If you need to find out your phone account balance, read the article. It contains a lot of useful information.

Each person may encounter circumstances when he needs to talk on his gadget, but there is no money in his account. This can happen for various reasons.

- For example, paid optional services were connected or due to simple inattention - you forgot to top up your account in a timely manner.

- To prevent this from happening, you need to check your balance in advance and replenish it on time.

- You will find information on what combination to dial to find out your mobile account balance for different operators below.

How to find out your Tele2 operator balance?

Tele2

Checking your account balance with any operator takes only a few seconds. With the Tele2 this can be done using the following methods:

- USSD additional service: dial *105#call key . The response SMS will contain information about the balance amount.

- “Voice balance” - this service is provided by this mobile operator. Call back to number 697 and listen to what the robot informant will tell you.

- A program application installed on a mobile phone will help not only check the balance, but also monitor the remaining minutes and traffic to the global network.

- Interactive submenu. Dial *111# call key. Instructions will appear on the display - follow each step. As a result, not only your balance will appear, but also your number, as well as all available services and tariff plan.

- Personal account on the Tele2 portal: to do this, go to your personal account on the portal using this link . It contains information about your money balance, free minutes, service package and the number of megabytes of visits on the network.

If you tried to apply the above methods, but for specific reasons they do not work, then you can find out the necessary data by calling the operator at toll-free numbers: 611 and 8-800-555-0611. It is also easy to set up, for example, in Internet banking, so that a payment is transferred to your account on a specific day.

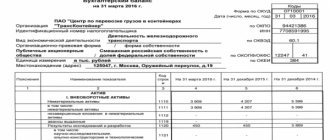

How to fill out a balance sheet using Form 1

Title part

After the name of the form, it is indicated on what date it is being generated. The actual date of submission of the report must be entered in the table, in the line “Date (day, month, year)”. Next, the full name of the subject is written down, and opposite in the table is its OKPO code.

After this, his TIN is indicated on the next line in the table. Next, you need to indicate the main type of activity - first in words, and then in a table using the OKVED2 code. Then the organizational form and form of ownership are indicated.

On the contrary, the corresponding codes are entered in the table, for example:

- The code for LLC is 65.

- for private property - 16.

On the next line you need to choose in what units the data in the balance sheet is presented - in thousands or millions. The table displays the required OKEI code. The last line contains the address of the subject's location.

Fixed assets

Line “Intangible assets” 1110 is the balance of account 04 (except for R&D work) minus the balance of account 05.

Line “Research results” 1120 - account balance 04 for sub-accounts that reflect R&D;

Line “Intangible search requests” 1130 - account balance 08, subaccount of intangible costs for search work.

Line “Material search requests” 1140 – account balance 08, subaccount for the costs of material assets for search work.

Line “Fixed assets” 1150 - account balance 01 minus account balance 02.

Line “Income-bearing investments in MC” 1160 - the balance of account 03 minus the balance of account 02 in terms of accrued depreciation on assets related to income-generating investments.

Line “Financial investments” 1170 - account balance 58 minus account balance 59, as well as account balance 73 in terms of interest-bearing loans over 12 months.

Line “Deferred tax assets” 1180 - account balance 09, it is possible to reduce it by account balance 77.

Line “Other non-current assets” 1190 - other indicators that need to be reflected in the section, but they are not included in any line.

The line “Total for section” 1100 is the sum of lines from 1110 to 1190.

Current assets

Line “Inventories” 1210 - the sum of indicators is entered in the line:

- account balance 10 minus account balance 14, or account balances 15, 16

- Balances on production accounts: 20, 21, 23, 29, 44, 46

- Balances of goods on accounts 41 (minus the balance on account 42), 43

- account balance is 45.

Line “Value added tax” 1220 - account balance 19.

Line “Accounts receivable” 1230 - the sum of indicators is entered:

- Debit balances of accounts 62 and 76 minus the credit balance of account 63 in the subaccount “Reserves for long-term debts”;

- The debit balance of the account is 60 for advances made for the supply of products and services.

- Debit balance of account 76, subaccount “Insurance payments”;

- The debit balance of the account is 73, excluding the amounts of loans on which interest is accrued;

- Debit balance of account 58, subaccount “Granted loans for which interest is not accrued.”

- Debit account balance 75;

- Debit account balance 68, 69

- The debit balance of the account is 71.

Line “Financial investments” 1240 - the sum of indicators is entered:

- account balance 58 minus account balance 59;

- account balance 55, subaccount “Deposits”;

- account balance 73, subaccount “Loan settlements”.

Line “Cash” 1250 - the sum of account balances 50, 51, 52, 55, 57 is entered.

Line “Other current assets” 1260 - indicators that should be shown in the section, but were not included in any previous line.

The line “Total for section” 1200 is the sum for lines from 1210 to 1260.

Line “Balance” 1600 - the sum of lines 1100 and 1200.

Capital and reserves

Line “Authorized capital of the organization” 1310 - account balance 80.

Line “Own shares” 1320 - account balance 81.

Line “Revaluation of non-current assets” 1340 - account balance 83 in terms of the amounts of revaluation of fixed assets and intangible assets.

Line “Additional capital” 1350 – account balance 83 without the amounts of additional valuation of fixed assets and intangible assets.

Line “Reserve capital” 1360 - the sum of account balances 82, as well as 84 in terms of special funds.

Line “Retained earnings (uncovered loss)” 1370 - account balance 84 without special funds.

Line “Total for section” 1300 - the sum for lines 1310, as well as from 1340 to 1370 minus line 1320.

long term duties

Line “Borrowed funds” 1410 - account balance 67, including the amount of loans and interest accrued on them.

Line “Deferred tax liabilities” 1420 - account balance 77, it can be reduced by account balance 09.

Line “Estimated liabilities” 1430 - account balance 96 for the subaccount of estimated liabilities for more than 12 months.

Line “Other liabilities” 1450 - credit balances of accounts 60, 62, 68, 69, 70, 76 for which liabilities with a maturity period of more than 12 months are reflected.

Line “Total for section” 1400 - the sum for lines from 1410 to 1450.

Short-term liabilities

Line “Borrowed funds” 1510 - account balance 66, including loan amounts and interest accrued on them.

Line “Accounts payable” 1520 - The amount of indicators is entered in the court:

- Balances of accounts 60 and 76, which show the debt to suppliers and contractors;

- The balance on the credit of account 70, except for the debt on payment of income on shares and shares;

- The balance on the credit of the sub-account “Settlements on deposited amounts” of account 76;

- Credit balances of accounts 68 and 69;

- Account credit balance 71;

- Balances on the subaccounts “Calculations for claims” and “Calculations for property insurance” on account 76;

- Credit balances on accounts 76 and 62 for advances received;

- Credit balance on the subaccounts “Calculations for the payment of income” of account 75 and “Calculations of income for the payment of income on shares” of account 70

Line “Deferred income” 1530 - loan balances for accounts 86 and 98.

Line “Estimated liabilities” 1540 - balance from account 96 in the subaccount of estimated liabilities for less than 12 months;

Line “Other short-term liabilities” 1550 - other short-term liabilities that cannot be included in the previous terms of Section V.

The line “Total for section” 1500 is the sum for lines from 1510 to 1550.

Line “Balance” 1700 - the amount for lines 1300, 1400 and 1500.

How to find out your Megafon operator balance?

Megafon

There are 7 proven methods to check the balance on Megafon

- USSD additional service: *100*0#call key or *100#call key .

- Your personal personal account page on the Megafon website. It is worth noting that the functionality of the site will be available even if you do not have access to the network. Of course, there will be restrictions, but you can see the balance without any problems. To access the page you will need a password. You can get it by dialing *105*00#call key . Enter the numbers or letters received via SMS in the “password” .

- Through your personal account page: dial *105#call key . Then in the submenu click “1-LK” . In the new “Remaining” , click on “1” . If you press “2” , you will find out more information about bonuses and other services.

- SMS request: send a blank SMS to the number 000100 or 000888 . In the response you will receive information about the status of your balance. To make your balance known online, type the word “balance” and send a message to 000663 .

- Call back to number 0500 . This is a free telephone combination for the Megafon call center. You can also call back at 8-800-333-0500 . The specialist will tell you not only about the availability of funds, but also tell you how to monitor transactions on the account.

- At the company's office: if you know where the operator's nearest office is located, go and ask any of the employees for the balance. But in this case you will need a passport.

- SIM menu: find the application in the list of your phone, select “Megaphone” and then “Balance” . The answer will come via SMS message.

It should be noted that this statement created . You can control the balance of a third party, just as someone close to you can control yours. To activate the service, you will need the consent of the client whose number will be monitored. You will find details about this service on the official Megafon website at this link .

Concept and essence

The analytical balance sheet should be understood as an aggregated form of the balance sheet. It makes a special regrouping of the main articles of Form No. 1, through which you can assess the status of both the company’s funds and the main sources of property creation. Here you can also find data on the real value of the company's assets involved in business activities.

There is one rule: items in the analytical balance sheet of an enterprise must be distributed according to the degree of liquidity of assets. The urgency of the obligations also needs to be taken into account.

Let us briefly present the purpose of analytical balance in the form of the following concepts:

- Research indicators both horizontally and vertically.

- Analytics on the main trends of balance sheet items.

- Identification of errors made in the accountant's calculations.

How to find out your MTS operator balance?

MTS

There are also many ways to check your balance on MTS

- USSD additional service: *100#call key .

- On the official MTS portal. Open the site using this link and enter your phone number and password. If you have not previously registered on the MTS , then you can receive a password via SMS. To do this, click on the corresponding active inscription on the left, as shown in the picture above.

- Call the operator at 0890 or 8-800-250-0890 . The balance will be communicated to you in voice mode. Corporate clients can call 0990 or +7-495-766-00-01 (but only for Moscow). In this case, the connection occurs almost instantly.

- Via SMS: send “11” to number 111. In the reply SMS you will see the balance for today’s date. This service may be needed if you need to prepare a balance sheet report for a specific date. You simply save SMS, of which there is a video of how much money you had in your account on a given day.

- Voice application for number 111 : dial this number and an MTS informant will tell you information about your balance.

- Personal account: install the application and log in to the MTS website. When you log in, you will see the balance of your phone number.

- Widget on Yandex: go to the Yandex widget catalog, find “ MTS ” and install this widget. Then connect the number.

On MTS you can control the balance of your child’s phone. To do this, dial *140*phone number#to determine the balance . But remember that such a voice balance is not available for other other people's numbers.

Horizontal balance sheet analysis. Example with conclusions

The method of analysis that will be discussed is called horizontal for the reason that information for each item of the balance sheet for several periods is located in a row horizontally. The more periods of activity the data is compared, the more columns there are in the analysis table.

Below is a list of basic information you need to know about horizontal analysis of financial statements:

- This method is used in cases where it is necessary to study the time dynamics of balance sheet results.

- Not only the values of absolute indicators (in rubles), but also relative ones (in %) are subject to comparison:

| Absolute deviations | |

| Relative deviations | |

| Rates of growth |

- To conduct the analysis, you should select 2-3 quarters or years. Absolute (or relative) values are consistently compared with similar indicators of later periods.

- Horizontal analysis makes it possible to assess whether production indicators have improved or worsened in comparison with the year before and last year.

When conducting a horizontal analysis, they first look at the balance sheet total for the Asset - if the value increases across the columns (from previous to future periods), this indicates the favorable development of the company and its chances for further growth.

Next, attention is drawn to the dynamics of indicators of external and working capital: if there is an increase in them from period to period, it means that the company is actively working, and the management staff is making the right decisions on the way to improving the base.

The next thing to check is the solvency of the company, whether the company has free money in circulation and, importantly, whether it is used for investment in order to extract additional income. arrived. All this can be judged by studying the dynamics of values for items directly related to money - “Cash”, “Accounts receivable”, “Financial investments”.

And finally, lines in the Passive are studied. To understand where the company under study gets its free money, you should pay attention to changes in the indicators for the items “Borrowed funds” and “Accounts payable”. Here, before drawing any conclusions, you need to carefully analyze the company’s policy regarding attracting third-party capital. Since a balance sheet analysis may show an increase in debt, however, this can be a positive thing if the money is invested wisely and generates additional income.

How to find out your Beeline operator balance?

Beeline

Beeline subscribers can find out the balance of their phone account using the following methods:

- USSD additional service: *102#call key . This option is suitable for subscribers who use a prepaid payment system. If you use a postpaid payment system, then dial: *110*04#call key .

- Beeline application. The program allows you to manage your account directly from the application.

- USSD commands for service package owners. Find out the remaining balance by SMS: *106# . Bonus control: *107# . Rest of the Internet: *108# .

- Voice informant: dial 0697 or 067404 .

- Via the Internet: the Personal Account service is available on the operator’s website using this link . On this portal you can manage your phone account, change tariffs and use other features.

To control the account status on your child’s number, dial *131*5*phone number you want to control#call key .

The essence of filling out the balance and instructions

The formation of a balance sheet is carried out in the process of the entrepreneur filling out all the lines of the form intended for this, taking into account the subtleties and nuances of the activities carried out by the company.

Both halves of the document are formed by lines in which those indicators that characterize the financial position of the enterprise are entered separately.

Each line has its own serial number, and also shows the name of the indicator that is displayed in this line.

The total amount of the asset, taking into account the order of filling out the balance sheet, is found by summing up all the indicators in the lines of this balance sheet according to their sequence throughout the first two balance sheet sections.

An example of filling out an Asset in the balance sheet:

Next, using the same technique for filling out the balance sheet, that is, taking into account the hierarchical meaning of the indicators in the rows, the liability table is filled out.

Example of filling out the Liability Balance:

Sometimes an amount equal to zero may be entered in some lines, then this fact should be explained in the documents accompanying the balance sheet.

Amounts are reflected in the balance sheet taking into account the reduction of amounts by three or six zeros (in thousands or millions). So, if the value of real estate owned by a given company is 10,000,000 rubles, then this amount can be reflected in the balance sheet as 10,000 thousand. Some companies whose scale of activity is very large may use their own abbreviation that is convenient for them.

You can choose how to express the indicators when filling out the header of the balance sheet form:

Complete instructions on how to create a balance sheet for dummies can be seen in this video:

So, when answering how to draw up a balance sheet, you should consider its two main components - these are Asset and Liability, which are presented in two tables and are designed to display all the financial processes occurring within the company and in its interaction with other organizations, from the point of view view of the financial transaction itself, as well as its source.

How to find out your Iota operator balance?

Iota

Iota operator may also limit services if the balance is zero. To control your account status with this operator, select one of the methods below:

- USSD additional service: *100#call key . The number of free minutes can be checked using the following combination: *101#call key .

- Mobile application Yota. In this application you will see an exact copy of your personal account from the Yota website using this link .

- Via the Internet on the website in the Yota Personal Account. You can access it using this link . The personal account provides all the information about your mobile account balance, tariff, and so on.

- Call specialists at the call center. Numbers to call: 8-800-550-00-07 or short number: 0999 .

Any application can be downloaded, depending on the OS of the smartphone or tablet, from Play Market , App Store , Microsoft Market . The mobile application of any operator is convenient because you can control expenses and account balance, as well as monitor the expiration date of paid days or find out about the remaining minutes, SMS and Internet traffic.

Ways to improve your balance sheet structure

It is almost impossible to create a perfect balance sheet for a company. For this purpose, an analysis of the financial condition of the enterprise is carried out. In the process of compiling it, negative trends that require improvement are always identified. Let's consider the most typical possible ways to improve the structure of the comparative analytical balance. Among these areas are:

- Use of specialized computer programs to ensure automation of the company's accounting processes.

- Bringing existing Russian accounting standards closer to international standards.

Existing shortcomings in the area of improving information support for balance users are associated with the use of modern automation tools. The main task is to optimize the company's information flows in terms of accounting information and towards the use of international standards, a reasonable system of classification, coding and data processing. This also includes the development of forms and methods of accounting in accounting, the use of computerization and modern software.

The introduction of automation processes makes it possible to improve the algorithm for calculating indicators when drawing up an analytical balance and conducting its analysis, and improve the quality of economic information.

It should be noted that the use of automation also makes it possible to reduce the time for receiving and processing operational accounting information about the state of balance sheet items and business assets.

How can I find out the account balance of another subscriber?

Not long ago, every mobile operator introduced a service that allows you to find out the balance of another subscriber. To do this you need to dial a simple combination:

- MTS - connect a special one by typing the following request: *111*2137# call key . You can also find out your balance by sending a message with the text “237” to 111 . The service is free.

- Megafon - first you need to get the consent of the subscriber whose balance you want to know. To do this, you need to send a message to the number 000006 , and put “+” . Then you can find out your balance by dialing the combination: *100*926…….#check balance . Instead of dots, put the subscriber's phone numbers.

- Beeline - just call +7-903-388-8696 . Follow the instructions and you will find out the balance of the subscriber you need.

- Tele2 - subscribers of this operator believe that such information is impossible to obtain. Tele2 does not have a special command, but you can find out the balance of another subscriber by calling 611 . Be prepared to provide the phone owner's passport details. If this is a complete stranger, then you will not have such data and then the operator will refuse the service. There will be no problems for relatives with information about the balance.

- Iota - this operator does not have such a service.

Now you know how to find out the balance of another subscriber from various popular mobile operators in Russia.

Formation and compilation methodology

As mentioned above, this balance is obtained by grouping the items of the company’s analytical balance sheet. In this case, the two most popular principles in the analysis process are applicable: liquidity and urgency.

When drawing up an analytical balance sheet, the principle of liquidity is that all active assets of the company are divided into four large groups:

- Assets with high liquidity. These include those funds that are cash or have the potential to become cash very quickly.

- Assets that are quickly realized. This usually includes all receivables that can be repaid in a short period of time, that is, within a period of up to 12 months.

- Assets that are slowly being realized. This includes stocks of raw materials, materials, goods, as well as receivables with a high return period, that is, for a period of more than 12 months.

- Assets that cannot be classified as current. These are buildings, structures, that is, non-current assets.

Let us consider the principle of urgency when forming an analytical balance. When using it, liability items are formed in the following areas:

- Liabilities that are very urgent, such as accounts payable.

- Liabilities that are current and short-term in nature: loans and credits for a period of up to 1 year.

- Liabilities that are long-term in nature: loans over 1 year and bonds.

- Liabilities classified as permanent: authorized capital, profit and reserves.

An important feature should be noted: the sum of all assets formed according to the principle of liquidity is equal to the sum of all liabilities formed according to the principle of urgency.

What to do if the balance is zero?

There are 0 rubles on your mobile phone account.

When your phone account balance is close to zero, it is always unpleasant. After all, without a phone, it’s like being “without hands”—it’s impossible to make a call or send an SMS, and you won’t be able to access the necessary services on the Internet. But the operators have taken care of their subscribers and offer a set of simple manipulations that will help them use the services without restrictions.

Tele2 - the balance is close to zero, there are 3 options to get out of this situation:

- Take the “promised payment”: *122*1#call key .

- Send a free SMS to friends or family with a request to call back: *118*number of the desired person via “8”#call key.

- Send free SMS via the Internet. This can be done in the subscriber’s personal account.

Megafon - if the balance is close to zero, you can connect. There are several ways to do this:

- SMS indicating the amount (150 or 300 rubles) to 0006.

- Call 0006 and follow the robot's instructions.

- Dial *106#call key or *1006#call key .

- Order the service on the official website, on the “ Top up balance ” page.

MTS - . Do the following:

- *110*phone number#call key.

- The subscriber will receive a message from you asking you to call back.

Beeline - if the balance is zero, Beeline is valid. In this case, you will not be able to make calls, but calls and SMS from other operators will reach you without problems. If you need to call, then do the following:

- Connect using the command *114*9#call key .

- : *141#call key . To find out how much money can be credited to your account, dial the following combination: *141*7#call key .

- . This service will help you automatically replenish your balance if it is less than 50 rubles. You only need to dial once: *141*11#call key .

- SMS “Top up my account” . You can make such a free request to friends, relatives or any other subscribers of this operator. Dial the following combination: *143*subscriber number#call key .

- Option “Call at the expense of the interlocutor” . Dial 05050 . Wait for the connection with the subscriber, and if he agrees to talk, then you will be connected. If the interlocutor is against paying for such a conversation, then there will be no connection.

- : *144*subscriber number#call key.

Yota

Yota - if there is no money in the account of the Yota operator, the subscriber does not need to do anything, since the operator has already taken care of it. You can continue to use the Internet even if you are unable to top up your account. But such a service is available if you are currently abroad and you are not able to top up your account. It will remain in effect as long as the phone remains in roaming. You can communicate with others with a zero balance using the following popular instant messengers:

- Viber

- Telegram

- Facebook Messenger

- iMessage

As you can see, each operator has provided everything necessary to make it easy for the subscriber to use mobile communication services. The combinations of requests and USSD commands are simple, as are the phone numbers by which you can find out specific account information.

Form Submission

The main feature of an analytical balance sheet (as opposed to a simple accounting balance sheet) is that the items in it do not need to be deciphered thoroughly and in detail, but can be presented in the form of specific groups. That is, it lacks deep detail of indicators. The presentation of this type of report is based on this feature.

The studied form can be represented more clearly by the following table:

| Index | Base period | Reporting period | Dynamics, thousand rubles. | ||

| in absolute units | V % | in absolute units | V % | in absolute units | in % of the change in TOTAL balance |

| Assets | |||||

| 1. Non-current assets | |||||

| 2. Current assets | |||||

| 2.1. Reserves | |||||

| 2.2. Accounts receivable | |||||

| 2.3. Cash and investments | |||||

| BALANCE TOTAL | |||||

| PASSIVE | |||||

| 3. Own capital | |||||

| 4. Long-term liabilities | |||||

| 5. Current liabilities | |||||

| 5.1. Loans | |||||

| 5.2. Creditors | |||||

| TOTAL BALANCE |

This table should reflect all existing values of the company and calculate the indicators:

- Structures (in % of the balance sheet total).

- Dynamics in absolute units (thousand rubles).

It is also possible to calculate the growth rate in % compared to the beginning of the year. This form allows you to draw the most understandable and convenient conclusions on changes in balance sheet items, as well as use specific data to calculate coefficients in financial analysis.

Answers to frequently asked questions on the topic “Horizontal and vertical balance sheet analysis”

Question: What are the advantages and disadvantages of using vertical and horizontal analysis of financial statements?

Answer: The positive side of horizontal analysis is the ability to assess the dynamics of financial indicators by year. A significant drawback is the fact that this type of analysis is of little use for assessing the financial condition and making decisions by managers - it is rather a diagnostic method. As for vertical analysis, it makes it possible to track changes in the structure of A and P of the company, but also does not allow assessing its financial condition.