Many individual entrepreneurs, who mainly work with small payments, accepting money from the public, operate without a bank account. And they are absolutely right. Not a single law of the Russian Federation obliges an entrepreneur to open such an account.

However, from time to time situations arise when an individual entrepreneur has to pay bills in cashless form. For example, an individual entrepreneur can rent premises from a legal entity or other entrepreneur who requires payment of rent by issuing an invoice and does not accept money through the cash register. Or an individual entrepreneur receives any goods from a supplier who works only on cashless payments. What to do in such a situation?

Paying a bill through a bank without opening a current account

Typically, an organization or entrepreneur issuing an invoice for non-cash payment indicates in it the details for crediting the payment. But this does not mean that you can simply come to the bank and top up the specified current account. Only the person to whom the account belongs has the right to do this. Others who wish to make payments to the account through the bank's cash desk using a receipt.

What do you need to pay an invoice through a bank cash desk? Come to the bank like any individual and fill out a receipt. In the “Purpose of payment” column, indicate: “Payment on invoice No...”. The last name, first name and patronymic of the entrepreneur are indicated as the payer. This is how entrepreneurs who do not have a current account pay taxes, transfer payments to extra-budgetary funds - and no problems arise with enrollment.

Attention . You should not additionally indicate an individual entrepreneur or individual entrepreneur. In this case, the bank teller may refuse to accept the payment. This is not entirely legal, since the provisions of Art. 845 of the Civil Code of the Russian Federation does not talk about limiting the crediting of funds to the client’s account; the powers of banks to limit these rights are not provided for by law. However, internal instructions of the bank or an agreement with the client may create certain obstacles to the transfer of funds.

Receive an invoice from the freelancer

Self-employed people have the right to receive payment without issuing an invoice. But it will be better for your accounting department if the freelancer still issues an invoice: this way there will be fewer problems with payment to an individual.

A self-employed person does not have tools for issuing an invoice in “My Tax” or a personal bank account. Therefore, offer him a template, for example, based on the invoices that the individual entrepreneur issues to you. The invoice must include:

- Self-employed details

- Date and account number

- Name of the payer organization, its TIN

- List of all services with prices

- Total invoice amount

- Signature of the self-employed

Typically the invoice is sent in PDF format. To make it convenient to fill out, you can create the invoice itself in Word or Excel, and then save it as PDF.

What is the maximum amount for a cash transfer?

Directive of the Central Bank of the Russian Federation dated October 7, 2013 N 3073-U “On cash payments” establishes a limit of 100,000 rubles for cash payments under one agreement.

At the same time, entrepreneurs often have a question: if a payment is made through a bank cash desk without opening a current account, can this be considered a cash payment.

Experts believe that these rules do not apply to banking operations, which include transferring funds without opening a current account. Therefore, you can make payments for any amount without any problems using this method.

It’s another matter if the invoice is paid through the counterparty’s cash desk. Here, an amount exceeding 100,000 rubles, even paid in installments on different days, if it relates to payment for one contract, will be considered a violation and lead to a fine.

Can an individual entrepreneur work without a current account?

When answering the question whether an individual entrepreneur is obliged to open a bank account, you can answer in the negative. In 2020, as before, you can conduct commercial activities without a current account. But practice shows that in the process of working as an individual entrepreneur without an account, a number of difficulties arise. For example, it will be impossible to carry out large settlements with legal entities. persons (in the amount of 100,000 rubles).

It is also better to transfer taxes from the account, and it does not matter whether the individual entrepreneur is on the simplified tax system, UTII, patent or general form of taxation. This way you will not be under suspicion from regulatory authorities for possible tax evasion.

How to transfer an amount exceeding the cash transfer limit?

What to do if you need to pay to the counterparty's cash desk an amount exceeding 100,000 rubles under one agreement? There are only 2 options here:

- deposit money into a current account through the cash desk of any bank using a receipt;

- break the contract into parts so that in the end each payment does not exceed 100 thousand rubles.

The first option is definitely more convenient. After all, you can deposit the whole amount. However, when transferring, each bank takes its own percentage . And the amount of interest can be quite significant. And not everyone will decide to carry a large amount of cash with them.

The second option is usually cheaper, since your own cash desk accepts payments without interest (if such a cash desk exists at all). However, you will have to come up with a justification to divide the contract into parts. For example, if the rent is high, there are recommendations to enter into a contract not for a year, but for a month. This way you can avoid paying large sums in cash. However, here we need a good trusting relationship between the tenant and the landlord, since monthly re-signing of the agreement is fraught, firstly, with a sudden change in the terms of the agreement, and secondly, with an unexpected refusal by both one and the other party without warning or any consequences. In addition, this creates a lot of additional paperwork: every month you have to draw up and sign a transfer deed for the premises.

When is an invoice required?

Opening a personal account account is mandatory in the following cases:

- In the process of mutual settlements with legal entities. persons.

- If clients pay with plastic cards.

- For settlements with government agencies.

- If the transaction amount exceeds 100 thousand rubles.

Also read: Where to open a current account quickly and free of charge: TOP 7 banks for individual entrepreneurs and LLCs

Can an individual entrepreneur pay a bill from a personal card or personal bank account?

If an individual entrepreneur, under any agreement, must deposit money into the current account of a legal entity or another entrepreneur, he can use funds from his personal account or transfer money from his card, for example, through Internet banking. Specialist consultants do not see any obstacles to this.

This position is supported by the Resolution of the Constitutional Court of the Russian Federation dated December 17, 1996 N 20-P, the Determination of the Constitutional Court of the Russian Federation dated May 15, 2001 N 88-O, according to which, from the point of view of the law, it is impossible to distinguish between the funds of an individual entrepreneur into his personal and those which he uses to conduct business.

Therefore, having a bank card as an individual, an entrepreneur can pay any invoice issued to him using his personal funds, for example, through Internet banking or mobile banking. And this money will be credited in the same way to the current account of a legal entity or other entrepreneur.

Please pay attention . This advice only applies to transferring money to a business account. If one individual entrepreneur pays a bill to another individual entrepreneur by transferring money to his personal bank account or card, problems with crediting may arise. The situation is twofold. Bank of Russia Instruction No. 153-I dated May 30, 2014 “On opening and closing bank accounts, deposit accounts, and deposit accounts” distinguishes between current accounts of legal entities and individual entrepreneurs opened for commercial activities and current accounts of individuals used for conducting settlement transactions.

At the same time, according to paragraph 3 of Art. 845 of the Civil Code of the Russian Federation, the bank does not have the right to determine and control the direction of use of the client’s funds and establish other restrictions not provided for by law or the bank account agreement on its right to dispose of funds at its own discretion.

That is, if a payment from another individual entrepreneur arrives on the personal account or card of an individual entrepreneur and at the same time the purpose of the payment is invoice payment, the bank, on the basis of an agreement concluded with the client, may not accept such a payment if it suspects that it is related to the conduct of a business activities. It is especially risky if such operations are carried out regularly.

Specify the chosen payment method and procedure in the contract

The contract must indicate:

- Payment method: cash or bank card.

- Time range for payment, for example within 5 days after accepting the job.

- Terms of prepayment and postpayment.

Also, do not forget to state that the performer applies tax on professional income - this will explain why you do not pay taxes and fees for him.

In the section with contacts and details, you need to indicate the full name, TIN and address of the freelancer, as well as the full details of his bank card.

How to confirm expenses for deduction if the payment was made using a receipt through a bank cash desk?

If an individual entrepreneur works under the general tax system or uses the simplified tax system of 15% (income minus expenses), then it is important for him to be able to confirm the expenses incurred, which reduce the tax base.

Sometimes the tax inspector has questions if the payment was made not from a current account, but through a bank cash desk. Here, you can justify the costs by indicating in the purpose of payment: “Payment on invoice No...”. If there is an agreement and the account itself, no problems will arise.

Thus, an entrepreneur (IP), without opening a bank account, can easily pay bills. There are at least 3 ways to do this:

- deposit money into the account at the counterparty's cash desk;

- pay a bill through the cash desk of any bank using a receipt as an individual;

- make a payment from a personal account or card via Internet banking.

Any of these payment methods will be completely legal, and the money will be credited to the bank account.

Payment for license, services

Payment for licenses and services is made in your personal Account on our website. In order to get into the Account, you need to be: 1. A registered user of the system 2. Log in to the system using your username and password. In the menu on the left, follow the link “Paying for a license, Next” and go to the payment page.If you have chosen to pay by bank transfer, then on the Payments page you will be prompted to enter the necessary data for issuing an invoice. (TIN, KPP, R/S, K/S, etc.). After filling out all the required fields, you must click on the “Write an invoice” button and receive a printed invoice form for payment. For more details, see: Payment by bank transfer (rubles) If you choose to pay by bank transfer for individuals. persons, then on the Payment page you will be asked to enter your address required to fill out the receipt. After filling out the “Address” field, you must click on the “Write a receipt” button and receive a printed form of a receipt for payment through the bank. For more details, see: Payment in cash through a bank (rubles) If you have chosen to pay with Yandex money, WM, mobile payment or a bank card, then on the Payments page you will be asked to check your data necessary to make an electronic payment. After checking the data, you need to click the “Pay” button and go directly to the payment process. Electronic payments are made through the Assist system. For more details, see: Payment by credit card (RUB, USD, EUR) Online payment (Yandex-money and WebMoney (WMR), mobile payment) If you choose to pay through the Qiwi payment terminal, you must first issue an invoice. To do this, in your Account, go to “Payment for license, Payment via Qiwi terminal”, print out an invoice for payment. For more details, see: Payment via Qiwi terminal!!! After completing the payment on the Assist electronic payment system website, you need to return to the AutoTransInfo website. If you have money in a virtual account, then you can select the payment method “Write off from a virtual account in ATI”. In this case, the money for the services will be debited from your virtual account, and access to the database section will be connected instantly upon completion of payment. You can read more about this payment method on the Virtual Account page.

On the page for selecting the required section(s) of the database and payment method, you can view the History of your payments. To do this, click on the “Payment History” link.

On this page you can see all the payments you have made, their amounts, dates, as well as the necessary documents for these payments.

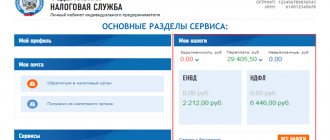

Individual entrepreneur pays tax for himself as an individual payment status

In 2020, insurance premiums were transferred to the tax authorities, which will regulate their calculations and payments. In this regard, managers and accountants had a question regarding filling out section 101 of the payment order. If before 2020, when paying insurance premiums, code 08 was indicated, then when filling out a payment from January 1, 2020, the Federal Tax Service recommends indicating the following statuses:

We recommend reading: Tuition Tax Refund 2020

The status in payment orders in 2020 when the taxpayer makes payments to government agencies must be indicated with some features, which are determined by the regulations of the Russian Ministry of Finance. Let's consider them, as well as other current provisions of the law regarding filling out payment slips.