Legislative aspect of the issue

Currently, non-cash transfers are becoming increasingly popular. Issuing funds by bank transfer is also no exception; it is often much more convenient for an accountant to pay an employee using a card to issue a report. The legislative framework only tells us about cash transactions and is regulated by Directive of the Central Bank of the Russian Federation 3210-U dated March 11, 2014. In turn, the Ministry of Finance and the Treasury came to the conclusion that it is not prohibited to transfer accountable money to a card. The main thing is that the employee reports after spending them.

Purpose of payment when returning accountable amounts

Untimely transfer of accountable amounts may cause the disruption of a business trip or other violations.

The Russian Ministry of Finance fundamentally disagrees with the tax authorities’ claims; officials presented their position in letter dated 04/08/2010 No. 03-04-06/3-65. However, it is easier to convince the tax inspector of the correctness of accounting with correctly executed documents.

The general concept of reporting, how funds are disbursed

Regulatory and local acts strictly stipulate expenses that can be reimbursed to employees by issuing financial statements. These include:

- Travel expenses

- For representation needs

- Purchasing office supplies

- Purchase of fuels and lubricants, gasoline for refueling a car

The process of registering an accountable amount consists of the following stages:

1. Funds can be issued according to an advance report, which is drawn up by an accountant for a specific person, an employee of an organization, either from the cash register or by bank transfer

2.After the employee has spent the advance, he must provide supporting documents to the accounting department

Transferring accountable amounts to an employee’s card

The procedure for transferring funds to the card is no different from the procedure for issuing from the cash register. The only thing you need to provide in advance is a number of conditions:

- The accounting policy of the enterprise must take into account non-cash transfers

- To ensure that the bank does not have additional questions regarding the receipt of unknown amounts into an individual’s account, it is better to indicate in the purpose of the payment that this is an advance for business needs

- You must submit an application from the employee with the details of his bank card or current account

- Then confirm the expenditure of funds by providing supporting documents

Important! The main thing is to comply with all the conditions for transferring funds to the employee’s card in order to avoid unnecessary questions from the tax office and the bank.

Filling out a document when returning non-cash funds

Transaction type – select “Return of funds to buyer”.

Current account – select the organization’s current account from which funds are spent. If the organization has one current account, it will be created automatically.

Counterparty – indicate the buyer to whom the funds are being returned. This can be done in two ways.

- Click on the “Advanced search” link and in the form that opens, use the search function to select a counterparty.

- Enter the name of the counterparty in the empty field and select the counterparty from the list that appears.

Counterparty current account – select the buyer’s current account to which funds are transferred. If the buyer has one current account, it will be added automatically.

Purpose – enter the name, number and date of the contract or sales documents for which the funds are being returned, and indicate the reason for the return.

Amount – enter the amount of funds being returned.

VAT rate – select the VAT rate from the drop-down list.

The VAT amount will be calculated automatically based on the selected rate. If you want to adjust the VAT amount, click “Set VAT amount manually” and enter the required amount.

Distribution (linking) of payment.

Click the "Add" button.

Agreement – select an agreement with the buyer under which the organization returns the funds. If the contract has not been drawn up, this field can be left blank.

Basis document – select from the drop-down list the type of document on the basis of which the refund is made.

Buyer’s order/Invoice for payment/ Sales/Buyer’s return – depending on the selected basis document, select the document according to which the funds are returned to the buyer. Click on the “Advanced Search” link and select a document in the form that opens.

Amount – enter the amount of funds being returned.

Click the “Save” button and the payment link will be added to the bookmark.

Accounting entries for advance reports

| Wiring | Decoding |

| Dt 71 Kt51 | 71 accounts – settlements with accountable persons 51 – current account The operation indicates the transfer of funds from a current account to an individual |

| Dt 26 Kt71 | 26 accounts - general business expenses Reflected expenses on the advance report |

| Dt 71 Kt50(51) | If there is an overrun |

| Dt 50 Kt71 | Cash returned to the cash register |

| Dt 51 Kt71 | The employee transferred the surplus to the organization's current account |

| Dt 70 Kt 71 | The amount is withheld from the employee’s salary to account for the advance report |

Issuance of money on account by bank transfer to the employee’s card

Increasingly, companies are moving away from using cash in their operations.

Payments from customers are transferred to a bank account, payments to suppliers are made by bank transfer, and salaries are transferred to employee cards. It’s convenient and profitable: you don’t need to go to the bank to deposit or withdraw cash, spend money on ensuring the safety of your money, or pay a commission for transactions with paper money. Like many other transactions, settlements with accountable persons can occur in non-cash form.

Transfer of accountable amounts

For a long time, transferring accountable amounts to an employee’s salary card was considered risky. The Federal Tax Service often regarded such transfers as payment of wages and subjected them to personal income tax. The funds, in turn, added additional contributions. However, after the publication of the letter of the Ministry of Finance dated October 5, 2012 No. 14-03-03/728, the situation changed: in fact, the ministry allowed the issuance of reports by bank transfer.

However, in order to avoid disputes with the Federal Tax Service and funds, the employer must organize the correct document flow:

— when issuing salary cards, discuss with the bank whether it is possible to indicate in the agreement that accountable amounts will also be transferred to the cards,

— in the reporting provisions, be sure to indicate that money can be transferred to employees’ salary cards. Read more about the reporting provisions here.

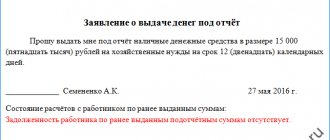

— ask the employee to write in the application for the issuance of money on account that the transfer should be made to his bank card. The statement is written here

- in the payment order, indicate the purpose of the payment so that it is clear that an accountable amount is being paid, for example: “issuance on account for business expenses.”

Advance report

As with the issuance of funds in cash, the employee must draw up an advance report. Read about the deadlines and procedure for submitting an advance report here.

All documents related to the calculations must be attached to the advance report. Did the accountant withdraw money from an ATM and pay in cash? Then he must provide a receipt from the ATM and a cash register receipt (BSO or sales receipt) from the seller. Did the employee pay with a card? Let him provide a slip and a receipt.

Return of unused imprest amounts

The legislation does not limit the period during which the accountable must return unspent money to the employer. However, this period must be indicated in the application for the issuance of accountable funds. If the money is not returned on time, tax authorities may reclassify the remaining amount as a loan or payment of employee remuneration and charge additional personal income tax.

An employee can return the money either in cash to the company’s cash desk or by wire transfer. If the accountant did not indicate in the payment order that the money being transferred is a return of the unused accountable amount, he must write this in an explanatory note.

Accounting

Let's look at an example of what entries a company should make when issuing money to the account by bank transfer.

On November 6, 2014, Klyuchik LLC transferred 30,000 rubles to the salary card. accountable money for the purchase of stationery for O.R. Klyuchkin. On November 7, Klyuchkin purchased the necessary inventory and materials in the amount of 27,350 rubles, paying for them with a bank card. On the same date, Klyuchkin provided the accounting department of Klyuchik LLC with an advance report with a cash register receipt, a receipt from PKO and a terminal slip, as well as a delivery note and an invoice in the name of the organization (since Klyuchkin was issued a power of attorney on behalf of the company). Also on November 7, Klyuchkin returned the remaining unspent amount in cash to the company’s cash desk.

The following entries will be made in accounting:

November 6, 2014:

D71 K51 – 30,000 rub. – the amount was issued for reporting,

November 7, 2014:

D10 K60 – 27,350 rub. - purchased stationery,

D60 K71 – 27,350 rub. – the debt to the stationery seller has been repaid,

D50 K71 – 2,650 rub. – the unused accountable amount is returned to the cash desk.

Sample order for issuance to report

LLC "Romashka"

TIN 920987567, checkpoint 2356789, Moscow, Znamenskaya st., 13

Order No. 38

About transferring funds against a report to a card

In order to reduce the turnover of cash at the cash desk of the enterprise, starting from September 1, 2020. issue sums of money to employees exclusively by non-cash transfer. The payment is made by transfer to the employee’s bank card opened as part of the salary project.

Receipt of cash is allowed only in agreement with the chief accountant of the enterprise.

Funds will be issued within three working days from the date of submission of the application to the accounting service.

All employees of the organization should familiarize themselves with Appendix No. 1 to this order - an application form for issuance for reporting.

I entrust control over execution to the chief accountant O.P. Petrova.

conclusions

On the presented topic, we will draw several main conclusions:

- Travel funds are allowed to be transferred to the employee’s salary card.

- The company’s internal regulations must contain the procedure for transferring non-cash funds for business trips.

- The employee must be familiar with the internal regulations of the organization upon signature.

- Funds are transferred to the employee on the basis of a business trip order.

- Non-cash transfer is carried out with

- the power of a payment order.

- The purpose of payment in the payment slip must contain information about compensation for travel expenses or the issuance of funds on account. Otherwise, you will have to pay taxes on the funds paid: personal income tax and insurance premiums.

- An incorrectly completed payment may result in penalties for the organization.

Errors in processing transfers to cards

Filling out a payment order is a very important stage in which it is better to avoid mistakes:

1.If an error is detected, the bank employee has the right to refuse to make the payment

2. Due to violation of the deadlines for transferring funds, an employee of the organization will not be able to go on a business trip on time.

3. If the assignment does not indicate that this is accountable money, the tax office may regard this as income received and require it to be taxed at 13%

How to properly reimburse an employee

Very often, employees, due to ignorance or for some other reason, violate the sequence in the preparation of documents and can spend their own funds on the necessary enterprises without formalizing the issue as required.

Important! In this situation, if the above sequence is violated, the personal funds spent are in no way accountable.

This can be explained by the fact that in this situation the employee acted on his own behalf; there is no guarantee that the manager will consider the expenditure of these funds appropriate. In fact, it turns out that the employee made the decision on his own without receiving consent from his superiors.

For example, such a story could arise when, after lengthy negotiations, the manager offered dinner to a client and paid for a trip to the restaurant and now wants a refund. Therefore, before spending your money, write an application to the accounting department to issue a report, and then confirm it with documents.

If the manager approves the reimbursement of costs incurred, then the enterprise must issue an order or order to pay compensation to the employee.

To ensure that the regulatory authorities do not have grounds for complaints, then the enterprise issues a general order, which reflects the procedure for reimbursement of such costs. The order specifies the maximum amount that accountable persons can spend, for what purposes, and the period during which reimbursement will be made.

Important! The order must be certified by the head of the enterprise, and all interested parties must also sign it, which indicates that they are familiar with this order.

Actions of an accountant upon receipt of documents for reimbursement of expenses to an employee:

- Check the correctness of the primary documents; if the documents are issued in the name of the company, then it is clear that the employee actually purchased valuables for the needs of the enterprise;

- Whether or not to pay personal income tax on the transferred funds to the employee. Since the employee did not receive any economic benefit from the compensation received, the amounts received cannot be called income and there is no need to pay personal income tax;

- It is necessary to formalize this payment using a cash receipt document.

- Make the appropriate entries in accounting: when issuing funds to an employee, Dt 73 Dt 73 “Settlements with personnel for other operations” Kt 50. And posting Dt 10 (07, 08, 11, 41) Kt 73 records that the acquired assets have been accepted for accounting.

Reimbursement of expenses to an employee without issuing a report

And in this situation, the employee was not given accountable amounts. To reflect settlements with an employee, in our opinion, it would be more correct to use account 73.03 “Settlements for other transactions”.

Since when purchasing goods at his own expense, the employee acted with the permission and in the interests of the organization, it is necessary to document that the organization approved such a transaction (clause.

1 tbsp. 183 Civil Code of the Russian Federation). Such documents may be:

- An order on behalf of the manager to reimburse expenses to an employee.

- An approved report on the funds spent with documents for purchase and payment attached to it (sales receipt, delivery note, invoice, etc.), including in the form based on AO-1.

- An employee’s application for reimbursement of expenses, approved by the manager (the resolution on the application is “pay”).

Funds spent by an employee on the purchase of goods or