Why do you need an application to transfer wages to a card?

This document is necessary for the employer company in order to ensure compliance of the procedure for paying wages to an employee with the provisions of Art. 136 of the Labor Code of the Russian Federation, which states that wages can be transferred through a credit institution, which is indicated in the employee’s application. At the same time, it is important that the employee’s employment contract with the company or collective agreement states that compensation for labor is transferred by the employer in non-cash form.

Note! The employer must request appropriate statements from employees regardless of how the salary is transferred - to an account opened as part of a salary project, or to the employee’s personal account opened by him independently.

If such statements are not provided to the company, the salary will have to be received at the cash desk, since the employer has no right to force payments to employees in non-cash form.

What should an employer do if an employee refuses to write an application to receive wages on a bank card as part of a salary project? The answer to this question was given by 2nd class adviser to the State Civil Service of the Russian Federation D. A. Mylnikov. Get free access to ConsultantPlus and read the official’s opinion.

Let's study the features of the application structure.

How to transfer salary to an employee’s personal card?

The Labor Code, namely Article 136, establishes a general procedure for transferring wages to all employees - by issuing the funds due at the cash desk at the place of work. Meanwhile, legislation allows for wages to be transferred to a card. This condition must appear in one of the following documents:

- in the employment agreement;

- in the collective agreement.

In them, the employer can indicate the mechanism for making payments. For example, the accounting department can transfer salaries entirely to the card.

Some employers prefer to issue an advance in hand. At the same time, a percentage ratio between cash and non-cash funds can be established.

Management often enters into agreements with banks to service the enterprise. All employees of the organization become participants in the salary project. They receive plastic cards, to which the accounting department subsequently transfers funds. In this case, it is more convenient for employers to immediately transfer the entire amount of wages to the accounts of their employees.

For more information about this, see “Organizing a salary project: essence and agreement.”

Keep in mind: an employee is not required to receive a salary card from a specific bank on the instructions of the manager. He has the right to independently choose a financial institution convenient for himself, to which the company will transfer his salary to the card.

Almost any credit institution - bank - has a special program for individual entrepreneurs and legal entities, called a salary project. To conclude the relevant agreement, the entrepreneur will need to separately contact the financial institution.

If he chooses a scheme for paying employees wages by bank transfer, he must perform the following series of actions:

- Visit a financial institution and declare your desire to enter into an agreement to formalize a salary project.

- Prepare documentation: a list of employees, applications from employees to open salary accounts, copies of their passports, constituent documents of the organization and other official papers that may be requested by bank employees.

- Conclude an agreement on servicing employee personal accounts and transferring salaries to them.

- Issue bank cards to employees.

Information that wages will be transferred to the bank account of employees must be included in the organization’s documents, employment contracts and collective agreement.

If there is a transition from a cash payment system to cooperation with banking organizations, it will be necessary to make appropriate adjustments to local regulations through additional agreements.

If the salary is transferred to the account of one of the employees, you will need to draw up a payment order. It will require you to fill in several fields:

- Recipient. Employee's full name.

- Recipient's account. Indicate the employee's individual account number.

- Purpose of payment. The purpose of the payment is indicated here, as well as a link to the date and register number.

The administration of a business entity has the right only to recommend to the employee a way to earn income. The employee must make the final decision himself. In particular, the employee is given the right to independently choose the banking organization in which to provide services.

Very often, banks where the company already has current accounts offer favorable conditions for salary card projects. In this situation, employees are issued cards on which they receive their earnings.

Using a card opened as part of such a project is most often beneficial to both the employee and the company. The employee gets the opportunity to open a loan on favorable terms with a reduced rate. For the company, funds are credited to such cards with a reduced commission.

However, before agreeing to open a salary project, the company needs to interview all its employees and take applications from them to open plastic card accounts. Next, it is necessary to make changes to the collective agreement and labor contracts with employees.

If an employee refuses to open a card account, the company has no right to force him to do so. Therefore, such an employee must be asked in writing how to receive his salary. If there is no response from him, then the money will need to be given to him in cash from the organization’s cash desk.

Employees can come to work already having current accounts opened in banks. Therefore, he can use his own card to receive a salary or ask for a salary project to be opened for him in a given business entity.

This decision must be made by the employee independently. Pressure from the employer is not allowed; the employee does not need to obtain the consent of the enterprise administration.

To make his choice, the employee should submit an application to the company management, in which he must provide full bank details. After receiving this application from the employee, the administration will have to send the salary to the bank indicated by the employee.

At the same time, the employee must remember that if the bank details are incomplete, the company management will have the right to refuse the transfer and give the salary in cash. In this case, the company must send a message to the employee about the need to clarify the details he specified.

Important! The legislation establishes the obligation of the employer to bear all expenses associated with the transfer of wages to the employee in the form of bank commissions.

It is more difficult and expensive for a company to transfer salaries to cards opened for employees in different banks than to participate in a salary project. You will have to issue different payments and spend money on a commission for transferring money (in a salary project, as a rule, there is no commission or it is greatly reduced). Therefore, it is more profitable for the company to leave the employee in the salary project.

The employee has the right to independently decide how he wants to receive wages.

If an employee refuses to write an application for a bank transfer of salary, it is necessary to find out exactly how he considers it necessary to make payments. If the employee does not give a clear answer, payment must be made in cash.

The administration of the enterprise has the right only to recommend, but does not have the right to force employees to write applications for bank transfers. The choice of bank is also made by the employee independently.

It is more profitable for an organization to use a salary project system. In this case, cards for all employees are issued in one bank. The commission percentage for transfers is significantly reduced, which is of additional interest to the employer. Banks also usually provide preferential credit conditions for cooperation participants.

Work within the framework of a salary project involves a preliminary survey of employees. Next, each of them must provide a personal application for opening an account. The organization's collective labor agreement and labor agreements with employees should include appropriate clarifications regarding the procedure for settlements with them.

Author of the article:

Evgenia Dolgaya

Article 136 of the Labor Code of the Russian Federation establishes the general procedure for transferring wages to all employees. We are talking about the issuance of funds from the cash desk of the organization at the place of work.

All costs of transferring wages to employees are borne entirely by the employer. There is no charge to employees for this. It should be noted that this applies not only to participants in the salary project, but also to those employees who independently chose a bank to open a salary card to which the salary will be transferred.

The employer has the right to take into account expenses incurred when calculating the amount of taxable income. These expenses can be classified as non-operating or other. It all depends on the accounting policy of the enterprise.

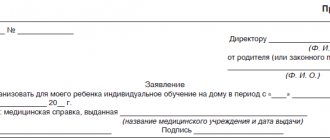

Structure of an application for salary transfer to a card

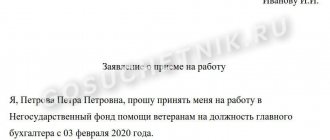

The application for transfer of salary to the card indicates:

- Full name and position of the compiler;

- Full name and position of the employee to whom the document is addressed (as a rule, this is the general director of the company or the chief accountant);

- name of the document: “Application for transfer of wages to an account in a financial institution (bank card)”;

- main text, where the employee, referring to Art. 136 of the Labor Code of the Russian Federation, expresses a request to transfer wages to a bank account and indicates the necessary details, including the card number;

- date of application.

The document must be signed personally by the employee. Some companies practice certifying the fact of its receipt by the management secretariat or accounting department by affixing the date of receipt and signature of the secretary or responsible accountant on the application.

Why do you need an application?

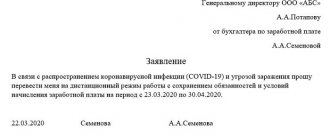

Let us repeat: having prescribed a condition for transferring wages to a card , the employer cannot oblige the subordinate to receive money in exactly this way. This desire is voluntary. Therefore, you can make a cashless transfer only after receiving written consent from the employee. This is why you need an application to transfer your salary to a card. The sample below will help you understand which details you need to remember.

At any time, an employee can choose another bank and declare his desire to receive wages in it. You need to notify your employer about this at least five working days before the payment is made. The new application for salary transfer to the card must indicate all the details necessary for the transfer.

https://youtu.be/Tj0YFQQoxFw

Results

An employer who decides to pay salaries to employees on a card must, in accordance with Art. 136 of the Labor Code of the Russian Federation, request from each of them the corresponding written consent in the form of a statement. It is sent by the employee to the general director or chief accountant of the company.

You can study other features of the legislative regulation of the use of salary bank cards by employer firms in the articles:

- “Not all commissions on salary cards can be included in expenses”;

- “Are the costs of producing and servicing “salary” bank cards for employees taken into account for tax purposes?”

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

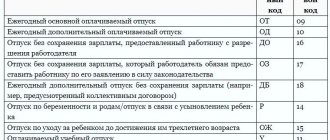

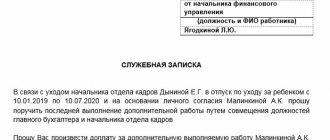

When else do you need to fill out a transfer application?

Important! The conditions for a special procedure for paying wages, including to the account of another person, must be fixed in the employment contract (based on part two of Article 57 of the Labor Code of the Russian Federation).

If there is an established condition in the employment contract, the employee has the right to indicate in the application for the transfer of wages to a bank card (sample) the account details of another recipient (individual and legal entity).

In addition to the account and details of the recipient, the application must also indicate the amount of payment, as well as the payment period, the obligation to provide compensation to the employer for expenses on banking services for transferring funds to a third party.

An application for the transfer of wages to a bank card (sample) is drawn up in any form addressed to the immediate manager of the organization, who must endorse the document submitted by the employee and send it to the accounting department for execution.

Any accountable amounts, including travel allowances, can be transferred by the head of the organization to a simple debit or salary card of the employee. This opportunity should be reflected in the company's internal documents.

Before making a transfer, you need to receive a corresponding statement from the employee, in which he expresses his desire to receive the funds due on his card.

Also see “Money for reporting: how to issue and process it.”

If you find an error, please highlight a piece of text and press Ctrl Enter.

Bank transfers require payment of a transaction fee. The employer is obliged to pay it himself, without in any case deducting from the employee’s salary.

Even if the banking organization chosen by a working citizen is not included in the company’s salary project system, the law prohibits imposing the obligation to pay a commission on an employee. Accounting allows such expenses to be classified as non-operating expenses.

Attention! Salary indexation calculator (Article 134 of the Labor Code of the Russian Federation)

Payments for transferring an employee's wages to the latter's bank account using non-cash payments fall entirely on the shoulders of employers.

Withholding commission from employees is prohibited by law.

This rule applies not only to employees receiving payments through the bank with which the salary project is concluded. The employer bears the costs even if the transaction is carried out through another bank chosen by the employee.

The costs of the operation can be taken into account when calculating the amount of taxable profit.

This expense item can be regarded as non-operating or otherwise. The basis for classification will be the company's accounting policies.

In addition to salary payments, the entrepreneur has the right to transfer travel allowances to the employee’s salary or debit bank card.

This opportunity should be displayed in the company’s local regulatory documents. But before making a transfer, you will need to receive a corresponding statement from the employee, where he indicates his desire to receive the money due to him on the card.

The head of the company has the right to transfer any accountable amounts of money to an employee’s simple debit or salary card. This possibility should be reflected in the internal documents of the organization.

Before making a transfer to an employee’s bank card, the employer needs to accept a statement from the employee in which he expresses a desire to receive salary by bank transfer to his card.

Helpful information? Share it with your friends!

Obviously, it is most profitable for an employer to maintain accounts for its employees in a bank with which it has an agreement on a salary project. In this case, employees receive the card for free. During the entire duration of the employment contract, she is also serviced free of charge (with the exception of additional services, for which fees are charged at the bank’s rate - for example, SMS notifications).

However, if an employee wishes to register payroll with another bank, then he will pay the fee for servicing the card himself, since this is his personal card, which does not relate to the salary project. However, the company must transfer the amount in full, i.e. She pays the transfer commission only herself.

In this case, the time frame for crediting wages may increase. In the usual case, the bank makes the transfer on the day the payment order is submitted or on the next business day. Therefore, if the payment of a salary, for example, falls on a Saturday, the accountant usually sends an order to the bank on Thursday so that the funds arrive on Friday. However, if the employee chooses his own bank, the transfer may take up to 3-5 business days.

Basic conditions

Cash or non-cash forms of payment of remuneration for labor is a condition that must be specified in the employment contract. Sometimes it is indicated in a collective agreement.

The nature of the amounts that will be transferred to the employee’s account from the employer, as a rule, is not indicated. For example, transferring travel allowances to a salary card is carried out without any special reservation.

As a rule, an organization chooses one bank in which it conducts a salary project for all employees. But, according to the mentioned Article 136, each employee has the right to change the credit institution upon application.

The employer has no right to refuse, nor does it have the right to oblige the use of non-cash payments. However, some managers are trying to get around this situation. They include in the employment contract a clause on receiving salary through a specific bank. But this is illegal and can be appealed in court (if desired).

Can an employee receive a salary on his open card?

The employee is given the right to independently choose how exactly to pay wages. This can be paid through a cash register or by bank transfer.

In this case, he can choose both transfer and cash payment at the same time.

For example, an advance on wages can be made by issuing money from the cash register, and the second part can be transferred to the employee to his card account.

The employee may submit an application in which he determines that these two payment methods can be used simultaneously. That is, he will receive a certain amount in cash, for example, 3,000 rubles, and the remaining money must be transferred to his card.

It is allowed to establish a percentage of the amount of salary that can be paid in cash and which can be paid by bank transfer.

In connection with the development of the card system, employees may already have their own accounts opened upon admission or in the course of further work. It may be more convenient for him to receive a salary on his old card rather than open a new one.

An employee does not need the employer's consent to receive remuneration for his work. It is enough to submit an application to the management to transfer your salary to the card and indicate the recipient’s bank with full details.

This is a very important point, since if these details are incomplete, the employer will be able to refuse the transfer for this reason. Then the salary will be issued in cash, and the employee will receive a letter asking for clarification of the details for the transfer.

We invite you to familiarize yourself with: Transfer of funds inv 15 sample filling

bukhproffi

Important! The administration must remember that no matter which bank the employee chooses, the costs of transferring his salary (bank commission) fall entirely on the shoulders of the employer. It is illegal to withhold commission from an employee's earnings.

Necessity

A sample application for transferring funds to a bank card should be located in the personnel department of the enterprise or in its settlement department. It can also be easily found on various websites.

Article 136 of the country’s Labor Code requires that the employee independently draw up an application for the transfer of wages to the card. This is one of the mandatory conditions when carrying out the procedure for registering labor relations between an employer and his employee.

Below is a sample application.

The law does not prohibit making payments using cash transactions and does not oblige either party to choose between transferring salaries to a card and receiving cash in hand. A person has the right to choose his own payment system. But non-cash transfers are characterized by a number of advantages for the employee.

- Receipt of funds to the card does not require personal presence or participation. There is no need to go to the factory on the day of payday or advance payment. Standing in line at the cash register, etc.

- Using the card makes it easy to make payments in stores. And receive cashback for non-cash payments.

- Payments for utilities and bank transactions are much simplified. Again, there is no need to get to payment acceptance points or stand in long queues. Today it is easier to pay both utilities and loans using Internet services.

- The card has multiple options and reliable security, which guarantees the integrity of its owner’s funds, which cannot be said about a wallet with cash.

- All card accounts are legal and legitimate. With their help, it is easier to monitor the status of your own insurance account and more.

When you have money on the card, you can give a gift to a person who is currently far away, or help someone who really needs help, simply by transferring money from card to card.

Salary project

Each bank runs several types of projects aimed at optimizing financial relationships with partner enterprises. They are constantly improving, innovations appear in them, designed to attract customers with their benefits.

This also applies to salary projects, within the framework of which financial institutions enter into an agreement with a company or organization. On the one hand, banks undertake obligations to service cards and move funds through them. On the other hand, the employer organizes work with employees on paperwork.

- Concludes an agreement with a financial organization as part of a salary project.

- Prepares the necessary documentation: a statement with employee data, their applications for salary transfers, copies of all necessary personal documents of employees, etc.

- Draws up an agreement for the provision of services for opening and servicing personal accounts.

- Issues salary cards to which money payments will be transferred.

The method of remuneration is fixed in orders and acts of the organization, where it is mandatory to indicate the current payment system for each employee individually.

Necessity

A sample application for transferring funds to a bank card should be located in the personnel department of the enterprise or in its settlement department. It can also be easily found on various websites.

Article 136 of the country’s Labor Code requires that the employee independently draw up an application for the transfer of wages to the card. This is one of the mandatory conditions when carrying out the procedure for registering labor relations between an employer and his employee.

Below is a sample application.

The law does not prohibit making payments using cash transactions and does not oblige either party to choose between transferring salaries to a card and receiving cash in hand. A person has the right to choose his own payment system. But non-cash transfers are characterized by a number of advantages for the employee.

- Receipt of funds to the card does not require personal presence or participation. There is no need to go to the factory on the day of payday or advance payment. Standing in line at the cash register, etc.

- Using the card makes it easy to make payments in stores. And receive cashback for non-cash payments.

- Payments for utilities and bank transactions are much simplified. Again, there is no need to get to payment acceptance points or stand in long queues. Today it is easier to pay both utilities and loans using Internet services.

- The card has multiple options and reliable security, which guarantees the integrity of its owner’s funds, which cannot be said about a wallet with cash.

- All card accounts are legal and legitimate. With their help, it is easier to monitor the status of your own insurance account and more.

When you have money on the card, you can give a gift to a person who is currently far away, or help someone who really needs help, simply by transferring money from card to card.

Rights and obligations

Servicing of a banking product must be paid. In case of transfer of salary to a card, all expenses fall on the shoulders of the enterprise administration. All commissions and service bills are paid by the employer, even if the employee chose to open an account in a financial institution of their own choosing.

In this article you will find information on how to competently and correctly, from a legal point of view, write an application for transferring a salary to a card, its sample, an overview of the main features and aspects of non-cash transfers. Today there are practically no enterprises left that pay cash for work performed. Payments to the card are beneficial and convenient for both parties to the employment relationship. They are transparent, easy to track and have a number of other advantages.

Salary project

Each bank runs several types of projects aimed at optimizing financial relationships with partner enterprises. They are constantly improving, innovations appear in them, designed to attract customers with their benefits.

This also applies to salary projects, within the framework of which financial institutions enter into an agreement with a company or organization. On the one hand, banks undertake obligations to service cards and move funds through them. On the other hand, the employer organizes work with employees on paperwork.

- Concludes an agreement with a financial organization as part of a salary project.

- Prepares the necessary documentation: a statement with employee data, their applications for salary transfers, copies of all necessary personal documents of employees, etc.

- Draws up an agreement for the provision of services for opening and servicing personal accounts.

- Issues salary cards to which money payments will be transferred.

The method of remuneration is fixed in orders and acts of the organization, where it is mandatory to indicate the current payment system for each employee individually.