Filling out tax registers

The main purpose of the registers is to summarize information on the source data in relation to each type of tax. Do registers help control taxpayers? and allow payers themselves to check the accuracy of the calculations made for each type of tax liability.

The forms developed should ensure simplicity and ease of completion, contain the necessary columns and lines to reflect the necessary data, which allows you to check the accuracy of the calculation of certain types of taxes.

Registers are useful both for the tax office in order to control payers, and for the companies themselves. Correctly filled out register forms allow you to correctly generate tax reporting and simplify the perception of the information necessary for calculation.

You can fill out registers electronically or on paper. The tax authorities do not impose any special requirements in this matter.

Responsibility for filling out registers falls on certain persons, whose signatures must certify the documents being drawn up. These persons must ensure not only that the registers are filled out correctly, but also that they are properly stored and that unauthorized persons do not make corrections.

Only a responsible person can edit the register, certifying the adjustments made with a signature, date and explanations.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

https://youtu.be/rqM3iqc96g4

Personal income tax registers

The responsibility for accounting for income paid to employed persons falls on the employer, who acts as a tax agent in relation to the tax calculated on the income of individuals. To correctly calculate income tax, you need to properly organize the accounting of paid income. For this purpose, the company creates its own registers for maintaining tax records for calculating personal income tax.

Registers are necessary both for the tax office in order to control employers, and for companies that use hired labor. Collecting data about working individuals, amounts paid to them, benefits applied and personal income tax withheld allows the employer to:

- See the overall picture for all employees;

- Fill out 2-NDFL certificates at the end of the year;

- Determine the rights of employees to the “children’s” deduction, track the moment when this right ceases;

- Establish rights to other deductions of a standard nature;

- Identify cases of incorrect calculation and withholding of tax.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Formation of the register

The company has the right to decide for itself how it will account for income and the personal income tax calculated from it, and what accounting forms will be used for this. The Tax Code of the Russian Federation determines what needs to be reflected in tax registers. The necessary information to be included in the register is set out in paragraph 1 of Article 230:

- Identification data for each individual;

- Types of paid income;

- Provided personal income tax benefits that reduce the base for calculating the tax;

- Amounts of amounts paid;

- Dates for issuing amounts to staff;

- The amount of calculated tax;

- Dates of its retention and transfer;

- Information about payment documentation confirming payment.

This information is provided for each employee.

The tax register form for personal income tax is developed in order to ensure convenient work with information and clarity of its presentation. In this case, the form includes the necessary information required by the tax authorities.

Qualities that the developed register form must have:

- Simplicity – there should be no confusion in presenting employee data;

- Visualization - the data should be easy to read, the form should allow you to quickly transfer the necessary information to 2-NDFL;

- Brevity - unnecessary information is not needed, it does not carry any significance and creates difficulty in perceiving the information.

The register form must take into account the specifics of the organization’s activities and the types of income paid, therefore a universal register form has not been approved. Each enterprise draws up a document that will include the necessary information and have the above properties.

For convenience, a company can create several tax registers to fully reflect the necessary data for personal income tax accounting purposes. Tax legislation does not limit employers in this matter. You can use a separate register for each type of income or each individual.

Companies often take the previously valid 1-NDFL certificate form as a basis, using an example of which to prepare a suitable register.

What is 1 personal income tax

So, 1 personal income tax is a form of card that reflects the taxpayer’s income and all the taxes he pays. This document was introduced in 2003 as a prize from the Ministry of Taxation and was one of the main documents of all tax accounting. This form worked for 8 years and was liquidated on January 1, 2011. Currently, individual entrepreneurs are not required to fill it out. Instead, the employer is required to fill out the personal income tax register, and the same data about the employee is entered; the procedure for filling it out is also identical.

But here’s an interesting situation: the tax register must be developed by the entrepreneur, that is, the tax agent, independently. And the income tax in this register must be calculated independently. All these functions are required to be performed by large organizations, that is, legal entities, individual entrepreneurs, as well as notaries working privately, and foreign organizations that have opened their representative offices in Russia.

The tax register, according to the Tax Code, must contain the following information. This is all the personal data of the employee that allows him to be identified, this is the employee’s status as a taxpayer, all amounts of his income, types of income indicating the codes in force today, taxes that were withheld from the employee, and their current codes. To this information are added the dates of payment of income and tax deductions, as well as the dates of transfer of tax amounts to the budgets of the Russian Federation. Next to each entry on the transfer of tax, it is necessary to indicate the name of the payment document and its details, all this is done to confirm the facts of the transfer of funds.

Some entrepreneurs practice maintaining a common register, one for all employees. In companies where there are few specialists, this is very convenient. But correct filling in accordance with the law requires maintaining a register for each individual employee. Therefore, it is best to spend a couple of hours more on the accountant’s time, but make the correct register and fill it out as required by law.

Personal income tax register form

The tax register being developed includes information from clause 1 of Article 230. The table below provides explanations for each type of information required.

| Mandatory register information | Explanations |

| Taxpayer identification information | Data on working individuals, including:

|

| Types of income | Each type of income paid must have a field to indicate a special digital code designation. The codes are approved by Order of the Federal Tax Service No. MMB-7-11/ [email protected] 10.09.15. It is not necessary to reflect data on income not subject to personal income tax, since they do not form the base. Income that is taxed within a limited limit must be reflected, since it can accumulate throughout the year. |

| Types of deductions | Deductions are reflected in the register indicating codes. Deduction codes are approved by the same order as income codes. |

| Amounts of income | It is recommended to indicate the amounts of income:

|

| Income payment dates | A field is provided to indicate the day when:

It is also recommended to provide a field to indicate the date of receipt of income according to the rules of Article 223 (in relation to salary, this is the last day of the month for which it was accrued). |

| Taxpayer status | The register includes a field to indicate whether an individual is a resident or non-resident of the Russian Federation. |

| Personal income tax withholding dates | In a special column, the actual day of tax withholding is indicated, which depends on the type of income. |

| Personal income tax transfer dates | Taken from supporting payment documentation. |

| Payment details | It is enough to indicate the number, date of payment and the amount of tax transferred for it. |

| Personal income tax | The calculated and withheld tax is entered into the register. |

If there are many employees, then it is more convenient to develop a register that would reflect data for each individual individual. The 1-NDFL form is built on this principle. You can take the specified form as a basis and adapt it to modern realities and the requirements of the Tax Code of the Russian Federation - add missing data, remove unnecessary, irrelevant ones.

The company maintains a register in a convenient form - paper or electronic.

What day is considered the date of payment of income and what is the deadline for paying personal income tax?

The last day of the month for which the salary was accrued is recognized as the actual date of its receipt (Article 223 of the Tax Code of the Russian Federation). If the employment relationship is completed on a day that is not the last in a given month, then the date of receipt of salary will be the last day of going to work.

When reflecting vacation pay amounts, you must follow the instructions of the letter of the Ministry of Finance of the Russian Federation dated 06.06.2012 No. 03-04-08/08-139: the date of receipt will be the day of payment. It is advisable to use this approach when indicating the date of payment of benefits for sick leave. Transfer personal income tax to the budget from vacation and sick leave benefits in accordance with clause 6 of Art. 226 of the Tax Code of the Russian Federation should be no later than the last day of the month in which these payments were made.

On the issue of determining the date of income in the form of vacation pay, see the material.

Labor legislation obliges employees to pay wages at least every half month (Article 136 of the Labor Code of the Russian Federation). But, despite the advance received, the employee does not generate income, and the obligation to the budget is formed on the last day of the month, so the date of transfer of the advance does not need to be reflected.

See here for details.

In paragraph 6 of Art. 226 of the Tax Code of the Russian Federation states that the organization is obliged to transfer the withheld personal income tax no later than the next day after the date of repayment of the debt to employees.

According to the new regulations of the Federal Tax Service, bonuses should be divided into labor and one-time bonuses. The date of receipt of income will be different for each, therefore, the deadline for transferring personal income tax is set separately.

Read about the nuances here.

Income tax register

For the purpose of recording indicators for calculating income tax, the company fills out independently developed tax register forms; data is transferred to these registers from accounting accounts and primary documentation.

Register forms are compiled taking into account the specifics of the activities of a particular enterprise. The relevance of using tax registers separately from income tax accounting ones arises if an organization carries out operations, the amounts for which are accounted for differently in accounting and taxation.

Tax and accounting requirements for some transactions may not coincide; in such cases, tax registers must be used separately.

If an enterprise does not carry out those operations for which tax accounting is kept in a form different from accounting, then accounting registers are sufficient to calculate income tax.

Tax registers can take the form of accounting ones with the necessary additions. It is also allowed to create separate forms that are not similar to accounting forms. The tax office allows companies to take the initiative in this matter and prepare a suitable form for themselves. The Tax Code of the Russian Federation provides only recommendations on what details are reflected in the register:

- Name of the form;

- The time period for which it is compiled;

- Quantitative and monetary measures of necessary indicators;

- Information about the operations performed;

- Signature of the responsible person.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Legal Consultation free Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

The main register items that were transferred from personal income tax card 1

The first paragraph of the document is information about the tax agent (source of income). Here you will need to indicate the TIN/KPP (for an organization or TIN for a tax agent - an individual entrepreneur), as well as the code of the tax authority where the tax agent is registered, the name (last name, first name, patronymic) of the tax agent and OKATO code. All this data is always available in the accounting department; there will be no problems filling it out.

Further, in the second paragraph , you should indicate information about the taxpayer (recipient of income). This is the TIN and pension insurance certificate number, last name, first name and patronymic of the employee, type of identification document. If this document is a passport, then you must indicate the code, series and number, date of birth (day, month, year), citizenship with country code, address of permanent residence, including country code, subject of the Russian Federation, region, territory, district, city , street, house, building, apartment. Next, you must indicate whether the taxpayer is a resident of the Russian Federation, and whether tax deductions are claimed.

The third paragraph calculates the tax base and personal income tax (for income taxed at rates of 13% and 30%). Tax deductions are indicated with a simultaneous description of the details of the documents that became the basis for calculating deductions. It will also be necessary to make a detailed calculation of the tax base and tax on income of an individual from equity participation in the organization’s activities (dividends), calculation of the tax on income taxed at a rate of 35%.

The following points must indicate the following data: the total amount of tax based on the results of the tax period, information about income, the taxation of which is carried out by the tax authorities, the results of tax recalculation for previous tax periods. And finally, information about the presentation of certificates provided to the taxpayer is indicated.

All this data is transferred from their cards to a new accounting form - a register, and is submitted in the form of a report to the tax office. If you have any questions, it is best to consult the tax office at the place of residence and registration of the individual entrepreneur.

E. Shchugoreva

0

Author of the publication

offline 7 years

Elena Shchugoreva

0

Comments: 0Publications: 208Registration: 02-03-2013

Tax accounting register for personal income tax in 2018: sample filling, form, form

Login / Registration Submit an article Submit an article

- Entrance

- Registration

- Management

- HR

- Marketing

- Sales

- Finance

- Self-development

- Starting a business

09 January 2020 at 14:20 13687 Share 0 Share 0 Share

Elena Konstantinova Independent expert in accounting and taxation The tax accounting register for personal income tax is developed by organizations independently. An accountant should study in detail the issue of compiling a register and filling it out correctly. Since correct registration and filling is the key to correct calculation and deduction of the tax itself. There are general requirements for the presence of mandatory data in the register. The developed form and sample must be approved by the organization’s accounting policy. What information should be contained in the personal income tax register will be discussed in the article.

Mandatory data that must be contained in the personal income tax register

Article 230 of the Tax Code of the Russian Federation determines what data must be reflected in the personal income tax register: 1. Taxpayer identification data; This is data about the organization - the tax agent and about the taxpayer himself - the individual. About the organization you should indicate:

- TIN/KPP;

- tax authority code;

- full name of the organization.

About an individual:

- Full name;

- TIN;

- passport details;

- Date of Birth;

- citizenship;

- address at the place of registration or location;

- status (resident/non-resident)

The tax rate for individuals depends on the last point. According to the Tax Code, a resident is a person who stays in Russia for more than 183 days a year. The tax rate for non-residents is 30%, for residents from 9 to 13%, depending on the type of income. 2. The type of income paid to the taxpayer and tax deductions provided, as well as expenses and amounts that reduce the tax base, in accordance with codes approved by the federal executive body authorized for control and supervision in the field of taxes and fees; Each type of income or deduction has its own code. Information is generated for each code separately. For example, wages are reflected under code 2000, and calculations for sick leave are 2300. New income codes have been added since 2020. For example, for compensation for vacation - 2013, accruals in the form of severance pay - 2014, 2611 - code for bad debt written off from the organization. 3. Amounts of income and dates of their payment; 4. Taxpayer status; 5. Dates of tax withholding and transfer to the budget system of the Russian Federation; The date of receipt of income is the last day of the month, this is enshrined in the tax code. If an employee is dismissed in the middle of the month, the date of receipt of income will be the last working day. When paying vacation pay, the date of payment. The same applies to payment for sick leave. Personal income tax on these payments must be transferred by the end of the month in which they were accrued. 6. Details of the relevant payment document.

Features of register filling

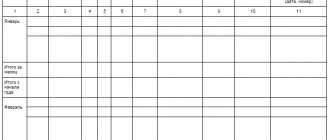

tax accounting for personal income tax Data for each employee is filled out separately. That is, a separate register is created for each employee. All accruals are indicated monthly, broken down by code, and deductions are the same. Payments with different income codes are indicated separately. If there are payments that are not subject to personal income tax, then they may not be indicated. However, if payments are not taxable up to a certain amount, then they must be indicated. Because then it will be immediately clear when personal income tax should begin to be calculated. According to labor law, the employer is obliged to pay wages at least 2 times a month. However, payment of an advance is not considered income; personal income tax is not transferred from this amount. And the advance date may not be indicated in the register. The frequency of preparation is determined by the employer. But it is better to compile it monthly so that the data is reflected in a timely manner and is always relevant. The correctness of calculation of deductions and deductions depends on this. Filling out the register ensures quick and reliable preparation of forms 2-NDFL and 6-NDFL.

An example of filling out the personal income tax register

Let's fill out the personal income tax register for one employee for the first quarter of 2018. Sidorov Alexander Alekseevich receives a monthly salary of 50,000 rubles, including personal income tax. He wrote an application for a standard deduction because he has a minor child. A deduction of 1,400 rubles is provided until the employee’s total income for the year reaches 350,000 rubles. The first section indicates the details of the organization - tax agent:

- TIN/KPP;

- tax authority code;

- name of company;

- OKTMO.

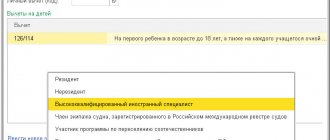

The second section contains the data of the taxpayer - an individual:

- FULL NAME;

- TIN (if available). If absent, the field should be left blank;

- Passport details;

- Date of Birth;

- Residence address;

- Status (1 - resident, 2 - non-resident, 3 - highly qualified foreigner).

Third section:

- Income taxed at a rate of 13% from the previous place of employment, if any;

- Grounds for providing standard deductions (application for deduction);

- For a property deduction, you must indicate the details of the document (usually a certificate from the tax office, which indicates the Federal Tax Service code, date of issue, certificate or notification number).

Next, the tabular part is filled in for each month. We will fill it in based on the available data. Let's assume that the employee worked fully for three months, without vacation or sick leave. Then for each month we enter the full salary for the month in the amount of 50,000 rubles. This is payment under an employment contract, so the income code is 2000. If there is income under other codes, then separate lines are added and the amounts related to these codes are entered. The next line is standard tax deductions. An employee receives this type of deduction for a child - deduction code 126. Since the total income for three months has not reached the limit of 350,000 rubles, the deduction is provided for all three months. The line “property deduction” is not filled in, since the deduction is not provided. The line “tax base at a rate of 13%” is filled in in accordance with the conditions of the example for each month and on a cumulative basis. The amount is determined as the difference between accrued wages and applicable deductions. In our case: 50,000 – 1,400 = 48,600 rubles for each month 48,600 rubles for January 97,200 rubles for February 145,800 rubles for March The line “tax base at rates of 9%, 30%, 35%” is not filled in, since the employee is a resident and receives income only under an employment contract. The line “amount of income from which tax is not withheld” is not filled in, since according to the conditions of the example, the employee’s tax was withheld and transferred in full. The lines “amount of tax calculated” and “amount of tax withheld” in our case coincide. The hold date is the last day of the month. The line “amount of tax transferred, payment document number” is filled in according to the details of the payment order. Transfer date is the day following the payment day. Since the last day of the month in March is Saturday, the transfer date has shifted to Monday, April 2, 2018.

Responsibility for incorrect maintenance of the personal income tax register

If, during an inspection by tax authorities, incorrect maintenance or absence of a tax register for personal income tax is discovered, a fine cannot be avoided. This offense falls under a gross violation of accounting for the organization’s income and expenses. Upon initial detection of improper register maintenance during one tax period, a fine of 10,000 rubles is imposed. If the register was not maintained for more than one tax period, the fine is 30,000 rubles. And in the case where improper maintenance of the register led to an underestimation of the tax base, the fine is at least 40,000 rubles.

Automation of accounting for any business The service will help you automate routine processes, it will do everything itself: calculate taxes, create invoices, fill out declarations, send to the tax office and funds Exclusively for readers of “Business World” A month of full access for free