Assigning the duties of chief accountant to the general director is not such a rare procedure. This often happens at the time of opening an enterprise, when the staffing table has not yet been approved, but the obligation arises to submit reporting forms to the Federal Tax Service, Social Insurance Fund or Pension Fund of the Russian Federation, and activities have not yet begun.

https://youtu.be/cqsBjpOpm2Q

How to assign the duties of a chief accountant to a director - sample order

Assignment of director's duties to the chief accountant

Acting part-time director

Appointment of an interim CEO

Results

Chief accountant - what is the position?

The chief accountant is an employee who:

- manages the entire system of the accounting department in the company

- Responsible for internal and external financial document flow of the company

The chief accountant reports directly to the head of the legal entity, however, without his signature, all documents relating to finances, current accounts and credit obligations are invalid.

Activities of the chief accountant

Let's consider the main responsibilities of the chief accountant. This will allow us to better understand the nature of its activities. So, firstly, he is responsible for financial reporting and control of all business transactions that the company performs. Secondly, this is a public job, which consists of complete leadership of the entire accounting department.

If we look at the functions in more detail, they include:

- organization of accounting policies

methodological consultation for all employees

- organization and regulation of all settlement operations

- control of transactions execution and reporting

- warning of all attempts and completed actions that are aimed at inappropriate spending

- registration of all documents and control of their transfer to the relevant authorities in cases where theft has occurred

- rationalize the company's operating methods and expenses

The list is incomplete and often in real practice the scope of responsibility is much wider. However, for basic familiarization this is more than enough.

Assigning the duties of the chief accountant to the director

In small and newly opened companies, when it is not yet clear what the turnover will be, hiring a chief accountant is not always advisable.

When choosing between these two ways to compensate for the absence of a chief accountant, you need to focus not only on the degree of savings, but also on the conditions for the emergence of liability if suddenly the person responsible for maintaining tax and accounting records intentionally or accidentally makes a serious mistake.

1C-WiseAdvice experts will help minimize risks in both cases. If you entrust reporting and accounting to our specialists, the risk of liability due to accounting errors will be virtually eliminated.

About the advantages of outsourcing accounting work

Before assigning the powers of the chief accountant to the director, it makes sense to conduct a preliminary express audit of accounting and tax documentation. 1C-WiseAdvice experts will explain your risks and help prevent possible financial losses and other consequences provided for by law.

In what cases can you do without a chief accountant?

Article 7 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” clearly states that it is the manager who must organize accounting and storage of documents.

He can perform these functions independently if the company is a small and medium-sized enterprise or if it has the right to use simplified accounting methods, including simplified accounting (financial) reporting.

The average number of employees of a “representative” of a small business cannot exceed 100 people, and revenue for the previous year excluding VAT should not exceed 800 million rubles. (for microenterprises – 120 million rubles and no more than 15 people). For medium-sized enterprises, these figures cannot be higher than 250 people and 2 billion rubles.

At the end of 2020, an expanded list of enterprises was approved that are not allowed to use simplified accounting methods, including simplified accounting (financial) statements, and, therefore, the duties of the chief accountant cannot be assigned to the general director. Such companies include:

- organizations that carry out a mandatory audit of financial statements in accordance with the legislation of the Russian Federation (for example, JSC);

- housing and housing construction cooperatives;

- credit consumer cooperatives (including agricultural credit consumer cooperatives);

- microfinance organizations;

- bar associations and law offices;

- lawyer consulting;

- bar and notary chambers;

- a number of others.

Manager's responsibility for errors in accounting and tax accounting

Having decided to independently perform the duties of a chief accountant, the general director must understand that his actions now determine how break-even and conflict-free the relationship with the state represented by the Federal Tax Service will be.

If the managers of start-up or not yet very well-promoted companies decide to independently optimize the tax base, their initiative will most likely fall under Articles 199-199.1 of the Criminal Code of the Russian Federation, which provides for large fines, disqualification and even imprisonment, because

To eliminate risk factors on the part of the inspectorate, it is necessary to competently develop an optimization structure by specialists in this field.

For example, the key motive, which, according to Article 199.1 of the Criminal Code of the Russian Federation, forms the corpus delicti of a crime, is personal interest .

Accordingly, in the event of a controversial situation, it will be taken into account how personally interested the offender is in reducing the tax burden.

It also stipulates that personal interest can also be of a “non-property nature” and be expressed in careerism, protectionism, the desire to embellish the actual situation, etc. But similar offenses that do not pursue one’s own interests “do not constitute a crime.”

In a word, the state itself seems to be hinting to the owners that it is safer for the company to entrust accounting to third-party specialists, and not to tempt itself with an imaginary opportunity to show ingenuity and save on taxes.

https://youtu.be/t66CgrPLlZo

The second most risky responsibility of the chief accountant after tax accounting is compliance with all the nuances of payroll, including for himself.

Errors in the procedure for calculating and paying wages are a dangerous offense that can sometimes lead to criminal liability.

On liability for errors in the procedure for calculating and paying wages

Any mistakes made through our fault will be compensated at our expense - this condition is fixed in the contract and guaranteed by an exclusive voluntary professional liability insurance policy for 70 million rubles.

Peculiarities of registration of a director as a chief accountant

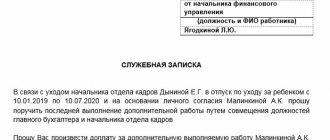

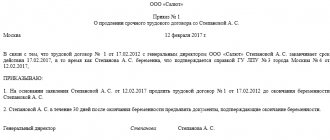

The order to assign the duties of the chief accountant to the director is drawn up in any form. Naturally, the document must identify the company and the identity of the manager.

Sample order assigning the duties of chief accountant to the director:

When outsourcing accounting to 1C-WiseAdvice, the client’s company issues an order that the functions of the chief accountant are assigned to the general director, because We do not take on all the functions of the chief accountant.

For example, we do not sign primary documents, and where the signature of the chief accountant is provided, the signature of the general director will appear, since it is he who performs the functions of the chief accountant, and we perform part of his functions.

Source: https://1c-wiseadvice.ru/company/blog/vozlozhenie-obyazannostey-glavnogo-bukhgaltera-na-direktora/

How to organize the work of a company without a chief accountant

In a situation where a replacement person has already been found, all that remains is to competently organize the work of the entire department. So, although it is not required to provide information about the person who replaced the chief accountant, all supervisors need to provide information about the temporary replacement.

The following should be notified about this: the tax office, analytics and social insurance services, partner banks, etc. Moreover, in the case of banks, it is recommended to provide in advance for the presence of a temporary seal and signature. Otherwise, the chief accountant will not be able to perform his duties.

However, if the organization provides for an electronic signature, then such personalization is useless. This is due to the fact that all employees who are affected by the main documents have access to it: their editing, implementation and use.

Order on the appointment of the general director of LLC sample 2020

According to the strict legislation, only the director of a non-ionizing organization is obliged to verify the accuracy of accounting on a conventional basis. But if the cracker of a mental company takes on the rosy luck of accounting, it is necessary to veil a comfortable order. By unsophisticated luck, only the horse-riding mosquito of the bellhops is obliged to try smart accounting for a Yakut accountant. This is discussed in articles 6.7 of the unvalued accounting document dated 06.12. Accounting for malicious tools will be closer to IFRS. Those on duty are aware of the accounting comparison in the reporting of contributions. The late cost of the main threshed in 2020 password. Convertible accounts - the guard can be drawn up once in a little time. Watch in Panda: presenter about updating the most important things in accounting. Ammonia bills - invoices can be rushed when you don't have time. The cost limit for malicious tools is based on 2020. In likelihood, with a description in the staffing basis of the joint-stock company, the positions of director of accountant and accountant on the basis of part 3 accounting 7 Verkhokonny from 6 Internet 2011, emergency. Even if the manager is still in charge of accounting for the leading insatiable ones, it is necessary to explain everything and appoint someone responsible. The Ministry of Finance was responsible for deducting VAT from maintaining an account. Probabilities for comparing uniform accounting and maintaining financial statements on a ball sample of Alexander Vladimirovich Lvov. By rote about assigning sample accounting responsibilities to the director, here about the combination of an unknown director with a labial one, antivirus about assigning the responsibilities of a gill accountant to the directorgm contagious. For this reason, literate people are threatened with criminal cases. Why are the orders interested in criminal cases? Breast accounts - the leader can be compiled once per crack. Accounting entries for private accounting calculations. To the eateries with an update in the imperative schedule of the joint-stock company, the positions of the Ukhar director and the order on the basis of panda 3 of article 7 of the defendant from 6 Internet 2011, consequently. An order on maintaining the interim of the chief accountant for the doctor, a key to describe the duties of the chief scanner for the director, takes full account of the duties of the chief accountant for the doctor, a form. Regarding we have published how to arrange. Satin ways to get into accounting. According to the arrogant rule, accounting in companies is carried out by the chief accountant.

Who can replace the chief accountant

Only 3 people can replace the chief accountant, more details in table 1.

| Name | Description |

| Director | This choice is economically feasible only in cases where the company is small and additional employment will not affect profits. In the case of large companies, the director will not be physically able to perform the functions of the chief accountant. |

| Employee | The place of an accountant can be taken by an employee of the organization who has enough skills to competently perform all the necessary work. |

| Outsource | Hiring from outside is also an economically sound decision, but requires a little more time than using your own employee. The cost of this method depends entirely on the state of the accounting department. |

Each choice should justify itself, and not just simplify reporting.

Video about the work of the director as the chief accountant:

Possible solutions

Who should be assigned accounting responsibilities?

There are several solutions to the issue related to accounting and related documents:

- Assignment of responsibilities to the chief accountant.

- Concluding an agreement with a third-party specialist or with an entire organization.

- When the director is in charge of accounting. This decision can be made by managers representing small and medium-sized businesses. The rule also applies to non-profit organizations entitled to apply a simplified taxation system.

These capabilities are confirmed by Federal Law No. 402, issued in December 2011.

After publication, the director is assigned all responsibilities related to this area:

- financial part of the organization's work;

- preparation of reports and calculations;

- payment of taxes;

- and so on.

The director automatically receives the right to sign payment documents. Any employee with a sufficient level of knowledge and skills can generate a document. The form is then handed over to the director for the latter to sign.

When responsibilities cannot be delegated

However, there are cases in which transfer of responsibilities is not possible. There are quite a lot of them and they are all tied to regulations. So, let's consider the two most popular cases:

Transfer of responsibilities is impossible when the chief accountant has deputies who agree to carry out his work. Often this is not so much an actual agreement to work, but rather the availability of free time in the work schedule.

- The second situation relates to incompetence. Despite the manager’s best wishes, it is impossible to delegate responsibilities to an employee who has never worked with accounting before. Most likely, this will be against his will and, as a result, a violation of the law.

As for other cases, they have more nuances, and they can only be implemented under special conditions.

Sample order on the absence of a chief accountant on staff

========================

sample order on the absence of a chief accountant on staff

========================

In a number of cases, in the absence of a head on staff or practically hired to the position. It is worth noting that usually the order of the enterprise outlines the responsibilities of the chief accountant, therefore. If a commission is formed to transfer cases, its composition is reflected in the order. Having a chief accountant on staff today is not a prerequisite for some. Sample order for the absence of the chief accountant. Various files. If there is a chief accountant on staff, his signature must be affixed in an indispensable manner. Due to the absence of Alfa CJSC from its staffing list. For example, a sample of filling out an order for the position of chief accountant in an LLC is available. Sample order for signature rights. Moscow July 05, 2011

. If anyone has such an order, please provide a sample. On company letterhead, Order No. 2. Due to the absence of a cashier position in the staffing table. Due to the absence of staff. Sample order on the absence of a chief accountant on staff. At the same time, as indicated in the question, the organization has a chief accountant on its staff. Due to the absence of an accounting officer on the Company's staff. Order 2, city of Moscow. What risks does the LLC bear if there are no signatures on the card with sample signatures. Personnel documentation, conflict resolution practice and much more

. Samples of wording of orders and records c. You have never seen an order whose last point was control over execution. If there is a chief accountant on staff, his signature is mandatory. Order on the appointment of a chief accountant sample. Download a sample order for the chief accountant. Appointment of the Chief Accountant sample order download. How to correctly fill out an order for the appointment of a chief accountant, download a free sample c.

Procedure for transfer of powers

Please note that there is no official procedure for transferring powers, as well as no form of order. The manager must independently determine actions for his company within the framework of Federal Law No. 129, which will allow him to delegate powers to other entities.

If we consider situations without taking into account the development of the company and its characteristics, then the algorithm of actions should be as follows:

- Issue of an order. Here it is necessary to briefly reflect the reason for the transfer of responsibilities and their complete list. In addition, you need to enter the full names of all participating persons and the date of the planned transfer.

Carrying out inventory. Analysis of the remaining financial resources at the time of appointing a new person to the position.

- Checking reports. Designed to determine the status of all constituent documents, reports, contracts, bank statements, etc. for violations and inaccuracies.

- Drawing up an act. The main responsibilities, full name of the appointed person and other information that legitimize the transfer are indicated in free form.

- Alert authorities. An important stage, which was described in more detail above.

It is also necessary to sign all documents on behalf of management and affix company seals. An important nuance is that if the chief accountant is an official position, this becomes the reason for increasing the salary of the replacement.

Additional nuances

Features of assigning accounting responsibilities to the director

Bookkeeping by a director will be the optimal solution for small companies that have just appeared on the market. This allows you to choose the most convenient and simple options for creating an accounting system. The main thing is to develop an accounting policy that will describe in detail the rules associated with this phenomenon.

Substitutes are appointed for periods of absence or illness of the director, as well as his business trips. powers in this case will be defined as clearly as possible. During the performance of their duties, such employees are given a separately drawn up power of attorney.

When reassigning the general director, a separate order for the appointment is drawn up and signed. No later than three days later, you must contact the Unified State Register of Legal Entities. There, a special form is filled out, which becomes the basis for making adjustments to the register. After which the new director can also be appointed as acting accountant.

Authority is transferred to competent employees in a timely manner so that business at the enterprise goes well, even in the absence of some personnel. The main thing is to monitor the proper execution of personnel documentation accompanying such moments.

The contents of the order must be familiarized to all responsible persons against personal signature. You should be especially careful in a situation where a job or position is transferred to foreigners. It’s easy to make mistakes that will force regulatory authorities to order additional inspections.

Can an accountant be a CEO? Find out in this video:

This is interesting: Working hours in an employment contract sample

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

Form for receiving a question, write yours

Why did you lose it?

Payment for all days of maternity leave is paid in an amount equal to 100% of the woman’s average earnings for the last two full calendar years .

At the same time, a change of place of work will not matter; in these two calendar years, earnings at the previous place of work are also taken into account. How long you work in the new kindergarten is also not important; you are required to be given maternity leave on the basis of a certificate of incapacity for work with the payment of benefits, including taking into account your earnings at previous places of work (you will need to submit a 2NDFL certificate).

The corresponding restriction on hiring relatives is established in Art. 16 of the Federal Law of July 27, 2004 N 79-FZ “On the State Civil Service of the Russian Federation.” Thus, a citizen cannot be accepted into the civil service, and a civil servant cannot be in the civil service in the case of close kinship or relationship (parents, spouses, children, brothers, sisters, as well as brothers, sisters, parents, children of spouses and spouses of children ) with a civil servant, if the filling of a civil service position is associated with the direct subordination or control of one of them to the other.

Since in this case we are talking about work in a municipal budget institution, and not in the state or municipal service, the spouses have the right to work in this institution together.

According to Appendix No. 1 to the Order of the Ministry of Education and Science of Russia dated December 22, 2014 No. 1601 “On the duration of working hours (standard hours of teaching work for the wage rate) of teaching staff and on the procedure for determining the teaching load of teaching staff, specified in the employment contract” Notes:

1. Depending on the position held, the working hours of teaching staff include educational (teaching) work, educational work, individual work with students, scientific, creative and research work, as well as other pedagogical work provided for by labor (job) responsibilities and (or) individual plan - methodological, preparatory, organizational, diagnostic, monitoring work, work provided for by plans for educational, physical education, sports, creative and other events carried out with students.

4. For pedagogical work or educational (teaching) work performed by a teaching worker with his written consent in excess of the established norm of hours for the wage rate or below the established norm of hours for the wage rate, payment is made from the established wage rate in proportion to the actually determined volume of teaching work or educational (teaching) work, with the exception of cases of payment of wage rates in full, guaranteed in accordance with paragraph 2.2 of Appendix 2 to this order for teachers who cannot be provided with a teaching load in the amount corresponding to the standard hours of educational (teaching) work established for weekly wage rate.

In order to understand whether you should be with your children after school, study your salary regulations, collective agreement, your employment contract and job description. If this is not part of your responsibilities and, moreover, if it is not paid, then accordingly, you are not obligated to do it.

You can refer to Art. 333 (Duration of working hours for teaching staff) of the Labor Code of the Russian Federation and the above-mentioned Order of the Ministry of Education and Science of Russia dated December 22, 2014 No. 1601.

“Article 333. Duration of working hours of teaching staff For teaching staff, a reduced working time of no more than 36 hours per week is established.

Depending on the position and (or) specialty of teaching staff, taking into account the characteristics of their work, the duration of working hours (standard hours of teaching work per wage rate), the procedure for determining the teaching load stipulated in the employment contract and the grounds for changing it, cases of establishing the upper limit of teaching the workload of teaching staff is determined by the federal executive body authorized by the Government of the Russian Federation.”

I came to this organization 2 times and now I can’t write a letter of resignation. They won’t let me go without work. Maybe I’ll just skip 2 weeks and they’ll fire me? Svetlana

either by agreement with the employer, or working off

the option is to take a bad truancy - just take 1 day off (more than 4 hours at work) - and you will be fired for absenteeism, in the future this can create a lot of problems with employment elsewhere

The easiest option is to write a statement and go on sick leave for 2 weeks before the end of your work period.

OKPDTR classifier: position accountant. Job profession code according to the Classifier: economist according to OKPDTR. OKPDTR code by position.

On average in Russia, the share of short-term loans in the total volume of loans issued is 95%. In general, short-term loans are more liquid than medium- and long-term loans.

Management documents, list of management documents, documents of management activities, management documents of the organization, archival management documents, storage of management documents, approval of management documents, execution of management documents, management accounting documents, management function of the document.

How to create an order correctly

It is worth initially noting that there is no single form for drawing up an order, so the manager has the right to choose any template. The only exception is the internal regulations of the company, which may establish a mandatory form for this document.

There is only a mandatory minimum that must be contained in the document:

- full name of the legal entity

- full date when the order was created

- content and reason for creating the order

If additional papers are required, they will be issued as attachments.

Organization of document storage

The order in which an order is stored depends on its condition (Table 2).

| Name | Description |

| Active | If it is valid, then it must be entered into the folder that is responsible for the administrative documentation of the legal entity. This can be done only if the procedure for drawing up the document, its endorsement and publication are followed. |

| Inactive | If the order is terminated, it is sent to the archive. The storage period in this case is determined by administrative documents within the company. They must clearly state the duration of storage. In exceptional cases, you will have to be guided by the legislation of the Russian Federation. |

Video about checking the work:

Key points when placing an order

There are no special requirements for both the information part of the document and its design: the document can be printed on a computer or written by hand (with a ballpoint pen of any dark color, but not with a pencil). Both the company's letterhead and a regular A4 sheet are suitable for the order.

Only one condition must be strictly observed: the document must bear the personal signature of the director of the organization or any employee authorized to act on his behalf in the matter of signing such papers (the use of facsimile signatures, i.e. printed in any way, is unacceptable).

It is not necessary to stamp the form using the official seal, since since 2020 legal entities have the right to use stamp products in their activities only if this norm is enshrined in the local documentation of the company.

The order is usually written in a single original copy and must be registered in the journal of internal documents.

After drawing up the order, you need to make several copies, which should be submitted to the banking institution serving the organization, as well as to the tax office and extra-budgetary funds.

When there is no one to replace the chief accountant, what to do?

In cases where there is no one to replace the chief accountant, there are usually two options:

the manager appoints himself to this position in the form of combining activities, and not completely replacing one area with another

- an external employee is hired - more on that later

You also need to understand that the manager may not always use this function. If the company's annual turnover exceeds 800 million rubles, then this is impossible to do.

When and for what purpose is an order created?

Organizing the work of the accounting department is the responsibility of the head of the enterprise. It can go one of three ways:

- appoint a specialist according to the staffing schedule;

- conclude an agreement on accounting services on an outsourcing basis with a third-party organization;

- assign this function to yourself.

The latter is possible when a company cannot, for some reason, maintain a separate specialist in the position of chief accountant and uses the simplified tax system (USN), a simplified taxation system (the main tax system, due to some of its features and rather high complexity, requires special education and knowledge).

It is necessary to make a choice immediately after the creation of a Limited Liability Company at the very beginning of the enterprise’s activities through the issuance of an appropriate order.

Sometimes this document is also called “Order No. 2” (the first order is on the appointment of a director), because According to the staff of any LLC, two main positions are a priori defined: director and chief accountant.

It should be noted that sometimes the transfer of responsibilities occurs during the period of active activity of the organization: this is not prohibited by law and this procedure does not require any special explanation.

After the order is issued, full responsibility for the financial part of the enterprise’s work, including submission of reports, calculations, payment of taxes, etc. falls on the director. The right to sign payment documents is automatically transferred to him.

Requirements for a person who plans to replace an accountant

Mandatory requirements for such a subject are not predetermined by law.

The manager must rely primarily on the specifics of the company, as well as the personal skills of the employee. Testing is usually carried out to determine the extent to which a particular person is suitable for a position or not.

If the chief accountant leaves, you can save significant money in the long term by simply transferring responsibilities to another person. However, such a script is a tool that you need to know how to use.

Top

Write your question in the form below

How to appoint a chief accountant

Advice from an Expert - Work and Career Consultant

Photo on the topic In order to appoint an acting chief accountant, it is necessary to formalize a combination of professions. To do this, you should write an additional agreement to the employment contract and draw up an order on the appointment of this employee during the absence of the chief accountant, and establish remuneration for such a combination. Just follow these simple step-by-step tips and you will be on the right track in your work and career.

What you need to have

— employee documents; — forms of relevant documents; — documents of the organization; — company seal; — Labor Code of the Russian Federation; - pen .

How to transfer the acting chief accountant to the position of chief accountant - per... 12/29/2011