excess. The Federal Tax Service receives this information independently from the declaration under the simplified tax system.

- There is no reporting requirement for the trade fee.

The only exceptions are individual entrepreneurs using the simplified tax system, who voluntarily switched to paying VAT. In this case, all obligations for payment and reporting of VAT fall on the entrepreneur in full.

Instructions for filling out a payment order for a fixed payment in the Pension Fund for individual entrepreneurs

Many entrepreneurs are deterred from opening a bank account by the fact that it will cause unnecessary costs. But at the moment, the tariff plans offered by various financial institutions are very flexible, and if an individual entrepreneur has a small account turnover, then you can choose a tariff without a subscription fee at all, however, the cost of the transfer for each individual payment will be higher.

And now what can please you is that every entrepreneur annually pays a fixed contribution “for himself” to the Pension Fund and the Health Insurance Fund. Its value is different every year and since 2020 it has been approved by the government. This year the contribution is 32,385 rubles. You can pay it all at once or in installments throughout the year, the main thing is that the payment goes out before December 31st. But usually, the fee is divided into four parts and paid quarterly. This is due to the fact that the amount of the fixed payment paid in the quarter for which you are calculating the simplified tax system reduces the advance tax payment. If the individual entrepreneur does not have hired personnel, then up to 100% (in our example, this is 8400 - (32385: 4) = 303.75 - the amount that needs to be transferred according to the simplified tax system), if there are employees, then up to 50%.

Sample payment order with KBK for individual entrepreneurs on the simplified tax system “Income”

You can make a payment order from the KBK for individual entrepreneurs on the simplified tax system with the “Income” base by clicking on the following → link.

sample payment order from KBK according to the simplified tax system “Income minus expenses”

Payment order of the simplified tax system “Income” - 2020: mandatory attributes

Each payment document detail requires careful attention and is filled out in accordance with the inscriptions on the form. For example, in the columns reserved for information about the payer, comprehensive information about him is entered, such as: the name of the company or full name of the businessman, INN, KPP (for companies), the name and BIC of the institution of the payer’s bank and the current account number from which the money is transferred to the budget payment, as well as the amount of payment. An important aspect is the detailed description of the purpose of payment, for example, advance payment for the 1st quarter.

The block of fields reserved for information about the payee is also thoroughly filled out. When creating a payment order, they indicate:

- Name, number of the Federal Tax Service;

- TIN/KPP inspection;

- Name of the local treasury office accepting payment for the Federal Tax Service;

- BIC of the bank, account number of the Federal Tax Service.

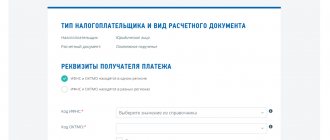

The details of the Federal Tax Service for correctly filling out the order can be found by calling the inspectorate at the place of registration, or on the Federal Tax Service website in the service “ ]]> Addresses and details of your inspection ]]> ”, for which you only need to select the payer category (legal or individual), Enter the Federal Tax Service code and select OKTMO.

Instructions for a beginner individual entrepreneur using simplified 6%

2) According to paragraphs. 1 clause 3.1 art. 346.21 of the Tax Code of the Russian Federation, the amount of tax (advance payment) under the simplified tax system for the tax (reporting) period can be reduced by the amount of insurance premiums that have been paid within the calculated amounts. But we are not talking about calculation in this period. Those. contributions can be calculated for previous periods, but paid in the current one. Based on this, for the amounts of insurance premiums paid in the tax (reporting) period that exceed the calculated ones, the “simplifier” with the object “income” does not have the right to reduce the amount of tax (advance payment) for the corresponding period.

- Funds received under credit or loan agreements, as well as funds received to repay such borrowings;

- Income taxed at other tax rates (dividends, bond coupons, etc.);

- Income taxed under other tax systems (personal income tax, UTII, patent, etc.);

- Receipts that are not inherently income: funds received upon return of defective goods, funds mistakenly transferred by the counterparty or mistakenly credited by the bank to the taxpayer’s current account, etc.