A former spouse living separately from his children has an obligation to pay alimony. The amount of these payments may be determined by a settlement agreement entered into voluntarily by the parties or by a court decision. Most often, women receive alimony as a percentage of their ex-spouse's salary. To ensure that payments are made correctly, you need to know how and what alimony payments related to the payer’s income are made up of.

- When is salary alimony awarded?

- From what salary payments is alimony collected? Components of earnings included in the calculation of alimony

- Salary payments not subject to alimony withholding

When is salary alimony awarded?

Art. 80 of the RF IC imposes on both parents the obligation to support children. If they do not live together, and the child is placed in the care of one person, then the second person will have to pay child support. Their size can be set:

- by mutual agreement by concluding an alimony (settlement) agreement;

- judicially.

The first option assumes variability in the nature of payments - parents themselves can choose in what form alimony will be paid (solid, % of earnings, in kind, property), how often this will happen. If it is not possible to resolve the issue peacefully, then the child’s mother turns to the judicial authorities to assign payments and determine their amount.

Art. 81 of the RF IC assumes the appointment of alimony in the form of a share of the salary in the general manner. This format is applicable if the payer has a permanent income. In other cases, it is possible to pay alimony in hard form (Article 83 of the RF IC). For example, this is allowed when receiving a salary in kind or in foreign currency, in the absence of earnings.

If a parent has a permanent job, then the payment of child support will most likely be assigned as a percentage of earnings. This format can also be applied to the unemployed if he is registered in the employment center and receives unemployment benefits.

Alimony in a fixed amount

In the absence of official earnings, for seasonal work, receiving wages in foreign currency, or other cases when it is impossible to establish alimony in a shared ratio, collection occurs in a fixed amount of money. The minimum amount is not specified in the law, but the amount is set as a multiple of the subsistence level in the region of residence of the person who receives the funds.

When making appointments, the following are taken into account:

- the amount of necessary monthly expenses for a child;

- the income level of the parent from whom child support is being collected;

- health status of the payer and the minor;

- presence of other dependent children.

The employer is obliged to index alimony every quarter in proportion to the increase in the subsistence level of the region of Russia where the recipient lives. In this case, it does not matter who sent the writ of execution to the accounting department - the parent with whom the child lives, or the bailiff.

From what salary payments is alimony collected?

Some women who have received the right to alimony from their ex-spouse in the form of a percentage of earnings believe that we are talking about wages. This is not entirely true, because:

- the amount of earnings may include other types of income (pensions, scholarships, income from business activities, rent, dividends and others - a complete list of them is given in Decree of the Government of the Russian Federation No. 841 of July 18, 1996);

- not the entire salary amount may imply the accrual of alimony from it.

Components of earnings included in the calculation of alimony

If, in addition to wages, the alimony payer does not have any types of income, then the amount of payments for children is calculated based on salary amounts. In this case, the following varieties are added (item 1 of the List):

- salary in the form of an official salary or tariff rate, % of revenue or commission - depending on the method of determining income at the enterprise;

- fees;

- allowances and additional payments (including regional coefficients, additional payments for length of service or level of qualifications, the presence of an academic title or for other advantages of an employee for work);

- payments for hazards, overtime work, going to work on holidays or weekends, for working at night;

- bonuses and other remunerations, the size and application of which are determined by the remuneration system at the enterprise;

- from vacation and sick leave.

This list can be supplemented within the region if any additional payments are established for employees of enterprises there.

Salary payments not subject to alimony withholding

The Federal Law “On Enforcement Proceedings” No. 229-FZ of October 2, 2007 provides a list of types of earnings from which alimony cannot be withheld (Article 101). These amounts cannot be taken into account when calculating payments.

If we are talking about paying alimony from a salary, then the following types of income should be excluded from the final amount of the base for calculation:

- compensation for injury to health or injury at work;

- travel expenses;

- compensation for transfer or assignment of an employee to another location;

- compensation for wear and tear of an employee’s personal tools used in his professional activities;

- payments on the occasion of marriage, birth of children or in connection with the death of a loved one;

- compensation for vacation vouchers or travel to the place of treatment (but only when the obligation to compensate for them lies with the employer, otherwise taxes and fees are levied on the amounts, and alimony is withheld).

When calculating alimony, these amounts are excluded from earnings. Afterwards the amount of payments is determined.

Is it possible to cancel alimony payments in shares?

Provisions of Art. 119 and 120 of the RF IC provide for the circumstances for the cancellation of alimony obligations. In order to cancel the percentage of alimony payments established by a voluntary agreement between the parties, it is necessary to terminate the document through a notary. According to the rules of Art. 101 of the RF IC, unilateral refusal of the agreement is not provided for, mutual desire is necessary. Otherwise, the dispute is resolved by filing a claim in court. If the alimony agreement has a validity period, then upon its expiration the document automatically ceases to be valid, which is enshrined in Part 1 of Art. 120 IC RF.

If alimony as a percentage was assigned by the court, it can be canceled only in the following cases:

- The child or the payer has died.

- The recipient has reached the age of 18, which means he does not need financial assistance.

- Until adulthood, the teenager received full legal capacity as a result of emancipation.

- Adoption of a child by new parents who take on maintenance responsibilities.

- The level of financial support of the parties has changed in such a way that the child’s representative (the parent with whom the minor offspring lives) does not need the support of the payer.

- Challenging paternity or maternity.

- Other circumstances worthy of attention.

Attention

If we are talking about the death of a person or the acquisition of full legal capacity by a child, the bailiffs should be notified about this. Enforcement proceedings are terminated, alimony as a percentage is no longer paid. When other circumstances arise that require proof, you need to go to court and get a legal decision.

Amount of alimony from salary

Once the amount for calculating child support is determined, a certain percentage can be charged from it towards child support payments. The final size of this “allowance” depends on a number of factors:

- number of children;

- salary amounts;

- the nature of payments (in the case under consideration - in the form of a percentage of income);

- presence of arrears in alimony payments.

The number of children directly affects the amount the mother receives. Moreover, the amount of alimony also depends on whether the father of her child has other children. The following portion of their earnings is provided for their maintenance in total:

- 25% – for 1 child;

- 1/3 – for two children;

- 50% - for 3 or more children.

Art. 81 of the RF IC provides for the possibility of both decreasing and increasing these amounts due to special circumstances. For example, the presence of a serious illness or disability may be a reason to reduce the amount of alimony.

A woman with one child may receive different amounts of alimony depending on whether the man has other children. For example, if he has 2 more children, then the mother will receive 1/3 of half the earnings, that is, about 16.67%. If the total number of children is 4, then this amount will be even less - ¼ or 12.5% of the salary.

Registration of alimony

The parent can provide financial assistance voluntarily and then the amount of payment will be established by the child support agreement. The law does not prohibit determining the established limit and paying the child more. A procedure for collecting payments through the court may be applied. In this case, the documents on the basis of which payment is made will be:

- court order;

- performance list.

A writ of execution is issued only after a standard trial. This document is not so easy to cancel. Having received the relevant document from the judge, the plaintiff can:

- Transfer it to the bailiff service. After this, enforcement proceedings will be opened. The documents will be handed over to the employer, who will begin to deduct the specified amount from earnings.

- You don’t have to contact the bailiffs, but send the enforcement documents directly to the defendant’s place of work.

The latter method speeds up the withholding of alimony, but ignoring the FSSP often leads to negative consequences. If you skip this point, the recipient risks:

- Lose a document. According to the law, only the original writ of execution needs to be handed over to the employer. If it is lost, it will be very difficult to prove its transfer. But if the procedure is carried out through bailiffs, then evidence will remain.

- Do not receive the full amount. Bailiffs have the right to check accounting documents, so they can easily identify various inconsistencies, the reason for the delay in payments, etc.

- Be left without alimony if the payer is fired. In this case, you will still have to go to the FSPP and initiate the collection of payments from the unemployed parent.

If we talk about voluntary, then everything is quite simple. The parents of a child (one or more) enter into an agreement on a mutual basis, which states how much (in the case of a fixed sum of money) or what percentage the child support payments are.

Concluding an agreement provides a huge range of opportunities for spouses: they can provide payments for the child’s treatment, education, etc.

The main condition is to have the contract certified by a notary. Otherwise, the agreement will not have legal force.

We invite you to familiarize yourself with the amount of payments when an employee is laid off

The collection of alimony through the court is a rather complicated procedure, both physically and morally. However, in Russia this particular species is found much more often than the one described above.

In order to start a case for collecting alimony, it is necessary to file a claim at the payer’s current place of residence in two copies and attach the relevant documents:

- A document from the defendant’s place of work, which reflects the salary and its form.

- Extract from the house magazine. Must be provided on both sides.

- Certificate of birth of a child.

- Marriage certificate.

After the completion of the trial, the judge makes a verdict on how much or what percentage will be calculated from the salary.

The accountant at the payer’s workplace must withhold the established portion of the salary every month and make a transfer to the account of the alimony recipient. The entire transfer must be completed within three days.

The court has the right to order payments in a fixed amount of money. Such measures are resorted to in the following situations:

- The defendant has an inconsistent income that changes every month.

- The payer receives income in kind.

- Income in foreign currency.

Alimony as a percentage can be assigned either voluntarily (by concluding an agreement) or in a forced manner (through the court). Each of these methods has its own characteristics that are worth paying attention to.

When signing the agreement, the parties themselves stipulate in what order alimony will be collected: the amount of payments, their frequency, the form of transfer (cash or to a bank account). If there are no objections, you must contact the notary with the following list of documents:

- passports of both parents;

- the child’s birth certificate, regardless of the presence of a passport;

- marriage certificate (or divorce certificate);

- salary certificate of the payer for at least the last three months.

When signing the agreement, both parties must be present in the notary's office, as well as children over 14 years of age. The legal force of the agreement corresponds to the legal force of the writ of execution.

The state fee for concluding an agreement on the payment of alimony is 250 rubles in accordance with clause 9, part 1, art. 333.24 of the Tax Code of the Russian Federation. However, the notary also charges fees for legal and technical services, which increases the cost many times over. You should check the price in advance with the notary office you will contact.

In the absence of an agreement, alimony is collected by force. If there are no disputes about minor children (establishing paternity, order of residence, etc.), such cases are considered in the magistrate's court. The following forms of collection exist:

- simplified (obtaining a court order);

- claim

An application for a court order can be filed if the defendant has a stable official income and has no other child support obligations. You can go to court both at the place of residence of the child’s mother and father.

The order is prepared within 5 working days without a court hearing and sent to the bailiff service for collection of funds. The defendant may refuse to pay alimony in writing. In this case, you will have to go to court again, but with a statement of claim.

Features of calculating and deducting alimony from wages

A woman who knows the size of her ex-husband's salary can guess the amount of alimony. For example, if a man has a salary of 25 thousand rubles. and has 1 child, then the ex-wife will count on receiving 6,250 rubles. In reality, this amount turns out to be lower. Why is this happening? Because a man receives less money than his salary due to income tax withholding.

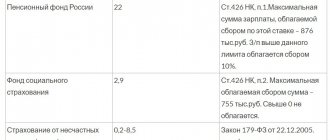

That is why paragraph 4 of Government Resolution No. 841 provides instructions on the collection of alimony from wages after personal income tax or other types of established taxes have been withheld from it.

It turns out that the amount of the base for calculating alimony is reduced by 13% - this is exactly how much is withheld in the form of personal income tax. If in the presented case a man receives 25 thousand rubles. According to his salary, he is given only 21,750 rubles, that is, it is from this amount that alimony is calculated. For an only child it will be 5,437.50 rubles.

Advantages and disadvantages of the method

Receiving alimony as a percentage of your salary has its strengths and weaknesses. More details about them can be found in the table.

| pros | Minuses |

| Possibility of simplified application for alimony | The payer may change jobs and not notify the new employer about payments, which often results in debts |

| The amount of payments increases along with the salary | Official salaries may decrease or not increase for a long time |

| Knowing the official income, it is easy to calculate the amount of alimony | Alimony is calculated from the official salary of the employee. Income in the “envelope” is not taken into account |

https://youtu.be/fCGYzcptzsI

Parents must take equal care of their common child even in the event of divorce. The ideal way to resolve child support issues is to sign an agreement. This frees the participants in the process from wasting time and effort, allowing them to take care of the child. If dialogue between former spouses is impossible, the only solution to the problem is to go to court.

Calculation example

Stepan Viktorovich Vorkutenko has a salary of 20 thousand rubles. Additionally, in July, he received a bonus in the amount of 5 thousand rubles, compensation for travel expenses - 2.5 thousand rubles, compensation for overtime work - 3 thousand rubles. He was also compensated for wear and tear of personal equipment in the amount of 1.5 thousand rubles.

Vorkutenko has 3 children, two of whom live with him and his current wife, and the third with his ex-wife. The latter was awarded alimony in the amount of 16.67% of earnings in court. How much money will she receive in child support for July?

First you need to understand which types of earnings will be included in the calculation and which will not. Bonus and compensation for overtime work must be added to the salary. Other payments are not added on. It turns out that the calculation base is: 20,000 + 5,000 + 3,000 = 28 thousand rubles.

Additionally, income tax must be subtracted from the resulting amount: 28,000 * (100 – 13%) = 24,360 rubles. this will be the final calculation basis.

Since the ex-wife was assigned 16.67% of earnings, then in July she will receive: 16.67% * 24,360 = 4,060.81 rubles.

Who pays whom?

Many people mistakenly think that the payment of benefits applies only to the male half. However, the money is taken from a parent who leaves the family and refuses to give money for the needs of minors.

For example, if suddenly during a divorce the children for some reason remain with their father, then the father has the right to file an application for alimony. In this case, the mother is obliged to pay benefits in the amount established by the court or voluntary agreement.

Few people know that you can apply for alimony during marriage. If one of the parents, usually the father, does not provide for his children, then the wife can sue him with an application for payment of a lien for the teenager.

According to the law, the husband and father must bear financial responsibility for the family, so the court will most likely satisfy the wife’s claim, and the husband will have to pay alimony.

Maximum payout amount

The court may increase the amount of alimony. The RF IC does not establish a maximum amount of payments as a share of earnings. But there are such restrictions in paragraph 3 of Art. 99 of Federal Law No. 229-FZ. They are directly related to the collection of alimony, among other things.

In court, it will not be possible to withhold more than 70% of the alimony worker’s earnings. This rule also applies to some other types of debt. For the rest, a limit of 50% is set.

However, the limit of 70% of income does not mean that you can receive that much in the form of alimony. Typically, this level is reached in cases where a man has alimony arrears and is required to pay it off.

Example . Yakushev has a salary of 30 thousand rubles. and one child, the amount of child support for which is 25% of earnings. Additionally, the man has arrears of alimony in the amount of 45 thousand rubles. How much can a woman receive per month from her ex-husband in this case? After deducting personal income tax, the salary is 30,000 * (100 – 13%) = 26,100 rubles. Of this, ¼*26,100 = 6,525 rubles are spent on alimony. In general, more than 70% or 18,270 rubles cannot be withheld from the salary. Consequently, a woman can receive more to pay the alimony debt: 18,270 – 6,525 = 11,745 rubles.

Documents for registration of alimony payments in percentage through the court

In order to formulate a competent appeal to the court, the applicant must not only draw up a statement of claim for the recovery of alimony as a percentage, but also collect the necessary attachments to it. An indicative list of documents for filing a petition is provided for in Art. 132 Code of Civil Procedure of the Russian Federation:

- A copy of the applicant's identity document. It is advisable to provide a passport.

- Certificate of registration and divorce.

- Birth certificate of the child or children.

- An extract from the house register or a certificate from housing and communal services confirming that the child lives with one of the parents.

- Certificate from the educational or care institution where the child is kept.

- Receipts, checks and other documents confirming the average monthly expenses for a child.

- A certificate from the place of work of each spouse confirming the level of income.

- Bank details for transferring alimony.

The specified list of documents must be provided both in the case of sending an application for a court order (to the magistrate) and in the case of applying to the district court. If necessary, the judge requests additional evidence based on the circumstances of the case.

Who withholds child support from wages?

The employer is responsible for withholding child support from a working father. The reasons for this are:

- alimony agreement;

- court order;

- performance list.

The employer is also involved in calculating the payments due based on the court decision. Recently, he has been indexing alimony (however, with the format as a percentage of earnings, indexation is not carried out).

The mother herself does not need to make complex calculations. She can help bailiffs in finding a new place of work for a negligent father in order to quickly provide them with a writ of execution.

Is alimony deducted from vacation pay?

Vacation funds are accruals to an employee during the vacation period from wages on account of previously worked time.

Based on the fact that vacation funds are considered part of the salary, deduction of alimony from them is mandatory. In accordance with Resolution No. 841, all types of leave are subject to alimony withholding:

- basic;

- additional;

- for irregular working hours.

In addition, alimony should also be calculated from compensation for unused vacations upon dismissal of an employee.

The period for accruing funds from vacation pay is regulated by family and labor legislation, which stipulates that the funds must be received by the claimant no later than the date the person obligated for alimony goes on vacation.

Example of calculating alimony from wages

In the case of shared alimony (based on a writ of execution or an employee’s application), the amount is calculated after deduction from personal income tax accruals.

Example

The official salary of an employee obliged to pay alimony is 30,000 rubles. before tax. After withholding personal income tax, the employee could receive 26,100 rubles. Alimony payments from such an employee, subject to percentage (share) payment, would be:

- for one child: 26,100 * 25% = 6,525 rubles;

- for two children: 26,100 * 33.3% = 8,691 rubles;

- for three children: 26,100 * 50% = 13,050 rubles.

How an individual entrepreneur pays alimony, see here.