How to draw up a document

The document is generated by an accountant or cashier of the organization, who draws up pay slips and, together with wages, hands them over to the staff. He also makes sure that every employee who receives a pay slip signs for it.

It must be said that at an enterprise during the reporting period, not one statement can be filled out, but several (for each structural unit separately).

Both in terms of the format of the statement and in terms of its design, everything is left to the compiler. The document can be generated on a simple ordinary piece of paper or on a form with company details and the company logo. The statement can also be drawn by hand or printed on a computer (in the vast majority of cases, the second option is used).

The statement is always made in one original copy. Its volume may vary, but if it contains several sheets, they must be numbered in order and fastened with thick, harsh thread. On the last page, a piece of paper is pasted onto the bundle, indicating the number of pages, the date and the signature of the responsible employee.

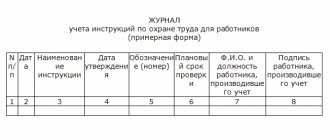

The journal for recording the issuance of pay slips is filled out based on them and the fact of handing them over to each employee separately. The filling process is not difficult at all. Since current legislation does not oblige the employer to issue notices of accruals to staff against signature, accordingly, there is no approved form of the journal. Each enterprise has the right to develop and approve its own form. Alternatively, you can purchase a ready-made magazine.

►Instructions for personnel records management according to the new GOST

On what basis is the journal compiled?

There is no unified form for the pay slip book; this gives organizations complete freedom in the formation of the document. The form should be developed taking into account the specifics of the activities of the public sector organization or other industry characteristics. You can log the issuance of payslips below.

The document must be approved by order of the head of the organization. If there are several divisions with a large number of workers, it is more convenient to create a document for each division. Don’t forget about temporary and freelance employees; pay slips must be issued to all employees without exception.

The magazine is bound, and on the last page it is required to put a stamp and indicate the total number of pages (in numbers and in words). The title page indicates basic information about the organization (division), maintenance and storage periods. Be sure to include information about the official who is responsible for maintaining the document.

IMPORTANT! Do not forget to include in the job description of the assigned employee the responsibility to maintain and store the log.

>Journal of payslips issuance

Explanation of the payslip

Article 136 of the Labor Code of the Russian Federation

In accordance with the requirements of Article 136 of the Labor Code of the Russian Federation, the following information must be reflected in the sheet:

- Data on parts of salary for the reporting period. The amount includes:

- salary;

- accrued bonus;

- established allowances (for hazardous conditions, for work in the northern region, etc.);

- compensation payments, for example, for using your own tools or for working on a day off.

- Salary deductions:

- personal income tax;

- pension contributions;

- union dues;

- other deductions (for example, unreturned travel advance);

- withholding under a writ of execution, for example, alimony.

- Additional charges:

- payment of vacation pay;

- payment upon dismissal;

- compensation for violation of labor laws by the employer;

- other payments.

- Summary information about the amount to be paid.

Note! A previously paid advance may be allocated separately.

Accountants additionally indicate the following information on the payslip:

- FULL NAME. and the position of the employee;

- Name of the structural unit (workshop or department);

- Personnel number, if available;

- Time period (usually a month);

- The number of hours worked and working hours in the reporting period in accordance with the established working hours.

The document may contain other information if this is required to fully inform employees about the amount of their earnings.

In some cases, parallel to the entries on the sheet, accounting codes corresponding to the purpose of each payment are entered.

What does a payroll slip include and how is it issued?

The components of wages are (Article 135 of the Labor Code of the Russian Federation): - fixed amount of remuneration (tariff rate, official salary, basic official salary); — compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in territories exposed to radioactive contamination, and other payments of a compensatory nature); — incentive payments (additional payments and bonuses of an incentive nature, bonuses and other incentive payments). The obligation for employers to notify employees about the components of wages is provided for in Art. 136 of the Labor Code of the Russian Federation since 2002 (that is, since the adoption of the Labor Code), and until recently nothing has changed in it.

How to issue correctly

Since the provision of information on the amount of earnings in the form of a payslip is the responsibility of the employer, care should be taken to document the transfer of these documents to employees.

There are 2 most common ways of doing this. The first is to make a piece of paper with a tear-off part. The papers are handed over to the head of the department, who distributes the sheets to employees and collects their signatures, and then submits the reports to the accounting department. This is advisable if we are talking about a large enterprise.

The second option is to keep a special journal where employees will sign for receipt of the document.

Note! Pay slips are also required to be issued when money is transferred to bank cards.

Do I need to take confirmation from the employee of receipt of the pay slip?

The procedure for confirming the issuance of pay slips to employees is also not defined by law, but it would be better to take care of such confirmation in order to avoid problems with regulatory authorities. A paper payslip can be issued to the employee personally against signature, but to transmit the slip via electronic communication channels, it is necessary to provide the technical ability to confirm receipt of the document by the employee.

_________________________________________

(name of institution)

Logbook for issuing pay slips for __________/_________.

| No. | Date of issue of payslip | Employee's full name | Employee position | Signature |

payslips ______________ ____________ _______________

position signature transcript of signature

To confirm the issuance of a pay slip, you can also add a separate column to the payroll in which employees will sign for receipt of the pay slip.

Speaking about the procedure for issuing pay slips, you need to remember that the income of an individual relates to the employee’s personal data (Clause 1, Article 3 of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”).

By virtue of Art. 7 of Federal Law No. 152-FZ, third parties gaining access to personal data must ensure the confidentiality of such data. Therefore, those responsible for issuing pay slips should be warned (under signature) of the need to maintain secrecy (confidentiality).

Dates for issuing to employees

Letter of Rostrud dated March 18, 2010 No. 739-6-1

Salaries are paid at least 2 times a month, as provided for in Article 136 of the Labor Code of the Russian Federation. The same article states that the employer is obliged to issue a payslip when paying money in general.

The Ministry of Labor in letter No. 739-6-1 dated March 18, 2010 indicates that the procedure for issuing these documents should be regulated by local regulations of the employer. In this case, employees must receive slips no later than the day on which the money is directly issued. This letter also states that employees can be informed once a month.

Based on this, we can draw the following conclusion: slips are issued once a month no later than the day the main part of the salary is transferred. It is advisable to do this 2 days in advance so that employees can voice their objections before the money is transferred.

Salary receipts by email

An electronic method of transmitting salary information to an employee is:

- economical: we do not waste paper or printing consumables;

- fast: uploading and sending a letter takes a few minutes;

- simple: no need to look for an employee, just select the recipient - and you're done.

But is it so reliable, since the receipts contain personal data? In order to protect your organization from fines from regulatory authorities, you should approve the procedure for transmitting receipts by email (based on the letter of the Ministry of Labor dated February 21, 2017 No. 14-1/OOG-1560).

Let’s say that not all employees of the organization have the opportunity and necessary skills to use a computer and e-mail. In this case, it is necessary to provide two options for transferring settlements. Approve both orders with an order and familiarize the employees with signature.

06/07/2018

Do I need to maintain payroll slips to record them?

The issuance of leaflets is a mandatory procedure. With each payment of wages, this form must be provided to each employee, regardless of the method of issuing funds - in cash from the cash register or on a card. How to understand the payslip?

| Accountant | Entrepreneur | Organization |

| primary disorder | ||

| 1 – 5 thousand rubles. | 30 – 50 thousand rubles. | |

| repeat offense | ||

| 10 – 20 thousand rubles. | 50 – 70 thousand rubles. | |

In case of a primary violation, you can get off with a simple warning. If repeated, the manager may additionally be disqualified for a period of 1 to 3 years.

However, if employees file a complaint about failure to provide the required document, the organization will be held accountable.

Without a registration entry in the journal, the employer will not be able to prove the issuance of the document.

It turns out that the accounting and registration journal is not mandatory, but without it you cannot prove the fact of compliance with the norms of the Labor Code of the Russian Federation.

There is another option for notifying employees about accrued wages - sending payslips by email. When using this option, you must first specify the email to send the notification.

Many organizations create corporate mailboxes, which are simply accessed during employment.

The method of notifying personnel must be specified in the local act that approves the form of the pay slip, in labor and collective agreements.

This is recommended by Rostrud in letter No. PG/365 dated December 27, 2016.

If the organization has a correct system for familiarizing employees with payslips, it will not be possible to hold the employer accountable.

He will always be able to prove that a document explaining the composition of wages was handed over to the employee. It doesn't matter by email or by hand.

The journal can be replaced by a statement of accounting and issuance of sheets.

How to fill it out?

The legislation does not oblige organizations to maintain a special journal for the issuance and registration of pay slips. Therefore, there is no unified form of this document.

There is only an approximate structure developed in practice.

It includes a number of main columns:

- date of issue of the document;

- employee data;

- employee signature.

The document must also have a title indicating the month for which the payslip is provided. Be sure to indicate the name of the organization. At the bottom of the document is the position, full name. and the signature of the employee responsible for maintaining the journal.

The registration log is filled out as pay slips are issued and stored in the accounting department and then in the archive.

The purpose of storage is to provide evidence of the issuance of the required document to the employee.

If the organization has a large number of people, it is recommended to keep such logs by structural divisions.

It is worth remembering that the information on the pay slip is confidential and passing the document through someone else is strictly prohibited.

Statements are subject to mandatory accounting. Information about each of them must be entered in a special accounting journal.

It is enough to include the form number and the date of its generation. The journal is kept by the compiler of the statements and, if necessary, it not only certifies the fact of the creation of the document, but also allows you to quickly find it.

Do payslips need to be kept in the organization?

Contents When receiving wages, each employee must receive a payslip. Despite the fact that the procedure for providing a document to an employee is not a right, but an obligation of the employer, many managers shy away from issuing it.

In accounting, you often hear the opinion that salaries are white, which means there is no point in simply printing and translating sheets. They only issue receipts upon request.

The issuance of pay slips is prescribed in labor legislation.

Therefore, each institution must follow the procedure for providing a document to an employee.

A pay slip is an important document for the employee and the employer himself. It is necessary to know the legal requirements regarding its issuance, as well as the main obligations of the institution’s management to the employee.

Payslips are provided for by the Labor Code of the Russian Federation. If they are not issued, the organization may be held accountable by the Labor Inspectorate.

A fine is an unpleasant consequence of non-delivery.

However, this is not the main negative aspect of the lack of sheets. The document is considered to confirm the fact of payment of wages.

If an employee decides to sue the employer, then there is a high probability that management will lose the case. According to the law, an employee must file a claim for illegal dismissal within a month after receiving the order or work record book.

If other disputes are considered, then it is given three months. If the application is submitted late, the employer will not be held liable.

Shelf life

The storage period for the statement is determined individually. It may depend on the company’s internal regulations or be calculated based on legislative norms (but not less than three years). Once the significance of a document is lost, it can be destroyed, but also only if a certain procedure prescribed by law is followed.

Payslips must be kept for 5 years, subject to verification. This procedure is contained in Order No. 558 of the Ministry of Culture dated August 25, 2010, which reflects the storage periods for most business documents.

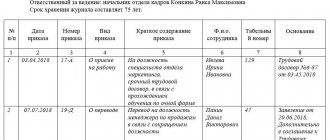

First, you need to draw up the title page of the journal, indicating on it the name of the register, the name of the enterprise (if necessary, division) and the start date. Just below leave a space for further indicating the end date of maintenance.

On the first sheet there is a plate indicating the name of the person responsible for filling out the form. Over time, this person may change, or the main employee may be replaced by a temporary one - all this information should be reflected in the table. The structure is quite simple: serial number, start and end dates of the assigned responsibility, full name of the responsible person and a place for his signature.

The main section will contain a table for entering data on the issuance of pay slips. It is most convenient to keep a register monthly; this will make it easier to find information if the need arises. As practice shows, the statement usually consists of the following columns:

- serial number;

- Full name of the employee;

- Personnel Number

- employee's position;

- date of issue of the payslip;

- signature of the employee upon receipt.

If the employer considers it necessary, additional columns for notes can be added to the book, in which you can note, for example, personnel changes (transfer to another structural unit, dismissal, going on maternity leave, etc.), which will simplify the procedure for finding information.

The general rules for filling out the journal for issuing pay slips are the same as for other similar statements. Entering data retroactively is not allowed, which is why information is entered on each line, without gaps. If the journal form is typed up manually, it is better to immediately set the line height to such a level that would make it possible to make corrections.

Corrections are undesirable, but possible if they are made carefully, legibly and certified by the signatures of the person responsible for the journal and the employee in respect of whom they were made, as well as the seal of the organization and the inscription “believe the corrected.”

Samples of required documents

The journal for recording the issuance of pay slips is filled out based on them and the fact of handing them over to each employee separately. The filling process is not difficult at all. Since current legislation does not oblige the employer to issue notices of accruals to staff against signature, accordingly, there is no approved form of the journal. Each enterprise has the right to develop and approve its own form. Alternatively, you can purchase a ready-made magazine.

►Instructions for personnel records management according to the new GOST

Deductions that may be included on a payslip include:

- alimony and other penalties according to executive documents;

- personal income tax amounts and insurance contributions to extra-budgetary funds;

- union dues;

- unearned advance issued on account of wages;

- unspent and not returned timely advance payment issued in connection with a business trip;

- amounts overpaid to the employee due to accounting errors, etc.

All types of deductions are also listed separately, for example: personal income tax (rounded to whole rubles), alimony, unreturned accountable amounts, deduction for unworked vacation days, additional insurance contributions for pensions, etc. The procedure for notifying employees about payment of earnings The Labor Code of the Russian Federation obliges the employer to issue pay slips to employees, therefore the fact of transferring them to employees must be confirmed.

Attention

According to Article 136 of the Labor Code of the Russian Federation, employers must issue pay slips to employees. In addition, this norm regulates their content. Payslips At its core, this document is a salary notice, which, according to the Labor Code, must contain the following information:

- the sum of the components of wages for a specific period;

- the amount of other accruals due to the employee, for example, due to delays in wages, vacation pay or dismissal payments;

- the amount and reasons for the deductions made;

- the total amount of money to be paid.

Despite the fact that the legislation clearly regulates the content of the salary notice, according to Article 136 of the Labor Code of the Russian Federation, the form of this document is developed and approved by each employer independently.

It is formed on paper, regardless of how the salary is paid: by card or through a cash register. In addition to the main staff, certificates are given to external part-time workers and temporary workers.

The employer independently develops an order for approval of the salary slip, to which is attached the prepared document form. Article 136.

Procedure, place and terms of payment of wages Article 372.

Code of the Russian Federation on Administrative Offenses for violation of labor legislation, a fine may be imposed in the amount of:

- from 1,000 to 5,000 rubles. – for officials and persons carrying out entrepreneurial activities without forming a legal entity (individual entrepreneurs);

- from 30,000 to 50,000 rub. - for legal entities.

In addition, rather than a fine, the suspension of the activities of an individual entrepreneur or organization for up to 90 days may be chosen as an administrative measure. To protect yourself and your organization from fines, develop and approve a payslip form in your organization and hand it over to employees when paying wages.

All employers, according to current legislation, are required to provide information about wages to employees in writing. Pay slips are used for this.

To confirm the fact of delivery of this document, enterprises keep a log of the issuance of pay slips. PPT edition.

ru will tell you what information these documents should contain and how long they should be kept.

According to Article 136 of the Labor Code of the Russian Federation, employers must issue pay slips to employees. In addition, this norm regulates their content.

Payslips

https://www.youtube.com/watch{q}v=BXzcMcg9umY

Despite the fact that the legislation clearly regulates the content of the salary notice, according to Article 136 of the Labor Code of the Russian Federation, the form of this document is developed and approved by each employer independently. However, there is a form of “calculation” developed by experts in practice. You can see a sample of it below.

Evasion of issuing pay slips may result in a fine for the employer and accountant. Such measures are provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation. For example, if the “settlement” was not handed to the employee or all the necessary information was not indicated in it, the organization faces a fine of 30,000 to 50,000 rubles.

If such a violation is repeated, the amount of the penalty will vary from 10,000 to 70,000 rubles, up to the disqualification of the manager for a period of one to three years.

Due to the fact that failure to issue “settlements” is quite harshly punished by law, managers and accountants try to protect themselves from possible legal consequences. In particular, logs of the issuance of pay slips are kept, designed to record the fact of issuing this document.

Existing legislation does not oblige the issuance of salary notices against the signature of the employee; accordingly, a unified form of the journal does not currently exist. At the same time, there is a structure developed in practice. In accordance with it, the journal should include the following information, organized in table form:

- employee serial number;

- FULL NAME;

- date of issue of the payslip;

- employee's position;

- signature.

The document is generated by an accountant or cashier of the organization, who draws up pay slips and, together with wages, hands them over to the staff. He also makes sure that every employee who receives a pay slip signs for it.

It must be said that at an enterprise during the reporting period, not one statement can be filled out, but several (for each structural unit separately).

Both in terms of the format of the statement and in terms of its design, everything is left to the compiler. The document can be generated on a simple ordinary piece of paper or on a form with company details and the company logo. The statement can also be drawn by hand or printed on a computer (in the vast majority of cases, the second option is used).

The statement is always made in one original copy. Its volume may vary, but if it contains several sheets, they must be numbered in order and fastened with thick, harsh thread. On the last page, a piece of paper is pasted onto the bundle, indicating the number of pages, the date and the signature of the responsible employee.

A number of companies, despite obvious risks, do not keep documentary records of the issuance of pay slips. Instead, employers announce to staff the time, place and procedure for issuing “settlements” or simply post them in employees’ personal accounts on the corporate website.

This practice is not prohibited by law. Even the presence in the Labor Code of the Russian Federation of a clause on the need to notify the employee about the components of wages in writing does not prevent the courts from interpreting this norm very broadly, therefore, in most cases, sending a “calculation” by e-mail or publishing it on a corporate website is not considered a violation (see. appeal ruling of the Supreme Court of the Karachay-Cherkess Republic in case No. 33-204/2013 dated April 29, 2013).

Let's look at how to fill out a sample journal for issuing pay slips to employees, using an example.

Step 1. Title page.

Indicate the full name of the organization, the year for which the accounting book was compiled, the date it was opened, and the person responsible for it.

Filling out the table is not difficult. It is necessary to enter information about the employee (full name, personnel number, department in which he works), indicate the date of issue of the receipt. The employee signs in the last column.

- Order on approval of the pay slip form

- Payslip form

- Logbook for issuing pay slips

In our article, we briefly tried to cover the main issues regarding the preparation of pay slips. Also, using sample documents, you can prepare the necessary data for the employee yourself.

If you would like to know the cost of accounting services or just personnel records, call the numbers listed on the website.

Each employer is required to notify employees monthly of the amount of accrued wages, deductions and payments made. The requirement is enshrined in Art. 136 Labor Code of the Russian Federation. To simplify the process of informing about the features and subtleties, the employer has the right to approve an arbitrary one (hereinafter referred to as the calculation, receipt) and issue it to employees monthly.

Receipts must be issued regardless of the method of receiving wages, observing the established time frame - no later than the day on which wages were paid.

Step 2. Tabular part.

Pay slip issuance journal

This document is created in each division of the company, or one for the entire organization. The log should contain the following columns:

- Record number;

- Date of issue;

- FULL NAME. employee;

- Job title;

- Employee signature;

- Signature of the person responsible for issuing.

The following information should be included on the cover of the magazine:

- Start and end dates;

- Title of the document;

- Name of the organization and department in which the document is maintained;

- FULL NAME. and the position of the employee responsible for issuing leaflets.

Keeping journals is entrusted to accountants or departmental clerks.

According to Art. 136 of the Labor Code of the Russian Federation, each employer is obliged to notify employees monthly about the amount of accrued wages, deductions and payments made. The issuance of payslips to employees is mandatory, and violation of this rule may result in administrative liability. The second copy of the “settlement” must be kept in the organization for at least five years.

At the same time, the law says nothing about the obligation to keep records of the issuance of slips, and therefore employers often have the question of how to prove, during an inspection by a labor or tax inspectorate, the fact that they were issued to employees.

►Sample order for approval of pay slip

Such a statement can become a supporting document in the event of an employee’s complaint about the non-issuance of a pay slip or its issuance on time. Almost none of the employees keep the “settlements” for five years, and the copy remaining in the organization does not have the employee’s signature on receipt. That is, it will be quite difficult to confirm that the documents were actually issued to employees and that this was done on time.

Thus, keeping a log of the issuance of pay slips in 2019 is in the interests of the employer in order to confirm, if necessary, that labor law standards are being followed accurately by him.

Journal of registration of pay slips for employees' salaries 2020

And, nevertheless, it is still advisable to prepare a journal for recording the issuance of slips in order to avoid difficulties during the next inspection by the same Labor Inspectorate or tax inspectorate.

It is quite difficult to prove that the employee was notified on time about the amount of his salary, as well as its amount, without written confirmation.

Moreover, none of the employees will definitely keep the sheets for five years, and on the copy of the specified document, which is stored in the accounting department, the signature of the workers, as a rule, is missing, as well as the date of delivery.

Document form

Considering that keeping a journal is not mandatory by law, its form is formed in any order, based on the rules adopted for maintaining documentation of this type.

In particular, the journal must:

- contain a title page with the name, terms of establishment and storage;

- be stitched in the manner prescribed by law, with a seal on the last page and an indication of the number of sheets.

Also, the journal should include data about the person who is charged with the responsibility for its registration and maintenance in tabular form, in which it is most convenient to record all the necessary information.

By the way, making retroactive entries is unacceptable. But the procedure for correcting errors can be fixed in the same Regulations on Journal Keeping.

After all, you can even edit work books, of course, in the manner prescribed by law, so why not use the same method when maintaining a journal for issuing pay slips.

What sections should it contain?

In order to correctly reflect all the necessary data to confirm receipt of the slip, the journal must contain the following columns:

- serial number;

- Full name of the employee;

- his personnel number;

- Job title;

- date of issue of the certificate;

- employee signature.

There is no need to include other information, given that the amount received relates to personal data, the processing of which requires permission from employees.

And there is no need for additional columns, although you can also provide a note where it is possible to reflect the same going on maternity leave, which will explain during a routine check the lack of data about an employee who was previously included on the list monthly.

Sample, form and completed example

An approximate sample of the log, as well as the procedure for filling it out, can be found below.

The form can be downloaded here:

Logbook for issuing pay slips

Who forms and fills it out?

As a rule, the finance department is responsible for maintaining all payroll documentation.

Consequently, the responsibilities for drawing up the sheet, as well as issuing it, are assigned to one of the ordinary accountants, who, in addition to the above obligations, is more appropriately charged with maintaining a journal, given that it will be much easier to obtain signatures from the very employee who hands the sheets.

Approval order (sample)

By virtue of Article 60 of the Labor Code of the Russian Federation, the employer does not have the right to demand the fulfillment of duties that are not specified in the employment contract.

Therefore, in order to assign the obligation to keep a log of the delivery of leaflets to one or another employee, it is necessary to issue an order, on the basis of which the employee will perform the task assigned to him.

At the same time, taking into account that the journal from the moment of its registration will relate to the documentation of the enterprise, it is advisable to issue another order, which will approve the Regulations on maintaining the journal and its form, not to mention other nuances, such as storage periods.

How much and where is it stored?

By virtue of Order No. 558, salary slips are stored in the company for at least 5 years and can be destroyed only after an audit.

In order to confirm the fact that leaflets were issued for a specified period, the journal must be kept for the same period in the company’s archives or in the accounting department.

Do I need an order to approve the payslip form? How is financial assistance paid for vacation? Find out here.

What is the fine for non-payment of wages? Read here.

Order on approval of the pay slip form

An example of an order to approve the form of a pay slip.

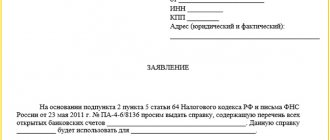

The form of a pay slip is not fixed at the legislative level. Taking into account the fact that this document must be issued to the employee, any organization needs to develop its own version and approve it by order of the manager.

The order must reflect the following information:

- Details – date, number, title of document and subject;

- Information about the organization – name, address, location;

- Reference to the requirements of Part 2 of Article 136 of the Labor Code of the Russian Federation;

- Establishing the form of the pay slip attached to the order, indicating the start date of this provision;

- Instructing a specific employee to ensure the issuance of payslips to employees 2 days before the transfer of wages (for example, to a cashier or accountant);

- Instructing employees of the organization (for example, heads of departments) to ensure the maintenance of logs for the issuance of pay slips in accordance with the appendix to the order;

- Assigning control over the execution of the order to one of the organization’s accountants;

- Attachments: pay slip form on 1 sheet and a sample log for issuing slips on 1 sheet;

- Date, signature, position, surname and initials of the head of the company.

Note! Before issuing an order, the employer should obtain the consent of trade union representatives to approve the form of the leaflet in accordance with Article 372 of the Labor Code of the Russian Federation.

The employees who are entrusted with the execution of the document are familiarized with the order against signature.

Issuing pay slips is not only an employer’s obligation, enshrined in law, but also an opportunity to provide employees with information about their current earnings in a simple form.

Issuance and storage of “settlements”

To optimize the issuance of this document, many enterprises practice the preparation of a special order. In particular, there may be a clause stating that the employee must independently appear at the specified place and time to receive it. This order must be familiarized to all employees against signature. This measure will help the employer to protect himself from possible claims from the labor inspectorate.

It is worth remembering that payslips, in accordance with paragraph 412 of Article 4.1 of Order No. 558 of the Ministry of Culture dated August 25, 2010, must be stored for five years, subject to an audit, or 75 years in the absence of personal accounts. Therefore, the log book should also be kept in accordance with these requirements.

Logbook for issuing pay slips (form)

The main document that is filled out when making cash payments at large enterprises is the payroll. Like any others, it has its own rules and design features.

This form is usually used specifically in large companies - small companies can issue incoming and outgoing orders for settlements (valid for one day).

Sample statement

If you need to create a payslip issuance sheet that you have never done before, use the recommendations below and look at its example - based on it, you can easily create what you need.

- First of all, indicate the name of the company on the form (abbreviated or full, it makes no difference).

- Then write the name of the document, assign it a number (if necessary), enter the month for which it is being compiled.

- It would not be amiss to enter the structural unit for which the document is being drawn up.

- It is better to do the further part in the form of a table. The number of rows and columns is determined depending on the needs of the organization. But these must include the date of issue of the pay slip, the position and full name of the employee who received it. Employees of the enterprise must sign their autographs in a separate column. After filling out the form, the responsible employee must also sign the form.

How to fill out a pay slip book

Let's look at how to fill out a sample journal for issuing pay slips to employees, using an example.

Step 1. Title page.

Indicate the full name of the organization, the year for which the accounting book was compiled, the date it was opened, and the person responsible for it.

Step 2. Tabular part.

Filling out the table is not difficult. It is necessary to enter information about the employee (full name, personnel number, department in which he works), indicate the date of issue of the receipt. The employee signs in the last column.

We invite you to familiarize yourself with the validity period of a medical certificate for a driver.