Without a chief accountant and general director, the activity of the enterprise, if not completely suspended, will at least be significantly disrupted. But both have the right to sick leave and annual leave, like any worker protected by labor legislation. Therefore, the law provides for the temporary replacement of the director and chief accountant - their responsibilities can be temporarily transferred to deputies. Even if the company does not have a full-time position of deputy general director and/or deputy chief accountant, another employee of the company can perform their functions on a temporary basis. In order to shift the responsibilities of the general director or chief accountant to an employee in accordance with the law, it is necessary to issue a corresponding document - an order for replacement during vacation. Let us consider the issue of forming this order in detail.

Replacement of the general director and chief accountant during vacation: general information

Companies that have a deputy general director and a deputy chief accountant on staff find it easier to deal with affairs during the absence of these key figures in the organization. Appointing a temporary replacement is somewhat more difficult. Let's consider the procedure using the example of replacing the chief accountant:

| The organization has a deputy chief accountant on staff | The company does not have a deputy chief accountant on staff |

| As a rule, the employment contract of the deputy chief accountant already states that he will perform the duties of the chief accountant during his absence due to going on vacation. | The functions of the chief accountant are transferred to another accounting employee (for example, leading accountant, payroll accountant). |

Procedure:

| Procedure:

|

Sample order for appointment of a manager as an accountant

Before appointing an acting chief accountant, it is necessary to formalize the combination of professions. For this procedure, an additional labor agreement is drawn up, as well as an order for the temporary appointment of an employee as acting chief accountant. A fee is also established for combining two positions.

In order to correctly and quickly register an employee for the position of acting chief accountant, the HR department employee will need the employee’s documents, documents and the seal of the organization in which he works, as well as forms of all the documents necessary for registration.

So, how to appoint a chief accountant correctly and quickly? To do this, follow the instructions:

Typically, a leading accountant is appointed to the position of chief accountant.

What role does the order to replace the general director and chief accountant during vacation play?

An order is an administrative document of a company.

With the help of an order, management legally regulates internal legal relations between employees of the company.

Despite the fact that in most cases an order can be generated by a company independently, without using standardized forms, it is necessary to take its writing very seriously. The reason for this is the possibility that any of the employees will file a claim with the employer in Rostrud or in the courts. If there is no order regulating the order of management on each issue, the employee will easily be able to challenge any instruction from management in case of dissatisfaction with something

.

Assignment of responsibilities to the chief accountant

There are different ways to transfer the responsibilities of a colleague to the chief accountant. The decision depends on the nature of the work and the frequency of its implementation (see table).

| Personnel solution option | When it's convenient |

| Combination of positions | Suitable when a new activity will be carried out for a certain period of time |

| Internal part-time job | Draw up if the chief accountant can carry out individual assignments in his free time from his main job |

| Expanding the scope of work | In addition to the main position, the specialist is engaged in other work duties, but there is only one position |

| Signing a civil contract | Suitable for one-time cooperation and cases when the employer is not interested in the process of completing each stage, but in the final result |

Which employee can replace the CEO during vacation?

The director of the company has the right to offer temporary replacement to any employee of the enterprise who, in the opinion of management, has sufficient team management skills and an acceptable level of education

. It is logical that in the overwhelming majority of cases, mid-level managers (managers) become temporary deputies. But in more or less large companies, the staffing table includes the position of deputy general director.

Important!

Due to the fact that an employee acting as general director will have to sign documents that are important for the company for a certain period of time (as well as attend business meetings, communicate with staff, maintain relationships with contractors, customers and partners of the company), he the CEO must have complete confidence.

Based on the above, we conclude that any company employee who:

- Instills complete confidence in the CEO.

- Has experience in management activities (ideally, he is a middle manager at the same company, knows the employees by sight and is familiar with the activities of the enterprise).

- Has a sufficient level of education.

- Able to conduct business negotiations and establish relationships in a team.

CFO and chief accountant: what's the difference?

05/09/2017 11 273 2 Reading time: 8 min. :

Today we will talk about the differences between the positions of financial director and chief accountant in an enterprise. It happens that one company has both of these positions, sometimes only one of them.

In some ways they are similar, but there are still significant differences, which I will discuss below. After reading this article, you will learn who the financial director is, who the chief accountant is, what they do, and what their job responsibilities are.

So, first things first.

Position "Financial Director"

The financial director is a management position (as is already evident from the name), one of the leading top managers at the enterprise, most often he is a member of the Board of Directors, that is, he is a person capable of influencing key decisions in the company’s development strategy.

The financial director is directly subordinate to the general director (president) of the company. This vacancy may have a slightly different name, for example, “deputy director for financial affairs,” “vice president for finance,” etc.

The job description of a financial director primarily includes the following key job responsibilities:

- Development and implementation of strategy and tactics for enterprise financial management;

- Strategic and monthly financial planning;

- Ensuring the financial stability of the enterprise, capital adequacy, working capital, etc.;

- Responsibility for the formation and submission of financial statements of the enterprise.

The financial director not only optimizes the state of finances within the enterprise, but also always analyzes the external infrastructure, trying to build the financial policy of the company in such a way that it optimally matches it.

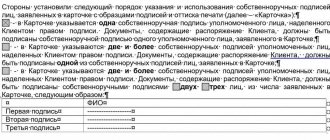

The financial director may or may not be the financially responsible person, and may or may not be granted the right of first or second signature on company documents.

Position "Chief Accountant"

The chief accountant is the head of the entire accounting department of an enterprise - a department of the company whose functions include conducting all financial transactions and controlling them. This position also reports directly to the head of the company.

An accountant can be the “chief”, even if he is the only one in the enterprise. The signature of the chief accountant on many documents (for example, on payment documents) is as necessary as the signature of the director - without it the document will be considered invalid.

The job description of the chief accountant includes the following job responsibilities:

- Maintenance and control over accounting at the enterprise;

- Preparation and submission of financial statements;

- Control over compliance with legislative norms regarding the performance of business transactions at the enterprise;

- Control over the correct and timely calculation and payment of wages to employees;

- Accounting for assets and property of the company;

- Control over receivables and payables;

- Ensuring interaction between the enterprise and banks;

- Internal financial control at the enterprise;

- Control over the timeliness of the transfer of taxes and other obligatory payments to the budget and extra-budgetary funds;

- Ensuring financial document flow in the enterprise and monitoring the safety of financial documents.

The chief accountant is given the right of second signature, with which he signs statements, bank documents and much more. He also has the right to issue orders that are binding on subordinate accounting employees.

The chief accountant at an enterprise is always a financially responsible person, and when conducting tax audits or identifying any violations in the company's reporting, an administrative fine may be personally imposed on him, and in some cases he may even be brought to criminal liability.

What is the difference between a financial director and a chief accountant?

Now let's highlight the key differences between a financial director and a chief accountant. In short, they all come down to the level of competence in managing the finances of the enterprise - the financial director has a higher level.

Thus, the financial director can manage the company’s financial resources and make decisions about where to direct them, but the chief accountant cannot, he only carries out management’s orders in this regard.

But at the same time, the chief accountant, following instructions, ensures that financial transactions are carried out in accordance with the law, do not “spoil” the reporting, comply with the overall financial strategy of the enterprise, and are carried out as competently and correctly as possible.

The CFO analyzes both internal and external financial infrastructure, while the chief accountant focuses only on the internal one.

The financial director is engaged in building the most efficient financial model for the enterprise, and the chief accountant ensures that it complies with the laws and regulations of economic activity.

In his work, the financial director constantly communicates and interacts with other top managers of the company, with external business partners, investors, and the chief accountant with the head of the company, his subordinate accountants and representatives of external control and supervisory organizations (tax, funds, statistics, etc.) .d.).

The chief accountant is always the financially responsible person in the enterprise, and may be subject to administrative penalties from regulatory authorities, but the financial director is not always.

If an enterprise simultaneously has the positions of a financial director and a chief accountant, then, as a rule, they are not subordinate to each other, but both report to the first head of the company. Their job responsibilities are clearly demarcated and do not coincide. If the enterprise has only one of these positions, then its responsibilities may include the responsibilities of both.

Now you have an idea of how a financial director differs from a chief accountant at an enterprise, and what is included in the job descriptions of these specialists.

That's all for me. Become financially literate with the Financial Genius website. , study the proposed materials, ask questions and communicate on the forum. See you on the pages of the site!

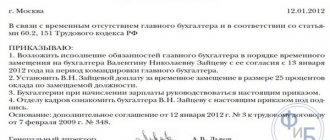

How to draw up an order for replacement during the CEO's vacation

Important!

As justification for the need to issue a replacement order, one can indicate the uninterrupted operation of the company and the management of the company during the absence of the general director from the workplace.

There is no officially approved form of order for replacing the general director during vacation. The law allows you to create an administrative document in any form (you can develop a single template and approve it as a local regulatory act of the enterprise).

The following information must appear in the order without fail:

| № | Information specified in the replacement order | Explanations |

| 1 | Standard data |

|

| 2 | Grounds for issuing the order | Link to the number and date of the order for the general director's leave, vacation schedule. |

| 3 | Replacement period | The specific period of time during which the employee will serve as CEO. |

| 4 | List of duties of a substitute employee | If necessary, the order can also list restrictions on the powers of the deputy. |

| 5 | Signature right | It is necessary to mention whether the deputy has the right to sign documents that are usually signed by the general director. |

| 6 | Labor functions | It is necessary to clarify whether the employee who is temporarily entrusted with the powers of the general director will continue to perform his usual duties, or whether during the general director’s vacation he will act exclusively as his deputy. |

| 7 | The principle of additional payment for combining professions | It is advisable to specify a specific amount of money that is due to the deputy for temporarily performing the duties of the general director. If this is impossible, you need to at least describe the compensation procedure. |

| 8 | List of documents attached to the order | For example, the written consent of the employee to whom it is planned to transfer the responsibilities of the general director. |

Important!

The replacement order must be registered in the company's local documentation journal.

Temporary performance of managerial duties by another employee

Answered by Natalya Silantyeva, expert When a manager is absent for some reason (sick, on a business trip, vacation, etc.), an employee is appointed who will temporarily perform his duties.

There is no need to draw up an order for transfer to another position in this situation.

Rationale From the recommendation of Ivan Shklovets, Deputy Head of the Federal Service for Labor and Employment How to formalize the temporary performance of the duties of a manager by another employee Temporary performance of the duties of the head of an institution is required in cases where he is absent for some reason (sick, on a business trip, vacation, etc.).

P.). Procedure for replacement The procedure for temporarily replacing a manager can be prescribed: – in the charter of a budgetary institution; – in the charter of the autonomous institution; – in the charter or in the regulations of a government institution (in cases provided for by law). This procedure follows from paragraphs 1, 3 of Article 14 of the Law of January 12, 1996.

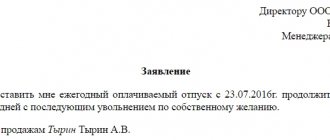

The management goes on vacation (we formalize the temporary transfer of powers of the chief accountant and director correctly)

The manager and chief accountant are the most significant people in any organization.

After all, they are the ones responsible for the correct documentation of the “economic life” of the company.

In particular, employees of the organization and the bank should not accept settlement documents without the signature of the chief accountant for execution. But we all, including the manager and the chief accountant, need rest. And the question arises, who will sign on all documents and perform other duties of the director and chief accountant during their vacation. It is no secret that in many organizations the addition “I.O.” appears in documents before the positions of manager and chief accountant during their absence. or "Vr.I.O."

We all know what this means: performing duties or temporarily performing the duties of an employee.

But such positions as I.O. manager or Acting Acting Officer There is simply no chief accountant in labor legislation.

Order to replace the General Director during vacation (form, sample)

Important!

The finished order (formed, endorsed, issued) is filed in a folder with current administrative documentation. When the relevance of the order is lost, the document is archived for a period regulated by law or internal rules of the company.

To download a blank order form for replacing the CEO during the vacation, follow the following → link.

Form of order for replacement during the CEO's vacation

Before creating an order to replace the general director during the vacation, pay attention to the sample document - this will help you avoid mistakes. You can download a sample order from the following → link.

Sample order for replacement during the CEO's vacation

What to pay attention to when drawing up an order

Today there is no single, unified sample order on assigning the duties of a chief accountant to a director, so representatives of enterprises and organizations can write it in any form, based on their vision of this document.

Some companies have their own order template that is mandatory for use. In any case, when drawing up a document, it is important to adhere to the norms of office work, business documentation and, no matter how trivial it may sound, the rules of the Russian language.

The document must include a number of certain information, without which it will not acquire legal force:

- number, date and place of creation;

- name of the enterprise;

- the reason for creating the order, as well as the essence: assigning the duties of the chief accountant to the director. The whole idea can be expressed in one or two sentences.

If there are any additional documents, they should also be attached to the document, noting them in the main part as a separate paragraph.

Common mistakes on the topic “Order for substitution during vacation”

Error:

An accounting employee (payroll accountant) learned that he was being appointed temporary deputy chief accountant the day before the chief accountant went on annual leave.

No employee (unless his position is called “deputy chief accountant”) can be forced to temporarily perform the duties of the chief accountant or general director of the company without his prior written consent. And even more so, an employee cannot be taken by surprise by such news.

Error:

The company's chief accountant did not appoint a temporary deputy for the period of annual leave. The chief accountant decided to sign accounting documents while on vacation, since he was going to spend his vacation at home anyway.

The chief accountant does not have the right to perform his official duties while on vacation, unlike the general director (since the second is the sole executive body of the enterprise).

Who does the chief accountant report to under the new law?

Business lawyer Who reports to the chief accountant, what rights and responsibilities does he have? The accounting service in an enterprise (organization) is headed by a chief accountant.

The chief accountant belongs to the category of management employees, therefore he reports only to management. Accounting is formed as an independent division, not being part of other structures.

The job of the chief accountant is to organize and develop a system of accounting and reporting.

Who does the chief accountant report to?

- 1 Legal status and organization of the accounting service

- 2 Who reports to the chief accountant

- 3 Status, rights, duties and responsibilities of the chief accountant 3.1 Functions of the chief accountant

- 3.2 Responsibilities of the chief accountant

- 3.3 Rights

- 3.4 Liability

Legal status and organization of the accounting service The manager is responsible for the organization of the accounting service at any enterprise (organization). Art.

6 of the Law establishes that he can:

- keep records in person

- transfer this function to an accountant, a specialized company, or a centralized service

- hire an accountant

- organize a service headed by a chief accountant

This means that the form of accounting is determined without the participation of the owners.

Who reports to the chief accountant, what rights and responsibilities does he have?

- Legal Resources

- Collections of materials

- Who does the chief accountant report to?

A selection of the most important documents upon request Who does the chief accountant report to (regulatory acts, forms, articles, expert consultations and much more).

Articles, comments, answers to questions: To whom does the chief accountant report Question: ...A close relative of the chief accountant of the institution has been hired as an accountant to the staff of a structural unit of a budgetary institution. The head of the accounting department of a structural unit is subordinate to the chief accountant of the institution.

Is there a conflict of interest in this situation? (Expert consultation, 2017) Question: The federal budgetary institution, created to carry out the tasks assigned to the federal government body, has a number of structural divisions.

A close relative of the institution's chief accountant has been hired as an accountant to a structural unit of the institution. The structural unit has a separate staffing table.

At the same time, the head of the accounting department of a structural unit is subordinate to the chief accountant of the institution. Is there a conflict of interest in the situation under consideration? Tax Guide.

The financial director systematically asks to change the structure of obedience, and the chief accountant relies on the requirements of legislation and carries out all instructions only from the main director. In the end, in controversial moments, financial issues are resolved in our time for months, and not so much that they remain, for how long the entire organization watched the quarrel of top managers.

On the topic “Who does the chief accountant report to, Legal norm” we have collected examples of documents that may interest you.

accounting structure and status of the chief accountant of the enterprise

He also has the right to issue orders that are binding on subordinate accounting employees.

The chief accountant at an enterprise is always a financially responsible person, and when conducting tax audits or identifying any violations in the company's reporting, an administrative fine may be personally imposed on him, and in some cases he may even be brought to criminal liability.

What is the difference between a financial director and a chief accountant? Now let's highlight the key differences between a financial director and a chief accountant. In short, they all come down to the level of competence in managing the finances of the enterprise - the financial director has a higher level.

Who does the chief accountant report to under the new law?

As soon as the law on accounting came into force, everyone relaxed a little, since there was already a chance that the issue of obedience to the chief accountant could be calmly resolved on their own.

In fact, previously the chief accountant was subordinate specifically to the head of the company and in these conditions, in a large number of companies, disputes arose regarding the type of relationship between the financial director and the chief accountant in the structure of obedience in the context of the new legislation on accounting, the chief can himself decide the issue of obedience of the chief accountant.

Who does the chief accountant of Ukraine report to?

- Distribution of responsibility between the head of the company and the chief accountant.

- Detailed problem solving process among the boss and chief accountant.

- The introduction of special qualification conditions for chief accountants of very significant organizations for the company, whose shares are quoted on the international market.

- Failure to obtain a certificate of a qualified accountant.

- The limitation in accounting is strictly for the head of the company.

- Lack of separate norms The legislation clearly shows the subordination, powers, obligations and responsibilities of the chief accountant, the mandatory nature of his rules for the formation of documents of business processes and the provision of important papers and information to the accounting department for each employee of the company. The Accounting Law will not have the rules presented.

Who does the chief accountant report to in the Republic of Kazakhstan?

- ensure rational use of the salary fundData analysis

- organize inventory

- ensure the correctness of calculations related to transfers to the budget and extra-budgetary funds

- prevent the formation of shortages, irrational use of resources

- draw up documentation of shortages and transfer them to law enforcement agencies

- ensure the legality of writing off debts and shortages

- accumulate finances to ensure the stability of the enterprise

- interact with banks in the process of purchasing securities, processing deposits, loans

- ensure timely preparation of balance sheets and statements of income and expenses, and other documentation related to tax and statistical reporting

It is possible to fulfill all duties only if you have the ability to properly manage accounting employees.

Who can the chief accountant report to?

The chief accountant (an accountant in the absence of a chief accountant position on the staff) is appointed to the position and dismissed by the head of the organization.

He reports directly to the head of the organization and is responsible for the formation of accounting policies, accounting, timely submission of complete and reliable financial statements (clauses 1, 2, article 7 of the Federal Law “On Accounting”). According to paragraph 3 of Art.

7 of the Federal Law “On Accounting”, the chief accountant ensures compliance of ongoing business transactions with the legislation of the Russian Federation, control over the movement of property and the fulfillment of obligations. The requirements of the chief accountant must be met by all employees of the organization.

On the topic “Who does the chief accountant report to, Legal norm” we have collected examples of documents that may interest you.

Cash and settlement documents, financial and credit obligations are considered valid from the moment they are signed by the chief accountant. If the enterprise has only one of these positions, then its responsibilities may include the responsibilities of both.

Now you have an idea of how a financial director differs from a chief accountant at an enterprise, and what is included in the job descriptions of these specialists. That's all for me. Become financially literate with the Financial Genius website.

Answers to frequently asked questions on the topic “Order for replacement during vacation”

Question:

Is the organization obliged to appoint a temporary deputy general director or chief accountant with the right to sign primary documentation? The head of our company is convinced that the absence of the chief accountant from the workplace for 25 calendar days will not negatively affect the work process.

Answer:

Writing an order to appoint an employee as a temporary deputy chief accountant with the right to sign documents is only the right of the company, but not its obligation. But it is better to leave a deputy so that cases do not accumulate and to avoid possible troubles.

Question:

Is it possible to do the following? The company will not appoint by order an employee who would temporarily replace the chief accountant, and the chief accountant, upon returning from vacation, will sign all primary documents retroactively.

Answer:

It's better not to do that. Documents signed retroactively raise questions among representatives of Rostrud.

Should the chief accountant report to the deputy director?

This position also reports directly to the head of the company. An accountant can be the “chief”, even if he is the only one in the enterprise.

The signature of the chief accountant on many documents (for example, on payment documents) is as necessary as the signature of the director - without it the document will be considered invalid.

The job description of the chief accountant includes the following job responsibilities: Maintaining and controlling accounting at the enterprise; Preparation and submission of financial statements; Control over compliance with legislative norms regarding the performance of business transactions at the enterprise; Control over the correct and timely calculation and payment of wages to employees; Accounting for assets and property of the company; Control over receivables and payables; Ensuring interaction between the enterprise and banks;

Deputy Director, Chief Accountant

Hello!

Combination is possible. If the head of the organization has decided to personally maintain accounting records, this must be reflected in the order on the organization’s accounting policy.

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel telephone If you find it difficult to formulate a question, call a free multi-channel telephone, a lawyer will help you Similar topics And if the director of an OJSC is not satisfied with the 0.5 rate of the chief accountant, how should he transfer her to the deputy chief accountant?

Without the employee’s consent, you cannot transfer him to another job in accordance with Article 72.1 of the Labor Code of the Russian Federation.

The financial director has it in his genes that the chief accountant must obey him

In all large Western companies, the financial director is also the chief accountant.

They are not required to know accounting techniques, since this is what accountants are for; they must be able to evaluate the final result of accounting work and use it correctly.

— What knowledge, in addition to accounting, should a financial director have? — He must understand taxation, since tax optimization is his job, lending, financial management, financial theory, etc.

d. - How

Chief Accountant

To perform the functions assigned to him, the chief accountant of the enterprise is obliged to: organize accounting of economic and financial activities and control over the economical use of material, labor and financial resources, the safety of the enterprise’s property; formulate an accounting policy in accordance with accounting legislation, based on the structure and characteristics of the enterprise’s activities, the need to ensure its financial stability; organize accounting of property, liabilities and business transactions, incoming fixed assets, inventory and cash, execution of cost estimates, performance of work (services), results of financial and economic activities of the enterprise, as well as financial, settlement and credit transactions, timely reflection on accounting accounts

Who does the chief accountant report to?

All employees of the department report to the chief accountant. A vertical structure is the organization of additional groups and departments headed by senior accountants.

In a large enterprise, the accounting service is divided into departments:

- general (collection of information)

- cash desk (working with securities and cash)

- material (accounting for tangible assets)

- settlement (calculation of salaries, taxes, social benefits)

- production (cost and cost calculation)

This service may also include other departments (at some enterprises they are organized as independent divisions): Accounting structure

- marketing (forms the retail price)

- labor and salary (takes into account working hours, vacations, sick leave)

- economic planning (plans the technical side of activities)

Credits

If you can organize work so that during the short-term vacation of the chief accountant no one performs his duties, and the organization continues to work as usual, and the chief accountant himself, during his absence, prepares the necessary documents “in advance” or sorts out the accumulated cases only after his return from vacation, then the responsibilities of the chief accountant need not be delegated to anyone. But, as a rule, even in the absence of the chief accountant, the organization, working as usual, needs to promptly resolve issues that were within the competence of the chief accountant.

And that means the appointment of an acting official. 0 0 3 6744 The director goes on vacation, the chief accountant performs his duties: the subtleties of combining positions The director goes on vacation.

Can the chief accountant act as a director if the company does not have a full-time deputy?

Does he need to be paid extra for performing these duties? And how to arrange all this correctly?

Answer Yes, the chief accountant has the right to temporarily act as director.