In how many days must the accountable person report?

And each is set for its own reporting stage. At what point does the obligation to submit an advance report arise? The only regulatory document that establishes deadlines for reporting on money issued for reporting is Directive of the Bank of Russia No. 3210-U dated March 11, 2014.

"On the procedure for conducting cash transactions."

In clause 6.3 (paragraph 2) of this Directive it is established that the deadline for submitting an advance report is three working (!) days.

And many novice accountants mistakenly start counting this three-day period from the moment the funds are issued for reporting.

In fact, the three-day reporting period begins:

- from the day following the end of the period for which funds were issued for the report.

Attention This wording applies to both fully and partially spent funds, and not spent money at all.

When should I report for accountable money?

Question Cash discipline.

Money is accounted for for how long it can be issued.

In the order on accountable amounts, I indicated the deadline for reporting on the amounts issued was 365 days, and the memo also indicated a period of 365 days. The manager made a remark to me about 365 days in the memo, what to do.

Answer When you issue cash on account to an employee of an organization (incl.

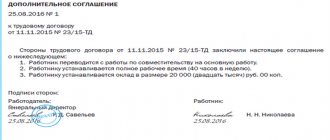

its manager), you need to obtain an application from the employee for the issuance of money on account. It must contain (clause 6.3, clause 6 of Directive N 3210-U): - the amount that must be issued for reporting; - the period for which the money is issued; — signature of the head of the organization (another person authorized to sign applications for the issuance of money under a power of attorney); — date of signing the application.

Each organization has the right to set the period for which accountable money is issued independently in an order or other local regulatory act.

- (98 kB)

- (8 kB)

- (50 kB)

- Hello!

Individual entrepreneur provides consulting services for LLCs in cash. The LLC plans to withdraw cash for payment from its current account and issue it from the company’s cash desk using a cash account…. - For what purposes of disbursing money from the organization's cash desk is it necessary to receive money from the current account?

✒ Cash in Russian currency received at the cash desk for goods sold (work performed,…. - The organization does not receive cash revenue. There was cash left in the cash register, previously withdrawn from the bank for household needs. The limit has not been exceeded. Is it possible to pay salaries from this money, or is it necessary....

- URGENTLY!

Good afternoon Does an employee of an organization have the right to demand payment of his salary for the first half of the month (advance) in an amount equal to more than would be calculated in proportion to the time worked?Could it be...

Back forward

Transfer of accountable amounts to bank cards

The legislation does not prohibit giving an employee funds on account by transferring them to the bank card of such an employee. It does not matter whether it is a personal card of the employee, opened by him independently, or a so-called “salary” card issued to the employee as part of an agreement between the employer and the bank for the transfer of wages to it (Letters of the Ministry of Finance dated July 21, 2017 No. 09-01 -07/46781, dated 08/25/2014 No. 03-11-11/42288, dated 10/05/2012 No. 14-03-03/728, Letter of the Ministry of Finance No. 02-03-10/37209, Treasury No. 42-7.4-05/ 5.2-554 dated September 10, 2013).

It would be advisable to provide for the possibility of transferring accountable funds to an employee’s card in local regulations. For example, in the Regulations on Business Travel.

The transfer of funds to the accountable person on the card is made on the basis of an order from the employer, a memo or an application from the employee, endorsed by the manager. In this document you will need to indicate the details of the card to which the accountable amounts should be transferred.

An employee’s application for the transfer of accountable amounts to a bank card can be either unlimited and relate to all accountable amounts due to him, or relate only to a specific business trip or the purchase of goods and materials for the employer.

In the payment order itself, in the purpose of payment, you will need to indicate that the funds are transferred for reporting. For example, mark “payment of travel expenses.”

Here is an example of an application for the transfer of imprest amounts to a salary card.

How to issue funds on ACCOUNTABILITY, how to submit an ADVANCE REPORT

To ensure the correctness of accounting, reliability of information and control when making payments to employees who have received money on account, approve the “Order for the release of funds from the cash register on account” view. An employee can spend the amount only for specific purposes specified in the order.

Familiarize the employee with the order for signature. Note: Download the manager's order .doc 38 KbOOO "Gazprom" INN 4308123456, KPP 430801001, OKPO 98756423 full name of the organization, identification codes (TIN, KPP, OKPO) ORDER No. 1984 on the issuance of accountable amounts from cash registers.

How to properly reimburse an employee

Very often, employees, due to ignorance or for some other reason, violate the sequence in the preparation of documents and can spend their own funds on the necessary enterprises without formalizing the issue as required.

Important! In this situation, if the above sequence is violated, the personal funds spent are in no way accountable.

This can be explained by the fact that in this situation the employee acted on his own behalf; there is no guarantee that the manager will consider the expenditure of these funds appropriate. In fact, it turns out that the employee made the decision on his own without receiving consent from his superiors.

For example, such a story could arise when, after lengthy negotiations, the manager offered dinner to a client and paid for a trip to the restaurant and now wants a refund. Therefore, before spending your money, write an application to the accounting department to issue a report, and then confirm it with documents.

If the manager approves the reimbursement of costs incurred, then the enterprise must issue an order or order to pay compensation to the employee.

To ensure that the regulatory authorities do not have grounds for complaints, then the enterprise issues a general order, which reflects the procedure for reimbursement of such costs. The order specifies the maximum amount that accountable persons can spend, for what purposes, and the period during which reimbursement will be made.

Important! The order must be certified by the head of the enterprise, and all interested parties must also sign it, which indicates that they are familiar with this order.

Actions of an accountant upon receipt of documents for reimbursement of expenses to an employee:

- Check the correctness of the primary documents; if the documents are issued in the name of the company, then it is clear that the employee actually purchased valuables for the needs of the enterprise;

- Whether or not to pay personal income tax on the transferred funds to the employee. Since the employee did not receive any economic benefit from the compensation received, the amounts received cannot be called income and there is no need to pay personal income tax;

- It is necessary to formalize this payment using a cash receipt document.

- Make the appropriate entries in accounting: when issuing funds to an employee, Dt 73 Dt 73 “Settlements with personnel for other operations” Kt 50. And posting Dt 10 (07, 08, 11, 41) Kt 73 records that the acquired assets have been accepted for accounting.

Is there a maximum period for issuing money for reporting?

True, in this case, problems with the tax authorities are not excluded.

Kirov. . . . . . . 09.14.2020 In order to purchase office supplies, I ORDER: Issue E.V. Ivanov from the cash register in the amount of 10,000 (Ten thousand) rubles. for a period of five calendar days. Appoint the chief accountant A.S. Petrova as responsible for the execution of the order. Director __________ A.V.

Thus, in letter No. 04-1-02/704 of the Federal Tax Service of Russia dated January 24, 2005, tax officials expressed the opinion that if the deadline for issuing cash on account is not specified, such a period is considered equal to 1 day. However, they do not justify their position with any legal acts. In connection with the above, making a decision at the level of local internal corporate acts on establishing (or not establishing) deadlines for issuing reports is based on an assessment of one’s own economic situation and possible risks.

Find out whether it is necessary to fill out an application to receive accountable amounts.

Typically, an order is not drawn up separately to set deadlines, but to describe the entire procedure for issuing accountable amounts.

In such an order it is necessary to indicate:

- the amount of amounts issued;

IMPORTANT! The maximum amount of accountable amounts to be issued is also not established by law.

Results

Neither the minimum nor maximum terms for issuing money to accountables are established by law. Business entities have the right to determine them independently. These deadlines can be recorded in the local acts of the enterprise. However, the law does not oblige the enterprise to draw up such administrative documents.

For information on the legislative framework relating to settlements with accountable persons, see the article “Settlements with accountable persons - regulatory documents” .

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Code of Administrative Offenses of the Russian Federation

- Directive of the Bank of Russia dated March 11, 2014 No. 3210-U

- Decree of the Government of the Russian Federation of October 13, 2008 No. 749

- Letter of the Federal Tax Service of Russia dated January 24, 2005 No. 04-1-02/704

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How long does it take to report back?

rub.

for officials and 40–50 thousand.

However, paragraph 7 of Directive No. 3210-U provides for the obligation for a legal entity and entrepreneur to determine:

- measures to ensure the safety of cash during cash transactions (and the issuance of money for reporting and reporting on them refers to cash transactions), during transportation and storage of money;

- the procedure and timing of inventory in order to establish the actual availability of cash in the cash register.

Therefore, if the period for which the funds are issued on account is quite long, then the organization and the entrepreneur should take measures to control these funds.

rub. for legal entities (clause 1 of article 15 of the Code of Administrative Offenses of the Russian Federation).

How long does it take to issue an overexpenditure on an advance report?

Important Cash payments are carried out in accordance with the requirements of the Central Bank No. 3073-U.

For example, periodic submission of an advance report with documents confirming expenses during the period for which the money was issued.

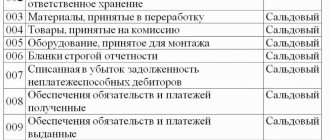

The Unified Chart of Accounts was approved by Order of the Ministry of Finance dated December 1, 2010 No. 157.

In other words, if the overexpenditure was issued later than the advance report, then the cost accounting is taken into account upon the fact of payment of money to the employee in a specific tax period.

However, within the framework of one contract, the amount of payment made by the employee should not exceed 100,000 rubles. (Instructions of the Central Bank No. 3073-U).

Possible exceeding of the limit is monitored by a responsible person appointed by the head of the enterprise. Violation of the established procedure may become the basis for bringing officials to administrative liability (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). How long does it take to reimburse? Reimbursement for overexpenditure must be made within a reasonable time.

Accountable funds: procedure for issuance and return

Therefore, in order to timely report and eliminate the risks of recognizing funds received as income of individuals with the accrual of personal income tax on them, in the same accounting policy or local act (a document that establishes the possibility of transferring money to a sub-account from account to account), you need to indicate the deadline for providing an advance report.

For example:

“For funds received accountable by non-cash method, an advance report is provided no later than 3 business days after the end of the period for which accountable funds were issued, but not earlier than the employee goes to work.”

. An employee who has received money in any way attaches to the advance report documents confirming his expenses for the needs of the enterprise (checks, BSO, receipts, invoices, travel tickets, etc.). Documents supporting expenses are listed on the reverse side of the expense report.

Errors in processing transfers to cards

Filling out a payment order is a very important stage in which it is better to avoid mistakes:

1.If an error is detected, the bank employee has the right to refuse to make the payment

2. Due to violation of the deadlines for transferring funds, an employee of the organization will not be able to go on a business trip on time.

3. If the assignment does not indicate that this is accountable money, the tax office may regard this as income received and require it to be taxed at 13%

How long does it take to report back?

However, they do not justify their position with any legal acts.

- description of the procedure for submitting advance reports.

- the terms for which funds are issued to accountants;

- a list of employees entitled to receive accountable money;

In what other document can you reflect the nuances of settlements with accountable persons, find out from the publication “Regulations on settlements with accountable persons - sample”.

It should be borne in mind that the deadlines for which funds will be issued to accountants may be the same for all employees of the company, or set for each of them individually. You can download an approximate sample order on accountable persons from this link: IMPORTANT!

All organizational issues relating to the procedure for issuing and returning accountable funds should be fixed only in orders, but not in accounting policies.