Familiarization with the job description and order for the transfer of cases

The new chief accountant needs to clearly understand his job responsibilities in order to organize his work and understand what to pay attention to when accepting cases from a departing specialist.

To do this, the new chief accountant should read the job description. Unfortunately, many companies simply do not have such documents. And although this is a gross violation of personnel records, such cases are not uncommon. And it is during the transfer of affairs that management draws attention to the fact that job descriptions are an integral part of a properly organized business. Without them, personnel changes can be very painful for the enterprise. So we recommend that you pay special attention to the order in personnel documents and check whether all positions have job descriptions and whether all employees are familiar with them.

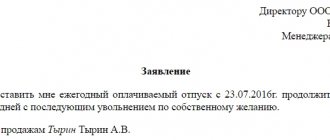

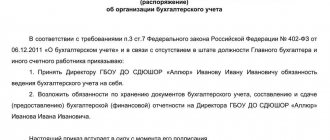

The transfer of cases is carried out on the basis of an order from the head of the organization. The document must indicate the last name, first name and patronymic of the person accepting the affairs (new chief accountant), the person transferring the affairs (former chief accountant), as well as the names of other employees involved in the transfer of affairs (manager, auditor, secretary).

The order should indicate: the reason for the acceptance and transfer of cases - for example, the dismissal of the chief accountant; the timing of the acceptance and transfer of cases and the period during which this procedure will be completed. If the chief accountant resigns of his own free will (clause 3 of Article 77 of the Labor Code of the Russian Federation), then the employer has two weeks to terminate the employment contract in accordance with Article 80 of the Labor Code. In this case, it is advisable to set a period of two weeks. In addition, the order must indicate the name of the employee responsible for the transfer of cases (last name, first name and patronymic of the outgoing chief accountant), and the name of the employee responsible for the reception (last name, first name and patronymic of the new specialist). Be sure to name each member included in the commission, as well as the chairperson of the referral committee. A commission is created if a large volume of documents is subject to transfer. It may include accounting employees, internal control services, security services and other employees. When creating a commission, responsibility for organizing and conducting the transfer of cases rests with the chairman of the commission. Among other things, do not forget that the order must indicate the deadline for drawing up the act of acceptance and transfer of cases.

Who should I hand over the cases to?

Several persons can take over the affairs of the outgoing chief accountant. Most often, this is the new chief accountant. But it may happen that there is no new employee yet, and the old one has the legal right to leave his position. Then, if you have several accountants, you can temporarily transfer matters to them.

Small businesses where the chief accountant is the entire accounting department find themselves in a difficult situation. The affairs are accepted by the head of the company, since he is responsible for organizing accounting.

If the manager is against accepting cases, then the previous chief accountant must document this fact in writing. If the manager refuses to sign the protocol with the refusal, the following must be done:

- draw up an inventory of cases for delivery (2 copies);

- send one copy to the tax service by registered mail or against the signature of the tax inspector.

If an employee cannot transfer cases (sick, died), then the manager must issue a decree on their acceptance by another person.

Checking the status of accounting and reporting

The new chief accountant must conduct an audit of the state of accounting and reporting. To do this, you need to check the availability of documents. These include: constituent and registration papers; accounting policy; primary accounting documents (agreements with suppliers, buyers and other counterparties, acts, invoices, etc.); accounting and tax registers; accounting certificates; financial and tax reporting; reporting to extra-budgetary funds; acts of reconciliation with the Federal Tax Service, acts of inspections; inventory records; cash documents, bank statements and payment orders; personnel papers, documents confirming wage arrears and personal income tax deductions; job responsibilities of accounting employees; a list of persons who have the right to sign on primary documents, and other papers related to the organization and maintenance of accounting and tax records.

The submitted documents must be filed. If there is no signature, a corresponding entry is made in the transfer and acceptance certificate and a list of documents is drawn up.

After this, you should familiarize yourself with the accounting policies for accounting and tax accounting for the two previous years and the current period, i.e., the time interval that can be covered by an on-site audit (clause 4 of Article 89 of the Tax Code of the Russian Federation).

note

The transfer of work is formalized by an act of acceptance and transfer of cases, which must indicate all the main points characterizing the state of the company on the date of dismissal of the previous specialist, and include as much information as possible collected and processed during the transfer of cases.

Then it is important to assess the compliance of accounting and tax reporting with the provisions of accounting policies and current legislation. For example, the creation of reserves, the sequence of application of accounting policies, the correctness of the formation of financial results, etc. The reporting is also checked for compliance of indicators with accounting data and the correctness of calculation of taxes and contributions, submission of declarations and calculations.

Next, you should conduct a random check of the primary documents for the correctness and timeliness of data reflected in the accounting accounts and in tax accounting.

Of course, it can be simply unrealistic for a new chief accountant to check all the primary papers due to their large number. In this case, you should confirm the availability of primary documents, the correctness of filling in the details and their reflection on the accounts. This needs to be done at least selectively. The criterion for such verification may be large amounts for which business transactions were carried out.

It is also advisable for the new chief accountant to familiarize himself with the audit reports, acts and decisions based on the results of the audits. This will allow you to get an idea of the typical mistakes of the former chief accountant, shortcomings in his work that were identified by the inspection bodies.

Read also “Errors in primary documents”

How are cases transferred?

It is quite rare for a full transfer of cases to take place.

The initiator of this procedure is the head of the department or the receiving party (new employee).

In practice, there are cases of conflict-based termination of a contract; in this regard, the resigning specialist refuses to transfer the cases.

In such a situation, it is necessary to record this fact using an act of acceptance and transfer. An employee hired for a vacant position, in order to avoid liability for the mistakes of others, unilaterally draws up an inventory of the accepted documentation.

It is risky for a successor to take over a job before going to work; the applicant for the position may not show up for work.

It is more correct to carry out the transfer on the day of dismissal.

Responsible specialists break this process into stages and carry it out in advance, within several days.

It is better to transfer matters not to a new employee, but to the head of the department.

When dismissing the chief accountant, it is more correct to transfer it to the head of the enterprise, because he is responsible for the correct maintenance of accounting records.

Do I need to make an order?

The employer requires the transfer of affairs and material assets to another specialist, if this is provided for in their job descriptions.

Positions that require this procedure:

- director;

- Chief Accountant;

- HR specialist - the procedure for receiving and transferring HR officer’s cases;

- financially responsible employee (cashier, manager).

If an employee performs functions with a high level of responsibility, his dismissal is always accompanied by a procedure for accepting and transferring cases.

At the legislative level, regulations have not been developed to regulate the process of termination of employment relations. Sometimes a clause on the obligation to transfer affairs is written into the employment contract.

When the chief accountant leaves

Before dismissal, the chief accountant must transfer affairs in accordance with the algorithm:

- drawing up an order indicating the deadlines and specific actions of the accountant and the person receiving the cases;

- carrying out inventory;

- meeting between the accountant and the successor;

- drawing up a transfer act with a detailed list of to-dos.

A successful inventory allows the next stage of transfer to proceed.

If shortcomings and errors are identified, then the accountant needs to put things in proper form.

The order to transfer the affairs of the chief accountant consists of several blocks:

- regulatory: name of the enterprise, title of the document, its number and date, signature of the director of the organization;

- individually personalized: surnames and initials of the receiving and transmitting parties, their positions;

- additional (listing of cases related to the transfer): deadline for transfer of cases, implementation of reconciliation acts, inventory, registration of requests and inventories of documentation.

The introductory signature is placed on the order by the chief accountant.

order on the transfer of files and documents upon dismissal of the chief accountant - word.

On the transfer of material assets and inventory upon termination of the contract with MOL

The order must contain all the necessary blocks, similar to those for the dismissal of an accountant. In the additional part, the fact of acceptance and transfer of inventory items is stated, and the necessary act is drawn up.

All employees mentioned in it are signed in the order.

The order serves as the basis for an audit, which consists of a number of activities:

- re-accounting of material assets entrusted to the employee;

- checking the condition and wear of objects, determining their value taking into account depreciation;

- drawing up an act of transferring property to a new specialist.

The act must refer to completed reports on the inventory of liabilities and assets.

It should be noted that the transfer of valuables upon dismissal of a financially responsible person can only be carried out to a new specialist who is included in the list of persons approved by the head of the organization.

order on the transfer of material assets upon dismissal of the financially responsible person - word.

The lack of instructions at the legislative level on the procedure for transferring cases indicates that there is no mandatory execution of the order for all employees without exception.

On the other hand, its registration will allow you to avoid errors when carrying out accounting and accounting of material assets, which can begin when changing the accountant and financially responsible specialist.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 938-43-28 — Moscow — CALL

+7 (812) 467-435-31 — St. Petersburg — CALL

+7 — Other regions — CALL

Reception and transmission of documents

The chief accountant must receive the following documents.

Constituent and registration papers:

- charter, constituent agreement;

- extract from the Unified State Register of Legal Entities;

- registration certificate;

- certificate of registration with the tax authorities;

- Certificate of registration with the Pension Fund, Social Insurance Fund.

Documents related to the organization of accounting:

- accounting policy;

- tax accounting policy;

- chart of accounts;

- job descriptions of accounting employees.

Accounting and tax registers:

- balance sheets for all accounting accounts;

- accounting and tax registers for all accounts.

Accounting, financial and tax reporting:

- financial statements;

- declarations and calculations for all taxes;

- books of purchases and sales;

- log of received and issued invoices.

Inventory documents:

- order to conduct an inventory;

- inventory and comparison lists.

Documents relating to relationships with tax authorities:

- tax audit reports;

- acts of reconciliation with inspectors.

Documents for accounting of fixed assets:

- order to create a commission for acceptance of fixed assets;

- acts of acceptance and transfer of fixed assets according to form No. OS-1;

- inventory cards for fixed assets in form No. OS-6;

- acts for write-off of fixed assets.

Documents for accounting of inventory items:

- materials accounting cards;

- receipt orders in form No. M-4;

- requirements – invoices in form No. M-11.

Cash accounting documents:

- cash book, incoming and outgoing cash orders;

- money orders;

- bank statements on current accounts;

- cashier-operator's journal and Z-reports.

Documents on labor and wages accounting:

- employment contracts;

- orders on hiring, dismissal, bonuses;

- staffing schedule;

- time sheets;

- payroll statements.

Documents for settlements with accountable persons:

- expense reports.

Documents for accounting of settlements by counterparties:

- agreements with suppliers and customers;

- acts of reconciliation with debtors and creditors;

- invoices, certificates of work performed, services rendered.

Other papers:

- primary documents for accounting for loans, financial investments, intangible assets;

- accounting certificates;

- waybills;

- strict reporting forms;

- powers of attorney and other papers.

What is the act of transfer of affairs upon dismissal of the chief accountant?

The act of transfer of affairs upon dismissal of the chief accountant is a document that allows the successor and management of the resigning chief accountant to know in what financial condition the enterprise is being transferred.

Such a document is needed so that the chief accountant who terminates the cooperation not only transfers all the folders with documentation according to the inventory, but also conducts an inventory of all material resources, including fixed assets.

Quarterly and annual reports, the status of settlements with employees, suppliers, subcontractors, contractors, tax calculations, the balance sheet of the enterprise - these and other issues must be covered and documented. Therefore, it is necessary to transfer reconciliation acts, registers of receivables and payables, tax papers, etc. to the new financial manager.

After the chief accountant receives the payment and leaves, it will be difficult to make inquiries and find out how and why the shortage of funds occurred. The act of transferring affairs will give the successor an idea of how accounting was conducted, what the financial policy was, and whether there were any abuses.

What to base the dismissal on?

According to the Labor Code, the end of cooperation with the chief accountant is exactly the same as with another employee. However, in addition to the articles of the Labor Code, federal laws provide some grounds specific to key positions, such as director and chief accountant. Let's consider all the legislative reasons for dismissing the chief accountant.

The chief accountant wants to leave on his own

An employee’s own desire is a valid reason for any dismissal. The value of an employee, financial responsibility and even a pile of unfinished business will not be able to detain the chief accountant if he decides to leave his job.

ATTENTION! Sometimes employers, wanting to protect the company, include clauses in the employment contract according to which the accountant is allegedly deprived of the right to resign during the period of unfinished reports, etc. Since the Labor Code as a legislative act takes precedence over internal documents, even after signing an agreement with such clauses, the accountant has the right to resign after working the required two weeks.

Guided by Art. 80 of the Labor Code, the accountant notifies the employee in writing 14 days in advance of his resignation. These days he hands over affairs to his successor. The manager is responsible for the acceptance of cases, as well as for all accounting (clause 1, article 6 of Federal Law No. 129). If he could not find a deputy, then he must take over the business himself, otherwise he will have to let the accountant go “as is.”

IMPORTANT! If the manager does not want to dismiss the chief accountant, refusing to sign the application and prohibiting him from registering it with the secretariat, the document can be sent by registered mail and the work can be stopped after the established 14 days. An illegally detained work book will have to be demanded through the court.

The manager's initiative in dismissing the chief accountant

The law provides many reasons for which a manager has the right to show the chief accountant the door. Among them are those that apply to both key and ordinary employees.

- Forged documents when drawing up an employment contract.

- Expiration of a fixed-term contract. A warning about unwillingness to renew the contract must be provided to the employee 3 days in advance. If this does not happen after the expiration of the term, the contract automatically turns into an open-ended one.

- Failure to fulfill one’s duties or performance with violations (several times, confirmed by penalties, or once, but rudely).

- Absenteeism.

- An employee appears drunk or under the influence of narcotic or other toxic drugs.

- Reluctance to work in changed conditions, subordination or territorial location.

- Violation of the provisions of the employment contract (if they do not contradict the Labor Code of the Russian Federation).

- Inconsistency of the position identified as a result of the certification.

- Liquidation of the organization.

- Reduction in staff or numbers.

IMPORTANT INFORMATION! Retrenchment is a fairly rare reason for dismissing an accountant, because any organization needs a person to keep financial records. Only if the enterprise is very small, the director himself can perform the functions of an accountant, then it is permissible to reduce this position.

Grounds related to financial liability

The chief accountant has the right to be dismissed if it is established that he:

- committed theft, embezzlement, destroyed or damaged anything belonging to the company or other employees (the fact must be confirmed by a court or other authorized body);

- by his actions or inaction related to the maintenance of valuables, he has lost the trust of management;

- participated in making a decision that resulted in damage to the organization’s property.

Reasons related to the uniqueness of accounting responsibilities

Due to the fact that the labor functions of the chief accountant provide for exceptional awareness of all business processes, it is permissible to replace this employee if:

- the organization has a new owner (having “your own person” in a key position is the right of the owner);

- the owner wants to change the organization’s property and persons in key positions;

- The chief accountant divulged a secret protected by law.

NOTE! Information contained in the constituent documents, as well as in submitted reports, cannot be considered secret. Therefore, information about the movement of money is not recognized by law as a trade secret, and if the accountant spilled the beans about this, dismissal on this basis is unacceptable.

The chief accountant decided to quit

Today it is difficult to find an organization in which the chief accountant has not changed at least once.

This action requires a lot of time and nerves. Let's start with the fact that the dismissal of the chief accountant is different from other dismissals. It “storms” the organization with a score corresponding to an on-site tax audit. We will not go into the legal details of the departure of the chief accountant. Let's just say that in addition to the standard ones, the chief accountant has special reasons to quit. The chief accountant has the right to leave if:

- Ownership rights to the organization's assets were transferred to the new owner.

- Any reorganization of the organizational and legal form of the organization has occurred.

- The department of a government agency has changed.

But there is also a limiting feature - a change of chief accountant is possible only in the period between reports.

Transfer of cases: in detail and tastefully

So, the manager approved the act and the dismissal of the chief accountant is imminent. Most likely, the day on which the delivery of cases is completed and the transfer certificate is approved will be the last working day of the resigning chief accountant. Finally, we will give step-by-step instructions for transferring the affairs of the chief accountant.

- A personal resignation letter was submitted and accepted by the manager. Or the employer’s initiative is brought to the attention of the chief accountant and agreed upon. The parties can inform about their decision one month before the date of dismissal of the chief accountant.

- An order for the transfer of affairs was created and signed, and a candidate for the position of a new chief accountant was selected.

- The cases were transferred within the time period established by the order. The act was approved.

- The dismissal of the chief accountant was formalized in compliance with the requirements of the law.

- The new chief accountant begins to perform his duties.

If in the future you need the help of the dismissed chief accountant and there is mutual agreement, then obtain personal permission from the boss for this. Better in writing.

Form

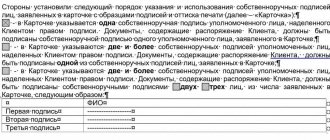

The legislation of the Russian Federation does not provide for a unified form of acceptance and transfer act upon the departure of the chief accountant, therefore such a form must be filled out freely.

In 2020, there are no special requirements for its completion in the legislative acts of the Russian Federation. Most often, the form of this form is developed by internal departmental regulations, enshrined in the order of the chief or other local document, which displays the necessary provisions. These include:

- When replacing the chief accountant, the acceptance and transfer act is drawn up only after ensuring current accounting operations, checking the reporting and financial position of the company (it is possible to involve independent auditors).

- Before filling out the form, an inventory of material, financial resources (checking the cash register and current account) and other balance sheet items of the company is carried out. Reconciliation of settlements with the tax service and extra-budgetary structures (PFR, Social Insurance Fund) is ensured.

- The deadlines for accepting and transferring cases and filling out the act, as well as the members of the created commission, are usually displayed at the disposal of the head of the institution.

Instructions for drawing up a document

The order is drawn up in the generally accepted form, but there are some differences from other documents for the enterprise.

The legislation has not developed a special form for such a document, which means freestyle. Like any other, such an order is printed with the company details and address at the top of the sheet.

Below in the center is the name - the order, on the next line on the left indicate the point where the change of chief accountant takes place and the company is located, and on the right - the date.

On the left, a short column describes the topic of the document, in this case it looks like this: “Concerns the transfer of affairs by the chief accountant.” Below, with a paragraph, the text part of the document begins.

Contents of the paper

As the first point, the head of the company, on whose behalf and signature the order will be issued, must state the reason for the transfer of financial papers, for example: “In connection with the dismissal of the chief accountant, I order:”, and then place the points one after another. When obliging to provide folders, papers, and information on a computer, it is imperative to set a deadline during which the orders must be completed.

The period for which the documentation is transferred should also be specified (usually 3 years).

If the chief accountant tries to hide information, does not disclose all the nuances of the actual situation of finances or taxes, the availability of materials, etc., or openly ignores this document, then it turns out that the order is not being executed, and it is possible that the employee who has access to the company’s finances , intends to hide the abuse.

In this case, completely different disciplinary measures may be taken, taken into account by the Labor Code of the Russian Federation, and the cases will be entrusted to a commission, the competence of which will make it possible to clarify the situation and identify shortages of funds or materials.

The order must specifically indicate the full name and position of the person submitting the case, as well as the details of his successor. The person accepting the papers may be the new chief accountant, and if the candidacy has not yet been approved, then there is an option to entrust the acceptance of the documentation to a deputy or other official.

It is important that the host has sufficient competence in financial matters and the nuances of tax policy. After the handing over person leaves, the one who accepted the case and signed his name takes full responsibility.

Other persons may also be involved in the transfer of cases - the financial director, a representative of the company's own security service, etc. During the period allocated for acceptance from the outgoing chief accountant, an inventory of the material base is usually also carried out.

The date of issue of the order must correspond to the one that coincides with the registration log, and at the same time precede the acceptance process by 1-2 days: the persons involved in this action must be familiar with the document for signature.

The document also stipulates the powers and responsibilities of those who participate in the delivery and acceptance of cases from the chief accountant. For example, you can indicate that if any shortages or discrepancies are identified, an audit firm should be involved. Based on the results of acceptance, an act must be drawn up, specifically specifying what the order should specify in the order and indicating the person responsible for this.

The manager usually retains control over the execution of this document. Under the text, indicate the full position of the manager and his full name, and after signing, list the positions and full names of everyone who should be familiar with the document.

What to do if your chief accountant quits or, for example, goes on maternity leave? What additional documents, in addition to the mandatory ones (personnel), must be drawn up? How and to whom should the affairs that are under the jurisdiction of the former chief accountant be transferred, and what actions should be taken? You will find answers to all these questions in this consultation.

General provisions

Often, an employee informs in advance of his intention to leave a position. Thus, upon dismissal, he notifies the employer two weeks in advance; the approximate date of going on maternity leave is also usually known to the employee.

Perhaps the chief accountant is going to take another position in the enterprise (for example, financial director)? But even then the transfer will not be carried out spontaneously. The chief accountant's retirement date will also be planned.

This way, there is time to complete all the necessary actions.

Today, the duty of the chief accountant upon leaving to draw up an act of acceptance and transfer of cases and/or documentation is not established by law.

However, we recommend that you carry out this procedure, because the correct execution of documentation when transferring cases is important for both the transferring and receiving parties.

We suggest you read: I want to draw up a marriage contract

Also, by decision of the head of the enterprise, an audit may be carried out in accordance with Law No. 3125.

First of all, it is necessary to determine who will take over the affairs of the chief accountant who is resigning. Ideally, this should be an employee who will later occupy this position.

But this is not always possible, for example, if a suitable candidate has not yet been found. Then the cases need to be transferred to the director of the enterprise, since in accordance with Part 2 of Art.

With such a transfer of affairs (from the chief accountant to the director), after registering a new employee, you can draw up a similar act of acceptance and transfer of affairs from the director of the enterprise to the new chief accountant (at the discretion of the parties).

The algorithm of actions when changing the chief accountant may be approximately as follows.

Stage 1. Carrying out an unscheduled inventory

The inventory procedure is regulated by Regulation No. 879. Thus, in accordance with paragraph 4 of section.

І of this document, the object of the inventory, its frequency and timing are determined by the head of the enterprise or an authorized body, except for cases when the inventory is mandatory.

Cases of mandatory inventory are listed in paragraph 7 of section. І Regulations No. 879, while the change of chief accountant does not apply to these. However, in practice, it is still recommended to carry out this procedure in order to avoid unpleasant situations after the departure of the predecessor.

Also note that a change in the financially responsible person (for example, an accountant-cashier) serves as the basis for mandatory inventory.

Therefore, if at an enterprise the chief accountant is also a cashier accountant, an unscheduled inventory is carried out without fail.

To do this, the head of the enterprise issues an order (see sample 1).

The inventory procedure is as follows:

- creation of an inventory commission;

- performing preparatory actions (completion of processing documents relating to the movement of assets; determining balances as of the inventory date; generating the latest registers of receipts and expenditure documents or reports on the movement of assets at the time of inventory);

- directly conducting an inventory (the presence and condition of assets is checked by counting, weighing or measuring);

- summing up the results of the inventory (the commission draws up a protocol on the results of the inventory, which is approved by the head of the enterprise).

Printable table available on the page: https://uteka.ua/tables/20523-0

| Sample 1 Order to conduct an unscheduled inventory In connection with the dismissal of the chief accountant of Svet LLC, Raisa Semenovna Petrova, from 08/01/16, in order to ensure the reliability of the accounting data and financial statements of the enterprise, I ORDER: 1. Conduct an unscheduled inventory of cash, strict reporting forms, inventories, as well as fixed assets and intangible assets.2. |

The current provisions of the Labor Code of the Russian Federation do not contain clear requirements for the transfer of the affairs of the dismissed chief accountant to a new employee.

However, any person holding such a high position in an organization understands that it is unprofessional to break off relations without transferring matters

The chief accountant is the same employee of the company as any other, therefore he has the right to resign at his own request and by agreement of the parties, as well as to be dismissed by order of the manager for violating labor laws.

When hiring a new chief accountant, you will need to correctly draw up an employment contract form, which you can fill out online in the functional and convenient HR program from Bukhsoft.

A fairly common question is: should the chief accountant hand over files upon dismissal? It is noteworthy that in the current provisions of the Labor Code of the Russian Federation there are no clear requirements and recommendations for transferring the affairs of the dismissed chief accountant to a new employee in his place. However, any person holding such a high position in an organization understands that it is unprofessional to break off a relationship without transferring matters. In today's article we will figure out what is the procedure for transferring the affairs of the chief accountant.

There is no specific sequence for transferring the affairs of a dismissed chief accountant, so each company develops its own procedure. Nevertheless, there is a standard scheme; with minor deviations, companies most often try to adhere to it.

The order signed by the head of the company must contain the following main points:

- the reason for the procedure for transferring cases (the dismissal of the chief accountant may be such a reason);

- period of acceptance and transfer of cases. It is important to note that if the chief accountant is dismissed at his own request (clause 3 of Article 77 of the Labor Code of the Russian Federation), the employer is obliged to terminate the employment agreement with him within two weeks (Article 80 of the Labor Code of the Russian Federation). If the dismissal is made at the initiative of the manager and there is a change in the owner of the property (clause 4 of Article 81 of the Labor Code of the Russian Federation), the period for terminating the employment relationship with the chief accountant is three months from the moment the ownership rights of the new owner are established (Article 75 of the Labor Code of the Russian Federation);

- listing the powers of the resigning chief accountant;

- information (full name) about the person responsible for submitting documents - the resigning chief accountant;

- information (full name) about the person accepting the cases (if a candidate for chief accountant has not yet been found, the head of the company is indicated, if he is found and works as a deputy chief accountant or simply an accountant, he must be indicated);

- information (full name) of other persons involved in the transfer of cases (for example, auditors and members of the appointed commission);

- end date for transfer of cases. The appointed day must be compared with the deadlines for submitting tax returns and accounting; transferring cases on the eve of submitting reports is at least unreasonable.

We invite you to familiarize yourself with: Sample of filling out an application form 1p 14 years

How to compose?

Since the organization of the accounting process is entrusted to the head of the organization, the creation of an order for the delegation of all matters when changing an accountant is included in his responsibilities. In order for the order to contain the maximum amount of useful information, it must contain all the information on the following points:

- The header of the document contains data standard for all forms of documents: full name of the enterprise, location, order number, date of its creation.

- Under the title of the document, it is necessary to enter clarifying information about which official is changing in the organization.

- Reason for changing the accountant (dismissal, retirement, transfer to another workplace).

- Full name and position of the person transferring and receiving the case.

Depending on the scope of activity and the specifics of the enterprise, additional points and clarifications may be included in the order .

Common mistakes

Error:

The act of acceptance and transfer of cases from the dismissed chief accountant to the new chief accountant was drawn up in a single copy.

A comment:

Two copies of the act of acceptance and transfer of affairs to the chief accountant must be drawn up - the first is stored in the organization, the second is transferred to the previous chief accountant.

Error:

The act of acceptance and transfer of affairs to the new chief accountant is not certified by the head of the company.

A comment:

The acceptance certificate must be signed by the head of the company, the former chief accountant and the current chief accountant, and the chairman of the commission (if it was convened).

Shelf life

The storage periods for accounting documentation depend on the form of the primary document or register. They are established by the law on accounting and a special list approved by order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558. The total period provided for by law is 5 years. But the list provides more specific deadlines.

For example, reporting must be kept as long as the organization operates, and information on the income of individuals must be kept for at least 75 years if there are no personal accounts of employees. The storage period begins with the year following the year of their last use, but sometimes it is calculated according to a different principle. For example, certificates of work performed under a contract must be kept for at least 5 years from the expiration date of the contract.

How to transfer business into new hands

The management must think over the mechanism for transferring accounting responsibilities even before it comes in handy, because the work of the accounting department should not be interrupted. This procedure is not stipulated by law, but usually the procedure for transferring cases is initiated by an order of the director, drawn up in free form.

This document must provide for the possibility of dividing the responsibility of the dismissed and new accountant. The text of the order must indicate:

- the basis for the transfer (dismissal article);

- deadlines for review and transfer of cases;

- composition of the commission carrying out the inspection;

- personal data of the receiving person;

- signatures of the parties, seal of the organization.

To whom should it be conveyed?

Cases are taken over by the future chief accountant selected by management. In large companies, the staffing table provides for the position of deputy chief accountant, which is very convenient in such situations. If a new employee has not been found, the director can appoint a temporary deputy or take over the work himself.

Checking cases

Before transferring affairs, the boss has the right to conduct a large-scale analysis of all accounting activities, check the maintenance of financial records, make an inventory of funds and an inventory of valuables.

Particular attention should be paid to the following points of accounting papers:

- accounting of finances, cash;

- government payments;

- inventory total;

- obligations to counterparties.

The director can carry out the audit on his own or invite a third-party auditor. If the results of the audit reveal violations on the part of the accountant, he faces administrative liability, including criminal liability, as well as financial liability, collected in accordance with the law.

What to convey?

The concept of “cases” subject to transfer refers to business documentation and attributes under the jurisdiction of the chief accountant:

- balance sheet and cash reports;

- documents of structural units;

- bank papers;

- archival documents valid for up to 5 years;

- safe key, seal.

Upon completion of the process, an act is drawn up that reflects the status of the accounting documents and records the position of funds as of the date specified in the resignation letter.