The essence of the concept

According to the Family Code, alimony refers to funds that are allocated for the maintenance of children by parents and adult relatives by children or spouses. At the legislative level, there is a mechanism for assigning, calculating and paying alimony. In addition to the Family Code, these issues are also regulated by the Civil, Tax, and Labor Codes.

Separate government and plenum resolutions spell out in detail the mechanism for calculating alimony. The obligation to pay the funds falls on employed citizens who have minor children or disabled close relatives. The basis for the transfer of funds is a court decision or a bilateral agreement. In the first case, funds are collected compulsorily, and in the second - on a voluntary basis.

How is child support calculated?

1 Contents Many women who have experienced a divorce are interested in the issue of calculating child support.

The main difficulties in calculating alimony are related to the timing of collection, as well as the amount due to the recipient of alimony for the maintenance of children. The family legislation of the Russian Federation gives the following definition of the concept of alimony - amounts of money or payment in kind for the maintenance of children until they reach adulthood, paid to those parents who live separately from the children.

Child support is paid in accordance with the following regulations:

- RF IC. Establishes the right of children to receive financial support from their parents;

- Federal Law No. 229 of October 2, 2007 “On enforcement proceedings.” Regulates the procedure for withholding money by state enforcement agents (bailiffs);

- Decree of the Government of Russia No. 841 of July 18, 1996. This act establishes the types of income from which alimony is calculated.

This issue is regulated by Resolution No. 841.

The salary is calculated from:

- Payments to civil servants and persons equivalent to them;

- Prizes and other rewards (in cash and in kind);

- Payments to health workers and teachers;

- Allowances and surcharges.

- Fees for media employees, literary authors, and arts workers;

- Other benefits provided for in the employment relationship (for example, compensation for food or travel);

- Salary;

Important! Alimony is not taken from payments due to the parent in connection with the birth of a child, marriage, survivor's pension, compensation for business trips, transfer to another position or to another region, as well as payments for depreciation of a vehicle or instrument that is the property of the alimony payer. If the payer himself receives alimony, payments are not made from them.

The above resolution also provides for the withholding of funds from

Alimony payers

The circle of responsible persons in Russia is much wider than in other countries. The payer and recipient must be members of the same family. Funds can be transferred not only for the maintenance of children and parents, but also former spouses, grandmothers, grandchildren, etc. The list of beneficiaries also includes actual educators (stepmother, stepfather).

The procedure for calculating alimony begins with determining the right to receive payment. Able-bodied relatives may be supported by:

- minor children, both legitimate and adopted;

- adult children who are unable to work due to disability;

- disabled parents, ex-spouses, brothers and sisters, grandchildren, grandparents, stepmother or stepfather.

Any of the listed relatives, except the actual caregivers, can pay alimony.

How child support is calculated correctly: rules and formula

8128 Raising children and providing them financially until adulthood is the main responsibility of parents.

Any issues related to family relationships in our country are resolved on the basis of the Family Code. It determines the persons in whose favor alimony is withheld and their amount is calculated. Article 81 of the Family Code explains how to calculate child support depending on the income of the second parent (or other person from whom it is withheld) and the number of children.

The government does not set a fixed amount that the child support provider must pay to his children every month. The amount of payments is influenced by a number of reasons and factors.

However, a person who is planning to file a lawsuit or has received a writ of execution can figure out how child support is calculated and the approximate amount to expect.

The amount that children remaining after divorce will receive monthly depends on the following factors:

- If alimony is assigned after filing an application with the court, then a variety of factors will be taken into account: the level of income of the parent, the immediate needs of the child. If he has health problems, the amount of payments will be larger. If the parent himself is a non-working disabled person, you can only count on minimal deductions from his benefit.

- Is the decision to pay voluntary? If the divorce is more or less amicable and both parents understand their responsibility in raising children, they can independently agree on how much the other parent should pay. In this case, the amount may not depend on the income of the former spouse. However, it should not be less than the minimum wage adopted in the region of residence of the child.

The calculation of alimony and its calculation will be made on the basis of the Federal Law “On Enforcement Proceedings” and under Article 113 of the Family Code. In order to start making payments from the salary, you need a statement from the parent himself, if this is his voluntary decision, an agreement sealed by a notary.

Forced collection

Domestic legislation provides for the possibility of forced collection of alimony through the court for spouses. This possibility may arise if one of the parents refuses to support the child. Collection of alimony can be carried out according to one of the following schemes:

- In an unregistered marriage, you will first have to go through the procedure of establishing paternity. For this purpose, either a birth certificate is used or a medical examination is carried out.

- According to the simplified order procedure. In this case, it is necessary to provide the court with information about family members, their place of residence, income, and the presence of dependents. Based on the data received, the financial and social status of the parties, the court will decide how alimony for one child will be calculated and paid.

- By way of claim proceedings. In this case, you can agree on the form of payment of alimony and collect debts for previous periods. Then the penalty for alimony is calculated. To receive payments, you must provide copies of: passport, birth certificate of each child, marriage registration certificate, certificate of family composition and place of residence of the applicant. You also need to provide a calculation of alimony in a fixed amount and justify the costs.

Indexation of alimony

Recalculation

Since alimony payments are made over a long period of time, and the cost of living rises almost every year, the ex-wife has the right to index the funds she receives for child support.

Indexation is carried out only for maintenance collected in hard monetary terms and is carried out taking into account the increase in the cost of living in the region of residence of the plaintiff. An increase in the amount of payments follows immediately after an increase in the cost of living.

If the payment amounts do not exceed 25,000 rubles, indexation is carried out by the enterprise where the debtor works. If this amount is exceeded, indexation is carried out by the bailiff service or the court.

In the case of payment of maintenance under a contract, the procedure and timing of indexation are established by the concluded agreement. If such a procedure is not provided for in the agreement, then in the manner prescribed by law.

It is worth keeping in mind that indexation allows not only to increase the size of penalties, but also to reduce them.

Exceptions

It is prohibited to withhold alimony from:

- one-time payments from the budget, extra-budgetary funds, the state, interstate organizations and other sources, provided in connection with a terrorist act, the death of a family member, for assistance in solving crimes;

- income received in the form of food costs;

- financial assistance paid at the birth of a child, marriage registration, death of a relative;

- compensation for travel expenses, depreciation of tools that belong to the worker;

- income from the sale of real estate.

How not to make mistakes when calculating and withholding alimony

April 18 April 18, 2020 Accountants often have to calculate child support and withhold it from employees’ wages.

Our article contains all the necessary information related to alimony withholding. In particular, there are answers to the questions: from what income can and cannot be withheld alimony; to what amount the maximum amount of deductions should be applied; what threatens an organization that refuses to withhold alimony, etc. The article also provides examples that clearly show the rules for calculating alimony.

Alimony is one of the mandatory deductions, the basis for which is:

- or an agreement on the maintenance of minor children (agreement on the payment of alimony), concluded between parents in writing and certified by a notary. A notarized agreement on the payment of alimony has the force of a writ of execution (Family Code of the Russian Federation);

- or a writ of execution (court order) issued by a judicial authority (RF IC).

Alimony is withheld from the wages and (or) other income of the person obligated to pay alimony.

Alimony is funds that, in cases established by law, some family members are obliged to pay for the maintenance of other family members in need. Most often, at the place of work, alimony for the maintenance of minor children is deducted from the wages of employees.

The list of types of wages and other income from which alimony for minor children is withheld is approved by a resolution of the Government of the Russian Federation. Such income includes, in particular:

- compensation payments established by the labor legislation of the Russian Federation:

- sums of money paid in compensation for harm caused to health;

- sums of money paid to persons who received injuries (wounds, injuries, concussions) in the performance of their official duties, and members of their families in the event of death of these persons;

- sums of money paid in compensation for damage in connection with the death of the breadwinner;

a) in connection with a business trip, transfer, employment or assignment to work in another location; b) due to wear and tear of a tool belonging to the employee;

- insurance coverage for compulsory social insurance, with the exception of old-age insurance pension, disability insurance pension (taking into account a fixed payment to the insurance pension, increases in the fixed payment to the insurance pension), as well as funded pensions, fixed-term pension payments and temporary disability benefits;

- the amount of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, from funds of foreign states, Russian, foreign and interstate organizations, and other sources:

a) in connection with a natural disaster or other emergency circumstances;

Calculation procedure as a percentage

How is alimony calculated? The law provides for two calculation schemes: shared payments and a fixed monetary amount. Most often, the court obliges the payer to make payments in the following proportion:

- 25% of income - for one child;

- 33% of income - for two children;

- 50% of income is for three or more children.

Formula for calculating alimony: Alimony = Base x Percentage of income.

Additionally, a fixed monetary amount of maintenance is established in case:

- the payer has an irregular income;

- income is received in the currency of another state or in kind;

- the payer has no official income;

- the appointment of alimony in a shared ratio violates the interests of the child.

Let's look at an example of calculating alimony withheld from wages. According to a court decision, 25% of the employee’s salary must be withheld monthly in the form of alimony. The worker's salary is 65 thousand rubles. Let's calculate the deductions:

- The tax deduction for one child is 1.4 thousand rubles.

- Calculation base = (65 - 1.4) * 0.13% = 8.268 thousand rubles.

- Alimony = (65 - 8.268) * 0.25 = 14.183 thousand rubles.

Calculation of alimony - how is it calculated and withheld from wages?

Contents Sometimes the help of relatives to each other is legally secured in the form of alimony. The Latin origin of the term explains its meaning, because the root of the word translates as “nutrition.”

Payment of alimony is made by one family member to another; it can be done voluntarily or under duress. The Family Code of the Russian Federation is the main document regulating the payment of alimony. Section IV of this legal act determines who, in what cases, to whom and to what extent should transfer alimony payments.

The grounds contained in the RF IC give the right to go to court to obtain the funds required by law. The next document regulating the procedure for appeals, the choice of court and the rules for considering cases is the Civil Procedure Code of the Russian Federation.

In a number of cases, in addition to the indicated codes, to make a decision on the case, acts of the Plenum of the Supreme Court of the Russian Federation will be taken into account (for example, Resolution of the Plenum No. 9, adopted back in October 1996).

It contains instructions and is actively used by judges in the following situations:

- the payer’s earnings are less than the subsistence level in the region;

- the payer knowingly provides false information about income;

- the claimant demands payment for the child’s education at the university;

- the payer does not provide information about income;

- the payer wants to reduce the amount of the penalty for unfulfilled obligations to pay alimony;

- In addition to collecting the amount of debt, the plaintiff wants to receive compensation for moral damage due to late payment.

On issues related to alimony, substantive law also regulates:

- Tax Code of the Russian Federation;

- Decree of the Government of the Russian Federation “On the list of types of wages and other income from which alimony for minor children is withheld.”

- Labor Code of the Russian Federation;

The income from which alimony can be deducted is clearly defined by current legislation.

Procedure for settlements in a fixed amount

How is alimony calculated in a fixed amount? Accruals are tied to the cost of living of a particular person in the region or country as a whole. The court sets a payment amount that is a multiple of this indicator. Average earnings do not matter for calculating alimony. However, the size of the payment is affected by the recipient’s region of residence and indexation.

Below is a table for calculating alimony.

| Stage | Action |

| PM | The cost of living is determined at the court date. |

| Multiplicity | (Alimony / PM) * PM |

| Tax deduction | Base = Earnings - Personal Income Tax |

Let us next consider an example of calculating alimony under PM. By court decision dated December 4, Ivanov was awarded alimony in the amount of 10.5 thousand rubles. The recipient of the funds lives in Moscow. as of the date of the trial, the PM level in the region is 10,443 thousand rubles.

Multiplicity = (10500 / 10443) * 10,443 = 10,552.5 rubles. — Ivanov will have to pay this amount of alimony from April 2012.

What amount is alimony calculated from?

Funds are withheld from the parent who does not live with the child.

As a rule, alimony is deducted from:

- Salaries and other income.

- Compensation payments for overtime and for work under special conditions.

- Premium.

- Rewards.

- Vacation pay.

- Pensions and scholarships.

- Unemployment benefits.

- Cash received from running a business.

- Finance from civil contractual agreements.

If the cost of living increases, then indexation is calculated taking into account the percentage of inflation. The calculation is made in the accounting department or signed by the two parties separately in the concluded agreement.

There are some restrictions on the calculation of alimony.

Alimony is not withheld:

- from compensation payments related to loss of health;

- when calculating the amount for injury as a result of an industrial accident;

- from travel expenses;

- from pension accruals in case of loss of a breadwinner;

- from humanitarian aid.

Collection

The grounds for deduction are:

- court order;

- performance list;

- voluntary agreement on alimony.

Signing an agreement is the most civilized way of making collections. Provided that the parents have discussed all the nuances: type, amount, timing of payments. The agreement can be drawn up in any form. The document must have the signatures of both parents. If the agreement is executed by a notary, it will become legally binding. If in the future one of the parents refuses their obligations, it will be enough to provide the document to the bailiffs so that they initiate proceedings. The amount of alimony must be no less than that which would be collected by force.

The issuance of a court order is initiated by the alimony claimant. If it was not possible to reach an amicable agreement with the second parent, then you should submit an application to the magistrate, as well as: a passport, a divorce certificate, a birth certificate. If the arguments presented are sufficient, the judge will make a decision without a hearing. Copies of the order will be sent to the applicant, payer and bailiffs. Only after the document reaches the bailiffs will it be accepted for execution.

It is worth filing an application with the court immediately if:

- the claimant wants payments to be made in a fixed amount when the plaintiff’s income is higher than the official one;

- if the plaintiff does not comply with the terms of the previously concluded agreement;

- if there is no information about the whereabouts and income of the child’s father.

The application should indicate any of the circumstances and attach copies of the documents necessary for issuing a court order. Collections will be carried out from the moment the application is received. If the plaintiff has arrears in payments, then a calculation of the penalty for alimony should be carried out and attached to the application, and the expenses should be justified. The case will be considered at a court hearing, but sometimes a decision is made in absentia. A copy of the decision is sent to the bailiffs, and then to the plaintiff and the claimant.

How is child support calculated?

» » 2 Contents The main and main problem when paying alimony is their calculation.

Income from which alimony is not withheld is listed in the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as Law No. 229-FZ).

The legislation (Article 81 of the RF IC) says this quite vaguely. There are virtually no specific numbers, clear minimum and maximum levels, since each situation is considered individually. However, there have long been general principles by which alimony is calculated, and their applied practice confirms them. Almost any income, with rare exceptions, is taken into account when calculating alimony.

However, even here everything depends on how exactly the potential payer earns, whether he receives official or unofficial wages, how many sources of income he has and what profit they give to the payer. This is the simplest option, in which the provisions of that same Article 81 are often used RF IC. Depending on the number of children, a person must pay from 25 to 50% of the profit, if there are no delays.

And if he admits it, then the whole 70%.

Determining the amount is not difficult, since all information is submitted to the statistical authorities and the only task of the recipient of the funds is to submit an application to the court for the issuance of a court order. Example: A person receives 20 thousand rubles from an official job.

We recommend reading: Sample application to the labor inspectorate for non-payment of wages

If he has one child, he will be required to transfer 25% of this amount monthly. That is, 5 thousand rubles each. The same is true for almost any other amount of earnings. This option is similar to the previous one, but interest is applied not to official wages, but to official benefits. Considering the fact that benefits are almost always significantly less than wages, the amount of alimony will also be reduced to a vanishingly small level. Example: A person works at an employment center and receives 2 thousand rubles a month.

This is not enough even to pay for utilities, but if he still pays alimony, then its amount will be only 500 rubles (25% of the amount, subject to the presence of 1 child). But in such a situation, everything is not so simple.

Example 1

The employee received two writs of execution. After paying personal income tax, the amount of income is 10 thousand rubles. According to writs of execution, 5.4 thousand rubles should be paid, 3 thousand rubles. The maximum deduction amount is: 10 * 0.7 = 7 thousand rubles. This amount is distributed proportionally between all sheets:

- First: 7 * 5.4 / 8.4 = 4.5 thousand rubles

- Second: 7 * 3 / 8.4 = 2.5 thousand rubles.

- Balance of debt: 8.4 - 4.5 - 2.5 = 1.4 thousand rubles.

After alimony is paid, the amount of accumulated debt must be withheld.

Writs of execution can be sent not only for alimony, but also for fines and damages. These requirements are satisfied secondarily. All alimony should be calculated at the same time, regardless of the time of receipt of writs of execution. Withholdings should be made once a month from the amount remaining after paying taxes. Therefore, no deductions are made from accrued advances. If an employee had no income during the second part of the month, this does not exempt him from paying alimony. This amount becomes a debt that must be paid off after the principal is paid. The situation is different if deductions are made as a percentage of income. In this case, lack of earnings is grounds for non-accrual of alimony.

How to calculate child support for one child

/ / Contents Many parents who have to apply for or pay child support would like to have at least a rough idea of what amounts of money are due per child. Is it possible to independently calculate alimony payments? This article is devoted to this issue.

The law does not establish the exact amount of money that a parent is supposed to pay to a minor child.

Its size depends on numerous factors that are taken into account in the calculation. Firstly, the amount of alimony depends on whether it is calculated and paid voluntarily or compulsorily.

For example, if parents independently agreed on child support, they may deviate from the minimum amounts of money established by law. But only in the direction of increasing, not decreasing, alimony payments! That is, assign larger rather than smaller amounts.

Secondly, if alimony payments are ordered by the court, it takes into account the level of welfare and income of the parents, as well as the needs of the child.

For example, if a child suffers from a chronic disease that requires expensive treatment and rehabilitation, the payments will be higher. Or, for example, if the parent is an unemployed disabled person, the amount of child support payments will not exceed the minimum.

The calculation of alimony payment for one child is carried out in accordance with legislative acts:

- Family Code of the Russian Federation (Article 113);

- Federal Law “On Enforcement Proceedings” (Article 102).

The basis for calculating and deducting amounts of money are the following documents:

- A written statement from a parent regarding voluntary payment of child support;

- A writ of execution issued by the court on the basis of a decision.

- Written and notarized alimony agreement;

- Court order;

So, child support payments can be calculated

- as a percentage of wages;

Penalties

Debt in alimony payments may arise not only due to the plaintiff’s refusal, but also due to his change of job. The accounting department from the old enterprise must transfer the writ of execution to the new organization. In practice, a certain amount of time may pass between these events, during which time the debt will accumulate. In this case, the current amount is first withheld, and then a penalty is charged. If information about the deduction scheme is not written down in the sheet, then a maximum of 70% can be recovered from income.

How to draw up a payment order

Payment order for transfer of alimony

A payment order is an important document that serves as the basis for the transfer of funds to the plaintiff. To fill it out correctly, it is necessary to accurately verify it with the court order and the writ of execution.

Rules for making entries:

- full surname and initials;

- number of the sheet for the execution of a judge’s decision or court order;

- indicate the period for which the money should be withheld;

- plaintiff's bank account number;

- amount withheld.

When deducting funds to a bank account, the payment slip must indicate:

- the amount of the defendant's monetary income;

- number of days worked;

- indicator of the amount of cash deduction of income tax;

- what debt needs to be paid off;

- percentage of deductions from salary;

- TIN number.

After the payment of wages, alimony must be withheld within three days.

Example 2

The accounting department received two writs of execution per employee. The first provides for the withholding of alimony for two children in the amount of 33% of income, and the second provides for arrears for the same alimony in the amount of 18.5 thousand rubles. The procedure for making deductions is not specified in the writ of execution. This means that you should focus on a maximum size of 70%.

We will calculate child support for two children. For the current month, the employee was accrued 22 thousand rubles. (after personal income tax withholding).

- Current amount of alimony: 22 * 0.33 = 7.26 thousand rubles.

- Maximum amount of deductions: 22 * 0.7 = 15.4 thousand rubles.

- Allowable amount of deductions on the second sheet: 15.4 - 7.26 = 8.14 thousand rubles.

- On the second sheet, the amount of debt is transferred to the next month: 18.5 - 8.14 = 10.36 thousand rubles.

It is extremely rare, but bailiffs check the procedure for accrual, deduction and payment of wages. Therefore, it is extremely important to be able to correctly calculate and recover the amounts of deductions.

We calculate alimony

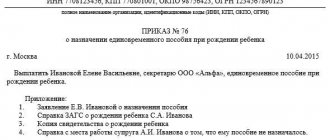

An accountant can begin to withhold alimony from an employee’s salary in two cases: if the employee is ready to pay it voluntarily or if the court has ordered alimony to be paid. In the first case, the employee must provide the accounting department with a notarized agreement between the parents, as well as an application for voluntary payment of alimony with the obligatory indication:

- passport data, full name, address of the recipient;

- details for transferring funds.

- information about the child (full name, address, date of birth);

- information on the calculation procedure - the amount of alimony and the date from which alimony must be withheld;

The agreement may specify the types of payments for which alimony should be calculated and the calculation procedure.

For example, an employee may not pay alimony or bonuses. In the second case, the organization receives a writ of execution from the bailiffs. Most often - in the format of an official letter. A writ of execution can also be brought by a party personally interested in alimony. The writ of execution will contain all the information about the recipient of alimony, the amount and procedure for paying alimony.

For your information, we note that the employer is obliged to comply with the requirements of the judicial authorities and does not have the right to reduce or increase the amount of alimony, as well as to suspend their withholding. Let us note that if there is no legally formalized agreement between the parents, and the employee insists on the speedy payment of alimony, it is still advisable to spend a little time and draw up such an agreement.

This way, the employee will be protected from possible conflict situations or litigation in the future. Some accountants, however, suggest that the employee issue a unilateral statement of intent to pay alimony, but in the long term this, first of all, may result in inconvenience for the employee himself. In my opinion, it is better to agree in advance, and according to the law.

Calculate alimony online in a few clicks in the Kontur.Accounting web service! Article 81 of the Family Code of the Russian Federation establishes the following

Payment period

In order to effectively record obligations within the framework of enforcement proceedings, it makes sense for the employer to use separate accounting documents.

1. Book of registration of writs of execution.

The fact is that for the loss of a writ of execution, an official of the employing company can be fined up to 2,500 rubles. (Article 431 of the Code of Civil Procedure of the Russian Federation). Therefore, the employer needs to appoint someone responsible for storing such documents and oblige him to use a special accounting book.

Writs of execution must be kept for 5 years, but not less than the period during which alimony payments are made, as well as another 3 years after the expiration of this period (Clause 1, Article 29 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, Clause 4 of Article 21 of Law 229-FZ).

2. Journal of alimony payments.

It makes sense to use such a document in order to generally improve the efficiency of accounting for transfers to an employee. The journal can classify such payments in various ways (for example, by the recipient’s marital status, by the method of calculating alimony - in a flat amount or as a percentage of earnings).

3. A form for notifying bailiffs about the fact of the debtor’s dismissal (and about his new place of work - if information about him is available).

The procedure for applying the first 2 documents should be fixed in the company’s accounting policy (clause 4 of PBU 1/2008).

Most often, the father begins paying alimony immediately after the divorce. In some cases, the first day of such payments is considered to be the date the woman goes to court to resolve controversial issues regarding alimony.

When can a father stop paying a certain amount of child support? As mentioned above, alimony is a payment that provides financial support for a minor child. That is, as soon as the son or daughter of the alimony provider turns eighteen years old, he has the legal right to stop providing financial assistance to his child.

It is noteworthy that if a minor child continues to study (at an institute, school or college), he still loses the right to official support from his father. In such cases, responsible parents continue to help their adult child, realizing that studying also requires large expenses.

However, there are some nuances here too. For example, if the son or daughter of the alimony provider is disabled since childhood (no matter what the disease), then the father is obliged to provide him with assistance for the duration of the period regulated by Russian legislation.

Child support is funds that parents pay to their minor children from their income. In addition to wages, income may be of a different nature, but alimony may not be withheld from everyone.

Let's look at how child support is calculated. To eliminate disagreements on this issue, you need to refer to the text of the Decree of the Government of the Russian Federation of July 18. 1996 No. 841. It details what types of assessments there are from which child support payments are withheld. This list includes:

- all types of wages;

- allowances and additional payments that are paid along with the salary for the presence of special skills and knowledge, for length of service;

- additional financial payments for working in difficult conditions, for going to work on weekends and holidays, for overtime;

- bonus payments;

- accrued vacation pay;

- pension payments, including bonuses and additional payments;

- scholarships;

- disability and unemployment benefits;

- income received in the process of carrying out entrepreneurial activities;

- funds received from the rental of property;

- shareholder returns;

- funds received as a result of signing civil contracts.

Alimony is withheld from any type of income only after all taxes have been written off.

Salary and time of payment of alimony

By law, alimony calculations must be made monthly, within a period of time not exceeding three days from the date of payment of wages. Salaries are issued to employees at least once every two weeks, but to collect alimony, an advance is not taken, but only an accrual based on the results of the month, since it is for this period that personal income tax is withheld.

As for the payments specified in the terms of the agreement, the period for their accrual must comply with these conditions, which do not necessarily have to establish monthly deductions. This could be a quarter or a half year.

Method of admission

| Way | Explanation |

| By way of claim proceedings | The plaintiff files a claim according to which the defendant must pay alimony and, if necessary, transfer the debt. This option is used if the father refuses child support obligations, deliberately understates the amount of payments, or hides |

| According to the alimony agreement | The parties enter into a peace agreement, according to which the father undertakes to systematically transfer a set amount or alimony in the amount of his salary. The option is relevant when there is no disagreement. The contract can specify any conditions that do not contradict the law: frequency of payment, amount, transfer procedure, etc. |

| By order of production | A woman submits an application to the court for a court order, according to which her ex-husband undertakes to pay alimony. This option is recommended to be used if there are no disputes between the parties, otherwise the man will be able to appeal the order in a lawsuit |

If alimony is collected in court, the result of the consideration of the case is the issuance of a decision and a writ of execution. Subsequently, it is transferred to the claimant, and he can contact the bailiffs or directly to the defendant’s employer, if there is information about his place of employment.

| Voluntarily | Automatically |

| Based on the writ of execution, the alimony provider independently transfers funds within the agreed time frame. He cannot change the amount of payments or not respect the dates. For each day of delay, a penalty in the amount of 0.1% of the amount of debt may be charged. | The transfer of alimony is made by the accounting department of the employing organization at the place of employment of the alimony worker on the basis of the presented writ of execution. The man's consent is not required. |

Important! If the person obligated for alimony does not work anywhere, this is not a basis for his release from alimony obligations. He must still pay money for the child, but in a minimal amount.

Before we look at whether alimony is calculated from a “clean” or “dirty” salary, let’s find out what opportunities a father has to help his children. All provisions regarding such payments are specified in Article 104 of the Family Code of the Russian Federation.

First of all, this is a shared accrual, according to which a certain percentage is deducted from the father’s official salary in the form of funds to cover the child’s needs. This is the most common type of alimony payment.

The second method is a specific fixed amount that the father is obliged to transfer to the mother of his child one time or monthly. This amount can be set by the court or it is stated in the agreement signed between the former spouses and certified by a notary.

But there is another possibility of paying alimony - mixed accrual, according to which financial assistance to the child is provided in other ways, not always expressed in monetary terms. Most often, this method is used when the father does not have a full-time job or his salary is insufficient to cover the child’s basic expenses.

In practice, the most common methods of alimony payments are:

- From the place of work. This option is considered the most popular, so we will discuss it in more detail below.

- By mail. To do this, you must indicate the last name, first name and patronymic of not only the recipient, but also the payer. It is also necessary to indicate in the postal order the date of payment, the specific amount and the exact period of time for which it is paid, and the address of the recipient. It is advisable to keep all the papers relating to this transfer until the child reaches adulthood, so that an unscrupulous recipient does not sue the alimony provider for allegedly not participating in the maintenance of his own child.

- From hand to hand. It is good when spouses can calmly communicate with each other after a divorce, jointly discussing issues of raising a child and its maintenance. However, it is important to be extremely careful here. When transferring alimony in person, it is important to take a receipt confirming receipt of the required amount as alimony payments. The document must indicate specific information (who received it, from whom, for what and how much), as well as the exact date of transfer of money.

In what cases does the court decide the case?

There are situations when spouses cannot agree on the amount of funds transferred, or when the alimony payer hides his official salary, or works unofficially or irregularly. In this case, the case is sent to court.

The judge, taking into account the financial status of both spouses, in order to create favorable conditions for the maintenance of a minor child, has the right to make the following decisions:

- If the payer does not work, he must pay a fixed amount per month for the maintenance of his child, calculated in accordance with the minimum subsistence level of the given region.

- If the alimony recipient has an irregular income or it is impossible to determine his arrears in payments, then the amount of payments can be equated to the average salary of the region where the interested person lives.

- If the payer receives a salary in non-ruble currency and has additional sources of income, the judge sets a specific amount of alimony, paid monthly or, very rarely, one time.

Responsibility for non-payment of alimony

Responsibility for late payment of alimony is provided for in Art. 115 of the Family Code of the Russian Federation. According to the legislation, when debt arises through the fault of the alimony payer, there is the following liability:

- In case of non-payment under an agreement on the payment of alimony, the person is liable in the manner prescribed by such agreement.

- If alimony is not paid by a court decision, the alimony payer must pay a penalty, the amount of which is 0.5% of the amount of unpaid alimony for each day of delay.

Important: the recipient of alimony has the right to seek recovery from the guilty person of all losses that are not covered by the penalty and caused by the delay in fulfilling alimony obligations.

Types of salaries

Now let’s move directly to the question of how alimony is calculated: from a “clean” or “dirty” salary? Before understanding this topic, let's find out what is meant by these concepts.

First of all, you should know that these terms are not official, but popular. “Dirty” wages are the amount a person receives per month without tax calculations. While the “net” salary is the money that the employee receives in his hands. It is clear that “dirty” wages are higher than “clean” wages. So how much is alimony calculated from?

According to the legislation of our homeland, there are a number of detailed instructions regarding how alimony is calculated. For example, paragraph one of Article No. 99 of the Federal Law “On Enforcement Proceedings,” dated October 2, 2007, states that alimony is calculated from the amount that remains after taxes are withheld. In other words, from a “net” salary.

It happens that before the alimony agreement was drawn up or the writ of execution was formed, the payer already had obligations to pay alimony (and they were not fulfilled). Alimony for the period between the moment such an obligation arises and the moment of its legal collection is subject to collection, but no more than 3 years before the possibility of its legal collection arises.

1. If the recipient of alimony is a minor child:

- based on the payer’s documented earnings;

- in the absence of such earnings - based on the average salary in Russia at the time of collection of alimony.

The average salary for calculating alimony in 2020 and other periods is taken according to Rosstat.

2. In other cases - in accordance with a court decision or alimony agreement.

The payer and recipient of alimony in any case have the right to challenge the method of calculating it in court (Clause 5 of Article 113 of the RF IC).