Home » Human Resources Department » How to apply for financial assistance on the occasion of the birth of a child

The birth of a baby is a joyful event in the life of parents and very expensive. The employee is required to be paid maternity and child care benefits . But in addition to mandatory payments, new parents may be provided with financial assistance at the birth of a child from the employer . This payment is obligatory for the administration only if the provision for this type of assistance is enshrined in the collective agreement , but the director in any case has the right to financially help the employee, and the personnel officer must know how the assistance is processed.

Financial assistance at the birth of a child. Legal grounds

In accordance with Article 129 of the Labor Code, an employer can encourage employees and help them financially in difficult situations . Voluntary payment is also provided for by other legal acts:

- Tax Code;

- Law “On Contributions to the Pension Fund, Compulsory Medical Insurance and Social Security” (No. 212).

Please note One-time financial assistance for the birth of a child is a service aimed at supporting an employee in need . An employer can help financially by:

- accrual of a monetary amount;

- purchasing clothes or baby care products;

- allocation of transport.

At the same time, assistance can be mandatory: if there is a condition in the collective agreement under which, in the event of the birth of a child, an employee is paid a certain amount of money as assistance, this can only be provided to a trade union member, then the administration is obliged to fulfill it.

Such a condition can also be enshrined in an independent local act of the company: in the provision on bonuses, financial assistance or payment.

Application for financial assistance in connection with the death of a relative

The grief that comes to a family not only has an emotional impact on all relatives, but also, as a rule, makes a significant hole in the budget. The employer, taking care of the staff, can help the bereaved employee a little financially. In this case, the funds are paid from the organization’s profit fund; these expenses have tax benefits.

To do this, the organization’s local regulations must stipulate this possibility and its regulations. For this purpose, a special Regulation may be created or the relevant information should be contained in the employment contract or collective agreement. Usually, not only the employee who has lost a loved one has the right to such a payment, but also, conversely, his relatives if the employee himself has died.

The first document required for the accrual of this type of financial assistance is the employee’s request, drawn up in the form of an application. In addition to the request for one-time financial support, the text must indicate:

- Full name of the manager (general director);

- all employee data (position and full name);

- degree of relationship with the deceased (close relatives in connection with whose death financial assistance is provided are brothers and sisters, children or parents of the employee);

- you can indicate the amount that the employer is asking for (it cannot be more than two months’ salary);

- a list of documents confirming relationship and death attached to the application;

- date, painting with transcript.

ATTENTION! It does not matter whether the amount of assistance is indicated in the application; in any case, the manager enters it into the Order, on the basis of which it will be calculated.

Sample application for financial assistance in connection with the death of a relative

To the General Director of Zarathustra LLC, Nikipelov Roman Olegovich, from the manager of the supply department, Anatoly Petrovich Rostovsky

STATEMENT

I ask you to provide me with financial assistance in connection with the death of a close relative - Rostovsky’s brother Mikhail Petrovich.

I am attaching to the application:

- certificate of family composition;

- death certificate of Rostovsky M.P.

06.20.2017 /Rostovsky/ A.P. Rostovsky

Who is entitled to assistance at the birth of a child?

In a collective agreement or other local act, provided that assistance for the birth of a baby is paid, categories of employees who need help may be specified . If there is no mandatory condition, then the director alone makes the decision: whether to help the employee or not and in what amount .

When making a decision, the manager will probably take into account the following factors:

- the contribution of the employee asking for help to the common cause;

- its characteristics;

- length of service and usefulness to the company;

- the value of a qualification or position;

- financial situation of both the employee and the company.

Employers, if they have free money in the budget, willingly help proven responsible employees. Violators of discipline or those recently employed can hardly count on the favor of their superiors.

Important Help can be provided :

- mom and dad of the baby (both are possible);

- guardians;

- to adoptive parents.

Documentation

To receive benefits, in addition to the application, young parents must provide other documents:

- passports of both spouses;

- SNILS;

- work books if parents do not work;

- a certificate from the second spouse’s company confirming that he did not receive child benefits at his job;

- if parents do not work, you will need a certificate from the labor exchange;

- birth certificate or medical document confirming the birth of a child.

In addition, in some situations other documents may be needed. For example, if the father of a newborn was called up to serve in the armed forces, then there must be a certificate about this provided by the military unit.

How much can you pay?

If the amount of financial assistance is established by a local act of the company, it cannot be underestimated, but it can be increased . In the absence of a condition, the director himself determines how much money can be allocated to an employee in need.

Financial assistance is not subject to taxes, that is, the company saves on this . However, in Article 9 of Federal Law No. 212 there is a clause stating that contributions do not need to be paid only if the conditions match:

- the child is under one year old;

- The amount of assistance is no more than 50 thousand rubles.

If the amount is greater, the company will pay all payments to the budget from the difference. And if the baby is older than one year, then contributions will be paid from the entire amount.

Under the same conditions, the employee is exempt from income tax according to the rule of Article 217 of the Tax Code..

important It is not profitable for an employer to help an employee with money in an amount exceeding 50 thousand rubles, or when the baby is older than a year .

How to write an application

The petition is drawn up on an A4 sheet. In the header you need to indicate who you are addressing. The applicant’s passport details must also be present here. In the body of the application, clearly indicate which benefits you are applying for. Please indicate how you would like to receive the money. If you chose bank transfer, you will need the relevant details. In the document, put the date and signature with a transcript.

A young mother can submit this application to the head of the organization where she was a full-time employee before maternity leave. In this case, the father must obtain a certificate stating that he did not receive such benefits at his job.

If the mother did not work before maternity leave, the father can submit an application at his job. If both spouses are unemployed, this application is submitted to the social protection department at the place of residence.

Sample

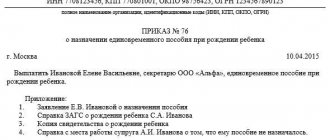

Order

An order for financial assistance is issued only on the basis of an endorsed application, which indicates the amount . If the amount is not indicated, then the director’s visa must appear on the application indicating it.

The order must be drawn up according to the rules of office work, since it will appear when calculating taxes and contributions . The structure must contain the following elements:

- company name;

- registration number and publication number;

- preamble (“Based on the application and in connection with the birth of the child, I order”);

- administrative part (“Pay the knitter of the rafter workshop Semyonova A.A. financial assistance for the birth of a child in the amount of 10,000 rubles. Ground: birth certificate AA No. 123 dated 08/10/2016”);

- personal signature of the manager;

- information line for interested parties (accountant and employee).

reminder You need to familiarize the employee and the accountant with the order, file an application with it and put it in the folder according to the nomenclature .

If financial assistance for the birth of a child from the employer is initiated by the employee’s immediate supervisor, the order will still be based on the personal statement of the employee in need . And his manager, with a memo or a visa on the application, can apply for the request to be granted.

How to apply for financial assistance at the birth of a child

A written request from an employee for financial support is issued by him upon the occurrence of any important events in life. One of these events is the birth of a child - first, second or third. A special occasion may be the birth of twins or triplets.

Many companies provide additional payments to their employees when a baby is born. This payment is not mandatory and is not considered a bonus for achievements in work or an incentive bonus, but serves as financial assistance to subordinates in special cases.

To receive it, the employee needs to write an application for the employer.

This application must contain a request for financial assistance indicating the reason for this request - the birth of a child in the family.

Parents of a newborn should be aware of the right to receive various social benefits - one-time at birth and monthly for care. You can also receive them on the basis of an application at your place of work or social security in the absence of official employment.

Sample application for benefits:

- at the birth of a child;

- for child care.

The above social benefits are mandatory payments.

Financial assistance is not such and can be provided either on the basis of a collective agreement if it contains such a basis for providing financial assistance, or by agreement with the employer.

In any case, the employee’s task is to write an application for financial support for the employer in connection with the birth of the first (second or third) child.

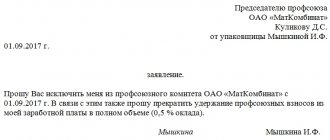

How to write an application for financial assistance at the birth of a child

In order for the application to be considered by the company's management, it must be completed in the following manner:

- the upper right corner of the form contains information about the position of the manager (in the genitive case), the name of the enterprise and its legal status, the full name of the manager;

- The applicant’s position, department, and full name are indicated below;

- in the middle of the sheet the title is written - “Statement”.

The main (text) part of the application begins with the phrase: “I ask you to provide financial assistance.” The following describes the reasons why this need arose (briefly and clearly). For example, “in connection with the birth of a child,” indicating his date of birth and his full name.

After the main block, the application is certified by the personal signature of the employee, recording the date of application.

The form is accompanied by documents confirming the validity of the request for financial assistance, which are written as an appendix.

If the outcome is positive, the manager signs an order for the payment of financial assistance.

Application samples:

| Sample 1: Material assistance is not registered in the employer’s LNA | Sample 2: Material assistance is assigned to the employer’s LNA |

You can download these sample statements below.

What documents need to be attached to the application for financial assistance?

To receive payment from the employer, the employee provides, in addition to the application, the following documents:

- a photocopy of the baby’s birth (guardianship, adoption) certificate;

- papers confirming the child's upbringing by one parent (divorce or death certificate) - if necessary.

The tax burden of income tax on financial assistance provided on the occasion of the birth of a child can be reduced by limiting the processing of financial assistance to the amount of 50,000 rubles. Tax is also not withheld if funds are received before the child reaches 12 months of age.

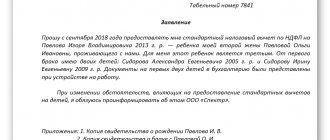

Attention to parents: upon the birth of a child, you have the right to a standard child tax deduction - write an application for the deduction to your employer and pay less taxes.

When is it possible to pay assistance for the birth of a child?

Payments of additional material incentives occur only at the request of the manager. In this regard, controversial situations often arise between subordinates and the director regarding the amounts and decisions made by the company administration.

If support for the birth (adoption, guardianship) of children is provided for in the local acts of the enterprise, then absolutely all subordinates can count on it.

The amount of financial incentives provided and the timing of its payment are also indicated in the company’s documents.

Regardless of the employment of young parents (one company or different), each of them can count on financial support. The amount of assistance is determined by the manager based on the financial capabilities of the company and personal attitude towards the employee. The limit of financial assistance (50 thousand rubles) is designated exclusively for taxation of employee income.

Financial payment is not mandatory; it is useless to demand it if this fact is not stated in the collective agreement or internal regulations of the company. In this case, the problem can be solved by contacting the trade union, labor inspectorate, and also the judicial authorities.

Financial support for the birth of a child is strict for certain categories of government employees and military personnel.

Before the birth of the child, no payment is made to the parents, since there is no basis for the issuance - a document on the birth (adoption, guardianship) of the child.

Sample design

Sample application for financial assistance at the birth of a child - download.

Sample when financial assistance is provided for by a collective agreement or other LNA - download.

Taxation of financial assistance from an employer to employees for a child

The legislation provides for certain restrictions on the amount of tax-free financial assistance. In particular, its general amount, which does not relate to the specific circumstances of the accrual, can be no more than 4 thousand rubles per year - many employers use this mechanism to provide financial assistance for employee vacations.

However, the birth of a child is an exception.

Thus, existing legislative standards suggest that financial assistance provided by an employer during the first year from the birth of a child or his adoption may not be subject to taxes up to an amount of 50 thousand rubles . However, it should be borne in mind that this amount can only be paid in the first year from the date of birth or adoption, and only to one parent. Control of this fact can be ensured by the tax service when checking the reports for each of the parents, and in this case it will be the parents, and not the employer, who will be held accountable for tax evasion.

Any amounts above this will be subject to taxes as usual. Insurance fees for financial assistance are collected on a general basis in the same way as personal income tax. That is, if the amount of assistance was no more than 4 thousand rubles, or no more than 50 thousand rubles upon the birth of a child, or if assistance was issued in connection with the death of an employee, his relative, or in an emergency situation or after a terrorist attack - contributions are not credited to it.

Depending on the standards established by the organization, both his immediate parents and other relatives can receive financial assistance for a child - in this case, everything depends on the established principles for calculating it. In addition, a separate option for providing these payments may also be financial assistance for the treatment of a child, if necessary, including expensive ones.

The tax-free limit only affects one child. That is, when several children are born, for example, twins or triplets, the amount of tax-free financial assistance increases at the rate of 50 thousand rubles for each child. However, some employers may specifically establish a procedure for providing financial assistance, for example, only in the case of the birth of twins or triplets, but not in the case of the birth of one child, in order to provide assistance to parents facing increased workload.

State payments

Currently, due to the demographic crisis, the Russian Government is taking a number of active measures to increase the birth rate.

One of these measures is the allocated benefit assigned to a newborn. In addition, the regulations of the Russian Federation provide for various ways to ease the burden of financial burden upon the birth of a baby in a family. For example, a maternal fund program has been operating in the country for over ten years, and it has proven itself well. Since the start of the fund in 2007, today its size has almost doubled and already amounts to more than 450,000 rubles.

For each newborn, the family is assigned financial support. This is regulated by Law No. 81-FZ of May 19, 1995 (as amended on March 28, 2017) “On State Benefits...”. The peculiarity of such support is that it is intended for the baby, and any parent has the right to purchase it once.

Such support is provided to each family after completing an order according to the accepted template and providing supporting materials. If parents work, then their company can provide them with such assistance. If they do not work, then one of them will have to write an application for support to the social security office at their place of residence.

How to write an application to receive benefits for the birth of a baby

As noted above, the Federal Law regulates the issuance of a one-time benefit upon the birth of a newborn.

To obtain it, you must submit an application. At the same time, you should not delay the time of submitting it, since the application time is limited to six months after the date of birth of the baby. How to make such an application? Below are instructions for filling it out:

- To receive benefits for a newborn, you must fill out an application form addressed to the head of the company where the mother works before going on maternity leave. If the mother does not work, then the father can submit such a petition at the place of his work. It should be noted that when one of the parents applies for the purchase of benefits, the other is required to obtain a certificate from his company stating that he was not given such benefits.

Note: If both parents do not work, then they can send a petition to the social security structures at their location.

- To draw up a forgiveness, you need a sheet of A4 paper. At the top of the right side of the page the addressee to whom the document is being submitted is displayed (the position of the head of the company, his full name, the name of the company). Below, information about the applicant is displayed (position, full name, passport details, place of actual residence and registration). The submitted form is accompanied by a certificate from the registry office, a birth document and a certificate from the spouse from the company, which indicates that benefits for the birth of the baby were not issued.

- The application can be drawn up in a free style. The main thing is to clearly write what benefits the applicant is applying for. Next, you need to display the method of receiving payment (transfer by mail or to a bank card). Moreover, when transferring to a bank card, you need to display personal payment details, as well as bank details. At the end of the completed form, the date and signature of the author of the document with a transcript are placed.

Sample application for financial assistance at the birth of a child

–

Personal income tax and insurance contributions from financial aid

According to paragraph 8 of Art. 217 of the Tax Code, financial assistance for the birth (adoption) of a child, paid at the expense of the employer, is exempt from personal income tax only if the following conditions are met:

- the total amount will not exceed 50 thousand rubles per child. Moreover, it can be paid at will to one parent or both, but the total amount should not be more than specified;

- paid to the parent or parents, as well as guardians in the case of adoption;

- produced at one time (is of a one-time nature);

- paid within one year after the birth or adoption of the child.

A similar approach to exemption from calculation and payment is applied in the case of insurance contributions to the Pension Fund, as well as social and compulsory health insurance funds.

It should be noted that the employer has the right to set the amount of material payment in any amount, including exceeding 50 thousand rubles. But only the specified limit will be exempt from personal income tax and insurance premiums. The amount exceeding this is subject to taxation in the usual manner.