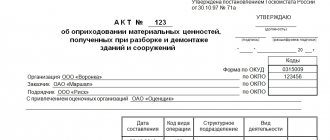

This form can be printed from the MS Word editor (in page layout mode), where the viewing and printing options are set automatically. To go to MS Word, click the button. Approximate form APPROVEDHead (name of organization) (full name)" » city (signature) » » city Place of drawing up The act was drawn up by the commission: Chairman - (position, initials, surname) Members of the commission: (chief accountant (accountant) , initials, surname) (position, initials, surname) (position, initials, surname) Grounds: Order on the creation of a commission for dismantling equipment No. dated » » 20

The commission dismantled the equipment that was subject to dismantling in accordance with the drawn up act No. dated » » 20. Reason for disassembly 1.

How to formalize dismantling of fixed assets

Important

This should also be reflected accordingly in accounting (budget) accounting. According to paragraph 85 of Instruction No. 157n, if the useful life of a depreciable fixed asset changes due to a change in its initially adopted standard performance indicators, including as a result of completion, retrofitting, reconstruction, modernization or partial liquidation, starting from the month in in which the useful life has been adjusted, the calculation of the annual amount of depreciation is carried out by the institution using the straight-line method, based on the residual value of the depreciable object on the date of change in the useful life and the adjusted depreciation rate, calculated taking into account the remaining useful life on the date of change in the useful life.

Who disassembles the OS and how?

The disassembly of the OS is carried out as follows according to a strict algorithm:

- An order is issued to dismantle the OS.

- The amount of depreciation of the fixed asset is determined.

- Disassembly costs are taken into account, which includes the creation of a commission by order of the company's general director.

The commission should include the chief accountant of the enterprise, as well as employees responsible for the safety of the organization’s facilities.

When accounting for expenses, several methods are used:

- If an item of fixed assets will continue to be used, its disposal costs are included in the cost at which it is accounted for in the warehouse.

- If the equipment is no longer used, it is disposed of, and the costs are included in other non-operating expenses.

Immediately after the dismantling work is completed, an acceptance certificate for the fixed asset, as well as modernized and reconstructed facilities, must be drawn up.

As a result, the accounting department must calculate the cost of the main property, taking into account the reduction by the cost of those components that were removed and reconstructed.

The following expenses must be reflected in accounting documents:

- Costs for dismantling capital equipment.

- VAT amount from the contractor.

- Contractor payment.

- Depreciation of a new object.

The act of dismantling equipment does not have a clear form; it depends largely on the specifics of the enterprise, as well as on the type of fixed asset that is subject to disassembly.

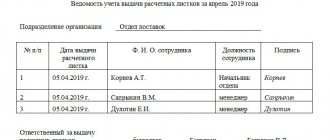

But the approximate form is almost the same everywhere. It includes the following information:

- Full name of the manager who approves the act, as well as date and signature.

- Who drew up the act (the commission and all its members who must sign the act).

- Place of compilation.

- Reason (number and name of the order for dismantling the main equipment).

- Reason for dismantling.

The following is a table containing the following information in the columns:

- Name of the dismantled equipment.

- Inventory and serial numbers of dismantled items.

- Date of release or construction of the object of interest.

- Date of acceptance of the fixed asset for accounting.

- The period of actual operation of an object that occurs at a given enterprise.

- The initial cost of the object at the time of acceptance for accounting.

- The amount of accrued depreciation.

- Residual value of dismantled equipment.

Only on the basis of such an act does the enterprise have the right to sell disassembled goods. In this case, the capitalization of the former equipment occurs at the residual price, which is indicated in the act.

Dismantling of inventory items of fixed assets

Features of the dismantling of fixed assets Quite often, an object of fixed assets is not a separate structurally isolated item intended to perform certain independent functions, but a separate complex of structurally articulated items that represent a single whole and are intended to perform a specific job. A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently ( P.

41 Instructions N 157n <1).

Dismantling of fixed assets (Lunina o.)

Info

Set amount in rubles (gr. 9 xx gr. 4) Total number of items after unpacking 1 2 3 4 5 6 7 8 9 10 11 1234567 Plate 22.5 cm “Orion” " 1 6 6 28.57 4.2855 0.71425 1915 11 490 120 1234568 Plate 26.4 cm "Orion" 1.5 6 9 42.86 6.429 1.0715 2874 17 244 120 1234569 Tureen 3 l " Orion" 6 1 6 28.57 4.2855 4.2855 11,493 11,493 20 Total: 13,217,260 Chairman of the commission: Mikhailova N.N. Signatures of the commission members: Nikolaeva S.S. Sergeeva M.M.

Dmitrieva D.K. 12/13/2005 Margarita Zgirovskaya, auditor, “Chief Accountant” magazine. Pricing" No. 12, 2005. For a more detailed study, see

Write-off of fixed assets: dismantling

This is explained by the fact that depreciation is calculated based on the cost of fixed assets. It includes the cost of components that are disposed of.

The procedure for changing the amount of depreciation charges is reflected in the company's accounting policies. If the useful life of the instrument remains the same, recalculation is performed in proportion to the cost or percentage of the retired component.

There is no procedure for determining markdowns in regulations. For this reason, the size of the markdown is determined by the organization itself. The markdown procedure must be established in the company’s local regulations.

We reflect the decommissioning of goods in accounting

As a result of disassembly, several types of other goods are obtained from one purchased product. Such an operation may be necessary, for example, when a company wants to sell a product not in its original form - as a single whole (as a set), but in parts (for example, bindings separately from skis). Or, let’s say, the battery in the charger has expired, so it was decided to write off the battery itself (as a separate product item), and count the charger as a new product.

Let us say right away that when dismantling the purchased product, you are not engaged in any production of a new product. After all, your actions do not change the essential characteristics of the components (for example, their service life), they do not acquire new properties. This means that dismantling is carried out within the framework of trading activities.

The organization itself must establish and prescribe in its accounting policies the procedure for determining the cost of new commodity items received after dismantling. Their cost is formed based on the actual cost of the original product, which is distributed among new types of goods.

If the elements that make up the set are the same, then you simply need to divide the cost of the set by the number of these elements. If the set consists of different things, then its actual cost can be distributed, for example, in proportion to the selling price of each thing.

In addition, the accounting policy also needs to reflect the method of accounting for the costs of dismantling goods, which can include, for example, employee salaries and insurance premiums accrued on it, costs for new packaging, etc. 7 PBU 1/2008 Cost accounting will depend on the moment when the company decided to dismantle the goods.

OPTION 1. The decision was made regarding the balances of previously recorded goods. Then such costs will not affect the cost of new product units. 2, 12 PBU 5/01. These amounts are included in commercial expenses and are recorded in account 44 “Sales expenses”.

We prepare documents

It is advisable to formalize the decision to dismantle goods by order of the manager, in which responsible persons should be appointed. It can also indicate the reason for dismantling (for example, low demand for kits).

Upon dismantling, it is necessary to draw up an act on the basis of which new goods will be entered into accounting.

We provide samples of these documents below.

https://youtu.be/JMag-hAo-9M

Certificate of dismantling of equipment (approximate form)

The cost of a 500 GB hard drive was written off in the amount of accrued depreciation 2,104 34,000 2,101 34,000 2333.33 The residual value of a 500 GB hard drive was written off 2,401 10,172 2,101 34,000 1166.67 A new 1 TB hard drive was purchased 2 105 36 thousand computer cost 2,101 34,000 2,106 31,000 6000 Reflected monthly depreciation charge after modernization 2,109 60,271 2,104 34,000 1101.85 Please note that in the case of complete disassembly of a complex fixed asset into its component parts and acceptance of some of them for accounting, it has The place is not partial liquidation (dismantling), but write-off (liquidation) of a fixed asset.

How to take into account costs when dismantling

Partial liquidation involves various expenses. They also need to be taken into account. This can be done in several ways:

- If the disposed object will be used in the future, disposal costs are included in the cost at which the item is taken to the warehouse.

- If the retired part will not be used in the future, it must be liquidated. Disposal expenses are included in other non-operating expenses.

When accounting, certain accounting entries are used. Each of them reflects a specific operation. That is, from the wiring we can conclude what action was carried out.

Accounting for dismantling

After disassembly, you need to draw up a certificate of acceptance and delivery of the OS. It is drawn up according to the OS-3 form. Liquidation of funds does not involve drawing up a primary statement in a given form. The procedure can be documented by an act of write-off of fixed assets in the OS-4 form. Correcting the initial cost of an object involves changing the information recorded in the inventory card. Finally, you need to reduce the initial cost of the OS by the cost of the seized object. Let's look at the wiring that is used during disassembly:

- DT01.09 CT01.01. Write-off of a commission share of the initial cost of fixed assets based on partial liquidation. Primary documentation: commission act, dismantling order, OS tool inventory card.

- DT02 KT01.09. Write-off of part of the depreciation that was accrued before dismantling work. Primary documentation: similar to the previous posting.

- DT10.09 CT01.09. Capitalization of a retired instrument at the residual price. Primary documentation: certificate-calculation.

- DT08.03 KT60.01, 70. Recording expenses for dismantling. Primary documentation: act of work performed, salary slip, act of write-off of materials, certificate of calculation.

- DT19.04 KT60.01. Fixation of the VAT amount presented by the contractor. Primary documentation: invoice.

- DT68.02 KT19.04. Acceptance of VAT for deduction. Primary documentation: certificate of work performed, invoice.

- DT60.01 KT51. Transfer of funds to the contractor. The extract is confirmed by an extract from the banking institution.

- DT01.01 CT08.03. Reconstruction costs were included in the initial cost. Primary documentation: Primary documentation: certificate of acceptance and delivery of OS tools, certificate of calculation of the recalculated cost.

- DT10.09 CT10.09. The disposed instrument is sent to another department or storage facility. PD: invoice, receipt order.

- DT20 KT02. Calculation of depreciation for fixed assets. The posting is confirmed by a calculation certificate.

The list of primary documents may be different. It all depends on the specifics of the specific company’s activities. However, the primary is required. It confirms that the transaction has taken place. Unconfirmed transactions should not be taken into account.

Certificate of completion of fixed assets sample

Information about the condition of the equipment as of the date of disassembly: Name of equipment Number Date Actual service life Initial cost at the time of acceptance to accounting Amount of accrued depreciation (wear and tear), rub. Remaining exact cost, rub. Inventory factory release (post-construction) acceptance for accounting or replacement cost, rub. 1 2 3 4 5 6 7 8 9 Access to the full version of this document is limited. You can familiarize yourself with the document by ordering a free demonstration of the Codex and Tekhekspert systems or buy this document right now for only 49 rubles.

- Order a demo Free, in your office

- Buy a document For only 49 rubles.

The payment process is completing.

To disassemble the kit, a special act is required

At the same time, the acceptance of new inventory accounting objects obtained as a result of dismantling is reflected in the debit of the corresponding analytical accounting accounts of account 0 101 00 000 “Fixed assets” and the credit of account 0 401 10 172 “Income from transactions with assets” with the simultaneous reflection of the amount of accrued depreciation on the credit of the corresponding accounts analytical accounting of account 0 104 00 000 “Depreciation” and debit of account 0 401 10 172 “Income from transactions with assets.” By Order of the Ministry of Finance of Russia dated November 16, 2016 No. 209n, paragraph 10 of Instruction No. 162n was amended - the KOSGU codes of analytical accounts of account 0 101 00 000 were clarified.

Act of completion and disassembly [126]

For Ukraine - standard configuration Debit Credit Description Balance sheet (in the accounting registers) 3723 Inventory account Cost of written-off inventory items Inventory account 3723 Cost of capitalized inventory items Off-balance sheet (entries in warehouse accounting registers) MOL 0 Write-off of inventory items 0 MOL Capitalization of inventory items Acquisition is carried out through the materially responsible person .Inventory account - the inventory account for the written-off object is determined automatically by write-off; for the incoming object it is specified in the “Account” field of the document. The write-off amount is calculated automatically according to batch accounting, depending on the established write-off method.

1C-Rating

Reprinting and other full or partial reproduction and reproduction of site materials/articles (as well as their copying on other Internet resources) is not permitted.

Publication date: 10/16/2012

In the course of the activities of public catering enterprises, the question often arises of formalizing such an operation in which the finished product must be sold in parts or the purchased product must be broken down into components. Such operations include cutting and disassembly.

First of all, let’s determine what the difference between these operations is. The main difference between cutting and dismantling operations lies in the purpose. Disassembly can be used to disassemble finished dishes (products), the ingredients (components) of which have not been processed and can be divided into components without any significant losses. The disassembly output is formed in accordance with the recipe. Cutting involves dividing some whole product into parts. Each component represents a certain fraction of the original product. In this case, the weight of the original product may differ from the weight of the cutting result.

This article will discuss the execution of the listed operations using the application solution “ 1C-Rating: Public catering ”.

Let's look at the design of cutting and dismantling operations using the following examples:

- A catering company purchases a whole beef carcass to prepare dishes that include beef. From the purchased carcass, several types of ingredients are obtained for preparing various dishes. For example, minced meat, fillet, bones, etc. In this case, the purchased carcass must be cut, which will entail some losses (waste), as a result of which the total weight after cutting will be less than the weight indicated during receipt.

- Let’s say that when preparing the “Banana Cocktail” drink, it turned out that the warehouse was out of bananas. At the same time, the “Fruit Assortment” dish was previously prepared, the recipe of which included this ingredient, but the order for this dish was canceled after it was prepared. That is, this ingredient has already been written off for production, although in fact it can be used to prepare the “Banana Cocktail” drink.

Let's determine what operations need to be completed for each example. In the first case, it is advisable to arrange the operation of cutting the carcass, since the original product will be divided into several components, the total weight of which will be less than the weight of the original product. In the second example, it is necessary to formalize the operation of disassembling the “Assorted Fruit” dish in order to use one of the components of this dish in the preparation of the “Banana Cocktail” drink.

Registration of the operation “Cutting”

According to the example under consideration, the following ingredients are obtained from beef carcass: minced meat, fillet and bones. For each ingredient it is necessary to create a new nomenclature and for each nomenclature set the unit of measurement “kilogram”.

Next, for the nomenclature “Carcass meat (beef)” we will enter a recipe for cutting (menu “Production” - “Recipes”).

We will indicate the type of recipe “Cutting”, and in the tabular part we will indicate the created nomenclature items “Beef fillet”, “Bones” and “Mind beef” as ingredients. For each ingredient, in the “Percent%” column, set the yield percentage. In this case, the total percentage of ingredients yield is 94.8, therefore the remaining 5.2% is waste. There is no need to include a percentage of waste in the recipe.

Next, we will formalize the cutting operation using the “Cutting” document (menu “Production” - “Cutting”). In the “Nomenclature” attribute we indicate the nomenclature “Carcass of meat (beef)” in the amount of one piece (the unit of measurement coefficient in this case will be equal to one, since the units of measurement of the nomenclature “Carcass of meat (beef)” and its ingredients are the same), in the attribute “ Recipe”, select the previously created “Cutting” recipe.

Next, fill out the “Components” tabular section using the “Fill” menu in the command panel of the tabular section. When you select the “Fill according to recipe” command, the tabular part will be filled with ingredients according to the specified recipe. The quantity of ingredients will also be filled in automatically according to the recipe. The composition of the tabular part can be changed if necessary - add components that are not in the recipe, or remove components that were not actually received.

In the “Price” column we indicate the prices of the components received. Prices for components are filled in automatically only if a price type is specified for the document, and prices of this type are set for the item. To select a price type, use the button «

Prices and Currency

"

in the top command bar of the document.

On the “Accounts” tab, you must specify accounts for accounting and tax accounting expenses to generate accounting entries for write-offs:

- Cost accounting account (AC) - this section indicates the accounting account (in this case it is account 8210 “Semi-finished products of own production”), through which the cutting or disassembly operation will be processed, and its analytics will also be filled out.

- Cost accounting account (CA) - this section is available only if the document has the attribute for reflection in tax accounting (the “Take into account CIT” attribute) set. Here you indicate the accounting account through which the cutting operation will be reflected in tax accounting.

- Reflection of expenses - this section indicates the cost item to which the difference between the amount written off and capitalized will be attributed if the amount written off is greater. This difference is reflected in account 7470 “Other expenses”.

- Reflection of income - in this section you fill in the type of income that arises when the amount written off is less than the amount credited.

The ability to reflect a document in tax accounting depends on the accounting policy parameter “Keeping records of temporary differences using the balance sheet method.” If this parameter is not enabled on the document date, then the details for reflecting the division of the operation in the NU will be unavailable and invisible. If this accounting policy parameter is in effect on the date of the document, then the reflection of cutting or disassembly in tax accounting can be enabled using the “Take into account CIT” flag.

When posting a document, accounting entries are generated:

- Write-off of inventory items - write-off of the original item “Meat carcass (beef)”, which is indicated in the header of the document from the item accounting account to the production account. The production account is indicated on the “Accounts” tab.

- Capitalization of goods and materials is the receipt of products listed in the tabular part “Components” (minced beef, bones, beef fillet) from the production account to the item accounting accounts, which are indicated in the details “Account BU” of the tabular part.

- In the example under consideration, the amount of write-off is greater than the amount of capitalization of cutting results, since the waste generated during cutting is taken into account. Therefore, the following posting is generated: Dt account 7470 (“Other expenses”) - Kt cost accounting account. The subconto of account 7470 is filled in with the cost item specified on the “Accounts” tab in the “Reflection of expenses” section of the document. If the write-off amount was less than the amount of capitalization of the cutting results, then the following entry would be generated: Dt account 6280 (“Other income”) - Kt cost accounting account. Analytics for account 6280 is filled out according to the “Type of income” detail, which can be filled out in the “Reflection of income” section on the “Accounts” page of the document form.

Information from the “Cutting” document can be printed using the “Cutting of items” button on the document form.

In addition, a printed form “Cutting Act” is available. The “Cutting Report” displays information about the quantity, price and amount of write-off of the original item, the output rate, as well as the actual output of semi-finished products, prices and the amount of output, the deviation of the actual output from the standard one.

Registration of the operation “Disassembly”

Now we will reflect the disassembly operation for the “Fruit Assortment” dish. To do this, we will create a recipe for this item with the recipe type “Disassembly”.

In the “Nomenclature” detail we will indicate the finished dish “Assorted Fruits”, we will also indicate the layout of the dish and the number of servings. We will leave the unit of measurement coefficient unchanged. Next, fill out the tabular part “Initial components” with the list and quantity of ingredients spent on preparing this dish.

Let’s create a new document “Cutting” for the product “Assorted Fruits”, in which we will indicate the created recipe in the “Recipe” attribute. The document operation type is specified by the type of the specified recipe. From the point of view of filling out documents and creating transactions, these operations are very similar.

The tabular part “Components” will be filled in automatically according to the specified recipe. Prices for components are filled in automatically only if a price type is set for the document and prices of this type are set for the item. To select a price type, use the button «

Prices and Currency

"

in the top command bar of the document.

On the “Accounts” tab, you must specify accounts for accounting and tax accounting costs, for example, accounts 1310 and 1310N “Raw materials and materials”. The composition of the details for filling is similar to the cutting operation.

When posting a document, accounting entries are generated:

- Write-off of inventory items during dismantling - write-off of the original item, which is indicated in the header of the document, from the item accounting account to the production account. The production account must be selected on the “Accounts” tab.

- Capitalization of goods and materials during disassembly is the receipt of products listed in the tabular part “Components” from the production account to the item accounting accounts, which are indicated in the tabular part.

- Other expenses during dismantling - an entry that reflects the difference between the amount written off and the amount received. If the write-off amount is greater, then a posting is made: Dt cost accounting account - Kt account 7470 (“Other expenses”). The subconto of account 7470 is filled in with the expense item specified on the “Accounts” tab in the “Reflection of expenses” section. When the write-off amount is less than the amount of capitalization of cutting/disassembly results, a posting is generated: Dt account 6280 (“Other income”) - Kt cost accounting account. Analytics for account 6280 is filled out according to the “Type of income” detail, which can be filled out in the “Reflection of income” section on the “Accounts” page of the “Division” document form.

If on the date of the document the accounting policy parameter “Keeping records of temporary differences using the balance sheet method” is in effect and the “Take into account CIT” flag is set in the document, then when posted, the document will generate transactions according to NU, which will be completely similar to transactions according to accounting.

Thus, the ingredients obtained when disassembling the “Fruit Assortment” dish can be used to prepare other dishes. In this example, the “Bananas” ingredient will be used to prepare the “Banana Cocktail” drink.

Information on disassembled items can be printed using the “Disassembly of items” button on the document form.

We wish you effective work at 1C-Rating: Public Catering!

SaveSaveSave